Internet of Things (IoT) Telecom Services Market Synopsis

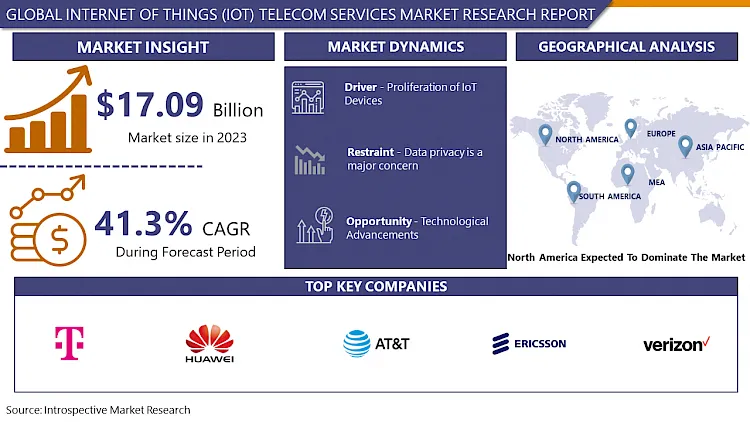

The Internet of Things (IoT) Telecom Services Market Size Was Valued at USD 17.09 Billion in 2023, and is Projected to Reach USD 383.7 Billion by 2032, Growing at a CAGR of 41.30% From 2024-2032.

Internet of Things (IoT) telecommunications services encompass a collection of offerings that are designed to streamline the process of connecting and managing IoT devices. The term "IoT" refers to an extensive collection of interconnected devices, including appliances, vehicles, sensors, and actuators, that are all specifically engineered to gather and exchange data independently.

Typically, telecommunications services for the Internet of Things comprise network connectivity, data transmission, device management, and security solutions. These services facilitate the exchange of data between backend systems and IoT devices, allowing for the monitoring, control, and analysis of data in real time across a wide range of industries and applications.

Fundamentally, IoT telecommunications services facilitate the expansion and scalability of IoT ecosystems through the provision of the infrastructure and assistance necessary for uninterrupted data exchange and connectivity. IoT telecom services empower organizations to maximize the benefits of IoT deployments by utilizing telecommunications networks and technologies, including cellular, satellite, and LPWAN (Low-Power Wide-Area Network).

This results in cost savings, increased efficiency, and innovation in various industries, including smart cities, healthcare, agriculture, manufacturing, and logistics. Furthermore, by prioritizing dependability, expandability, and protection, these services endeavor to tackle the distinct obstacles linked to the administration and protection of extensive IoT implementations, thereby promoting the ongoing development and progression of the IoT domain.

.webp)

Internet of Things (IoT) Telecom Services Market Trend Analysis

The deployment of 5G offers high-speed

- The deployment of 5G indeed acts as a significant driver for the Internet of Things (IoT) Telecom Services Market. By their exceptional velocity, minimal latency, and substantial capacity, 5G networks provide a paradigm-shifting framework to accommodate the enormous proliferation of Internet of Things devices. Real-time data transmission and processing are facilitated by the increased bandwidth and decreased latency of 5G networks.

- This is of the utmost importance for time-sensitive applications, including but not limited to autonomous vehicles, remote healthcare monitoring, and industrial automation. The ability of IoT devices to exchange larger volumes of data, communicate more efficiently, and utilize advanced functionalities is made possible by this high-speed connectivity; consequently, this opens up novel opportunities for efficiency and innovation in a variety of industries.

- Furthermore, the capacity of 5G to facilitate an unfathomable quantity of concurrent connections per square kilometer significantly enhances the scalability of Internet of Things implementations. In scenarios involving smart cities or industrial IoT environments, where a large number of IoT devices must operate within a confined space, this scalability is especially critical.

- 5G networks facilitate the integration of Internet of Things (IoT) devices and guarantee dependable connectivity, thereby encouraging the growth of advanced IoT applications and services. The implementation of 5G networks thus expedites the expansion of the IoT Telecom Services Market through the provision of a connectivity solution characterized by swiftness, minimal latency, and the ability to accommodate the ever-changing requirements of various IoT applications.

Continuous innovation in areas like IoT protocols and 5G interconnection

- Constant advancements in technologies such as 5G interconnection and Internet of Things (IoT) protocols represent a substantial opportunity for the IoT Telecom Services Market. The advancement of protocols contributes to the improvement of interoperability, security, and efficiency in IoT networks as ecosystems progress.

- Procedural advancements in the Internet of Things (IoT) facilitate the integration and communication of a wide range of devices and platforms, thereby promoting the implementation of interconnected solutions in numerous industries. Furthermore, progress in 5G interconnection technologies provides improved compatibility and integration functionalities, thereby empowering Internet of Things (IoT) devices to more efficiently exploit the advantages of 5G networks in terms of speed and latency.

- This creates opportunities for the development of Internet of Things (IoT) applications that necessitate dependable connectivity, scalability on a vast scale, and real-time data transmission. As a result, there is a growing need for specialized telecommunications services that are specifically designed to meet these demands.

- In addition, the ongoing development of IoT protocols and 5G interconnection facilitates a vibrant ecosystem of services and solutions, thereby presenting telecom providers with prospects to provide value-added offerings. To distinguish themselves, telecommunications service providers must remain at the vanguard of technological developments and offer innovative solutions that cater to the ever-changing requirements of Internet of Things deployments.

- Innovative IoT telecom services leverage the most recent developments to provide improved functionalities and performance, including but not limited to network stability, security, and integration with emerging technologies such as artificial intelligence and edge computing. This phenomenon not only stimulates the expansion of the IoT Telecom Services Market but also expedites the implementation of IoT solutions across various sectors, thereby bolstering revenue growth for telecom providers.

Internet of Things (IoT) Telecom Services Market Segment Analysis:

Internet of Things (IoT) Telecom Services Market Segmented based on Type, Technology, and Application.

By Type, the connectivity technology segment is expected to dominate the market during the forecast period

- A commonly dominant segment within the Internet of Things (IoT) Telecom Services Market is connectivity technology. The reason for this dominance is the crucial function that connectivity performs in Internet of Things deployments.

- The increasing prevalence of Internet of Things (IoT) devices in diverse sectors has generated a need for dependable connectivity solutions that can transmit data and enable communication between devices and backend systems at high speeds. Telecom providers place significant emphasis on providing a wide range of connectivity alternatives, such as cellular, LPWAN (Low-Power Wide-Area Network), satellite, and emerging technologies like 5G, to accommodate the distinct requirements of various Internet of Things use cases.

- As businesses seek dependable and scalable connectivity solutions to fuel their IoT deployments, connectivity technology continues to be a fundamental component of IoT infrastructure, generating substantial revenue for the telecom services sector.

- Moreover, the IoT Telecom Services Market is frequently dominated by the Services sector. Telecom service providers offer an extensive array of value-added services to bolster Internet of Things (IoT) deployments, surpassing the provision of connectivity. These services comprise network administration, device provisioning, security solutions, and data analytics.

- The utilization of these services is critical to maximize the performance of the Internet of Things, guarantee the integrity of data, and improve operational efficiency as a whole. The increasing intricacy of IoT ecosystems and the varied needs of IoT applications in different sectors have generated a surge in the need for specialized services that are designed to tackle the distinct obstacles and prospects that arise from IoT deployments.

- By investing in the expansion of their service offerings to satisfy the market's changing demands, telecom providers propel growth and establish dominance in the Services sector of the IoT Telecom Services Market.

By Technology, Cellular Technologies segment held the largest share in 2023

- The Internet of Things (IoT) telecommunications services market is frequently dominated by cellular technologies. The prevalence of this dominance can be attributed to the broad accessibility, dependability, and adaptability of cellular networks in facilitating IoT implementations in various sectors.

- Cellular technologies, including the forthcoming 5G and 4G LTE, provide extensive coverage, low latency, and rapid data transmission, rendering them highly suitable for interconnecting Internet of Things devices in both urban and rural settings. Moreover, cellular networks are indispensable for facilitating large-scale IoT deployments due to their comprehensive security features and capacity to support a large number of concurrent connections.

- To meet the rising demand for IoT connectivity solutions, telecom service providers invest significantly in expanding and optimizing their cellular infrastructure; this drives Cellular Technologies' market dominance in the IoT Telecom Services Market.

- Additionally, Low-Power Wide Area Network (LPWAN) technologies are of considerable importance in the IoT Telecom Services Market, specifically for use cases that necessitate extended connectivity over long distances while conserving energy. LPWAN technologies, including LoRaWAN and Sigfox, provide economically viable alternatives for interconnecting battery-powered Internet of Things (IoT) devices across extensive distances.

- This renders them well-suited for implementations such as environmental monitoring, asset tracking, smart metering, and asset tracking. The distinct benefits of LPWAN technologies in addressing particular IoT use cases are frequently acknowledged by telecom providers, who frequently offer specialized services designed to aid LPWAN deployments. It is anticipated that LPWAN technologies will persist in their significance and aid in the expansion and diversification of the IoT Telecom Services Market, as the IoT environment continues to grow.

Internet of Things (IoT) Telecom Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the Internet of Things (IoT) Telecom Services Market for several reasons. To begin with, the area is distinguished by a resilient telecommunications network infrastructure that encompasses cutting-edge cellular technologies such as 5G, in addition to extensive broadband and wireless connectivity.

- The robust framework established by this foundation ensures the smooth operation of Internet of Things (IoT) implementations in diverse sectors, thereby stimulating the need for specialized telecommunications services that are customized to meet the specific demands of IoT. In addition, a flourishing ecosystem of technology companies, entrepreneurs, and innovators resides in North America, focusing on critical IoT sectors including industrial automation, healthcare, smart cities, and healthcare.

- The consolidation of knowledge and assets in this area creates a conducive atmosphere for the advancement and implementation of Internet of Things (IoT) solutions, thereby stimulating the expansion of the IoT Telecom Services Market in the area.

- In addition, the supportive policies and proactive regulatory environment in North America are pivotal in stimulating the adoption and investment in the Internet of Things (IoT). Government initiatives that seek to foster innovation, digital transformation, and the development of IoT infrastructure motivate enterprises to allocate resources towards IoT solutions and services, consequently stimulating market expansion.

- Furthermore, the region's robust emphasis on research and development nurturing ongoing advancements in IoT technologies and telecommunications services enables it to sustain its competitive advantage in the international marketplace. These elements, in conjunction with a sizable addressable market and a culture that embraces technology early on, contribute to the Internet of Things Telecom Services Market's preeminence in North America.

Active Key Players in the Internet of Things (IoT) Telecom Services Market

- AT&T (Dallas, Texas, USA)

- Verizon Communications (New York City, New York, USA)

- Ericsson (Headquarters: Stockholm, Sweden)

- Huawei Technologies Co. (Shenzhen, Guangdong, China)

- Sprint Corporation (Overland Park, Kansas, USA)

- Deutsche Telekom AG (Bonn, Germany)

- Vodafone (London, United Kingdom)

- Aeris (San Jose, California, USA)

- T-Mobile (Bellevue, Washington, USA), Other Major Players

Key Industry Developments in the Internet of Things (IoT) Telecom Services Market:

- In February 2023, A statement from Snowflake announced the recent introduction of the Telecom Data Cloud, an integration of its data platform, partner-provided solutions, and telecom-segment-specific datasets. By utilizing the Telecom Data Cloud, organizations are empowered to access data in near real-time with enhanced security and speed. This data can subsequently be fortified with machine learning models, shared, and analyzed to facilitate more informed decision-making. It facilitates the bridging of data divisions around the ecosystem and within organizations for telecommunications service providers.

- In February 2022, IoT roaming was implemented nationwide by BT. By establishing connections with mobile networks via IoT national roaming SIMs, intelligent devices can remain connected even when they are in remote locations or on the move. The devices will be linked to EE, the largest and most reliable network in the United Kingdom, via BT's IoT national roaming SIMs. This guarantees that data will be delivered promptly and dependably to the locations that require it the most.

|

Global Internet of Things (IoT) Telecom Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

41.30% |

Market Size in 2032: |

USD 383.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Internet of Things (IoT) Telecom Services Market by Type (2018-2032)

4.1 Internet of Things (IoT) Telecom Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Connectivity Technology

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Network Management Solution

4.5 Services

Chapter 5: Internet of Things (IoT) Telecom Services Market by Technology (2018-2032)

5.1 Internet of Things (IoT) Telecom Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cellular Technologies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Low-Power Wide Area Network (LPWAN)

5.5 Narrowband-IoT (NB-IOT)

5.6 Radio Frequency-Based

5.7 Others

Chapter 6: Internet of Things (IoT) Telecom Services Market by Application (2018-2032)

6.1 Internet of Things (IoT) Telecom Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Smart Buildings

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Capillary Network Management

6.5 Industrial Automation

6.6 Vehicle Telematics

6.7 Transportation and Traffic Management

6.8 Energy and Utilities

6.9 Smart Healthcare

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Internet of Things (IoT) Telecom Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AEGIS SERVICES (UNITED KINGDOM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CARDINUS (UNITED KINGDOM)

7.4 CHOLARISK (UNITED KINGDOM)

7.5 CHUBB (UNITED KINGDOM)

7.6 CITATION (UNITED KINGDOM)

7.7 CONTEGO SERVICES (UNITED KINGDOM)

7.8 EAST SUSSEX FIRE & RESCUE SERVICE (UNITED KINGDOM)

7.9 ELITE FIRE PROTECTION (UNITED KINGDOM)

7.10 FIRE & RISK ALLIANCE (UNITED KINGDOM)

7.11 INTERNATIONAL FIRE CONSULTANTS (UNITED KINGDOM)

7.12 MCFP (UNITED KINGDOM)

7.13 PLC FIRE SAFETY SOLUTIONS (UNITED KINGDOM)

7.14 RED BOX FIRE (UNITED KINGDOM)

7.15 ROSPA (ROYAL SOCIETY FOR THE PREVENTION OF ACCIDENTS) (UNITED KINGDOM)

7.16 STROMA TECH (UNITED KINGDOM)

7.17 TP FIRE AND SECURITY (UNITED KINGDOM)

7.18 WEST MIDLANDS FIRE SERVICE (UNITED KINGDOM)

7.19 OTHER KEY PLAYERS

7.20

Chapter 8: Global Internet of Things (IoT) Telecom Services Market By Region

8.1 Overview

8.2. North America Internet of Things (IoT) Telecom Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Connectivity Technology

8.2.4.2 Network Management Solution

8.2.4.3 Services

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Cellular Technologies

8.2.5.2 Low-Power Wide Area Network (LPWAN)

8.2.5.3 Narrowband-IoT (NB-IOT)

8.2.5.4 Radio Frequency-Based

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Smart Buildings

8.2.6.2 Capillary Network Management

8.2.6.3 Industrial Automation

8.2.6.4 Vehicle Telematics

8.2.6.5 Transportation and Traffic Management

8.2.6.6 Energy and Utilities

8.2.6.7 Smart Healthcare

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Internet of Things (IoT) Telecom Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Connectivity Technology

8.3.4.2 Network Management Solution

8.3.4.3 Services

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Cellular Technologies

8.3.5.2 Low-Power Wide Area Network (LPWAN)

8.3.5.3 Narrowband-IoT (NB-IOT)

8.3.5.4 Radio Frequency-Based

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Smart Buildings

8.3.6.2 Capillary Network Management

8.3.6.3 Industrial Automation

8.3.6.4 Vehicle Telematics

8.3.6.5 Transportation and Traffic Management

8.3.6.6 Energy and Utilities

8.3.6.7 Smart Healthcare

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Internet of Things (IoT) Telecom Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Connectivity Technology

8.4.4.2 Network Management Solution

8.4.4.3 Services

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Cellular Technologies

8.4.5.2 Low-Power Wide Area Network (LPWAN)

8.4.5.3 Narrowband-IoT (NB-IOT)

8.4.5.4 Radio Frequency-Based

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Smart Buildings

8.4.6.2 Capillary Network Management

8.4.6.3 Industrial Automation

8.4.6.4 Vehicle Telematics

8.4.6.5 Transportation and Traffic Management

8.4.6.6 Energy and Utilities

8.4.6.7 Smart Healthcare

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Internet of Things (IoT) Telecom Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Connectivity Technology

8.5.4.2 Network Management Solution

8.5.4.3 Services

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Cellular Technologies

8.5.5.2 Low-Power Wide Area Network (LPWAN)

8.5.5.3 Narrowband-IoT (NB-IOT)

8.5.5.4 Radio Frequency-Based

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Smart Buildings

8.5.6.2 Capillary Network Management

8.5.6.3 Industrial Automation

8.5.6.4 Vehicle Telematics

8.5.6.5 Transportation and Traffic Management

8.5.6.6 Energy and Utilities

8.5.6.7 Smart Healthcare

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Internet of Things (IoT) Telecom Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Connectivity Technology

8.6.4.2 Network Management Solution

8.6.4.3 Services

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Cellular Technologies

8.6.5.2 Low-Power Wide Area Network (LPWAN)

8.6.5.3 Narrowband-IoT (NB-IOT)

8.6.5.4 Radio Frequency-Based

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Smart Buildings

8.6.6.2 Capillary Network Management

8.6.6.3 Industrial Automation

8.6.6.4 Vehicle Telematics

8.6.6.5 Transportation and Traffic Management

8.6.6.6 Energy and Utilities

8.6.6.7 Smart Healthcare

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Internet of Things (IoT) Telecom Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Connectivity Technology

8.7.4.2 Network Management Solution

8.7.4.3 Services

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Cellular Technologies

8.7.5.2 Low-Power Wide Area Network (LPWAN)

8.7.5.3 Narrowband-IoT (NB-IOT)

8.7.5.4 Radio Frequency-Based

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Smart Buildings

8.7.6.2 Capillary Network Management

8.7.6.3 Industrial Automation

8.7.6.4 Vehicle Telematics

8.7.6.5 Transportation and Traffic Management

8.7.6.6 Energy and Utilities

8.7.6.7 Smart Healthcare

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Internet of Things (IoT) Telecom Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

41.30% |

Market Size in 2032: |

USD 383.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||