Oxygen Market Synopsis

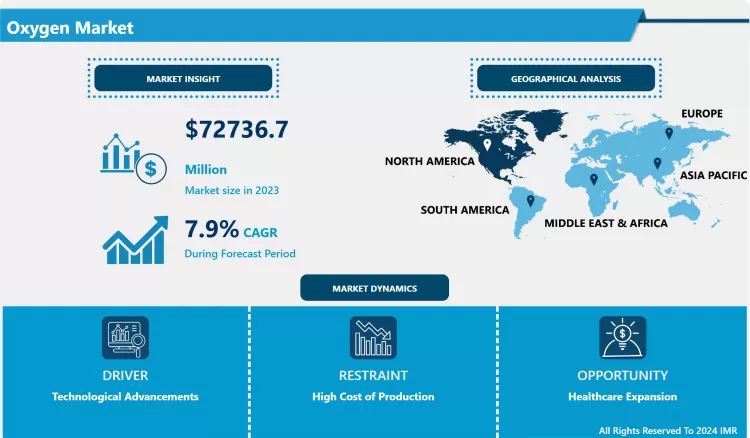

Oxygen Market Size Was Valued at USD 72736.7 Million in 2023 and is Projected to Reach USD 144193.8 Million by 2032, Growing at a CAGR of 7.9 % From 2023-2032.

The oxygen market refers to the global industry involved in the production, distribution, and consumption of oxygen gas. Oxygen is a crucial element in various industrial processes, healthcare applications, and environmental solutions. It is widely used in medical treatments, metallurgy, chemical manufacturing, water treatment, and aerospace industries. The market encompasses the production of oxygen through various methods such as cryogenic distillation, pressure swing adsorption, and electrolysis of water. Growth in the oxygen market is driven by increasing industrialization, healthcare needs, environmental regulations promoting cleaner technologies, and advancements in production technologies improving efficiency and purity of oxygen supply.

- The global oxygen market is experiencing steady growth driven by increasing industrial applications, healthcare demand, and technological advancements. Industrial sectors, such as steel manufacturing, chemicals, and electronics, heavily rely on oxygen for processes like combustion, oxidation, and wastewater treatment, thereby boosting market growth. In healthcare, oxygen therapy continues to be pivotal for treating respiratory disorders and supporting surgical procedures, fueling the medical oxygen segment.

- Technological innovations, including advancements in oxygen generation and delivery systems, are enhancing efficiency and safety across various applications. Geographically, Asia Pacific is witnessing significant growth due to industrial expansion and healthcare infrastructure development.

- However, regulatory challenges and supply chain disruptions pose occasional constraints to market expansion. Overall, the oxygen market is poised for continued growth, driven by diverse industrial and healthcare applications supported by technological advancements and expanding global infrastructure.

Oxygen Market Trend Analysis

Medical Oxygen Demand and Supply Chains

- The COVID-19 pandemic starkly illustrated the essential role of medical oxygen in critical care settings worldwide. As the virus spread rapidly, severely ill patients often experienced respiratory distress, necessitating urgent access to oxygen therapy. This surge in demand overwhelmed healthcare systems in many countries, exposing vulnerabilities in supply chains that were unprepared for such a widespread and prolonged crisis. Hospitals faced acute shortages, prompting swift action to ramp up production and distribution capabilities to meet unprecedented needs.

- In response to these challenges, governments, healthcare providers, and oxygen manufacturers collaborated to enhance supply chain resilience and emergency preparedness. Measures included increasing production capacity, optimizing distribution networks, and implementing strategic stockpiling of medical oxygen reserves. Efforts were also directed towards improving storage infrastructure and ensuring timely delivery to hospitals and healthcare facilities in remote or underserved areas. This crisis underscored the critical importance of robust supply chains and proactive planning in safeguarding public health during emergencies, prompting ongoing efforts to strengthen healthcare infrastructure globally.

Expansion of Oxygen in Industrial Applications

- Oxygen plays a crucial role in a wide array of industrial processes, making it indispensable in sectors such as steel production, chemical manufacturing, and wastewater treatment. In steelmaking, oxygen is used in blast furnaces and basic oxygen furnaces to facilitate combustion and remove impurities from molten iron, thereby enhancing productivity and quality of steel output. Similarly, in chemical manufacturing, oxygen serves as a feedstock for synthesizing various chemicals and as an oxidizing agent in oxidation reactions critical for producing plastics, pharmaceuticals, and other compounds.

- The expanding industrialization, particularly in emerging economies like China, India, and Brazil, has significantly bolstered the demand for industrial-grade oxygen. Rapid urbanization and infrastructure development in these regions have spurred construction activities, which require oxygen in processes such as oxy-fuel welding and cutting. Moreover, as these economies diversify and modernize their industrial bases, the demand for oxygen in manufacturing sectors such as automotive, electronics, and aerospace continues to grow. This trend is further supported by technological advancements that improve the efficiency of oxygen production and distribution, making it more accessible and cost-effective for industrial applications.

- As global industries strive for higher efficiency and environmental sustainability, the role of oxygen becomes even more critical. Innovations in oxygen production technologies, such as pressure swing adsorption (PSA) and cryogenic distillation, are enabling industries to optimize their processes while reducing carbon emissions. Additionally, stringent environmental regulations are driving industries to adopt cleaner technologies that rely on oxygen for processes like combustion and emissions control. This evolving landscape underscores the ongoing importance of oxygen in supporting industrial growth and innovation worldwide.

Oxygen Market Segment Analysis:

Oxygen Market Segmented based on By Form, By Type and By Application .

By Form, Gas segment is expected to dominate the market during the forecast period

- The gas segment is the dominant form in the industrial gases market, primarily due to its extensive and varied use across multiple industries such as healthcare, pharmaceuticals, and chemicals. In healthcare, gases like oxygen are critical for respiratory therapies, surgeries, and intensive care treatments, making them indispensable in medical settings. The pharmaceutical industry also relies heavily on gases for processes like inerting, blanketing, and sterilization. Additionally, the chemical industry utilizes industrial gases like nitrogen, hydrogen, and carbon dioxide for various synthesis and production processes, enhancing product quality and operational efficiency. This wide-ranging applicability across essential sectors underscores the significant market share held by the gas segment.

- Furthermore, the logistical advantages of gas forms significantly contribute to their dominance in the industrial gases market. Compressed and liquefied gases are easier to transport and store, allowing for efficient distribution to end-users. Advanced technologies for gas storage, such as cryogenic tanks and high-pressure cylinders, ensure that gases are maintained in optimal conditions until they reach their destination. The flexibility in delivery methods, including pipelines, tankers, and cylinders, accommodates the diverse needs of different industries, from large-scale manufacturing plants to small medical facilities. This ease of handling and the ability to meet varying demands further solidify the position of the gas segment as the leading form in the industrial gases market.

By Application, Metals and Mining segment held the largest share in 2023

- The metals and mining segment holds a significant share in the industrial gases market due to the essential role gases play in metal production processes. Oxygen, for instance, is crucial in steel manufacturing, where it is used in blast furnaces and basic oxygen furnaces to enhance combustion efficiency and remove impurities from molten iron. This results in higher-quality steel with reduced carbon content, which is crucial for various applications. Similarly, hydrogen is employed in processes like direct reduction iron (DRI) to produce steel without emitting carbon dioxide, aligning with global efforts to reduce greenhouse gas emissions. These applications not only improve the efficiency and quality of metal production but also contribute to more sustainable practices in the industry.

- The growth of the construction and automotive industries significantly boosts the demand for metals, thereby driving the need for industrial gases in mining and metallurgy. The construction industry, with its ever-increasing demand for steel and other metals for infrastructure projects, residential buildings, and commercial developments, relies heavily on efficient metal production processes supported by industrial gases. Similarly, the automotive industry requires high-quality metals for manufacturing vehicles, which includes everything from the body frame to the engine components. As these industries expand, the demand for steel and other metals increases, leading to a corresponding rise in the consumption of industrial gases. This interdependence highlights the vital role that the metals and mining segment plays in the broader industrial gases market, fueling its growth and ensuring its significant market share.

Oxygen Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America, the oxygen market benefits significantly from a robust healthcare infrastructure characterized by advanced medical facilities and a high standard of care. Medical oxygen applications are crucial across hospitals, clinics, and emergency services, where oxygen therapy plays a vital role in treating various respiratory conditions and supporting patients in critical care. The region's focus on healthcare innovation and research further drives demand for oxygen, as new medical technologies and treatments continually require reliable oxygen supply systems.

- Beyond healthcare, North America's aerospace industry represents another cornerstone of oxygen demand. Oxygen is indispensable for life support systems in aircraft, ensuring the safety and well-being of passengers and crew during flights. Aerospace companies in the region prioritize high-quality oxygen systems to comply with rigorous safety standards and ensure operational reliability. This demand is augmented by ongoing advancements in aerospace technology and the increasing volume of air travel, which continue to propel the market for oxygen supply systems across North America.

- Overall, North America's oxygen market thrives on the dual pillars of advanced healthcare infrastructure and a robust aerospace sector. These sectors not only sustain current demand levels but also drive innovation and technological advancements in oxygen supply systems, positioning the region as a key player in the global oxygen market landscape.

Active Key Players in the Oxygen Market

- Air Products Inc.

- Air Liquide

- Bhuruka Gases Limited

- Daesung Group

- Gulf Cryo

- Inox-Air Products Inc

- KOATSU GAS KOGYO CO., LTD.

- Linde plc

- Matheson Tri-Gas, Inc

- Messer North America Inc

- Nippon Gases

- SHOWA DENKO K.K

- SOL Spa

- TAIYO NIPPON SANSO CORPORATION

- Yingde Gases Group and Other Major Players

|

Global Oxygen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 72736.7 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 144193.8 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oxygen Market by Form (2018-2032)

4.1 Oxygen Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gas

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Liquid

4.5 Solid

Chapter 5: Oxygen Market by Type (2018-2032)

5.1 Oxygen Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Medical

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial

Chapter 6: Oxygen Market by Application (2018-2032)

6.1 Oxygen Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Metals and Mining

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Chemical Industry

6.5 Oil And Gas

6.6 Healthcare

6.7 Pharmaceutical

6.8 Other Applications

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oxygen Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIR PRODUCTS INCAIR LIQUIDE

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BHURUKA GASES LIMITED

7.4 DAESUNG GROUP

7.5 GULF CRYO

7.6 INOX-AIR PRODUCTS INC

7.7 KOATSU GAS KOGYO COLTDLINDE PLC

7.8 MATHESON TRI-GAS INC

7.9 MESSER NORTH AMERICA INC

7.10 NIPPON GASES

7.11 SHOWA DENKO K.K

7.12 SOL SPA

7.13 TAIYO NIPPON SANSO CORPORATION

7.14 YINGDE GASES GROUP

Chapter 8: Global Oxygen Market By Region

8.1 Overview

8.2. North America Oxygen Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Form

8.2.4.1 Gas

8.2.4.2 Liquid

8.2.4.3 Solid

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Medical

8.2.5.2 Industrial

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Metals and Mining

8.2.6.2 Chemical Industry

8.2.6.3 Oil And Gas

8.2.6.4 Healthcare

8.2.6.5 Pharmaceutical

8.2.6.6 Other Applications

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oxygen Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Form

8.3.4.1 Gas

8.3.4.2 Liquid

8.3.4.3 Solid

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Medical

8.3.5.2 Industrial

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Metals and Mining

8.3.6.2 Chemical Industry

8.3.6.3 Oil And Gas

8.3.6.4 Healthcare

8.3.6.5 Pharmaceutical

8.3.6.6 Other Applications

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oxygen Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Form

8.4.4.1 Gas

8.4.4.2 Liquid

8.4.4.3 Solid

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Medical

8.4.5.2 Industrial

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Metals and Mining

8.4.6.2 Chemical Industry

8.4.6.3 Oil And Gas

8.4.6.4 Healthcare

8.4.6.5 Pharmaceutical

8.4.6.6 Other Applications

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oxygen Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Form

8.5.4.1 Gas

8.5.4.2 Liquid

8.5.4.3 Solid

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Medical

8.5.5.2 Industrial

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Metals and Mining

8.5.6.2 Chemical Industry

8.5.6.3 Oil And Gas

8.5.6.4 Healthcare

8.5.6.5 Pharmaceutical

8.5.6.6 Other Applications

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oxygen Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Form

8.6.4.1 Gas

8.6.4.2 Liquid

8.6.4.3 Solid

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Medical

8.6.5.2 Industrial

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Metals and Mining

8.6.6.2 Chemical Industry

8.6.6.3 Oil And Gas

8.6.6.4 Healthcare

8.6.6.5 Pharmaceutical

8.6.6.6 Other Applications

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oxygen Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Form

8.7.4.1 Gas

8.7.4.2 Liquid

8.7.4.3 Solid

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Medical

8.7.5.2 Industrial

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Metals and Mining

8.7.6.2 Chemical Industry

8.7.6.3 Oil And Gas

8.7.6.4 Healthcare

8.7.6.5 Pharmaceutical

8.7.6.6 Other Applications

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Oxygen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 72736.7 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 144193.8 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Oxygen Market research report is 2024-2032.

Air Products Inc., Air Liquide, Bhuruka Gases Limited, Daesung Group, Gulf Cryo, Inox-Air Products Inc, KOATSU GAS KOGYO CO., LTD., Linde plc, Matheson Tri-Gas, Inc, Messer North America Inc, Nippon Gases, SHOWA DENKO K.K, SOL Spa, TAIYO NIPPON SANSO CORPORATION, Yingde Gases Group and Other Major Players.

The Oxygen Market is segmented into By Form, By Type , By Application and region. By Form, the market is categorized into Gas, Liquid and Solid. By Type, the market is categorized into Medical and Industrial. By Application, the market is categorized into Metals and Mining, Chemical Industry, Oil And Gas, Healthcare, Pharmaceutical and Other ApplicationsBy region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The oxygen market refers to the global industry involved in the production, distribution, and consumption of oxygen gas. Oxygen is a crucial element in various industrial processes, healthcare applications, and environmental solutions. It is widely used in medical treatments, metallurgy, chemical manufacturing, water treatment, and aerospace industries. The market encompasses the production of oxygen through various methods such as cryogenic distillation, pressure swing adsorption, and electrolysis of water. Growth in the oxygen market is driven by increasing industrialization, healthcare needs, environmental regulations promoting cleaner technologies, and advancements in production technologies improving efficiency and purity of oxygen supply.

Oxygen Market Size Was Valued at USD 72736.7 Million in 2023 and is Projected to Reach USD 144193.8 Million by 2032, Growing at a CAGR of 7.9 % From 2023-2032