Pharmaceutical Manufacturing Software Market Synopsis:

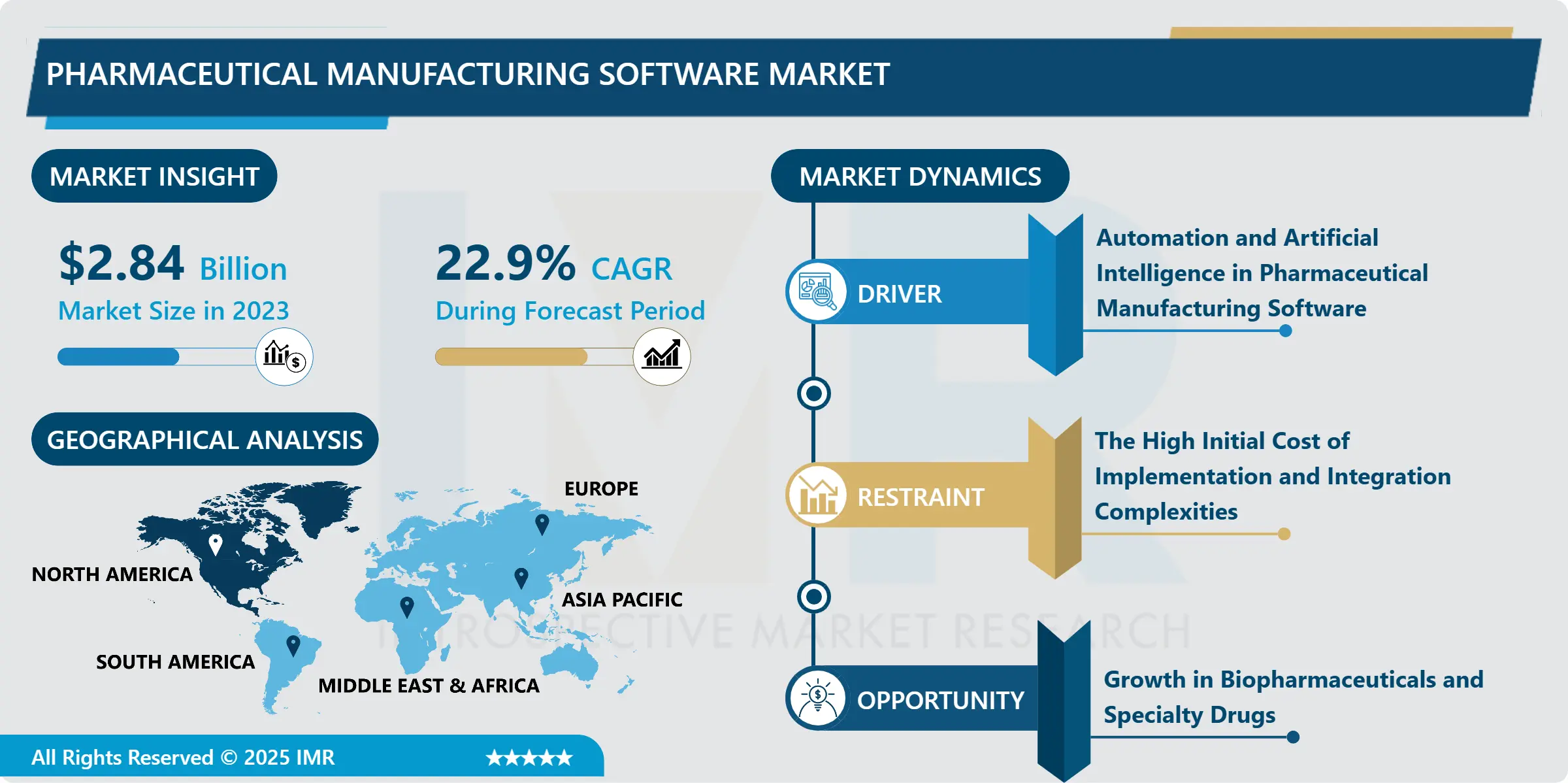

Pharmaceutical Manufacturing Software Market Size Was Valued at USD 2.84 Billion in 2023, and is Projected to Reach USD 18.16 Billion by 2032, Growing at a CAGR of 22.9% From 2024-2032.

Pharmaceutical Manufacturing Software can be defined as that portion of software industry which is specially involved in designing and implementing software solutions in the manufacturing process of pharmaceuticals. These solutions are mainly implemented to facilitate enhancement of productivity, organization, conformance to legal requirements and product quality within the context of the pharmaceutical manufacturing business. Pharmaceutical manufacturing software can be used for a range of features that includes manufacturing planning, business inventories, batch control, and quality assurance, reporting, equipment control, etc.

Pharmaceutical Manufacturing Software market is in the phase of growth specially in view of ever rising demand of better manufacturing performance and requirements of regulatory compliances in this sector. Industrials involved in the production of pharmaceuticals are constantly on the lookout for effective means of streamlining their production together with meeting very high production standards and legal production requirements across the world. This has given more importance to incorporating technologies that help them gain real-time access, analysis of data and effective work flows. In this sector where safety and precision is of paramount importance, it is central in the enhancement of this area through increased productivity, minimized errors and the ability to track products.

The use of automation technologies and Artificial Intelligence (AI) in the software used in the production of pharmaceuticals has facilitate the efficiency of manufacture in the past few years. This technological change enables these manufactures to achieve not only the legal satisfaction but also satisfy other objectives such as increasing their capacity, productivity and quality of product while equally reducing the cost of production. However, as businesses evolved, especially with the current COVID-19 pandemic that highly promoted adoption of digital phase within the pharmaceutical industry it forced the need to find innovative pharmaceutical software solutions. The world demand for pharmaceutics has also been rising, especially for biologics and specialty drugs, to sustain such a market, there is a need for advanced manufacturing software that can handle complex and more tailored processes.

Pharmaceutical Manufacturing Software Market Trend Analysis:

Automation and Artificial Intelligence in Pharmaceutical Manufacturing Software

-

Another trend that have been observed in the market of pharmaceutical manufacturing software is use of automatic systems and Artificial Intelligence systems. These new technologies are proving very useful in ensuring that new manufacturing cycles are developed that can improve efficiency, help prevent equipment failure and contribute to better decision making. Application of automation in pharmaceutical manufacturing software has the following purposes: automation of workloads, minimizing human errors, and rendering high-speed performances. AI on the other hand has further improved the software on aspects like forecasting the likely outcomes of the production processes, allocation of resources and this too in addition to identification of probable incidences that may become big problems in future. In this regard, as more manufacturers adopt these technologies, the pharmaceutical industry is moved closer to era of smarter production that is driven by more data and automation.

- AI and automation instruments also help manufacturers to respond to the fast-growing changes in the market and regulatory environment. AI applications also make it easier to analyze production processes and schedules, and inventory management in an effort to satisfy the constantly rising global demand for medicines while achieving quality and regulatory compliance goals. As the computing algorithms used in AI and machine learning models continue to improve pharma manufacturing software is becoming smarter and capable of making decisions on its own to optimize the production lines.

Growth in Biopharmaceuticals and Specialty Drugs

-

Another giant opportunity in the pharmaceutical manufacturing software market exists in a rise in the production of biopharmaceuticals and specialty drugs. These categories of drugs involve drastic speciality in their manufacture and come under strict cop regulation; this makes it important for the manufacturers require sophisticated software to deal with such complex processes. Lifestyle diseases, increase in cancer cases and the shift towards ‘molecular’ medicine that requires fairly sophisticated biotechnology to manufacture . Therefore, more and more pharmaceutical manufactures use the software solutions to achieve these complicated production flows and meet the changing regulatory demands.

- Furthermore, the continuing growth in the global consumption of advanced therapeutic products such as personalized medicine and biologics triggers the development of software tools with adaptable and real-time systems in order to address the concerns with small-batch production and product differentiation. These specialty products need formulating to be distinct from regular products thus the need for the large pharma companies to invest in new software solutions that can handle mass production as well as specialty production lines. The factor of extending capabilities of pharmaceutical manufacturing software to the executing of such complexities can be considered as the significant growth aspect for vendors in the market, as more focus is being paid to the production of biopharmaceuticals.

Pharmaceutical Manufacturing Software Market Segment Analysis:

Pharmaceutical Manufacturing Software Market is Segmented on the basis of Product Type, Application, End User, and Region.

By Product Type, software segment is expected to dominate the market during the forecast period

-

The segmentation of the Pharmaceutical Manufacturing Software Market has also been done on the basis of product type which includes just two products known as software and services. In the area of software there are several category of software applications used in the manufacturing of Pharmaceuticals, there include Manufacturing Execution Systems (MES), Enterprise Resource Planning (ERP) systems and quality management systems and solutions and regulatory compliance solution All these software solutions are essential for enhancing production efficiency, quality, inventory and for compliance to various regulatory measures. As the need for higher-performing manufacturing processes rises, the software segment develops rapidly, and the cloud-based solutions are especially popular for the mentioned reason.

- Services division refers to consulting, support and maintenance and training services that are very important in the successful integration and use of pharmaceutical manufacturing software. Technical points refused by consulting services enable the proper selection of software solutions and their integration into the pharmaceutical company’s existing systems. primary since it focuses on technical problems, software upgrades, and related problems that help keep the software operating properly. Training services are also needed, because they prepare the employees of the pharmaceutical manufacturers for the use of the software, helping them get the maximum benefit out of it. All these services play a great role in this market especially when businesses require professional assistance to improve performance and withstand regulations.

By Application, Quality Management segment expected to held the largest share

-

This Pharmaceutical Manufacturing Software Market is accepted in various applications – Production Planning & Scheduling, Batch Management, Inventory Management, and Quality Management. Manufacturing planning and scheduling software assists healthcare producers in defining production flow, minimizing resources required for production, preventing bottlenecks and delivering manufacturing goals on time. Batch management software is significant in pharmaceutical industries to enhance control and monitoring of pharmaceutical batches to take care of industry requirements, standard and guidelines. Inventory management applications assist in stock controlling assistance to reduce wastage all along with checking the desired raw material inventory in the production line. Through monitoring, inspections and tests conducted in real time by quality management software it becomes possible to guarantee that all pharmaceutical products meet the stipulated standards.

- Conversely, Regulatory Compliance Management and Equipment Maintenance Management are important applications for functioning of the pharma manufacturing industry. Regulatory compliance management software makes it possible for pharmaceutical manufacturers to meet tough global regulatory standards of conduct on documentation, reporting, and auditing among others. Maintenance management system is utilized to schedule and monitor the equipment maintenance processes so as to keep the production equipment in good working condition hence reducing on unnecessary breakdowns and enhancing on the useful life of equipment’s. Other application areas include data analysis, track & trace solutions, and supply chain management which add more value to the overall process and effectiveness of decision making, in pharmaceutical production.

Pharmaceutical Manufacturing Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North American has the largest share in the global pharmaceutical manufacturing software market in 2023. The exceptional performance of the region has been elicited by the fact that it has a well-established pharmaceutical sector, high focus on research, and development and early implementation of digital manufacturing platforms. The United States specifically has a large number of the largest drug manufacturers, which means that many of the most innovative software applications used to support manufacturing processes and compliance and quality control are developed there. The shift to digitalisation of the operations of pharma in the North American region that is experiencing growth also increases drug manufacturing software demand.

- Market analysis of North American market is expected to be above 40% in the pharmaceutical manufacturing software market within the region with the United States alone controlling the largest market share. The authorities of the region reported a high level of technological advance, sound legislative environment, and a growing number of recent partnerships between pharmaceutical firms and technology vendors. In addition, the continuous investment in AI and automation technologies across the US and Canada will continue to retain the region’s dominance in the pharmaceutical manufacturing software market in the future years.

Active Key Players in the Pharmaceutical Manufacturing Software Market:

-

ABB Ltd. (Switzerland)

- Accenture (Ireland)

- Dassault Systems (France)

- Emerson Electric Co. (United States)

- Fortress Technology (Canada)

- Honeywell International Inc. (United States)

- IBM Corporation (United States)

- Infor (United States)

- IQVIA (United States)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- Rockwell Automation (United States)

- SAP SE (Germany)

- Siemens AG (Germany), and Other Active Players

|

Global Pharmaceutical Manufacturing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.84 Billion |

|

Forecast Period 2024-32 CAGR: |

22.9 % |

Market Size in 2032: |

USD 18.16 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Manufacturing Software Market by Product Type

4.1 Pharmaceutical Manufacturing Software Market Snapshot and Growth Engine

4.2 Pharmaceutical Manufacturing Software Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Software: Geographic Segmentation Analysis

4.4 Services (Consulting

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services (Consulting: Geographic Segmentation Analysis

4.5 Support & Maintenance

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Support & Maintenance: Geographic Segmentation Analysis

4.6 Training)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Training): Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Manufacturing Software Market by Application

5.1 Pharmaceutical Manufacturing Software Market Snapshot and Growth Engine

5.2 Pharmaceutical Manufacturing Software Market Overview

5.3 Production Planning & Scheduling

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Production Planning & Scheduling: Geographic Segmentation Analysis

5.4 Batch Management

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Batch Management: Geographic Segmentation Analysis

5.5 Inventory Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Inventory Management: Geographic Segmentation Analysis

5.6 Quality Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Quality Management: Geographic Segmentation Analysis

5.7 Regulatory Compliance Management

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Regulatory Compliance Management: Geographic Segmentation Analysis

5.8 Equipment Maintenance Management

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Equipment Maintenance Management: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Manufacturing Software Market by End User

6.1 Pharmaceutical Manufacturing Software Market Snapshot and Growth Engine

6.2 Pharmaceutical Manufacturing Software Market Overview

6.3 Pharmaceutical Manufacturers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical Manufacturers: Geographic Segmentation Analysis

6.4 Contract Manufacturers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Contract Manufacturers: Geographic Segmentation Analysis

6.5 Biopharmaceutical Companies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Biopharmaceutical Companies: Geographic Segmentation Analysis

6.6 Generic Pharmaceutical Companies

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Generic Pharmaceutical Companies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Manufacturing Software Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ACCENTURE (IRELAND)

7.4 DASSAULT SYSTEMS (FRANCE)

7.5 EMERSON ELECTRIC CO. (UNITED STATES)

7.6 FORTRESS TECHNOLOGY (CANADA)

7.7 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

7.8 IBM CORPORATION (UNITED STATES)

7.9 INFOR (UNITED STATES)

7.10 IQVIA (UNITED STATES)

7.11 MICROSOFT CORPORATION (UNITED STATES)

7.12 ORACLE CORPORATION (UNITED STATES)

7.13 ROCKWELL AUTOMATION (UNITED STATES)

7.14 SAP SE (GERMANY)

7.15 SIEMENS AG (GERMANY)

7.16 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Manufacturing Software Market By Region

8.1 Overview

8.2. North America Pharmaceutical Manufacturing Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Software

8.2.4.2 Services (Consulting

8.2.4.3 Support & Maintenance

8.2.4.4 Training)

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Production Planning & Scheduling

8.2.5.2 Batch Management

8.2.5.3 Inventory Management

8.2.5.4 Quality Management

8.2.5.5 Regulatory Compliance Management

8.2.5.6 Equipment Maintenance Management

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Pharmaceutical Manufacturers

8.2.6.2 Contract Manufacturers

8.2.6.3 Biopharmaceutical Companies

8.2.6.4 Generic Pharmaceutical Companies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Manufacturing Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Software

8.3.4.2 Services (Consulting

8.3.4.3 Support & Maintenance

8.3.4.4 Training)

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Production Planning & Scheduling

8.3.5.2 Batch Management

8.3.5.3 Inventory Management

8.3.5.4 Quality Management

8.3.5.5 Regulatory Compliance Management

8.3.5.6 Equipment Maintenance Management

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Pharmaceutical Manufacturers

8.3.6.2 Contract Manufacturers

8.3.6.3 Biopharmaceutical Companies

8.3.6.4 Generic Pharmaceutical Companies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Manufacturing Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Software

8.4.4.2 Services (Consulting

8.4.4.3 Support & Maintenance

8.4.4.4 Training)

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Production Planning & Scheduling

8.4.5.2 Batch Management

8.4.5.3 Inventory Management

8.4.5.4 Quality Management

8.4.5.5 Regulatory Compliance Management

8.4.5.6 Equipment Maintenance Management

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Pharmaceutical Manufacturers

8.4.6.2 Contract Manufacturers

8.4.6.3 Biopharmaceutical Companies

8.4.6.4 Generic Pharmaceutical Companies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Manufacturing Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Software

8.5.4.2 Services (Consulting

8.5.4.3 Support & Maintenance

8.5.4.4 Training)

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Production Planning & Scheduling

8.5.5.2 Batch Management

8.5.5.3 Inventory Management

8.5.5.4 Quality Management

8.5.5.5 Regulatory Compliance Management

8.5.5.6 Equipment Maintenance Management

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Pharmaceutical Manufacturers

8.5.6.2 Contract Manufacturers

8.5.6.3 Biopharmaceutical Companies

8.5.6.4 Generic Pharmaceutical Companies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Manufacturing Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Software

8.6.4.2 Services (Consulting

8.6.4.3 Support & Maintenance

8.6.4.4 Training)

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Production Planning & Scheduling

8.6.5.2 Batch Management

8.6.5.3 Inventory Management

8.6.5.4 Quality Management

8.6.5.5 Regulatory Compliance Management

8.6.5.6 Equipment Maintenance Management

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Pharmaceutical Manufacturers

8.6.6.2 Contract Manufacturers

8.6.6.3 Biopharmaceutical Companies

8.6.6.4 Generic Pharmaceutical Companies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Manufacturing Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Software

8.7.4.2 Services (Consulting

8.7.4.3 Support & Maintenance

8.7.4.4 Training)

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Production Planning & Scheduling

8.7.5.2 Batch Management

8.7.5.3 Inventory Management

8.7.5.4 Quality Management

8.7.5.5 Regulatory Compliance Management

8.7.5.6 Equipment Maintenance Management

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Pharmaceutical Manufacturers

8.7.6.2 Contract Manufacturers

8.7.6.3 Biopharmaceutical Companies

8.7.6.4 Generic Pharmaceutical Companies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pharmaceutical Manufacturing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.84 Billion |

|

Forecast Period 2024-32 CAGR: |

22.9 % |

Market Size in 2032: |

USD 18.16 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||