Pepper Sprays Market Synopsis:

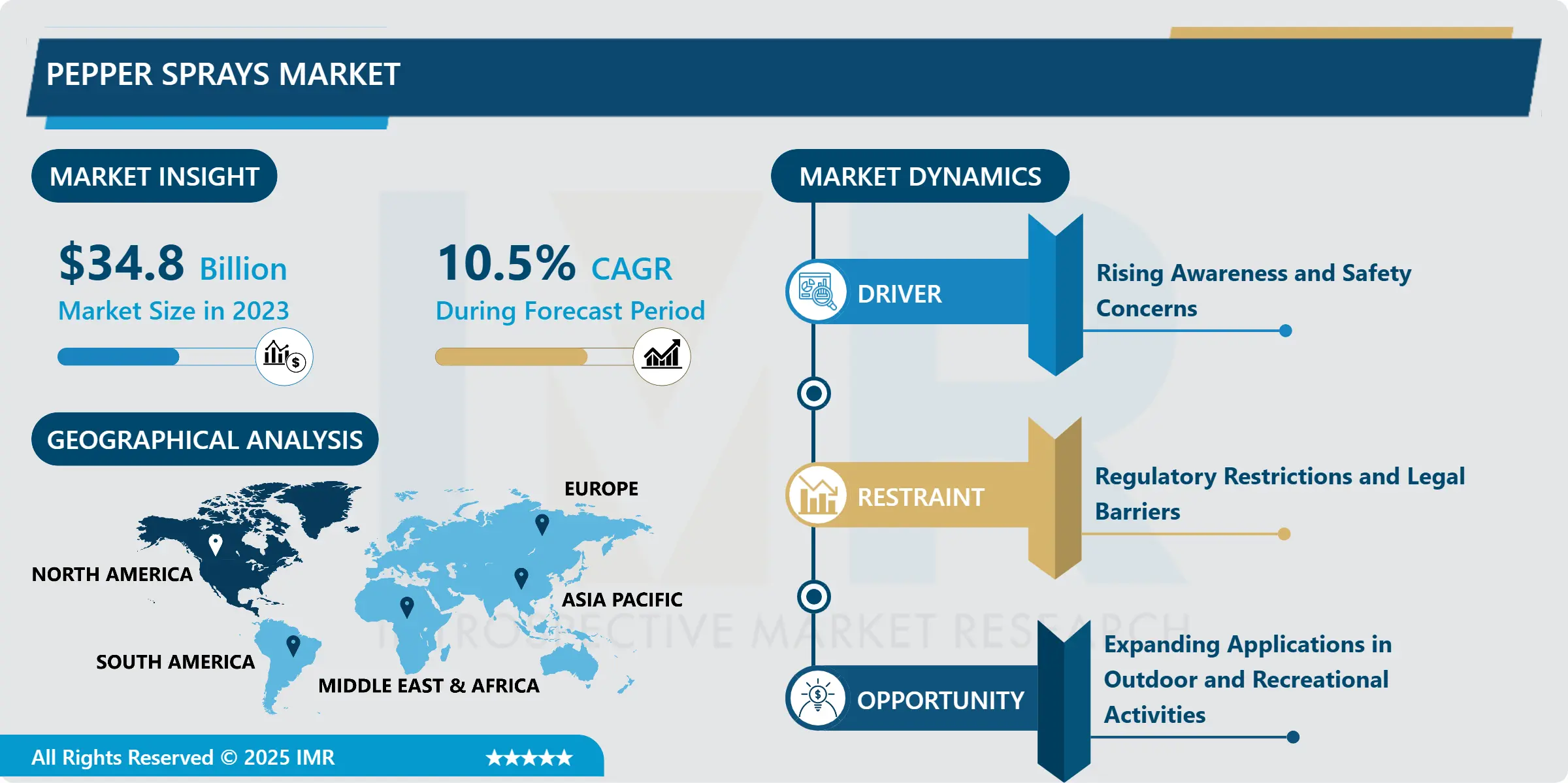

Pepper Sprays Market Size Was Valued at USD 34.8 Billion in 2023, and is Projected to Reach USD 85.5 Billion by 2032, Growing at a CAGR of 10.5% From 2024-2032.

The Pepper Sprays market refers to the manufactures and sellers of pepper sprays which are chemical agents that are mainly used as less lethal weapons for personal protection, in law enforcement and military services, and for recreational purposes while conforming to sports activities. These products emit an Oleoresin Capsicum (OC) which is an extract from hot peppers and if fired at the eyes or skin they will cause temporary blindness, itching and pains.

The Pepper Sprays market is emerging sub-sector of the personal safety and security and products market, promoted by the growing demand for self-defense tools and products. As crime increases, people’s fears for their safety, and expanded call for lesser lethal force, pepper spray has become popular among both average citizens and police officers. Chasers are legal as long as they conform to the laws of the country or state of usage across the world. They give an instant or probable menacing potential to the attacker thus no need for physical contact or even use of guns.

Besides individual protection, pepper spray is used in policing organizations and armed forces as tear gas, restraining the subjects or dispersing crowds, or eliminating threats in small spaces. Pepper spray comes in different types such as gel-based, foam-based and liquid-based depending on ones situation and or preference. That is why gel based pepper sprays do not get blown back like traditional spray formulas which is perfect for outdoor usage Gel foam pepper sprays generate a greater coverage area making the barrier wider. This versatility of pepper spray products is an area that is helping to fuel continued growth of the market.

Market has also seen enhanced uptake of pepper spray in activities that occur in the outdoors and recreational sports. As more and more people go hiking or camping in the wild or forests to chase away the blues of a dull life, they are arming themselves with pepper sprays in case of wild animals’attacks or other related mishaps. New retail in this market through extending the coverage of online retail channels and e- commerce platforms also extend for this self-defense products market.

Pepper Sprays Market Trend Analysis:

Increasing Demand for Non-lethal Defense Products

-

Increasing Demand for Non-lethal Defense Products has been evidenced by a increasing preferred trends in less lethal products used in self-protection like pepper sprays. This is in light of security issues to the selves, most especially those dwelling in areas considered as insecure due to high incidence of crimes. Consumers are also waking up to other personal security instrumenta that enable one to defend themselves without necessarily killing another person. Because these are non-lethal and can be easily carried, the pepper sprays fit the preferences of a vast number of buyers who want a straightforward and usable product. Also, get access and ease to use is among the reasons that has boosted the demand.

-

The stream of non-lethal products has been strengthened by increasing demand for non-violent approach towards civilians and conflicts. With more police departments and military using pepper spray for riot control and for subduing suspects, civilians are also also appreciating the elementary worth of pepper spray in self-defense. This has pushed the sale of pepper spray and increased product development where manufacturers of this product have come up with smaller and easier to use pepper spray products that suit customers’ preferences.

Expanding Applications in Outdoor and Recreational Activities

-

A new growth area can be defined in pepper spray market which relates to its use in outdoor and recreational activities. In a situation where individuals opt for outdoor activities such as hiking, camping or trial running safety becomes a major issue, especially in the areas with little or no population. It is a perfect combination and safe guard to all those that adventure in the wild or face personal threats from fellow humans. This growing segment therefore holds a good potential for companies to directly target the outdoor market given that there are products meant for such activities, there are compact, portable, and highly effective weather resistant sprays that could be fitted in a carry case to be deployed in case of an emergency.

-

The macro opportunity is that adventure tourism is on the rise, wandering and finding oneself in true wilderness is getting more and more popular. With this trend, manufacturers can come up with pepper spray products that come with specialized packaging which are convenient to carry by the sports people through carabiner clips or small containers in traveling. Demonstration of pepper spray as a safety tool could also be another popular method of marketing it especially when collaborations have been made with other retailers who sell products to people who loves the outdoors, hiking and other adventure related activities.

Pepper Sprays Market Segment Analysis:

Pepper Sprays Market is Segmented on the basis of Product Type, Application, Distribution Channel, End User, and Region.

By Product Type, Gel-based Pepper Sprays segment is expected to dominate the market during the forecast period

-

The pepper spray market in terms of the product type differ in versatility and variety of formulations that provide options for usage. Gel based sprays are used nowadays more often than others because they are more accurate and less dangerous in terms of blowback. Judging by high demand from those camping, hiking, and living in windy regions prefer this type, the manufacturers are working to extend the range and effectiveness of gel sprays. Foam-based is not as common as liquid sprays, yet it is used by professionals such as policemen and the military when the population must be controlled.

-

The existing aerosols employing liquid dispersions will maintain their market predominance because of their universality, low cost, and performance in various situations. Still, more and more often new products are being released on the market that include certain qualities of both gels and liquids since it fits different demands from consumers. This is quite apparent in the pepper spray category which continues to foster technological changes in an endeavor to satisfy various clients.

By Application, Self-defense segment expected to held the largest share

-

Pepper spray in its self-defense use takes a large share of the market since people want to be safe due to the unknown nature of the society. As people become increasingly more concerned for their safety and especially in the towns, pepper spray is one of the most affordable and easily seen self-defense devices which people can carry around. As crime rates on women increase especially in the regions, awareness of self-defense for women contributes to the expansion of this segment.

-

In policing and paramilitary forces, pepper spray is among the most important self-defense devices that are employed to restrain dangerous people, also in an event of riots, and eliminate threats without necessarily killing such people. These sectors remain the second largest applications and LEAs continue to purchase and seek higher quality and more potent pepper sprays. The company takes advantage of upgrades made to pepper spray and the technology used to deliver the product to fulfill the capacity of professional industries.

Pepper Sprays Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is leading region within the pepper spray market due to rising demand for personal protection equipment and its application in police and military forces. The legal conditions of the area enable pepper sprays to be sold freely and the customers are very much informed of its advantages. In the United States the demand for protection products such as pepper spray is well developed especially among the female and aged population.

-

The demand is also driven by the use of pepper spray by most police forces across the United States and Canada. Since crime and security risks persist, there shall be continued preference of non-firearm products in the way law enforcement bodies are equipped. The market developments for retail and online pepper spray products are well set up within North America and create a commercially accessible environment for market growth.

Active Key Players in the Pepper Sprays Market:

- SABRE (USA)

- Mace Security International (USA)

- Kimberley-Clark Corporation (USA)

- Piexon AG (Switzerland)

- Fox Labs International (USA)

- BCB International Ltd. (UK)

- Counter Assault (USA)

- Safety Technology (USA)

- Guard Alaska (USA)

- Zarc International (USA)

- First Defense (USA)

- The Pepper Spray Store (USA)

- Other Active Players

Key Industry Developments in the Pepper Sprays Market:

-

In April 2023, Mace Security International, Inc., entered into a distribution agreement with SurgePays, Inc., a technology and telecommunications company focused on the underbanked and underserved. The agreement provides for the distribution of pepper spray and other personal defense products through the SurgePays network of thousands of corner stores, bodegas, and gas stations.

|

Global Pepper Sprays Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.8 Billion |

|

Forecast Period 2024-32 CAGR: |

10.5% |

Market Size in 2032: |

USD 85.5 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pepper Sprays Market by Indication

4.1 Pepper Sprays Market Snapshot and Growth Engine

4.2 Pepper Sprays Market Overview

4.3 Gastric Ulcers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Gastric Ulcers: Geographic Segmentation Analysis

4.4 Duodenal Ulcers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Duodenal Ulcers: Geographic Segmentation Analysis

4.5 Zollinger-Ellison Syndrome

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Zollinger-Ellison Syndrome: Geographic Segmentation Analysis

Chapter 5: Pepper Sprays Market by Distribution Channel

5.1 Pepper Sprays Market Snapshot and Growth Engine

5.2 Pepper Sprays Market Overview

5.3 Hospital Pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

5.4 Retail Pharmacies

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Retail Pharmacies: Geographic Segmentation Analysis

5.5 Online Pharmacies

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 6: Pepper Sprays Market by Formulation

6.1 Pepper Sprays Market Snapshot and Growth Engine

6.2 Pepper Sprays Market Overview

6.3 Tablets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Tablets: Geographic Segmentation Analysis

6.4 Capsules

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Capsules: Geographic Segmentation Analysis

6.5 Oral Suspensions

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Oral Suspensions: Geographic Segmentation Analysis

6.6 Injections

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Injections: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pepper Sprays Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SABRE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MACE SECURITY INTERNATIONAL (USA)

7.4 KIMBERLEY-CLARK CORPORATION (USA)

7.5 PIEXON AG (SWITZERLAND)

7.6 FOX LABS INTERNATIONAL (USA)

7.7 BCB INTERNATIONAL LTD. (UK)

7.8 COUNTER ASSAULT (USA)

7.9 SAFETY TECHNOLOGY (USA)

7.10 GUARD ALASKA (USA)

7.11 ZARC INTERNATIONAL (USA)

7.12 FIRST DEFENSE (USA)

7.13 THE PEPPER SPRAY STORE (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Pepper Sprays Market By Region

8.1 Overview

8.2. North America Pepper Sprays Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Indication

8.2.4.1 Gastric Ulcers

8.2.4.2 Duodenal Ulcers

8.2.4.3 Zollinger-Ellison Syndrome

8.2.5 Historic and Forecasted Market Size By Distribution Channel

8.2.5.1 Hospital Pharmacies

8.2.5.2 Retail Pharmacies

8.2.5.3 Online Pharmacies

8.2.6 Historic and Forecasted Market Size By Formulation

8.2.6.1 Tablets

8.2.6.2 Capsules

8.2.6.3 Oral Suspensions

8.2.6.4 Injections

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pepper Sprays Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Indication

8.3.4.1 Gastric Ulcers

8.3.4.2 Duodenal Ulcers

8.3.4.3 Zollinger-Ellison Syndrome

8.3.5 Historic and Forecasted Market Size By Distribution Channel

8.3.5.1 Hospital Pharmacies

8.3.5.2 Retail Pharmacies

8.3.5.3 Online Pharmacies

8.3.6 Historic and Forecasted Market Size By Formulation

8.3.6.1 Tablets

8.3.6.2 Capsules

8.3.6.3 Oral Suspensions

8.3.6.4 Injections

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pepper Sprays Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Indication

8.4.4.1 Gastric Ulcers

8.4.4.2 Duodenal Ulcers

8.4.4.3 Zollinger-Ellison Syndrome

8.4.5 Historic and Forecasted Market Size By Distribution Channel

8.4.5.1 Hospital Pharmacies

8.4.5.2 Retail Pharmacies

8.4.5.3 Online Pharmacies

8.4.6 Historic and Forecasted Market Size By Formulation

8.4.6.1 Tablets

8.4.6.2 Capsules

8.4.6.3 Oral Suspensions

8.4.6.4 Injections

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pepper Sprays Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Indication

8.5.4.1 Gastric Ulcers

8.5.4.2 Duodenal Ulcers

8.5.4.3 Zollinger-Ellison Syndrome

8.5.5 Historic and Forecasted Market Size By Distribution Channel

8.5.5.1 Hospital Pharmacies

8.5.5.2 Retail Pharmacies

8.5.5.3 Online Pharmacies

8.5.6 Historic and Forecasted Market Size By Formulation

8.5.6.1 Tablets

8.5.6.2 Capsules

8.5.6.3 Oral Suspensions

8.5.6.4 Injections

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pepper Sprays Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Indication

8.6.4.1 Gastric Ulcers

8.6.4.2 Duodenal Ulcers

8.6.4.3 Zollinger-Ellison Syndrome

8.6.5 Historic and Forecasted Market Size By Distribution Channel

8.6.5.1 Hospital Pharmacies

8.6.5.2 Retail Pharmacies

8.6.5.3 Online Pharmacies

8.6.6 Historic and Forecasted Market Size By Formulation

8.6.6.1 Tablets

8.6.6.2 Capsules

8.6.6.3 Oral Suspensions

8.6.6.4 Injections

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pepper Sprays Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Indication

8.7.4.1 Gastric Ulcers

8.7.4.2 Duodenal Ulcers

8.7.4.3 Zollinger-Ellison Syndrome

8.7.5 Historic and Forecasted Market Size By Distribution Channel

8.7.5.1 Hospital Pharmacies

8.7.5.2 Retail Pharmacies

8.7.5.3 Online Pharmacies

8.7.6 Historic and Forecasted Market Size By Formulation

8.7.6.1 Tablets

8.7.6.2 Capsules

8.7.6.3 Oral Suspensions

8.7.6.4 Injections

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pepper Sprays Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.8 Billion |

|

Forecast Period 2024-32 CAGR: |

10.5% |

Market Size in 2032: |

USD 85.5 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||