NB loT Technology Market Synopsis

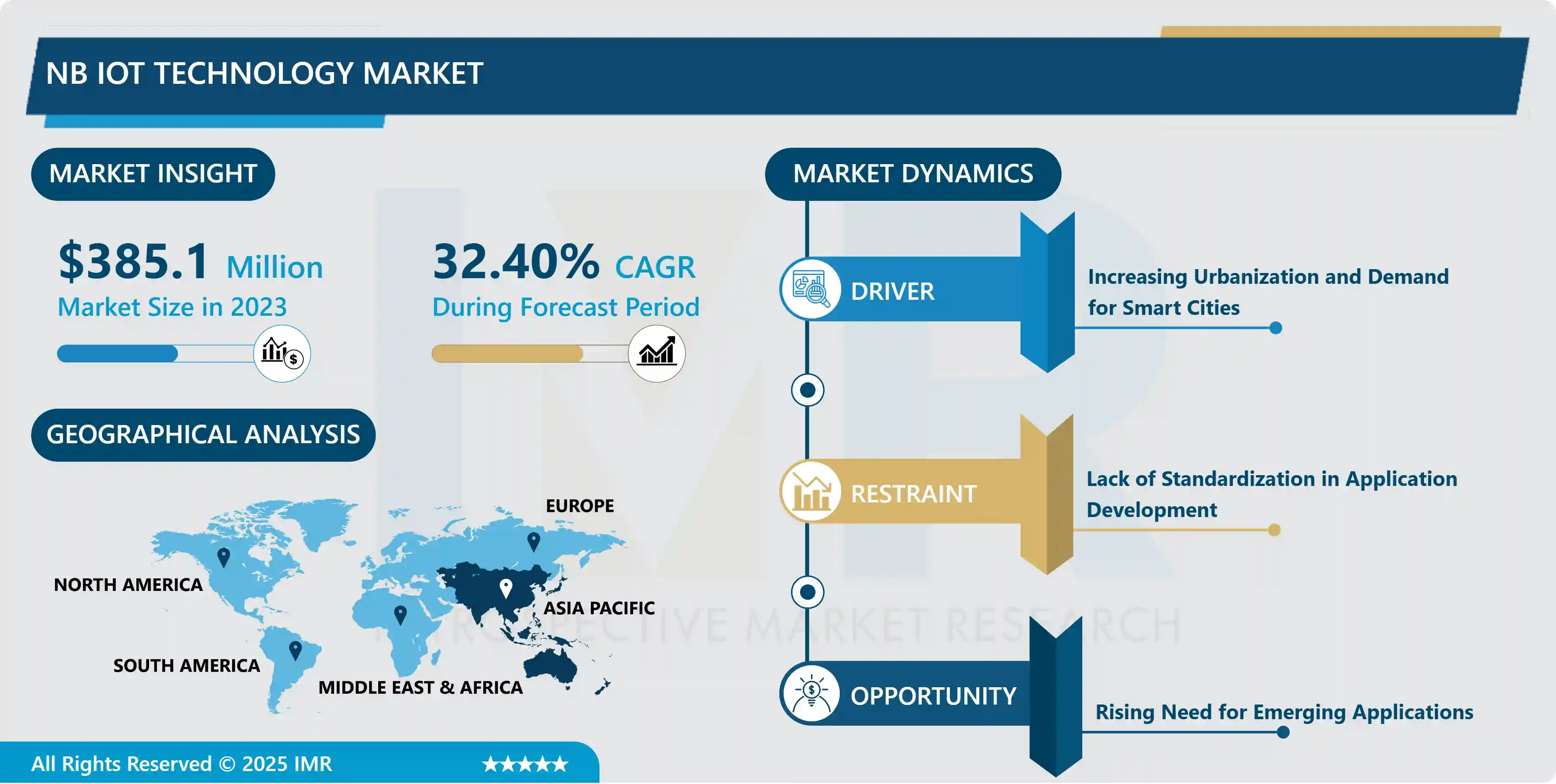

NB loT Technology Market Size Was Valued at USD 385.1 Million in 2023, and is Projected to Reach USD 2945.6 Million by 2032, Growing at a CAGR of 32.4 % From 2024-2032.

Narrowband Internet of Things (NB-IoT) is a low-power, wide-area network (LPWAN) technology crafted for the efficient communication of small, sporadic data transmissions across a multitude of devices. Utilizing licensed cellular spectrum, NB-IoT offers enhanced coverage, prolonged battery life, and simplified device configurations, making it well-suited for connecting diverse Internet of Things (IoT) devices.

Smart cities, agriculture, healthcare, and industrial automation are just a few of the many industries where NB-IoT applications are used. It enables the more efficient administration of resources such as parking systems, garbage disposal, and street lighting in smart cities. Through the monitoring of crop health, irrigation systems, and soil conditions, NB-IoT helps with precision farming in agriculture. With support for tracking medical equipment and remote patient monitoring, NB-IoT benefits the healthcare industry. Improved connection for process optimization, predictive maintenance, and machinery monitoring and control results from industrial automation.

The market for narrowband IoT (NB-IoT) is expected to increase significantly due to the IoT sector's rapid advancement and the growing need for new communication technologies. This new technology is intended for use with Internet of Things LPWA applications. The automotive and transportation sectors have witnessed a surge in demand for in-car infotainment services, including navigation. Furthermore, cheap component costs, low power consumption, and exceptional penetration coverage are expected to bode well for the worldwide narrowband Internet of Things (NB-IoT) market in a few years.

NB IoT Technology Market Trend Analysis:

Increasing Urbanization and Demand for Smart Cities

- The Narrowband Internet of Things (NB-IoT) technology industry is growing due in large part to rising urbanization and the need for smart city projects. Cities must manage their resources, infrastructure, and services more efficiently as the world's population continues to expand. These issues are successfully addressed by NB-IoT technology, which offers a scalable and affordable way to connect and keep an eye on a large number of low-power devices dispersed throughout large metropolitan areas. The development of smart city ecosystems is made possible by this connectedness, which enables the smooth integration and optimization of several elements, including waste management, energy grids, public safety, and transportation systems.

- Smart cities use NB-IoT to improve urban living by using data-driven insights and resource efficiency. For instance, by enabling real-time traffic situation monitoring, putting smart parking solutions into place, and enhancing public transportation services, NB-IoT enables intelligent transportation systems. Furthermore, it is essential to the implementation of smart energy networks, which enhance the distribution and consumption management of electricity.

- Encouraging innovation in critical domains like public safety, healthcare, and environmental monitoring, promotes an all-encompassing strategy for urban growth. The need for NB-IoT technology is expected to continue growing as cities throughout the world adopt the smart infrastructure paradigm, influencing urban living in the future with increased efficiency, sustainability, and connectedness.

Rising Need for Emerging Applications

- Growing consumer demand for new applications presents a significant potential for the market's expansion. Given how rapidly technology is changing a variety of sectors, creative solutions that can adapt to new difficulties and boost productivity are becoming more and more necessary. This requirement is especially clear in industries like healthcare, where cutting-edge technologies like telemedicine, tailored healthcare solutions, and remote patient monitoring are becoming more and more popular. These applications' incorporation of Narrowband Internet of Things (NB-IoT) technology offers a reliable and expandable connection option, enabling more efficient and easily accessible healthcare services.

- Furthermore, there are a lot of chances for the NB-IoT market to grow given the growing trajectory of smart cities and the Internet of Things (IoT) across many industries. Smart city programs are constantly evolving, with applications such as energy management, environmental monitoring, and intelligent transportation systems. due to its wide coverage capabilities, energy-efficient characteristics, and affordability, NB-IoT is positioned to be an important enabler for the expansion of these applications.

- The flexibility and adaptability of NB-IoT perform a significant role in designing and implementing innovative solutions as companies aggressively research and integrate emerging technologies to remain competitive and fulfil changing customer needs. The growing desire for new applications in a variety of industries highlights how revolutionary NB-IoT technology will be in influencing connectivity in the future and driving market growth.

NB IoT Technology Market Segment Analysis:

NB IoT Technology Market is Segmented Based on By Component, Deployment, Application, and End-User.

By Application, Smart Metering Segment Is Expected to Dominate the Market During the Forecast Period

- Narrowband Internet of Things (NB-IoT) connectivity is used by smart meters to gather data on energy use and monitor it in real time. This technology is particularly well-suited for large-scale utility deployments due to its cost-effectiveness, low power consumption, and wide coverage. NB-IoT-powered smart metering systems are being used by utility companies globally as the emphasis on energy saving grows. Smart meter integration makes it possible for utilities to remotely monitor, control, and optimize energy use, which greatly improves operational efficiency and sustainable practices. The market domination of NB-IoT technology is expected to be established by the smart metering segment, owing to the growing need for intelligent utility systems and smart grids.

By Deployment, Standalone Segment Held the Largest Share Of 53.10% In 2022

- The standalone segment has asserted its dominance in the market, holding the largest share, owing to its self-contained deployment and independence from existing infrastructure. This prominence is rooted in the autonomy of standalone Narrowband Internet of Things (NB-IoT) applications, which operate with their dedicated network architecture. This autonomy provides a solution that is flexible and easily implementable across various industries, contributing significantly to the segment's leadership position. Standalone NB-IoT solutions are widely adopted in scenarios where establishing new infrastructure is feasible or where independence from existing networks is a priority. With the standalone segment's capacity to meet diverse deployment requirements in sectors like industrial automation, agriculture, and smart cities, it maintains a significant share, underscoring its adaptability and effectiveness in addressing specific industry needs.

NB IoT Technology Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific area is set to take the lead in the industry and become a driving force behind the adoption and use of Narrowband Internet of Things (NB-IoT) technology. The fast-developing economy, increasing urbanization, and expanding population of the area all have an impact on this leadership. Asia-Pacific nations, including China, India, and Japan, are aggressively investing in and embracing IoT technology for a variety of uses, including smart cities, industrial automation, and agriculture. The area is leading the way in the growth of the NB-IoT industry, which is further reinforced by robust government backing and a healthy ecosystem of technology suppliers. Asia Pacific is positioned to maintain its leadership and play a crucial role in determining the global course of the NB-IoT market as industries there use NB-IoT for creative solutions and start digital transformations.

Key Players Covered in NB IoT Technology Market:

- Intel Corporation (U.S.)

- Twilio (U.S.)

- Qualcomm Technologies (U.S.)

- AT&T Inc (U.S.)

- Verizon Wireless (U.S.)

- Sierra Wireless (Canada)

- Rogers Communications (Canada)

- Vodafone Group (United Kingdom)

- SEQUANS Communications SA (France)

- Deutsche Telekom (Germany)

- Nokia Corporation (Finland)

- Ericsson Corporation (Sweden)

- Huawei Technologies Co., Ltd (China)

- Samsung Group (South Korea)

- MediaTek Inc. (Taiwan)

- u-blox Holding AG (Switzerland)

- China Unicom (China)

- China Telecom Corporation Limited (China)

- Etisalat Corporation (United Arab Emirates)

- Sony Semiconductor Israel Ltd. (Israel), and Other Major Players

Key Industry Development in The NB IoT Technology Market:

- In March 2023, Monogoto, a cloud-based cellular network provider, announced a new roaming agreement with Skylo Technologies, a Non-Terrestrial Network (NTN) service operator. This new partnership lowers developers' barriers to adding satellite connectivity to existing public and/or private networks on Monogoto Cloud, giving the world's most economical and accessible solution for NB-IoT Satellite connectivity for asset monitoring solutions. Also, SODAQ, a low-power tracking and sensing system developer, will unveil a new asset-tracking trial kit using a Monogoto connection and network.

|

Global NB IoT Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 385.1 Mn. |

|

Forecast Period 2024-32 CAGR: |

32.4% |

Market Size in 2032: |

USD 2945.6 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: NB IoT Technology Market by Component (2018-2032)

4.1 NB IoT Technology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: NB IoT Technology Market by Deployment (2018-2032)

5.1 NB IoT Technology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Standalone

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 In-Band

5.5 Guard-Band

Chapter 6: NB IoT Technology Market by Application (2018-2032)

6.1 NB IoT Technology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Smart Metering

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Asset Tracking

6.5 Alarms & Event Detectors

6.6 Smart Parking

6.7 Smart Bins

6.8 Others

Chapter 7: NB IoT Technology Market by End-User (2018-2032)

7.1 NB IoT Technology Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Healthcare

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Retail

7.5 Energy & Utilities

7.6 Transportation & Logistics

7.7 Agriculture

7.8 Smart Cities

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 NB IoT Technology Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 EAGLESOFT (U.S)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 REVENUEWELL (U.S)

8.4 CHIROFUSION (U.S)

8.5 CHIROTOUCH (U.S)

8.6 RAINTREE PRACTICE MANAGER (U.S)

8.7 WEAVE (U.S)

8.8 DENTRIX (U.S)

8.9 OPEN DENTAL (U.S)

8.10 COMPULINK (U.S)

8.11 REVOLUTIONEHR (U.S)

8.12 MY VISION EXPRESS (U.S)

8.13 EYEFINITY (U.S)

8.14 CRYSTAL PM

8.15 (U.S)

8.16 MYCHARTSONLINE (ITALY)

8.17

Chapter 9: Global NB IoT Technology Market By Region

9.1 Overview

9.2. North America NB IoT Technology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Hardware

9.2.4.2 Software

9.2.4.3 Services

9.2.5 Historic and Forecasted Market Size by Deployment

9.2.5.1 Standalone

9.2.5.2 In-Band

9.2.5.3 Guard-Band

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Smart Metering

9.2.6.2 Asset Tracking

9.2.6.3 Alarms & Event Detectors

9.2.6.4 Smart Parking

9.2.6.5 Smart Bins

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Healthcare

9.2.7.2 Retail

9.2.7.3 Energy & Utilities

9.2.7.4 Transportation & Logistics

9.2.7.5 Agriculture

9.2.7.6 Smart Cities

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe NB IoT Technology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Hardware

9.3.4.2 Software

9.3.4.3 Services

9.3.5 Historic and Forecasted Market Size by Deployment

9.3.5.1 Standalone

9.3.5.2 In-Band

9.3.5.3 Guard-Band

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Smart Metering

9.3.6.2 Asset Tracking

9.3.6.3 Alarms & Event Detectors

9.3.6.4 Smart Parking

9.3.6.5 Smart Bins

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Healthcare

9.3.7.2 Retail

9.3.7.3 Energy & Utilities

9.3.7.4 Transportation & Logistics

9.3.7.5 Agriculture

9.3.7.6 Smart Cities

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe NB IoT Technology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Hardware

9.4.4.2 Software

9.4.4.3 Services

9.4.5 Historic and Forecasted Market Size by Deployment

9.4.5.1 Standalone

9.4.5.2 In-Band

9.4.5.3 Guard-Band

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Smart Metering

9.4.6.2 Asset Tracking

9.4.6.3 Alarms & Event Detectors

9.4.6.4 Smart Parking

9.4.6.5 Smart Bins

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Healthcare

9.4.7.2 Retail

9.4.7.3 Energy & Utilities

9.4.7.4 Transportation & Logistics

9.4.7.5 Agriculture

9.4.7.6 Smart Cities

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific NB IoT Technology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Hardware

9.5.4.2 Software

9.5.4.3 Services

9.5.5 Historic and Forecasted Market Size by Deployment

9.5.5.1 Standalone

9.5.5.2 In-Band

9.5.5.3 Guard-Band

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Smart Metering

9.5.6.2 Asset Tracking

9.5.6.3 Alarms & Event Detectors

9.5.6.4 Smart Parking

9.5.6.5 Smart Bins

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Healthcare

9.5.7.2 Retail

9.5.7.3 Energy & Utilities

9.5.7.4 Transportation & Logistics

9.5.7.5 Agriculture

9.5.7.6 Smart Cities

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa NB IoT Technology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Hardware

9.6.4.2 Software

9.6.4.3 Services

9.6.5 Historic and Forecasted Market Size by Deployment

9.6.5.1 Standalone

9.6.5.2 In-Band

9.6.5.3 Guard-Band

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Smart Metering

9.6.6.2 Asset Tracking

9.6.6.3 Alarms & Event Detectors

9.6.6.4 Smart Parking

9.6.6.5 Smart Bins

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Healthcare

9.6.7.2 Retail

9.6.7.3 Energy & Utilities

9.6.7.4 Transportation & Logistics

9.6.7.5 Agriculture

9.6.7.6 Smart Cities

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America NB IoT Technology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Hardware

9.7.4.2 Software

9.7.4.3 Services

9.7.5 Historic and Forecasted Market Size by Deployment

9.7.5.1 Standalone

9.7.5.2 In-Band

9.7.5.3 Guard-Band

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Smart Metering

9.7.6.2 Asset Tracking

9.7.6.3 Alarms & Event Detectors

9.7.6.4 Smart Parking

9.7.6.5 Smart Bins

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Healthcare

9.7.7.2 Retail

9.7.7.3 Energy & Utilities

9.7.7.4 Transportation & Logistics

9.7.7.5 Agriculture

9.7.7.6 Smart Cities

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global NB IoT Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 385.1 Mn. |

|

Forecast Period 2024-32 CAGR: |

32.4% |

Market Size in 2032: |

USD 2945.6 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the NB IoT Technology market research report is 2024-2032.

Intel Corporation (U.S.), Twilio (U.S.), Qualcomm Technologies (U.S.), AT&T Inc (U.S.), Verizon Wireless (U.S.), Sierra Wireless (Canada), Rogers Communications (Canada), Vodafone Group (United Kingdom), SEQUANS Communications SA (France), Deutsche Telekom (Germany), Nokia Corporation (Finland), Ericsson Corporation (Sweden), Huawei Technologies Co., Ltd (China), Samsung Group (South Korea), MediaTek Inc. (Taiwan),u-blox Holding AG (Switzerland), China Unicom (China), China Telecom Corporation Limited (China), Etisalat Corporation (United Arab Emirates), Sony Semiconductor Israel Ltd. (Israel), and Other Major Players.