Network As A Service Market Synopsis

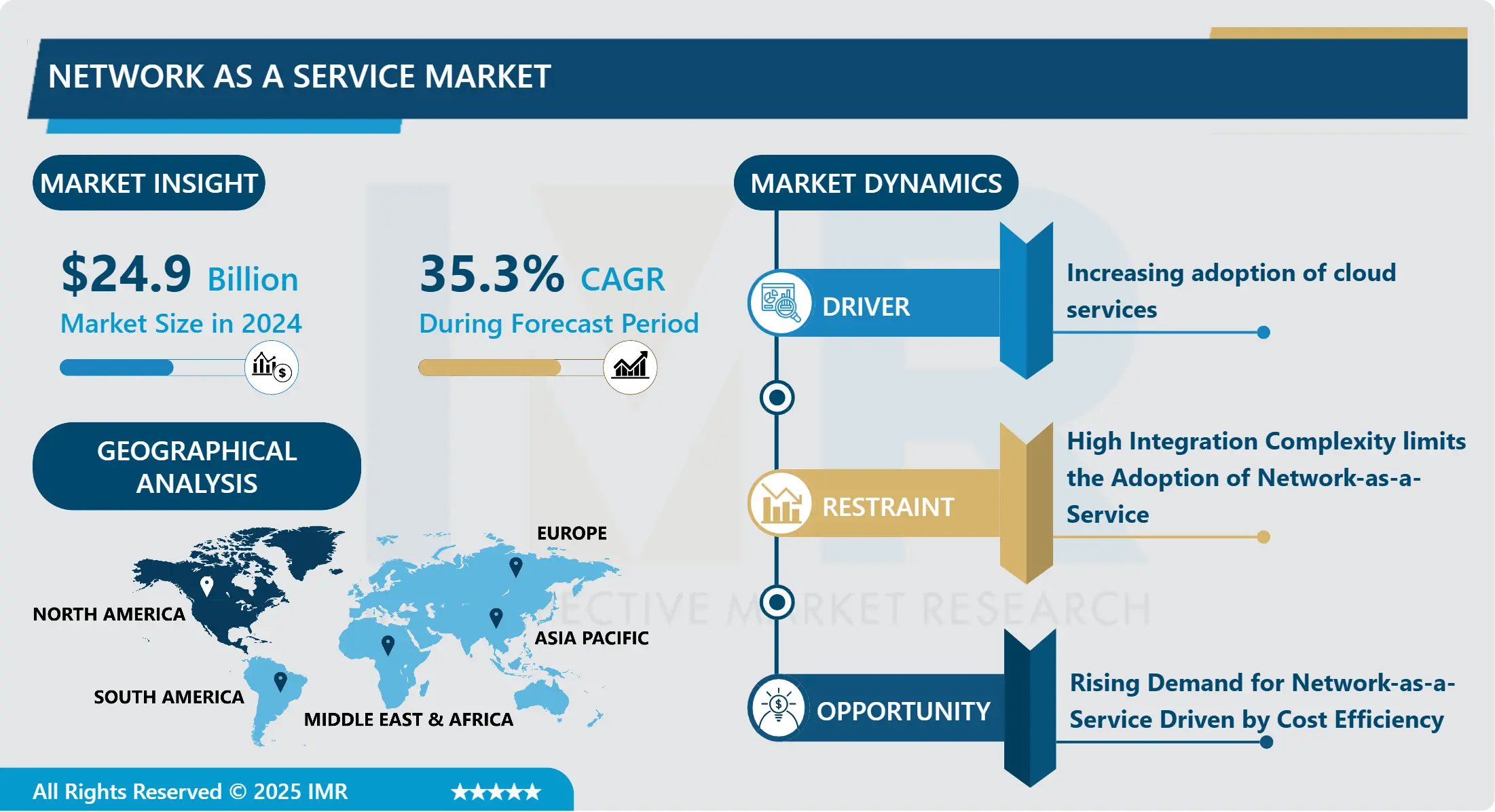

Network As A Service Market Size Was Valued at USD 24.9 Billion in 2024 and is Projected to Reach USD 279.63 Billion by 2032, Growing at a CAGR of 35.3% From 2025-2032.

Network-as-a-service is a conceptual model of network outsourcing since the user gives a cloud provider the possibility to perform networking services rather than developing their own network. Network-asa- service is a concept that enables the organization to outsource the network without establishing or proprietary ownership of the actual networks required for the desired outcomes. Network-aaS takes software-defined networking (SDN), transport, programmable networking and API interoperation to WAN services, Multi-cloud, Hybrid cloud, Private Network Interconnect, and Internet exchanges.

Data technologies and networking technologies such as IoT, blockchain, cognitive, and advanced analytics increase the occurrence of connectivity advances across diverse industries. Network-as-a-service means the following for companies: Network as a service makes companies to have more flexibility and even an increased performance in the network. On-demand purchasing allows companies when they need it, and some networking services can be cheaper than to buy leases. The last benefit is the flexibility in the provisioning area that is also provided by network-as-a-service can also be helpful for companies which require a high granularity in the network but do not want to re-design it or sign contracts again from scratch as with other providers.

NAAS vendors offer sophisticated network security measures including encryption, firewall, and intrusion detection as additional security measures to fight cybercrimes. Through NaaS, organizations are able to adopt a centralized approach towards their security posture, thus promoting better adherence to compliance standards within the entire network infrastructure of an organization. Additionally, through real-time threat intelligence integration, NaaS also is a way to provide the ability to react quickly to newly identified security threats.

Key elements of NaaS solutions include scalability and flexibility upon which they solely depend on. This requirement, in turn, leads to another key business condition stemming from the rapidly changing opportunities and signs of the business environment that call for the ability to rapidly scale network resources and be ready to satisfy emerging demands. Thus, through NaaS, some companies are being endowed with this indisputable requirement. Concerning what a business becomes facing an unusual condition of escalating as well as a fluctuating point of a network demand for instance, the service market is seasonality or market dynamics, NaaS offers the best means to expand and contract the network capacity without any efforts at all.

Conventional networking standard is significantly over-proportioned for initial physical plant investment and modern occupancy expenses. With NaaS, TiM goes through the traditional model where companies only pay for the particular network services that they require and not as a whole ownership. Capital expenditure and operational cost are the two factors which are considered because this is a pay-as-you-go method whereby funding is only done on consumption.

Network As A Service Market Trend Analysis

Network As A Service Market Growth Driver- Rising need for wireless communication for industrial

- The increasing demand for wireless connectivity in industrial and commercial applications could also present fresh opportunities for the NAAS market in the future. Network as a service can therefore be described as a delivery model for net that simplifies net management for various organizations. That is, the business model provides significant elasticity and flexibility, including the opportunity to turn from CapEx to OpEx. Since people can get results they want without directly owning any infrastructure, maintaining, or developing it, this make the market more demanded in the global market.

Network As A Service Market Expansion Opportunity- Growing Technological Advancements

- Technologies like the SDN, NFV, and especially edge computing help NaaS providers bring new services that are more flexible, elastic, and thus leaner. Such advancements enable organizations to avoid the building overhead costs associated with networking hardwares, while at the same time enjoying the benefits of applying advanced networking technologies in their operations. To address growing customer demand, advanced technologies of artificial intelligence (AI) and machine learning (ML) are being incorporated into NaaS solutions to improve network efficiency, security and to automate management, which will also accelerate the growth of the market.

Network As A Service Market Segment Analysis:

Network As A Service Market Segmented based on Type, Enterprise Type, Application, End User, Industry, and Region.

By Enterprise Type, Large Enterprise segment is expected to dominate the market during the forecast period

- On the basis of enterprise type the global Enterprise File Synchronization & Sharing market is segmented into Small and Medium-sized Enterprise and Large Enterprise. Among the enterprise segments, the large enterprise segment is expected to contribute to the largest market share in the 2024-2032 period due to the adoption of cloud services such as NaaS and Paas. Enterprise networks, particularly those of big corporations, are using virtualized technology to address the connectivity requirement between distant enterprise locations, and growing interest in the BYOD practice, which lets large organizations manage various forms of sources efficiently and economically. The technologies identified above are expected to enhance the adoption of networks as a service since their investments lower the overall costs and allow the company to concentrate on other areas.

- Small and medium-sized enterprise segment is expected to grow at the highest compound annual growth rate because of low infrastructure investments involved in implementing smart technologies. Attitudes reveal that SMEs pay attention to digital business to leverage technologies like cloud, SDN, analytics, and IoT, because the availability of low-cost cloud services and as-a-services model.

By type, WAN as a Service segment held the largest share in 2024

- Of all the segment types, the WAN as a Service segment will continue to have the largest market share due to the popularity of WAN solutions among enterprises in different markets. It establishes a communication infrastructure with the help of assets like the communication devices like the mobile phones, computers, remote offices and data centres. There are two parameters available for establishing customer-access options: Private or public gateway connections may be permitted based on users’ requirements.

- SD-WAN has emerged as one of the industries’ most rapidly growing adoptions in recent years since it can cater the next-generation criterion by having a robust and scalable network based on agility, flexibility, security and compliance. Also, it provides a last word-absolute best customer satisfaction by extending various branch services at reasonable and sustainable cost. There is an increasing exposure of leading players who opt for SD-WAN services to drive segmental opportunities.

- For instance, In May 2022, Colt Technology Services entered into a partnership with VMware in order to create a managed WAN based on VMware’s SD-WAN. The partnership added products while creating opportunities to allow their clientele to have hybrid multi-cloud and SaaS options, and more. The LAN as a Service segment is expected to grow at the highest Compound Annual Growth Rate, CAGR during the forecasted years due to the increase in the demand for LANaaS solutions which include on-demand ports and Wi-Fi hotspots for connection for internet services with facilitate corporations offer mobile device access to their personnel.

Network As A Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American Network as a Service market area will lead this market; The United States is a developed country which has greater demand for advanced technology, improving network automation and increasing the implementation of cloud services, and other factors that drive the development of Network as a Service (NaaS) market. While introducing hybrid products that use software, cloud intelligence, and the versatility to manage physical infrastructure on-premises as required, most IT departments will likely adopt NaaS more often over the next five or so years. Increased demand for the services to enhance the network performance has been witnessed due to the increased growth in connected and mobile devices. It was the most popular area for the connected devices as the United States remained the world’s most effective country at integrating new technologies into its society.

- The largest market share in the global Accelleran water meter market during the forecast period is expected to come from North America. Market growth in the region: The market is benefited from technological advancement adaptable in the data center and network structures and research & development on the network expansion technology. The economic development of the region is substantial and sustainable, and it is capable to invest in R & D and, thus, to contribute towards the formation of new technologies in the context of NSPs in the period of network service providers. The factor that the market participants, including leading players, pay attention to the introduction of new service partnerships will stimulate the market’s development.

Active Key Players in the Network As A Service Market

- Amdocs Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Megaport Limited (Australia)

- Hewlett Packard Enterprise (Aruba Networks) (U.S.)

- NEC Corporation (Japan)

- ARTERIA Networks Corporation (Japan)

- NTT Group (Japan)

- Cisco Systems Inc. (U.S.)

- Cloudflare, Inc. (U.S.)

- Verizon Communications Inc. (U.S.)

- Other Active Players.

Key Industry Developments in the Network As A Service Market:

- In May 2023, Cloudflare has further inked a deal with IT services major Kyndryl to launch of new managed WAN as a Service. This partnership integrated networking services with Magic WAN company DDoS mitigation and connectivity that will work to improve the performance and security of users moving to the digital era technologies.

- In April 2023, HPE has unveiled the latest features of HPE Aruba Networking Central, its cloud management platform, including AIOps and advanced networking features during the Annual Atmosphere Event. Building on GreenLake, the firm provided discrete IT services that included AI data analysis and network management for performance enhancements from administrators.

- In April 2023, Megaport worked with Element Critical to deploy its NaaS platform for utilizing the internet exchange. By this symbiosis, customers may employ the company’s SDN and CIX services to directly connect their assets that are allocated by the company to multiple clouds and branch offices via a single port to the worldwide network, which yields more control and characteristics of cost control.

|

Global Network As A Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 24.9 Bn. |

|

Forecast Period 2025-32 CAGR: |

35.3 % |

Market Size in 2032: |

USD 279.63 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Enterprise Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Network As A Service Market by Type (2018-2032)

4.1 Network As A Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 WAN as a Service

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 LAN as a Service

Chapter 5: Network As A Service Market by Enterprise Type (2018-2032)

5.1 Network As A Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium-sized Enterprise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprise

Chapter 6: Network As A Service Market by Application (2018-2032)

6.1 Network As A Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Wide Area Network

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Virtual Private Network

6.5 Cloud-based Services

6.6 Bandwidth on Demand

6.7 Others (Integrated Network Security as a Service)

Chapter 7: Network As A Service Market by End User (2018-2032)

7.1 Network As A Service Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Corporate Customers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Individual Customers

Chapter 8: Network As A Service Market by Industry (2018-2032)

8.1 Network As A Service Market Snapshot and Growth Engine

8.2 Market Overview

8.3 BFSI

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 IT & Telecommunication

8.5 Manufacturing

8.6 Healthcare

8.7 Retail

8.8 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Network As A Service Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AMDOCS INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AMAZON WEB SERVICES INC. (U.S.)

9.4 MEGAPORT LIMITED (AUSTRALIA)

9.5 HEWLETT PACKARD ENTERPRISE (ARUBA NETWORKS) (U.S.)

9.6 NEC CORPORATION (JAPAN)

9.7 ARTERIA NETWORKS CORPORATION (JAPAN)

9.8 NTT GROUP (JAPAN)

9.9 CISCO SYSTEMS INC. (U.S.)

9.10 CLOUDFLARE INC. (U.S.)

9.11 VERIZON COMMUNICATIONS INC. (U.S.)

9.12 OTHER KEY PLAYERS.

Chapter 10: Global Network As A Service Market By Region

10.1 Overview

10.2. North America Network As A Service Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 WAN as a Service

10.2.4.2 LAN as a Service

10.2.5 Historic and Forecasted Market Size by Enterprise Type

10.2.5.1 Small and Medium-sized Enterprise

10.2.5.2 Large Enterprise

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Wide Area Network

10.2.6.2 Virtual Private Network

10.2.6.3 Cloud-based Services

10.2.6.4 Bandwidth on Demand

10.2.6.5 Others (Integrated Network Security as a Service)

10.2.7 Historic and Forecasted Market Size by End User

10.2.7.1 Corporate Customers

10.2.7.2 Individual Customers

10.2.8 Historic and Forecasted Market Size by Industry

10.2.8.1 BFSI

10.2.8.2 IT & Telecommunication

10.2.8.3 Manufacturing

10.2.8.4 Healthcare

10.2.8.5 Retail

10.2.8.6 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Network As A Service Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 WAN as a Service

10.3.4.2 LAN as a Service

10.3.5 Historic and Forecasted Market Size by Enterprise Type

10.3.5.1 Small and Medium-sized Enterprise

10.3.5.2 Large Enterprise

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Wide Area Network

10.3.6.2 Virtual Private Network

10.3.6.3 Cloud-based Services

10.3.6.4 Bandwidth on Demand

10.3.6.5 Others (Integrated Network Security as a Service)

10.3.7 Historic and Forecasted Market Size by End User

10.3.7.1 Corporate Customers

10.3.7.2 Individual Customers

10.3.8 Historic and Forecasted Market Size by Industry

10.3.8.1 BFSI

10.3.8.2 IT & Telecommunication

10.3.8.3 Manufacturing

10.3.8.4 Healthcare

10.3.8.5 Retail

10.3.8.6 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Network As A Service Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 WAN as a Service

10.4.4.2 LAN as a Service

10.4.5 Historic and Forecasted Market Size by Enterprise Type

10.4.5.1 Small and Medium-sized Enterprise

10.4.5.2 Large Enterprise

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Wide Area Network

10.4.6.2 Virtual Private Network

10.4.6.3 Cloud-based Services

10.4.6.4 Bandwidth on Demand

10.4.6.5 Others (Integrated Network Security as a Service)

10.4.7 Historic and Forecasted Market Size by End User

10.4.7.1 Corporate Customers

10.4.7.2 Individual Customers

10.4.8 Historic and Forecasted Market Size by Industry

10.4.8.1 BFSI

10.4.8.2 IT & Telecommunication

10.4.8.3 Manufacturing

10.4.8.4 Healthcare

10.4.8.5 Retail

10.4.8.6 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Network As A Service Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 WAN as a Service

10.5.4.2 LAN as a Service

10.5.5 Historic and Forecasted Market Size by Enterprise Type

10.5.5.1 Small and Medium-sized Enterprise

10.5.5.2 Large Enterprise

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Wide Area Network

10.5.6.2 Virtual Private Network

10.5.6.3 Cloud-based Services

10.5.6.4 Bandwidth on Demand

10.5.6.5 Others (Integrated Network Security as a Service)

10.5.7 Historic and Forecasted Market Size by End User

10.5.7.1 Corporate Customers

10.5.7.2 Individual Customers

10.5.8 Historic and Forecasted Market Size by Industry

10.5.8.1 BFSI

10.5.8.2 IT & Telecommunication

10.5.8.3 Manufacturing

10.5.8.4 Healthcare

10.5.8.5 Retail

10.5.8.6 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Network As A Service Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 WAN as a Service

10.6.4.2 LAN as a Service

10.6.5 Historic and Forecasted Market Size by Enterprise Type

10.6.5.1 Small and Medium-sized Enterprise

10.6.5.2 Large Enterprise

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Wide Area Network

10.6.6.2 Virtual Private Network

10.6.6.3 Cloud-based Services

10.6.6.4 Bandwidth on Demand

10.6.6.5 Others (Integrated Network Security as a Service)

10.6.7 Historic and Forecasted Market Size by End User

10.6.7.1 Corporate Customers

10.6.7.2 Individual Customers

10.6.8 Historic and Forecasted Market Size by Industry

10.6.8.1 BFSI

10.6.8.2 IT & Telecommunication

10.6.8.3 Manufacturing

10.6.8.4 Healthcare

10.6.8.5 Retail

10.6.8.6 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Network As A Service Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 WAN as a Service

10.7.4.2 LAN as a Service

10.7.5 Historic and Forecasted Market Size by Enterprise Type

10.7.5.1 Small and Medium-sized Enterprise

10.7.5.2 Large Enterprise

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Wide Area Network

10.7.6.2 Virtual Private Network

10.7.6.3 Cloud-based Services

10.7.6.4 Bandwidth on Demand

10.7.6.5 Others (Integrated Network Security as a Service)

10.7.7 Historic and Forecasted Market Size by End User

10.7.7.1 Corporate Customers

10.7.7.2 Individual Customers

10.7.8 Historic and Forecasted Market Size by Industry

10.7.8.1 BFSI

10.7.8.2 IT & Telecommunication

10.7.8.3 Manufacturing

10.7.8.4 Healthcare

10.7.8.5 Retail

10.7.8.6 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Network As A Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 24.9 Bn. |

|

Forecast Period 2025-32 CAGR: |

35.3 % |

Market Size in 2032: |

USD 279.63 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Enterprise Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||