Nanoelectromechanical Systems Market Synopsis

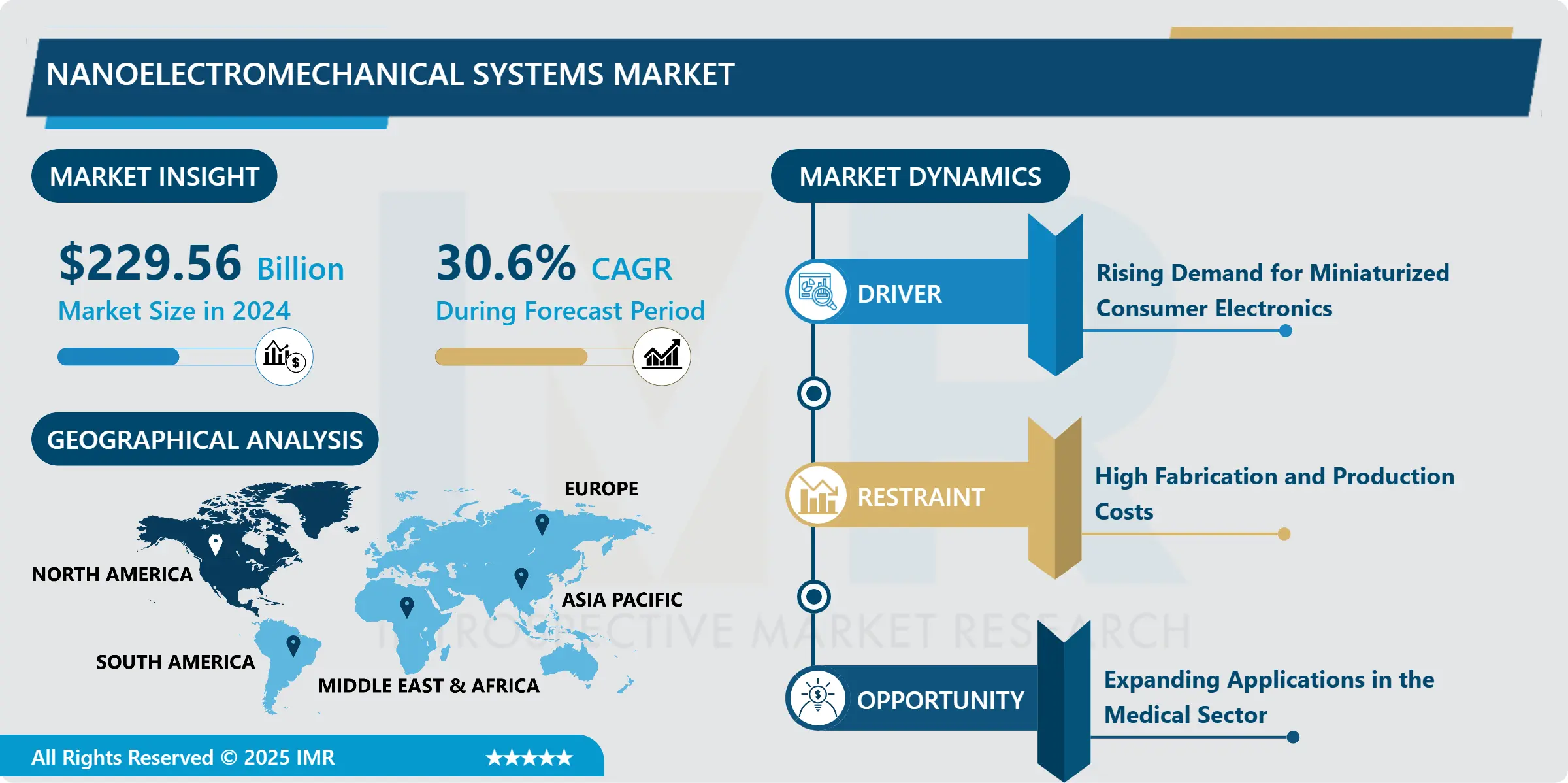

Nanoelectromechanical Systems Market Size Was Valued at USD 229.56 Billion in 2024, and is Projected to Reach USD 4327.84 Billion by 2035, Growing at a CAGR of 30.6% From 2025-2035.

Nanoelectromechanical Systems are miniaturized elements of integrated electric and mechanical features with dimensions approaching one nanometer. Used in sensor, actuator and communicational appliances, the unique mechanical properties of nanomaterials employed allow maximize precision and high sensitivity.

The Nanoelectromechanical Systems (NEMS) market is the emerging market situated on the border between nanotechnology and Microelectromechanical systems (MEMS). NEMS is the next generation of miniaturization technology where mechanical structures, sensors, actuators and electronics are made at nanoscale level and they provide substantially improved performance, sensitivity, and energy efficiency over the MEMS systems. Such systems are often used especially in the cases when high accuracy is required which is the typical characteristic of many diagnostic instruments, monitoring devices, and even some elements of high-frequency communication devices. The use of NEMS has increasing demand due to the development in nanomaterials such as carbon nanotubes, graphene and other two-dimensional material that portray high electrical, mechanical and thermal characteristic. Besides, NEMS are gradually becoming indispensable subassemblies in the creation of new generation sensors that offer improved sensitivity and power efficiency for the incorporation in IoTs and other smart devices.

Market growth is also supported through dedicated efforts in research and development on both the private and the public part. Concerning the development and maturation of NEMS technology, universities and research institutions sit at the center of the process, primarily through their research and in cooperation with industries for the fabrication of products. The governments of technologically developed countries including North America, Europe and part of Asia-Pacific are also investing on NEMS research as a means of improving their countries’ position in the global semiconductor and nanotechnology market. Another crucial growth area is the integration of NEMS in medical devices, including novel biomedical and bio-sensing applications like early disease detection, accentuated drugs delivery and differentiated treatment. High precision and small dimensions of NEMS enable applications that are impossible to perform with other materials: implantable devices observing biological activity at a cellular level.

However, there are some challenges that affect the NEMS market that can hinder it to grow to the next level. The first challenge is related to the difficulty in nano manufacturing due to the escalating costs that are attributed to this detailing process. The fabrication processes involve the use of complex structures such as the electron beam lithography, and atomic layer deposition that are costly and can hardly be implemented in large scale production. Further, there are practical issues quoted with reference to dimensional stability reliability and durability of NEMS devices due to wear and tear, environmental and quantum effects more dominant at nanoscale than at macro levels. To further pursue these manufacturing and material stability challenges for removing the barriers for using NEMS in commercial application. Standards and intellectual property rights are a problem as this is a rather competitive and saturated area with effectively countless patents and unique technologies that might create difficulties on the way to creating.

In the coming years, more growth path is expected for the NEMS market since advancements go on knocking down the technical and manufacturing barriers. AI and machine learning combined with NEMS are set to explode like new territories in which the integration of advanced intelligent and self-powered, or increasingly self-powered sensor networks that can process data locally with low energy loss will be possible. Another potential application lies in the development of NEMS based energy harvesting devices to capacitively power small electronics using even ambient mechanical vibrations, thermal gradients or light for use in applications in remote areas or where it is difficult to replace batteries. Besides, as the demand for miniaturized electronics grows around the world especially in the field of wearable electronics, portable smart phones, and medical devices, the utilization of NEMS for improved performance and functionality will be even more important. Academic, industry, and government partnerships will need to be fostered to overcome these challenges if NEMS are to be optimally deployed in many diverse application domains.

Nanoelectromechanical Systems Market Trend Analysis

Integration of Nanoelectromechanical Systems in IoT Devices

- One trend that is steering the growth of the NEMS market is the incorporation of Nanoelectromechanical Systems into the internet of things gadgets. Unlike the past when there were only a few IoT devices, the demand for these sensors continue to grow when there is a need for smaller and more energy efficient sensors that operate with higher sensitivity and accuracy on the internet. NEMS fill these requirements by offering high-resolution sensing, which will be central to new IoT protocols in intelligent dwelling, health care, and manufacturing systems. This trend is further encouraged by the steady improvement of nanofabrication technologies that see NEMS becoming cheaper to manufacture making it easier to be integrated into IoT systems.

- The advancement in the miniaturization of sensors through NEMS not only increases the performance of the IoT devices but also provides power efficiency for battery/energy-harvesting IoT devices. Therefore, NEMS are gaining their importance in the context of IoT, in which the demand for the incorporating real-time data measurement and analysis persists. The use of NEMS in IoT should gain further traction as industries work to integrate or create more complex and networked components to work in myriad application spaces from extreme industrial settings to everyday home use.

Expanding Applications in the Medical Sector

- The commercial expansion of NEMS in the medical sector is seen as one of the major opportunities in the niche. NEMS are capable of offering revolutionary viable solutions in healthcare domain as they can be used for multiplexing diagnostic and/or therapeutic modality with very high precision using minimally invasive actions. Hence, in patients care, development of diseases at molecular levels can be diagnosed early by incorporating NEMS-based biosensors in medical diagnostics. These systems can be used in different medical device products, such as lab-on-a-chips, which perform various tests with small sample volume, and at high speed. This opportunity is complemented by the increasing trend towards personalised medicines, as NEMS allow for highly sensitive and selective detection of biomarkers that will support personalised treatment strategies.

- However, NEMS have applications in drug releaser systems due to the nanoscale mechanical inducts they can be used to release therapeutic agents increasing the effectiveness of treatments. Given the nature of NEMS that enables its functionality at a very small scale opens up possibilities of using targeted therapy whose side effects would be minimal, a key benefit considering cancer and other acute medical complications. Due to a constant increase in the level of differentiation in diagnostics and therapies there is a steady need for boosting the medical sector for implementing the NEMS technology, as research and development demonstrates further application opportunities for such systems.

Nanoelectromechanical Systems Market Segment Analysis:

Nanoelectromechanical Systems Market Segmented based on Material Type, Application, Product Type and Fabrication Technology.

By Product Type, Nano-Accelerometers segment is expected to dominate the market during the forecast period

- The NEMS market is categorized with regard to product types such as Nano Tweezers, Nano Cantilevers, Nano Switches, Nano Accelerometers, and Nano Fluidic Modules. Nano-Tweezers are widely used in any work involving the handling of nanoparticles for instance in biotechnology and material sciences. They afford a high level of spatial resolution, which is necessary for operations such as separation or arrangement of nanoscale structures. On the other hand, Nano-Cantilevers are incorporated in sensing devices because they are highly responsive to physical, chemical and biological variations. These cantilevers could be used to measure changes in mass or force and are therefore well suited to biosensing and environmental applications.

- Nano-Switches and Nano-Accelerometers in becoming a hot and promising area in the electronics industry to enhance the performance of the electronic devices. Nano-Switches with high speed of switching are applied in next-generation transistors, while Nano-Accelerometers are applied in various motion sensing applications especially in the use of consumer electronics like Smartphones and gaming devices. Nano-Fluidic Modules that are applied to control fluids at nanoscale, useful in lab-on-a-chip systems, improving the accuracy of the control of fluids in diagnostic and drug delivery devices.

By Fabrication Technology , Micromachining segment held the largest share in 2024

- The construction of NEMS is usually in accordance of the following technologies complex; Micromachining, Silicon on Insulator (SOI) and LIGA (Lithography Electroplating and Molding technologies. Micromachining is a common method, which comprises the selective reduction in material to create channels at the nanoscale. It is especially applied for forming components such as Nano-Cantilevers as well as Nano-Tweezers owing to the efficiency and the ability to scale. Silicon on Insulator Technology (SOI) is the other fundamental fabrication process, which is significant in developing high performance SOI/NEMS devices with low power consumption and increased signal strength. SOI is handy in application that require high reliability across different environments, a feature that is exhibited by several sensors that are used in the automotive and aerospace domains.

- LIGA is an acronym for Lithography, Electroplating, and Molding and is a micromachining fabrication technique that can be used to produce LIGA structures with high aspect ratios tertiary mechanical properties. This technology for applications that need high precision parts like Nano-Fluidic Modules for use in medical applications. These fabrication technologies can therefore be employed in creation of NEMS possessing a wide range of functions thus satisfying the requirements of the various consumer oriented industries such as electronics and health.

Nanoelectromechanical Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Currently, the North America leads the NEMS market due to concentrated key manufacturers, developed research facilities, and large funding towards the nanotechnology. Ontario has well-developed academic base and government and private supports in terms of research funding and development and commercialization of NEMS technologies. The US, for instance, is most actively developing NEMS with ongoing work in Universities and in specialized nanotechnology centres. Another factor that underlines this focus is the extension of cooperation with industries that help turn the results of research into real market offers.

- In addition, there is a high demand for NEMS in North America because the region is home to industries that are critical users of NEMS including consumer electronics, healthcare, and automotive. Recent growth in the usage of NEMS in biomedical diagnostics and drug delivery system manifests the regions advanced health care sector and emphasis on technology development. Hence, the North American region shall continue to dominate the NEMS market owing to ongoing research and development as well as increasing application of nanoscale device solutions.

Active Key Players in the Nanoelectromechanical Systems Market

- Cnano Technology Ltd. (China)

- Asylum Research (USA)

- Bruker Corporation (USA)

- Sun Innovation Inc. (USA)

- Veeco Instruments Inc. (USA)

- KLA Corporation (USA)

- Nanonics Imaging Ltd. (Israel)

- NanoIntegris Inc. (Canada)

- Nanomix Inc. (USA)

- Agilent Technologies Inc. (USA)

- Others Key Player

|

Global Nanoelectromechanical Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 229.56 Bn. |

|

Forecast Period 2025-35 CAGR: |

30.6% |

Market Size in 2035: |

USD 4327.84 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By Product Type |

|

||

|

By Fabrication Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nanoelectromechanical System (NEMS) Market by Material Type (2018-2035)

4.1 Nanoelectromechanical System (NEMS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Graphene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Carbon Nanotubes

4.5 SiC

4.6 SiO2

Chapter 5: Nanoelectromechanical System (NEMS) Market by Application (2018-2035)

5.1 Nanoelectromechanical System (NEMS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tools & Equipment Application

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sensing & Control Applications

5.5 Solid State Electronics

Chapter 6: Nanoelectromechanical System (NEMS) Market by Product Type (2018-2035)

6.1 Nanoelectromechanical System (NEMS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Nano-Tweezers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Nano-Cantilevers

6.5 Nano-Switches

6.6 Nano-Accelerometers

6.7 Nano-Fluidic Modules

Chapter 7: Nanoelectromechanical System (NEMS) Market by Fabrication Technology (2018-2035)

7.1 Nanoelectromechanical System (NEMS) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Micromachining

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Silicon on Insulator Technology - SOI

7.5 LIGA - Lithography Electroplating and Molding

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Nanoelectromechanical System (NEMS) Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LOCKHEED MARTIN (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 RAYTHEON TECHNOLOGIES (US)

8.4 NORTHROP GRUMMAN (US)

8.5 AEROJET ROCKETDYNE HOLDINGS INC. (US)

8.6 L3HARRIS TECHNOLOGIES (US)

8.7 COLLINS AEROSPACE (US)

8.8 HONEYWELL INTERNATIONAL INC. (US)

8.9 GENERAL DYNAMICS (US)

8.10 BOEING(US)

8.11 BAE SYSTEMS (UK)

8.12 MBDA FRANCE (FRANCE)

8.13 THALES (FRANCE)

8.14 LEONARDO (ITALY)

8.15 SAAB AB (SWEDEN)

8.16 RHEINMETALL (GERMANY)

8.17 IAI - ISRAEL AEROSPACE INDUSTRIES LTD. (ISRAEL)

8.18 ISRAEL AEROSPACE INDUSTRIES (ISRAEL)

8.19 RAFAEL ADVANCED DEFENSE SYSTEMS LTD. (ISRAEL)

8.20 ALMAZ-ANTEY AIR DEFENSE CONCERN (RUSSIA)

8.21 BHARAT DYNAMICS LIMITED (INDIA)

8.22 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION (CHINA)

8.23 CHINA NORTH INDUSTRIES GROUP CORPORATION (CHINA)

8.24 CHINA SOUTH INDUSTRIES GROUP CORPORATION (CHINA)

8.25 HANWHA AEROSPACE (SOUTH KOREA)

8.26 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

Chapter 9: Global Nanoelectromechanical System (NEMS) Market By Region

9.1 Overview

9.2. North America Nanoelectromechanical System (NEMS) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Material Type

9.2.4.1 Graphene

9.2.4.2 Carbon Nanotubes

9.2.4.3 SiC

9.2.4.4 SiO2

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Tools & Equipment Application

9.2.5.2 Sensing & Control Applications

9.2.5.3 Solid State Electronics

9.2.6 Historic and Forecasted Market Size by Product Type

9.2.6.1 Nano-Tweezers

9.2.6.2 Nano-Cantilevers

9.2.6.3 Nano-Switches

9.2.6.4 Nano-Accelerometers

9.2.6.5 Nano-Fluidic Modules

9.2.7 Historic and Forecasted Market Size by Fabrication Technology

9.2.7.1 Micromachining

9.2.7.2 Silicon on Insulator Technology - SOI

9.2.7.3 LIGA - Lithography Electroplating and Molding

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Nanoelectromechanical System (NEMS) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Material Type

9.3.4.1 Graphene

9.3.4.2 Carbon Nanotubes

9.3.4.3 SiC

9.3.4.4 SiO2

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Tools & Equipment Application

9.3.5.2 Sensing & Control Applications

9.3.5.3 Solid State Electronics

9.3.6 Historic and Forecasted Market Size by Product Type

9.3.6.1 Nano-Tweezers

9.3.6.2 Nano-Cantilevers

9.3.6.3 Nano-Switches

9.3.6.4 Nano-Accelerometers

9.3.6.5 Nano-Fluidic Modules

9.3.7 Historic and Forecasted Market Size by Fabrication Technology

9.3.7.1 Micromachining

9.3.7.2 Silicon on Insulator Technology - SOI

9.3.7.3 LIGA - Lithography Electroplating and Molding

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Nanoelectromechanical System (NEMS) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Material Type

9.4.4.1 Graphene

9.4.4.2 Carbon Nanotubes

9.4.4.3 SiC

9.4.4.4 SiO2

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Tools & Equipment Application

9.4.5.2 Sensing & Control Applications

9.4.5.3 Solid State Electronics

9.4.6 Historic and Forecasted Market Size by Product Type

9.4.6.1 Nano-Tweezers

9.4.6.2 Nano-Cantilevers

9.4.6.3 Nano-Switches

9.4.6.4 Nano-Accelerometers

9.4.6.5 Nano-Fluidic Modules

9.4.7 Historic and Forecasted Market Size by Fabrication Technology

9.4.7.1 Micromachining

9.4.7.2 Silicon on Insulator Technology - SOI

9.4.7.3 LIGA - Lithography Electroplating and Molding

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Nanoelectromechanical System (NEMS) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Material Type

9.5.4.1 Graphene

9.5.4.2 Carbon Nanotubes

9.5.4.3 SiC

9.5.4.4 SiO2

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Tools & Equipment Application

9.5.5.2 Sensing & Control Applications

9.5.5.3 Solid State Electronics

9.5.6 Historic and Forecasted Market Size by Product Type

9.5.6.1 Nano-Tweezers

9.5.6.2 Nano-Cantilevers

9.5.6.3 Nano-Switches

9.5.6.4 Nano-Accelerometers

9.5.6.5 Nano-Fluidic Modules

9.5.7 Historic and Forecasted Market Size by Fabrication Technology

9.5.7.1 Micromachining

9.5.7.2 Silicon on Insulator Technology - SOI

9.5.7.3 LIGA - Lithography Electroplating and Molding

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Nanoelectromechanical System (NEMS) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Material Type

9.6.4.1 Graphene

9.6.4.2 Carbon Nanotubes

9.6.4.3 SiC

9.6.4.4 SiO2

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Tools & Equipment Application

9.6.5.2 Sensing & Control Applications

9.6.5.3 Solid State Electronics

9.6.6 Historic and Forecasted Market Size by Product Type

9.6.6.1 Nano-Tweezers

9.6.6.2 Nano-Cantilevers

9.6.6.3 Nano-Switches

9.6.6.4 Nano-Accelerometers

9.6.6.5 Nano-Fluidic Modules

9.6.7 Historic and Forecasted Market Size by Fabrication Technology

9.6.7.1 Micromachining

9.6.7.2 Silicon on Insulator Technology - SOI

9.6.7.3 LIGA - Lithography Electroplating and Molding

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Nanoelectromechanical System (NEMS) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Material Type

9.7.4.1 Graphene

9.7.4.2 Carbon Nanotubes

9.7.4.3 SiC

9.7.4.4 SiO2

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Tools & Equipment Application

9.7.5.2 Sensing & Control Applications

9.7.5.3 Solid State Electronics

9.7.6 Historic and Forecasted Market Size by Product Type

9.7.6.1 Nano-Tweezers

9.7.6.2 Nano-Cantilevers

9.7.6.3 Nano-Switches

9.7.6.4 Nano-Accelerometers

9.7.6.5 Nano-Fluidic Modules

9.7.7 Historic and Forecasted Market Size by Fabrication Technology

9.7.7.1 Micromachining

9.7.7.2 Silicon on Insulator Technology - SOI

9.7.7.3 LIGA - Lithography Electroplating and Molding

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Nanoelectromechanical Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 229.56 Bn. |

|

Forecast Period 2025-35 CAGR: |

30.6% |

Market Size in 2035: |

USD 4327.84 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By Product Type |

|

||

|

By Fabrication Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||