Toilet Paper Market Synopsis

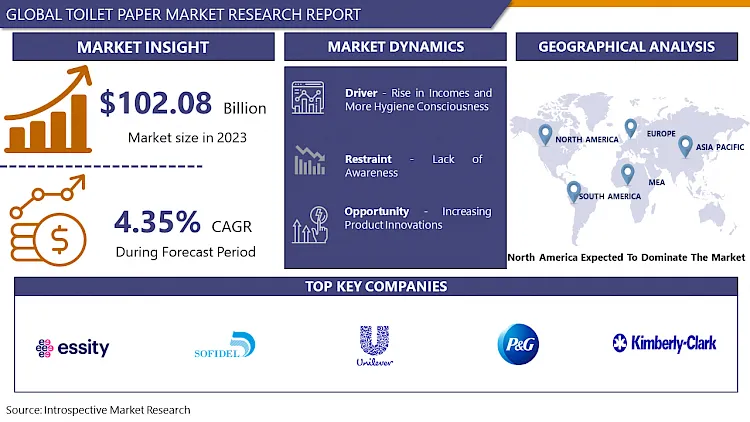

The Global Toilet Paper Market size was valued at USD 106.52 Billion in 2024 and is projected to reach USD 149.75 Billion by 2032, growing at a CAGR of 4.35% from 2025 to 2032.

Toilet paper also known as toilet roll is a type of tissue paper and is considered an essential item among tissue papers. Toilet paper has become a bathroom hygiene necessity in most developed countries. It is a multipurpose product and is mainly used in the toilet, for wiping up makeup and spills.

One of the most necessary commodities among all toilet goods is toilet paper. These papers are mainly separated into two groups, at home, and away from home, and the rise of the global market is being supported by booming demand from both categories.

In developed markets, premium products featuring embossed, ultra-soft, scented, and printed toilet toilets are becoming more popular. On the other hand, the prevalence of clogged septic systems is leading to an increase in flushable toilet paper use.

The development of online distribution channels has also helped the market for sanitary paper products grow. Due to cost or a lack of infrastructure, 70–75 percent of the world still doesn't use toilet paper.

Regular toilet paper is still used aboard the International Space Station, but it must be compressed and packed in specialized canisters. The Renova brand of toilet paper from Portugal is the priciest in the world.

Renova is available in a variety of hues, including black, red, blue, and green. It is three-ply, perfumed, and costs $3 per roll. Only red Renova toilet paper is used by Beyonce. Kris Jenner only ever uses the black Renova toilet. When asked what item they would bring to a desert island, 49% of respondents selected toilet paper before food in a recent survey.

Toilet Paper Market Trend Analysis

Toilet Paper Market Driving Factors- Rise in Incomes and More Hygiene Consciousness

- The demand for additional personal care and hygiene goods has increased as a result of rising income levels and a rise in hygiene awareness, which has helped the toilet paper industry grow. As consumers' spending power increases and their quality of life rises, more toilet paper of all kinds is sold. Further increases in pathogenic bacteria, microbes, and dirt have had a knock-on impact that has caused people to focus more on their personal hygiene and health.

- The market will expand more quickly in the upcoming years as a result of improved economic growth and rising health and hygiene concerns. The demand for additional personal care and hygiene goods has increased as a result of rising income levels and a rise in hygiene awareness, which has helped the toilet paper industry grow. As consumers' spending power increases and their quality of life rises, more toilet paper of all kinds is sold. Further increases in pathogenic bacteria, microbes, and dirt have had a knock-on impact that has caused people to focus more on their personal hygiene and health. The market will expand more quickly in the upcoming years as a result of improved economic growth and rising health and hygiene concerns.

- To lessen environmental damage brought on by plastic-based products, businesses recently produced sanitary paper products using sustainably derived resources like wood fiber and recycled paper pulp. The initiatives of these businesses will present fresher chances for market expansion. For example, Cascades Inc. introduced a new line of paper towels, toilet paper, and face wrapping composed of recycled fibers in April 2019. It is anticipated that the current market trends for toilet paper will support total product demand. Thus, the hygienic consciousness increases this factor driving the growth of the toilet paper market.

Toilet Paper Market Opportunity- Increasing Product Innovations

- Leading companies in the industry are launching innovative homecare and hygiene products to meet the needs of varied populations as a result of the increase in tissue and toilet paper usage across residential, healthcare, and office settings.

- The toilet paper market is becoming more diverse thanks to key premium brands with great absorbency, strength, and softness. Additionally, due to growing environmental concerns, items using eco-friendly and organic raw ingredients are being introduced to the market. Additionally, the demand for toilet paper will increase during the projected period due to governments around the world supporting public health.

- The epidemic and increasing number of internet users have contributed to a rise in demand for online purchases of various tissue and toilet paper goods. The trend is anticipated to continue in the upcoming years, and the toilet paper market is anticipated to expand more over the forecast period due to improvements in pack sizes and packaging with more ship-ready toilet paper goods. This increasing new innovation is increasing this creating major opportunities for the toilet paper market.

Toilet Paper Market Materials and Services Market

Toilet Paper market segments cover the Type, application, and end-users. By Type, the two-ply segment is Anticipated to Dominate the Market Over the Forecast period.

- The market is divided into one, two, and other segments based on the number of plies. Tissue strength increases as the number of plies rises.

- As a result, more individuals are searching for items with 3, 4, and 5 plies. In a study conducted by the Consumer Council-Hong Kong, 4-ply toilet paper rolls were found to be stronger than tested 3-ply versions. However, the cost of the final product rises as the number of plies does.

- As a result, the two-ply sector is predicted to dominate the market since it has a good balance of strength and softness and can be purchased for a reasonable price. Since it is often less expensive than 3-ply toilet paper, 2 ply toilet paper is frequently seen as the more cost-effective choice. However, some people believe that 2-ply toilet paper is weaker and more likely to shred.

- With two layers of cushioning, the two-ply paper has an extra layer that often makes it stronger and slightly softer. Since it just has one layer, 1 ply toilet paper is often the weakest of all types, but it also disintegrates the quickest.

Regional Analysis of the Toilet Paper Market

North America is Expected to Dominate the Market Over the Forecast Period.

- In terms of revenue, the U.S. dominated the North American market in 2021. In the United States, pulp and papermakers put in extra hours to keep stores stocked because over 90% of the toilet paper consumers buy is produced on their own property, according to a blog post by Alliance of American Manufacturing.

- Due to expanding tourism and the hospitality industries, as well as growing public awareness of health and cleanliness, North America dominates the global market for tissue paper.

- Asia Pacific is also the largest producer of the raw materials required to make toilet paper, and it is predicted that it would expand at the quickest CAGR throughout the projected period.

- The fastest growth rate is anticipated to occur in the Asia-Pacific area as a result of rising disposable incomes, rapid urbanization, and increased awareness of personal hygiene.

Top Key Players Covered in Toilet Paper Market

- Procter & Gamble Co. (U.S.)

- Kimberly-Clark (U.S.)

- Essity AB (Sweden)

- Georgia-Pacific LLC (U.S.)

- Hengan Group (China)

- Sofidel Group (Italy)

- Kruger Inc. (Canada)

- Empresas CMPC S.A (Chile)

- WEPA Hygieneprodukte GmbH (Germany)

- Unilever (U.K.)

- ABC Tissue (Australia)

- Suzano (Brazil)

- Absormex CMPC Tissue (U.S)

- Caprice Paper Products Pty. Ltd. (Australia), and Other Active Players.

Key Industry Developments in the Toilet Paper Market:

- In April 2024, Atlanta - Georgia-Pacific announced an investment of more than $150 million to rebuild a paper machine at its mill in Wauna, Oregon. This investment rebuilt a 1965-vintage paper machine into a world-class machine for producing paper for Angel Soft® and strategic private label bath tissue. This modernization project positioned the mill and the overall business to remain competitive in the market.

- In March 2024, Kruger Products Inc., a company in which KP Tissue Inc. announced a major increase in its production of Scotties® facial tissues at its Richelieu Plant in Gatineau, Québec. The announcement was made in the presence of Christopher Skeete, Québec Minister for the Economy. Through this expansion project, which received investments totaling $14.5 million and created 16 jobs, Kruger Products commissioned a new facial tissue converting line at its Richelieu Plant in November 2023. The additional equipment increased the production of facial tissue by 25%.

|

Global Toilet Paper Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 106.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.35% |

Market Size in 2032: |

USD 149.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Toilet Paper Market by Type (2018-2032)

4.1 Toilet Paper Market Snapshot and Growth Engine

4.2 Market Overview

4.3 One-ply

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Two-ply

4.5 Others

Chapter 5: Toilet Paper Market by Distribution Channel (2018-2032)

5.1 Toilet Paper Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offline

Chapter 6: Toilet Paper Market by Application (2018-2032)

6.1 Toilet Paper Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Household

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Healthcare

6.5 Hospitality

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Toilet Paper Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CEMOI CHOCOLATIER (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 REPUBLICA DEL CACAO (ECUADOR)

7.4 NESTLÉ S.A. (SWITZERLAND)

7.5 MARS INCORPORATED (U.S.)

7.6 FUJI OIL HOLDINGS INC. (JAPAN)

7.7 GUITTARD CHOCOLATE CO. (U.S.)

7.8 GHIRARDELLI CHOCOLATE CO. (U.S.)

7.9 VARIHONA INC. (FRANCE)

7.10 BARRY CALLEBAUT AG (SWITZERLAND)

7.11 ALPEZZI CHOCOLATE SA DE CV (MEXICO)

7.12 KERRY GROUP PLC (IRELAND)

7.13 OLAM INTERNATIONAL LTD. (SINGAPORE)

7.14 TCHO VENTURES INC. (U.S.)

7.15 THE HERSHEY COMPANY (U.S.)

7.16 CARGILL INCORPORATED (U.S.)

7.17 BLOMMER CHOCOLATE COMPANY (U.S.)

7.18 FOLEY'S CANDIES LP (CANADA)

7.19 PURATOS GROUP NV (BELGIUM)

7.20 FERRERO INTERNATIONAL S.A. (ITALY)

7.21 MARS INC

7.22 (U.S.)

7.23 MONDELEZ INTERNATIONAL (U.S.)

7.24 MEIJI CO LTD (JAPAN)

7.25 LINDT

7.26 RITTER SPORT (SWITZERLAND)

7.27 AMUL

7.28 BLOMMER CHOCOLATE COMPANY (INDIA)

7.29 BROOKSIDE FOODS (CANADA)

7.30 CHOCOLATE FREY (SWITZERLAND)

7.31 EZAKI GLICO (JAPAN)

Chapter 8: Global Toilet Paper Market By Region

8.1 Overview

8.2. North America Toilet Paper Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 One-ply

8.2.4.2 Two-ply

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Distribution Channel

8.2.5.1 Online

8.2.5.2 Offline

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Household

8.2.6.2 Healthcare

8.2.6.3 Hospitality

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Toilet Paper Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 One-ply

8.3.4.2 Two-ply

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Distribution Channel

8.3.5.1 Online

8.3.5.2 Offline

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Household

8.3.6.2 Healthcare

8.3.6.3 Hospitality

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Toilet Paper Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 One-ply

8.4.4.2 Two-ply

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Distribution Channel

8.4.5.1 Online

8.4.5.2 Offline

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Household

8.4.6.2 Healthcare

8.4.6.3 Hospitality

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Toilet Paper Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 One-ply

8.5.4.2 Two-ply

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Distribution Channel

8.5.5.1 Online

8.5.5.2 Offline

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Household

8.5.6.2 Healthcare

8.5.6.3 Hospitality

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Toilet Paper Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 One-ply

8.6.4.2 Two-ply

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Distribution Channel

8.6.5.1 Online

8.6.5.2 Offline

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Household

8.6.6.2 Healthcare

8.6.6.3 Hospitality

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Toilet Paper Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 One-ply

8.7.4.2 Two-ply

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Distribution Channel

8.7.5.1 Online

8.7.5.2 Offline

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Household

8.7.6.2 Healthcare

8.7.6.3 Hospitality

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Toilet Paper Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 106.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.35% |

Market Size in 2032: |

USD 149.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||