Methyl Mercaptan Market Synopsis

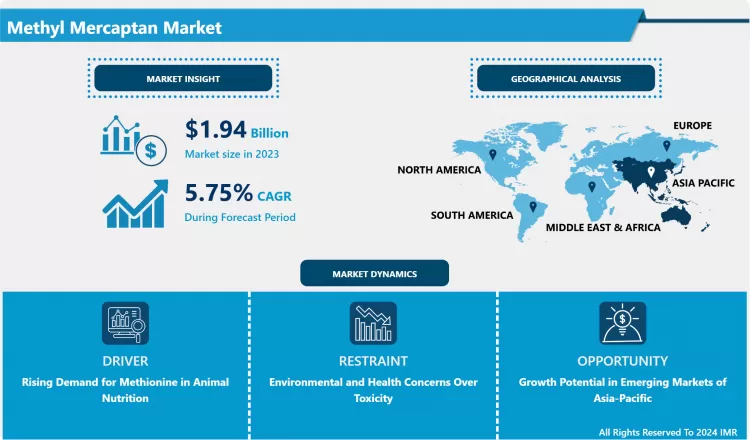

Methyl Mercaptan Market Size is Valued at USD 1.94 Billion in 2023, and is Projected to Reach USD 3.04 Billion by 2032, Growing at a CAGR of 5.75% From 2024-2032.

Methyl mercaptan (CH³SH) is an organic sulphur compound in the form of a flammable, non-poisonous but very pungent gas with an Odor of rotten cabbages. Majorly, it is employed as a transitional substance in the manufacturing of methionine that is a dietary amino acid for animals and is used as material in formulation of herbicides, organic polymers, and drugs. Methyl mercaptan is equally important in the petrochemical industry especially being a reagent for many reactions. Methyl mercaptan is used in large percentages in agriculture and chemicals industries in the synthesis of agrochemicals and animal feeds.

- The methyl mercaptan market is most influenced by the rising need for methionine in animal feeding. As the demand for the livestock industry increases worldwide and more animals required protein products, methionine is in higher demand so that increase the consumption of methyl mercaptan which is its intermediate. In addition, methyl mercaptan that used in preparation of agrochemicals like, herbicide factor and insecticides this is because of the growing importance of optimum yield in agricultural productivity and protection from diseases. Concerns of generalizing mass population across the globe and meeting the basic necessities most importantly food are factors that contribute to this.

- Another important reason has been the opportunity of the petrochemical sector with methyl mercaptan as raw material. Since the requirement of petrochemicals in the manufacturing sector is increasingly rising particularly the sectors of plastics and rubbers, methyl mercaptan has emerged as a vital feedstock. The opportunities of the pharmaceutical industry where methyl mercaptan as the reagent for syntheses of different drugs contribute to the growth of the market. A continuing emphasis on research and development in these industries helps guarantee that methyl mercaptan will remain in VLCC demand in the years to come.

Methyl Mercaptan Market Trend Analysis

Growing adoption of sustainable agriculture practices.

- Of the factors that can be identified, one can discuss the development of sustainable strategies of agriculture production. Because the agricultural segment is shifting toward sustainability, there is an expectation that bio-based agrochemicals and innovative animal feed supplements will also become consumer demand. Methyl mercaptan is used in the production of methionine, which is an environmentally friendly synthetic feed supplement in contrast to current trend in green farming.

- Also, new methodologies of chemical synthesis are helping to increase the yield of methyl mercaptan manufacturing processes. About process technologies and environmental technologies for emission control, advances for materials manufacturing that increase production efficiency and minimize byproducts and emissions are being developed. This not only makes methyl mercaptan more economic but also fulfils the increasing consumption rate from different end use industries.

Witnessing rapid industrialization and growth in their agricultural and petrochemical sectors.

- There exist opportunities for the methyl mercaptan market, particularly in Asia and Pacific regions. China and India are good examples of countries that are in the process of industrialization and expand their agricultural and oil industries. Growing concentration of large-scale production farming and the need for better quality animal feeds should offer sound market footing for methyl mercaptan in these jurisdictions.

- Also, increasing concentration on food security and the application of innovative agrochemical products are expected to boost the growth of the market. New opportunities to grow could be found in investments in research work for further improvement of the use of methyl mercaptan in different fields, including the fields of pharmaceuticals and biotechnology. In addition, the favorable policies of the government for sustainable farming, and the chemical developments will further fuel market growth.

Methyl Mercaptan Market Segment Analysis:

Methyl Mercaptan Market Segmented on the basis of type, Source, and end-users.

By Type, Liquid segment is expected to dominate the market during the forecast period

- Hence, based on type, the performance of the methyl mercaptan market can be divided into liquid methyl mercaptan and gaseous methyl mercaptan. The liquid for of methyl mercaptan is used where mobility and flexibility regarding transportation is key in a controlled environment. This is explained by the ability of the liquid form to facilitate an accurate measurement when used in chemical reactions such as synthesis of methionine and manufacture of agrochemicals. However, the gaseous form is exclusively applied in activities such as detection of gas leaks and in processes in the petrochemical industry. Both forms are essential in their respective uses, and the demand for each depends on the need of the industrial user.

By Source, Natural segment held the largest share in 2024

- By source, the methyl mercaptan market can be broadly classified into natural and synthetic. Natural MM is predominantly synthesized by microorganisms and occurs in the nature in rather low concentrations, and as a component of some natural gases and plant volatiles. Synthetic methyl mercaptan is produced chemically industrially and it is obtained by the reaction of methanol and hydrogen sulfide. The synthetic route is favored more in large scale production to augment the demand for the product in agriculture, petrochemical and pharmaceutical industries.

Methyl Mercaptan Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Thus, the Asia-Pacific area is currently leading the methyl mercaptan market growth due to the higher rates of development of agriculture and animal feeding sectors in countries such as China, India, and Japan. Growing numbers of livestock and a rise in the use of methionine for animal feed are major factors driving methyl mercaptan consumption in the region. In addition, high growth rates in petrochemicals and quadrupling of pharmaceutical industries in Asia-Pacific increases the consumption of methyl mercaptan as a basic chemical input.

- Methyl mercaptan is widely used in many industries and China, which is a global factory of almost all industries, is expected to have high demand for methyl mercaptan products. Czech Republic being a growing producer of chemical copolymers and appreciating food security and sustainable agriculture, dominates the global methyl mercaptan market. Government policies, for example the subsidies and incentives offered to producers of agricultural inputs also supports the regions position in the market.

Active Key Players in the Methyl Mercaptan Market

- Evonik Industries AG (Germany)

- Arkema S.A. (France)

- Chevron Phillips Chemical Company LLC (USA)

- DuPont de Nemours, Inc. (USA)

- BASF SE (Germany)

- Chevron Corporation (USA)

- Merck KGaA (Germany)

- Sumitomo Chemical Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- Zibo Xinhe Chemical Co., Ltd. (China)

- Others

|

Global Methyl Mercaptan Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.94 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.75 % |

Market Size in 2032: |

USD 3.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Methyl Mercaptan Market by Type (2018-2032)

4.1 Methyl Mercaptan Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Liquid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gas

Chapter 5: Methyl Mercaptan Market by Source (2018-2032)

5.1 Methyl Mercaptan Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Synthetic

Chapter 6: Methyl Mercaptan Market by End User (2018-2032)

6.1 Methyl Mercaptan Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Chemical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food

6.5 Feed

6.6 Mining

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Methyl Mercaptan Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EVONIK INDUSTRIES AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARKEMA S.A. (FRANCE)

7.4 CHEVRON PHILLIPS CHEMICAL COMPANY LLC (USA)

7.5 DUPONT DE NEMOURS INC. (USA)

7.6 BASF SE (GERMANY)

7.7 CHEVRON CORPORATION (USA)

7.8 MERCK KGAA (GERMANY)

7.9 SUMITOMO CHEMICAL COLTD. (JAPAN)

7.10 TORAY INDUSTRIES INC. (JAPAN)

7.11 ZIBO XINHE CHEMICAL COLTD. (CHINA)

7.12 OTHERS

7.13

Chapter 8: Global Methyl Mercaptan Market By Region

8.1 Overview

8.2. North America Methyl Mercaptan Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Liquid

8.2.4.2 Gas

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 Natural

8.2.5.2 Synthetic

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Chemical

8.2.6.2 Food

8.2.6.3 Feed

8.2.6.4 Mining

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Methyl Mercaptan Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Liquid

8.3.4.2 Gas

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 Natural

8.3.5.2 Synthetic

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Chemical

8.3.6.2 Food

8.3.6.3 Feed

8.3.6.4 Mining

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Methyl Mercaptan Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Liquid

8.4.4.2 Gas

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 Natural

8.4.5.2 Synthetic

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Chemical

8.4.6.2 Food

8.4.6.3 Feed

8.4.6.4 Mining

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Methyl Mercaptan Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Liquid

8.5.4.2 Gas

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 Natural

8.5.5.2 Synthetic

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Chemical

8.5.6.2 Food

8.5.6.3 Feed

8.5.6.4 Mining

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Methyl Mercaptan Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Liquid

8.6.4.2 Gas

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 Natural

8.6.5.2 Synthetic

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Chemical

8.6.6.2 Food

8.6.6.3 Feed

8.6.6.4 Mining

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Methyl Mercaptan Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Liquid

8.7.4.2 Gas

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 Natural

8.7.5.2 Synthetic

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Chemical

8.7.6.2 Food

8.7.6.3 Feed

8.7.6.4 Mining

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Methyl Mercaptan Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.94 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.75 % |

Market Size in 2032: |

USD 3.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Methyl Mercaptan Market research report is 2024-2032.

Evonik Industries AG (Germany), Arkema S.A. (France), Chevron Phillips Chemical Company LLC (USA), DuPont de Nemours, Inc. (USA), BASF SE (Germany), Chevron Corporation (USA), Merck KGaA (Germany), Sumitomo Chemical Co., Ltd. (Japan), Toray Industries, Inc. (Japan), Zibo Xinhe Chemical Co., Ltd. (China). and Other Major Players.

The Methyl Mercaptan Market is segmented into by Type (Liquid, Gas), By Source (Natural, Synthetic), End-User (Chemical, Food, Feed, Mining). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Methyl mercaptan (CH³SH) is an organic sulphur compound in the form of a flammable, non-poisonous but very pungent gas with an Odor of rotten cabbages. Majorly, it is employed as a transitional substance in the manufacturing of methionine that is a dietary amino acid for animals and is used as material in formulation of herbicides, organic polymers, and drugs. Methyl mercaptan is equally important in the petrochemical industry especially being a reagent for many reactions. Methyl mercaptan is used in large percentages in agriculture and chemicals industries in the synthesis of agrochemicals and animal feeds.

Methyl Mercaptan Market Size is Valued at USD 1.94 Billion in 2023, and is Projected to Reach USD 3.04 Billion by 2032, Growing at a CAGR of 5.75% From 2024-2032.