Surgical Tubing Market Synopsis

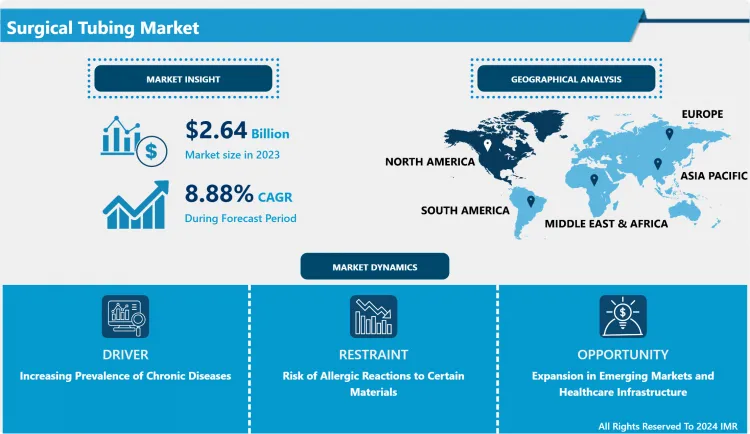

Surgical Tubing Market Size is Valued at USD 2.64 Billion in 2023, and is Projected to Reach USD 5.22 Billion by 2032, Growing at a CAGR of 8.88% From 2024-2032.

The global Surgical Tubing is actually the market of flexible and rugged tubes which are being used in surgeries and other medical needs. These tubes are widely used for fluids’ transfer, drainages and connecting medical instruments, can be made from materials such as PVC, polyurethane and silicone. The main drivers for the market are advancement in medical technology and the rising trend of minimally invasive procedures to be performed the rising demand for safe and efficient surgeries.

- The major actors stimulating the Sales of Surgical Tubing are the growing prevalence of illnesses, as well as the related boost in operations. With healthcare systems all over the world seeking ways to offer better patients’ outcome, better and more enhanced surgical instruments and equipments are being required. Surgical advancement and development of minimally invasive surgeries require the application of appropriate tubing technology to meet precise and safe surgery requirements. In addition, growing prevalence of surgery and aging population is likely to drive the growth of surgical robotics market.

- Another considerable factor consists in the increase of healthcare centers and the development of the healthcare sector in the countries of the third world. We find that, with countries investing in the welfare of their nations, the overall enhancement of their health care system, the surgical tubing plays a significant role since other related surgical tools are being developed. Further, the availability of technologically superior material in the tubing range is due to the constant growth in the field of material science that enables tubing to provide high performance with more biocompatibility and flexibility according to the requirements of the surgeons and other doctors.

Surgical Tubing Market Trend Analysis

Shift towards biocompatible materials

- The revelation of biocompatibility is today one of the most popular trends in the development of the Surgical Tubing Market. Surgical tubing products have gained the focus of manufacturers to produce the products and materials that will not hurt the patients. Another current that is actively developing is the use of biodegradable and environmentally friendly materials, meeting the general trend of sustainable development of the healthcare sector. It not only makes patient safety more reliable but also brings out better performances to surgery overall.

- One more trend can be mentioned which effects the market – that is, the increased utilization of digital solutions in the sphere of healthcare, including telemedicine and remote monitoring. These advancement requires the development of new and sophisticated surgical tubing solutions that can conform with the existing advanced medical devices. With the healthcare providers attempting to enhance their operational productivity and quality of patient care the market for the surgical tubing that is capable of supporting such technologies is increasing venturing into the future of the surgical tubing market.

Emerging Economies Where Healthcare Infrastructure Is Rapidly Evolving

- This is so because the Surgical Tubing Market is greatly embedded with many opportunities especially within the developing nations with the advanced healthcare system. Growing interest in the healthcare infrastructure and the continued occurrences of chronic diseases related to lifestyles provide opportunities for the growth of the market. This is because manufacturers who are able to develop unique products that fit the needs of individual markets such as cost effective and quality surgical tubing can easily set down roots and hence foster growth of the market.

- In addition, market relationships and affiliations between tubing manufacturers and medical device manufacturers can pose significant opportunities for change. It points to the fact that these entities can develop new surgical solutions that improve the effectiveness and safety of surgical procedures when joined in efforts. Such approach may culminate into the creation of products that respond to orders of the day of different surgical specialties, a factor that enables participants in the Surgical Tubing Market to cherish competitiveness.

Surgical Tubing Market Segment Analysis:

Surgical Tubing Market Segmented on the basis of Material type, Product Type, application, and end-users.

By Material Type, Polyvinyl Chloride (PVC) segment is expected to dominate the market during the forecast period

- The Surgical Tubing Market has been categorized based on material type, and there includes options like Polyvinyl Chloride (PVC), Polyurethane (PU), Silicone, Natural Rubber, and other materials. PVC is preferred due to its ubiquity and economic viability not just to mention the mechanical characteristics embraced by many industries. Polyurethane provides improved performance in application where toughness and flexibility are required over criticalty and silicone provides biocompatibility and excellent thermal stability for application such as medical. Natural rubber is desirable for its high degree of extensibility and its elasticity or shock absorbing capacity but has some drawbacks or draw-backs such as possible allergic reactions. Such other materials can be specialty plastics or compounds that are intended to achieve the certain regulatory policies or performance indicators required by the surgical market.

By Application, Cardiovascular Surgery segment held the largest share in 2024

- The Surgical Tubing Market is divided by application and includes Cardiovascular, Orthopedic, Neuro, Gen, and other surgical applications. Another application in cardiovascular surgery is specialized tubing for, for example, angioplasty, and bypass surgery – applications where the fluid mechanics are paramount. Surgical tubing in orthopedic surgery comprises of uses such as reconstruction and fixture in which strength and durability are crucial. Specialised tubing may be needed for the neurosurgery application as the tubing used needs to compatible with the biological setting and flexible as it will be used during nervous system related procedures. General surgery includes a large number of operations that may require different kinds of surgical tubing for operations such as drainage or fluid transfer. Furthermore, other assorted applications involve meticulous fields that may be related to gastroenterology or urology respectively due to the flexibility of surgical tubing.

Surgical Tubing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- At present, North America rules the Surgical Tubing Market because of better healthcare amenities, and increasing rates of chronic diseases requiring surgery. The region has a very good healthcare infrastructure base, followed by high investment in research and developmental activities. In addition to this, key player in the region are constantly developing innovating and encouraging the use of new technologies in order to come up with better quality surgical tubing products that are able to meet the varying medical needs.

- Further, the North America market leads the global smart pill dispenser market due to the embracement of more advanced patient safety measures and the subsequent, strict accomplishment of the regulatory standards. Surgical procedures are getting to be more and complex and the healthcare providers are using complex tubes which must be biocompatible. Specifically for Surgical Tubing Market, it is evident that North America would continue to dominate the market owing to the increasing awareness for less invasive surgeries and the market’s future prospects appears to be incredibly stable for continued expansion.

Active Key Players in the Surgical Tubing Market

- B. Braun Melsungen AG (Germany)

- Medtronic plc (Ireland)

- Fisher Scientific (United States)

- Teleflex Incorporated (United States)

- Boston Scientific Corporation (United States)

- Abbott Laboratories (United States)

- Smiths Medical (United Kingdom)

- Terumo Corporation (Japan)

- ConvaTec Group PLC (United Kingdom)

- Halyard Health, Inc. (United States)

- Others

Global Surgical Tubing Market Scope:

|

Global Surgical Tubing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.88 % |

Market Size in 2032: |

USD 5.22 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

B. Braun Melsungen AG (Germany), Medtronic plc (Ireland), Fisher Scientific (United States), Teleflex Incorporated (United States), Boston Scientific Corporation (United States), Abbott Laboratories (United States), Smiths Medical (United Kingdom), Terum, Corporation (Japan), ConvaTec Group PLC (United Kingdom) Halyard Health, Inc. (United States), and Other Major Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Tubing Market by Material Type (2018-2032)

4.1 Surgical Tubing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polyvinyl Chloride (PVC)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polyurethane (PU)

4.5 Silicone

4.6 Natural Rubber

4.7 Others

Chapter 5: Surgical Tubing Market by Product Type (2018-2032)

5.1 Surgical Tubing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Medical Grade Tubing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-Medical Grade Tubing

Chapter 6: Surgical Tubing Market by Application (2018-2032)

6.1 Surgical Tubing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cardiovascular Surgery

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Orthopedic Surgery

6.5 Neurosurgery

6.6 General Surgery

6.7 Others

Chapter 7: Surgical Tubing Market by End user (2018-2032)

7.1 Surgical Tubing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Ambulatory Surgical Centers (ASCs)

7.5 Specialty Clinics

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Surgical Tubing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 B. BRAUN MELSUNGEN AG (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MEDTRONIC PLC (IRELAND)

8.4 FISHER SCIENTIFIC (UNITED STATES)

8.5 TELEFLEX INCORPORATED (UNITED STATES)

8.6 BOSTON SCIENTIFIC CORPORATION (UNITED STATES)

8.7 ABBOTT LABORATORIES (UNITED STATES)

8.8 SMITHS MEDICAL (UNITED KINGDOM)

8.9 TERUMO CORPORATION (JAPAN)

8.10 CONVATEC GROUP PLC (UNITED KINGDOM)

8.11 HALYARD HEALTH INC. (UNITED STATES)

8.12 OTHERS

Chapter 9: Global Surgical Tubing Market By Region

9.1 Overview

9.2. North America Surgical Tubing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Material Type

9.2.4.1 Polyvinyl Chloride (PVC)

9.2.4.2 Polyurethane (PU)

9.2.4.3 Silicone

9.2.4.4 Natural Rubber

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Product Type

9.2.5.1 Medical Grade Tubing

9.2.5.2 Non-Medical Grade Tubing

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Cardiovascular Surgery

9.2.6.2 Orthopedic Surgery

9.2.6.3 Neurosurgery

9.2.6.4 General Surgery

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by End user

9.2.7.1 Hospitals

9.2.7.2 Ambulatory Surgical Centers (ASCs)

9.2.7.3 Specialty Clinics

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Surgical Tubing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Material Type

9.3.4.1 Polyvinyl Chloride (PVC)

9.3.4.2 Polyurethane (PU)

9.3.4.3 Silicone

9.3.4.4 Natural Rubber

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Product Type

9.3.5.1 Medical Grade Tubing

9.3.5.2 Non-Medical Grade Tubing

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Cardiovascular Surgery

9.3.6.2 Orthopedic Surgery

9.3.6.3 Neurosurgery

9.3.6.4 General Surgery

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by End user

9.3.7.1 Hospitals

9.3.7.2 Ambulatory Surgical Centers (ASCs)

9.3.7.3 Specialty Clinics

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Surgical Tubing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Material Type

9.4.4.1 Polyvinyl Chloride (PVC)

9.4.4.2 Polyurethane (PU)

9.4.4.3 Silicone

9.4.4.4 Natural Rubber

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Product Type

9.4.5.1 Medical Grade Tubing

9.4.5.2 Non-Medical Grade Tubing

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Cardiovascular Surgery

9.4.6.2 Orthopedic Surgery

9.4.6.3 Neurosurgery

9.4.6.4 General Surgery

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by End user

9.4.7.1 Hospitals

9.4.7.2 Ambulatory Surgical Centers (ASCs)

9.4.7.3 Specialty Clinics

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Surgical Tubing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Material Type

9.5.4.1 Polyvinyl Chloride (PVC)

9.5.4.2 Polyurethane (PU)

9.5.4.3 Silicone

9.5.4.4 Natural Rubber

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Product Type

9.5.5.1 Medical Grade Tubing

9.5.5.2 Non-Medical Grade Tubing

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Cardiovascular Surgery

9.5.6.2 Orthopedic Surgery

9.5.6.3 Neurosurgery

9.5.6.4 General Surgery

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by End user

9.5.7.1 Hospitals

9.5.7.2 Ambulatory Surgical Centers (ASCs)

9.5.7.3 Specialty Clinics

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Surgical Tubing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Material Type

9.6.4.1 Polyvinyl Chloride (PVC)

9.6.4.2 Polyurethane (PU)

9.6.4.3 Silicone

9.6.4.4 Natural Rubber

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Product Type

9.6.5.1 Medical Grade Tubing

9.6.5.2 Non-Medical Grade Tubing

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Cardiovascular Surgery

9.6.6.2 Orthopedic Surgery

9.6.6.3 Neurosurgery

9.6.6.4 General Surgery

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by End user

9.6.7.1 Hospitals

9.6.7.2 Ambulatory Surgical Centers (ASCs)

9.6.7.3 Specialty Clinics

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Surgical Tubing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Material Type

9.7.4.1 Polyvinyl Chloride (PVC)

9.7.4.2 Polyurethane (PU)

9.7.4.3 Silicone

9.7.4.4 Natural Rubber

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Product Type

9.7.5.1 Medical Grade Tubing

9.7.5.2 Non-Medical Grade Tubing

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Cardiovascular Surgery

9.7.6.2 Orthopedic Surgery

9.7.6.3 Neurosurgery

9.7.6.4 General Surgery

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by End user

9.7.7.1 Hospitals

9.7.7.2 Ambulatory Surgical Centers (ASCs)

9.7.7.3 Specialty Clinics

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Global Surgical Tubing Market Scope:

|

Global Surgical Tubing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.88 % |

Market Size in 2032: |

USD 5.22 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

B. Braun Melsungen AG (Germany), Medtronic plc (Ireland), Fisher Scientific (United States), Teleflex Incorporated (United States), Boston Scientific Corporation (United States), Abbott Laboratories (United States), Smiths Medical (United Kingdom), Terum, Corporation (Japan), ConvaTec Group PLC (United Kingdom) Halyard Health, Inc. (United States), and Other Major Players. |

||

Frequently Asked Questions :

The forecast period in the Surgical Tubing Market research report is 2024-2032.

B. Braun Melsungen AG (Germany), Medtronic plc (Ireland), Fisher Scientific (United States), Teleflex Incorporated (United States), Boston Scientific Corporation (United States), Abbott Laboratories (United States), Smiths Medical (United Kingdom), Terum, Corporation (Japan), ConvaTec Group PLC (United Kingdom), Halyard Health, Inc. (United States), and Other Major Players. and Other Major Players.

The Surgical Tubing Market is segmented into by Material Type (Polyvinyl Chloride (PVC), Polyurethane (PU), Silicone, Natural Rubber, Others), By Product Type (Medical Grade Tubing, Non-Medical Grade Tubing), By application (Cardiovascular Surgery, Orthopedic Surgery, Neurosurgery, General Surgery, Others), End-User (Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The global Surgical Tubing is actually the market of flexible and rugged tubes which are being used in surgeries and other medical needs. These tubes are widely used for fluids’ transfer, drainages and connecting medical instruments, can be made from materials such as PVC, polyurethane and silicone. The main drivers for the market are advancement in medical technology and the rising trend of minimally invasive procedures to be performed the rising demand for safe and efficient surgeries.

Surgical Tubing Market Size is Valued at USD 2.64 Billion in 2023, and is Projected to Reach USD 5.22 Billion by 2032, Growing at a CAGR of 8.88% From 2024-2032.