Mushroom Market Synopsis

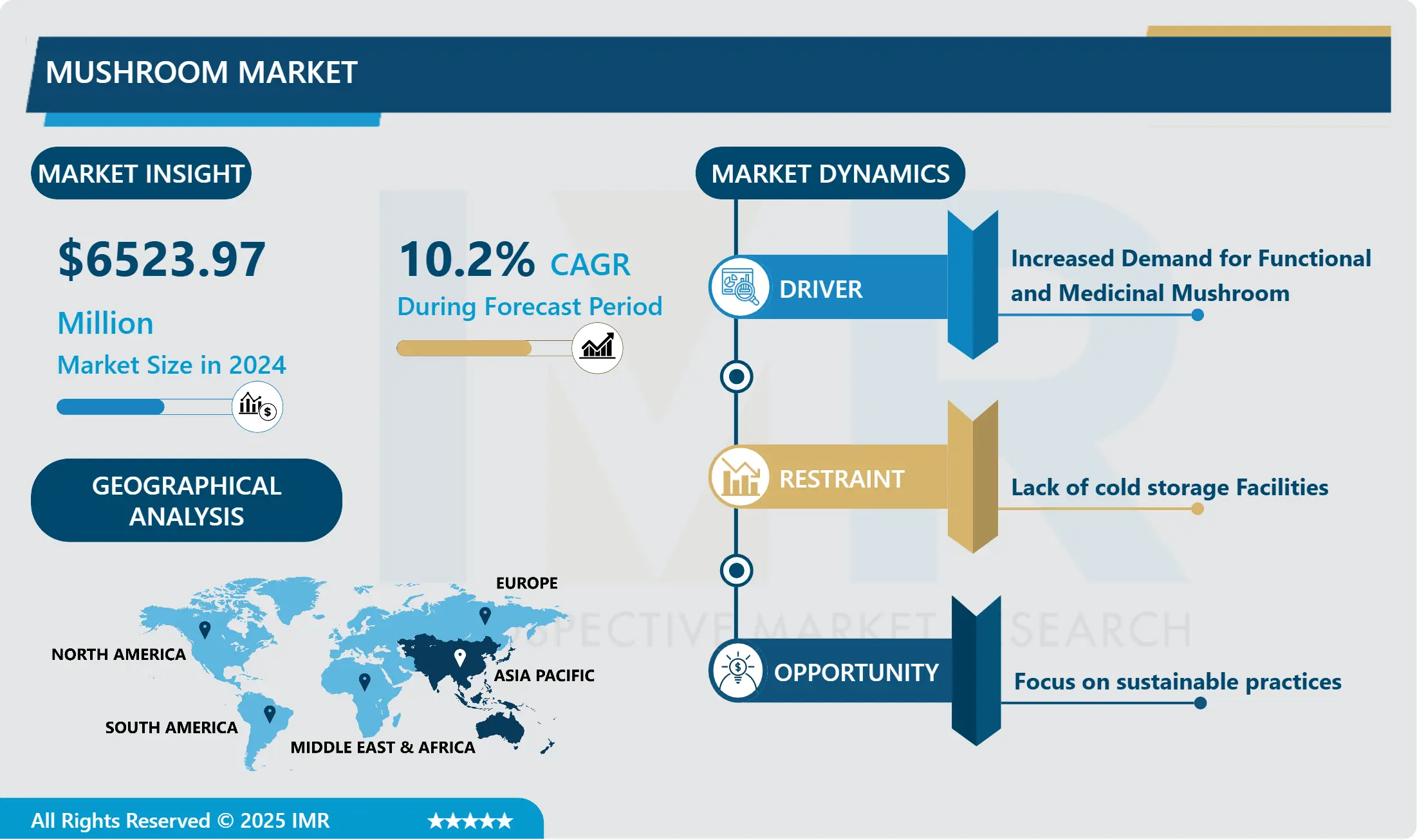

Mushroom Market Size Was Valued at USD 6523.97 Million in 2024 and is Projected to Reach USD 14189.42 Million by 2032, Growing at a CAGR of 10.2 % From 2025-2032.

Mushrooms are succulent, nutritious fruiting bodies of specific macrofungal categories that can be harvested by hand and develop either below or above the ground. Its suitability for consumption is determined by its lack of harmful effects on people, along with a pleasant taste and smell. The demand for mushrooms is increasing every year, leading to a significant growth in the global Mushroom market. They are a nourishing and wholesome ingredient that can be incorporated into various recipes. Farmers and home gardeners are increasingly interested in growing them because they are relatively easy to cultivate.

Consumers are becoming more health-conscious and are actively seeking nutritious and natural food options. Mushrooms are low in calories, fat-free, cholesterol-free, and packed with nutrients like vitamins, minerals, Fiber, and antioxidants. They are also known for their potential health benefits, including immune system support, heart health, and improved digestion. This growing awareness of the nutritional value of mushrooms has led to increased consumer demand and consumption. The rising popularity of plant-based diets and veganism has further fuelled the demand for mushrooms.

As a versatile ingredient, mushrooms are often used as a meat substitute in various plant-based recipes. Their unique texture, umami flavour, and ability to absorb different Flavors make them a preferred choice for plant-based protein alternatives. Mushroom-based burgers, meatballs, sausages, and other plant-based meat substitutes are gaining popularity, contributing to the growth of the Mushroom market.

Mushrooms have versatile culinary applications and are used in various cuisines worldwide. They can be incorporated into soups, stir-fries, salads, sauces, toppings, and even used as a pizza topping. Also, mushrooms are used as ingredients in processed food products like snacks, sauces, dressings, and seasonings. The growth of the food industry and the demand for innovative and healthy food options have contributed to the increased use of mushrooms as an ingredient.

From this graph, it is shown that the share value of Mushroom Production Worldwide in percentage country wise. Asia held largest share in Mushroom production market worldwide about 80%.

Mushroom Market Trend Analysis

Mushroom Market Growth Driver- Increased Demand for Functional and Medicinal Mushroom

- Mushroom market is being primarily driven by the growing consumer health consciousness and the escalating need for nutrient-rich and cholesterol-free food products. The emerging trend of veganism and the widespread adoption of mushrooms as a substitute for meat, due to their rich umami taste, are also propelling market growth.

- The increasing utilization of mushrooms in dietary supplements, as they contain a rich amount of Fiber and digestive enzymes promoting gut and immunological health, is further catalysing product demand. Advancements in Mushroom packaging technologies, such as the development of humidity-regulating packaging materials that prevent water condensation to extend shelf-life, are also augmenting market growth.

- The rising usage of mushrooms by the pharmaceutical industry for the treatment of several diseases, such as hypercholesterolemia and hypertension, is acting as another growth-inducing factor. Growing scientific evidence supports the health benefits of mushrooms. Studies have shown that certain Mushroom species contain bioactive compounds like beta-glucans, polysaccharides, and antioxidants, which may have immune-boosting, anti-inflammatory, and antioxidant properties.

Mushroom Market Expansion Opportunity- Focus on sustainable practices

- Sustainability has become a key focus area for the Mushroom industry. Producers are implementing eco-friendly practices such as recycling agricultural waste for substrate production, using renewable energy sources, and minimizing water consumption to reduce environmental impact.

- There's a growing emphasis on adopting advanced cultivation techniques to increase Mushroom production and meet rising demand. Techniques such as controlled environment agriculture (CEA) and vertical farming are being explored to optimize production efficiency and crop yields.

- Rapidly evolving production, marketing and distribution technologies, awareness of consumers towards the health benefits of mushrooms, availability of variety of Mushroom dishes by hotels and restaurants are bound to push Mushroom consumption demand in India.

Mushroom Market Segment Analysis:

Mushroom Market is Segmented on the basis of type, Form, Distribution channel application, End-users and Region.

By Type, Button Mushroom Segment Is Expected to Dominate The Market During The Forecast Period

- Button mushrooms, known scientifically as Agaricus bisporus, hold a dominant position in both consumption and production. Their widespread cultivation and consumption are attributed to several factors, including their versatility in various culinary applications, mild flavour profile, and consistent availability throughout the year. Button mushrooms are integral ingredients in a wide range of Indian dishes, including curries, stir-fries, soups, and salads, etc.

- Button mushrooms are one of the most commonly consumed mushrooms globally, and many consumers are familiar with them. Their widespread use in cooking and their presence in popular dishes contribute to their dominance in the market. Button mushrooms have a reasonably long shelf life, especially when properly stored. This characteristic makes them attractive to both consumers and retailers, as they can be stocked for longer periods without significant spoilage.

By Application, Food Processing Sector Segment Held the Largest Share In 2024

- Mushrooms are processed into various forms such as canned mushrooms, frozen mushrooms, dried mushrooms, and Mushroom powder. These processed forms are used as ingredients in packaged food products, sauces, snacks, and seasonings, contributing to the convenience and flavour enhancement of processed foods. Mushroom are recognized for their nutritional value and health benefits, leading to their inclusion in dietary supplements.

- Mushroom extracts, powders, and capsules are consumed for their potential immune-boosting, antioxidant, and other health-promoting properties. Food processing industry contributes to the Mushroom market by innovating new products and flavours, thus expanding the consumer base and driving market growth. With increasing consumer awareness about the health benefits of mushrooms and the convenience of processed Mushroom products, the food processing industry is likely to continue dominating the Mushroom market worldwide.

Mushroom Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region accounts for a substantial portion of global Mushroom production. China, in particular, is the world's largest producer of mushrooms, cultivating a wide range of species including button mushrooms, shiitake mushrooms, and oyster mushrooms. Other countries in the region, such as India, South Korea, and Japan, also have significant Mushroom production industries. As economies in the Asia-Pacific region continue to develop and urbanize, there's a growing demand for diverse and nutritious food options.

- Mushrooms, with their rich flavour, versatility, and nutritional benefits, are increasingly sought after by consumers in the region as both a staple food and a gourmet ingredient. The Mushroom industry in the Asia-Pacific region has benefited from advancements in cultivation techniques, including indoor cultivation, controlled environment agriculture, and substrate optimization. These technologies have increased efficiency, productivity, and quality in Mushroom production, further driving the region's dominance in the global market.

Mushroom Market Key Players

- Monaghan Mushrooms Ltd. (Ireland)

- Bonduelle SA (France)

- Okechamp SA (Poland)

- Drinkwater's Mushrooms Ltd. (United Kingdom)

- Costa Group Holdings Limited (Australia)

- The Mushroom Company (Spain)

- Greenyard NV (Belgium)

- Giorgio Fresh Co. (United States)

- Champion Mushroom Inc. (Canada)

- Agro Dutch Industries Ltd. (India)

- Phillips Mushroom Farms (United States)

- Shanghai Finc Bio-Tech Inc. (China)

- Banken Champignons BV (Netherlands)

- CMP Mushrooms Greenyard NV (Poland)

- Hampshire Mushroom (United States)

- Yukiguni Maitake Co. Ltd. (Japan)

- Scelta Mushrooms BV (Netherlands)

- California Mushroom Farms Inc. (United States)

- The Mushroom Company (Pty) Ltd. (South Africa)

- Yuguan (China)

- To-Jo Fresh Mushrooms Inc. (United States)

- Fujishukin Co. Ltd. (Japan)

- South Mill Champs (United States)

- Seiryo Sangyo Co. Ltd. (Japan)

- Modern Mushroom Farms (Canada)

- Other Active players.

Key Industry Developments in the Mushroom Market

- In Jan 2024, Hamburg-based biotech Infinite Roots bags €53 million Series B to Mushroom up production. Mushlabs, a leading German biotech company, announced the closing of its €53 million Series B funding round. The oversubscribed funding round represents the largest investment in mycelium technologies in Europe to date and underlines the growing importance of mycelium in the global food system.

- In Sept 2023, MISTERCAP'S, a new wellness company founded by multi-platinum-selling, GRAMMY and Golden Globe Award-nominated recording artist, Wiz Khalifa, officially announced its launch as a mushroom-forward brand promoting healthy living via natural organic mushrooms.

- In Aug 2023, Applied Food Sciences Inc. (AFS) is pleased to announce its equity investment and partnership with KÄÄPÄ Biotech, a Finland-based company specializing in fungi cultivation and research. With the functional Mushroom market proliferating, AFS recognizes the need to collaborate with a partner dedicated to mycology and to supply the best quality ingredients for product formulators.

|

Global Mushroom Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6523.97 Million |

|

Forecast Period 2025-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 14189.42 Million. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mushroom Market by Type (2018-2032)

4.1 Mushroom Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Button Mushroom

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Shiitake Mushroom

4.5 Oyster Mushroom

4.6 Portobello Mushroom

4.7 Cremini Mushroom

Chapter 5: Mushroom Market by Form (2018-2032)

5.1 Mushroom Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fresh Mushroom

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Frozen Mushroom

5.5 Canned Mushroom

5.6 Dried Mushroom

Chapter 6: Mushroom Market by Distribution Channel (2018-2032)

6.1 Mushroom Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets and Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Grocery Stores

6.5 Online Stores

6.6 Medicinal Purpose and Others

Chapter 7: Mushroom Market by Application (2018-2032)

7.1 Mushroom Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Industrial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Power Generation

7.5 Residential

7.6 Commercial

7.7 Transportation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Mushroom Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MONAGHAN MUSHROOMS LTD. (IRELAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BONDUELLE SA (FRANCE)

8.4 OKECHAMP SA (POLAND)

8.5 DRINKWATER'S MUSHROOMS LTD. (UNITED KINGDOM)

8.6 COSTA GROUP HOLDINGS LIMITED (AUSTRALIA)

8.7 THE MUSHROOM COMPANY (SPAIN)

8.8 GREENYARD NV (BELGIUM)

8.9 GIORGIO FRESH CO. (UNITED STATES)

8.10 CHAMPION MUSHROOM INC. (CANADA)

8.11 AGRO DUTCH INDUSTRIES LTD. (INDIA)

8.12 PHILLIPS MUSHROOM FARMS (UNITED STATES)

8.13 SHANGHAI FINC BIO-TECH INC. (CHINA)

8.14 BANKEN CHAMPIGNONS BV (NETHERLANDS)

8.15 CMP MUSHROOMS GREENYARD NV (POLAND)

8.16 HAMPSHIRE MUSHROOM (UNITED STATES)

8.17 YUKIGUNI MAITAKE CO. LTD. (JAPAN)

8.18 SCELTA MUSHROOMS BV (NETHERLANDS)

8.19 CALIFORNIA MUSHROOM FARMS INC. (UNITED STATES)

8.20 THE MUSHROOM COMPANY (PTY) LTD. (SOUTH AFRICA)

8.21 YUGUAN (CHINA)

8.22 TO-JO FRESH MUSHROOMS INC. (UNITED STATES)

8.23 FUJISHUKIN CO. LTD. (JAPAN)

8.24 SOUTH MILL CHAMPS (UNITED STATES)

8.25 SEIRYO SANGYO CO. LTD. (JAPAN)

8.26 MODERN MUSHROOM FARMS (CANADA)

Chapter 9: Global Mushroom Market By Region

9.1 Overview

9.2. North America Mushroom Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Button Mushroom

9.2.4.2 Shiitake Mushroom

9.2.4.3 Oyster Mushroom

9.2.4.4 Portobello Mushroom

9.2.4.5 Cremini Mushroom

9.2.5 Historic and Forecasted Market Size by Form

9.2.5.1 Fresh Mushroom

9.2.5.2 Frozen Mushroom

9.2.5.3 Canned Mushroom

9.2.5.4 Dried Mushroom

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Supermarkets and Hypermarkets

9.2.6.2 Grocery Stores

9.2.6.3 Online Stores

9.2.6.4 Medicinal Purpose and Others

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Industrial

9.2.7.2 Power Generation

9.2.7.3 Residential

9.2.7.4 Commercial

9.2.7.5 Transportation

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Mushroom Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Button Mushroom

9.3.4.2 Shiitake Mushroom

9.3.4.3 Oyster Mushroom

9.3.4.4 Portobello Mushroom

9.3.4.5 Cremini Mushroom

9.3.5 Historic and Forecasted Market Size by Form

9.3.5.1 Fresh Mushroom

9.3.5.2 Frozen Mushroom

9.3.5.3 Canned Mushroom

9.3.5.4 Dried Mushroom

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Supermarkets and Hypermarkets

9.3.6.2 Grocery Stores

9.3.6.3 Online Stores

9.3.6.4 Medicinal Purpose and Others

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Industrial

9.3.7.2 Power Generation

9.3.7.3 Residential

9.3.7.4 Commercial

9.3.7.5 Transportation

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Mushroom Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Button Mushroom

9.4.4.2 Shiitake Mushroom

9.4.4.3 Oyster Mushroom

9.4.4.4 Portobello Mushroom

9.4.4.5 Cremini Mushroom

9.4.5 Historic and Forecasted Market Size by Form

9.4.5.1 Fresh Mushroom

9.4.5.2 Frozen Mushroom

9.4.5.3 Canned Mushroom

9.4.5.4 Dried Mushroom

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Supermarkets and Hypermarkets

9.4.6.2 Grocery Stores

9.4.6.3 Online Stores

9.4.6.4 Medicinal Purpose and Others

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Industrial

9.4.7.2 Power Generation

9.4.7.3 Residential

9.4.7.4 Commercial

9.4.7.5 Transportation

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Mushroom Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Button Mushroom

9.5.4.2 Shiitake Mushroom

9.5.4.3 Oyster Mushroom

9.5.4.4 Portobello Mushroom

9.5.4.5 Cremini Mushroom

9.5.5 Historic and Forecasted Market Size by Form

9.5.5.1 Fresh Mushroom

9.5.5.2 Frozen Mushroom

9.5.5.3 Canned Mushroom

9.5.5.4 Dried Mushroom

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Supermarkets and Hypermarkets

9.5.6.2 Grocery Stores

9.5.6.3 Online Stores

9.5.6.4 Medicinal Purpose and Others

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Industrial

9.5.7.2 Power Generation

9.5.7.3 Residential

9.5.7.4 Commercial

9.5.7.5 Transportation

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Mushroom Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Button Mushroom

9.6.4.2 Shiitake Mushroom

9.6.4.3 Oyster Mushroom

9.6.4.4 Portobello Mushroom

9.6.4.5 Cremini Mushroom

9.6.5 Historic and Forecasted Market Size by Form

9.6.5.1 Fresh Mushroom

9.6.5.2 Frozen Mushroom

9.6.5.3 Canned Mushroom

9.6.5.4 Dried Mushroom

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Supermarkets and Hypermarkets

9.6.6.2 Grocery Stores

9.6.6.3 Online Stores

9.6.6.4 Medicinal Purpose and Others

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Industrial

9.6.7.2 Power Generation

9.6.7.3 Residential

9.6.7.4 Commercial

9.6.7.5 Transportation

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Mushroom Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Button Mushroom

9.7.4.2 Shiitake Mushroom

9.7.4.3 Oyster Mushroom

9.7.4.4 Portobello Mushroom

9.7.4.5 Cremini Mushroom

9.7.5 Historic and Forecasted Market Size by Form

9.7.5.1 Fresh Mushroom

9.7.5.2 Frozen Mushroom

9.7.5.3 Canned Mushroom

9.7.5.4 Dried Mushroom

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Supermarkets and Hypermarkets

9.7.6.2 Grocery Stores

9.7.6.3 Online Stores

9.7.6.4 Medicinal Purpose and Others

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Industrial

9.7.7.2 Power Generation

9.7.7.3 Residential

9.7.7.4 Commercial

9.7.7.5 Transportation

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Mushroom Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6523.97 Million |

|

Forecast Period 2025-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 14189.42 Million. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||