Luxury Car Market Synopsis

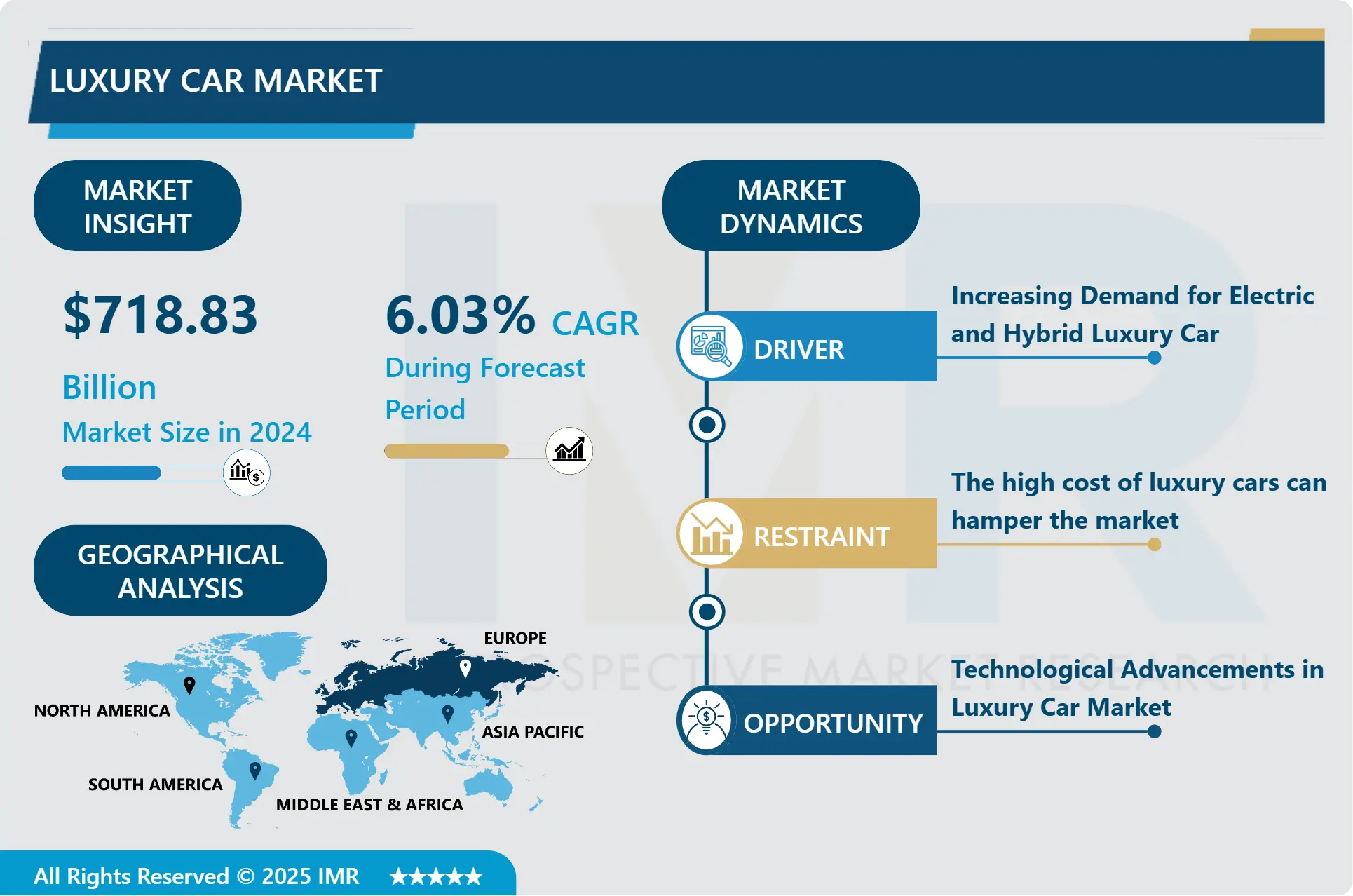

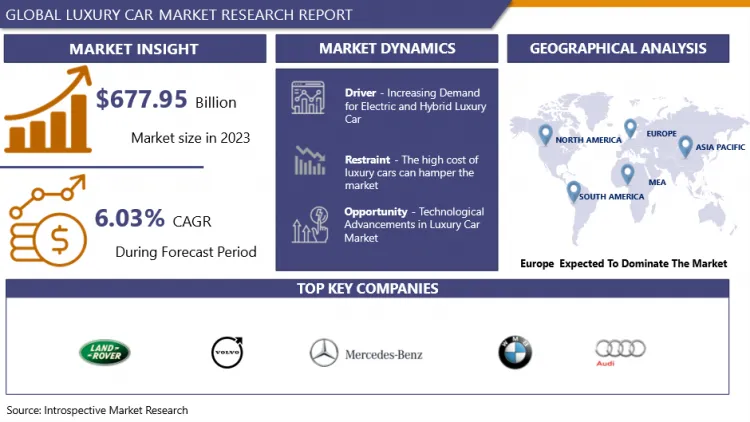

Luxury Car Market Size Was Valued at USD 718.83 Billion in 2024, and is Projected to Reach USD 1148.30 Billion by 2032, Growing at a CAGR of 6.03% From 2025-2032.

An automobile that offers above-average to high-end comfort, features, and equipment is considered a luxury vehicle. Customers anticipate higher build quality and more expensive materials and surface treatments. Compared to cars in the low- and mid-market segments, the often-higher price and more upscale appearance are frequently linked to better social status of the users. The luxury car market is being driven by a number of significant reasons, including rising global income and technology advances. This rise is especially noticeable in emerging nations, where rising disposable incomes allow more buyers to consider purchasing luxury vehicles.

The rise of electric and hybrid vehicles has been a key trend in the luxury car market. Major car firms are investing considerably in R&D to meet the growing demand for environmentally friendly alternatives. Connectivity elements such as Internet of Things (IoT) capabilities, AI-driven interfaces, and autonomous driving technologies are becoming mainstream options, dramatically improving the driving experience. Furthermore, advances in electric and driverless vehicles are altering the market environment, attracting tech-savvy consumers seeking cutting-edge automotive experiences.

Luxury car market is the surge in electric and hybrid models. Major automotive companies are investing heavily in research and development to cater to the increasing demand for eco-friendly alternatives. Connectivity features such as Internet of Things (IoT) capabilities, AI-driven interfaces, and autonomous driving technologies are becoming standard offerings, significantly enhancing the driving experience and attracting a modern, technologically inclined consumer base.

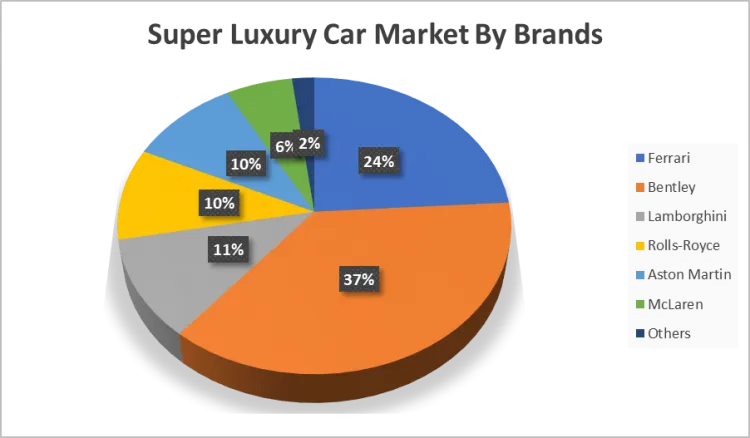

In this graph, it is shown that the super luxury car market is experiencing significant growth, as evidenced by the latest market share data. Bentley leads the market with a commanding 37%, showcasing its strong appeal among high-end car enthusiasts. Ferrari follows with a substantial 24% share, reflecting its enduring popularity and brand prestige. Lamborghini holds an 11% share, indicating its steady presence in the luxury car segment. Rolls-Royce and Aston Martin each capture 10% of the market, demonstrating their sustained demand and reputation for unparalleled luxury. McLaren, with 6%, continues to carve out its niche with its high-performance vehicles. The remaining 2% is occupied by other luxury car brands, highlighting the diverse options available to consumers in this growing market.

Luxury Car Market Trend Analysis

Luxury Car Market Growth Driver- Increasing Demand for Electric and Hybrid Luxury Car

- The electric vehicle (EV) market has grown in popularity due to the technology's quick growth. The performance and range of electric cars have increased advancements in battery technology, making them a good choice for luxury automobile buyers who don't want to give up on convenience or performance. Customers are looking for solutions to lessen their carbon impact as they become more ecologically concerned. Ecologically conscious buyers find that electric and hybrid cars are a more sustainable option than conventional gasoline-powered vehicles.

- Governments from all throughout the world are providing tax advantages, subsidies, and rebates to encourage the purchase of electric vehicles. Furthermore, greener options are being sought after by businesses and customers alike due to tighter emission standards. In addition to being eco-friendly, high-end electric and hybrid cars also provide cutting-edge performance and technology. Tech-savvy customers are drawn to features like fast acceleration, instant torque, and sophisticated driver aid systems.

- Large luxury automakers are making significant investments in hybrid and electric vehicle technologies. Customers now have access to a wider and more alluring selection of options thanks to this investment. To set themselves apart in the increasingly competitive luxury automobile market, automakers are introducing electric and hybrid models. Providing unique and environmentally friendly alternatives makes firms stand out and draws in a certain market of luxury car purchasers.

Luxury Car Market Opportunity- Technological Advancements in Luxury Car Market

- Luxury cars are increasingly becoming connected devices, integrating with smart home systems and personal devices. This connectivity offers enhanced functionality, such as remote vehicle control, diagnostics, and updates. Advanced infotainment systems with high-definition displays, voice recognition, and personalized user interfaces provide a rich in-car experience that appeals to tech-savvy consumers.

- The advancement of cutting-edge autonomous driving technologies gives luxury automobiles a differentiator. The attractiveness of these cars is increased by features like automated parking, hands-free driving, and advanced driver assistance systems (ADAS). Buyers who appreciate cutting-edge safety features and user-friendliness find luxury cars more appealing when they have access to autonomous technology, which boosts safety and convenience.

- AI-driven personalisation provides a customised driving experience by adjusting infotainment settings, driving modes, and vehicle settings according to user profiles. The exclusivity and allure of luxury cars are increased by technologies that make it simple for customers to customise the features and appearance of their vehicles to suit their preferences.

Luxury Car Market Segment Analysis:

Luxury Car Market is segmented on the basis of Vehicle type, Drive Type, Component Type and Fuel Type

By Vehicle Type, Sport Utility Vehicle (SUV) Segment Is Expected to Dominate the Market During the Forecast Period

- Performance and fuel economy of luxury SUVs have advanced significantly. Nowadays, a lot of models come with strong engines that don't compromise fuel efficiency, and some premium companies sell SUVs that are electric or hybrid and appeal to customers who care about the environment. Recent SUVs come with cutting-edge features and technologies that improve driving. Luxury SUVs offer a high-tech, comfortable ride thanks to their cutting-edge safety features and entertainment systems.

- SUVs have become increasingly popular among consumers because of its increased safety features, mobility, and higher seating posture. SUVs are known for providing both comfort and capability, which is what luxury automobile consumers are increasingly seeking for. Luxury SUVs offer more capacity for passengers and goods compared to typical cars. They are therefore desirable to individuals and families who require additional space without sacrificing comfort or elegance.

- SUVs are gradually replacing sedans as the vehicle of choice for high-end buyers in the luxury market, which is also reflecting this trend. Rich customers that like travelling, road excursions, and outdoor activities are good fits for luxury SUVs. SUVs' adaptability and toughness support these pursuits while offering the luxury and prestige that consumers seek.

By Drive Type, Internal Combustion Engine (ICE) Segment Held the Largest Share In 2024

- The infrastructure supporting ICE vehicles, including fuelling stations and maintenance facilities, is well-established and widespread. This convenience and familiarity make ICE luxury cars an attractive option for many buyers. Luxury car brands have a long history of developing high-performance ICE engines that provide a unique driving experience. The sound, power delivery, and overall feel of ICE engines are highly valued by car enthusiasts and traditional luxury car buyers.

- Due to their established performance, dependability, and the perceived luxury of conventional petrol and diesel engines, many luxury car purchasers still favour internal combustion engines (ICEs). The tactile elements of operating a strong internal combustion engine (ICE), such as quickness and engine sound, continue to be desirable. Despite the fact that EVs are becoming less expensive, ICE cars are still often more reasonably priced up front. Additionally, compared to the still-restricted selection of premium EVs, the diversity of available ICE vehicles offers greater options at various price points.

- Compared to most EVs, ICE vehicles have larger ranges and require less time to refill. For consumers who frequently travel long distances and do not wish to deal with the present constraints of EV charging infrastructure, this is a big benefit. ICE technology keeps advancing to minimise emissions and increase fuel efficiency. Modern internal combustion engines (ICEs) are more efficient and ecologically friendly than their predecessors thanks to features like direct injection, turbocharging, and mild hybridization.

Luxury Car Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- European automobile brands with a long history of luxury, performance, and quality include Mercedes-Benz, BMW, Audi, Porsche, and Rolls-Royce. These companies have spent decades building strong brand identities that appeal to consumers of premium cars all across the world. European businesses are well known for their inventiveness and superior engineering. In particular, the German auto industry has raised the bar for luxury car performance, accuracy, and cutting-edge technology.

- When it comes to technological innovation in electric and driverless vehicles, European manufacturers are leading the way. To appeal to a new generation of luxury automobile consumers, companies like Audi and Tesla, which has a presence in the European market, are actively investing in electric vehicles and autonomous driving technologies. A vast array of models, including sedans, SUVs, sports cars, and electric vehicles, are available from European luxury companies. This variety serves a range of market groups and consumer preferences.

- Customised cars are becoming more and more popular. By providing a wide range of personalisation choices, European automakers can take advantage of this and increase the uniqueness and allure of their cars. European luxury cars can be further distinguished by the use of cutting-edge technologies like augmented reality (AR), artificial intelligence (AI), and improved networking features. Companies that innovate in technology can draw in tech-savvy customers.

Luxury Car Market Key Players:

- Mercedes-Benz (Germany)

- BMW (Germany)

- Audi (Germany)

- Lexus (Toyota Motor Corporation) (Japan)

- Porsche (Germany)

- Jaguar (United Kingdom)

- Land Rover (United Kingdom)

- Cadillac (USA)

- Lincoln (USA)

- Volvo (Sweden)

- Tesla (USA)

- Bentley (United Kingdom)

- Rolls-Royce (United Kingdom)

- Maserati (Italy)

- Ferrari (Italy)

- Aston Martin (United Kingdom)

- Lamborghini (Italy)

- McLaren (United Kingdom)

- Alfa Romeo (Italy)

- Genesis (Hyundai Motor Group) (South Korea)

- Infiniti (Nissan Motor Corporation) (Japan)

- Acura (Honda Motor Company) (Japan)

- Bugatti (Volkswagen Group) (France)

- Rivian (USA)

- Lucid Motors (USA)

- Other Active Players

Key Industry Developments in the Luxury Car Market:

- In Jan 2024, Las Vegas, Technology company Continental is showcasing its Crystal Centre In a world-first, the premium automotive display is fully embedded in a stylish crystal housing – opening up completely new possibilities to integrate minimalist luxury into car interiors with its frameless and semi-transparent look.

|

Global Luxury Car Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 718.83 Billion |

|

Forecast Period 2025-32 CAGR: |

6.03 % |

Market Size in 2032: |

USD 1148.30 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Drive Type |

|

||

|

By Component Type |

|

||

|

By Fuel Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Luxury Car Market by Vehicle Type (2018-2032)

4.1 Luxury Car Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hatchback

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sedan

4.5 Sports Utility Vehicle

4.6 Multi-Purpose Vehicle

Chapter 5: Luxury Car Market by Drive Type (2018-2032)

5.1 Luxury Car Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Internal Combustion (IC) Engine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electric and Hybrid Vehicle

Chapter 6: Luxury Car Market by Component Type (2018-2032)

6.1 Luxury Car Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Drivetrain

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Interior

6.5 Body

6.6 Electronics

6.7 Chassis

Chapter 7: Luxury Car Market by Fuel Type (2018-2032)

7.1 Luxury Car Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Gasoline

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Diesel

7.5 Electric

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Luxury Car Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MERCEDES-BENZ (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BMW (GERMANY)

8.4 AUDI (GERMANY)

8.5 LEXUS (TOYOTA MOTOR CORPORATION) (JAPAN)

8.6 PORSCHE (GERMANY)

8.7 JAGUAR (UNITED KINGDOM)

8.8 LAND ROVER (UNITED KINGDOM)

8.9 CADILLAC (USA)

8.10 LINCOLN (USA)

8.11 VOLVO (SWEDEN)

8.12 TESLA (USA)

8.13 BENTLEY (UNITED KINGDOM)

8.14 ROLLS-ROYCE (UNITED KINGDOM)

8.15 MASERATI (ITALY)

8.16 FERRARI (ITALY)

8.17 ASTON MARTIN (UNITED KINGDOM)

8.18 LAMBORGHINI (ITALY)

8.19 MCLAREN (UNITED KINGDOM)

8.20 ALFA ROMEO (ITALY)

8.21 GENESIS (HYUNDAI MOTOR GROUP) (SOUTH KOREA)

8.22 INFINITI (NISSAN MOTOR CORPORATION) (JAPAN)

8.23 ACURA (HONDA MOTOR COMPANY) (JAPAN)

8.24 BUGATTI (VOLKSWAGEN GROUP) (FRANCE)

8.25 RIVIAN (USA)

8.26 LUCID MOTORS (USA)

Chapter 9: Global Luxury Car Market By Region

9.1 Overview

9.2. North America Luxury Car Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Vehicle Type

9.2.4.1 Hatchback

9.2.4.2 Sedan

9.2.4.3 Sports Utility Vehicle

9.2.4.4 Multi-Purpose Vehicle

9.2.5 Historic and Forecasted Market Size by Drive Type

9.2.5.1 Internal Combustion (IC) Engine

9.2.5.2 Electric and Hybrid Vehicle

9.2.6 Historic and Forecasted Market Size by Component Type

9.2.6.1 Drivetrain

9.2.6.2 Interior

9.2.6.3 Body

9.2.6.4 Electronics

9.2.6.5 Chassis

9.2.7 Historic and Forecasted Market Size by Fuel Type

9.2.7.1 Gasoline

9.2.7.2 Diesel

9.2.7.3 Electric

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Luxury Car Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Vehicle Type

9.3.4.1 Hatchback

9.3.4.2 Sedan

9.3.4.3 Sports Utility Vehicle

9.3.4.4 Multi-Purpose Vehicle

9.3.5 Historic and Forecasted Market Size by Drive Type

9.3.5.1 Internal Combustion (IC) Engine

9.3.5.2 Electric and Hybrid Vehicle

9.3.6 Historic and Forecasted Market Size by Component Type

9.3.6.1 Drivetrain

9.3.6.2 Interior

9.3.6.3 Body

9.3.6.4 Electronics

9.3.6.5 Chassis

9.3.7 Historic and Forecasted Market Size by Fuel Type

9.3.7.1 Gasoline

9.3.7.2 Diesel

9.3.7.3 Electric

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Luxury Car Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Vehicle Type

9.4.4.1 Hatchback

9.4.4.2 Sedan

9.4.4.3 Sports Utility Vehicle

9.4.4.4 Multi-Purpose Vehicle

9.4.5 Historic and Forecasted Market Size by Drive Type

9.4.5.1 Internal Combustion (IC) Engine

9.4.5.2 Electric and Hybrid Vehicle

9.4.6 Historic and Forecasted Market Size by Component Type

9.4.6.1 Drivetrain

9.4.6.2 Interior

9.4.6.3 Body

9.4.6.4 Electronics

9.4.6.5 Chassis

9.4.7 Historic and Forecasted Market Size by Fuel Type

9.4.7.1 Gasoline

9.4.7.2 Diesel

9.4.7.3 Electric

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Luxury Car Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Vehicle Type

9.5.4.1 Hatchback

9.5.4.2 Sedan

9.5.4.3 Sports Utility Vehicle

9.5.4.4 Multi-Purpose Vehicle

9.5.5 Historic and Forecasted Market Size by Drive Type

9.5.5.1 Internal Combustion (IC) Engine

9.5.5.2 Electric and Hybrid Vehicle

9.5.6 Historic and Forecasted Market Size by Component Type

9.5.6.1 Drivetrain

9.5.6.2 Interior

9.5.6.3 Body

9.5.6.4 Electronics

9.5.6.5 Chassis

9.5.7 Historic and Forecasted Market Size by Fuel Type

9.5.7.1 Gasoline

9.5.7.2 Diesel

9.5.7.3 Electric

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Luxury Car Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Vehicle Type

9.6.4.1 Hatchback

9.6.4.2 Sedan

9.6.4.3 Sports Utility Vehicle

9.6.4.4 Multi-Purpose Vehicle

9.6.5 Historic and Forecasted Market Size by Drive Type

9.6.5.1 Internal Combustion (IC) Engine

9.6.5.2 Electric and Hybrid Vehicle

9.6.6 Historic and Forecasted Market Size by Component Type

9.6.6.1 Drivetrain

9.6.6.2 Interior

9.6.6.3 Body

9.6.6.4 Electronics

9.6.6.5 Chassis

9.6.7 Historic and Forecasted Market Size by Fuel Type

9.6.7.1 Gasoline

9.6.7.2 Diesel

9.6.7.3 Electric

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Luxury Car Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Vehicle Type

9.7.4.1 Hatchback

9.7.4.2 Sedan

9.7.4.3 Sports Utility Vehicle

9.7.4.4 Multi-Purpose Vehicle

9.7.5 Historic and Forecasted Market Size by Drive Type

9.7.5.1 Internal Combustion (IC) Engine

9.7.5.2 Electric and Hybrid Vehicle

9.7.6 Historic and Forecasted Market Size by Component Type

9.7.6.1 Drivetrain

9.7.6.2 Interior

9.7.6.3 Body

9.7.6.4 Electronics

9.7.6.5 Chassis

9.7.7 Historic and Forecasted Market Size by Fuel Type

9.7.7.1 Gasoline

9.7.7.2 Diesel

9.7.7.3 Electric

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Luxury Car Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 718.83 Billion |

|

Forecast Period 2025-32 CAGR: |

6.03 % |

Market Size in 2032: |

USD 1148.30 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Drive Type |

|

||

|

By Component Type |

|

||

|

By Fuel Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||