Oilfield Chemicals Market Synopsis

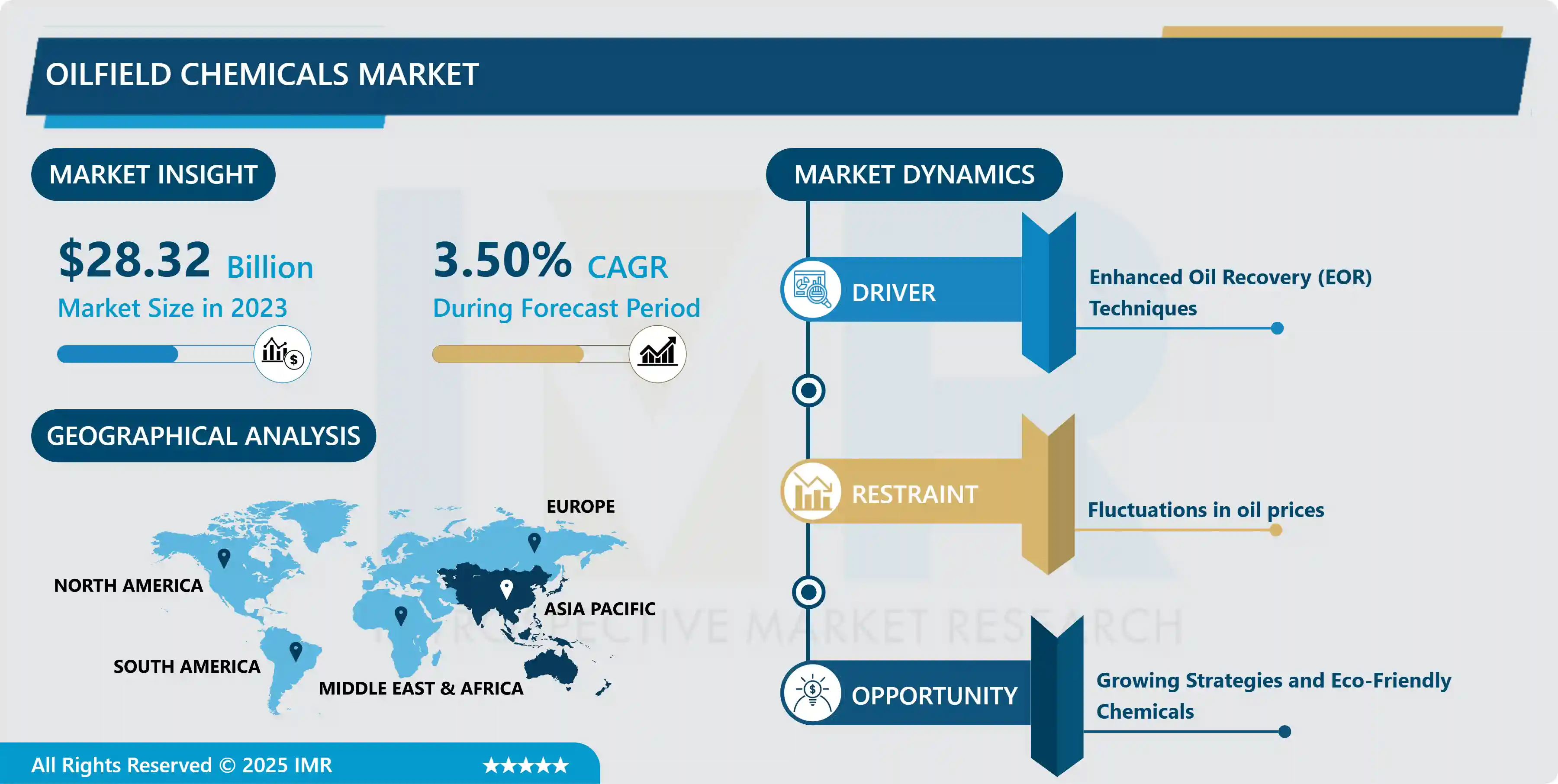

Oilfield Chemicals Market Size Was Valued at USD 28.32 billion in 2023 and is Projected to Reach USD 38.6 Billion by 2032, Growing at a CAGR of 3.5% From 2024-2032.

Oilfield chemicals are essential in the oil and gas industry for various purposes, including drilling efficiency, equipment corrosion prevention, formation damage control, oil recovery rates, and wastewater treatment. They include corrosion inhibitors, demulsifiers, scale inhibitors, biocides, surfactants, and polymers, all playing a crucial role in maintaining operational integrity, optimizing production, and ensuring environmental compliance.

Oilfield chemicals play a pivotal role in the oil and gas industry, offering various advantages. They aid in smoother drilling operations by reducing friction, managing pressure, and safeguarding equipment against corrosion, thereby enhancing safety and longevity. During production, these chemicals optimize oil recovery rates by mitigating formation damage, minimizing water production, and ensuring seamless flow. In refining processes, they are instrumental in treating produced water and mitigating environmental impact.

These chemicals find applications across the entire oil and gas value chain. They are essential in drilling fluids for stabilizing wellbores and providing lubrication. In production operations, they manage reservoir conditions, prevent scale formation, and inhibit corrosion. Enhanced Oil Recovery (EOR) techniques rely heavily on specialized chemicals to maximize hydrocarbon extraction from reservoirs. Furthermore, oilfield chemicals are vital for preserving infrastructure integrity and ensuring environmental compliance throughout oil and gas asset lifecycles.

Market dynamics in the oilfield chemicals sector are witnessing a surge in demand for eco-friendly and cost-efficient solutions. Emphasis is on sustainable practices, leading to the emergence of bio-based and environmentally friendly chemicals. Additionally, technological breakthroughs such as nanotechnology and digitalization are reshaping the industry, offering innovative solutions for improved performance and efficiency. Overall, the demand trajectory for oilfield chemicals is projected to remain upward, fueled by ongoing global exploration and production activities.

Oilfield Chemicals Market Trend Analysis

Enhanced Oil Recovery (EOR) Techniques

- Enhanced Oil Recovery (EOR) techniques are pivotal drivers behind the demand for oilfield chemicals, aimed at optimizing the extraction of hydrocarbons from reservoirs. EOR methods seek to augment the recovery of oil from existing fields beyond what primary and secondary recovery methods can achieve. These techniques often entail injecting specialized fluids or chemicals into reservoirs to modify the properties of the oil and reservoir rock, thereby enhancing flow dynamics and displacing trapped oil.

- Oilfield chemicals play a vital role in EOR processes by serving as essential constituents of injection fluids. For instance, polymers may be incorporated to boost the viscosity of injected water, thereby enhancing sweep efficiency and displacing more oil from the reservoir. Similarly, surfactants and alkalis can be employed to alter the interfacial tension between oil and water, facilitating the mobilization and recovery of trapped oil. With the global adoption of EOR techniques on the rise, there is a corresponding surge in demand for specialized oilfield chemicals tailored for these applications, propelling market expansion.

Growing Strategies and Eco-Friendly Chemicals

- The oilfield chemicals sector is witnessing a shift towards sustainable practices and environmentally friendly solutions, presenting notable growth opportunities. Companies are increasingly prioritizing the development and implementation of eco-conscious strategies to align with regulatory mandates and fulfill the sustainability objectives of various stakeholders.

- One emerging strategy involves the creation and deployment of eco-friendly oilfield chemicals. These formulations are crafted using renewable resources or biodegradable materials and processes, aiming to reduce environmental impact while maintaining high-performance standards. They offer advantages such as reduced toxicity, lower emissions, and enhanced biodegradability when compared to traditional chemical counterparts.

- Firms are investing in research and development efforts to innovate and broaden their range of eco-friendly oilfield chemicals. This includes advancements in bio-based surfactants, biodegradable polymers, and environmentally safe corrosion inhibitors.

Oilfield Chemicals Market Segment Analysis:

Oilfield Chemicals Market Segmented on the basis of Chemical Type and Application.

By Chemical Type, Corrosion and Scale Inhibitors segment is expected to dominate the market during the forecast period

- The segment of Chemical Type, particularly Corrosion and Scale Inhibitors, is projected to exert significant influence over the oilfield chemicals market. Corrosion inhibitors are indispensable for protecting oilfield equipment and infrastructure against corrosion, a threat that can lead to costly downtime and pose safety risks. They are pivotal for prolonging the operational life of assets and ensuring uninterrupted production.

- Scale Inhibitors play a crucial role in preventing the buildup of mineral scales like calcium carbonate and barium sulfate in oilfield equipment and wellbores. Scale deposition can impede flow rates, diminish production efficiency, and necessitate expensive remedial actions. By effectively managing scale formation, inhibitors aid in maintaining optimal production levels and mitigating the risk of wellbore obstructions. Given the paramount importance of corrosion and scale control in oilfield operations, the demand for corrosion and scale inhibitors is anticipated to remain robust.

- Advancements in chemical formulations, alongside heightened regulatory scrutiny and emphasis on asset integrity, are propelling the adoption of innovative corrosion and scale inhibition solutions, further solidifying the dominance of this segment in the oilfield chemicals market.

By Application, Drilling and Cementing segment is expected to dominate the market during the forecast period

- The drilling and cementing segment is poised to assert its dominance in the oilfield chemicals market owing to its crucial role in upstream oil and gas operations. This segment encompasses drilling fluids, integral for ensuring wellbore stability, pressure control, and cuttings removal during drilling endeavors. Within drilling fluids, a variety of oilfield chemicals, such as lubricants, corrosion inhibitors, and weighting agents, are employed to optimize performance and address specific geological challenges.

- The cementing process, pivotal for sealing the wellbore with cement to uphold structural integrity and avert fluid migration, relies on specialized oilfield chemicals. Cement additives like dispersants, retarders, and accelerators are utilized to tailor the properties of cement slurries and enhance their efficacy in diverse downhole conditions.

- Given the ongoing global exploration and extraction efforts in oil and gas fields, the demand for drilling and cementing services remains steadfast. Consequently, the requisite for associated oilfield chemicals is anticipated to persist, cementing the dominance of the drilling and cementing segment in the oilfield chemicals market.

Oilfield Chemicals Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is anticipated to emerge as the dominant force in the oilfield chemicals market for several reasons. Primarily, the region is experiencing rapid economic growth and industrial development, resulting in heightened energy demands and consequent escalations in oil and gas exploration and production endeavors. This surge in activity necessitates a greater reliance on oilfield chemicals to facilitate these operations.

- Asia Pacific encompasses key emerging economies, including China and India, which boast extensive untapped hydrocarbon reserves. These nations are intensifying efforts to exploit their domestic energy resources, consequently driving up the demand for oilfield chemicals.

- Technological advancements and substantial investments within the oil and gas sector across the Asia Pacific are enhancing operational efficiencies and productivity levels, further fueling the demand for specialized chemicals. The region's strategic geographic location and proximity to major oil-producing areas position it as a vital hub for oilfield services and chemicals. These factors collectively underscore Asia Pacific's projected ascent as a dominant player in the global oilfield chemicals landscape.

Oilfield Chemicals Market Top Key Players:

- Dow (U.S.)

- Albemarle Corporation (U.S.)

- Stepan Company (U.S.)

- The Lubrizol Corporation (U.S.)

- Baker Hughes (U.S.)

- Halliburton (U.S.)

- Solvay (Belgium)

- Solvay S.A. (Belgium)

- BASF SE (Germany)

- Clariant (Switzerland)

- Croda International Plc (U.K.)

- NALCO (U.K.)

- Nouryon (Netherlands)

- Kemira (Finland)

- Pon Pure Chemicals Group (India)

- SMC Global (India)

- Aquapharm Chemical Pvt. Ltd. (India)

- Thermax Chemical Division (India), and Other Major Players.

Key Industry Developments in the Oilfield Chemicals Market:

- In December 2022, Champion X unveiled the inauguration of a state-of-the-art oilfield services chemicals laboratory and distribution center situated in Chaguaramas, Trinidad. This cutting-edge facility will conduct a multitude of analytical tests, including corrosion coupon analysis, chemical compatibility assessments, and determination of bacteria levels in produced water.

- In March 2022, Halliburton disclosed the establishment of the Halliburton Chemical Reaction Plant located in Saudi Arabia. This plant is dedicated to the production of a diverse array of chemicals catering to the entirety of the oil and gas industry's value chain.

|

Global Oilfield Chemicals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.5 % |

Market Size in 2032: |

USD 38.60 Bn. |

|

Segments Covered: |

By Chemical Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oilfield Chemicals Market by Chemical Type (2018-2032)

4.1 Oilfield Chemicals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Biocides

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Corrosion and Scale Inhibitors

4.5 Demulsifiers

4.6 Polymers

4.7 Surfactants

Chapter 5: Oilfield Chemicals Market by Application (2018-2032)

5.1 Oilfield Chemicals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Drilling and Cementing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Enhanced Oil Recovery

5.5 Production

5.6 Well Stimulation

5.7 Workover and Completion

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Oilfield Chemicals Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DOW (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALBEMARLE CORPORATION (U.S.)

6.4 STEPAN COMPANY (U.S.)

6.5 THE LUBRIZOL CORPORATION (U.S.)

6.6 BAKER HUGHES (U.S.)

6.7 HALLIBURTON (U.S.)

6.8 SOLVAY (BELGIUM)

6.9 SOLVAY S.A. (BELGIUM)

6.10 BASF SE (GERMANY)

6.11 CLARIANT (SWITZERLAND)

6.12 CRODA INTERNATIONAL PLC (U.K.)

6.13 NALCO (U.K.)

6.14 NOURYON (NETHERLANDS)

6.15 KEMIRA (FINLAND)

6.16 PON PURE CHEMICALS GROUP (INDIA)

6.17 SMC GLOBAL (INDIA)

6.18 AQUAPHARM CHEMICAL PVT. LTD. (INDIA)

6.19 THERMAX CHEMICAL DIVISION (INDIA)

6.20

Chapter 7: Global Oilfield Chemicals Market By Region

7.1 Overview

7.2. North America Oilfield Chemicals Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Chemical Type

7.2.4.1 Biocides

7.2.4.2 Corrosion and Scale Inhibitors

7.2.4.3 Demulsifiers

7.2.4.4 Polymers

7.2.4.5 Surfactants

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Drilling and Cementing

7.2.5.2 Enhanced Oil Recovery

7.2.5.3 Production

7.2.5.4 Well Stimulation

7.2.5.5 Workover and Completion

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Oilfield Chemicals Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Chemical Type

7.3.4.1 Biocides

7.3.4.2 Corrosion and Scale Inhibitors

7.3.4.3 Demulsifiers

7.3.4.4 Polymers

7.3.4.5 Surfactants

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Drilling and Cementing

7.3.5.2 Enhanced Oil Recovery

7.3.5.3 Production

7.3.5.4 Well Stimulation

7.3.5.5 Workover and Completion

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Oilfield Chemicals Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Chemical Type

7.4.4.1 Biocides

7.4.4.2 Corrosion and Scale Inhibitors

7.4.4.3 Demulsifiers

7.4.4.4 Polymers

7.4.4.5 Surfactants

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Drilling and Cementing

7.4.5.2 Enhanced Oil Recovery

7.4.5.3 Production

7.4.5.4 Well Stimulation

7.4.5.5 Workover and Completion

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Oilfield Chemicals Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Chemical Type

7.5.4.1 Biocides

7.5.4.2 Corrosion and Scale Inhibitors

7.5.4.3 Demulsifiers

7.5.4.4 Polymers

7.5.4.5 Surfactants

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Drilling and Cementing

7.5.5.2 Enhanced Oil Recovery

7.5.5.3 Production

7.5.5.4 Well Stimulation

7.5.5.5 Workover and Completion

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Oilfield Chemicals Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Chemical Type

7.6.4.1 Biocides

7.6.4.2 Corrosion and Scale Inhibitors

7.6.4.3 Demulsifiers

7.6.4.4 Polymers

7.6.4.5 Surfactants

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Drilling and Cementing

7.6.5.2 Enhanced Oil Recovery

7.6.5.3 Production

7.6.5.4 Well Stimulation

7.6.5.5 Workover and Completion

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Oilfield Chemicals Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Chemical Type

7.7.4.1 Biocides

7.7.4.2 Corrosion and Scale Inhibitors

7.7.4.3 Demulsifiers

7.7.4.4 Polymers

7.7.4.5 Surfactants

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Drilling and Cementing

7.7.5.2 Enhanced Oil Recovery

7.7.5.3 Production

7.7.5.4 Well Stimulation

7.7.5.5 Workover and Completion

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Oilfield Chemicals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.5 % |

Market Size in 2032: |

USD 38.60 Bn. |

|

Segments Covered: |

By Chemical Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||