Smart Electric Drive Market Synopsis:

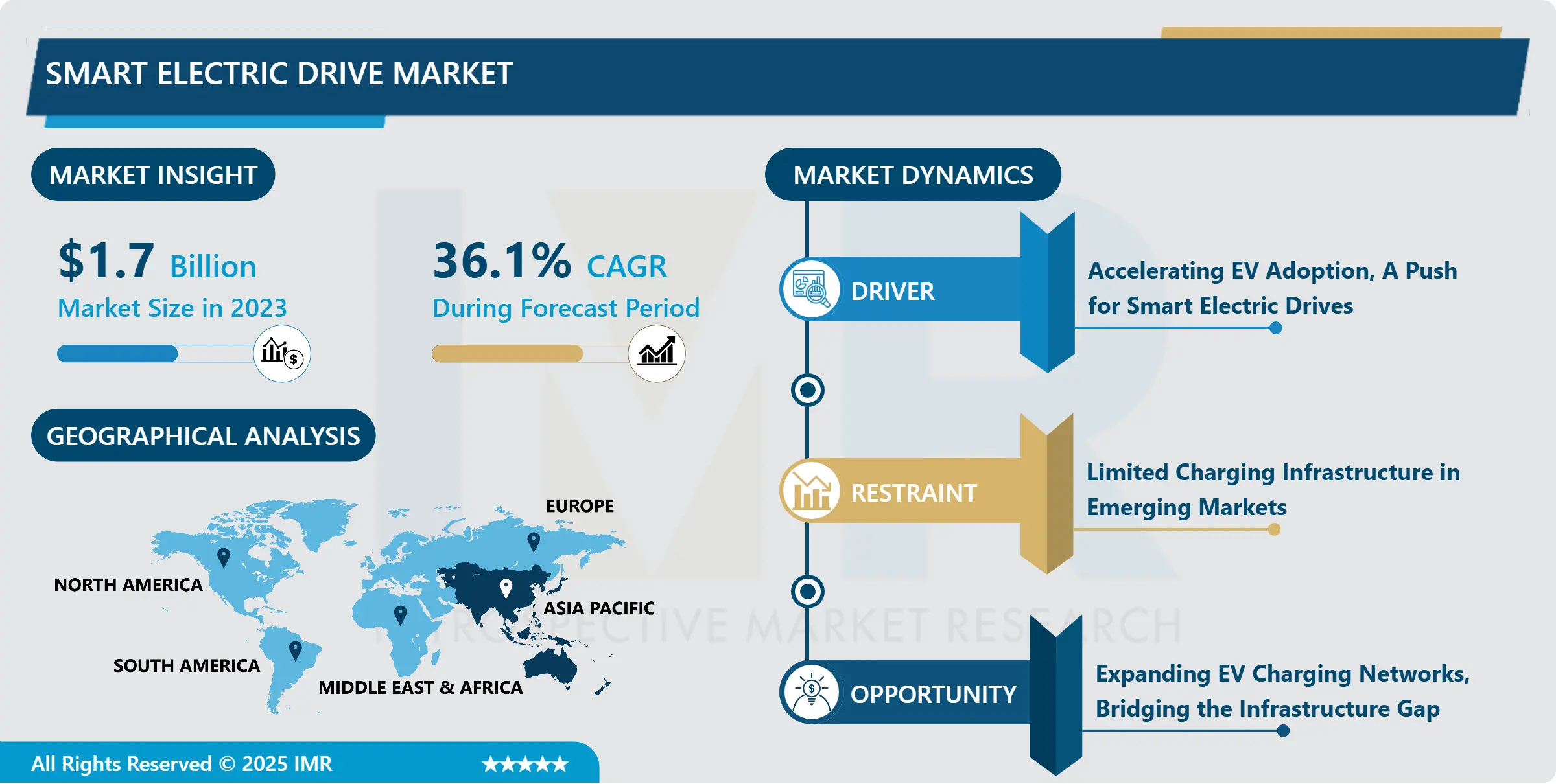

Smart Electric Drive Market Size Was Valued at USD 1.70 Billion in 2023, and is Projected to Reach USD 27.23 Billion by 2032, Growing at a CAGR of 36.10% From 2024-2032.

Smart Electric Drive Market as defined in this research is the automotive sector that deals in electric drive components that are software and hardware integrated solutions for use in electric and hybrid vehicles. This counts elements like electric motor, battery control system, and control software, which would allow improved power, decreased pollution, and increased durability.

One of the main trends stimulating the demand for smart electric drive is the constantly growing EV market around the world resulting from stricter governmental requirements to emissions and growing concern of customers to ecological problems. Subsidies for EVs, tax exemptions for EVs, and mandatory action to transition from ICE vehicles to EVs are still being granted.

One of the key trends of vehicle development is the improvement of batteries, their energy density and costs, which in turn free the vehicle from the constraints of a limited range and high cost. Automotive integrated smart electric drive systems play a major factor in global energy conservation thus; reforming the automotive industry with smart drives automation and electrification enhancing the global smart electric drive system market.

Smart Electric Drive Market Trend Analysis:

Growing integration of artificial intelligence

-

One major development that has been noticed about the market is the increased adoption of artificial intelligence and machine learning in the electric drive systems. They also increase real-time energy control and monitoring of the vehicle performance for routine maintenance. Also, wireless charging technology integration is growing, thus reducing demands for physical charging equipment in applications.

- The third trend is the shared development of smart drive solutions that have become a focus of cooperation between automotive manufacturers and IT companies. Strategic alliances and acquisitions are driving the growth of innovative electric drives with integrated miniaturization designs, multifaceted power delivery capacity, and adaptive control over a multiplicity of vehicle profiles.

The expansion of EV charging infrastructure

-

Smart Electric Drive Presents a Major Opportunity In the EV charging infrastructure expansion of the global electric vehicle industry particularly to emerging regions. Even to charge these vehicles, governments and private players are investing heavily for networks, and this will make evs more practical hence fuelling demand for better electric drive systems.

- Bridging market segments with electrification trends is another opportunity that can be registered in the commercial vehicle sector. Systems involved in intelligent electrical drives in buses, trucks, and delivery vehicles show a vast saving in the cost of fuel and maintenance leading to the emergence of a large lucrative segment where business organizations are looking forward to Green Logistics.

Smart Electric Drive Market Segment Analysis:

Smart Electric Drive Market is Segmented on the basis of Type, Vehicle Type, Application, and Region.

By Type, Software segment is expected to dominate the market during the forecast period

-

The smart electric drive market has been segmented by hardware and software. Hardware is the equipment or apparatus that are required for conversion of electrical power and for movement, for instance electric motors, inverters and batteries. Software refers to control programs, energy controlling systems and such other diagnostic tools that help drive the electric system for smooth running of automobiles.

By Application, In-Vehicle Applications segment expected to held the largest share

-

The market is also classified based on the application which include in-car applications and charging stations. In-vehicle applications are related to powering and improving smart electric drives within passenger and commercial vehicles for optimum efficiency and eco-friendliness. Charging stations, on the other hand, provide these vehicles with infrastructure required to replace energy and thereby are a part of electric ecosystem.

Smart Electric Drive Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

-

The global smart electric drive market is currently held by Asia Pacific. Luckily there is strong Manufacturing PMI indications like China, Japan and South Korea that boast of innovation, production and Adoption of EVs. China is comprised of a highly competitive government that has supported market development through offering subsidies and incentives to purchasers and makers of EVs.

- Moreover, Asia Pacific has a very favorable supply chain associated with batteries and electrical parts that could be achieved at a low cost and to a large extent. The rising stakes in the EV charging infrastructure additionally improve the region and establish it as the biggest sharer of the smart electric drive market.

Active Key Players in the Smart Electric Drive Market

- BorgWarner (USA)

- Bosch (Germany)

- Continental (Germany)

- Hitachi Astemo (Japan)

- Magna International (Canada)

- Mahle (Germany)

- Nidec Corporation (Japan)

- Siemens (Germany)

- Tesla (USA)

- ZF Friedrichshafen (Germany)

- Other Active Players.

|

Global Smart Electric Drive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.70 Billion |

|

Forecast Period 2024-32 CAGR: |

36.10 % |

Market Size in 2032: |

USD 27.23 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Electric Drive Market by Component

4.1 Smart Electric Drive Market Snapshot and Growth Engine

4.2 Smart Electric Drive Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

4.5 Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Services: Geographic Segmentation Analysis

Chapter 5: Smart Electric Drive Market by Application

5.1 Smart Electric Drive Market Snapshot and Growth Engine

5.2 Smart Electric Drive Market Overview

5.3 Food Monitoring and Tracking

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Food Monitoring and Tracking: Geographic Segmentation Analysis

5.4 Inventory Management

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Inventory Management: Geographic Segmentation Analysis

5.5 Fleet Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Fleet Management: Geographic Segmentation Analysis

5.6 Others)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others) : Geographic Segmentation Analysis

Chapter 6: Smart Electric Drive Market by End User

6.1 Smart Electric Drive Market Snapshot and Growth Engine

6.2 Smart Electric Drive Market Overview

6.3 Food Manufacturers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food Manufacturers: Geographic Segmentation Analysis

6.4 Retailers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retailers: Geographic Segmentation Analysis

6.5 Restaurants and Food Service Providers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Restaurants and Food Service Providers: Geographic Segmentation Analysis

6.6 Logistics Providers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Logistics Providers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Electric Drive Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BOSCH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CONTINENTAL (GERMANY)

7.4 SIEMENS (GERMANY)

7.5 TESLA (USA)

7.6 ZF FRIEDRICHSHAFEN (GERMANY)

7.7 BORGWARNER (USA)

7.8 NIDEC CORPORATION (JAPAN)

7.9 MAHLE (GERMANY)

7.10 HITACHI ASTEMO (JAPAN)

7.11 MAGNA INTERNATIONAL (CANADA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Smart Electric Drive Market By Region

8.1 Overview

8.2. North America Smart Electric Drive Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Hardware

8.2.4.2 Software

8.2.4.3 Services

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Food Monitoring and Tracking

8.2.5.2 Inventory Management

8.2.5.3 Fleet Management

8.2.5.4 Others)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Food Manufacturers

8.2.6.2 Retailers

8.2.6.3 Restaurants and Food Service Providers

8.2.6.4 Logistics Providers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Electric Drive Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Hardware

8.3.4.2 Software

8.3.4.3 Services

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Food Monitoring and Tracking

8.3.5.2 Inventory Management

8.3.5.3 Fleet Management

8.3.5.4 Others)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Food Manufacturers

8.3.6.2 Retailers

8.3.6.3 Restaurants and Food Service Providers

8.3.6.4 Logistics Providers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Electric Drive Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Hardware

8.4.4.2 Software

8.4.4.3 Services

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Food Monitoring and Tracking

8.4.5.2 Inventory Management

8.4.5.3 Fleet Management

8.4.5.4 Others)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Food Manufacturers

8.4.6.2 Retailers

8.4.6.3 Restaurants and Food Service Providers

8.4.6.4 Logistics Providers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Electric Drive Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Hardware

8.5.4.2 Software

8.5.4.3 Services

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Food Monitoring and Tracking

8.5.5.2 Inventory Management

8.5.5.3 Fleet Management

8.5.5.4 Others)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Food Manufacturers

8.5.6.2 Retailers

8.5.6.3 Restaurants and Food Service Providers

8.5.6.4 Logistics Providers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Electric Drive Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Hardware

8.6.4.2 Software

8.6.4.3 Services

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Food Monitoring and Tracking

8.6.5.2 Inventory Management

8.6.5.3 Fleet Management

8.6.5.4 Others)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Food Manufacturers

8.6.6.2 Retailers

8.6.6.3 Restaurants and Food Service Providers

8.6.6.4 Logistics Providers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Electric Drive Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Hardware

8.7.4.2 Software

8.7.4.3 Services

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Food Monitoring and Tracking

8.7.5.2 Inventory Management

8.7.5.3 Fleet Management

8.7.5.4 Others)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Food Manufacturers

8.7.6.2 Retailers

8.7.6.3 Restaurants and Food Service Providers

8.7.6.4 Logistics Providers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Smart Electric Drive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.70 Billion |

|

Forecast Period 2024-32 CAGR: |

36.10 % |

Market Size in 2032: |

USD 27.23 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||