PET Packaging Market Synopsis:

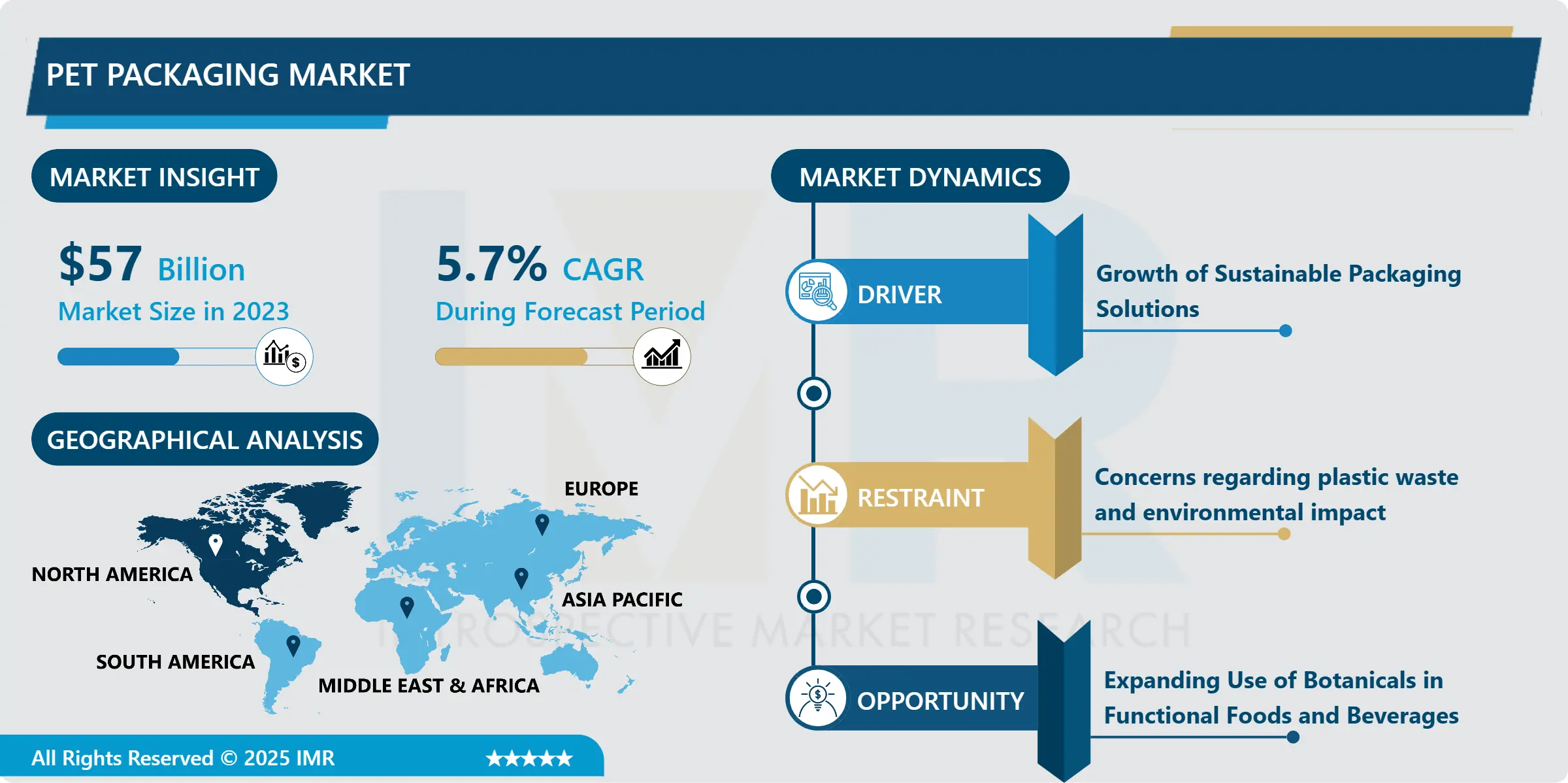

PET Packaging Market Size Was Valued at USD 57 Billion in 2023, and is Projected to Reach USD 123 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

Over the past few years the PET Packaging Market has grown greatly due to flexibility, low weight, durability and cost saving properties that the packaging material exhibits. PET (polyethylene terephthalate) is a well-known thermoplastic polymer because of its excellent barrier properties, high clarity and enhanced impact strength which finds its application in packaging of beverages and food products, pharmaceutical and personal care products. Sustainable packaging solutions have gone a notch higher in boosting the uptake of PET since the material is 100% recyclable and can be made from recycled material with the increase in sensitivity to the environment by consumers and producers.

The beverage industry has been the major consumer of PET packaging material because of the light weight and its efficiency in keeping the products fresh. With consumers hooked on bottled water, carbonated soft drinks and ready to drink beverages, PET bottles have become a popular packaging type for manufacturers. Third, PET is highly convenient as well as portable, which makes it well-favored by consumers, and this has the potential to accelerate the growth of the PET packaging market. Moreover, the introduction of online tailor-made services contributed to the growth of the PET Packaging Market since it requires more secure and efficient means to deliver the products.

Still, the PET Packaging Market is not without out challenges such as the increase in concern and awareness concerning the negatives impacts of plastics and particularly single use plastics. As a result of these challenges, firms are committing resources towards innovations to increase the level of PET recyclability as well as research on biodegradable polymers. Further, such technologies that provide sustainable packaging are enhancing regulators to work for new materials and advance technologies. Over time, a tremendous advancement in innovation of PET packaging is estimated to happen with a focus on sustainability and enhanced packaging outlook as the PET Packaging Market unfolds as outlined below.

PET Packaging Market Trend Analysis:

Growth of Sustainable Packaging Solutions

-

In more detail, this research notes that one of the key market trends in the PET Packaging Business is the need for green solutions. And as green consciousness rises in importance, consumers and producers are steadily looking for biodegradable substitutes of conventional packaging. This has culminated to formation of the recycled PET or rPET products named since they use recycled post consumer material and then convert it into new packaging material.

- The increase in the adoption of rPET by brands to portray their sustainability efforts is spurring the change in the PET packaging design and manufacture. Also, the advancement in biodegradable or compostable material is also observing growth which also enriches the concept of sustainability in the PET Packaging Market.

Expanding Use of Botanicals in Functional Foods and Beverages

-

The following is a breakdown of several trends that will influence the PET Packaging Market going forward: the incorporation of sophisticated technologies in the manufacturing line. Businesses are now utilizing the latest strategies including the use of the 3D printing, automation and smart packaging to minimize cost and improve on the quality of their products. These technologies allow firms to develop unique packaging products that would address many clients’ demands while there being efficient usage of resources.

- In addition, features like QR codes and NFC are added to PET packaging to make the interaction with consumers richer and provide them with more information about specific products of brands. With these technologies advancing, there is much expected in the future growth of the PET Packaging Market.

PET Packaging Market Segment Analysis:

PET Packaging Market is Segmented on the basis of Packaging Type, Form, Pack Type, Filling Technology, End-User, and Region.

By Packaging Type, Rigid Packaging segment is expected to dominate the market during the forecast period

-

The PET Packaging Market is further categorized on the basis of packaging type as rigid packaging or flexible packaging based on the applications or customer requirements. PET bottles and containers are some of the most common examples of rigid packaging that is used in the beverage, food and pharmaceutical industries, because this type of packaging provides strength and durability, and properly preserves the quality of products. This sector is most relevant in the bottled water and carbonated beverage industries since clients require compact and durable packaging materials.

- Whereas laminated films based on polyester PET films are gradually taking a foothold in the market in terms of such benefits as variability, ease and compactness. The innovative PET packaging is often used for snacks, ready to use meals and other goods that correspond to a new tendency of any time eating. With rigid as well as flexible PET packaging changing further the manufacturers are putting their emphasis on novelty along with viability to cater to the increased customer requirements and industry regulations to strengthen the growth of PET Packaging Market.

By End-User, Beverages Industry segment expected to held the largest share

-

Pet packaging is widely demanded by a large number of industries which are related to beverages, household products, foods and drinks, medicine and other industries. They are most popular in the beverages industry due to their low density, non-returnable, and highly recyclable attributes which makes them ideal for use in bottled water, soft fruits and juices. This sector also gains from PET packaging because it provides strong and multi-utility packaging solution for the washing commodities and personal products.

- In food industry it extends, maintains the shelf life of food and offers protection against contamination or spoilt food products and food borne diseases. The pharmaceutical industry is among the industries that benefactor from PET because of its capability to safeguard delicate products and meet set standards. Thus, the multifunctional nature of PET across these sectors of use given the increasing demand from consumers for sustainable and innovative packaging presents PET for steady growth in the market.

PET Packaging Market Regional Insights:

Asia Pacific is experiencing significant growth in PET packaging Market

-

Asia Pacific region presents a favorable growth for the PET Packaging Market majorly because of the increased urbanization, the growth rate of consumers’ spending on foods and beverages packaged as well as an increasing demand for packaged food in general across the Asia Pacific. The convenience and lightweight nature of PET packaging make it a appropriate choice of packaging, especially in the food and beverage, personal care and pharmaceutical industries.

- People in developed countries and those on the ascent to the class, such as those in China and India, are drinking more bottled water and soft drinks packaged in PET bottles. Also, due to the consumer demand towards sustainability, the use of recycled PET is increasing among the manufacturers that make the market more environmentally friendly. Consequently, the Asia Pacific PET Packaging market has positioned well to grow continuously in the coming years due to the innovation in packaging technology and design that continues to meet the changing preferences of consumer and business.

Active Key Players in the PET Packaging Market:

- Amcor plc (Switzerland),

- Berry Global (USA),

- Graham Packaging Company (USA),

- Dunmore Corporation (USA),

- Huhtamäki Oyj (Finland),

- Resilux NV (Belgium),

- E. I. du Pont de Nemours and Company (USA),

- Silgan Holdings Inc. (USA),

- GTX Hanex Plastic (South Korea),

- Comar LLC (USA),

- Sonoco Products Company (USA),

- Nampak Ltd. (South Africa),

- CCL Industries Inc. (Canada),

- Smurfit Kappa Group (Ireland),

- Rexam PLC (England), and Other Active Players

|

Global Botanical Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 57 Billion |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 123 Billion |

|

Segments Covered: |

By Packaging Type |

|

|

|

By Form |

|

||

|

By Pack Type |

|

||

|

By Filling Technology |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: PET Packaging Market by Packaging Type

4.1 PET Packaging Market Snapshot and Growth Engine

4.2 PET Packaging Market Overview

4.3 Rigid Packaging

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Rigid Packaging: Geographic Segmentation Analysis

4.4 Flexible Packaging

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Flexible Packaging: Geographic Segmentation Analysis

Chapter 5: PET Packaging Market by Form

5.1 PET Packaging Market Snapshot and Growth Engine

5.2 PET Packaging Market Overview

5.3 Amorphous PET

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Amorphous PET: Geographic Segmentation Analysis

5.4 Crystalline PET

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Crystalline PET: Geographic Segmentation Analysis

Chapter 6: PET Packaging Market by Pack Type

6.1 PET Packaging Market Snapshot and Growth Engine

6.2 PET Packaging Market Overview

6.3 Bottles and Jars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Bottles and Jars: Geographic Segmentation Analysis

6.4 Bags and Pouches

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Bags and Pouches: Geographic Segmentation Analysis

6.5 Trays

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Trays: Geographic Segmentation Analysis

6.6 Lids/Caps and Closures

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Lids/Caps and Closures: Geographic Segmentation Analysis

6.7 and Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 and Others: Geographic Segmentation Analysis

Chapter 7: PET Packaging Market by Filling Technology

7.1 PET Packaging Market Snapshot and Growth Engine

7.2 PET Packaging Market Overview

7.3 Hot Fill

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hot Fill: Geographic Segmentation Analysis

7.4 Cold Fill

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Cold Fill: Geographic Segmentation Analysis

7.5 Aseptic Fill

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Aseptic Fill: Geographic Segmentation Analysis

7.6 and Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 and Others: Geographic Segmentation Analysis

Chapter 8: PET Packaging Market by End-User

8.1 PET Packaging Market Snapshot and Growth Engine

8.2 PET Packaging Market Overview

8.3 Beverages Industry

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Beverages Industry: Geographic Segmentation Analysis

8.4 Household Goods Sector

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Household Goods Sector: Geographic Segmentation Analysis

8.5 Food Industry

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Food Industry: Geographic Segmentation Analysis

8.6 Pharmaceutical Industry

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Pharmaceutical Industry: Geographic Segmentation Analysis

8.7 and Others

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 and Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 PET Packaging Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AMCOR PLC (SWITZERLAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BERRY GLOBAL (USA)

9.4 GRAHAM PACKAGING COMPANY (USA)

9.5 DUNMORE CORPORATION (USA)

9.6 HUHTAMÄKI OYJ (FINLAND)

9.7 RESILUX NV (BELGIUM)

9.8 E. I. DU PONT DE NEMOURS AND COMPANY (USA)

9.9 SILGAN HOLDINGS INC. (USA)

9.10 GTX HANEX PLASTIC (SOUTH KOREA)

9.11 COMAR LLC (USA)

9.12 SONOCO PRODUCTS COMPANY (USA)

9.13 NAMPAK LTD. (SOUTH AFRICA)

9.14 CCL INDUSTRIES INC. (CANADA)

9.15 SMURFIT KAPPA GROUP (IRELAND)

9.16 REXAM PLC (ENGLAND)

9.17 OTHER ACTIVE PLAYERS

Chapter 10: Global PET Packaging Market By Region

10.1 Overview

10.2. North America PET Packaging Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Packaging Type

10.2.4.1 Rigid Packaging

10.2.4.2 Flexible Packaging

10.2.5 Historic and Forecasted Market Size By Form

10.2.5.1 Amorphous PET

10.2.5.2 Crystalline PET

10.2.6 Historic and Forecasted Market Size By Pack Type

10.2.6.1 Bottles and Jars

10.2.6.2 Bags and Pouches

10.2.6.3 Trays

10.2.6.4 Lids/Caps and Closures

10.2.6.5 and Others

10.2.7 Historic and Forecasted Market Size By Filling Technology

10.2.7.1 Hot Fill

10.2.7.2 Cold Fill

10.2.7.3 Aseptic Fill

10.2.7.4 and Others

10.2.8 Historic and Forecasted Market Size By End-User

10.2.8.1 Beverages Industry

10.2.8.2 Household Goods Sector

10.2.8.3 Food Industry

10.2.8.4 Pharmaceutical Industry

10.2.8.5 and Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe PET Packaging Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Packaging Type

10.3.4.1 Rigid Packaging

10.3.4.2 Flexible Packaging

10.3.5 Historic and Forecasted Market Size By Form

10.3.5.1 Amorphous PET

10.3.5.2 Crystalline PET

10.3.6 Historic and Forecasted Market Size By Pack Type

10.3.6.1 Bottles and Jars

10.3.6.2 Bags and Pouches

10.3.6.3 Trays

10.3.6.4 Lids/Caps and Closures

10.3.6.5 and Others

10.3.7 Historic and Forecasted Market Size By Filling Technology

10.3.7.1 Hot Fill

10.3.7.2 Cold Fill

10.3.7.3 Aseptic Fill

10.3.7.4 and Others

10.3.8 Historic and Forecasted Market Size By End-User

10.3.8.1 Beverages Industry

10.3.8.2 Household Goods Sector

10.3.8.3 Food Industry

10.3.8.4 Pharmaceutical Industry

10.3.8.5 and Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe PET Packaging Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Packaging Type

10.4.4.1 Rigid Packaging

10.4.4.2 Flexible Packaging

10.4.5 Historic and Forecasted Market Size By Form

10.4.5.1 Amorphous PET

10.4.5.2 Crystalline PET

10.4.6 Historic and Forecasted Market Size By Pack Type

10.4.6.1 Bottles and Jars

10.4.6.2 Bags and Pouches

10.4.6.3 Trays

10.4.6.4 Lids/Caps and Closures

10.4.6.5 and Others

10.4.7 Historic and Forecasted Market Size By Filling Technology

10.4.7.1 Hot Fill

10.4.7.2 Cold Fill

10.4.7.3 Aseptic Fill

10.4.7.4 and Others

10.4.8 Historic and Forecasted Market Size By End-User

10.4.8.1 Beverages Industry

10.4.8.2 Household Goods Sector

10.4.8.3 Food Industry

10.4.8.4 Pharmaceutical Industry

10.4.8.5 and Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific PET Packaging Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Packaging Type

10.5.4.1 Rigid Packaging

10.5.4.2 Flexible Packaging

10.5.5 Historic and Forecasted Market Size By Form

10.5.5.1 Amorphous PET

10.5.5.2 Crystalline PET

10.5.6 Historic and Forecasted Market Size By Pack Type

10.5.6.1 Bottles and Jars

10.5.6.2 Bags and Pouches

10.5.6.3 Trays

10.5.6.4 Lids/Caps and Closures

10.5.6.5 and Others

10.5.7 Historic and Forecasted Market Size By Filling Technology

10.5.7.1 Hot Fill

10.5.7.2 Cold Fill

10.5.7.3 Aseptic Fill

10.5.7.4 and Others

10.5.8 Historic and Forecasted Market Size By End-User

10.5.8.1 Beverages Industry

10.5.8.2 Household Goods Sector

10.5.8.3 Food Industry

10.5.8.4 Pharmaceutical Industry

10.5.8.5 and Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa PET Packaging Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Packaging Type

10.6.4.1 Rigid Packaging

10.6.4.2 Flexible Packaging

10.6.5 Historic and Forecasted Market Size By Form

10.6.5.1 Amorphous PET

10.6.5.2 Crystalline PET

10.6.6 Historic and Forecasted Market Size By Pack Type

10.6.6.1 Bottles and Jars

10.6.6.2 Bags and Pouches

10.6.6.3 Trays

10.6.6.4 Lids/Caps and Closures

10.6.6.5 and Others

10.6.7 Historic and Forecasted Market Size By Filling Technology

10.6.7.1 Hot Fill

10.6.7.2 Cold Fill

10.6.7.3 Aseptic Fill

10.6.7.4 and Others

10.6.8 Historic and Forecasted Market Size By End-User

10.6.8.1 Beverages Industry

10.6.8.2 Household Goods Sector

10.6.8.3 Food Industry

10.6.8.4 Pharmaceutical Industry

10.6.8.5 and Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America PET Packaging Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Packaging Type

10.7.4.1 Rigid Packaging

10.7.4.2 Flexible Packaging

10.7.5 Historic and Forecasted Market Size By Form

10.7.5.1 Amorphous PET

10.7.5.2 Crystalline PET

10.7.6 Historic and Forecasted Market Size By Pack Type

10.7.6.1 Bottles and Jars

10.7.6.2 Bags and Pouches

10.7.6.3 Trays

10.7.6.4 Lids/Caps and Closures

10.7.6.5 and Others

10.7.7 Historic and Forecasted Market Size By Filling Technology

10.7.7.1 Hot Fill

10.7.7.2 Cold Fill

10.7.7.3 Aseptic Fill

10.7.7.4 and Others

10.7.8 Historic and Forecasted Market Size By End-User

10.7.8.1 Beverages Industry

10.7.8.2 Household Goods Sector

10.7.8.3 Food Industry

10.7.8.4 Pharmaceutical Industry

10.7.8.5 and Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Botanical Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 57 Billion |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 123 Billion |

|

Segments Covered: |

By Packaging Type |

|

|

|

By Form |

|

||

|

By Pack Type |

|

||

|

By Filling Technology |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||