Sleeve Labels Market Synopsis:

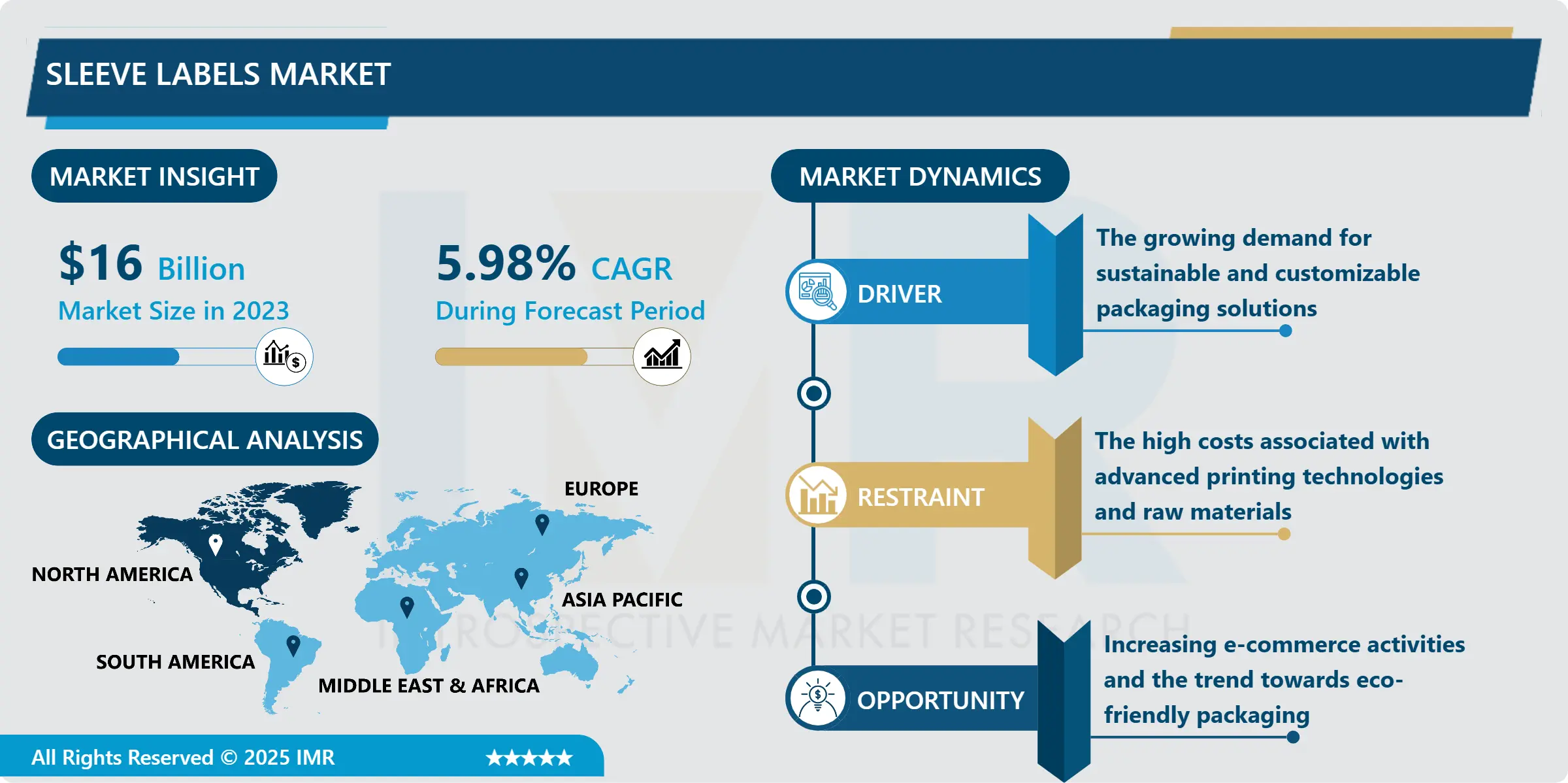

Sleeve Labels Market Size Was Valued at USD 16 Billion in 2023, and is Projected to Reach USD 23.72 Billion by 2032, Growing at a CAGR of 5.98% From 2024-2032.

Sleeve labels market is in growth stage globally due to the rising need of innovative and attractive packaging aspects across foods and beverages, personal care and household products. Each sleeve label is a 360-degree branding solution that has more visibility and shelf appeal than the traditional brands. Due to their ability to be wrapped around containers and their ability to adapt to size and shape of containers, sleeve labels are preferred by manufacturers in competitive shelf space environments.

Scope major forces Technology advancements in the field of print media like digital printing and flexographic printing has also positively impacted the market. These innovations enhance high quality vivid color graphics that can be tailored to fit particular brand demands without necessarily having to break the bank. Also, the current focus of the population on the use of environmentally friendly products has led to pressure from the market for the use of recyclable sleeves and biodegradable labels.

There is a trend indicating that the Asia-Pacific region may become a crucial one because of the growth in urbanization, a raise in the level of income per capita, and sales in the retail industry. As more companies give focus to branding and sustainability, this mold cavity identification or sleeve labels market can even expand in the future years.

Sleeve Labels Market Trend Analysis:

Shift Towards Sustainable Materials

- An important trend in the sleeve labels market relates to sustainability that has emerged as a key driver in the market. With emphasis on sustainability of the environment, customer majority seeks packaging choices that offer least emission onto the environment. To this end, manufacturers are coming up with sleeve labels that are made from materials that are recyclable, biodegradable as well as compostable. It also allows a company to fulfill its legal obligations to the populace and respond to the tendencies towards eco-friendliness of the population, which would contribute to increased customer loyalty and improved positions on the market.

Adoption of Smart Labeling Technologies

- The adoption of smart labeling technologies is revolutionizing product packaging. With the expansion of IoT and smart packaging, brands are integrating codes like QR, NFC (Near Field Communication), and augmented reality into sleeve labels. These technologies enhance consumer engagement by providing additional product information and interactive experiences. Consumers can easily access details about the product’s origin, usage, or even access promotional content via smartphones.

- By incorporating smart labeling, companies can improve brand visibility, streamline supply chains, and create more engaging packaging experiences. This innovative approach not only boosts consumer interaction but also drives sales, as it appeals to modern consumers who value transparency, convenience, and enhanced product experiences, positioning brands for greater success in a competitive market.

Sleeve Labels Market Segment Analysis:

Sleeve Labels Market is Segmented on the basis of by Type, Printing Technology, Application, End Use, and Region.

By Type, Shrink Sleeves segment is expected to dominate the market during the forecast period

- By type, the Shrink Sleeves segment is expected to dominate the market during the forecast period. Shrink sleeves, made from heat-sensitive materials, contract tightly around a product’s packaging when exposed to heat, offering a full-surface wrap. This style is widely used for its ability to provide extensive branding space and tamper-evident features, making it ideal for product security and graphic appeal. While stretch sleeves offer flexibility and are commonly used for food and beverage packaging due to their elastic properties, shrink sleeves' superior ability to cover containers and enhance branding makes them a preferred choice in many industries.

By Application, Pressure Sensitive segment expected to held the largest share

- The pressure- sensitive labels are also most commonly used as they require no further fixing agents and can be easily attached to any surface. Heat transfer labels tamper-proof and bent which makes them ideal for products that need the best appearance. In-mould labels are incorporated into the packaging and as such they form a solid bond with the packaging and colors are bright. Heat-shrink labels are usually applied around a container, contracted when heat is applied to them and hence creating a good tight and large surface area for branding. Stretch labels can stretch to fit contours, and therefore perfect to put on any kind of shaped bottle. The other way of affixing the sleeve label is the application of an adhesive glue although this is done less frequently in the market of sleeve labels and especially on the side of the heavy packages. Both application methods further the utility and visibility of products, satisfying the various needs of producers and users in the packaging sector.

Sleeve Labels Market Regional Insights:

Asia-Pacific is expected to dominate the sleeve labels market during the forecast period

- The increased pace of industrialization and an expanding customer base in the area have increased the market’s need for packaging products in food and beverages, medicines, and cosmetics in Asia Pacific. Also, the current development and use of various new generation of printing technologies, and the entry of the e-marketplace to other industries are also acting as key drivers toward the faster development of new MOU or better perform. The market is most influenced by countries such as China and India, as developments in manufacturing capacity and increasing awareness of sustainable packaging in these countries are changing the market. This combination of factors makes Asia-Pacific the largest consumer of sleeve labels for what can be expected to be strong future growth and interest for manufacturers in the region.

Active Key Players in the Sleeve Labels Market

- Avery Dennison Corporation (U.S.)

- Barry-Wehmiller Companies (U.S.)

- Bemis Manufacturing Company (U.S.)

- Berry Global Inc. (U.S.)

- Bonset America Corporation (U.S.)

- CCL Industries (Canada)

- Cenveo Worldwide Limited (U.S.)

- Constantia Flexibles (Austria)

- Danone S.A. (France)

- Eastman Chemical Company (U.S.)

- Esko-Graphics BV (Belgium)

- Flint Group (Luxembourg)

- Intertape Polymer Group (Canada)

- Nestlé (Switzerland)

- PepsiCo (U.S.)

- Procter & Gamble (U.S.)

- Taghleef Industries Group (U.A.E.)

- The Coca-Cola Company (U.S.)

- Unilever (U.K.)

- Walmart (U.S.)

- Other Active Players

|

Sleeve Labels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16 Billion |

|

Forecast Period 2024-32 CAGR: |

5.98% |

Market Size in 2032: |

USD 23.72 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Printing Technology |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sleeve Labels Market by Type

4.1 Sleeve Labels Market Snapshot and Growth Engine

4.2 Sleeve Labels Market Overview

4.3 Stretch Sleeves

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Stretch Sleeves: Geographic Segmentation Analysis

4.4 Shrink Sleeves

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Shrink Sleeves: Geographic Segmentation Analysis

Chapter 5: Sleeve Labels Market by Printing Technology

5.1 Sleeve Labels Market Snapshot and Growth Engine

5.2 Sleeve Labels Market Overview

5.3 Gravure

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Gravure: Geographic Segmentation Analysis

5.4 Flexographic

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Flexographic: Geographic Segmentation Analysis

5.5 Offset

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Offset: Geographic Segmentation Analysis

5.6 Digital

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Digital: Geographic Segmentation Analysis

5.7 Letterpress

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Letterpress: Geographic Segmentation Analysis

Chapter 6: Sleeve Labels Market by Application

6.1 Sleeve Labels Market Snapshot and Growth Engine

6.2 Sleeve Labels Market Overview

6.3 Pressure Sensitive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pressure Sensitive: Geographic Segmentation Analysis

6.4 Heat Transfer

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Heat Transfer: Geographic Segmentation Analysis

6.5 In-Mould

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 In-Mould: Geographic Segmentation Analysis

6.6 Heat-Shrink and Stretch and Glue-Applied

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Heat-Shrink and Stretch and Glue-Applied: Geographic Segmentation Analysis

Chapter 7: Sleeve Labels Market by End Use

7.1 Sleeve Labels Market Snapshot and Growth Engine

7.2 Sleeve Labels Market Overview

7.3 Food

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food: Geographic Segmentation Analysis

7.4 Beverages

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Beverages: Geographic Segmentation Analysis

7.5 Pharmaceuticals

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pharmaceuticals: Geographic Segmentation Analysis

7.6 Personal Care and Home Care

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Personal Care and Home Care: Geographic Segmentation Analysis

7.7 Chemicals

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Chemicals: Geographic Segmentation Analysis

7.8 and Others)

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 and Others) : Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Sleeve Labels Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BEMIS MANUFACTURING COMPANY (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AVERY DENNISON CORPORATION (U.S.)

8.4 BERRY GLOBAL INC. (U.S.)

8.5 CENVEO WORLDWIDE LIMITED (U.S.)

8.6 CONSTANTIA FLEXIBLES (AUSTRIA)

8.7 INTERTAPE POLYMER GROUP (CANADA)

8.8 EASTMAN CHEMICAL COMPANY (U.S.)

8.9 WALMART (U.S.)

8.10 UNILEVER (U.K.)

8.11 NESTLÉ (SWITZERLAND)

8.12 PROCTER & GAMBLE (U.S.)

8.13 PEPSICO (U.S.)

8.14 THE COCA-COLA COMPANY (U.S.)

8.15 DANONE S.A. (FRANCE)

8.16 BARRY-WEHMILLER COMPANIES (U.S.)

8.17 TAGHLEEF INDUSTRIES GROUP (U.A.E.)

8.18 BONSET AMERICA CORPORATION (U.S.)

8.19 ESKO-GRAPHICS BV (BELGIUM)

8.20 CCL INDUSTRIES (CANADA)

8.21 FLINT GROUP (LUXEMBOURG)

8.22 OTHER ACTIVE PLAYERS

Chapter 9: Global Sleeve Labels Market By Region

9.1 Overview

9.2. North America Sleeve Labels Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Stretch Sleeves

9.2.4.2 Shrink Sleeves

9.2.5 Historic and Forecasted Market Size By Printing Technology

9.2.5.1 Gravure

9.2.5.2 Flexographic

9.2.5.3 Offset

9.2.5.4 Digital

9.2.5.5 Letterpress

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Pressure Sensitive

9.2.6.2 Heat Transfer

9.2.6.3 In-Mould

9.2.6.4 Heat-Shrink and Stretch and Glue-Applied

9.2.7 Historic and Forecasted Market Size By End Use

9.2.7.1 Food

9.2.7.2 Beverages

9.2.7.3 Pharmaceuticals

9.2.7.4 Personal Care and Home Care

9.2.7.5 Chemicals

9.2.7.6 and Others)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Sleeve Labels Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Stretch Sleeves

9.3.4.2 Shrink Sleeves

9.3.5 Historic and Forecasted Market Size By Printing Technology

9.3.5.1 Gravure

9.3.5.2 Flexographic

9.3.5.3 Offset

9.3.5.4 Digital

9.3.5.5 Letterpress

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Pressure Sensitive

9.3.6.2 Heat Transfer

9.3.6.3 In-Mould

9.3.6.4 Heat-Shrink and Stretch and Glue-Applied

9.3.7 Historic and Forecasted Market Size By End Use

9.3.7.1 Food

9.3.7.2 Beverages

9.3.7.3 Pharmaceuticals

9.3.7.4 Personal Care and Home Care

9.3.7.5 Chemicals

9.3.7.6 and Others)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Sleeve Labels Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Stretch Sleeves

9.4.4.2 Shrink Sleeves

9.4.5 Historic and Forecasted Market Size By Printing Technology

9.4.5.1 Gravure

9.4.5.2 Flexographic

9.4.5.3 Offset

9.4.5.4 Digital

9.4.5.5 Letterpress

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Pressure Sensitive

9.4.6.2 Heat Transfer

9.4.6.3 In-Mould

9.4.6.4 Heat-Shrink and Stretch and Glue-Applied

9.4.7 Historic and Forecasted Market Size By End Use

9.4.7.1 Food

9.4.7.2 Beverages

9.4.7.3 Pharmaceuticals

9.4.7.4 Personal Care and Home Care

9.4.7.5 Chemicals

9.4.7.6 and Others)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Sleeve Labels Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Stretch Sleeves

9.5.4.2 Shrink Sleeves

9.5.5 Historic and Forecasted Market Size By Printing Technology

9.5.5.1 Gravure

9.5.5.2 Flexographic

9.5.5.3 Offset

9.5.5.4 Digital

9.5.5.5 Letterpress

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Pressure Sensitive

9.5.6.2 Heat Transfer

9.5.6.3 In-Mould

9.5.6.4 Heat-Shrink and Stretch and Glue-Applied

9.5.7 Historic and Forecasted Market Size By End Use

9.5.7.1 Food

9.5.7.2 Beverages

9.5.7.3 Pharmaceuticals

9.5.7.4 Personal Care and Home Care

9.5.7.5 Chemicals

9.5.7.6 and Others)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Sleeve Labels Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Stretch Sleeves

9.6.4.2 Shrink Sleeves

9.6.5 Historic and Forecasted Market Size By Printing Technology

9.6.5.1 Gravure

9.6.5.2 Flexographic

9.6.5.3 Offset

9.6.5.4 Digital

9.6.5.5 Letterpress

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Pressure Sensitive

9.6.6.2 Heat Transfer

9.6.6.3 In-Mould

9.6.6.4 Heat-Shrink and Stretch and Glue-Applied

9.6.7 Historic and Forecasted Market Size By End Use

9.6.7.1 Food

9.6.7.2 Beverages

9.6.7.3 Pharmaceuticals

9.6.7.4 Personal Care and Home Care

9.6.7.5 Chemicals

9.6.7.6 and Others)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Sleeve Labels Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Stretch Sleeves

9.7.4.2 Shrink Sleeves

9.7.5 Historic and Forecasted Market Size By Printing Technology

9.7.5.1 Gravure

9.7.5.2 Flexographic

9.7.5.3 Offset

9.7.5.4 Digital

9.7.5.5 Letterpress

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Pressure Sensitive

9.7.6.2 Heat Transfer

9.7.6.3 In-Mould

9.7.6.4 Heat-Shrink and Stretch and Glue-Applied

9.7.7 Historic and Forecasted Market Size By End Use

9.7.7.1 Food

9.7.7.2 Beverages

9.7.7.3 Pharmaceuticals

9.7.7.4 Personal Care and Home Care

9.7.7.5 Chemicals

9.7.7.6 and Others)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Sleeve Labels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16 Billion |

|

Forecast Period 2024-32 CAGR: |

5.98% |

Market Size in 2032: |

USD 23.72 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Printing Technology |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||