Micro Fulfillment Market Synopsis:

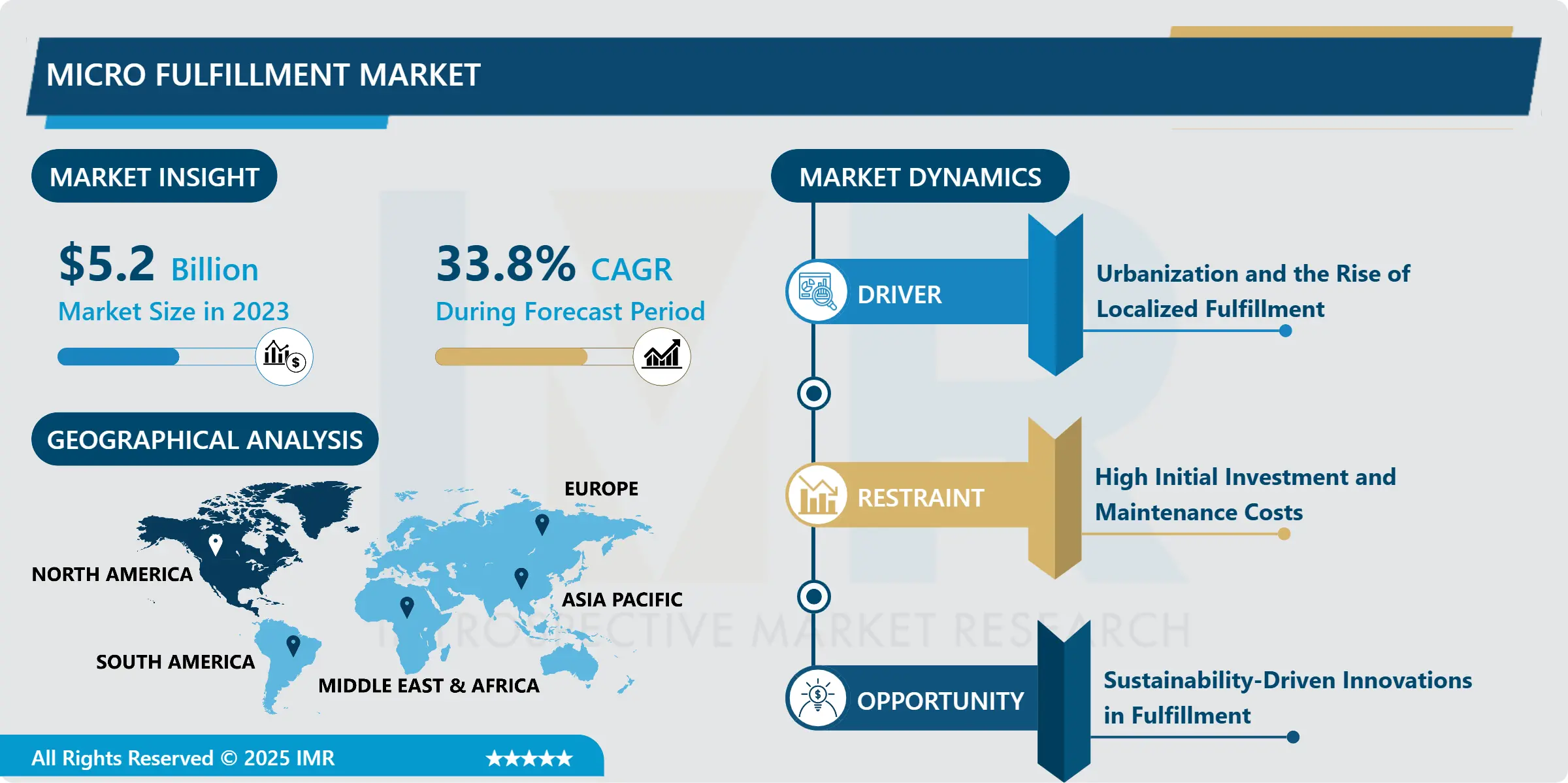

Micro Fulfillment Market Size Was Valued at USD 5.20 Billion in 2023, and is Projected to Reach USD 71.46 Billion by 2032, Growing at a CAGR of 33.80% From 2024-2032.

The Micro Fulfillment Market means the use of compact and fully automated warehouses for improving the last mile delivery processes. Sited in the urban or suburban zones, these centers use advanced technologies of robotics and artificial intelligence, and inventory management systems to meet the increasing need for quick and efficient eCommerce & retail deliveries.

E-commerce activities across the world have been on the rise, and they are considered the main booster to the Micro Fulfillment Market. Due to high consumer expectations for speedy delivery and personalized shopping experiences micro fulfillment centers are proving to be efficient for large corporations. Moreover, the burgeoning urban population requires higher velocity and place solutions and has therefore forced businesses to pursue compact distribution centers.

Another key enabler is the cost reduction benefits link to micro fulfillment on a greatly important level. Through reducing last mile delivery costs, automating labor costs and enhancing its customer satisfaction. Furthermore, the development of realizing technologies such as AI or robots in these centers guarantees more efficient inventory control as well as accuracy in order handling and thus promote market demand in various operational sectors.

Micro Fulfillment Market Trend Analysis:

Increasing integration of artificial intelligence and machine learning technologies

-

One of the progressions in the Micro Fulfillment Market that has been found is the application of Artificial Intelligence and Machine Learning. These tools increase the effectiveness of prognosis, optimize the turnover of stocks, and support predictive planning of the demand. Furthermore, customer analytics implemented in artificial intelligence give improved understanding of purchasing habits hence enhances business functions and product development.

- The other trend is growing cooperation and interconnection of the technology suppliers and the retailers. Due to large variation in the demand, companies are looking for solutions that are more flexible and easily scalable, thus there has been remarkable progress in the creation of modular and micro FF. This trend is in accordance with the general shift towards sustainability as localized operations lead to transportation-related emission and improved sustainability in the supply chain.

Growing need for rapid delivery of medical supplies

-

Examining its application in the pharmaceutical industry, shows that it indeed has potential for growth to be harnessed in the Micro Fulfillment Market. Due to the increasing demand in the express delivery of healthcare products such as medicines, micro fulfillment centers are being adopted into the heathcare supply chain. These centres help maintain product quality, and facilitate delivery within the shortest time possible especially in the urban centres.

- Asia-Pacific and Latin America are still untapped regions that can present impressive growth figures. These include: growth in mobility, spread of smart devices and growth in e-commerce in such areas, which presents a suitable environment for growth of micro fulfillment technologies. Thus, the market enters a new phase of continual growth by receiving government support for logistics and infrastructure improvements.

Micro Fulfillment Market Segment Analysis:

Micro Fulfillment Market is Segmented on the basis of Component, Automation Type, Application, End User, and Region.

By Component, Software segment is expected to dominate the market during the forecast period

-

The software segment is expected to dominate the micro-fulfillment market during the forecast period, driven by the increasing demand for automated solutions and the growing adoption of e-commerce. As businesses strive to meet the need for faster, more efficient order fulfillment, software solutions that enable real-time tracking, inventory management, and optimization of order routing have become crucial. These advanced software platforms integrate with automated micro-fulfillment systems, allowing retailers to optimize their supply chains, reduce costs, and improve customer satisfaction by ensuring faster delivery times.

- The rise in demand for personalized services and same-day delivery further propels the adoption of software solutions in micro-fulfillment centers. The continuous advancements in artificial intelligence, machine learning, and data analytics are making these software tools more efficient, scalable, and cost-effective. As a result, software is poised to play a key role in shaping the future of the micro-fulfillment market.

By Application, Retail segment expected to held the largest share

-

The retail segment is anticipated to hold the largest share in the micro-fulfillment market due to the growing demand for faster and more efficient delivery systems. Micro-fulfillment centers (MFCs) are designed to improve the speed and accuracy of order fulfillment by being located closer to the end consumer, typically in urban or suburban areas. This is a critical advantage for retailers, especially with the rise in online shopping and the increasing consumer expectation for quick delivery times.

- Retailers are adopting micro-fulfillment solutions to streamline their supply chains, reduce last-mile delivery costs, and enhance customer satisfaction. By utilizing automation, robotics, and AI in these facilities, retailers can efficiently handle a high volume of small orders. As a result, the retail sector, including grocery chains, e-commerce platforms, and other consumer goods businesses, is expected to continue driving the demand for micro-fulfillment centers, leading to its largest market share.

Micro Fulfillment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the micro-fulfillment market over the forecast period due to several key factors. The region has a well-established e-commerce infrastructure, a tech-savvy consumer base, and significant investments in automation and logistics technologies, which are driving the adoption of micro-fulfillment centers (MFCs). These centers enable businesses to efficiently meet growing customer demands for faster delivery times and reduced shipping costs.

- large retailers and e-commerce giants in North America are increasingly adopting micro-fulfillment solutions to streamline operations and improve last-mile delivery efficiency. The region also benefits from a favorable regulatory environment and significant funding in the logistics and supply chain sectors, further accelerating the growth of micro-fulfillment. As customer expectations for quick, on-demand services continue to rise, North America is poised to lead the market throughout the forecast period, influencing global trends in micro-fulfillment strategies.

Active Key Players in the Micro Fulfillment Market:

- Alert Innovation (USA)

- Attabotics (Canada)

- AutoStore (Norway)

- Dematic (USA)

- Exotec (France)

- Fabric (Israel)

- Geek+ (China)

- Ocado Group (UK)

- Swisslog (Switzerland)

- Takeoff Technologies (USA), and Other Active Players

|

Global Micro Fulfillment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.20 Billion |

|

Forecast Period 2024-32 CAGR: |

33.80 % |

Market Size in 2032: |

USD 71.46 Billion |

|

Segments Covered: |

By component |

|

|

|

By Automation Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Micro Fulfillment Market by Component

4.1 Micro Fulfillment Market Snapshot and Growth Engine

4.2 Micro Fulfillment Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

4.5 Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Services: Geographic Segmentation Analysis

Chapter 5: Micro Fulfillment Market by Automation Type

5.1 Micro Fulfillment Market Snapshot and Growth Engine

5.2 Micro Fulfillment Market Overview

5.3 Fully Automated

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Fully Automated: Geographic Segmentation Analysis

5.4 Semi-Automated

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Semi-Automated: Geographic Segmentation Analysis

Chapter 6: Micro Fulfillment Market by Application

6.1 Micro Fulfillment Market Snapshot and Growth Engine

6.2 Micro Fulfillment Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Retail: Geographic Segmentation Analysis

6.4 Grocery

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Grocery: Geographic Segmentation Analysis

6.5 E-commerce

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 E-commerce: Geographic Segmentation Analysis

6.6 Pharmaceutical

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Pharmaceutical: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Micro Fulfillment Market by End User

7.1 Micro Fulfillment Market Snapshot and Growth Engine

7.2 Micro Fulfillment Market Overview

7.3 Large Enterprises

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Large Enterprises: Geographic Segmentation Analysis

7.4 Small & Medium Enterprises (SMEs)

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Small & Medium Enterprises (SMEs): Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Micro Fulfillment Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AUTOSTORE (NORWAY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DEMATIC (USA)

8.4 OCADO GROUP (UK)

8.5 FABRIC (ISRAEL)

8.6 TAKEOFF TECHNOLOGIES (USA)

8.7 SWISSLOG (SWITZERLAND)

8.8 GEEK+ (CHINA)

8.9 EXOTEC (FRANCE)

8.10 ATTABOTICS (CANADA)

8.11 ALERT INNOVATION (USA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Micro Fulfillment Market By Region

9.1 Overview

9.2. North America Micro Fulfillment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Component

9.2.4.1 Hardware

9.2.4.2 Software

9.2.4.3 Services

9.2.5 Historic and Forecasted Market Size By Automation Type

9.2.5.1 Fully Automated

9.2.5.2 Semi-Automated

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Retail

9.2.6.2 Grocery

9.2.6.3 E-commerce

9.2.6.4 Pharmaceutical

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Large Enterprises

9.2.7.2 Small & Medium Enterprises (SMEs)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Micro Fulfillment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Component

9.3.4.1 Hardware

9.3.4.2 Software

9.3.4.3 Services

9.3.5 Historic and Forecasted Market Size By Automation Type

9.3.5.1 Fully Automated

9.3.5.2 Semi-Automated

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Retail

9.3.6.2 Grocery

9.3.6.3 E-commerce

9.3.6.4 Pharmaceutical

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Large Enterprises

9.3.7.2 Small & Medium Enterprises (SMEs)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Micro Fulfillment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Component

9.4.4.1 Hardware

9.4.4.2 Software

9.4.4.3 Services

9.4.5 Historic and Forecasted Market Size By Automation Type

9.4.5.1 Fully Automated

9.4.5.2 Semi-Automated

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Retail

9.4.6.2 Grocery

9.4.6.3 E-commerce

9.4.6.4 Pharmaceutical

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Large Enterprises

9.4.7.2 Small & Medium Enterprises (SMEs)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Micro Fulfillment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Component

9.5.4.1 Hardware

9.5.4.2 Software

9.5.4.3 Services

9.5.5 Historic and Forecasted Market Size By Automation Type

9.5.5.1 Fully Automated

9.5.5.2 Semi-Automated

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Retail

9.5.6.2 Grocery

9.5.6.3 E-commerce

9.5.6.4 Pharmaceutical

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Large Enterprises

9.5.7.2 Small & Medium Enterprises (SMEs)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Micro Fulfillment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Component

9.6.4.1 Hardware

9.6.4.2 Software

9.6.4.3 Services

9.6.5 Historic and Forecasted Market Size By Automation Type

9.6.5.1 Fully Automated

9.6.5.2 Semi-Automated

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Retail

9.6.6.2 Grocery

9.6.6.3 E-commerce

9.6.6.4 Pharmaceutical

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Large Enterprises

9.6.7.2 Small & Medium Enterprises (SMEs)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Micro Fulfillment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Component

9.7.4.1 Hardware

9.7.4.2 Software

9.7.4.3 Services

9.7.5 Historic and Forecasted Market Size By Automation Type

9.7.5.1 Fully Automated

9.7.5.2 Semi-Automated

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Retail

9.7.6.2 Grocery

9.7.6.3 E-commerce

9.7.6.4 Pharmaceutical

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Large Enterprises

9.7.7.2 Small & Medium Enterprises (SMEs)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Micro Fulfillment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.20 Billion |

|

Forecast Period 2024-32 CAGR: |

33.80 % |

Market Size in 2032: |

USD 71.46 Billion |

|

Segments Covered: |

By component |

|

|

|

By Automation Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||