Surgical Site Infection Market Synopsis

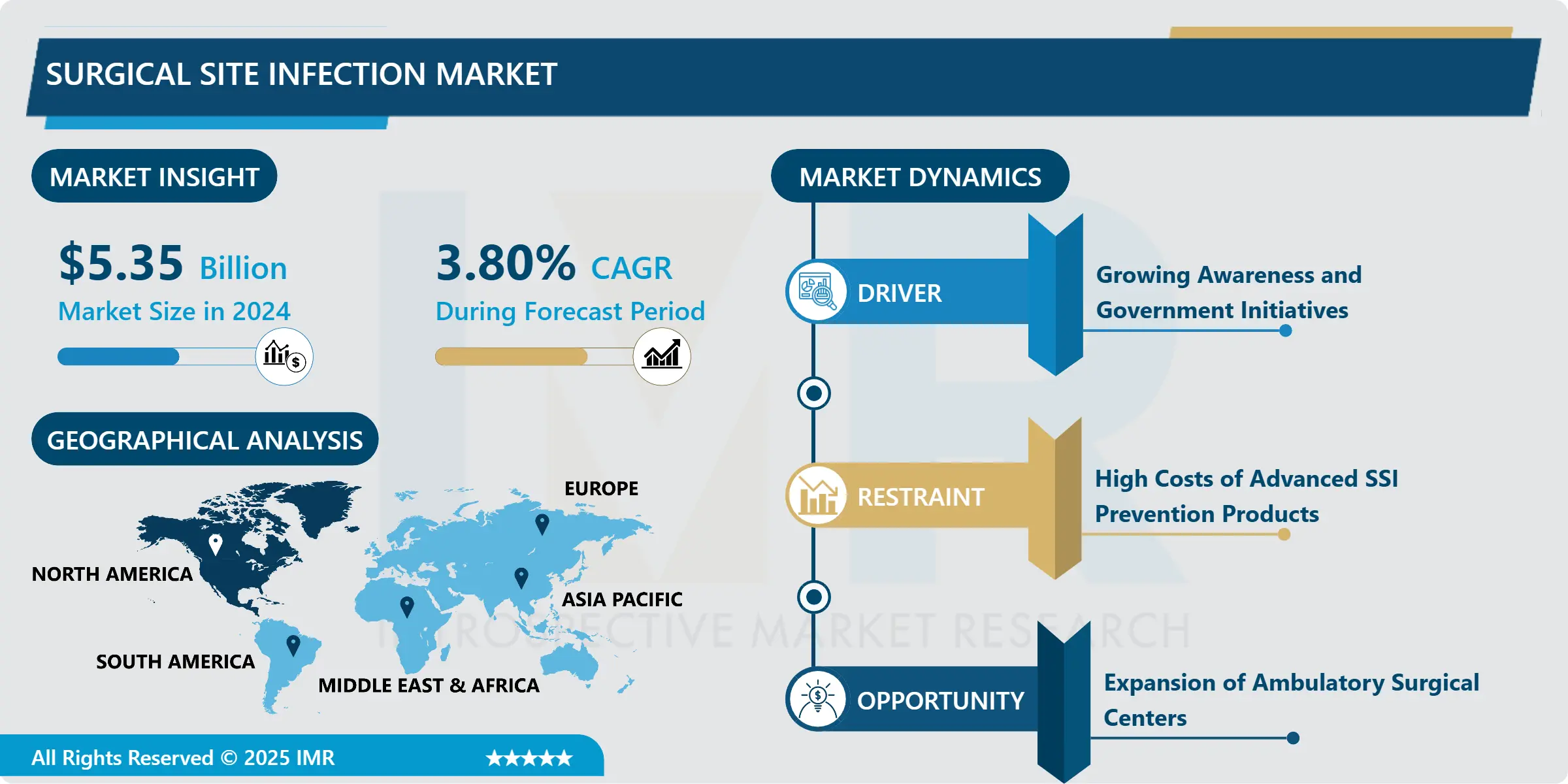

Surgical Site Infection Market Size Was Valued at USD 5.35 Billion in 2024, and is Projected to Reach USD 7.20 Billion by 2032, Growing at a CAGR of 3.80% From 2025-2032.

The Surgical Site Infection (SSI) market encompasses the range of products, services, and technologies aimed at preventing, diagnosing, and treating infections that occur at or near the surgical incision site within 30 days of surgery (or within one year if an implant is placed). This market includes antiseptics, antibiotics, advanced wound care products, diagnostic tools, sterilization equipment, and various surgical instruments designed to minimize infection risk. It also covers the development and implementation of infection control protocols, surveillance systems, and educational programs to reduce the incidence of SSIs, which are significant contributors to post-surgical morbidity and healthcare costs.

The surgical site infection (SSI) market is a vital area of the global healthcare industry, driven by the increasing incidence of infections following surgical procedures. Medical personnel face significant challenges as a result of these surgical site infections, which can lead to increased hospital admissions, higher medical costs, and in severe cases, patient mortality. The market is fueled by variables like the rise in chronic illness cases, the number of surgical procedures performed globally, and the general public's growing knowledge of infection control practices.

The global market for surgical supplies is segmented according to the kind of product. Surgical drapes, surgical gloves, surgical scrubs, antiseptics, and more are among them. Much of these might be attributed to the crucial function that antiseptics and disinfectants play in preoperative and postoperative care. Geographically, due to its advanced healthcare system, high cost of care, and stringent regulatory frameworks, North America dominates the market, followed by Europe. However, it is anticipated that emerging nations in the Asia-Pacific region will experience significant growth due to rising healthcare costs and the cost of surgery.

Technological advancements have a big impact on the SSI industry. Innovations such as advanced wound care products, infection surveillance systems, and microorganism-coated sutures are improving the effectiveness of wound care strategies. Usingshare.

A couple of challengesless invasive surgical techniques also reduces the risk of infection, which encourages market growth. Major industry players are focusing on research and development in order to introduce new goods and enhance their market confronting the SSI market are the emergence of antibiotic-resistant germs and the high expense of advanced infection control equipment. In addition to continuing research and development costs, industry players, lawmakers, and healthcare providers must work together to address these concerns. All things considered, the market for surgical sutures (SSIs) is anticipated to grow as a result of the persistent need for effective infection control methods and the continuous advancement of medical techniques.

Surgical Site Infection Market Trend Analysis

Surgical Site Infection Market Drivers- Rising Cesarean Sections and Their Impact on the Surgical Site Infection Control Market

- The increasing number of surgeries conducted worldwide, particularly cesarean sections (C-sections), has led to a growing demand for surgical site infection (SSI) management techniques. Cesarean sections rank among the most common surgical procedures performed worldwide, and their frequency has been steadily rising. This increase is attributed to a number of factors, including an increase in the prevalence of obesity, older moms, and increased use of assisted reproductive technologies. Because of the huge number of C-sections performed annually, infection management in these surgeries is a concern because even a small percentage of infections can result in a considerable number of cases. Infections following cesarean sections can have major consequences for both the mother and the child, necessitating extended hospital stays, therapies, and increased costs.

- Intrinsic characteristics of C-sections increase the risk of infection. The surgery site is particularly vulnerable because of the lower abdominal and uterine incisions, which are prone to bacterial contamination from the gastrointestinal and vaginal systems. Moreover, the procedure weakens the natural defenses of the uterine wall and skin, creating an opening for infections. Because of this, the market for SSI control is now mostly concentrated on SSI prevention following C-sections. Hospitals and healthcare practitioners are increasingly using comprehensive infection control methods, like prophylactic antibiotics, antiseptics, and high-tech surgical drapes and gowns, to lower the risk of infection. Along with rigorous attention to infection control and hygiene standards, these activities are essential for reducing the prevalence of SSIs and improving patient outcomes following C-section deliveries.

Surgical Site Infection Market Opportunity- Increasing Emphasis on Antibiotic Prophylaxis in Surgical Site Infection Control

- One important development in the surgical site infection (SSI) control market is the emphasis on antibiotic prophylaxis. Antibiotic prophylactic solutions control the majority of the market because they are crucial for preventing surgical site infections (SSIs) by ensuring that the right doses of antibiotics are present in the tissue at the earliest stages of potential bacterial contamination. The effectiveness of antibiotic prophylaxis is greatly influenced by the selection and timing of the antibiotic. It is often injected no later than sixty minutes before the surgical incision in order to maximize tissue concentrations at the moment when contamination risk is maximum. This approach is critical for high-risk surgical operations such as orthopedic and colorectal procedures, where specific drugs are selected using the most common bacteria associated with these procedures. The dominance of the market in terms of antibiotic prophylaxis products is supported by continuous advancements and modifications to clinical guidelines that maximize their use in various surgical operations.

- Prominent medical associations have developed new guidelines and standards that have bolstered the effort to optimize antibiotic use. For instance, comprehensive guidelines for antibiotic prophylaxis have been developed in collaboration with the American Association for the Surgery of Trauma, the World Surgical Infection Society Europe, and other international health organizations. These suggestions emphasize the importance of individualized antibiotic regimens for different surgical procedures, including the type of procedure, the patient's risk profile, and local patterns of germ resistance. This tactic not only helps prevent SSIs but also lessens the possibility of antibiotic resistance, which is a growing concern in the healthcare industry. As a result of these recommendations, the surgical site infection rate has decreased and overall surgical operation results have improved as the industry has developed more specialized and potent antibiotic prophylactic remedies.

Surgical Site Infection Market Segment Analysis:

Surgical Site Infection Market Segmented based on By Product Types and By Applications

By Product Types, Intraoperative Phasesegment is expected to dominate the market during the forecast period

- Within the medical field, the intraoperative phase of surgery is critical and involves a wide range of specialized equipment meant to ensure the smooth execution of surgeries. Essentially, this phase entails employing state-of-the-art surgical tools made for specific procedures, ranging from forceps and scalpels to more sophisticated tools like retractors and electrocautery apparatus. Surgeons can perform intricate surgeries as precisely and quickly as possible with the help of this meticulously crafted equipment. Furthermore, anesthetic supplies are critical at this point because they ensure the patient's comfort and safety throughout the process. These include medications, monitoring systems that help regulate vital signs, and equipment that administer anesthesia in accordance with a patient's needs.Furthermore, technological advancements like surgical navigation systems have significantly enhanced the intraoperative period. These systems provide real-time support to surgeons during surgeries, enabling more precise navigation of complex anatomical structures, by integrating imaging technologies like CT and MRI scans. These innovations reduce the risk of invasive procedures, shorten operating times, and improve surgical outcomes. Consequently, the market for intraoperative goods is expanding due to the demand for minimally invasive treatments and the extensive usage of state-of-the-art medical technologies in healthcare facilities worldwide. The category's domination emphasizes how important it is in modern surgical operations, where patient safety, accuracy, and efficiency are of the utmost importance.

By Applications, Hospitals segment held the largest share in 2024

- Hospitals are the cornerstone of healthcare delivery, and because of their varied responsibilities in patient care, research, and education, they drive significant demand for surgical items throughout all stages. Hospitals provide a wide range of surgical needs, from simple operations to complicated surgeries needing specialized tools and equipment. They are the main providers of all-inclusive medical care. A wide range of surgical products, such as but not limited to diagnostic instruments, surgical implants, operating room equipment, and postoperative care supplies, are required due to the hospital's extensive range of services. This all-inclusive need is a result of hospitals' ability to treat a wide range of illnesses and surgical procedures, providing patients with a variety of healthcare requirements under one roof.

- Hospitals' large volume of surgical procedures also contributes to their dominance in the surgical goods market. These facilities do a great deal of surgery every day in a variety of specialties, including neurosurgery, orthopedics, cardiology, and more. The need for specialist surgical items is further increased by the fact that each specialization has distinct procedural needs that call for certain surgical equipment and technologies. Furthermore, hospitals' status as hubs for medical innovation and scholarly inquiry promotes ongoing improvements in surgical methods and apparatus, thereby sustaining the demand for cutting-edge goods that improve procedure results and patient safety. Hospitals play a crucial role in the delivery of healthcare, and their substantial market share in surgical products essentially reflects this. Their integration of cutting-edge technologies and comprehensive surgical solutions highlights their dedication to delivering high-quality care and achieving optimal patient outcomes.

Surgical Site Infection Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the market leader for surgical site infections (SSIs), mostly due to its sophisticated healthcare infrastructure, high rates of healthcare spending, and strict adherence to infection control procedures. With programs run by institutions like the Centers for Disease Control and Prevention (CDC), the United States, in particular, has a well-established system for keeping an eye on and preventing SSIs. The National Healthcare Safety Network (NHSN) is one of these programs; it gathers information on infections linked to healthcare and gives healthcare facilities instructions for infection prevention and control. Prominent industry participants, like 3M, Johnson & Johnson, and Becton, Dickinson and Company, consistently allocate resources towards research and development, thereby augmenting the accessibility and effectiveness of goods designed to prevent and cure stroke. Strong patient and healthcare professional knowledge of the value of infection control methods is also essential to the market's expansion. In addition, organizations such as the Joint Commission implement strict certification requirements and regulations that guarantee adherence to infection control best practices, which lowers SSI rates and increases market demand.

- The need for SSI prevention and treatment products is further fueled by the aging population and rising incidence of chronic conditions including diabetes and obesity in North America, which are driving an increase in surgical operations. A higher risk of surgical site infections (SSIs) results from a rise in the incidence of disorders needing surgical interventions as the population ages, including orthopedic surgery and cardiovascular procedures. Robust infection control strategies are necessary since surgical outcomes are typically complicated by chronic conditions. The industry is also developing as a result of improvements in surgical procedures and the increasing use of minimally invasive surgeries, which necessitate strict infection control protocols despite lowering overall surgical stress. The market is also stimulated by the healthcare sector's emphasis on lowering hospital stays and improving patient outcomes through efficient SSI management, which is in line with larger public health objectives. The introduction of sophisticated wound dressings and sutures coated with microbes has led to continual technological developments, which have made the North American SSI market well-positioned to grow steadily and meet the changing demands of the healthcare system.

Active Key Players in the Surgical Site Infection Market

- 3M Company

- Paul Hartmann AG

- CareFusion Coporation (Becton, Dickinson and Company)

- Lac-Mac Limited

- B. Braun Melsungen AG

- Medtronic Plc

- Covalon Technologies Ltd.

- Johnson & Johnson

- Getinge Group

- Belimed AG

- Ansell Limited

- SSIP, LLC

- Steris PLC

- Stryker Corporation

- Other Active Players

|

Global Surgical Site Infection Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.35 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.80% |

Market Size in 2032: |

USD 7.20 Bn. |

|

Segments Covered: |

By Product Types |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Site Infection Market by Product Types (2018-2032)

4.1 Surgical Site Infection Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Intraoperative Phase

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Preoperative Phase

4.5 Postoperative Phase

Chapter 5: Surgical Site Infection Market by Applications (2018-2032)

5.1 Surgical Site Infection Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ambulatory Surgical Centers (ASCs)

5.5 Clinics

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Surgical Site Infection Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 A-DEC INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 GETINGE AB (EUROPE)

6.4 HERBERT WALDMANN GMBH & CO. KG (GERMANY)

6.5 INTEGRA LIFESCIENCES CORPORATION (UNITED STATES)

6.6 KLS MARTIN GROUP (GERMANY)

6.7 KONINKLIJKE PHILIPS N.V. (EUROPE)

6.8 S.I.M.E.O.N. MEDICAL GMBH & CO. KG (GERMANY)

6.9 SKYTRON LLC (UNITED STATES)

6.10 HILL-ROM HOLDINGS INC. (UNITED STATES)

6.11 DR. MACH GMBH & CO. KG (GERMANY)

6.12 BOVIE MEDICAL CORPORATION (UNITED STATES)

6.13 DRE MEDICAL (AVANTE HEALTH SOLUTIONS) (UNITED STATES)

6.14 STRYKER CORPORATION (UNITED STATES)

6.15 TRUMPF MEDICAL (PART OF HILL-ROM HOLDINGS INC.) (GERMANY)

6.16 STARKSTROM (PART OF BRANDON MEDICAL) (UNITED KINGDOM)

6.17 MERIVAARA CORP. (FINLAND)

6.18 MINDRAY MEDICAL INTERNATIONAL LIMITED (CHINA)

6.19 WELCH ALLYN INC. (UNITED STATES)

6.20 STERIS PLC (UNITED KINGDOM)

6.21

Chapter 7: Global Surgical Site Infection Market By Region

7.1 Overview

7.2. North America Surgical Site Infection Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Types

7.2.4.1 Intraoperative Phase

7.2.4.2 Preoperative Phase

7.2.4.3 Postoperative Phase

7.2.5 Historic and Forecasted Market Size by Applications

7.2.5.1 Hospitals

7.2.5.2 Ambulatory Surgical Centers (ASCs)

7.2.5.3 Clinics

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Surgical Site Infection Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Types

7.3.4.1 Intraoperative Phase

7.3.4.2 Preoperative Phase

7.3.4.3 Postoperative Phase

7.3.5 Historic and Forecasted Market Size by Applications

7.3.5.1 Hospitals

7.3.5.2 Ambulatory Surgical Centers (ASCs)

7.3.5.3 Clinics

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Surgical Site Infection Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Types

7.4.4.1 Intraoperative Phase

7.4.4.2 Preoperative Phase

7.4.4.3 Postoperative Phase

7.4.5 Historic and Forecasted Market Size by Applications

7.4.5.1 Hospitals

7.4.5.2 Ambulatory Surgical Centers (ASCs)

7.4.5.3 Clinics

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Surgical Site Infection Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Types

7.5.4.1 Intraoperative Phase

7.5.4.2 Preoperative Phase

7.5.4.3 Postoperative Phase

7.5.5 Historic and Forecasted Market Size by Applications

7.5.5.1 Hospitals

7.5.5.2 Ambulatory Surgical Centers (ASCs)

7.5.5.3 Clinics

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Surgical Site Infection Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Types

7.6.4.1 Intraoperative Phase

7.6.4.2 Preoperative Phase

7.6.4.3 Postoperative Phase

7.6.5 Historic and Forecasted Market Size by Applications

7.6.5.1 Hospitals

7.6.5.2 Ambulatory Surgical Centers (ASCs)

7.6.5.3 Clinics

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Surgical Site Infection Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Types

7.7.4.1 Intraoperative Phase

7.7.4.2 Preoperative Phase

7.7.4.3 Postoperative Phase

7.7.5 Historic and Forecasted Market Size by Applications

7.7.5.1 Hospitals

7.7.5.2 Ambulatory Surgical Centers (ASCs)

7.7.5.3 Clinics

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Surgical Site Infection Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.35 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.80% |

Market Size in 2032: |

USD 7.20 Bn. |

|

Segments Covered: |

By Product Types |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||