Resin Flooring Systems Market Synopsis

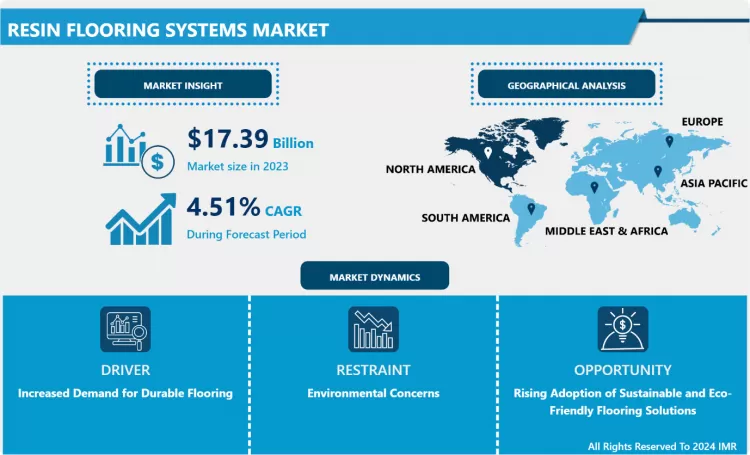

Resin Flooring Systems Market Size Was Valued at USD 17.39 Billion in 2023, and is Projected to Reach USD 25.87 Billion by 2032, Growing at a CAGR of 4.51% From 2024-2032.

Resin flooring is a tough plastic surface that is long-lasting and created by combining different materials which react chemically to produce a strong final layer. Because of its strength and durability, it is commonly utilized in high-traffic settings such as industrial kitchens, automotive factories, warehouses, and manufacturing plants.

- Resin floors are poured as a liquid onto a surface that has been prepared beforehand. Once they have hardened, they create a strong layer that can endure heavy weight and impact.

- Three primary types of resin flooring include PMMA, polyurethane (PU), and epoxy. PMMA, or polymethyl methacrylate, is expensive but perfect for industries with precise requirements due to its high level of customization, resistance to chemicals, and quick curing times. PU flooring can tolerate high temperatures, making it suitable for commercial kitchens, but it needs more time to cure compared to PMMA. Epoxy flooring is well-liked due to its affordability, low maintenance, and strength, particularly in industrial environments with high levels of foot and vehicle activity.

- Resin floors have a higher compressive strength compared to concrete, preventing cracking and including a special sealer that guards against moisture. This makes them perfect for environments with strict hygiene requirements, as they are easy to clean and maintain a hygienic surface.

Resin Flooring Systems Market Trend Analysis

Increased Demand for Durable Flooring

- Resin flooring is at the forefront of the increasing demand for long-lasting flooring options, with its remarkable durability and resilience. Resin flooring, unlike conventional flooring materials, is durable against heavy foot traffic and chemicals, making it a preferred option in industries like manufacturing, automotive, and food processing.

- These industries need durable floors that can withstand daily activities without displaying any damage. Resin flooring offers both durable performance and a smooth surface that is easy to clean and maintain, essential for upholding hygiene standards in food processing environments.

- Businesses strive to establish efficient and secure work areas, and the durability of resin flooring lessens the necessity for frequent replacements, resulting in long-term cost savings. Many industries are turning to it as a top choice because it can perform effectively under pressure while still looking good. Companies can rely on resin flooring to provide durable floors that meet their operational requirements and improve the overall atmosphere of their facilities.

Rising Adoption of Sustainable and Eco-Friendly Flooring Solutions

- The increasing use of environmentally friendly flooring options provides a major chance in the resin flooring systems market. Carpets and other conventional flooring choices often have volatile organic compounds (VOCs) that can cause indoor pollution and health issues. Resin-based flooring is one eco-friendly option that offers a low-VOC solution to tackle these issues.

- Resin flooring, made from bio-based or recycled materials, is both long-lasting and able to resist water, stains, and wear, making it a great option for environmentally conscious homes and commercial spaces.

- Resin flooring is capable of imitating natural looks such as stone or wood, all while avoiding resource depletion and deforestation. This is in line with the growing consumer demand for eco-friendly products, as individuals look for ways to enhance indoor air quality and minimize waste. Due to its low maintenance, long lifespan, and ability to be customized, the resin flooring market is poised for growth as customers place a premium on eco-friendly materials. Companies that prioritize bio-based resins or include recycled materials in flooring products can take advantage of the growing demand, promoting a future that is more sustainable and health-oriented.

Resin Flooring Systems Market Segment Analysis:

Resin Flooring Systems Market Segmented on the basis of type, application, formulation and end-users.

By Type, Epoxy Flooring segment is expected to dominate the market during the forecast period

- Epoxy flooring is expected to dominate in the resin flooring industry, and its strong presence is backed by a number of important characteristics. Above all, epoxy provides excellent durability, making it perfect for busy settings like factories and warehouses. Its strong construction allows it to endure the demands of heavy equipment and constant foot traffic, leading to lower maintenance expenses and longer lifespan.

- Epoxy flooring's excellent chemical resistance, in addition to its strength, makes it ideal for industries that frequently encounter harsh substances. This feature enables businesses to uphold a hygienic and secure workplace by effectively managing spills of oils, solvents, and chemicals without causing damage to the flooring.

- Moreover, epoxy flooring offers a great deal of flexibility, coming in a wide range of colors and finishes that can be customized to match a company's branding or unique design choices. Its versatility makes it a great option for a wide variety of uses, from car showrooms to medical centers. Through the use of epoxy flooring, businesses can improve their operational efficiency and aesthetic appeal, ultimately setting themselves up for success in the long run within their markets.

By Application, Warehouses segment to dominate the market during the forecast period

- Warehouses are the predominant application area in the resin flooring market due to various important factors. Warehouses experience high levels of foot and vehicle activity, especially from machinery like forklifts and pallet jacks. Epoxy flooring is ideal for these environments because it provides great durability and load-bearing capacity, enabling it to resist heavy usage without significant deterioration over time.

- Numerous warehouses house a variety of materials, such as chemicals and dangerous goods. Epoxy flooring's chemical resistance enables the surface to stay undamaged, making cleaning and maintenance easier. This characteristic doesn't just improve safety, it also helps cut down on operational expenses by reducing the frequency of repairs or replacements.

- Another key benefit of epoxy flooring is its smooth surface, making cleaning easier and promoting a safe work environment. Warehouse operators are very drawn to this low-maintenance feature as they put a premium on reducing downtime and enhancing productivity. Also, epoxy flooring offers a range of options for colors and finishes, giving warehouse owners the ability to enhance the appearance of their facilities without sacrificing functionality. Although parking lots, decks, and airfields also play a role in the market, the warehouse sector is the primary driver of growth in the resin flooring industry.

Resin Flooring Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The resin flooring systems market, mainly fueled by a strong construction sector, is dominated by North America. The region's heavy focus on commercial and industrial uses has greatly increased the need for high-quality flooring options. Resin flooring is being more and more used in manufacturing facilities, warehouses, and retail spaces because of its durability, low maintenance, and attractive appearance.

- The increasing focus on sustainability and energy efficiency in construction practices is making resin systems more attractive, making them a top choice for builders and property owners. The growing construction sector in North America, along with a trend towards new flooring technologies, suggests ongoing opportunities for resin flooring systems, highlighting the importance of this market for companies looking to expand and invest strategically.

Active Key Players in the Resin Flooring Systems Market

- Altro (UK)

- Ardex Group (Germany)

- Conica (Switzerland)

- Covestro AG (Germany)

- Degafloor (UK)

- Duraamen Engineered Products Inc (USA)

- Ecoflor (UK)

- Floortech (Ireland)

- Global Resins (UK)

- Huntsman Corporation (USA)

- Tripolarcon Pvt Ltd (India)

- Mapei (Italy)

- Mastertop (Germany)

- Monarch (India)

- Promix (Czech Republic)

- Remmers (Germany)

- Resdev (UK)

- Resincoat (UK)

- Rinol (Germany)

- RCR Industrial Flooring Group (Spain)

- Sherwin-Williams Company (USA)

- Sika AG (Switzerland)

- Stonhard (USA), and Other Active Players

Key Industry Developments in the Resin Flooring Systems Market:

- In July 2024, Sherwin-Williams Protective & Marine Coatings introduced specialized flooring systems for EV battery manufacturing, designed to withstand harsh chemicals, control electrostatic discharge (ESD), and improve slip resistance. These systems, tested to stringent industry standards, ensure safety and efficiency in cleanroom environments. With features like fast installation on green concrete, they support rapid setup. This launch underscores Sherwin-Williams’ role in advancing EV production facility solutions.

- In April 2023, Dur-A-Flex, Inc., a Connecticut-based manufacturer of resinous flooring and wall systems, launched Vent-E, a new breathable epoxy system designed for concrete floors with high moisture and salt content. This innovative flooring solution allows moisture to pass through without causing blisters or adhesion failures, addressing a common issue in epoxy coatings. Vent-E combines the benefits of traditional epoxy with stain resistance and easy maintenance, offering quick installation and foot traffic readiness in just four to six hours.

|

Global Resin Flooring Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.51 % |

Market Size in 2032: |

USD 25.87 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Formulation |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Resin Flooring Systems Market by Type (2018-2032)

4.1 Resin Flooring Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 PMMA (Polymethyl Methacrylate) Flooring

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polyurethane flooring

4.5 Epoxy flooring

Chapter 5: Resin Flooring Systems Market by Application (2018-2032)

5.1 Resin Flooring Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Parking lot

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Deck

5.5 Sidewalk

5.6 Warehouse

5.7 Airfield

5.8 Others

Chapter 6: Resin Flooring Systems Market by Formulation (2018-2032)

6.1 Resin Flooring Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Solvent-based resins

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Water-based resins

6.5 100% solid resins

Chapter 7: Resin Flooring Systems Market by End User (2018-2032)

7.1 Resin Flooring Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

7.6 Institutional

7.7 Government

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Resin Flooring Systems Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALTRO (UK)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ARDEX GROUP (GERMANY)

8.4 CONICA (SWITZERLAND)

8.5 COVESTRO AG (GERMANY)

8.6 DEGAFLOOR (UK)

8.7 DURAAMEN ENGINEERED PRODUCTS INC (USA)

8.8 ECOFLOR (UK)

8.9 FLOORTECH (IRELAND)

8.10 GLOBAL RESINS (UK)

8.11 HUNTSMAN CORPORATION (USA)

8.12 TRIPOLARCON PVT LTD (INDIA)

8.13 MAPEI (ITALY)

8.14 MASTERTOP (GERMANY)

8.15 MONARCH (INDIA)

8.16 PROMIX (CZECH REPUBLIC)

8.17 REMMERS (GERMANY)

8.18 RESDEV (UK)

8.19 RESINCOAT (UK)

8.20 RINOL (GERMANY)

8.21 RCR INDUSTRIAL FLOORING GROUP (SPAIN)

8.22 SHERWIN-WILLIAMS COMPANY (USA)

8.23 SIKA AG (SWITZERLAND)

8.24 STONHARD (USA)

8.25 AND

Chapter 9: Global Resin Flooring Systems Market By Region

9.1 Overview

9.2. North America Resin Flooring Systems Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 PMMA (Polymethyl Methacrylate) Flooring

9.2.4.2 Polyurethane flooring

9.2.4.3 Epoxy flooring

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Parking lot

9.2.5.2 Deck

9.2.5.3 Sidewalk

9.2.5.4 Warehouse

9.2.5.5 Airfield

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by Formulation

9.2.6.1 Solvent-based resins

9.2.6.2 Water-based resins

9.2.6.3 100% solid resins

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.7.4 Institutional

9.2.7.5 Government

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Resin Flooring Systems Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 PMMA (Polymethyl Methacrylate) Flooring

9.3.4.2 Polyurethane flooring

9.3.4.3 Epoxy flooring

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Parking lot

9.3.5.2 Deck

9.3.5.3 Sidewalk

9.3.5.4 Warehouse

9.3.5.5 Airfield

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by Formulation

9.3.6.1 Solvent-based resins

9.3.6.2 Water-based resins

9.3.6.3 100% solid resins

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.7.4 Institutional

9.3.7.5 Government

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Resin Flooring Systems Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 PMMA (Polymethyl Methacrylate) Flooring

9.4.4.2 Polyurethane flooring

9.4.4.3 Epoxy flooring

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Parking lot

9.4.5.2 Deck

9.4.5.3 Sidewalk

9.4.5.4 Warehouse

9.4.5.5 Airfield

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by Formulation

9.4.6.1 Solvent-based resins

9.4.6.2 Water-based resins

9.4.6.3 100% solid resins

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.7.4 Institutional

9.4.7.5 Government

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Resin Flooring Systems Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 PMMA (Polymethyl Methacrylate) Flooring

9.5.4.2 Polyurethane flooring

9.5.4.3 Epoxy flooring

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Parking lot

9.5.5.2 Deck

9.5.5.3 Sidewalk

9.5.5.4 Warehouse

9.5.5.5 Airfield

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by Formulation

9.5.6.1 Solvent-based resins

9.5.6.2 Water-based resins

9.5.6.3 100% solid resins

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.7.4 Institutional

9.5.7.5 Government

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Resin Flooring Systems Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 PMMA (Polymethyl Methacrylate) Flooring

9.6.4.2 Polyurethane flooring

9.6.4.3 Epoxy flooring

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Parking lot

9.6.5.2 Deck

9.6.5.3 Sidewalk

9.6.5.4 Warehouse

9.6.5.5 Airfield

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by Formulation

9.6.6.1 Solvent-based resins

9.6.6.2 Water-based resins

9.6.6.3 100% solid resins

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.7.4 Institutional

9.6.7.5 Government

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Resin Flooring Systems Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 PMMA (Polymethyl Methacrylate) Flooring

9.7.4.2 Polyurethane flooring

9.7.4.3 Epoxy flooring

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Parking lot

9.7.5.2 Deck

9.7.5.3 Sidewalk

9.7.5.4 Warehouse

9.7.5.5 Airfield

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by Formulation

9.7.6.1 Solvent-based resins

9.7.6.2 Water-based resins

9.7.6.3 100% solid resins

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.7.4 Institutional

9.7.7.5 Government

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Resin Flooring Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.51 % |

Market Size in 2032: |

USD 25.87 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Formulation |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Resin Flooring Systems Market research report is 2024-2032.

Altro (UK), Ardex Group (Germany), Conica (Switzerland), Covestro AG (Germany), Degafloor (UK), Duraamen Engineered Products Inc (USA), Ecoflor (UK), Floortech (Ireland), Global Resins (UK), Huntsman Corporation (USA), Tripolarcon Pvt Ltd (India), Mapei (Italy), Mastertop (Germany), Monarch (India), Promix (Czech Republic), Remmers (Germany), Resdev (UK), Resincoat (UK), Rinol (Germany), RCR Industrial Flooring Group (Spain), Sherwin-Williams Company (USA), Sika AG (Switzerland), Stonhard (USA), and other active players.

The Resin Flooring Systems Market is segmented into Type, Application, Formulation, End User, and region. By Type, the market is categorized into PMMA (Polymethyl Methacrylate) Flooring, Polyurethane Flooring, Epoxy Flooring. By Application, the market is categorized into Parking Lot, Deck, Sidewalk, Warehouse, Airfield, Others. By Formulation, the market is categorized into Solvent-Based Resins, Water-Based Resins, 100% Solid Resins. By End User, the market is categorized into Residential, Commercial, Industrial, Institutional, Government. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Resin flooring is a tough plastic surface that is long-lasting and created by combining different materials which react chemically to produce a strong final layer. Because of its strength and durability, it is commonly utilized in high-traffic settings such as industrial kitchens, automotive factories, warehouses, and manufacturing plants.

Resin Flooring Systems Market Size Was Valued at USD 17.39 Billion in 2023, and is Projected to Reach USD 25.87 Billion by 2032, Growing at a CAGR of 4.51% From 2024-2032.