Vehicle Insurance Market Synopsis:

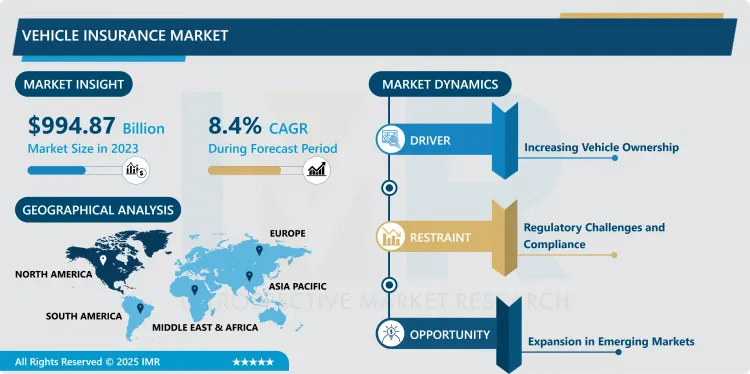

Vehicle Insurance Market Size Was Valued at USD 994.87 Billion in 2023, and is Projected to Reach USD 2,056.03 Billion by 2032, Growing at a CAGR of 8.4% From 2024-2032.

The vehicle insurance market covers the financial service that insures against losses arising from automobiles events for instance an accident, theft, fire, and any harm. They include third party liability insurance, collision insurance, comprehensive insurance and liability insurance to lower the possibilities of losing lots of amount of money in case of several events.

The global vehicle insurance business is a lucrative segment within the overall insurance industry, this due to the number of vehicles that are on the road today and the want to be protected financially. This availability is complemented with the growth in traffic circulation with the advancement in urbanization and the increase in disposable incomes as more people and companies acquire car to satisfy their need of transport hence the rise in demand for vehicle insurance products. This market is typically segmented by the types of products and services offered where there is emphasis on specialization in respect to clientele, customers and clients being people, companies, and government.

The market is made up of several products that are commonly referred to as insurance policies, these products include comprehensive insurance, third party insurance as well as collision insurance. Moreover, there are increased use of technology interfaces and or online services in facilitating consumer comparison and purchase of the vehicle insurance thus expanding the market. Also, the increasing use of electric vehicles (EVs) and improving technologies of autonomous driving should impact the markets for vehicle insurance in the future as insurers develop strategies to deal with new risks.

The market is also regulated in various areas of geographical location and tries to make sure that the insurance providers are standardized and offering enough coverage. The growth of data aggregation and analysis plus the emergence of AI and telematics has led to the increasing use of insurance policy customization as well as continuous pricing based on use of data. Consequently, technology is used to optimize claim handling, customer management, and risk assessment, which will drive the further development of the vehicle insurance market.

Vehicle Insurance Market Trend Analysis:

Integration of Telematics and Usage-Based Insurance

- Another important tendency of the changes in vehicle insurance market is the increasing popularity and implementation of telematics and usage base insurance. A number of automotive industry is show telematics, the ability to monitor driving style thereby having control on the speed, braking and, mileage is the culmination of a must-have tool among insurance companies. The clusters obtained from telematics systems allow improving the risk assessment of specific drivers and, therefore, offering fair premium rates. This trend is useful especially for young or high risk drivers because with ubi policies, you are likely to pay less for better driving. With an increasing number of cars equipped with connection and localization, as well as motion and other sensors, for the insurance business an attractive opportunity to collect data on driving opens, which will make it possible to narrow the range of offers.

- Apart from being unique products in the field of personal auto insurance, telematics-based insurance policies are gradually penetrating the scope of commercial fleets. Companies with more than one vehicle on the road are implementing UBI models to measure their fleet’s behaviour and trends as well as the compliance of their drivers to legal statutes. Insurers are in a position to eliminate or minimize large claims by offering bonuses to drivers that display prudent driving practices to the benefit of fleet owners. That is why, the evolution of the concept of connected vehicles, that may include such characteristics as ADAS or autonomous driving, also influences this pattern and offers insurers the opportunities to improve their risk assessment for offering more adequate price formulas.

Expansion in Emerging Markets

- The latter developing market remains the new frontier of opportunities for new growth within the vehicle insurance market. Over the years, middle income as well as urbanization locally and in countries in the Asia-Pacific, Latin America and Africa here, means call for car usage and hence insurance. The populations of these regions are enjoying a higher standard of living due to economic development leading to rise in disposable income to emit more on the car sales rate. As may be seen from the table above, in most of these countries, penetration of vehicle insurance is still low; thus, we can see there is a lot of room for the growth of insurance companies. With growing demand for protection of these assets in these markets, insurers are in a position to provide solutions that will suit needs of local customers whether in terms of price or flexibility of the insurance product being offered.

- Also, the increasing concern regarding vehicle insurance and advanced and enhanced facilities of the internet in emerging markets are indicative of a rising market. Mobile phones and internet connection have made it possible for consumer to access different insurance policies from different companies through use of social media and other sites. These social media platforms create an opportunity for insurers to reach much more people and enhance customer attraction in these growing markets. There is a belief that innovative financial offers to customers, for example, introducing new products like micro-insurance policies or per mile tariffs, the car insurance penetration in these regions will improve as more customers will be interested in buying this type of insurance.

Vehicle Insurance Market Segment Analysis:

Vehicle Insurance Market is Segmented on the basis of Insurance Type, Vehicle Type, Distribution Channel, Coverage, Vehicle Age, End User, and Region.

By Insurance Type, Comprehensive Insurance segment is expected to dominate the market during the forecast period

- The three forms of insurance are unique and different from each other and serve different clients’ requirements in unique ways. Collision and comprehensive insurance is perfect for people who want complete coverage especially for new car owners for those located in regions which have high risks of natural disasters or car jack batching. It builds confidence that the car is protected under all sorts of circumstances Translated by Ekaterina Shapovalova. Third party insurance is more cheaper and this is why drivers who own old cars or those that only want to meet the legal requirement pick it.

- Nonetheless it provides very little protection and entails the vehicle owner has to pay such a high price in case of an accident. This kind of coverage is important for those who drive their vehicle often, or in regions where there are more accidents since it protects the car, despite the fault. Last but not the least important, liability insurance is important for safeguarding against any body’s physical injury or property damage for which the vehicle owner may be held legally responsible, it is compulsory in many states.

By End User, Individuals segment expected to held the largest share

- The purchase of vehicle insurance is mainly voluntary for each person, but the risks include type of car being driven, the frequency of usage and area of residence. The people may also be motivated by issues to do with the cost, the variety of covers, and the availability of bonuses for safe drivers. While individuals mostly use insurance to protect their lives and property against unfortunate events, corporates use it to reduce operational risks on their fleets.

- Another contributor is a sponsorship policy since several vehicles are involved, and this comes with high risks. SMEs insurance may have specific services like an injury prevention plan or extra limits on certain forms of vehicles. To the governments, vehicle insurance is normally a regulatory standard to ensure that, public transport and other government vehicles are insured legally and for operations.

Vehicle Insurance Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Measured by size, North America leads the global vehicle insurance with the highest level of vehicle ownership especially in the United States and Canada. As discussed earlier the factors that may explain dominance of this region include high economic status, high per capita disposable income and availability of insurance services. Furthermore, the laws in North American require that drivers should have an insurance cover to make sure market is well developed. [Map insurers in this region are Getting established with No new players entering due to maturity of the market mature where Telematics and usage based insurance are already in place technology used] North America again takes the lion share of insurance distribution throughout the world besides having the highest level adoption of new generation insurance products and services that tries to retail and tailor its offerings to suit the unique needs of the target market consumers.

- Large insurance multinationals, competition and insurance market in the United States also a company supports North America’s dominance. Both the increasing focus on digitalisation and the increased connectivity of cars are likely to promote further traffic in this area. The general public is growing more informed and wanting better tailored insurance options pushing for products that are telematics and UBI based. Moreover, North America more and more centralising the directions linked with the creation of autonomous and electric vehicles offers the insurers more opportunities to competently gear up offers and come nearer to appearing risks related to novelties in this sphere.

Active Key Players in the Vehicle Insurance Market:

- Allstate (USA)

- AXA (France)

- State Farm (USA)

- Allianz (Germany)

- Zurich (Switzerland)

- Progressive (USA)

- Generali (Italy)

- MetLife (USA)

- Berkshire Hathaway (USA)

- Chubb (USA)

- Liberty Mutual (USA)

- Munich Re (Germany), and Other Active Players.

|

Global Vehicle Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 994.87 Billion |

|

Forecast Period 2024-32 CAGR: |

8.4% |

Market Size in 2032: |

USD 2,056.03 Billion |

|

Segments Covered: |

By Insurance Type |

|

|

|

By Vehicle Type |

|

||

|

By Distribution Channel |

|

||

|

By Coverage |

|

||

|

By End-User |

|

||

|

By Vehicle Age |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vehicle Insurance Market by Insurance Type (2018-2032)

4.1 Vehicle Insurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Comprehensive Insurance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Third-Party Insurance

4.5 Collision Insurance

4.6 Liability Insurance

Chapter 5: Vehicle Insurance Market by Vehicle Type (2018-2032)

5.1 Vehicle Insurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

5.5 Two-Wheelers

5.6 Electric Vehicles

Chapter 6: Vehicle Insurance Market by Distribution Channel (2018-2032)

6.1 Vehicle Insurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Sellers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Insurance Agents

6.5 Brokers

6.6 Online Platforms

Chapter 7: Vehicle Insurance Market by Coverage (2018-2032)

7.1 Vehicle Insurance Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Third-Party Coverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Own Damage Coverage

7.5 Fire and Theft Coverage

7.6 Personal Accident Coverage

Chapter 8: Vehicle Insurance Market by End-User (2018-2032)

8.1 Vehicle Insurance Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Individuals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Corporates

8.5 Government

Chapter 9: Vehicle Insurance Market by Vehicle Age (2018-2032)

9.1 Vehicle Insurance Market Snapshot and Growth Engine

9.2 Market Overview

9.3 New Vehicles

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Used Vehicle

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Vehicle Insurance Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 ALLSTATE (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 AXA (FRANCE)

10.4 STATE FARM (USA)

10.5 ALLIANZ (GERMANY)

10.6 ZURICH (SWITZERLAND)

10.7 PROGRESSIVE (USA)

10.8 GENERALI (ITALY)

10.9 METLIFE (USA)

10.10 BERKSHIRE HATHAWAY (USA)

10.11 CHUBB (USA)

10.12 LIBERTY MUTUAL (USA)

10.13 MUNICH RE (GERMANY)

10.14 OTHER ACTIVE PLAYERS

Chapter 11: Global Vehicle Insurance Market By Region

11.1 Overview

11.2. North America Vehicle Insurance Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Insurance Type

11.2.4.1 Comprehensive Insurance

11.2.4.2 Third-Party Insurance

11.2.4.3 Collision Insurance

11.2.4.4 Liability Insurance

11.2.5 Historic and Forecasted Market Size by Vehicle Type

11.2.5.1 Passenger Cars

11.2.5.2 Commercial Vehicles

11.2.5.3 Two-Wheelers

11.2.5.4 Electric Vehicles

11.2.6 Historic and Forecasted Market Size by Distribution Channel

11.2.6.1 Direct Sellers

11.2.6.2 Insurance Agents

11.2.6.3 Brokers

11.2.6.4 Online Platforms

11.2.7 Historic and Forecasted Market Size by Coverage

11.2.7.1 Third-Party Coverage

11.2.7.2 Own Damage Coverage

11.2.7.3 Fire and Theft Coverage

11.2.7.4 Personal Accident Coverage

11.2.8 Historic and Forecasted Market Size by End-User

11.2.8.1 Individuals

11.2.8.2 Corporates

11.2.8.3 Government

11.2.9 Historic and Forecasted Market Size by Vehicle Age

11.2.9.1 New Vehicles

11.2.9.2 Used Vehicle

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Vehicle Insurance Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Insurance Type

11.3.4.1 Comprehensive Insurance

11.3.4.2 Third-Party Insurance

11.3.4.3 Collision Insurance

11.3.4.4 Liability Insurance

11.3.5 Historic and Forecasted Market Size by Vehicle Type

11.3.5.1 Passenger Cars

11.3.5.2 Commercial Vehicles

11.3.5.3 Two-Wheelers

11.3.5.4 Electric Vehicles

11.3.6 Historic and Forecasted Market Size by Distribution Channel

11.3.6.1 Direct Sellers

11.3.6.2 Insurance Agents

11.3.6.3 Brokers

11.3.6.4 Online Platforms

11.3.7 Historic and Forecasted Market Size by Coverage

11.3.7.1 Third-Party Coverage

11.3.7.2 Own Damage Coverage

11.3.7.3 Fire and Theft Coverage

11.3.7.4 Personal Accident Coverage

11.3.8 Historic and Forecasted Market Size by End-User

11.3.8.1 Individuals

11.3.8.2 Corporates

11.3.8.3 Government

11.3.9 Historic and Forecasted Market Size by Vehicle Age

11.3.9.1 New Vehicles

11.3.9.2 Used Vehicle

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Vehicle Insurance Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Insurance Type

11.4.4.1 Comprehensive Insurance

11.4.4.2 Third-Party Insurance

11.4.4.3 Collision Insurance

11.4.4.4 Liability Insurance

11.4.5 Historic and Forecasted Market Size by Vehicle Type

11.4.5.1 Passenger Cars

11.4.5.2 Commercial Vehicles

11.4.5.3 Two-Wheelers

11.4.5.4 Electric Vehicles

11.4.6 Historic and Forecasted Market Size by Distribution Channel

11.4.6.1 Direct Sellers

11.4.6.2 Insurance Agents

11.4.6.3 Brokers

11.4.6.4 Online Platforms

11.4.7 Historic and Forecasted Market Size by Coverage

11.4.7.1 Third-Party Coverage

11.4.7.2 Own Damage Coverage

11.4.7.3 Fire and Theft Coverage

11.4.7.4 Personal Accident Coverage

11.4.8 Historic and Forecasted Market Size by End-User

11.4.8.1 Individuals

11.4.8.2 Corporates

11.4.8.3 Government

11.4.9 Historic and Forecasted Market Size by Vehicle Age

11.4.9.1 New Vehicles

11.4.9.2 Used Vehicle

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Vehicle Insurance Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Insurance Type

11.5.4.1 Comprehensive Insurance

11.5.4.2 Third-Party Insurance

11.5.4.3 Collision Insurance

11.5.4.4 Liability Insurance

11.5.5 Historic and Forecasted Market Size by Vehicle Type

11.5.5.1 Passenger Cars

11.5.5.2 Commercial Vehicles

11.5.5.3 Two-Wheelers

11.5.5.4 Electric Vehicles

11.5.6 Historic and Forecasted Market Size by Distribution Channel

11.5.6.1 Direct Sellers

11.5.6.2 Insurance Agents

11.5.6.3 Brokers

11.5.6.4 Online Platforms

11.5.7 Historic and Forecasted Market Size by Coverage

11.5.7.1 Third-Party Coverage

11.5.7.2 Own Damage Coverage

11.5.7.3 Fire and Theft Coverage

11.5.7.4 Personal Accident Coverage

11.5.8 Historic and Forecasted Market Size by End-User

11.5.8.1 Individuals

11.5.8.2 Corporates

11.5.8.3 Government

11.5.9 Historic and Forecasted Market Size by Vehicle Age

11.5.9.1 New Vehicles

11.5.9.2 Used Vehicle

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Vehicle Insurance Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Insurance Type

11.6.4.1 Comprehensive Insurance

11.6.4.2 Third-Party Insurance

11.6.4.3 Collision Insurance

11.6.4.4 Liability Insurance

11.6.5 Historic and Forecasted Market Size by Vehicle Type

11.6.5.1 Passenger Cars

11.6.5.2 Commercial Vehicles

11.6.5.3 Two-Wheelers

11.6.5.4 Electric Vehicles

11.6.6 Historic and Forecasted Market Size by Distribution Channel

11.6.6.1 Direct Sellers

11.6.6.2 Insurance Agents

11.6.6.3 Brokers

11.6.6.4 Online Platforms

11.6.7 Historic and Forecasted Market Size by Coverage

11.6.7.1 Third-Party Coverage

11.6.7.2 Own Damage Coverage

11.6.7.3 Fire and Theft Coverage

11.6.7.4 Personal Accident Coverage

11.6.8 Historic and Forecasted Market Size by End-User

11.6.8.1 Individuals

11.6.8.2 Corporates

11.6.8.3 Government

11.6.9 Historic and Forecasted Market Size by Vehicle Age

11.6.9.1 New Vehicles

11.6.9.2 Used Vehicle

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Vehicle Insurance Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Insurance Type

11.7.4.1 Comprehensive Insurance

11.7.4.2 Third-Party Insurance

11.7.4.3 Collision Insurance

11.7.4.4 Liability Insurance

11.7.5 Historic and Forecasted Market Size by Vehicle Type

11.7.5.1 Passenger Cars

11.7.5.2 Commercial Vehicles

11.7.5.3 Two-Wheelers

11.7.5.4 Electric Vehicles

11.7.6 Historic and Forecasted Market Size by Distribution Channel

11.7.6.1 Direct Sellers

11.7.6.2 Insurance Agents

11.7.6.3 Brokers

11.7.6.4 Online Platforms

11.7.7 Historic and Forecasted Market Size by Coverage

11.7.7.1 Third-Party Coverage

11.7.7.2 Own Damage Coverage

11.7.7.3 Fire and Theft Coverage

11.7.7.4 Personal Accident Coverage

11.7.8 Historic and Forecasted Market Size by End-User

11.7.8.1 Individuals

11.7.8.2 Corporates

11.7.8.3 Government

11.7.9 Historic and Forecasted Market Size by Vehicle Age

11.7.9.1 New Vehicles

11.7.9.2 Used Vehicle

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Vehicle Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 994.87 Billion |

|

Forecast Period 2024-32 CAGR: |

8.4% |

Market Size in 2032: |

USD 2,056.03 Billion |

|

Segments Covered: |

By Insurance Type |

|

|

|

By Vehicle Type |

|

||

|

By Distribution Channel |

|

||

|

By Coverage |

|

||

|

By End-User |

|

||

|

By Vehicle Age |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Vehicle Insurance Market research report is 2024-2032.

Allstate (USA), AXA (France), State Farm (USA), Allianz (Germany), Zurich (Switzerland), Progressive (USA), Generali (Italy), MetLife (USA), Berkshire Hathaway (USA), Chubb (USA), Liberty Mutual (USA), Munich Re (Germany), and Other Active Players.

The Vehicle Insurance Market is segmented into Insurance Type, Vehicle Type, Distribution Channel, Coverage, Vehicle Age, End User and region. By Insurance Type, the market is categorized into Comprehensive Insurance, Third-Party Insurance, Collision Insurance, Liability Insurance. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles, Two-Wheelers, Electric Vehicles. By Distribution Channel, the market is categorized into Direct Sellers, Insurance Agents, Brokers, Online Platforms. By Coverage, the market is categorized into Third-Party Coverage, Own Damage Coverage, Fire and Theft Coverage, Personal Accident Coverage. By End-User, the market is categorized into Individuals, Corporates, Government. By Vehicle Age, the market is categorized into New Vehicles, Used Vehicle. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The vehicle insurance market covers the financial service that insures against losses arising from automobiles events for instance an accident, theft, fire, and any harm. They include third party liability insurance, collision insurance, comprehensive insurance and liability insurance to lower the possibilities of losing lots of amount of money in case of several events.

Vehicle Insurance Market Size Was Valued at USD 994.87 Billion in 2023, and is Projected to Reach USD 2,056.03 Billion by 2032, Growing at a CAGR of 8.4% From 2024-2032.