Performance Elastomers Market Synopsis

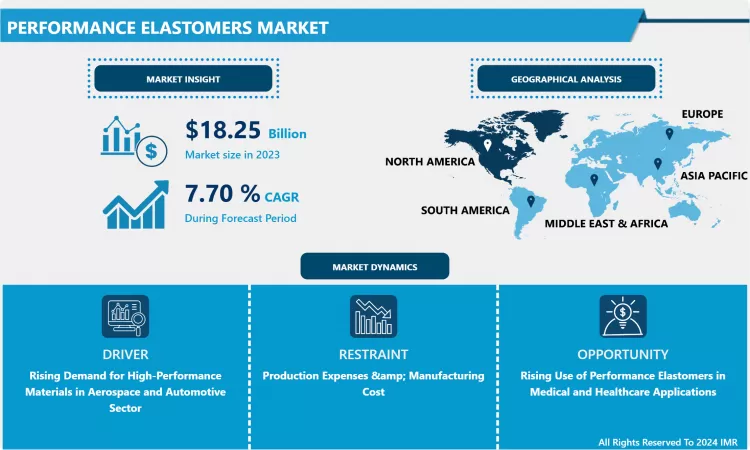

Performance Elastomers Market Size is Valued at USD 18.25 Billion in 2024, and is Projected to Reach USD 35.76 Billion by 2032, Growing at a CAGR of 7.70% From 2024-2032.

The Performance Elastomers Market is the industry of the elastomers where the materials used are of high-performance rubber that retains elasticity, resilience, and strength in several situations. These elastomers are used across a variety of industries because they demonstrate enhanced chemical, thermal and mechanical performance making them suitable for challenging applications like seals, gaskets, hoses and components of automobiles, aerospace, medical, and manufacturing industries.

- Among the main growth stimulators of the Performance Elastomers Market, special mention should be made of the desire to use new materials in the automotive and aerospace industries. As car builders looked for better fuel economy and better performing vehicles, they turned to high performance elastomers for producing lightweight and long-life part. This change of materials towards lightweighting aids on lessening of overall vehicle weight hence less emissions and better fuel economy.

- The other factor that has help drive this factor is the increasing concern over environmental issues and the related legislation. Thus, industries are gradually looking for the products that not only respond to the performances but also comply with the environmental standards. High-performance elastomers, especially those sourced from renewable feed stocks or display low environmental impact are on the rise since companies are seeking ways to meet the complicated regulatory standards as well as enhance their sustainability indices.

Performance Elastomers Market Trend Analysis

Rising adoption of thermoplastic elastomers (TPE).

- A strong emerging trend for Performance Elastomers Market is seen in the increasing use of thermoplastic elastomers (TPE). TPEs are gaining acceptance in numerous applications because of its easier processing compared to other rubber materials, owing to its ease of conversion, and because of their recyclability. Since TPEs fit well into the trend of manufacturing companies looking for ways to minimize material waste and costs they are experiencing increasing use especially in automotive interiors and consumer goods.

- The advancing materials formulation into new digs is that there are new menu of the elastomers to suit certain uses. New chemical formulations and polymerization techniques are making it possible to develop elastomers with higher operating temperatures, better compatibility and mechanical properties. They are pushing the market toward more specific uses in such areas as healthcare and electronics.

Rapid industrialization, coupled with increasing investments in automotive and aerospace sectors.

- The global Performance Elastomers Market has better prospects in the Asia-Pacific region especially in two large populous nations, namely China and India. The growth of automotive and aerospace industries due to general expansion in industrial capacity is resulting in demand for high performance elastomers. Since these countries are investing heavily on their manufacturing plants and industries, elastomer producers also enjoy a large prospect of establishing their market. • In addition, the care industry especially the healthcare sector is opening up for IPOs.owth in the Asia-Pacific region, particularly in countries like China and India. Rapid industrialization, coupled with increasing investments in automotive and aerospace sectors, is driving the demand for high-performance elastomers. As these countries continue to expand their manufacturing capabilities and infrastructure, there is a substantial opportunity for elastomer producers to tap into this growing market.

- Furthermore, the healthcare sector is emerging as a key area of opportunity. Some of the advancement of new products contain high performance material that help in increasing the elasticity of the products like elastomers are used as medical application in drug delivery systems, medical tubing and in prostheses. It is driven by the increase in technology and health care needs that are occasioned by the increase in the size of the ageing population.

Performance Elastomers Market Segment Analysis:

- Performance Elastomers Market Segmented on the basis of type, application, and end-users.

By Type, Silicone Elastomers segment is expected to dominate the market during the forecast period

- Based on the type of material, the performance elastomers market divided into silicone elastomers, fluoroelastomers, Thermoplastic elastomers (TPE), polyurethane elastomers and others. Silicon elastomers are characterized by various properties such as high thermal stability, flexibility and heat resistance and therefore widely used for applications in automobile and aerospace industries. Chemically, fluoroelastomers provide excellent resistance, and the materials are especially suitable for use with hot and aggressive chemicals. Thermoplastic elastomers (TPE) have characteristics of rubber and plastics; easy to process and recycle which makes them commonplace in consumer products and automotive interiors. Polyester polyols have their application in the production of polyurethane elastomers that can be used as seals and other industrial parts. The ‘others’ category includes a number of specific elastomers that fall outside of standard applications and have demand according to specialty and durability, or performance needs of industries.

By Application, Seals & Gaskets segment held the largest share in 2024

- The performance elastomers market is also divided on the basis of application area including; seals and gaskets, hoses and tubes, O-rings, coating, adhesives and others. Performance elastomers are an important use for creating fasteners as seals and gaskets helping to avoid leaks in intricate mechanical assemblies and particularly in automotive and industrial industries. Hoses and tubes utilize the composition of elastomers to create effective and long-lasting systems for fluid delivery. O-rings are used to produce accurate seals in numerous apparatuses, and these rely on elastomers for sealed performance under pressure. One of the advantages of coatings derived from performance elastomers is that these coatings afford protection to their substrates by opposing forces that cause wear, chemicals and environment. High-performance elastomeric adhesives offer excellent bonding strength coupled with flexibility and therefore are used in various industries. The remaining one is termed as others consisting of specialized applications where specific formulation or properties may be needed, which in this shows that performance elastomers can indeed fit specific industry requirements.

Performance Elastomers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- United States is presently the largest market for performance elastomers, mainly due to the highly developed automotive and aerospace industries in the region. The region is advanced technologically and research-oriented resulting into enhanced production of new elastomer solutions. Also, increasing strict standards for emissions and environmental friendliness are inspiring the usage of high-performance materials, which ensure North Americas leading position in this market.

- Also, there are well-developed supply chain relations with the North American market, and a focus on constant product development. Dynisco has presented its research that key players in the region are focusing on sustainable initiatives and improving advanced elastomers market offerings to address the industry requirements. Therefore, due to the ongoing increase in the requirement for high performance elastomers, North America will retain the leading position in the Performance Elastomers Market.

Active Key Players in the Performance Elastomers Market

- Dow Inc. (United States)

- BASF SE (Germany)

- Momentive Performance Materials Inc. (United States)

- Kraton Corporation (United States)

- Wacker Chemie AG (Germany)

- SABIC (Saudi Arabia)

- Evonik Industries AG (Germany)

- Huntsman Corporation (United States)

- 3M Company (United States)

- Celanese Corporation (United States)

- Others

|

Global Performance Elastomers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.25 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.70 % |

Market Size in 2032: |

USD 35.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Performance Elastomers Market by Type (2018-2032)

4.1 Performance Elastomers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Silicone Elastomers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fluoroelastomers

4.5 Thermoplastic Elastomers (TPE)

4.6 Polyurethane Elastomers

4.7 Others

Chapter 5: Performance Elastomers Market by Application (2018-2032)

5.1 Performance Elastomers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Seals & Gaskets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hoses & Tubes

5.5 O-Rings

5.6 Coatings

5.7 Adhesives

5.8 Others

Chapter 6: Performance Elastomers Market by End User (2018-2032)

6.1 Performance Elastomers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aerospace

6.5 Healthcare

6.6 Consumer Goods

6.7 Industrial

6.8 Electronics

6.9 Construction

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Performance Elastomers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 OFFERINGS TO ADDRESS THE INDUSTRY REQUIREMENTS. THEREFORE

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DUE TO THE ONGOING INCREASE IN THE REQUIREMENT FOR HIGH PERFORMANCE ELASTOMERS

7.4 NORTH AMERICA WILL RETAIN THE LEADING POSITION IN THE PERFORMANCE ELASTOMERS MARKET.ACTIVE KEY PLAYERS IN THE PERFORMANCE ELASTOMERS MARKETDOW INC. (UNITED STATES)

7.5 BASF SE (GERMANY)

7.6 MOMENTIVE PERFORMANCE MATERIALS INC. (UNITED STATES)

7.7 KRATON CORPORATION (UNITED STATES)

7.8 WACKER CHEMIE AG (GERMANY)

7.9 SABIC (SAUDI ARABIA)

7.10 EVONIK INDUSTRIES AG (GERMANY)

7.11 HUNTSMAN CORPORATION (UNITED STATES)

7.12 3M COMPANY (UNITED STATES)

7.13 CELANESE CORPORATION (UNITED STATES)

7.14 OTHERS

7.15

Chapter 8: Global Performance Elastomers Market By Region

8.1 Overview

8.2. North America Performance Elastomers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Silicone Elastomers

8.2.4.2 Fluoroelastomers

8.2.4.3 Thermoplastic Elastomers (TPE)

8.2.4.4 Polyurethane Elastomers

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Seals & Gaskets

8.2.5.2 Hoses & Tubes

8.2.5.3 O-Rings

8.2.5.4 Coatings

8.2.5.5 Adhesives

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Automotive

8.2.6.2 Aerospace

8.2.6.3 Healthcare

8.2.6.4 Consumer Goods

8.2.6.5 Industrial

8.2.6.6 Electronics

8.2.6.7 Construction

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Performance Elastomers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Silicone Elastomers

8.3.4.2 Fluoroelastomers

8.3.4.3 Thermoplastic Elastomers (TPE)

8.3.4.4 Polyurethane Elastomers

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Seals & Gaskets

8.3.5.2 Hoses & Tubes

8.3.5.3 O-Rings

8.3.5.4 Coatings

8.3.5.5 Adhesives

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Automotive

8.3.6.2 Aerospace

8.3.6.3 Healthcare

8.3.6.4 Consumer Goods

8.3.6.5 Industrial

8.3.6.6 Electronics

8.3.6.7 Construction

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Performance Elastomers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Silicone Elastomers

8.4.4.2 Fluoroelastomers

8.4.4.3 Thermoplastic Elastomers (TPE)

8.4.4.4 Polyurethane Elastomers

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Seals & Gaskets

8.4.5.2 Hoses & Tubes

8.4.5.3 O-Rings

8.4.5.4 Coatings

8.4.5.5 Adhesives

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Automotive

8.4.6.2 Aerospace

8.4.6.3 Healthcare

8.4.6.4 Consumer Goods

8.4.6.5 Industrial

8.4.6.6 Electronics

8.4.6.7 Construction

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Performance Elastomers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Silicone Elastomers

8.5.4.2 Fluoroelastomers

8.5.4.3 Thermoplastic Elastomers (TPE)

8.5.4.4 Polyurethane Elastomers

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Seals & Gaskets

8.5.5.2 Hoses & Tubes

8.5.5.3 O-Rings

8.5.5.4 Coatings

8.5.5.5 Adhesives

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Automotive

8.5.6.2 Aerospace

8.5.6.3 Healthcare

8.5.6.4 Consumer Goods

8.5.6.5 Industrial

8.5.6.6 Electronics

8.5.6.7 Construction

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Performance Elastomers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Silicone Elastomers

8.6.4.2 Fluoroelastomers

8.6.4.3 Thermoplastic Elastomers (TPE)

8.6.4.4 Polyurethane Elastomers

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Seals & Gaskets

8.6.5.2 Hoses & Tubes

8.6.5.3 O-Rings

8.6.5.4 Coatings

8.6.5.5 Adhesives

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Automotive

8.6.6.2 Aerospace

8.6.6.3 Healthcare

8.6.6.4 Consumer Goods

8.6.6.5 Industrial

8.6.6.6 Electronics

8.6.6.7 Construction

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Performance Elastomers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Silicone Elastomers

8.7.4.2 Fluoroelastomers

8.7.4.3 Thermoplastic Elastomers (TPE)

8.7.4.4 Polyurethane Elastomers

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Seals & Gaskets

8.7.5.2 Hoses & Tubes

8.7.5.3 O-Rings

8.7.5.4 Coatings

8.7.5.5 Adhesives

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Automotive

8.7.6.2 Aerospace

8.7.6.3 Healthcare

8.7.6.4 Consumer Goods

8.7.6.5 Industrial

8.7.6.6 Electronics

8.7.6.7 Construction

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Performance Elastomers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.25 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.70 % |

Market Size in 2032: |

USD 35.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Performance Elastomers Market research report is 2024-2032.

Dow Inc. (United States), BASF SE (Germany), Momentive Performance Materials Inc. (United States), Kraton Corporation (United States), Wacker Chemie AG (Germany), SABIC (Saudi Arabia), Evonik Industries AG (Germany), Huntsman Corporation (United States), 3M Company (United States), Celanese Corporation (United States) and Other Major Players.

The Performance Elastomers Market is segmented into by Type (Silicone Elastomers, Fluoroelastomers, Thermoplastic Elastomers (TPE), Polyurethane Elastomers, Others), By Application (Seals & Gaskets, Hoses & Tubes, O-Rings, Coatings, Adhesives, Others) End-User (Automotive, Aerospace, Healthcare, Consumer Goods, Industrial, Electronics, Construction, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Performance Elastomers Market is the industry of the elastomers where the materials used are of high-performance rubber that retains elasticity, resilience, and strength in several situations. These elastomers are used across a variety of industries because they demonstrate enhanced chemical, thermal and mechanical performance making them suitable for challenging applications like seals, gaskets, hoses and components of automobiles, aerospace, medical, and manufacturing industries.

Performance Elastomers Market Size is Valued at USD 18.25 Billion in 2023, and is Projected to Reach USD 35.76 Billion by 2032, Growing at a CAGR of 7.70% From 2024-2032.