Liquid Lecithin Market Synopsis

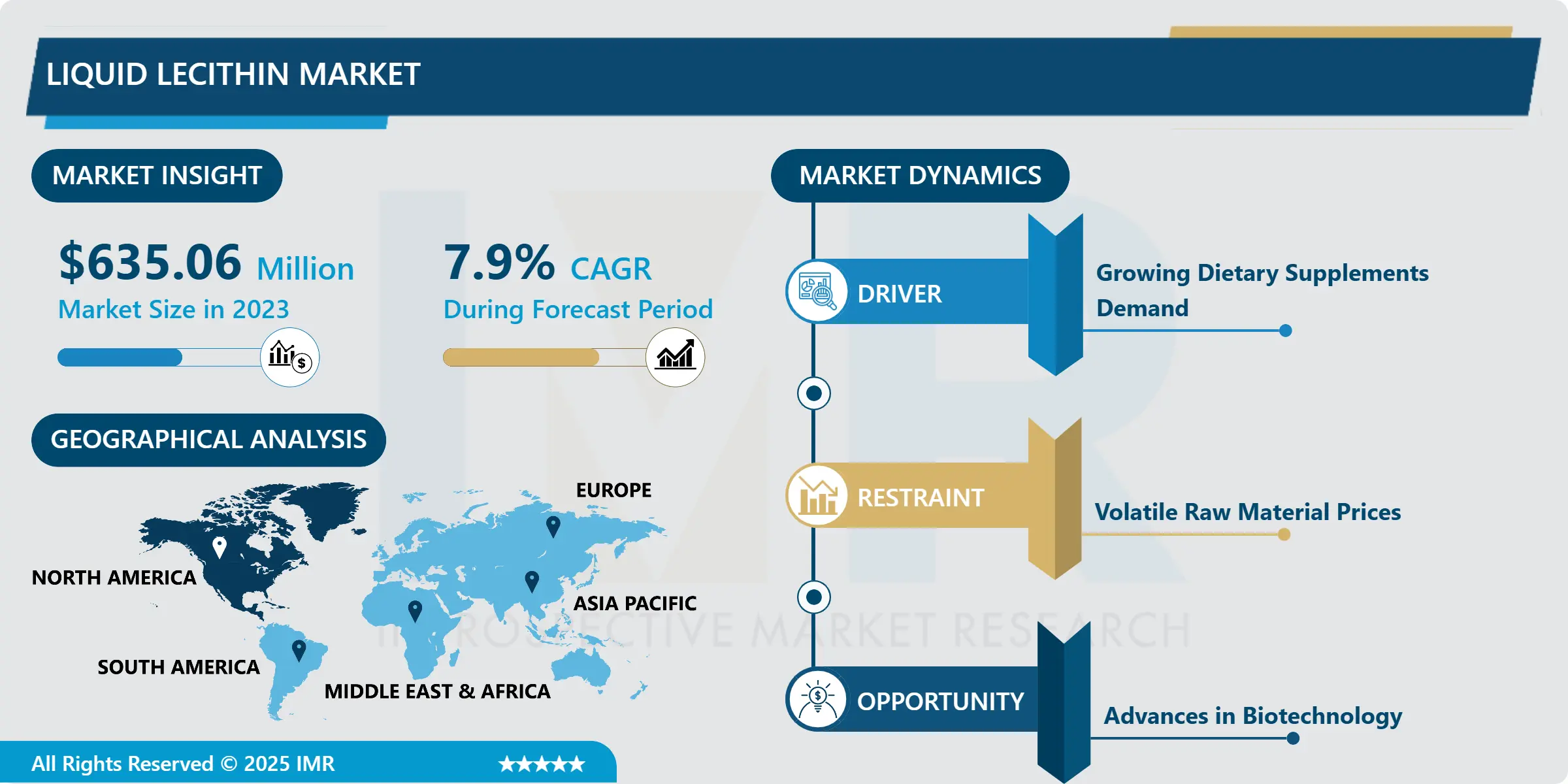

Liquid Lecithin Market Size is Valued at USD 635.06 Million in 2023, and is Projected to Reach USD 1258.95 Million by 2032, Growing at a CAGR of 7.9% From 2024-2032.

Lecithin, liquid lecithin is an oily product produced from soy beans or sun flower seeds, used in large quantities in several industries. It is used in foods as an emulsifier that helps to maintain the suspension of oil and water based preparations in each other. Used in most food processing industries due to its role in improving the texture and appearance of margarine, salad dressings and many more. It is also used in pharmaceuticals and cosmetics especially for the function of moistening and coagulation.

The market demand for liquid lecithin has been on its upward trend over the years since this product has a versatile use in the food industry, pharmaceutical, cosmetic, and even as a feed additive in the animal industry. Lecithin is a natural emulsifying agent that can also be sourced from soybeans, sunflower and egg yolks and is prized for its properties that helps to impart better texture profile, extends the shelf life of products offered and contributes to improved nutritional profile. The demand for clean label products and natural ingredients has driven the utilization of liquid lecithin with particular emphasis being placed on the food and beverages industries. In the current generation with peoples’ concern on their health; liquid lecithin is being appreciated for functional aspects due to its specific health benefits like being good for the brain and heart.

North America and Europe continue to have the largest share of the global liquid lecithin market, and due to an increased focus on the nutritional value of products and healthy diets. Future developments in the North American market are also defined by growing popularity of plant-based diets and higher demand for emulsifiers that are suitable for vegans. On the other hand, the Asia-Pacific region is seen to become a key market mainly driven by the growth of food processing sector and consumer consciousness on functional components. Moreover, improvement in extraction techniques and product development will improve the quality and shelf life for liquid lecithin thus propelling the market growth. The liquid lecithin market is expected to exhibit above average growth, owing to natural ingredient trend and continuously emerging new applications across levels of industries.

Liquid Lecithin Market Trend Analysis

The Rise of Liquid Lecithin in Clean-Label and Plant-Based Products

- Thanks to increasing consumer concern in health and wellbeing, the trend of clean label , which refers to products with fewer, less recognizable ingredients, has grown vastly. This trend is most prevalent within the food and beverage industries as people are trending to pay more attention to the labels and require companies to show the content samples. Presently, liquid lecithin sourced from natural products like soy and sunflower finds its way to the market as a popular choice by most brands hoping to cater for this market. Its task as a stabilizer is essential; it helps contain water and oil, restoring stabilities for the improvement of the body of food items. In addition, liquid lecithin acts as an anti-oxidant to enhance shelf-life of heat processed foods besides adding value to foods through provision of essential fatty-acid and phospholipid nutrients. Such versatile use makes it possible for the manufacturer to develop quality products targeted to consumers who are health conscious but who would not like to forgo taste.

- This rises the demand of liquid lecithin even higher since more people are adopting vegan and plant based diets due to conscious production and environmentally friendly production. This evolving trend is putting pressure on manufacturers to find plant-based sources, that are in line with the attitudes of most conscious consumers. Liquid lecithin, being of plant origin, is a perfect fit with this kind of trend because it is an easily actionable ingredient that can be smoothly added into a wide range of applications, starting with bakery products and ending with dairy products. Liquid lecithin has the potential to improve emulsification and stabilisation in vegan products including plant-based milk, meat analogues and sauces, for which makes it one of most important tools in the tool-chest of foods reformulators seeking to create exciting new healthy finished products. Further, the centredness on sustainability is giving pressures to supply chains, forcing manufacturers to source lecithin from non-GMO and organic ones as the new health conscious as well as environmental conservation conscious population segment is emerging in the market.

The Expanding Role of Liquid Lecithin in Dietary Supplements and Functional Foods

- The increased use of liquid lecithin in the ASF segment as well as the continuously increasing tendency signalling the use of functional foods in diet supplements is a trend within the sphere of health and wellness industry. Consumers have gradually shifted their focus towards health and wellness and their preference of fitting food products hence the demand for functional ingredients has grown. Liquid lecithin, which contains a high amount of phospholipid, has many potential benefits from which those on the hunt for a healthier lifestyle today can benefit. A recent literature review has suggested that lecithin, through its ability to transport fat soluble vitamins and improving intelligence, is possibly linked with an enhancement of brain functions as well as maintaining the required level of cholesterol for the smooth functioning of the heart. Thus, more and more producers of dietary supplements add liquid lecithin into the formulation of the products that can increase focus, memory and have positive effect on the cardiovascular system – it opens the possibility to get a share of a promising and popular niche among the buyers who are in search of the effective and useful compound.

- Moreover, enhanced extraction and processing technologies greatly enhance the quality and properties of liquid lecithin making it a more appealing ingredient to manufacturer. Improved processing techniques also allow the obtaining of lecithin with higher concentrations of the beneficial properties to remain undisturbed. It also expands the range of uses for liquid lecithin and stimulates new food product development at the same time. For example, manufacturers are now also able to produce liquid lecithin products to be easily incorporated into powder, gummy, and bottled supplements that consumers prefer. Since individualization is gradually becoming the norm for foods and supplements in health and wellness, liquid lecithin is set to fit the market trends as it does. With these factors at work the liquid lecithin market is poised for long term growth based on the versatile use of lecithin as an ingredient in dietary supplements and functional foods that are apropos of modern nutritional consciousness.

Liquid Lecithin Market Segment Analysis:

Liquid Lecithin Market Segmented based on By Source, By Modification and By Application.

By Source, Sunflower segment is expected to dominate the market during the forecast period

- Sunflower oil is received from the seeds of the sunflower plant and due to its bland taste and relatively high smoke point, it can be used for most of the types of cooking like fry, bake etc. Free from trans fatty acids, it has a precise percentage of unsaturated fatty acids of which linoleic acid is proved to have multiple benefits on the health of the heart. Following the culinary purpose, the sunflower oil is also an essential product in the food industry as flavor enhancer in may salads, margarine and other manufactured foods. Given that consumers today are becoming conscious with their diet, this cooking oil has been widely used because of its perceived health benefits over the others.

- Besides being used in cooking, sunflower oil has the highest demand in the cosmetic and beauty products’ sector. Due to its all natural moisturizing abilities it is used in many skin care products, hair care preparations, and cosmetics. The increase in the health consciousness of the people has made them shift towards natural and organic products and therefore the sunflower oil finds ready market. These trends are expected to persist in future driving the sunflower oil segment as the sunflower oil becomes standard in both food and personal care markets.

By Application, Feed segment held the largest share in 2023

- The use of oils and fats is witnessed in animal feed formulations to provide energy bearing and essential fatty acids necessary for the health of the animals in production. Soybean and canola oil, painted as feed-grade oils, are particularly popular because of what they contain and how well they are metabolized in the body. These oils increases feed conversion, where by animals are able to turn feed into muscle/milk better. With the livestock industry changing as the years go by, it is only necessary that researchers and producers introduce high quality oils into their feeds to improve animal health and production.

- Meat and dairy foods are a popular type of product on the global market; the consumption of these products has been on the rise owing to the increasing population and changing consumer preferences. This situation has caused the livestock producers to look for feeding strategies that would help the animals gain market weight within the shortest time possible and still do it health wise. In this regard, the feed application segment of oils and fats is set to expand since producers are already focusing quality feed application to reach the consumers. Moreover, increasing concerns on sustainable and responsible production of livestock also add to the need to utilize the high quality feed oil, which form a very important component of the current and efficient animal production systems.

Liquid Lecithin Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The liquid lecithin market in North America is experiencing vast growth; demand for health supplements is on the rise over consumers’ health-conscious diets. The increase in consciousness towards health and fitness is making customers look for more application ingredients which lecithin being a rich source of phospholipids is fast becoming. This shift is especially apparent in the rapidly growing dietary supplements category for which lecithin is known as an ingredient with functional benefits linked to cognitive health and cardiovascular health. In addition to this, consumers are gaining knowledge about their diet, and many are shifting focus to natural and processed organic foods. With the rise of clean label which encourages manufacturers to include more natural substances in production, lecithin has been adopted by manufactures as a natural emulsifier than chemical emulsifiers. This synchronization with the consumer preference profile is aiding the growth of liquid lecithin market in the region.

- Of the regions in North America, the United States presents itself as one of the largest consumers of liquid lecithin owing to a robust and adaptive food and beverages industry. Currently The country has a variety of products with lecithin including bakery products, dairy, and non-dairy products showing the flexible role of lecithin as an emulsifier. In this respect, awareness of-orange’s health benefits linked to lecithin equally contributes to market penetration. As new studies that link lecithin to improved brain function, cholesterol level regulation, and liver health crops up, more consumers are beginning to look for the functional ingredient on the products they consume. Therefore, saturated consumer demand for healthy products and a lively food sector send the prospects of the North American liquid lecithin market to orbit in the years to come.

Active Key Players in the Liquid Lecithin Market

- VAV Life Sciences Pvt. Ltd. (India)

- American Lecithin Company (U.S.)

- ADM (U.S.)

- AVRIL SCA (France)

- LASENOR EMUL, S.L. (Spain)

- Sonic Biochem (India)

- Bunge Limited (U.S.)

- Avanti Polar Lipids (U.S.)

- Cargill, Incorporated (U.S.)

- SODRUGESTVO GROUP (Luxembourg)

- Lecital (Serbia)

- Stern-Wywiol Gruppe GmbH & Co. KG (Germany)

- Lipoid GmbH (Germany)

- DuPont (U.S.)

- Wilmar International Ltd (Singapore)

- Victoria Group (Serbia)

- Sternchemie GmbH & Co. KG (Germany)

- THEW ARNOTT & CO LTD (U.K.)

- NOW Foods (U.S.)

- Soya International (U.K.)

- Other Key Players

Key Industry Developments in the Liquid Lecithin Market:

- In August 2022, Louis Dreyfus Company Agricultural Industries LLC (LDC) expanded its global lecithin manufacturing capabilities by opening a new soy liquid lecithin production facility in Claypool, Indiana, US. This strategic move strengthens LDC's position in the lecithin market, enhancing its ability to meet growing demand for high-quality soy-based ingredients

- In January 2022, SepPure Technologies, based in Singapore, entered a strategic partnership with GIIAVA, a leading soy lecithin producer, to develop and implement innovative process solutions at a soy lecithin production facility in Singapore. This collaboration aims to enhance production efficiency and product quality, leveraging SepPure’s advanced technology

- In September 2021, AAK, a global leader in vegetable oils and fats, acquired BIC Ingredients, the lecithin product division of PIC International Holdings. This acquisition allows AAK to expand its portfolio with non-GMO specialty lecithins and lecithin compounds, enhancing its offerings in the natural and functional ingredient markets

|

Global Liquid Lecithin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 635.06 Mn. |

|

Forecast Period 2023-34 CAGR: |

7.9 % |

Market Size in 2032: |

USD 1258.95 Mn. |

|

Segments Covered: |

By Source |

|

|

|

By Modification |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Liquid Lecithin Market by Source (2018-2032)

4.1 Liquid Lecithin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sunflower

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Egg

4.5 Soy

4.6 Rapeseed

4.7 Others

Chapter 5: Liquid Lecithin Market by Modification (2018-2032)

5.1 Liquid Lecithin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Genetically Modified

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-Genetically Modified

Chapter 6: Liquid Lecithin Market by Application (2018-2032)

6.1 Liquid Lecithin Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Feed

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

6.5 Convenience Food

6.6 Bakery

6.7 Confectionary

6.8 Pharmaceutical

6.9 Personal Care and Cosmetics

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Liquid Lecithin Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 VAV LIFE SCIENCES PVT. LTD. (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMERICAN LECITHIN COMPANY (U.S.)

7.4 ADM (U.S.)

7.5 AVRIL SCA (FRANCE)

7.6 LASENOR EMUL

7.7 S.L. (SPAIN)

7.8 SONIC BIOCHEM (INDIA)

7.9 BUNGE LIMITED (U.S.)

7.10 AVANTI POLAR LIPIDS (U.S.)

7.11 CARGILL INCORPORATED (U.S.)

7.12 SODRUGESTVO GROUP (LUXEMBOURG)

7.13 LECITAL (SERBIA)

7.14 STERN-WYWIOL GRUPPE GMBH & CO. KG (GERMANY)

7.15 LIPOID GMBH (GERMANY)

7.16 DUPONT (U.S.)

7.17 WILMAR INTERNATIONAL LTD (SINGAPORE)

7.18 VICTORIA GROUP (SERBIA)

7.19 STERNCHEMIE GMBH & CO. KG (GERMANY)

7.20 THEW ARNOTT & CO LTD (U.K.)

7.21 NOW FOODS (U.S.)

7.22 SOYA INTERNATIONAL (U.K.)

7.23 OTHER KEY PLAYERS

Chapter 8: Global Liquid Lecithin Market By Region

8.1 Overview

8.2. North America Liquid Lecithin Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Source

8.2.4.1 Sunflower

8.2.4.2 Egg

8.2.4.3 Soy

8.2.4.4 Rapeseed

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Modification

8.2.5.1 Genetically Modified

8.2.5.2 Non-Genetically Modified

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Feed

8.2.6.2 Industrial

8.2.6.3 Convenience Food

8.2.6.4 Bakery

8.2.6.5 Confectionary

8.2.6.6 Pharmaceutical

8.2.6.7 Personal Care and Cosmetics

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Liquid Lecithin Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Source

8.3.4.1 Sunflower

8.3.4.2 Egg

8.3.4.3 Soy

8.3.4.4 Rapeseed

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Modification

8.3.5.1 Genetically Modified

8.3.5.2 Non-Genetically Modified

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Feed

8.3.6.2 Industrial

8.3.6.3 Convenience Food

8.3.6.4 Bakery

8.3.6.5 Confectionary

8.3.6.6 Pharmaceutical

8.3.6.7 Personal Care and Cosmetics

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Liquid Lecithin Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Source

8.4.4.1 Sunflower

8.4.4.2 Egg

8.4.4.3 Soy

8.4.4.4 Rapeseed

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Modification

8.4.5.1 Genetically Modified

8.4.5.2 Non-Genetically Modified

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Feed

8.4.6.2 Industrial

8.4.6.3 Convenience Food

8.4.6.4 Bakery

8.4.6.5 Confectionary

8.4.6.6 Pharmaceutical

8.4.6.7 Personal Care and Cosmetics

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Liquid Lecithin Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Source

8.5.4.1 Sunflower

8.5.4.2 Egg

8.5.4.3 Soy

8.5.4.4 Rapeseed

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Modification

8.5.5.1 Genetically Modified

8.5.5.2 Non-Genetically Modified

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Feed

8.5.6.2 Industrial

8.5.6.3 Convenience Food

8.5.6.4 Bakery

8.5.6.5 Confectionary

8.5.6.6 Pharmaceutical

8.5.6.7 Personal Care and Cosmetics

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Liquid Lecithin Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Source

8.6.4.1 Sunflower

8.6.4.2 Egg

8.6.4.3 Soy

8.6.4.4 Rapeseed

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Modification

8.6.5.1 Genetically Modified

8.6.5.2 Non-Genetically Modified

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Feed

8.6.6.2 Industrial

8.6.6.3 Convenience Food

8.6.6.4 Bakery

8.6.6.5 Confectionary

8.6.6.6 Pharmaceutical

8.6.6.7 Personal Care and Cosmetics

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Liquid Lecithin Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Source

8.7.4.1 Sunflower

8.7.4.2 Egg

8.7.4.3 Soy

8.7.4.4 Rapeseed

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Modification

8.7.5.1 Genetically Modified

8.7.5.2 Non-Genetically Modified

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Feed

8.7.6.2 Industrial

8.7.6.3 Convenience Food

8.7.6.4 Bakery

8.7.6.5 Confectionary

8.7.6.6 Pharmaceutical

8.7.6.7 Personal Care and Cosmetics

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Liquid Lecithin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 635.06 Mn. |

|

Forecast Period 2023-34 CAGR: |

7.9 % |

Market Size in 2032: |

USD 1258.95 Mn. |

|

Segments Covered: |

By Source |

|

|

|

By Modification |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||