Molecular Diagnostics Market Synopsis

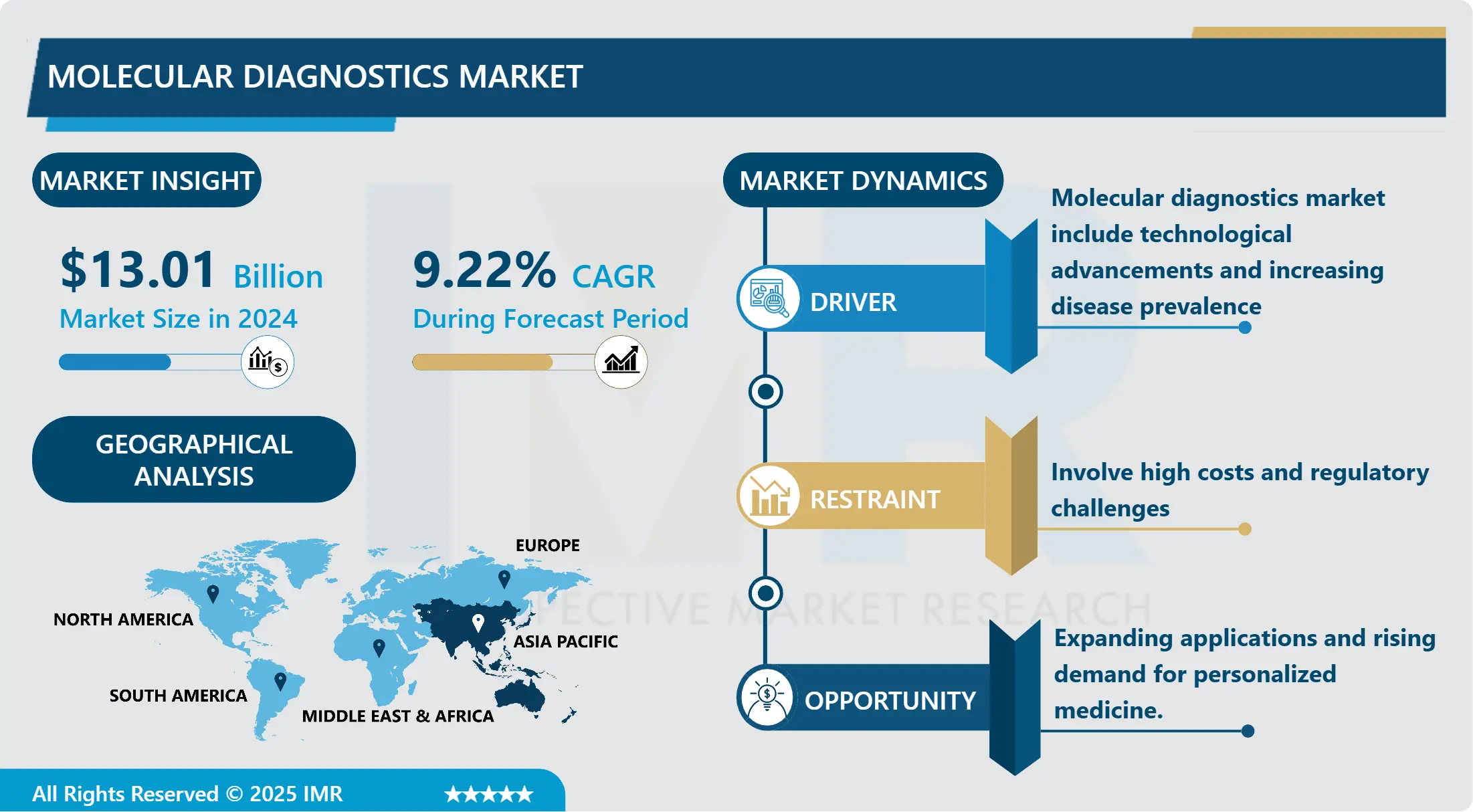

Molecular Diagnostics Market Size is Valued at USD 13.01 Billion in 2024, and is Projected to Reach USD 26.34 Billion by 2032, Growing at a CAGR of 9.22% From 2025-2032.

Advancements in genomics and personalized medicine are driving significant expansion in the molecular diagnostics market. This market includes technologies such as PCR, next-generation sequencing, and microarrays, which are employed to detect and monitor genetic disorders, infectious diseases, and malignancies. The market is expanding due to the increasing demand for rapid and accurate diagnostic techniques, as well as the increasing prevalence of these diseases. Additionally, the market has been further stimulated by the increased awareness and utilization of molecular diagnostic tests as a result of the COVID-19 pandemic. In order to create diagnostic solutions that are more user-friendly, cost-effective, and efficient, key actors are consistently innovating.

The molecular diagnostics market is a rapidly expanding sector of the healthcare industry, fueled by the growing demand for personalized and precise medical care and technological advancements. Molecular diagnostics is the process of analyzing genetic material to diagnose diseases, predict outcomes, and inform treatment decisions. This field has experienced substantial development as a result of its capacity to offer comprehensive information on cancer, infectious diseases, and genetic disorders.

Recent advancements in molecular diagnostic tools, such as polymerase chain reaction (PCR) and next-generation sequencing, have improved the accuracy and speed of diagnostic procedures. These technologies have enabled the earlier identification of maladies and the customization of treatments to the unique profiles of individual patients, thereby improving patients' overall health.

An extensive array of applications, such as genetic testing, infectious diseases, and oncology, characterize the market. In order to accommodate the changing requirements of healthcare providers and patients, the industry's leading actors are consistently creating new products and broadening their portfolios.

The market is expanding globally, with substantial growth in the Asia-Pacific, Europe, and North America regions. Factors such as the increasing prevalence of chronic diseases, the rising healthcare expenditure, and the growing awareness of early diagnosis influence the market's expansion. In general, the molecular diagnostics market is on the brink of further expansion, propelled by the growing emphasis on precision medicine and technological advancements.

Molecular Diagnostics Market Trend Analysis

Molecular Diagnostics Market Growth Driver- Integration of Artificial Intelligence (AI)

- The integration of Artificial Intelligence (AI) in the molecular diagnostics market is transforming how diseases are detected and managed. AI technologies enhance the accuracy and efficiency of molecular diagnostics by analyzing complex data sets with greater precision. Machine learning algorithms can identify patterns and biomarkers that may be missed by traditional methods, leading to earlier and more accurate diagnoses.

- AI-driven tools are also streamlining the diagnostic workflow. Automated systems powered by AI can rapidly process samples and interpret results, reducing the time and labor involved in diagnostics. This increased efficiency not only accelerates patient care but also helps in managing healthcare costs effectively.

- Moreover, AI is enabling personalized medicine through advanced data analysis. By integrating genomic data with AI, healthcare providers can tailor treatments to individual patient profiles, improving treatment outcomes and reducing adverse effects.

- The growing adoption of AI in molecular diagnostics reflects a broader trend towards digital transformation in healthcare. As AI technology continues to advance, its role in molecular diagnostics is expected to expand, offering new possibilities for precision medicine and improved patient care.

Molecular Diagnostics Market Expansion Opportunity- Growth in Liquid Biopsies

- Advancements in molecular diagnostics are driving significant expansion in the liquid biopsy market. Liquid biopsies, which involve the analysis of biomarkers in blood or other bodily fluids, offer a less invasive alternative to traditional tissue biopsies. This approach is especially useful for early cancer detection and disease progression monitoring.

- Recent technological advancements have improved the precision and sensitivity of liquid biopsy tests. Advanced bioinformatics and next-generation sequencing (NGS) have further stimulated the market. The high precision with which these technologies can detect genetic mutations and alterations makes liquid biopsies a critical instrument in personalized medicine.

- Also contributing to market expansion is the growing incidence of cancer and other chronic diseases. The demand for liquid biopsies is on the rise as healthcare providers and patients continue to pursue more efficient diagnostic tools. Furthermore, the growing focus on early diagnosis and preventive healthcare reinforces this trend.

- The molecular diagnostics sector, which includes liquid biopsies and other technologies, is on the brink of significant growth. As research and development continue to progress, we anticipate the market to expand, providing new opportunities for innovation and enhanced patient outcomes.

Molecular Diagnostics Market Segment Analysis:

Molecular Diagnostics Market Segmented on the basis of By Products, Technology, Application, End User, and Region.

By Products, Reagents and Kits segment is expected to dominate the market during the forecast period

- The molecular diagnostics market is a sector that is expanding at a rapid pace, fueled by the growing demand for diagnostic instruments that are both precise and efficient, as well as technological advancements. This market includes reagents, packages, instruments, services, and software. Reagents and packages are indispensable for the execution of molecular tests and assays, as they provide the essential instruments for sample preparation and analysis. Instruments incorporate advanced apparatus and devices essential for the automation and precision of molecular diagnostics.

- The market provides a range of services, such as laboratory testing, support, and consulting, all aimed at optimizing the use of diagnostic technologies. Software solutions are also essential, as they offer data administration, analysis, and integration capabilities that improve the functionality of diagnostic systems. The synergy between these product categories enhances innovation and diagnostic capabilities across a variety of applications.

- The molecular diagnostics market is expanding significantly in response to the increasing demand for personalized medicine and early disease detection. Advances in genomic and proteomic technologies are driving the ongoing development of new and improved diagnostic instruments, enhancing the market's potential. The integration of automated instruments and advanced software further enhances the accuracy and efficacy of diagnostics.

- Generally, the dynamic and evolving nature of the molecular diagnostics market is evident in the continuous advancements made across all product segments. The market is poised for sustained expansion in the years ahead, driven by the increasing demand for healthcare, technological advancements, and a greater emphasis on personalized medicine.

By Application, Pharmacogenomics segment held the largest share in 2024

- The molecular diagnostics market is experiencing significant growth due to its expanding applications in a variety of medical domains. In the field of oncology, molecular diagnostics are critical for early cancer detection and the development of personalized treatment strategies based on genetic mutations. These technologies also benefit pharmacogenomics by facilitating the development of personalized drug therapies that optimize efficacy and reduce adverse effects, thereby improving patient outcomes.

- Molecular diagnostics are indispensable for the effective treatment and containment of infectious diseases, as they provide rapid and precise identification of pathogens in the field of microbiology. The use of molecular techniques in prenatal testing has enabled early diagnosis of genetic disorders and improved management of pregnancy-related risks. To improve organ transplant compatibility and identify genetic abnormalities, tissue typing and blood screening also employ molecular methodologies.

- Additionally, the market is experiencing expansion in applications that pertain to neurological and cardiovascular diseases. Molecular diagnostics are instrumental in the early detection and personalized management of cardiovascular conditions, as well as the advancement of research and treatment strategies for neurological disorders.

- Infectious diseases continue to drive the demand for molecular diagnostics, as they are essential for the precise identification of pathogens and the monitoring of outbreaks. The increasing significance and potential of molecular diagnostics in a variety of medical fields underscore its versatility, which in turn drives market expansion and innovation.

Molecular Diagnostics Market Regional Insights:

Asia-Pacific is expected to witness significant growth

- Increased healthcare needs and technological advancements are driving the molecular diagnostics market in the Asia-Pacific region towards significant development. The increasing prevalence of chronic diseases and rapid urbanization are driving the demand for precise and efficient diagnostic solutions. Governments and healthcare organizations make substantial investments in infrastructure and research, further bolstering the market's expansion.

- The region's extensive and diverse population is a significant factor in this growth, as it requires the development of innovative diagnostic instruments to address a variety of health issues. The demand for early disease detection and the growing awareness of personalized medicine are also significant factors. This trend is notably apparent in countries such as China, India, and Japan, where healthcare systems are undergoing rapid evolution.

- Technological advancements, such as the development of next-generation sequencing and PCR technologies, are improving the capabilities of molecular diagnostics. These innovations enhance the accuracy and rapidity of disease detection, essential for the effective management and treatment of patients.

- Furthermore, the increasing number of partnerships between pharmaceutical companies and diagnostic firms is promoting innovation in molecular diagnostics. As these partnerships continue to expand, offering a variety of opportunities for growth and development, we anticipate the Asia-Pacific region to remain a significant participant in the global molecular diagnostics market.

Active Key Players in the Molecular Diagnostics Market

- F. Hoffmann-La Roche Ltd (Switzerland)

- Hologic, Inc., (U.S.)

- bioMérieux (France)

- Abbott (U.S.)

- QIAGEN (Netherlands)

- Thermo Fisher Scientific (U.S.)

- Siemens (Germany)

- Danaher (U.S.)

- Myriad Genetics Inc. (U.S.)

- Illumina Inc. (U.S.)

- Agilent Technologies Inc. (U.S.)

- BD (U.S), DiaSorin S.p.A (Italy)

- Grifols S.A. (Spain)

- Quidel Corporation (U.S.)

- Genetic Signatures (Australia)

- MDxHealth, Inc. (U.S.)

- Exact Sciences Corporation (U.S.)

- Biocartis (Belgium)

- TBG Diagnostics Limited (Australia)

- GenMark Diagnostics Inc. (U.S.)

- Luminex Corporation (U.S.)

- HTG Molecular Diagnostics Inc. (U.S.)

- Vela Diagnostics (Singapore)

- Amoy Diagnostics Co., Ltd. (China)

- Molbio Diagnostics Pvt. Ltd. (India)

- GeneOmbio (India)

- Others Active players.

|

Global Molecular Diagnostics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.01 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.22% |

Market Size in 2032: |

USD 26.34 Bn. |

|

Segments Covered: |

By Products |

|

|

|

By Technology Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Molecular Diagnostics Market by Products (2018-2032)

4.1 Molecular Diagnostics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reagents and Kits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Instruments

4.5 Services

4.6 Software

Chapter 5: Molecular Diagnostics Market by Technology Type (2018-2032)

5.1 Molecular Diagnostics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mass Spectrometry (MS)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Capillary Electrophoresis

5.5 Next Generation Sequencing (NGS)

5.6 Chips And Microarray

5.7 Polymerase Chain Reaction (PCR)-Based Methods

5.8 Cytogenetics

5.9 In Situ Hybridization (ISH or FISH)

5.10 Molecular Imaging

5.11 Others

Chapter 6: Molecular Diagnostics Market by Application (2018-2032)

6.1 Molecular Diagnostics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Oncology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmacogenomic

6.5 Microbiology

6.6 Prenatal Tests

6.7 Tissue Typing

6.8 Blood Screening

6.9 Cardiovascular Diseases

6.10 Neurological Diseases

6.11 Infectious Diseases

6.12 Others

Chapter 7: Molecular Diagnostics Market by End User (2018-2032)

7.1 Molecular Diagnostics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospital

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinical Laboratories

7.5 Academics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Molecular Diagnostics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HOLOGIC INC(U.S.)

8.4 BIOMÉRIEUX (FRANCE)

8.5 ABBOTT (U.S.)

8.6 QIAGEN (NETHERLANDS)

8.7 THERMO FISHER SCIENTIFIC (U.S.)

8.8 SIEMENS (GERMANY)

8.9 DANAHER (U.S.)

8.10 MYRIAD GENETICS INC. (U.S.)

8.11 ILLUMINA INC. (U.S.)

8.12 AGILENT TECHNOLOGIES INC. (U.S.)

8.13 BD (U.S)

8.14 DIASORIN S.P.A (ITALY)

8.15 GRIFOLS S.A. (SPAIN)

8.16 QUIDEL CORPORATION (U.S.)

8.17 GENETIC SIGNATURES (AUSTRALIA)

8.18 MDXHEALTH INC. (U.S.)

8.19 EXACT SCIENCES CORPORATION (U.S.)

8.20 BIOCARTIS (BELGIUM)

8.21 TBG DIAGNOSTICS LIMITED (AUSTRALIA)

8.22 GENMARK DIAGNOSTICS INC. (U.S.)

8.23 LUMINEX CORPORATION (U.S.)

8.24 HTG MOLECULAR DIAGNOSTICS INC. (U.S.)

8.25 VELA DIAGNOSTICS (SINGAPORE)

8.26 AMOY DIAGNOSTICS COLTD. (CHINA)

8.27 MOLBIO DIAGNOSTICS PVT. LTD. (INDIA)

8.28 GENEOMBIO (INDIA)

8.29 AND OTHERS KEY PLAYERS

Chapter 9: Global Molecular Diagnostics Market By Region

9.1 Overview

9.2. North America Molecular Diagnostics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Products

9.2.4.1 Reagents and Kits

9.2.4.2 Instruments

9.2.4.3 Services

9.2.4.4 Software

9.2.5 Historic and Forecasted Market Size by Technology Type

9.2.5.1 Mass Spectrometry (MS)

9.2.5.2 Capillary Electrophoresis

9.2.5.3 Next Generation Sequencing (NGS)

9.2.5.4 Chips And Microarray

9.2.5.5 Polymerase Chain Reaction (PCR)-Based Methods

9.2.5.6 Cytogenetics

9.2.5.7 In Situ Hybridization (ISH or FISH)

9.2.5.8 Molecular Imaging

9.2.5.9 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Oncology

9.2.6.2 Pharmacogenomic

9.2.6.3 Microbiology

9.2.6.4 Prenatal Tests

9.2.6.5 Tissue Typing

9.2.6.6 Blood Screening

9.2.6.7 Cardiovascular Diseases

9.2.6.8 Neurological Diseases

9.2.6.9 Infectious Diseases

9.2.6.10 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Hospital

9.2.7.2 Clinical Laboratories

9.2.7.3 Academics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Molecular Diagnostics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Products

9.3.4.1 Reagents and Kits

9.3.4.2 Instruments

9.3.4.3 Services

9.3.4.4 Software

9.3.5 Historic and Forecasted Market Size by Technology Type

9.3.5.1 Mass Spectrometry (MS)

9.3.5.2 Capillary Electrophoresis

9.3.5.3 Next Generation Sequencing (NGS)

9.3.5.4 Chips And Microarray

9.3.5.5 Polymerase Chain Reaction (PCR)-Based Methods

9.3.5.6 Cytogenetics

9.3.5.7 In Situ Hybridization (ISH or FISH)

9.3.5.8 Molecular Imaging

9.3.5.9 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Oncology

9.3.6.2 Pharmacogenomic

9.3.6.3 Microbiology

9.3.6.4 Prenatal Tests

9.3.6.5 Tissue Typing

9.3.6.6 Blood Screening

9.3.6.7 Cardiovascular Diseases

9.3.6.8 Neurological Diseases

9.3.6.9 Infectious Diseases

9.3.6.10 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Hospital

9.3.7.2 Clinical Laboratories

9.3.7.3 Academics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Molecular Diagnostics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Products

9.4.4.1 Reagents and Kits

9.4.4.2 Instruments

9.4.4.3 Services

9.4.4.4 Software

9.4.5 Historic and Forecasted Market Size by Technology Type

9.4.5.1 Mass Spectrometry (MS)

9.4.5.2 Capillary Electrophoresis

9.4.5.3 Next Generation Sequencing (NGS)

9.4.5.4 Chips And Microarray

9.4.5.5 Polymerase Chain Reaction (PCR)-Based Methods

9.4.5.6 Cytogenetics

9.4.5.7 In Situ Hybridization (ISH or FISH)

9.4.5.8 Molecular Imaging

9.4.5.9 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Oncology

9.4.6.2 Pharmacogenomic

9.4.6.3 Microbiology

9.4.6.4 Prenatal Tests

9.4.6.5 Tissue Typing

9.4.6.6 Blood Screening

9.4.6.7 Cardiovascular Diseases

9.4.6.8 Neurological Diseases

9.4.6.9 Infectious Diseases

9.4.6.10 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Hospital

9.4.7.2 Clinical Laboratories

9.4.7.3 Academics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Molecular Diagnostics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Products

9.5.4.1 Reagents and Kits

9.5.4.2 Instruments

9.5.4.3 Services

9.5.4.4 Software

9.5.5 Historic and Forecasted Market Size by Technology Type

9.5.5.1 Mass Spectrometry (MS)

9.5.5.2 Capillary Electrophoresis

9.5.5.3 Next Generation Sequencing (NGS)

9.5.5.4 Chips And Microarray

9.5.5.5 Polymerase Chain Reaction (PCR)-Based Methods

9.5.5.6 Cytogenetics

9.5.5.7 In Situ Hybridization (ISH or FISH)

9.5.5.8 Molecular Imaging

9.5.5.9 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Oncology

9.5.6.2 Pharmacogenomic

9.5.6.3 Microbiology

9.5.6.4 Prenatal Tests

9.5.6.5 Tissue Typing

9.5.6.6 Blood Screening

9.5.6.7 Cardiovascular Diseases

9.5.6.8 Neurological Diseases

9.5.6.9 Infectious Diseases

9.5.6.10 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Hospital

9.5.7.2 Clinical Laboratories

9.5.7.3 Academics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Molecular Diagnostics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Products

9.6.4.1 Reagents and Kits

9.6.4.2 Instruments

9.6.4.3 Services

9.6.4.4 Software

9.6.5 Historic and Forecasted Market Size by Technology Type

9.6.5.1 Mass Spectrometry (MS)

9.6.5.2 Capillary Electrophoresis

9.6.5.3 Next Generation Sequencing (NGS)

9.6.5.4 Chips And Microarray

9.6.5.5 Polymerase Chain Reaction (PCR)-Based Methods

9.6.5.6 Cytogenetics

9.6.5.7 In Situ Hybridization (ISH or FISH)

9.6.5.8 Molecular Imaging

9.6.5.9 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Oncology

9.6.6.2 Pharmacogenomic

9.6.6.3 Microbiology

9.6.6.4 Prenatal Tests

9.6.6.5 Tissue Typing

9.6.6.6 Blood Screening

9.6.6.7 Cardiovascular Diseases

9.6.6.8 Neurological Diseases

9.6.6.9 Infectious Diseases

9.6.6.10 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Hospital

9.6.7.2 Clinical Laboratories

9.6.7.3 Academics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Molecular Diagnostics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Products

9.7.4.1 Reagents and Kits

9.7.4.2 Instruments

9.7.4.3 Services

9.7.4.4 Software

9.7.5 Historic and Forecasted Market Size by Technology Type

9.7.5.1 Mass Spectrometry (MS)

9.7.5.2 Capillary Electrophoresis

9.7.5.3 Next Generation Sequencing (NGS)

9.7.5.4 Chips And Microarray

9.7.5.5 Polymerase Chain Reaction (PCR)-Based Methods

9.7.5.6 Cytogenetics

9.7.5.7 In Situ Hybridization (ISH or FISH)

9.7.5.8 Molecular Imaging

9.7.5.9 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Oncology

9.7.6.2 Pharmacogenomic

9.7.6.3 Microbiology

9.7.6.4 Prenatal Tests

9.7.6.5 Tissue Typing

9.7.6.6 Blood Screening

9.7.6.7 Cardiovascular Diseases

9.7.6.8 Neurological Diseases

9.7.6.9 Infectious Diseases

9.7.6.10 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Hospital

9.7.7.2 Clinical Laboratories

9.7.7.3 Academics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Molecular Diagnostics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.01 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.22% |

Market Size in 2032: |

USD 26.34 Bn. |

|

Segments Covered: |

By Products |

|

|

|

By Technology Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||