Liquid crystal polymer (LCP) Market Synopsis

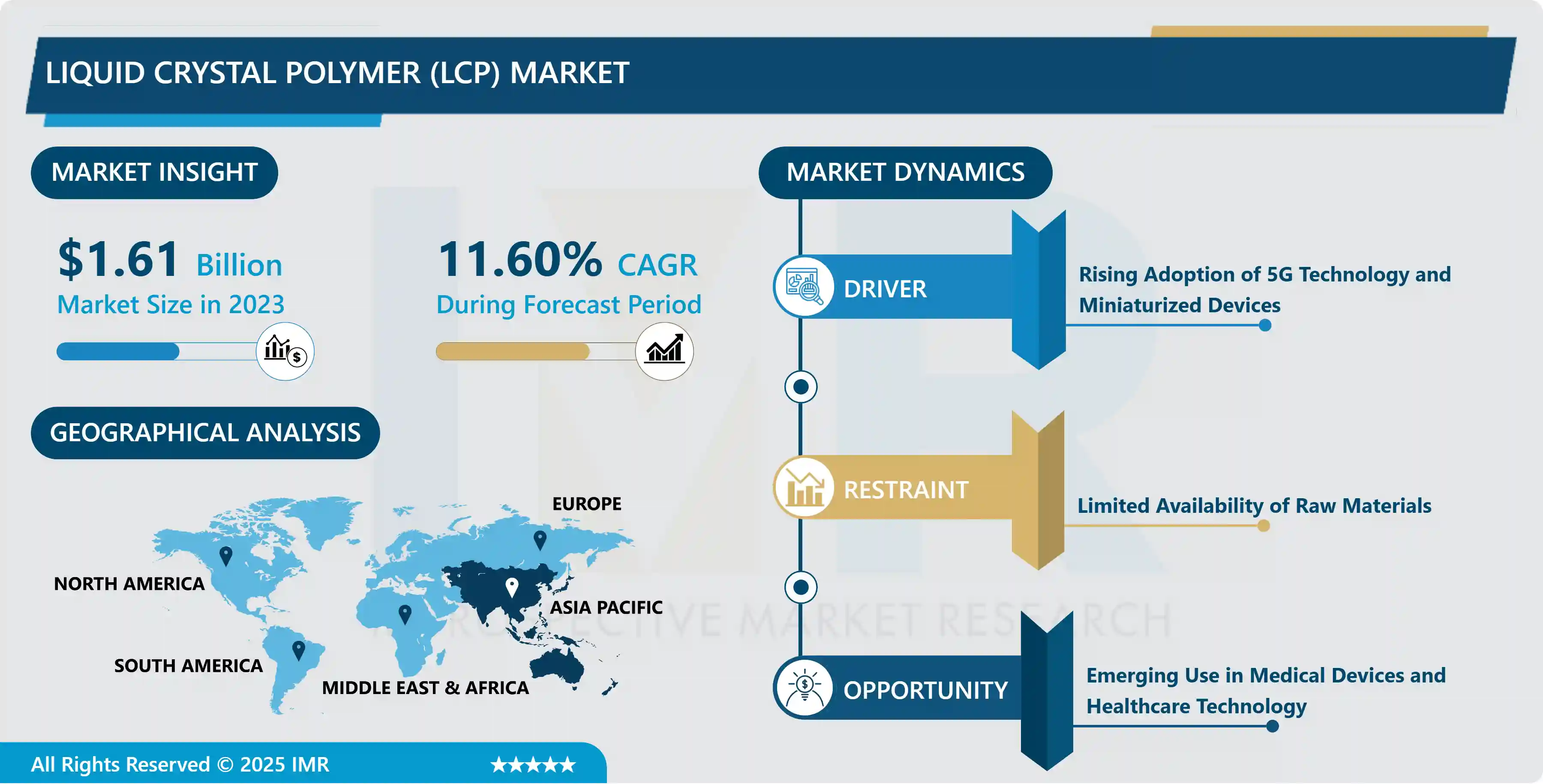

Liquid crystal polymer (LCP) Market Size is Valued at USD 1.61 Billion in 2023, and is Projected to Reach USD 4.34 Billion by 2032, Growing at a CAGR of 11.60% From 2024-2032.

High Performance Engineering Thermoplastics (HPEs) are a group of polymers that possess one or more of the following properties; High heat resistance, mechanical strength, chemical resistance and low combustibility; Liquid Crystal Polymers (LCPs) are one example of HPEs. They bear systemic molecular organization that offers static stability and better performance in different difficult conditions. LCPs due to their ability to conduct heat and electricity are applied where high accuracy and reliability are needed in electronics, automobile, aerospace and medical industries making them to be some of the materials of high demand.

The main force expected to fuel the Liquid Crystal Polymer (LCP) market is the ever-increasing need from the electronics and electrical areas. Due to their high dielectric constant and low loss, lightweight, and high-temperature stability, LCPs are widely employed to make components parts including connectors, flexible circuits, and antenna substrates. The growth of miniaturized electronics and their corresponding increase in use creates a market niche for LCPs whose primary properties of being small, yet delivering high performance, is a strong advantage. Also, the growing adoption of 5G technology and the progress in telecommunications technology have also contributed to the market for LCP based products because they have good signal transmitting properties.

Other stimuli include the automotive industry, common on trend of minimisation of vehicles’ weight for efficiency, and the growing market of EVs. LCPs are applied to automotive part like ignition systems, engine parts and sensors because of superior high temperature resistance and corrosion resistance. Considering the fact that the currently existing global trends for utilizing EV technology focus on increasing sustainability and performance, LCP materials are gradually turning into a solution that more and more manufacturers choose to implement for the sake of increasing vehicular performance as well as energy efficiency rates resulting from lower vehicle weight.

Liquid crystal polymer (LCP) Market Trend Analysis

Growing focus on the development of sustainable and eco-friendly alternatives.

- Another trend visible in the LCP market structure is that the companies are shifting their focus to the environmental aspect of LCPs. As a result of global awareness and legislation measures on the volume of plastic waste that can be produced and used, companies are also looking for ways in which they can develop LCP’s that are recyclable and derived from bio material. As industries move up the curve and begin to look for more sustainable ways of performing, there is now a demand for better quality LCP formulations that provide the highest typical properties of these formulations without a disastrous impact on the environment.

- Another growing pattern prevailing the market is the incorporation of LCPs in medical and Health care industries. Due to their biocompatibility, sterilization insusceptibility and mechanical soundness of LCP materials, they are currently employed in medical applications / devices including; medical connected pieces, surgery apparatuses and implantable segments. Thus, with increased development of health care technologies, the pharmaceuticals companies are bound to find new uses for LCPs in medical applications thus providing future growth prospects for LCPs manufacturers.

The rapid expansion of 5G networks

- With the increased proliferation of 5G networks in the recent past, the market for LCPs has a shot at experiencing tremendous growth. With the advancement of 5G technology it is realized that high frequency signals require advanced dielectric materials. Flexible circuits, antennas and connectors are made from LCPs because of their low dielectric constant and signal loss, essential for the 5G technology. With the ongoing expansion of 5G services by telecom companies around the world, the requirement of LCPs in the constituent networks of the hardware is expected to soar exponentially and thereby open up vast market prospects for the suppliers.

- In the same regard, the growing application of electric vehicles (EVs) present a brilliant growth opportunity for the LCP market. The focus in current car manufacturing is the electromobility, the requirements for the material properties have to be higher in terms of thermal and electric conductivity. DUBLIN, September 21, 2021 /PRNewswire/ — Due to their high-temperature stability and resistance to harsh chemicals, LCPs are used in several EV components such as casings of batteries, structural parts of powertrains, and electrical control boards. The performance of LCP-based solutions will increase as demand rises due to the growth of EV market.

Liquid crystal polymer (LCP) Market Segment Analysis:

Liquid crystal polymer (LCP) Market Segmented on the basis of type, By Processing Method, application, and end-users.

By Type, Lyotropic Liquid Crystal Polymers segment is expected to dominate the market during the forecast period

- LCPs are classified into Lyotropic Liquid Crystal Polymers and Thermotropic Liquid Crystal Polymers based on processing and behavior characteristics. Lyotropic LCPs become anisotropic in solution and the molecular orientation is influenced by alteration in concentration. These are frequently employed in the synthesis of fibres and films. On the other hand, thermotropic LCPs show liquid crystalline Phase at high temperatures as well as have higher flow at enhanced temperatures. Thermotropic LCPs are used mainly in injection molding and extrusion techniques for applications in electronics, automotive and other high-performance parts industries.

By Application, Electrical & Electronics segment held the largest share in 2024

- However, there are numerous uses of LCPs because of their various characteristics. In the electrical and electronics sector; LCPs are employed in making connector, flexible circuit as well as chip carriers owing to their dielectric characteristic and thermal stability. In automotive application, they are used for engine parts, sensors and other parts which require high temperature applications. They are also used in industrial machines where parts with the necessary strength and stability are needed for precise accessories. In consumer goods, they are used with durable products that require light weight and high strength material. LCPs are biocompatible and chemically resistant; thus, they act as a proper material for flexible operating tools and implantable medical devices. Last but not the least, LPCs are used in other industry segments including aerospace and defense industries in which high-performance materials are mandatory to ensure optimal performance in the environment to save lives.

Liquid crystal polymer (LCP) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region has the highest uptake of Liquid Crystal Polymer (LCP) globally, motivated by the increasing electronics and automotive industries in the region. Today, many countries such as China, Japan and South Korea have original electronic components makers that can be termed as the largest in the world. Owing to increasing concern for miniaturization and early 5G adoption in this region, the demand for these LCPs has remained strong. Also, with the rising automobile industry in the region for EV and lightweight structures use LCP material as per the market need.

- Apart from being a manufacturing area, the Asia-Pacific area also enjoys a high level of investment in research and development. Corporations across the region are deploying new LCP-based products to increasing demand for advanced forms of the material across multiple sectors. The domination of the region, at a steady growth rate, is expected to continue because of development in telecommunication, automobile, and consumer electronics.

Active Key Players in the Liquid crystal polymer (LCP) Market

- Sumitomo Chemical Co., Ltd. (Japan)

- Celanese Corporation (United States)

- Polyplastics Co., Ltd. (Japan)

- Toray International, Inc. (Japan)

- Ueno Fine Chemicals Industry, Ltd. (Japan)

- Solvay S.A. (Belgium)

- SABIC (Saudi Arabia)

- Shanghai PRET Composites Co., Ltd. (China)

- Kuraray Co., Ltd. (Japan)

- RTP Company (United States)

- Others

|

Global Liquid Crystal Polymer (LCP) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.61 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.60 % |

Market Size in 2032: |

USD 4.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Processing Method |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Liquid crystal polymer (LCP) Market by Type (2018-2032)

4.1 Liquid crystal polymer (LCP) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lyotropic Liquid Crystal Polymers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thermotropic Liquid Crystal Polymers

Chapter 5: Liquid crystal polymer (LCP) Market by Processing Method (2018-2032)

5.1 Liquid crystal polymer (LCP) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Injection Molding

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Extrusion Molding

5.5 Blow Molding

5.6 Other Processing Methods

Chapter 6: Liquid crystal polymer (LCP) Market by Application (2018-2032)

6.1 Liquid crystal polymer (LCP) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Electrical & Electronics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 Industrial Machinery

6.6 Consumer Goods

6.7 Medical Devices

6.8 Others (Aerospace

6.9 Defense)

Chapter 7: Liquid crystal polymer (LCP) Market by End User (2018-2032)

7.1 Liquid crystal polymer (LCP) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Electronics & Electrical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Automotive & Transportation

7.5 Industrial Machinery

7.6 Consumer Goods

7.7 Medical Devices

7.8 Other End-use Industries

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Liquid crystal polymer (LCP) Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SUMITOMO CHEMICAL COLTD. (JAPAN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CELANESE CORPORATION (UNITED STATES)

8.4 POLYPLASTICS COLTD. (JAPAN)

8.5 TORAY INTERNATIONAL INC. (JAPAN)

8.6 UENO FINE CHEMICALS INDUSTRY LTD. (JAPAN)

8.7 SOLVAY S.A. (BELGIUM)

8.8 SABIC (SAUDI ARABIA)

8.9 SHANGHAI PRET COMPOSITES COLTD. (CHINA)

8.10 KURARAY COLTD. (JAPAN)

8.11 RTP COMPANY (UNITED STATES)

8.12 OTHERS

8.13

Chapter 9: Global Liquid crystal polymer (LCP) Market By Region

9.1 Overview

9.2. North America Liquid crystal polymer (LCP) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Lyotropic Liquid Crystal Polymers

9.2.4.2 Thermotropic Liquid Crystal Polymers

9.2.5 Historic and Forecasted Market Size by Processing Method

9.2.5.1 Injection Molding

9.2.5.2 Extrusion Molding

9.2.5.3 Blow Molding

9.2.5.4 Other Processing Methods

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Electrical & Electronics

9.2.6.2 Automotive

9.2.6.3 Industrial Machinery

9.2.6.4 Consumer Goods

9.2.6.5 Medical Devices

9.2.6.6 Others (Aerospace

9.2.6.7 Defense)

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Electronics & Electrical

9.2.7.2 Automotive & Transportation

9.2.7.3 Industrial Machinery

9.2.7.4 Consumer Goods

9.2.7.5 Medical Devices

9.2.7.6 Other End-use Industries

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Liquid crystal polymer (LCP) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Lyotropic Liquid Crystal Polymers

9.3.4.2 Thermotropic Liquid Crystal Polymers

9.3.5 Historic and Forecasted Market Size by Processing Method

9.3.5.1 Injection Molding

9.3.5.2 Extrusion Molding

9.3.5.3 Blow Molding

9.3.5.4 Other Processing Methods

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Electrical & Electronics

9.3.6.2 Automotive

9.3.6.3 Industrial Machinery

9.3.6.4 Consumer Goods

9.3.6.5 Medical Devices

9.3.6.6 Others (Aerospace

9.3.6.7 Defense)

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Electronics & Electrical

9.3.7.2 Automotive & Transportation

9.3.7.3 Industrial Machinery

9.3.7.4 Consumer Goods

9.3.7.5 Medical Devices

9.3.7.6 Other End-use Industries

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Liquid crystal polymer (LCP) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Lyotropic Liquid Crystal Polymers

9.4.4.2 Thermotropic Liquid Crystal Polymers

9.4.5 Historic and Forecasted Market Size by Processing Method

9.4.5.1 Injection Molding

9.4.5.2 Extrusion Molding

9.4.5.3 Blow Molding

9.4.5.4 Other Processing Methods

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Electrical & Electronics

9.4.6.2 Automotive

9.4.6.3 Industrial Machinery

9.4.6.4 Consumer Goods

9.4.6.5 Medical Devices

9.4.6.6 Others (Aerospace

9.4.6.7 Defense)

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Electronics & Electrical

9.4.7.2 Automotive & Transportation

9.4.7.3 Industrial Machinery

9.4.7.4 Consumer Goods

9.4.7.5 Medical Devices

9.4.7.6 Other End-use Industries

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Liquid crystal polymer (LCP) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Lyotropic Liquid Crystal Polymers

9.5.4.2 Thermotropic Liquid Crystal Polymers

9.5.5 Historic and Forecasted Market Size by Processing Method

9.5.5.1 Injection Molding

9.5.5.2 Extrusion Molding

9.5.5.3 Blow Molding

9.5.5.4 Other Processing Methods

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Electrical & Electronics

9.5.6.2 Automotive

9.5.6.3 Industrial Machinery

9.5.6.4 Consumer Goods

9.5.6.5 Medical Devices

9.5.6.6 Others (Aerospace

9.5.6.7 Defense)

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Electronics & Electrical

9.5.7.2 Automotive & Transportation

9.5.7.3 Industrial Machinery

9.5.7.4 Consumer Goods

9.5.7.5 Medical Devices

9.5.7.6 Other End-use Industries

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Liquid crystal polymer (LCP) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Lyotropic Liquid Crystal Polymers

9.6.4.2 Thermotropic Liquid Crystal Polymers

9.6.5 Historic and Forecasted Market Size by Processing Method

9.6.5.1 Injection Molding

9.6.5.2 Extrusion Molding

9.6.5.3 Blow Molding

9.6.5.4 Other Processing Methods

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Electrical & Electronics

9.6.6.2 Automotive

9.6.6.3 Industrial Machinery

9.6.6.4 Consumer Goods

9.6.6.5 Medical Devices

9.6.6.6 Others (Aerospace

9.6.6.7 Defense)

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Electronics & Electrical

9.6.7.2 Automotive & Transportation

9.6.7.3 Industrial Machinery

9.6.7.4 Consumer Goods

9.6.7.5 Medical Devices

9.6.7.6 Other End-use Industries

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Liquid crystal polymer (LCP) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Lyotropic Liquid Crystal Polymers

9.7.4.2 Thermotropic Liquid Crystal Polymers

9.7.5 Historic and Forecasted Market Size by Processing Method

9.7.5.1 Injection Molding

9.7.5.2 Extrusion Molding

9.7.5.3 Blow Molding

9.7.5.4 Other Processing Methods

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Electrical & Electronics

9.7.6.2 Automotive

9.7.6.3 Industrial Machinery

9.7.6.4 Consumer Goods

9.7.6.5 Medical Devices

9.7.6.6 Others (Aerospace

9.7.6.7 Defense)

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Electronics & Electrical

9.7.7.2 Automotive & Transportation

9.7.7.3 Industrial Machinery

9.7.7.4 Consumer Goods

9.7.7.5 Medical Devices

9.7.7.6 Other End-use Industries

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Liquid Crystal Polymer (LCP) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.61 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.60 % |

Market Size in 2032: |

USD 4.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Processing Method |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||