Reactive Energy Management System Market Synopsis:

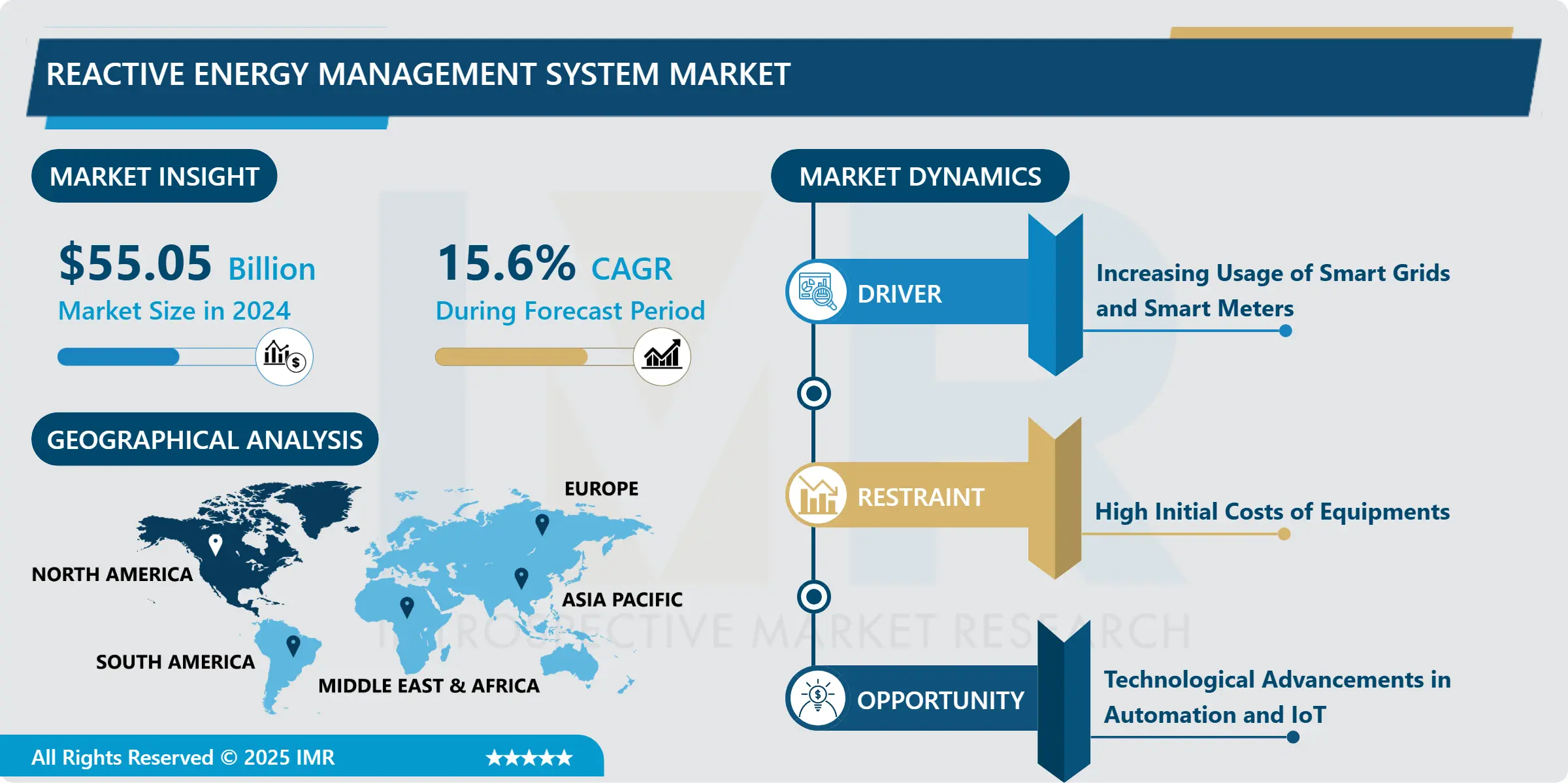

Reactive Energy Management System Market Size Was Valued at USD 55.05 billion in 2024, and is Projected to Reach USD 175.56 billion by 2032, Growing at a CAGR of 15.60% from 2025-2032.

A Reactive Energy Management System, known as REMS, works as a digital or automated system created to handle reactive power (kVAR) in power grids or industrial systems. It adjusts things like capacitor banks, reactors, or synchronous condensers. The main purpose is to optimize the power factor, lower energy waste, and keep voltage steady throughout the network.

A Reactive Energy Management System (REMS) helps manage reactive power in electrical networks to boost power factor and improve energy use. This system plays a critical role in places like factories and commercial buildings, where equipment like motors and transformers can lower the power factor. REMS works by using devices such as capacitor banks or synchronous condensers to adjust reactive power in real-time. This reduces energy waste, cuts electricity costs, and ensures rules set by utilities are met. It also helps stabilize the grid by handling voltage and stopping overloads in systems with changing or high-power needs.

The Reactive Energy Management System (REMS) market is driven by several factors. A major factor lies in the growing use of renewable energy sources like wind and solar, which can cause fluctuations and reactive power issues in electricity grids. Urban growth and industrialization are increasing electricity usage, pushing energy providers to find smarter tools to reduce transmission losses and improve power stability. Improved technologies in automation, AI, and IoT are making these systems more effective, adaptable, and affordable, leading to wider use in industrial, business, and even household settings.

Reactive Energy Management System Market Growth and Trend Analysis:

Reactive Energy Management System Market Growth Driver- Increasing Usage of Smart Grids and Smart Meters

- The reactive energy management systems market is growing as smart grids and meters become more widespread. These tools help monitor energy in real time and balance loads to handle reactive power in complicated power grids. Governments are prioritizing energy efficiency by modernizing their systems. For instance, the UK is rolling out smart meters nationwide, and Europe is pushing for lower emissions.

- This keeps raising interest in advanced grid solutions. Reactive energy management systems help keep voltage steady and improve power factor, which is key when using renewable energy sources that can be unpredictable. They manage reactive power flow to cut losses and make the grid more reliable overall. The rise of smart appliances and interconnected systems has added to the need for solutions that can handle reactive power. As smart technology becomes more common, reactive energy management is becoming essential for stable, efficient, and sustainable power networks.

Reactive Energy Management System Market Limiting Factor- High Initial Costs of Equipment

- High initial costs have a significant effect on the growth of the reactive energy management system market. Installing these systems demands advanced equipment like smart meters, power analyzers, automated controls, and connections to grid infrastructure. This makes the setup expensive for smaller power distributors and industries in developing countries. Companies also face higher expenses because experts are needed to install, design, and maintain the systems.

- These systems offer long-term savings and better energy efficiency, but the steep initial budget puts many organizations off. This cost issue slows adoption in price-sensitive markets where firms are cautious about return on investment. The challenge becomes worse because of the lack of consistent technology standards between regions, which can lead to compatibility troubles and make projects more complex and costly. As a result, market growth struggles even though the systems help improve energy use.

Reactive Energy Management System Market Expansion Opportunity- Technological Advancements in Automation and IoT

- Automation and the Internet of Things (IoT) are opening big doors in the reactive energy management system market. Industries and utilities moving toward smart grid setups now rely on real-time monitoring and loads. Systems for reactive energy management use smart sensors and automated controls to keep power factors steady and improve voltage regulation.

- Devices with IoT features gather detailed data about how energy is used and how reactive power moves through the system. This lets systems use predictive tools and take automatic actions to fix issues. These technologies cut down on energy waste and boost how things run, which makes them popular in today’s energy setups. The growth of cloud technology and edge-based analytics also makes it possible to control these systems from afar and connect them with larger energy platforms. This combination of tech is creating more active grid operations and giving manufacturers and service providers new possibilities in managing reactive energy.

Reactive Energy Management System Market Challenge Barrier- Lack of Standardised Protocols

- The reactive energy management system market struggles due to there are no standardized protocols. This creates problems for systems and technologies used by utilities, industries, and smart grids to work together. Without shared standards, connecting devices made by different companies gets tricky. This causes communication and control to become inefficient.

- Unclear regulations across regions make companies unsure about putting money into these technologies. Due to this, energy providers worry about compatibility problems and hesitate to adopt or upgrade these solutions. This division raises costs and stretches out project timelines, which holds back market growth. A proper global framework with unified standards is needed to build trust, lower technical hurdles, and encourage wider use of reactive energy management systems.

Reactive Energy Management System Market Segment Analysis:

Reactive Energy Management System Market is segmented based on Type, Components, Voltage level, End-Users, and Region

By Type, the IEMS Segment is Expected to Dominate the Market During the Forecast Period

- Industrial Energy Management Systems (IEMS) dominated the reactive energy management system market by leveraging their strong presence in industrial sectors. The widespread adoption of IoT-enabled smart energy solutions within manufacturing environments allows these systems to efficiently monitor and control reactive energy consumption. By integrating advanced technologies such as network communications, smart grids, and bidirectional communication, IEMS facilitate real-time tracking and management of energy-intensive equipment, including HVAC systems.

- This integration supports the optimization of reactive power, reducing energy wastage and enhancing overall operational efficiency. Moreover, the rise of Industry 4.0 practices has further strengthened the dominance of IEMS, enabling industries to achieve substantial energy savings through proactive management of reactive loads. These capabilities make IEMS essential in driving improvements in power quality and reducing penalties related to reactive energy consumption, solidifying their leading position in the reactive energy management system market.

By End-User, the Renewable Energy Plants Segment Held the Largest Share in 2024

- Renewable energy plants dominated the reactive energy management system market. These plants generate power with variability, which demands advanced solutions to keep grids stable and maintain power quality. As solar and wind sources become more connected to the energy grid, the need to control reactive power and manage voltage has grown.

- Reactive energy management systems help renewable plants balance voltage levels, cut down transmission losses, and keep the grid running even with unpredictable generation. They also make it easier to connect distributed energy resources and allow renewable systems to work alongside traditional power setups. The push to lower carbon emissions and upgrade grids is speeding up the use of these systems, turning renewable plants into essential players for growth and innovation in this market.

Reactive Energy Management System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominated the reactive energy management system market due to its strong technology and clear rules that support saving energy. The United States and Canada are at the forefront of putting a lot of money into smart grid systems and clean energy projects. These investments push the use of reactive energy management even further. The market is also growing as more companies use industrial energy systems and smart building technologies.

- These tools help manage reactive power better, cutting down energy waste and making the grid more stable. The rising focus on clean energy in homes and businesses is also driving up demand for these solutions. Governments and private companies in the region work together to support energy-saving plans, increasing this leadership. With advanced technology, proper policies, and growing awareness, North America remains a key player in reactive energy management systems.

Reactive Energy Management System Market Active Players:

- ABB (Switzerland)

- Cisco Systems, Inc. (US)

- Eaton (US)

- Emerson (US)

- General Electric (US)

- GridPoint (US)

- Honeywell International (US)

- IBM (US)

- Johnson Controls, Inc. (US)

- Oracle (US)

- Rockwell Automation (US)

- SAP SE (Germany)

- Schneider Electric (France)

- Siemens AG (Germany)

- Other Active Players

Key Industry Developments in the Reactive Energy Management System Market:

- In January 2025, ABB partnered with Toronto-based startup Edgecom Energy to advance AI-driven energy management solutions. Through ABB Electrification Ventures, ABB invested in Edgecom, integrating generative AI to optimize power usage and reduce demand peaks. This collaboration aimed to enhance energy efficiency and support sustainable industrial operations, focusing on the North American market.

- In November 2024, Emerson launched its Energy Manager solution, a plug-and-play system designed to simplify industrial electricity monitoring. Preinstalled on PACSystems RXi, it enabled real-time energy tracking, helping manufacturers reduce energy waste and carbon emissions by up to 30%. The scalable solution offered asset-specific insights, aiding operational efficiency and supporting sustainability goals across diverse industrial sectors.

|

Reactive Energy Management System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 55.05 Bn. |

|

Forecast Period 2025-32 CAGR: |

15.60 % |

Market Size in 2032: |

USD 175.56 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Components |

|

||

|

By Voltage Level |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Reactive Energy Management System Market by Types (2018-2032)

4.1 Reactive Energy Management System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 BEMS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 IEMS

4.5 HEMS)

Chapter 5: Reactive Energy Management System Market by Components (2018-2032)

5.1 Reactive Energy Management System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Reactors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Voltage regulators

5.5 Sensors and smart meters

Chapter 6: Reactive Energy Management System Market by Voltage Level (2018-2032)

6.1 Reactive Energy Management System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Low Voltage (LV)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medium Voltage (MV)

6.5 High Voltage (HV)

6.6 Extra High Voltage (EHV)

Chapter 7: Reactive Energy Management System Market by End-Users (2018-2032)

7.1 Reactive Energy Management System Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial and Renewable Energy Plants

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Reactive Energy Management System Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ABB (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 CISCO SYSTEMS

8.4 INC. (US)

8.5 EATON (US)

8.6 EMERSON (US)

8.7 GENERAL ELECTRIC (US)

8.8 GRIDPOINT (US)

8.9 HONEYWELL INTERNATIONAL (US)

8.10 IBM (US)

8.11 JOHNSON CONTROLS

8.12 INC. (US)

8.13 ORACLE (US)

8.14 ROCKWELL AUTOMATION (US)

8.15 SAP SE (GERMANY)

8.16 SCHNEIDER ELECTRIC (FRANCE)

8.17 SIEMENS AG (GERMANY)

8.18 AND OTHER ACTIVE PLAYERS

Chapter 9: Global Reactive Energy Management System Market By Region

9.1 Overview

9.2. North America Reactive Energy Management System Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Reactive Energy Management System Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Reactive Energy Management System Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Reactive Energy Management System Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Reactive Energy Management System Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Reactive Energy Management System Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Reactive Energy Management System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 55.05 Bn. |

|

Forecast Period 2025-32 CAGR: |

15.60 % |

Market Size in 2032: |

USD 175.56 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Components |

|

||

|

By Voltage Level |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||