Processed Mushroom Market Synopsis:

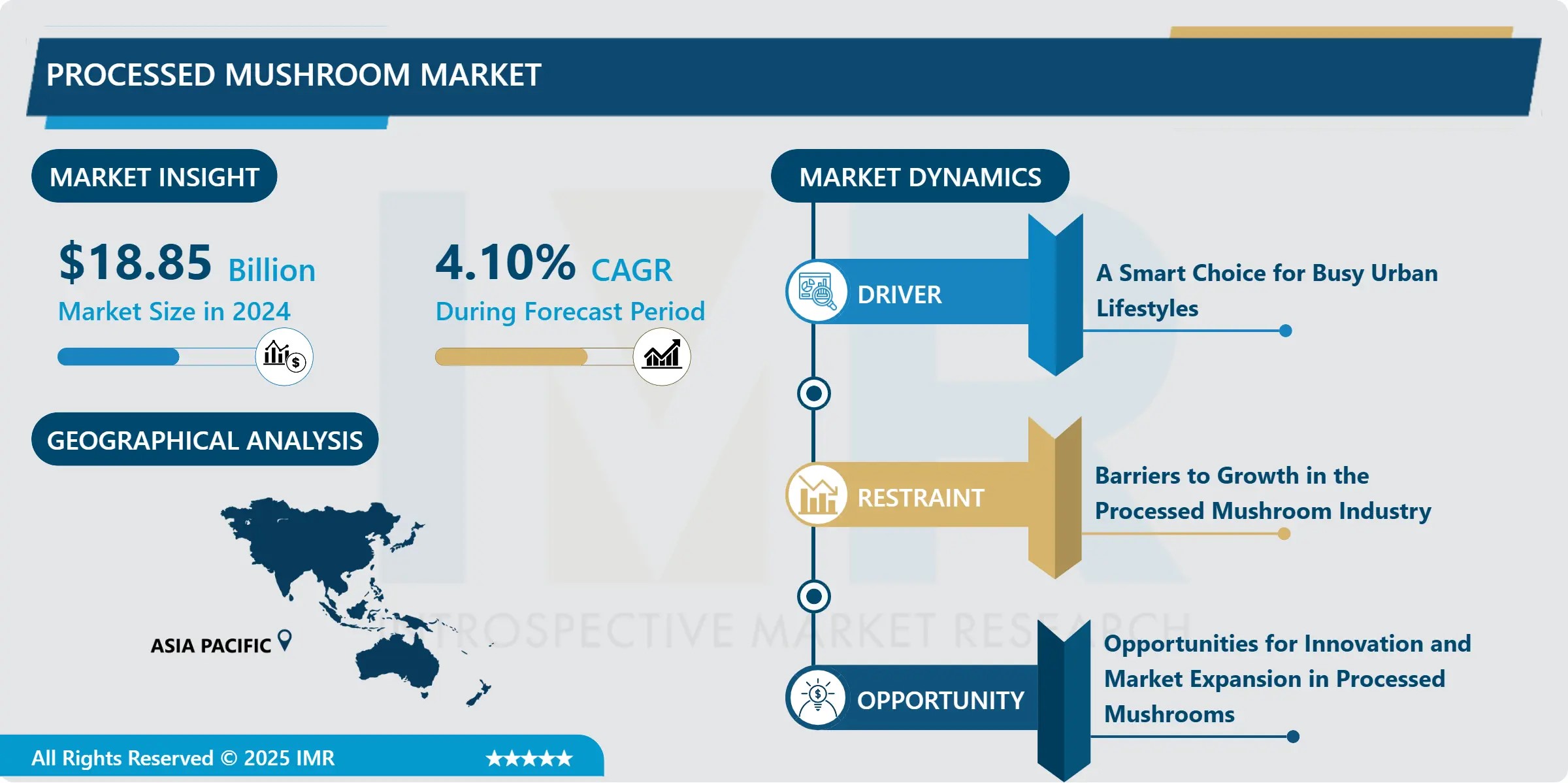

Processed Mushroom Market Size Was Valued at USD?18.85?billion in 2024, and is Projected to Reach USD?29.33?billion by 2035, Growing at a CAGR of 4.10% from 2025-2035.

- The global processed mushroom market is experiencing robust growth, driven by rising consumer interest in plant-based, sustainable, and functional foods. As awareness around health, environmental sustainability, and ethical consumption increases, mushrooms have emerged as a key alternative protein and wellness ingredient. Processed mushroom products ranging from canned, dried, and frozen mushrooms to innovative offerings like mushroom-based burgers, snacks, jerky, and supplements are gaining popularity across mainstream and niche consumer segments.

- Major food and wellness brands are capitalizing on this trend through new product development and strategic market positioning. The appeal of processed mushrooms lies in their nutritional density, low environmental impact, and adaptability in various culinary and health-focused formats. With the added momentum of technological innovation in food processing and increasing demand from vegan and flexitarian populations, the processed mushroom market is poised for continued expansion globally.

Processed Mushroom Market Growth and Trend Analysis:

Processed Mushroom Market Growth Driver- Processed Mushrooms: A Smart Choice for Busy Urban Lifestyles

- Today, many people live in cities and have very busy lives. They often don’t have much time to cook meals from scratch. Because of this, they want food that is quick, easy to use, and healthy. That’s why processed mushrooms are becoming a smart choice for many people.

- Processed mushrooms come in many forms like canned, frozen, or dried. These are already cleaned, cut, and ready to cook. This saves time in the kitchen. You can add them straight into soups, noodles, rice, or sauces without doing much work.

- These mushrooms are also easy to find in stores all year round. Fresh mushrooms can spoil quickly or may not be available in every season. But processed mushrooms last longer and can be stored at home for weeks or months. This makes them a handy food option for busy people.

- Some companies also make meal kits with mushrooms. These kits help people make fast and healthy meals at home with little effort. In short, processed mushrooms are a great food for people who want something that is healthy, tasty, quick to cook, and always available. They fit perfectly into the fast-moving life of city living.

Processed Mushroom Market Limiting Factor - Barriers to Growth in the Processed Mushroom Industry

- One of the main challenges limiting the growth of the processed mushroom market is the short shelf life of fresh mushrooms and supply chain issues. Although processing helps extend shelf life, mushrooms are still delicate and can spoil easily if not stored or transported properly. This creates problems during packaging, shipping, and storage especially in hot or humid climates.

- Another limiting factor is the high cost of production for specialty mushrooms, such as shiitake or lion’s mane, which are popular in health and wellness products. These varieties often need controlled environments to grow, which adds to production costs. This can make final products more expensive for consumers.

- Also, low consumer awareness in some regions about the health benefits and uses of mushrooms can slow market growth. In many places, people still prefer traditional vegetables or animal-based protein and are unfamiliar with how to cook or eat processed mushrooms.

- Lastly, taste and texture preferences can also limit demand. Some consumers may not enjoy the earthy taste or chewy texture of mushrooms, especially when processed. While the market is growing, challenges like shelf life, high production costs, limited awareness, and consumer preferences can slow down progress. Overcoming these issues with better technology, education, and marketing can help the market grow faster.

Processed Mushroom Market Expansion Opportunity - Opportunities for Innovation and Market Expansion in Processed Mushrooms

- The processed mushroom market has many chances to grow in the coming years. One big opportunity is the rising demand for plant-based and healthy foods. More people are choosing plant-based diets for health, environmental, and ethical reasons. Mushrooms are a great meat alternative because they are full of nutrients, low in calories, and have a meaty texture. This makes them perfect for making mushroom-based burgers, snacks, and jerky.

- Another big opportunity is in the functional food and supplement market. Some mushrooms like lion’s mane, reishi, and chaga are known for their health benefits. They can help with memory, focus, and the immune system. Companies are now making mushroom capsules, powders, and drinks to meet the demand for natural wellness products.

- The market can also grow by reaching new regions and markets. In some countries, mushrooms are not yet a common part of daily meals. With the right marketing and education, companies can introduce mushrooms as an easy, healthy food choice.

- Lastly, innovation in processing and packaging can help products last longer and stay fresh, making them easier to sell in stores and online. With growing interest in health,/ sustainability, and plant-based foods, the processed mushroom market has many new ways to expand globally.

Processed Mushroom Market Challenge and Risk- High Production Costs

- Some types of mushrooms, like shiitake and lion’s mane, are not easy to grow. They need special conditions such as the right temperature, humidity, and light. These conditions are often created in controlled environments, like indoor farms or greenhouses, which can be very expensive to build and run.

- Farmers also need special equipment and skilled workers to take care of these mushrooms. This adds even more cost to the growing process. Because it costs a lot to grow and process these mushrooms, the final products like mushroom powders, capsules, or ready-to-eat snacks often have higher prices in stores.

- This can be a problem, especially in areas where people are not willing or able to pay more for food. When the price is too high, fewer people may buy the product. As a result, companies may not sell as much, which slows down the market's growth. Growing some mushrooms is expensive. These costs make mushroom products more expensive for customers, which can make it harder to sell them to a wider market.

Processed Mushroom Market Segment Analysis:

Processed Mushroom Market is segmented based on Type, Application, End-Users, and Region

By Type, Processed Mushroom Segment is Expected to Dominate the Market During the Forecast Period

- Button mushrooms are the most common and popular type of mushroom used in homes and restaurants around the world. They are small, white, and have a mild flavour that goes well with many types of food. One of the main reasons why button mushrooms are so popular is that they are affordable and easy to find in most grocery stores.

- These mushrooms are often sold in processed forms like canned or frozen. This makes them easy to store and use, especially for busy people who want quick and healthy meals. Canned button mushrooms are already cleaned, sliced, and cooked, so they can be added directly to dishes like pizza, pasta, soups, or stir-fries. Frozen button mushrooms also stay fresh for a long time and are great for cooking at home or in restaurants.

- Because they are mild in taste, button mushrooms can be used in many recipes without changing the overall flavour too much. This makes them a favourite ingredient in both vegetarian and non-vegetarian meals.

- In the processed mushroom market, button mushrooms take up a big share because of their low price, long shelf life, and wide use in everyday cooking. Their popularity continues to grow as more people look for healthy, convenient, and budget-friendly food options.

By Application, Processed Mushroom Segment Held the Largest Share in 2024

- Processed mushrooms are becoming very popular in the nutraceuticals and supplements market. Nutraceuticals are products that offer health benefits beyond basic nutrition, such as helping the brain, boosting energy, or improving the immune system. Many people today are looking for natural ways to stay healthy, and mushrooms are seen as a strong option.

- Certain types of mushrooms, like lion’s mane, reishi, and chaga, are known for their powerful health benefits. For example, lion’s mane is believed to support brain health and improve memory and focus. Reishi mushrooms are often used to boost the immune system and help reduce stress, while chaga is thought to increase energy levels and fight tiredness.

- These mushrooms are usually processed into capsules, powders, or drink mixes. This makes them easy to take every day, either by swallowing a pill or adding the powder to coffee, smoothies, or tea. Many companies are now creating wellness products that combine mushrooms with vitamins, herbs, and other healthy ingredients.

- As more people become aware of the health benefits of mushrooms, the demand for mushroom-based supplements is growing quickly. This trend is especially strong among people who want natural, plant-based solutions for better health. The nutraceuticals and supplements segment is expected to play a big role in the future growth of the processed mushroom market.

Processed Mushroom Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region is the largest and most important market for processed mushrooms in the world. This region includes countries like China, India, Japan, and South Korea, which play a big role in both producing and consuming mushrooms. In fact, China alone produces more than half of the world’s mushrooms, making it a global leader.

- People in Asia have used mushrooms in cooking and medicine for centuries. Mushrooms like shiitake, enoki, and reishi are commonly added to soups, stir-fries, and teas. They are also known for their health benefits, such as boosting immunity and improving brain function. Because of this, there is a strong demand for dried, canned, and powdered mushroom products.

- The region is also seeing growth in functional mushroom products, such as mushroom coffee, capsules, and wellness powders. These are popular among younger and health-conscious consumers looking for natural supplements.

- Processed mushroom products from Asia are also exported to other parts of the world, including North America and Europe. This boosts the region’s economic importance in the global mushroom trade. With its high production capacity, strong local demand, and growing interest in mushroom-based health products, Asia-Pacific is expected to continue leading the global processed mushroom market in the coming years.

Processed Mushroom Market Active Players:

- Agro Dutch Industries Ltd. (India)

- Bonduelle Group (France)

- Drinkwater Mushrooms Ltd. (United Kingdom)

- Monaghan Mushrooms (Ireland)

- Monterey Mushrooms, Inc. (United States)

- OKECHAMP S.A. (Poland)

- The Mushroom Company (United States)

- South Mill Champs (United States)

- To-Jo Mushrooms (United States)

- Banken Champignons B.V. (Netherlands)

- Scelta Mushrooms BV (Netherlands)

- Valley Mushrooms Ltd. (Canada)

- Ann Miller’s Speciality Mushrooms Ltd. (United Kingdom)

- SA Mushrooms Pty Ltd. (Australia)

- Nasza Chata (Poland)

- Ecolink Baltic (Latvia)

- Giorgio Fresh Co. (United States)

- Fresh Directions International (United States)

- Modern Mushroom Farms (United States)

- Ostrom’s Mushroom Farms (United States)

- Phillips Mushroom Farms (United States)

- Kitchen Pride Mushroom Farms (United States)

- CMP Mushrooms (Ireland)

- Highline Mushrooms (Canada)

- WeikField Foods Pvt. Ltd. (India)

- Shanghai Finc Bio-Tech Inc. (China)

- Farmmi Inc. (China)

- Nammex (North American Medicinal Mushroom Extracts) (Canada)

- M2 Ingredients (United States)

- MyForest Foods (Ecovative Design) (United States)

- Other Active Players

Key Industry Developments in the Processed Mushroom Market:

- Functional mushroom beverages like coffee and energy drinks with reishi, lion’s mane, and turkey tail are booming. In 2024, functional mushroom drinks achieved over $700 million in U.S. sales, and snacks with mushrooms are also growing fast

- In June 2023, My Forest Foods raised $15 million in Series A-2 funding and hired a new CEO. They've also expanded My Bacon into over 100 retail locations in the Northeastern United States, including Fairway and Gourmet Garage

|

Processed Mushroom Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD?18.85?billion |

|

Forecast Period 2025-35 CAGR: |

4.10 % |

Market Size in 2035: |

USD?29.33?billion |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application

|

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Contract Catering Market by Product (2018-2035)

4.1 Contract Catering Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed Price

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cost Plus

4.5 Self-Operated

4.6 Outsourced

4.7 Others

Chapter 5: Contract Catering Market by Application (2018-2035)

5.1 Contract Catering Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Meal Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Canteen Management

5.5 Event Based

5.6 Disaster Relief

Chapter 6: Contract Catering Market by Distribution Channel (2018-2035)

6.1 Contract Catering Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Event Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Direct

6.5 Indirect

Chapter 7: Contract Catering Market by End User (2018-2035)

7.1 Contract Catering Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Educational Institution

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare Facilities

7.5 Corporate Office

7.6 Transportation Hub

7.7 OthersS

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Contract Catering Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ABM INDUSTRIES INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ARAMARK CORPORATION (USA)

8.4 ARAMARK UNIFORM SERVICES (USA)

8.5 ATALIAN SERVEST GROUP LTD (UK)

8.6 BAXTERSTOREY (UK)

8.7 BLUE APPLE CATERING (UK)

8.8 BROOKWOOD PARTNERSHIP (UK)

8.9 CATERLINK LTD (UK)

8.10 CENTERPLATE (UK)

8.11 CH&CO CATERING GROUP (UK)

8.12 COMPASS EUREST (UK)

8.13 COMPASS GROUP PLC (UK)

8.14 DELAWARE NORTH COMPANIES (UK)

8.15 DUSSMANN GROUP (GERMANY)

8.16 ELIOR GROUP (FRANCE)

8.17 EUREST SERVICES (UK)

8.18 GATHER & GATHER (UK)

8.19 GUCKENHEIMER (USA)

8.20 INTERSERVE FACILITIES MANAGEMENT (UK)

8.21 ISS A/S (DENMARK)

8.22 ISS FACILITY SERVICES INC. (USA)

8.23 MITIE GROUP PLC (UK)

8.24 OCS GROUP (UK)

8.25 SERCO GROUP PLC (UK)

8.26 SFM FACILITY MANAGEMENT (INDIA)

8.27 SODEXO JUSTICE SERVICES (FRANCE)

8.28 SODEXO LIVE (FRANCE)

8.29 SODEXO PRESTIGE (FRANCE)

8.30 SODEXO S.A. (FRANCE)

8.31 WILSON VALE (UK)

8.32 OTHERS ACTIVE PLAYERS.

Chapter 9: Global Contract Catering Market By Region

9.1 Overview

9.2. North America Contract Catering Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Contract Catering Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Contract Catering Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Contract Catering Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Contract Catering Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Contract Catering Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Processed Mushroom Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD?18.85?billion |

|

Forecast Period 2025-35 CAGR: |

4.10 % |

Market Size in 2035: |

USD?29.33?billion |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application

|

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||