Oxidized Bitumen Market Synopsis

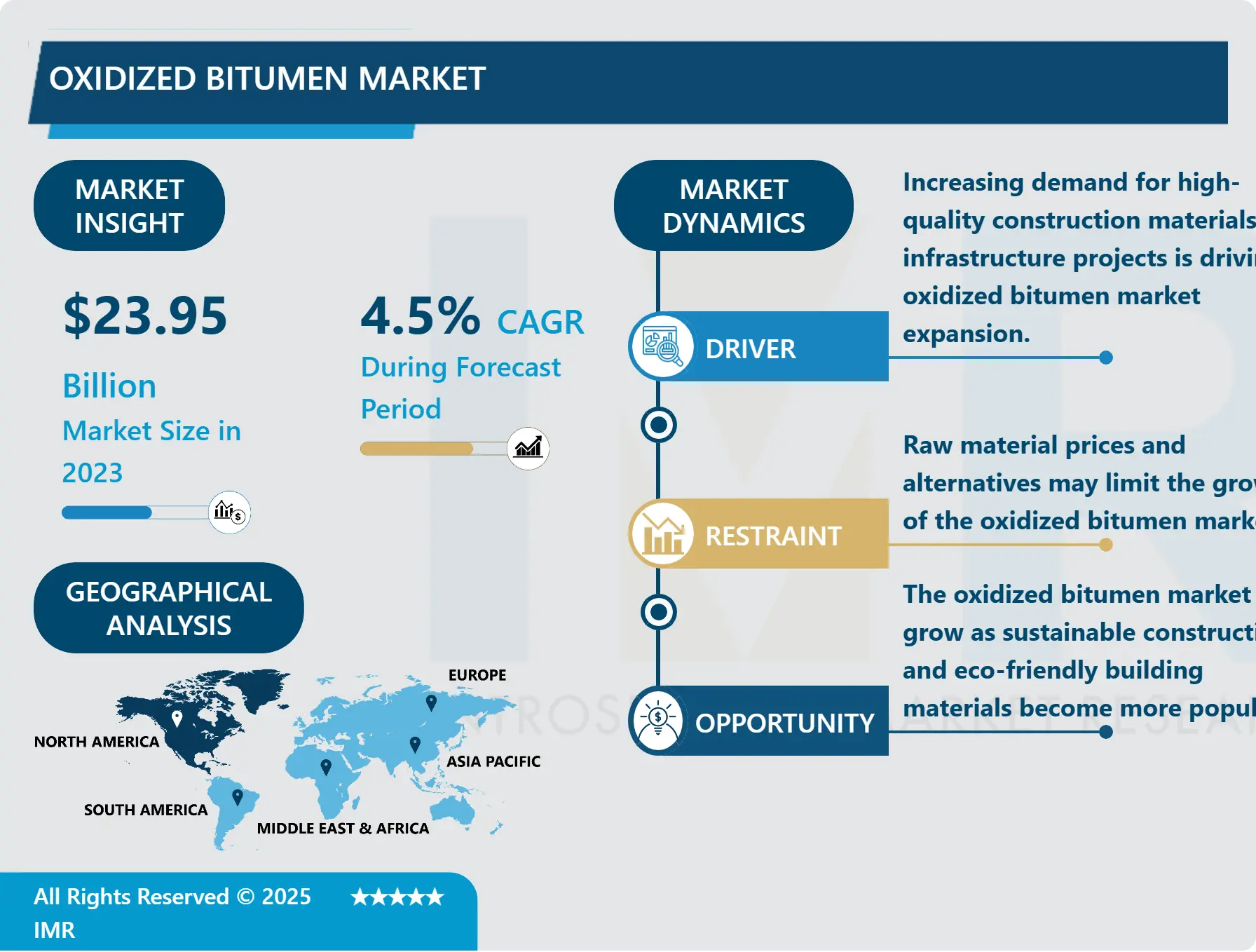

Oxidized Bitumen Market Size is Valued at USD 23.95 Billion in 2023, and is Projected to Reach USD 35.60 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

There has been a steady increase in demand of oxidized bitumen over time due to the versatility that the product has shown since its discovery in several segments of construction including roads construction and waterproofing sector of industries. Oxidized bitumen or blasted bitumen are produced from heated bitumen where air is forced through it making the product more hard and sticky. It is most suitable for use in construction industries in bitumen sector, sealants, and roofing industries owing to its strong adhesive characteristics, thermal stability and aging resistance. Due to continuous expansion of urbanization and infrastructural development all over the world, oxidized bitumen is projected to experience a significant demand.

The Asia-Pacific region can be considered as a quickly emerging player in the oxidized bitumen market due to such factors as the construction material request, industrialization, and urbanization.. This is something which is attributed to the geography of this place. Oxidized bitumen for construction of roads and water proofing is gradually on a rise due to the enhancement in infrastructure activities in countries such as China and India. Apart from the increasing focus on the sustainable construction activities, North America and Europe controls a considerable market share due to the well-developed construction industries. Oxidised bitumen is the most appropriate waterproofing as well as sealing agent used in construction.

Potential consumers may also be expected to increase the demand for oxidized bitumen in the future due to high performance products and technology improvement in the manufacturing processes. They expect it to probably grow due to the increasing need for energy efficient buildings, and the continuing focus on sustainability in construction products, some of which may mandate oxidized bitumen development accordingly. Furthermore, the market is expected to grow continuously in future years because the application of the product is still exploratory in automotive and industrial manufacturing industries.

Oxidized Bitumen Market Trend Analysis

Growing Demand for Sustainable Construction Materials

- Since more and more firms are becoming environmentally conscious in their selection of roofing systems and waterproofing, oxidized bitumen is a popular product. Green building certifications prefer the oxidized bitumen due its durability and longitivity which result from the green conception whereby building materials emphasis on low density to the environment. Our projection for future use of oxidized bitumen is that there will be a continued rise in the need for the construction materials for different applications as construction companies and projects continue to embrace sustainability.

- As the use of sustainable construction materials rises, products such as oxidized bitumen which are and versatile throughout a wide range of applications affect the oxidized bitumen market. With the increasing focus on green construction, green roofing systems and waterproofing systems increase the efficiency, energy and performance of oxidized bitumen.

Technological Advancements in Production Processes

- Developments in its manufacturing techniques are enhancing the property performance of oxidized bitumen and its uses. Modern methods help shape a diverse chain of oxidized bitumen products intended to fulfil certain demands of the sector, including thermal stability, weather tolerance, and adhesion properties. Many of these technologies complement the process of oxidation further while helping the manufacturers meet a greater need for the production of high-performance materials for construction, which in turn fuels the market.

- It has been possible by the better blow up techniques and better refining result; manufacturers can formulate oxidized bitumen with special characteristics including better thermal stability, improved resistance to weathering, and higher level of adhesion. Furthermore, these changes contribute to the improvement of the quality and stability of oxidized bitumen while also satisfying the growing market requirements for high-performance construction products.

Oxidized Bitumen Market Segment Analysis:

Oxidized Bitumen Market Segmented on the basis of By Product, and By Application

By Product, Grade 95/25 segment is expected to dominate the market during the forecast period

- The oxidized bitumen market is also broadly classified by product grade such as Grade 95/25, Grade 85/25, Grade 90/40, Grade 115/15 and others. Grade 95/25 is commonly utilized in roofing and insulation because of its good adhesion and heat resistance to provide outstanding performance for high end roofing systems. The blending ratio of 85/25 is most preferred when used in road construction and maintenance as the blend is highly elastic and very durable.

- However, Grade 90/40 is commonly employed in industries where structures need more characteristics and resistance to chemicals and weather conditions. Grade 115/15 is used in technical applications where excellent waterproofing characteristic is an essential requirement. Product grades further provide an opportunity to meet the demands of different industries with required performance characteristics, construction and automotive industries as well as manufacturing industries.

By Application, Cements segment held the largest share in 2024

- Oxidized bitumen is unique as it enhances the properties of products that are used across a number of industries, including paints, cement, pipe coating and metal primers. In paints industry, oxidized bitumen helps in binding its applications perfectly on substrates with high durability and bond strength. The cement sector employs it in enhancing the performance and basically the waterproofing capacity of build materials.

- Moreover, pipe coatings often use oxidized bitumen in an effort to ward off corrosion and other adverse conditions that may act on external surfaces of a pipe thereby shortening the lifespan of a pipeline. It remains essential across a wide range of commercial uses due to the role of a metal undercoat, which enhances the bonding of a range of coatings together with protection against corrosion. We expect the demand for oxidized bitumen in these segments to grow rapidly in the future as the demand for implementation of construction and maintenance projects increases worldwide.

Oxidized Bitumen Market Regional Insights:

North America is expected to dominate the market due to growth in the construction industry.

- Another key aspect of this research shows that North America region is expected to be the leading market for oxidized bitumen because of the growing construction industry that boosts by increased infrastructure and renovation projects.. There has been a growing market need for superior quality building & construction materials, and especially roofing and waterproofing because construction contractors and builders are constantly in search of high quality, maximum long-term performance material that will not fail.

- Tough ordinances are further boosting the market as they promote energy-efficient construction, the properties of oxidized bitumen match with sustainable construction. Due to continuous funding in public infrastructure and focus on high-performance products, North America is in a strong place to drive the oxidized bitumen market in the coming years.

Active Key Players in the Oxidized Bitumen Market

- Eagle Petrochem (U.S.)

- Rahaoil, Inc. (Iran)

- ATDM CO. LTD (Iran)

- ASIA Bitumen (Singapore)

- Tiki Tar Industries (India)

- PETRO TAR Co. (Iran)

- SHELL International B.V. (Netherlands)

- bp p.l.c (U.K.)

- Exxon Mobil Corporation (U.S.)

- Indian Oil Corporation Ltd (India)

- others

Global Oxidized Bitumen Market Scope:

|

Global Oxidized Bitumen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50% |

Market Size in 2032: |

USD 35.60 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oxidized Bitumen Market by Product (2018-2032)

4.1 Oxidized Bitumen Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Grade 95/25

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Grade 85/25

4.5 Grade 90/40

4.6 Grade115/15

4.7 Other

Chapter 5: Oxidized Bitumen Market by Application (2018-2032)

5.1 Oxidized Bitumen Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Paints

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cements

5.5 Pipe Coatings

5.6 Metal Primers

5.7 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Oxidized Bitumen Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 EAGLE PETROCHEM (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 RAHAOIL INC. (IRAN)

6.4 ATDM CO. LTD (IRAN)

6.5 ASIA BITUMEN (SINGAPORE)

6.6 TIKI TAR INDUSTRIES (INDIA)

6.7 PETRO TAR CO. (IRAN)

6.8 SHELL INTERNATIONAL B.V. (NETHERLANDS)

6.9 BP P.L.C (U.K.)

6.10 EXXON MOBIL CORPORATION (U.S.)

6.11 INDIAN OIL CORPORATION LTD (INDIA)

6.12 OTHERS

6.13

Chapter 7: Global Oxidized Bitumen Market By Region

7.1 Overview

7.2. North America Oxidized Bitumen Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Grade 95/25

7.2.4.2 Grade 85/25

7.2.4.3 Grade 90/40

7.2.4.4 Grade115/15

7.2.4.5 Other

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Paints

7.2.5.2 Cements

7.2.5.3 Pipe Coatings

7.2.5.4 Metal Primers

7.2.5.5 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Oxidized Bitumen Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Grade 95/25

7.3.4.2 Grade 85/25

7.3.4.3 Grade 90/40

7.3.4.4 Grade115/15

7.3.4.5 Other

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Paints

7.3.5.2 Cements

7.3.5.3 Pipe Coatings

7.3.5.4 Metal Primers

7.3.5.5 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Oxidized Bitumen Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Grade 95/25

7.4.4.2 Grade 85/25

7.4.4.3 Grade 90/40

7.4.4.4 Grade115/15

7.4.4.5 Other

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Paints

7.4.5.2 Cements

7.4.5.3 Pipe Coatings

7.4.5.4 Metal Primers

7.4.5.5 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Oxidized Bitumen Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Grade 95/25

7.5.4.2 Grade 85/25

7.5.4.3 Grade 90/40

7.5.4.4 Grade115/15

7.5.4.5 Other

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Paints

7.5.5.2 Cements

7.5.5.3 Pipe Coatings

7.5.5.4 Metal Primers

7.5.5.5 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Oxidized Bitumen Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Grade 95/25

7.6.4.2 Grade 85/25

7.6.4.3 Grade 90/40

7.6.4.4 Grade115/15

7.6.4.5 Other

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Paints

7.6.5.2 Cements

7.6.5.3 Pipe Coatings

7.6.5.4 Metal Primers

7.6.5.5 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Oxidized Bitumen Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Grade 95/25

7.7.4.2 Grade 85/25

7.7.4.3 Grade 90/40

7.7.4.4 Grade115/15

7.7.4.5 Other

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Paints

7.7.5.2 Cements

7.7.5.3 Pipe Coatings

7.7.5.4 Metal Primers

7.7.5.5 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Global Oxidized Bitumen Market Scope:

|

Global Oxidized Bitumen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50% |

Market Size in 2032: |

USD 35.60 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||