Tourism Vehicle Rental Market Synopsis:

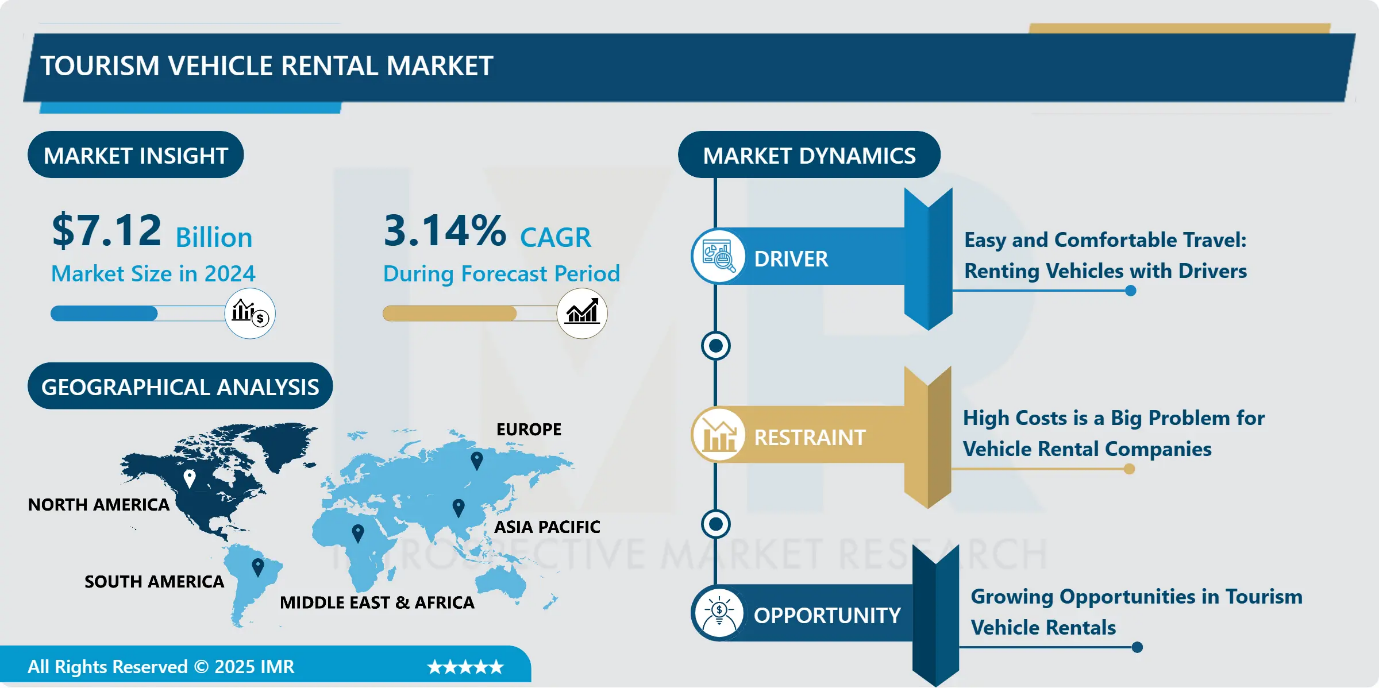

Tourism Vehicle Rental Market Size was Valued at USD 71.2 Billion in 2024, and is Projected to Reach USD 100.0 Billion by 2035, Growing at a CAGR of 3.14% From 2025–2035.

The tourism vehicle rental market is a service where tourists can rent different types of vehicles like cars, vans, SUVs, or motorhomes for travel. This service is very helpful for travellers who want freedom and comfort while exploring new places. Instead of using buses or taxis, renting a vehicle allows tourists to travel at their own pace.

Tourism vehicle rental is becoming more popular because more people are traveling for holidays, business, and adventure. Tourists also like rental vehicles because they can choose the type of vehicle they need big cars for families, small cars for city travel, or even luxury cars for a special experience.

One big trend in this market is the use of eco-friendly vehicles, like electric or hybrid cars. These help reduce pollution and are better for the environment. Many rental companies are starting to offer these green options to attract customers who care about nature.

Technology is also helping the market grow. Tourists can now easily book vehicles online or through mobile apps. These apps make it simple to choose a vehicle, book it, and even track it during the trip. However, the market also faces some challenges like high costs for buying and maintaining vehicles, rising fuel prices, and tough competition among rental companies. Overall, the tourism vehicle rental market is growing because more people want easy, comfortable, and flexible ways to travel. With better technology, green vehicles, and smart planning, this market has a strong future ahead.

Tourism Vehicle Rental Market Growth and Trend Analysis:

Tourism Vehicle Rental Market Growth Driver- Easy and Comfortable Travel: Renting Vehicles with Drivers

-

Renting vehicles with drivers is a good choice for tourists who want a relaxed and easy travel experience. It is helpful for people who do not want to drive in places they don’t know. Families, older people, and those on holiday who want comfort often choose this option.

- Having a driver makes travel simple. Tourists can sit back and enjoy the trip without worrying about traffic or directions. The drivers also know the local area well. They can show travellers special places that are not easy to find on a map. This makes the trip more interesting and fun.

- In some places, driving can be hard because of traffic or bad roads. A local driver knows how to handle these problems and can drive safely. This helps travellers feel calm and enjoy their journey more.

- As more people look for easy and special travel options, the demand for renting vehicles with drivers is growing. Rental companies are offering more of these services to make tourists happy. This way of travel gives comfort, safety, and a chance to see more of the local culture. Overall, renting a vehicle with a driver is a smart and easy way to travel. It helps people enjoy their vacation without stress and gives them a better travel experience.

Tourism Vehicle Rental Market Limiting Factor - High Costs is a Big Problem for Vehicle Rental Companies

-

One big problem for vehicle rental companies is the high cost of running the business. First, they need to spend a lot of money to buy cars. If they want to use new or eco-friendly cars, like electric or hybrid ones, it costs even more. These cars are good for the environment, but they are more expensive than normal cars.

- After buying the cars, companies must take care of them. This means regular cleaning, checking tires, oil changes, and fixing any damage. If a car breaks down, it needs quick repair so it can be rented again. These things cost money every month. Insurance is another big cost. Every car needs insurance to cover accidents or theft. If the company has many cars, insurance becomes very expensive. They must also pay more if they had accidents before.

- Fuel prices also change a lot. If fuel becomes more expensive, some people may not want to rent a car. Or they may ask for cheaper prices, which means the company earns less money. In some cities, rental companies also have to pay extra taxes or parking fees. These charges make renting more expensive for tourists and harder for companies to manage.

- All these costs buying cars, repairs, fuel, insurance, and taxes make it hard for rental companies to earn a steady income. This is a big problem, especially for small companies with less money. In short, high costs are a strong reason why some rental businesses struggle to grow.

Tourism Vehicle Rental Market Expansion Opportunity - Growing Opportunities in Tourism Vehicle Rentals

-

The tourism vehicle rental market is growing fast as more people travel again. There are many new chances for rental companies to do well. One big trend is eco-tourism. Many travellers now care about the environment and want to travel in eco-friendly ways. Companies that use electric or hybrid vehicles will attract these green-minded customers.

- Technology is also helping the rental market. Mobile apps now let people book cars easily and track them during their trip. This makes travel smooth and stress-free. Some companies are also working with hotels and local travel groups. These partnerships help them offer full travel packages, including places to stay and cars to use.

- Another good change is the use of digital tools. Rental companies can use data to learn what customers like and improve their services. This helps them keep customers happy and loyal. Also, with the rise of sharing services, companies can try new ideas like letting people rent cars from each other. This helps use cars more and earn extra money.

- More tourists now want trips that fit their personal style. Rental companies that offer flexible and smart services will have more success in the future. By using eco-friendly vehicles, smart apps, and new business ideas, these companies can grow and meet the needs of modern travellers. In short, the future looks bright for vehicle rentals in tourism if companies follow these smart trends.

Tourism Vehicle Rental Market Challenge and Risk - Big Competition and Changing Tourist Seasons

-

One big challenge in the tourism vehicle rental market is strong competition. There are many rental companies, big and small, all trying to get the same customers. Big companies have more money, more cars, and better technology. They can make fancy apps, offer cheaper prices, and give special discounts. This makes it hard for small rental companies to keep up.

- Small companies may not have many cars or money to spend on advertising. They may also not have online booking systems or other digital tools. Even if their service is good, they might not get many customers because big companies are more popular.

- Another problem is that the number of tourists changes with the seasons. In some months, like summer or holidays, lots of tourists travel and rent cars. But in other months, like during school or work seasons, very few people travel. This means that rental companies earn a lot of money during busy times, but very little during quiet times. Even when there are fewer customers, companies still need to pay for things like car repairs, rent, and staff salaries. This makes it hard to keep steady income all year.

- To do well, rental companies need to plan smartly. They can offer good service, focus on loyal customers, and use online tools to help their business. In short, strong competition and changing tourist seasons make it difficult for rental companies to grow and earn steady money.

Tourism Vehicle Rental Market Segment Analysis:

Tourism Vehicle Rental Market is segmented based on Type, Application, End-Users, and Region

By Type, Tourism Vehicle Rental Market segment is expected to dominate the market during the forecast period

-

The luxury or premium part of the tourism vehicle rental market is for travellers who want the best comfort and style when they travel. These vehicles are not regular cars; they are high-end cars, fancy SUVs, or special sedans. These cars come with modern technology, soft and expensive materials inside, and many luxury features like comfortable seats, good sound systems, and advanced safety tools.

- People who choose luxury rentals want to feel special and enjoy their trip in a classy way. Some might be business travellers who want to arrive at meetings in style. Others might be tourists who want to relax and treat themselves during their vacation.

- Even though luxury vehicles make up a smaller part of the whole rental market, they are very important. They bring in more money for rental companies because customers pay more for this exclusive service. People who rent these cars usually want the best quality and are willing to pay extra for it.

- The luxury vehicle rental service gives travellers a chance to enjoy their trip with sophistication. It also helps rental companies by adding variety to their offerings. By having luxury cars available, companies can attract customers who want something more than just a regular rental car. In simple words, the luxury segment is for those who want to travel in style and comfort. It is smaller but very special because it offers a high-class experience for people who want the best on their trip.

By Application, Tourism Vehicle Rental Market segment held the largest share in 2024

-

Online booking means using websites or mobile apps to find, compare, and book rental vehicles. This way is very popular because it is easy and quick. Travelers can check different cars, prices, and services from their phones or computers. They can also book early to get better deals. This is great for people who like to plan ahead and want more choices. Because of this, online booking is growing fast and has become the main way people rent vehicles for travel.

- Offline booking means going to a rental office in person, like at the airport, train station, or city centre. Some travellers prefer this because they like talking face-to-face or may decide to rent a car suddenly. In some places, online booking is not common or available, so offline rentals are the only option. Although offline rentals are less popular now, they are still important, especially for last-minute bookings or in areas with fewer internet options.

- In short, online booking is the easiest and most popular way to rent vehicles, but offline booking is still used and useful in certain situations. Both ways help tourists get the cars they need for a good trip.

Tourism Vehicle Rental Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is very strong and well-developed. Many tourists, both from inside the country and from other countries, visit North America every year. Because of this, there is a big demand for rental vehicles.

- In North America, travellers can rent many types of vehicles. They can choose from cars, RVs (recreational vehicles), and special vehicles depending on what they want. This helps meet the needs of different kinds of travellers. Some like to travel in small cars, while others prefer big RVs for longer trips.

- One reason why the rental market is so good in North America is because the roads and travel facilities are very good. The country has many tourist places to visit, which makes people want to travel by road. Also, driving is a popular way to explore in North America, which helps the rental market grow.

- Big rental companies in North America use new ideas to attract customers. For example, they have easy-to-use mobile apps where travellers can book cars quickly. Some companies also have loyalty programs, where customers get rewards or discounts when they rent cars often. These features help companies stay popular and keep their customers happy.

- In simple words, the tourism vehicle rental market in North America is strong because many people travel, the roads are good, and rental companies use smart ways to serve their customers well. This makes it easy and fun for travellers to rent vehicles and enjoy their trips.

Tourism Vehicle Rental Market Active Players:

- Alamo Rent A Car (USA)

- AutoEurope (Germany)

- Avis Budget Group Inc. (USA)

- Avis Car Rental (UK)

- Buchbinder Rent-a-Car (Germany)

- Budget Rent a Car (USA)

- CarTrawler (Ireland)

- Dollar Rent A Car (USA)

- EasyCar (UK)

- Enterprise Holdings Inc. (USA)

- Europcar Australia (Australia)

- Europcar Mobility Group (France)

- Europcar UK (UK)

- Fox Rent A Car (USA)

- Green Motion (UK)

- Hertz Global Holdings Inc. (USA)

- Keddy by Europcar (Europe)

- Localiza Rent a Car (Brazil)

- Movida Rent a Car (Brazil)

- National Car Rental (USA)

- Payless Car Rental (USA)

- Redspot Car Rentals (New Zealand)

- Rent-A-Car (USA)

- Rentcars.com (Brazil)

- Simba Car Hire (Australia)

- Sixt Rent a Car (USA)

- Sixt SE (Germany)

- Thrifty Car Rental (USA)

- Turo Inc. (USA)

- Zoomcar India Pvt. Ltd. (India)

- Other Active Players

|

Tourism Vehicle Rental Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 71.2 Billion |

|

Forecast Period 2025-35 CAGR: |

3.14% |

Market Size in 2035: |

USD 100.0 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Tourisim Vechicle Rental Market by Product (2018-2035)

4.1 Tourisim Vechicle Rental Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Economy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Luxury/Premium

Chapter 5: Tourisim Vechicle Rental Market by Application (2018-2035)

5.1 Tourisim Vechicle Rental Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Not Applicable

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

Chapter 6: Tourisim Vechicle Rental Market by Distribution Channel (2018-2035)

6.1 Tourisim Vechicle Rental Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Tourisim Vechicle Rental Market by End User (2018-2035)

7.1 Tourisim Vechicle Rental Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Self Driven

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Rental Agencies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Tourisim Vechicle Rental Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ALAMO RENT A CAR (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 AUTOEUROPE (GERMANY)

8.4 AVIS BUDGET GROUP INC. (USA)

8.5 AVIS CAR RENTAL (UK)

8.6 BUCHBINDER RENT-A-CAR (GERMANY)

8.7 BUDGET RENT A CAR (USA)

8.8 CARTRAWLER (IRELAND)

8.9 DOLLAR RENT A CAR (USA)

8.10 EASYCAR (UK)

8.11 ENTERPRISE HOLDINGS INC. (USA)

8.12 EUROPCAR AUSTRALIA (AUSTRALIA)

8.13 EUROPCAR MOBILITY GROUP (FRANCE)

8.14 EUROPCAR UK (UK)

8.15 FOX RENT A CAR (USA)

8.16 GREEN MOTION (UK)

8.17 HERTZ GLOBAL HOLDINGS INC. (USA)

8.18 KEDDY BY EUROPCAR (EUROPE)

8.19 LOCALIZA RENT A CAR (BRAZIL)

8.20 MOVIDA RENT A CAR (BRAZIL)

8.21 NATIONAL CAR RENTAL (USA)

8.22 PAYLESS CAR RENTAL (USA)

8.23 REDSPOT CAR RENTALS (NEW ZEALAND)

8.24 RENT-A-CAR (USA)

8.25 RENTCARS.COM (BRAZIL)

8.26 SIMBA CAR HIRE (AUSTRALIA)

8.27 SIXT RENT A CAR (USA)

8.28 SIXT SE (GERMANY)

8.29 THRIFTY CAR RENTAL (USA)

8.30 TURO INC. (USA)

8.31 ZOOMCAR INDIA PVT. LTD. (INDIA)

8.32 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global Tourisim Vechicle Rental Market By Region

9.1 Overview

9.2. North America Tourisim Vechicle Rental Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Tourisim Vechicle Rental Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Tourisim Vechicle Rental Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Tourisim Vechicle Rental Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Tourisim Vechicle Rental Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Tourisim Vechicle Rental Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Tourism Vehicle Rental Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 71.2 Billion |

|

Forecast Period 2025-35 CAGR: |

3.14% |

Market Size in 2035: |

USD 100.0 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||