Petrochemicals Market Synopsis

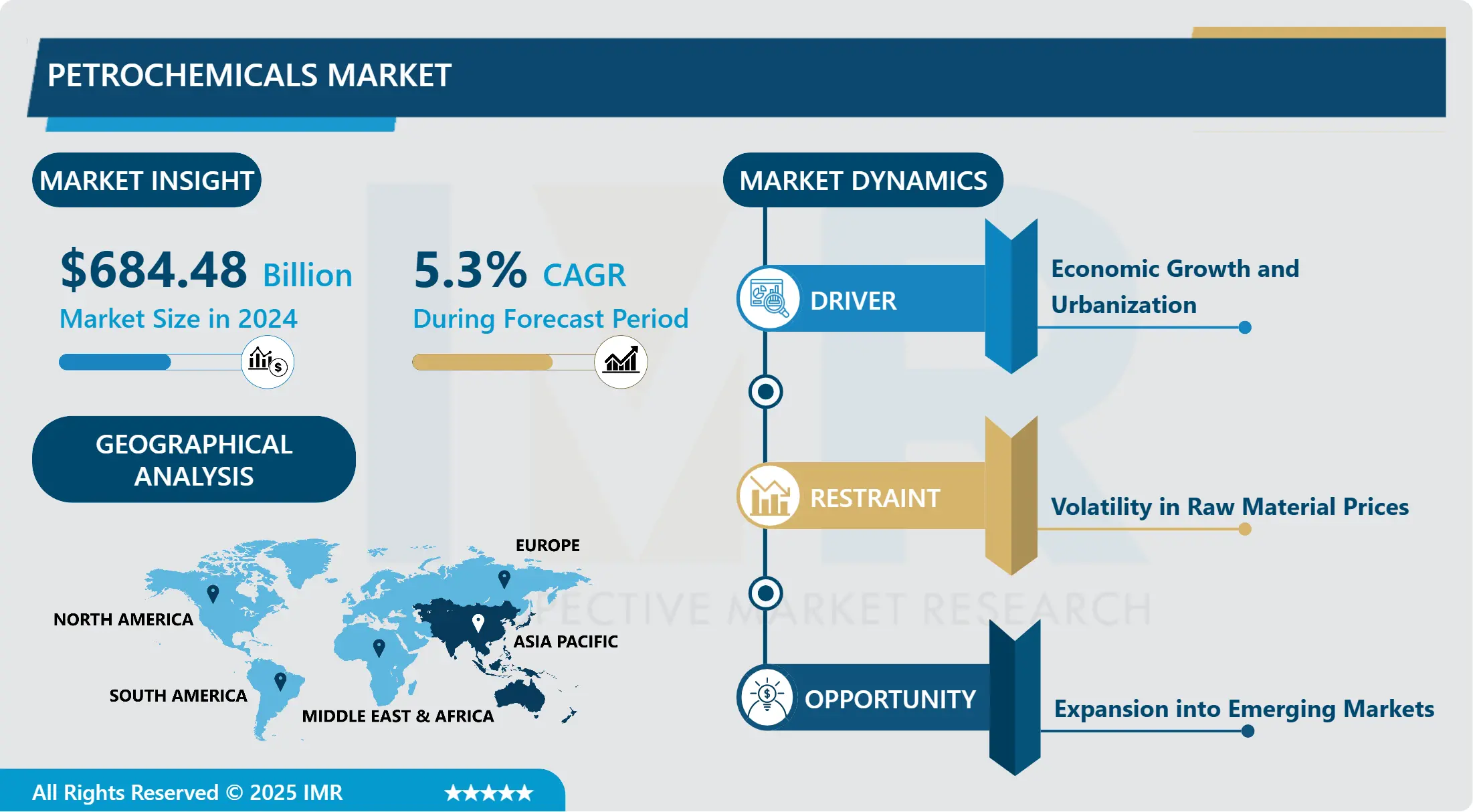

Petrochemicals Market Size Was Valued at USD 684.48 Billion in 2024 and is Projected to Reach USD 1034.64 Billion by 2030, Growing at a CAGR of 5.3% From 2025-2032.

The petrochemicals market refers to the industry involved in the production and distribution of chemical products derived from petroleum and natural gas. Petrochemicals serve as essential raw materials for a wide range of products, including plastics, synthetic fibers, rubber, and chemicals used in various industrial processes. This market is characterized by its dependence on the fluctuations in oil and gas prices, technological advancements, and regulatory changes affecting environmental standards. The growth of the petrochemicals market is driven by increasing demand across diverse sectors, including automotive, construction, and consumer goods, coupled with ongoing innovations in production technologies and sustainability practices.

The global petrochemicals market, encompassing a broad range of chemicals derived from petroleum and natural gas, is a critical component of the modern industrial landscape. Valued at approximately USD X billion in 2023, the market is anticipated to grow at a compound annual growth rate (CAGR) of Y% from 2024 to 2030. This growth is driven by the increasing demand for petrochemical products across various sectors including automotive, construction, consumer goods, and healthcare.

Key drivers of the petrochemicals market include the expansion of the automotive industry, where petrochemicals are essential in the production of tires, synthetic fibers, and various automotive components. Additionally, the rise in construction activities worldwide fuels demand for petrochemical-derived materials such as plastics and synthetic rubber. The ongoing technological advancements and innovations in petrochemical production processes, including the development of more efficient and environmentally friendly methods, also play a significant role in market growth.

However, the market faces several challenges. Environmental regulations and the shift towards sustainable practices are prompting a transition towards alternative and greener raw materials, which may impact the traditional petrochemicals market. Fluctuations in crude oil prices also pose a risk to market stability, affecting production costs and profitability. Furthermore, the increasing focus on recycling and circular economy principles is influencing the demand dynamics within the petrochemicals sector.

Geographically, the Asia-Pacific region is expected to dominate the market, driven by rapid industrialization and urbanization in countries like China and India. North America and Europe also represent significant markets, supported by established industrial infrastructure and technological advancements. Emerging markets in the Middle East and Africa are witnessing increasing investments in petrochemical production facilities, contributing to the overall market expansion.

In summary, while the petrochemicals market continues to experience robust growth, it must navigate the complexities of regulatory changes and shifting market dynamics. The industry's ability to adapt to these challenges while capitalizing on growth opportunities will be crucial for maintaining its trajectory in the coming years.

Petrochemicals Market Trend Analysis

Petrochemicals Market Growth Driver- Increased Demand for Specialty Chemicals

- The increased demand for specialty chemicals derived from petrochemicals reflects a significant shift towards more sophisticated and high-value-added products. Specialty chemicals, such as high-performance polymers, advanced composites, and specialty adhesives, are gaining traction across various industries due to their unique properties and functionalities. High-performance polymers, for instance, offer exceptional strength, durability, and resistance to extreme temperatures and chemicals. These attributes make them ideal for use in the automotive industry, where they contribute to the production of lightweight, fuel-efficient vehicles with enhanced safety features. Similarly, advanced composites, which combine polymers with reinforcing materials like fibers, are increasingly utilized in aerospace applications. Their high strength-to-weight ratio is critical for improving fuel efficiency and performance in aircraft and spacecraft.

- Specialty adhesives, another key category of specialty chemicals, play a crucial role in various sectors. In the electronics industry, these adhesives are essential for assembling components and ensuring long-term reliability of electronic devices. Their precise bonding capabilities are vital for maintaining the integrity of intricate electronic circuits and components. Additionally, the automotive and aerospace industries rely on specialty adhesives for assembly and repair applications, where strong, durable bonds are required to withstand harsh conditions and mechanical stresses.

- This shift towards specialty chemicals is driven by the need for advanced materials that offer improved performance, efficiency, and functionality. As industries continue to evolve and demand higher standards for their products, the petrochemical sector is responding by focusing on the development and production of these high-value-added chemicals. This trend not only enhances the performance of end-use products but also drives innovation and growth within the petrochemical industry.

Petrochemicals Market Expansion Opportunity- The Rise of Asia-Pacific as a Petrochemical Powerhouse

- The growth of emerging markets, particularly in the Asia-Pacific region, is significantly propelling the expansion of the petrochemicals market. Countries like China and India are at the forefront of this trend due to their rapid industrialization and urbanization. As these nations continue to develop their infrastructure, manufacturing capabilities, and consumer goods sectors, the demand for petrochemical products rises correspondingly. In China, massive investments in industrial parks and manufacturing facilities have bolstered the production of various petrochemicals, from basic polymers to advanced specialty chemicals. Similarly, India’s burgeoning economy and growing middle class are driving up the need for a wide range of petrochemical products, which are crucial for the production of consumer goods, automotive components, and construction materials. The burgeoning infrastructure projects and increasing urban populations in these countries further fuel the demand for petrochemical products used in construction and housing.

- The Asia-Pacific region’s role as a central hub for petrochemical manufacturing and consumption is increasingly evident. The region's substantial market size, coupled with its strategic location for global trade, positions it as a pivotal player in the global petrochemicals industry. The establishment of large-scale petrochemical complexes and refining facilities in countries like China, India, and Southeast Asian nations underscores the strategic importance of this region. These facilities are designed to meet the rising local demand while also serving as export hubs for international markets. The expansion of these petrochemical hubs is supported by favorable government policies, including investments in infrastructure and incentives for the industry. As a result, Asia-Pacific is not only enhancing its role in global petrochemical supply chains but also setting the pace for future growth and innovation within the sector.

Petrochemicals Market Segment Analysis:

Petrochemicals Market Segmented based on Product, End-Use Industry, and Region.

By Product, Ethylene segment is expected to dominate the market during the forecast period

- Ethylene, a key player in the petrochemicals market, is renowned for its foundational role in the production of various essential chemicals and materials. As the most produced petrochemical globally, ethylene serves as the primary feedstock for the manufacturing of polyethylene, a versatile polymer used in a multitude of applications. This includes packaging materials such as films, containers, and bags, which are integral to the food and consumer goods industries. In the automotive sector, polyethylene is used in components like bumpers and fuel tanks, enhancing the durability and safety of vehicles. Additionally, in construction, polyethylene is utilized in products such as pipes, insulation, and membranes, contributing to the industry's demand for robust and long-lasting materials.

- The dominance of ethylene in the market is further underscored by its adaptability and broad application base. Ethylene's role extends beyond polyethylene to the production of other important derivatives, including ethylene oxide and ethylene glycol, which are essential in producing antifreeze, polyester fibers, and various solvents. Its continuous demand is fueled by growth in end-use industries, technological advancements, and the increasing emphasis on sustainable and efficient materials. Consequently, ethylene's significant market share is a testament to its pivotal role in driving the petrochemical sector's evolution and its capacity to meet diverse industrial needs.

By End-Use Industry, Packaging segment held the largest share in 2024

- The packaging industry commands the largest share in the petrochemicals market, largely due to the extensive use of plastics and films derived from petrochemical products. Packaging materials such as polyethylene, polypropylene, and polystyrene are integral to various packaging applications, including containers, wraps, and bags. These materials offer several advantages, including flexibility, durability, and cost-effectiveness, which make them ideal for preserving and protecting a wide range of products. As global consumption of packaged goods continues to rise, the demand for these petrochemical-based materials remains robust, driving the industry's significant market share. The ability of plastics to be customized for specific functions, such as barrier protection and tamper resistance, further enhances their popularity in the packaging sector.

- Additionally, the growing emphasis on convenience and sustainability in consumer preferences has bolstered the demand for innovative packaging solutions. The rise of e-commerce and on-the-go lifestyles has increased the need for efficient and reliable packaging options. Moreover, advancements in packaging technology, such as biodegradable and recyclable materials, are being driven by both regulatory pressures and consumer demand for environmentally friendly options. This shift towards more sustainable packaging solutions is expected to continue influencing the market, ensuring that the packaging industry remains a dominant force in the petrochemicals sector. The sector's continuous evolution in response to changing market dynamics underscores its critical role in the global petrochemical landscape.

Petrochemicals Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region stands as the largest and fastest-growing petrochemicals market globally, fueled by its rapid industrialization and urbanization. Countries such as China, India, and various Southeast Asian nations are driving substantial demand for petrochemical products due to their expanding manufacturing sectors and increasing consumer bases. China's role is particularly significant; as the largest consumer in the region, it is undertaking extensive projects to boost its petrochemical production capacity. The country is investing heavily in new facilities and technologies to enhance efficiency and meet the growing domestic demand. Moreover, China's initiatives aim to reduce reliance on imported petrochemical products, focusing on self-sufficiency and sustainability through investments in infrastructure and advanced production technologies.

- In addition to China, other Asia-Pacific nations are also ramping up their petrochemical production capabilities. India and Southeast Asian countries are making considerable strides in expanding their petrochemical industries to support their own rapid economic growth and industrial development. These nations are leveraging their advantageous positions in terms of low-cost feedstocks and favorable geographic locations to enhance their production and export capabilities. The region’s focus on increasing production efficiency and reducing import dependence is reflected in the ongoing development of new petrochemical plants and the modernization of existing facilities. As a result, Asia-Pacific is not only expanding its share of the global petrochemicals market but also setting trends in technological advancements and strategic investments.

Active Key Players in the Petrochemicals Market

- BASF SE

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petrochemical Corporation

- ExxonMobil Corporation

- INEOS Group Ltd.

- LyondellBasell Industries Holdings B.V.

- Royal Dutch Shell PLC

- SABIC

- Dow

- Other Active Players

Key Industry Developments in the Petrochemicals Market:

- In November 2023, Dow announced invest of USD 8.9 billion for a net-zero petrochemical plant project in Alberta's Industrial Heartland, Canada. It is projected to produce around 3 million tons of low-emission ethylene and polyethylene derivatives. The construction of the project is set to start construction in 2024

- In July 2023, SABIC introduced its latest PCR-based NORYLTM portfolio to reduce carbon footprint by incorporating bio-based and recycled materials in petrochemical products, a step for making the chemical sector environment friendly

- In July 2023, ExxonMobil Corporation declared its agreement to acquire Denbury Inc. to expand its carbon capture and storage (CCS) solutions, and reduce carbon emissions for the petrochemical and energy industries.

- In May 2023, Dow Corporate collaborated with New Energy Blue to produce bio-based ethylene from renewable residues of agriculture. Ethylene is a petrochemical-based raw material, and with its production Dow aims to initiate a sustainable approach to produce plastic.

|

Global Petrochemicals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 684.48 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.3% |

Market Size in 2032: |

USD 1034.64 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End-Use Industry

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Petrochemicals Market by Product (2018-2032)

4.1 Petrochemicals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ethylene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Propylene

4.5 Butadiene

4.6 Benzen

4.7 Xylene

4.8 Toluene

4.9 Methanol

Chapter 5: Petrochemicals Market by End-Use Industry (2018-2032)

5.1 Petrochemicals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Packaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electronics

5.5 Construction

5.6 Automotive

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Petrochemicals Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BASF SE

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CHEVRON CORPORATION

6.4 CHINA NATIONAL PETROLEUM CORPORATION (CNPC)

6.5 CHINA PETROCHEMICAL CORPORATION

6.6 EXXONMOBIL CORPORATION

6.7 INEOS GROUP LTDLYONDELLBASELL INDUSTRIES HOLDINGS B.VROYAL DUTCH SHELL PLC

6.8 SABIC

6.9 DOW

Chapter 7: Global Petrochemicals Market By Region

7.1 Overview

7.2. North America Petrochemicals Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Ethylene

7.2.4.2 Propylene

7.2.4.3 Butadiene

7.2.4.4 Benzen

7.2.4.5 Xylene

7.2.4.6 Toluene

7.2.4.7 Methanol

7.2.5 Historic and Forecasted Market Size by End-Use Industry

7.2.5.1 Packaging

7.2.5.2 Electronics

7.2.5.3 Construction

7.2.5.4 Automotive

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Petrochemicals Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Ethylene

7.3.4.2 Propylene

7.3.4.3 Butadiene

7.3.4.4 Benzen

7.3.4.5 Xylene

7.3.4.6 Toluene

7.3.4.7 Methanol

7.3.5 Historic and Forecasted Market Size by End-Use Industry

7.3.5.1 Packaging

7.3.5.2 Electronics

7.3.5.3 Construction

7.3.5.4 Automotive

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Petrochemicals Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Ethylene

7.4.4.2 Propylene

7.4.4.3 Butadiene

7.4.4.4 Benzen

7.4.4.5 Xylene

7.4.4.6 Toluene

7.4.4.7 Methanol

7.4.5 Historic and Forecasted Market Size by End-Use Industry

7.4.5.1 Packaging

7.4.5.2 Electronics

7.4.5.3 Construction

7.4.5.4 Automotive

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Petrochemicals Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Ethylene

7.5.4.2 Propylene

7.5.4.3 Butadiene

7.5.4.4 Benzen

7.5.4.5 Xylene

7.5.4.6 Toluene

7.5.4.7 Methanol

7.5.5 Historic and Forecasted Market Size by End-Use Industry

7.5.5.1 Packaging

7.5.5.2 Electronics

7.5.5.3 Construction

7.5.5.4 Automotive

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Petrochemicals Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Ethylene

7.6.4.2 Propylene

7.6.4.3 Butadiene

7.6.4.4 Benzen

7.6.4.5 Xylene

7.6.4.6 Toluene

7.6.4.7 Methanol

7.6.5 Historic and Forecasted Market Size by End-Use Industry

7.6.5.1 Packaging

7.6.5.2 Electronics

7.6.5.3 Construction

7.6.5.4 Automotive

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Petrochemicals Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Ethylene

7.7.4.2 Propylene

7.7.4.3 Butadiene

7.7.4.4 Benzen

7.7.4.5 Xylene

7.7.4.6 Toluene

7.7.4.7 Methanol

7.7.5 Historic and Forecasted Market Size by End-Use Industry

7.7.5.1 Packaging

7.7.5.2 Electronics

7.7.5.3 Construction

7.7.5.4 Automotive

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Petrochemicals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 684.48 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.3% |

Market Size in 2032: |

USD 1034.64 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End-Use Industry

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||