Sports Betting Market Synopsis

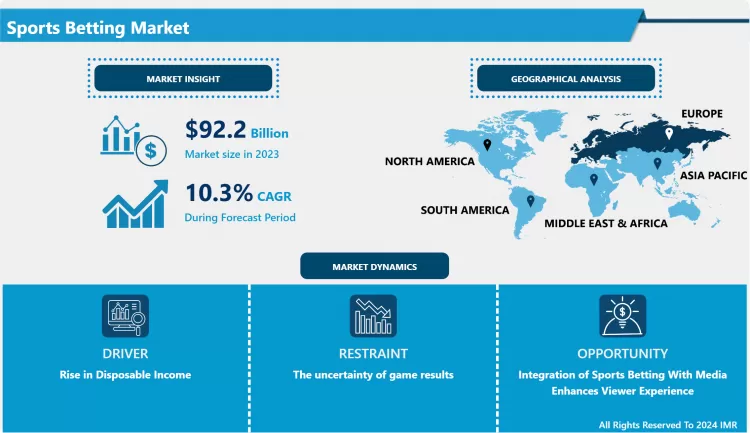

Sports Betting Market Size Was Valued at USD 92.2 Billion in 2023, and is Projected to Reach USD 222.8 Billion by 2032, Growing at a CAGR of 10.3% From 2024-2032.

Sport betting could be defined as the practice of making a prediction on the outcomes of sporting events and then staking money on that prediction. People can bet on any type of sports such as football, basketball, baseball, horse and other forms of racing sports etc. There are the following types of sport bets: money line bets, point spread bets, and over/under bets that are different to some extent and have their peculiarities. This is a type of betting that involves the application of logic in an occasion accompanied by the risk of losing or gaining money depending on the result of the guess made.

- The future market in sports betting is expected to be boosted with the expansion of digital networks and the availability of wireless connectivity. Technological advancement specifically in the use of mobile devices such as smart phones has enhanced this through altering the way consumers conduct a range of activities including games betting. There are around 6. It is estimated that there are 3 billion smartphone users around the globe in the current year, and this number is expected to rise over the years. Moreover, there is a rising market for the betting of the sports industry due to the many athletic events and leagues being organized across the world.

- Key factors which will continue to drive the demand for sports betting include, but not limited to the fact that; there has been a measured shift in the legal regulation of the global gambling industry, increased uptake of connected devices and, emerging digital infrastructure. The COVID 19 has significantly affected the world’s sports industry, and this has been amplified by limitations on sports in the entire world. Although, with the current progression over the year involving eSports and similar types of bets, online sports betting emerged during the pandemic. Moreover, the advancement of technology, especially in the use of Smartphones has made the use of the internet for the purpose of betting on sports more popular and hence, boosting the growth of the global market.

- The factors affecting the growth in the market includes, growth in connectivity of the smart smartphones, transformation in the virtual environment in the SA economy, and occurrence of the online betting among the young generation.

- With the enhancement in digital platforms, a completely new paradigm has emerged and the international market is almost all in online or virtual mode. Today, modern consumers can comfortably connect with the sportsbooks with facilitation of Internet besides, the availability of the numerous mobile applications and web sites. Furthermore, through online and virtual environments, statistical functionalities and new graphics that may well fascinate end-users are incorporated. Hence, it is believed that popularity of the same will rise further via digital revolution whereas it is expected to drive the global market throughout the forecast period.

Sports Betting Market Trend Analysis

Growing Popularity of Worldwide Sports

- Increased access to world sports through TV and the internet, the growth of activities like fantasy leagues on sports, and the legalization of sports betting. Besides, the advance in sports has also extended the number of international events in betting and involved a broad audience. This makes it evident that there is a positive correlation between the global sport and the betting market as the two complement each other and experience an ongoing cycle of growth and adaptation.

- Consumer demand has increased with advances in technology thus making the market to grow. The major stakeholders are focused on allocating considerable capital on machine learning tools, which are proving to be rather accurate in terms of prediction. There is need to pay specific attention to betting patterns. Esports have also become more prominent alongside conventional sports such as baseball, which were disrupted by the pandemic. This surge affected the sports gambling and betting sector to a great extent. There was a rise in betting revenues by the online betting platforms, this was due to the enhanced marketing strategies. Components of spread betting were attributed to the growth of the market in line with sports wagering.

Legalization of Sports Betting Fosters an Accessible Marketplace

- The presence of regulations means that operators’ entry is not constrained which in turn causes more operators to come up and compete. This is due to the accessibility of the online platform which is both appealing to the professional bettor, and the novice. Furthermore, legalization makes the customers trust and believe in the marijuana business, thereby increasing the use of the products. Thus, the increased competition makes the market more active, which positively affects its revenue, innovations, and the overall penetration into new niches. Legalization emerges as a critical force, finding the true potential of the sports betting market

Sports Betting Market Segment Analysis:

Sports Betting Market Segmented based on Platform, Type, and Sports.

By Platform, Online segment is expected to dominate the market during the forecast period

- It is forecasted that the online segment will continue to lead the market until the end of the foreseen period due to the increasing availability of smartphones and Internet of Things gadgets across the globe.

- The growth of the segment has its roots in the increased usage of the smartphone and enhancing internet connectivity around the globe. Today, with the help of smartphones, C2C e-commerce was complemented by means of growth in terms of developing video streaming services and instant messaging services. That through enhancement of the available current apps in smartphones usage is expected to have an influence on consumer engagement, is projected to have an indirect impact on consumer interaction. In the analysis of the potential of the betting industry over the forecast period the presence of 5G networks is expected to positively impact the sports betting through Smartphone utilization for betting.

By Sports, Football segment held the largest share in 2023

- The football segment is expected to have the highest CAGR during the forecast period as there is a rise in the fame of this game. The oval shaped football players including Lionel Messi, Cristiano Ronaldo, Neymar, and Robert Lewandowski among others have also been instrumental in the growth of this market since football and its related products has a large consumer base all over the world.

- In addition, more games like UEFA European Championship, FIFA World Cup 2018, FA Cup, Copa America, UEFA Europa League, and UEFA Champions League have also supported the growth of the football sports. Furthermore, these aspects make people bet with higher amounts on a timely manner.

- The key driver that has been noted to be pushing the growth of the market is a continuous rise in annual events from the various sports leagues such as NFL, IPL, and EFL among others. For instance, based on the consumption and participation analysis in Colorado Department of Revenue, NFL was the most popular sport to bet on in September 2022 followed by baseball and NCAA football in Colorado, U. S.

Sports Betting Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- The regional market in Europe has the largest share in terms of revenue, and this is set to remain the same in the course of the forecast period. This is due to safety legislation and regulations of both off and online betting for the region to grow. This could be attributed to the freedom of the regional market consequent to the inclusion of safety legislation and regulations to online and offline betting in most of the region’s countries.

- In addition, famous games like horse racing and football, widely known football teams like liver F. C. , Manchester United and Chelsea F. C. , and so on are also popular in countries like Germany and United Kingdom.

- The laws as applied to the various European countries with regard to the sector of sports betting/gambling are considered friendly by the population. For instance, while in U. K. the legal sport betting has been allowed since 1960 and has the most developed laws allowing for legal betting. The online betting business was remarkable in the European continent because of the minimum retail betting actions and scaled up its market to more than USD 40 billion by the end of the forecasting period.

Active Key Players in the Sports Betting Market

- 888 Holdings Plc

- Bet365

- Betsson AB

- Churchill Downs Incorporated

- Entain plc

- Flutter Entertainment Plc

- IGT

- Kindred Group Plc

- Sportech Plc

- William Hill Plc, Other Key Players.

Key Industry Developments in the Sports Betting Market:

- In December 2023, Betsson, one of the market leaders in sports betting, made a significant partnership with Racing Club de Avellaneda. This partnership, which was planned for 2023/2024 season, entailed that Betsson’s logo was to appear on the upper back region of the First Division football teams for both men and women, for home and away local and international matches as from MAY 19. This partnership help to be considered as successful positioning and engagement within the sports industry where football plays an key role for reaching new clients and ramming the market

- In September 2023 Betsson obtained a license aiming to offer online sports betting in the regulated French market in collaboration with an established local platform. It began in the fourth quarter of 2023 under the brand Betsson, which entered the development of the company’s internet betting sites and portals in France.

- In September 2022, Bet365 entered the Colorado market to offer e-sports betting under Century Casinos’ statewide master license meaning that it can reach the market thanks to its partner.

- In September of 2022, Entain Plc, partnered with Bally’s Corporation, BetMGM, DraftKings FanDuel, and MGM Resorts International in a joint plan to promote responsible gambling. This collective effort is for improving and promoting their universal brand value by focusing and demanding safe gambling all over their media outlets.

|

Global Sports Betting Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 92.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.3 % |

Market Size in 2032: |

USD 222.8 Bn. |

|

Segments Covered: |

By Platform |

|

|

|

By Type |

|

||

|

By Sports |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sports Betting Market by Platform (2018-2032)

4.1 Sports Betting Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Online

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Offline

Chapter 5: Sports Betting Market by Type (2018-2032)

5.1 Sports Betting Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fixed Odds Wagering

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Exchange Betting

5.5 Live/In Play Betting

5.6 Pari-mutuel

5.7 E-sports Betting

5.8 Others

Chapter 6: Sports Betting Market by Sports (2018-2032)

6.1 Sports Betting Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Football

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Basketball

6.5 Baseball

6.6 Horse Racing

6.7 Cricket

6.8 Hockey

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sports Betting Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 888 HOLDINGS PLC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BET365

7.4 BETSSON AB

7.5 CHURCHILL DOWNS INCORPORATED

7.6 ENTAIN PLC

7.7 FLUTTER ENTERTAINMENT PLC

7.8 IGT

7.9 KINDRED GROUP PLC

7.10 SPORTECH PLC

7.11 WILLIAM HILL PLC

7.12 OTHER KEY PLAYERS.

Chapter 8: Global Sports Betting Market By Region

8.1 Overview

8.2. North America Sports Betting Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Platform

8.2.4.1 Online

8.2.4.2 Offline

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Fixed Odds Wagering

8.2.5.2 Exchange Betting

8.2.5.3 Live/In Play Betting

8.2.5.4 Pari-mutuel

8.2.5.5 E-sports Betting

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by Sports

8.2.6.1 Football

8.2.6.2 Basketball

8.2.6.3 Baseball

8.2.6.4 Horse Racing

8.2.6.5 Cricket

8.2.6.6 Hockey

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sports Betting Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Platform

8.3.4.1 Online

8.3.4.2 Offline

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Fixed Odds Wagering

8.3.5.2 Exchange Betting

8.3.5.3 Live/In Play Betting

8.3.5.4 Pari-mutuel

8.3.5.5 E-sports Betting

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by Sports

8.3.6.1 Football

8.3.6.2 Basketball

8.3.6.3 Baseball

8.3.6.4 Horse Racing

8.3.6.5 Cricket

8.3.6.6 Hockey

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sports Betting Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Platform

8.4.4.1 Online

8.4.4.2 Offline

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Fixed Odds Wagering

8.4.5.2 Exchange Betting

8.4.5.3 Live/In Play Betting

8.4.5.4 Pari-mutuel

8.4.5.5 E-sports Betting

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by Sports

8.4.6.1 Football

8.4.6.2 Basketball

8.4.6.3 Baseball

8.4.6.4 Horse Racing

8.4.6.5 Cricket

8.4.6.6 Hockey

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sports Betting Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Platform

8.5.4.1 Online

8.5.4.2 Offline

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Fixed Odds Wagering

8.5.5.2 Exchange Betting

8.5.5.3 Live/In Play Betting

8.5.5.4 Pari-mutuel

8.5.5.5 E-sports Betting

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by Sports

8.5.6.1 Football

8.5.6.2 Basketball

8.5.6.3 Baseball

8.5.6.4 Horse Racing

8.5.6.5 Cricket

8.5.6.6 Hockey

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sports Betting Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Platform

8.6.4.1 Online

8.6.4.2 Offline

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Fixed Odds Wagering

8.6.5.2 Exchange Betting

8.6.5.3 Live/In Play Betting

8.6.5.4 Pari-mutuel

8.6.5.5 E-sports Betting

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by Sports

8.6.6.1 Football

8.6.6.2 Basketball

8.6.6.3 Baseball

8.6.6.4 Horse Racing

8.6.6.5 Cricket

8.6.6.6 Hockey

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sports Betting Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Platform

8.7.4.1 Online

8.7.4.2 Offline

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Fixed Odds Wagering

8.7.5.2 Exchange Betting

8.7.5.3 Live/In Play Betting

8.7.5.4 Pari-mutuel

8.7.5.5 E-sports Betting

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by Sports

8.7.6.1 Football

8.7.6.2 Basketball

8.7.6.3 Baseball

8.7.6.4 Horse Racing

8.7.6.5 Cricket

8.7.6.6 Hockey

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Sports Betting Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 92.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.3 % |

Market Size in 2032: |

USD 222.8 Bn. |

|

Segments Covered: |

By Platform |

|

|

|

By Type |

|

||

|

By Sports |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Sports Betting Market research report is 2024-2032.

888 Holdings Plc; Bet365; Betsson AB; Churchill Downs Incorporated; Entain plc; Flutter Entertainment Plc; IGT, Kindred Group Plc; Sportech Plc; William Hill Plc, and Other Major Players.

The Sports Betting Market is segmented into platform, type, sports, and region. By platform, the market is categorized into online, and offline. By type, the market is categorized into fixed odds wagering, exchange betting, live/in-play betting, pari-mutuel, e-sports betting, others. By sports, the market is categorized into football, basketball, baseball, horse racing, cricket, hockey, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Sport betting refers to a process whereby individuals risk their money with the aim of getting profit out of the outcome of sports activities which may encompass football, basketball, horse racing and other disciplines. Individuals forecast the occurrence of events, select an event upon which they are willing to wager, and wager by either making a bet with a bookmaker or through the use of the internet. Valid forecasts give out pay-offs as stipulated by the offered probabilities thereby creating a sub-market within the gambling business due to people’s need for fun and relish from risk interest.

Sports Betting Market Size Was Valued at USD 92.2 Billion in 2023, and is Projected to Reach USD 222.8 Billion by 2032, Growing at a CAGR of 10.3% From 2024-2032.