Mechanical Testing Equipment Market Synopsis

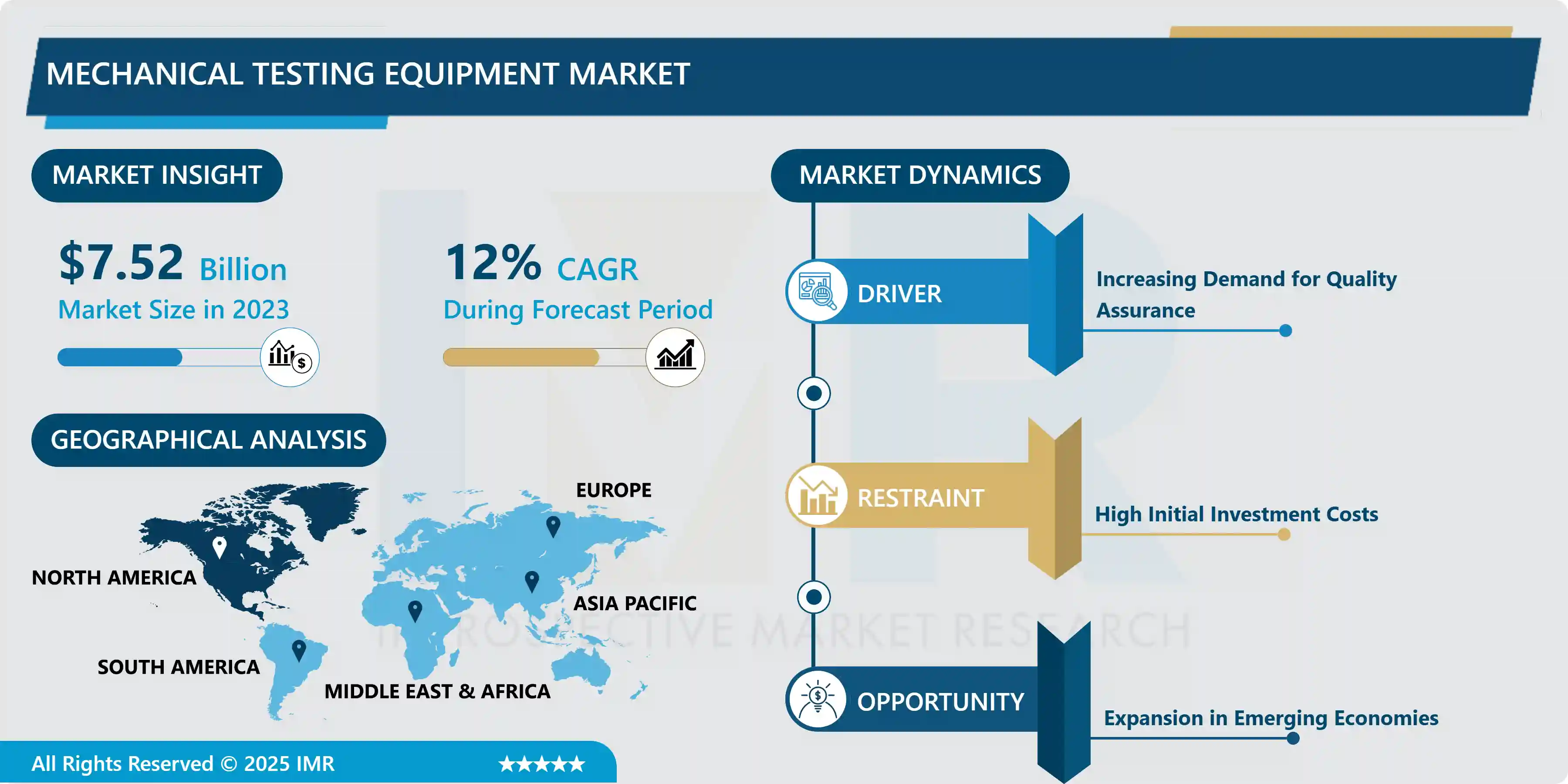

Mechanical Testing Equipment Market Size is Valued at USD 7.52 Billion in 2023, and is Projected to Reach USD 18.63 Billion by 2032, Growing at a CAGR of 12% From 2024-2032.

Mechanical Testing Equipment Market derives from instruments, machines and other gadgets required for the measurement of mechanical properties of materials and structures, like tensile strength, compressive strength, and fatigue limit. This equipment is essential in automotive, aerospace, construction, and electronics industries, where material properties must conform to specified and predetermined safety features and performance characteristics. The market is made up of tensile and compression testing machines and hardness testers, for the laboratory and the field.

The key reason for the Mechanical Testing Equipment Market growth is the growing trend of quality and material testing in industries. To ensure that product reliability and safety are realized among manufacturers, great emphasis and effort is placed on testing of raw materials and finished products. This development is particularly striking in the car and aircraft industries, where component failure can be disastrous. Legal requirements and industry trends create higher demands for high-performance mechanical testing technology to support market expansion.

The other great force behind this growth is the continuing innovation involving testing equipment. Automation as well as digital data acquisition and use of improved software makes mechanical testing to be more efficient and accurate. Such developments it is possible to monitor and analyze the test results in the process of testing, and provide manufacturers with the necessary result. Also, the growing application of non-destructive testing is getting recognition, which will definitely strengthen the mechanical testing equipment market.

Mechanical Testing Equipment Market Trend Analysis

Growing emphasis on sustainability and eco-friendly materials

- One notable trend in the Mechanical Testing Equipment Market is the growing emphasis on sustainability and eco-friendly materials. As industries move toward more sustainable practices, the demand for testing equipment that can evaluate alternative materials such as composites, bio-based plastics, and recycled materials has increased. This shift necessitates the development of specialized testing machines designed to assess the unique properties of these innovative materials, driving market diversification. Another trend is the integration of Industry 4.0 principles within mechanical testing processes. Manufacturers are increasingly adopting smart testing equipment that connects to the Internet of Things (IoT), allowing for better data management and real-time analytics. This integration enhances productivity and provides valuable insights into material performance, contributing to more efficient design and manufacturing processes.

As industrialization and manufacturing activities expansion

- The Global Mechanical Testing Equipment Market has huge growth potential, specially in the developing nations. The growth of industrialization and manufacturing sectors such as Asia-Pacific and Latin America, which involve Change, the demand for testing apparatuses will request. To benefit from this the companies should open branch offices and provide solutions that suit these emerging markets. On the same note, there is also an increasing chance in the growth of sophisticated testing equipment that integrates the use of Artificial Intelligence (AI), and Machine Learning (ML). Such innovations can enhance and streamline or testing processes, advance predictive maintenance, and refine data analysis to give a competitive advantage in the market place. Organizations that are willing to develop better strategies and innovative approaches to testing through investment in R&D should stand to benefit from this sort of change.

Mechanical Testing Equipment Market Segment Analysis:

Mechanical Testing Equipment Market Segmented on the basis of type, Load Capacity, application, and end-users.

By Type, Tensile Testing Machines segment is expected to dominate the market during the forecast period

- The mechanical testing equipment market can be classified by type into various categories for the evaluation of material characteristics where each catagory has a specialised purpose. Tensile testing machines are intended to test how a material performs under tension force, including the measure of the strength and ductility of that material. Whereas, compression testing machines determine the ability of the material to bear axial loads, and measures the material’s compressive strength and behaviour.

- The materials are tested for their ability to bend with the help of flexural testing machines while durability of the material under cyclic loading is conducted with the help of fatigue testing machines. The impact testing machines are used to determine how resistant a material is to added force or impacts and hardness testing machines allow for determining how resistant a material is to localized deformation necessary in determining its wear and abrasion resistance. Each of the types of testing equipment is crucial in the evaluation process of quality assurance and material selection in diverse industries to conform with performance requirements.

By Application, Material Testing segment held the largest share in 2024

- The mechanical testing equipment market can be divided into several main applications to meet certain requirements of different industries. A material test involves characterizing the physical and mechanical properties pertaining to the raw materials with the view of ascertaining if they have complied with the standards that are essential for subsequent processing and production. Structural testing is more concerned with the load and environmental conditions to evaluate the performance of structures or specific components of the desired structure in areas like construction and aeronautics among others whereby safety is mandatory.

- This is the process of assessing finished products to see that they perform well, and they are of good quality hence reducing on the cases of conformity to the standard market quality. Moreover, through the use of mechanical testing equipment; materials research and development applications are conducted in order to discover new materials and better product designs as well as enhancing technologies that improve performance of products in various fields. These applications demonstrate that mechanical testing plays an integral role in promoting improvements in product quality, safety and development.

Mechanical Testing Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is presently the largest Mechanical Testing Equipment Market owing to the mature industries present in this region including aerospace, automotive, and electronics. The highly regulated region and the high importance placed on product quality coupled with safety in this region adds to the propelling of this market for advanced mechanical testing equipment. Moreover the steady focus on research and development by leading organizations keeps North America in a vantage position regarding technological innovations in the field of mechanical testing.

- Also, there is a favourable market infrastructure, a developed workforce, and a good relationship between the academic institutions and companies in the North American context. It is within this ecosystem that innovation is encouraged, and new testing solutions are developed. It is considered that North America will continue to dominate the mechanical testing equipment market due to the growing awareness of industries regarding its significance for material testing across the product range.

Active Key Players in the Mechanical Testing Equipment Market

- MTS Systems Corporation (United States)

- Instron (United States)

- Shimadzu Corporation (Japan)

- ZwickRoell (Germany)

- ETRAGE Testing Systems (Italy)

- Hounsfield Test Equipment (United Kingdom)

- Tinius Olsen (United States)

- Hegewald & Peschke (Germany)

- Kammrath & Weiss GmbH (Germany)

- ADMET, Inc. (United States)

- Others

|

Global Mechanical Testing Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

12 % |

Market Size in 2032: |

USD 18.63 Bn. |

|

Segments Covered: |

By Type |

|

|

|

Load Capacity |

|

||

|

By Application |

|

||

|

End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mechanical Testing Equipment Market by Type (2018-2032)

4.1 Mechanical Testing Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Tensile Testing Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Compression Testing Machines

4.5 Flexural Testing Machines

4.6 Fatigue Testing Machines

4.7 Impact Testing Machines

4.8 Hardness Testing Machines

4.9 Load Capacity

4.10 Low Load Capacity

4.11 Medium Load Capacity

4.12 High Load Capacity

Chapter 5: Mechanical Testing Equipment Market by Application (2018-2032)

5.1 Mechanical Testing Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Material Testing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Structural Testing

5.5 Product Testing

5.6 Research and Development

5.7 End user

5.8 Automotive

5.9 Aerospace

5.10 Construction

5.11 Electronics

5.12 Medical

5.13 Consumer Goods

5.14 Energy

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Mechanical Testing Equipment Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MTS SYSTEMS CORPORATION (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 INSTRON (UNITED STATES)

6.4 SHIMADZU CORPORATION (JAPAN)

6.5 ZWICKROELL (GERMANY)

6.6 ETRAGE TESTING SYSTEMS (ITALY)

6.7 HOUNSFIELD TEST EQUIPMENT (UNITED KINGDOM)

6.8 TINIUS OLSEN (UNITED STATES)

6.9 HEGEWALD & PESCHKE (GERMANY)

6.10 KAMMRATH & WEISS GMBH (GERMANY)

6.11 ADMET INC. (UNITED STATES)

6.12 OTHERS

6.13

Chapter 7: Global Mechanical Testing Equipment Market By Region

7.1 Overview

7.2. North America Mechanical Testing Equipment Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Tensile Testing Machines

7.2.4.2 Compression Testing Machines

7.2.4.3 Flexural Testing Machines

7.2.4.4 Fatigue Testing Machines

7.2.4.5 Impact Testing Machines

7.2.4.6 Hardness Testing Machines

7.2.4.7 Load Capacity

7.2.4.8 Low Load Capacity

7.2.4.9 Medium Load Capacity

7.2.4.10 High Load Capacity

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Material Testing

7.2.5.2 Structural Testing

7.2.5.3 Product Testing

7.2.5.4 Research and Development

7.2.5.5 End user

7.2.5.6 Automotive

7.2.5.7 Aerospace

7.2.5.8 Construction

7.2.5.9 Electronics

7.2.5.10 Medical

7.2.5.11 Consumer Goods

7.2.5.12 Energy

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Mechanical Testing Equipment Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Tensile Testing Machines

7.3.4.2 Compression Testing Machines

7.3.4.3 Flexural Testing Machines

7.3.4.4 Fatigue Testing Machines

7.3.4.5 Impact Testing Machines

7.3.4.6 Hardness Testing Machines

7.3.4.7 Load Capacity

7.3.4.8 Low Load Capacity

7.3.4.9 Medium Load Capacity

7.3.4.10 High Load Capacity

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Material Testing

7.3.5.2 Structural Testing

7.3.5.3 Product Testing

7.3.5.4 Research and Development

7.3.5.5 End user

7.3.5.6 Automotive

7.3.5.7 Aerospace

7.3.5.8 Construction

7.3.5.9 Electronics

7.3.5.10 Medical

7.3.5.11 Consumer Goods

7.3.5.12 Energy

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Mechanical Testing Equipment Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Tensile Testing Machines

7.4.4.2 Compression Testing Machines

7.4.4.3 Flexural Testing Machines

7.4.4.4 Fatigue Testing Machines

7.4.4.5 Impact Testing Machines

7.4.4.6 Hardness Testing Machines

7.4.4.7 Load Capacity

7.4.4.8 Low Load Capacity

7.4.4.9 Medium Load Capacity

7.4.4.10 High Load Capacity

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Material Testing

7.4.5.2 Structural Testing

7.4.5.3 Product Testing

7.4.5.4 Research and Development

7.4.5.5 End user

7.4.5.6 Automotive

7.4.5.7 Aerospace

7.4.5.8 Construction

7.4.5.9 Electronics

7.4.5.10 Medical

7.4.5.11 Consumer Goods

7.4.5.12 Energy

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Mechanical Testing Equipment Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Tensile Testing Machines

7.5.4.2 Compression Testing Machines

7.5.4.3 Flexural Testing Machines

7.5.4.4 Fatigue Testing Machines

7.5.4.5 Impact Testing Machines

7.5.4.6 Hardness Testing Machines

7.5.4.7 Load Capacity

7.5.4.8 Low Load Capacity

7.5.4.9 Medium Load Capacity

7.5.4.10 High Load Capacity

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Material Testing

7.5.5.2 Structural Testing

7.5.5.3 Product Testing

7.5.5.4 Research and Development

7.5.5.5 End user

7.5.5.6 Automotive

7.5.5.7 Aerospace

7.5.5.8 Construction

7.5.5.9 Electronics

7.5.5.10 Medical

7.5.5.11 Consumer Goods

7.5.5.12 Energy

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Mechanical Testing Equipment Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Tensile Testing Machines

7.6.4.2 Compression Testing Machines

7.6.4.3 Flexural Testing Machines

7.6.4.4 Fatigue Testing Machines

7.6.4.5 Impact Testing Machines

7.6.4.6 Hardness Testing Machines

7.6.4.7 Load Capacity

7.6.4.8 Low Load Capacity

7.6.4.9 Medium Load Capacity

7.6.4.10 High Load Capacity

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Material Testing

7.6.5.2 Structural Testing

7.6.5.3 Product Testing

7.6.5.4 Research and Development

7.6.5.5 End user

7.6.5.6 Automotive

7.6.5.7 Aerospace

7.6.5.8 Construction

7.6.5.9 Electronics

7.6.5.10 Medical

7.6.5.11 Consumer Goods

7.6.5.12 Energy

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Mechanical Testing Equipment Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Tensile Testing Machines

7.7.4.2 Compression Testing Machines

7.7.4.3 Flexural Testing Machines

7.7.4.4 Fatigue Testing Machines

7.7.4.5 Impact Testing Machines

7.7.4.6 Hardness Testing Machines

7.7.4.7 Load Capacity

7.7.4.8 Low Load Capacity

7.7.4.9 Medium Load Capacity

7.7.4.10 High Load Capacity

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Material Testing

7.7.5.2 Structural Testing

7.7.5.3 Product Testing

7.7.5.4 Research and Development

7.7.5.5 End user

7.7.5.6 Automotive

7.7.5.7 Aerospace

7.7.5.8 Construction

7.7.5.9 Electronics

7.7.5.10 Medical

7.7.5.11 Consumer Goods

7.7.5.12 Energy

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Mechanical Testing Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

12 % |

Market Size in 2032: |

USD 18.63 Bn. |

|

Segments Covered: |

By Type |

|

|

|

Load Capacity |

|

||

|

By Application |

|

||

|

End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||