Insulating Glass Window Market Overview

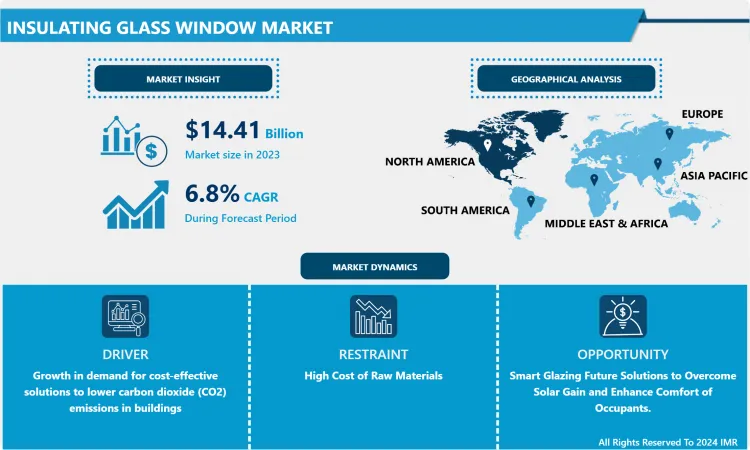

Insulating Glass Window Market Size Was Valued at USD 15.39 Billion in 2024, and is Projected to Reach USD 31.73 Billion by 2035, Growing at a CAGR of 6.8% From 2025-2035.

A couplings unit, incorporating liters of glass, which are sealed at the edges and separated by dehydrated space(s), is considered for vision areas of buildings. The unit is normally utilized for windows, picture windows, window walls, sliding doors, patio doors, or other types of fenestrations. In addition, windows, which have a U-value that is controlled by an insulating glass unit (IGU) U-value, must be a building's only enclosure element, which has no design value concept. The announced U-value, which is calculated or measured with 0°C of external regulated temperature, is used instead of the design value. For most of a building's elements, its thermal transmittance with a decline in the external temperature reduces a little, i.e., improves. With growing energy prices and decreasing natural resources, rising attention is being paid to declining energy utilization in buildings. Buildings consume about 40% of the European Union's total energy consumption, which has led to the rising discussion on declining the energy consumption of buildings. Installing insulating glass windows might save up to 15% on annual air conditioning costs. Subsequently, this is anticipated to improve the insulating glass window market in the coming years. Moreover, governments have enforced regulations to overcome home carbon footprints, owing to growth in the consciousness of sustainability as a result of the acknowledgment of climate change. To execute such measures, governments often provide different subsidies for the replacement of old windows and furnaces, which lead to wastage of energy. Such subsidies turn the demand for the insulating glass window market during the forecast period.

Market Dynamics and Factors for the Insulating Glass Window Market:

Insulating Glass Window Market Drivers- Growth in demand for cost-effective solutions to lower carbon dioxide (CO2) emissions in buildings

Growth in demand for cost-effective solutions to lower carbon dioxide (CO2) emissions in buildings is anticipated to increase the insulated glass market throughout the forecast period. The number of legislations and regulatory guidelines are rising every year over the world for more efficient forms of energy conservation. This is boosting the demand for cost-effective solutions such as insulated glass during the forecast period.

The high energy utilization in buildings is accelerating the demand for energy-efficient building materials such as insulating glass windows. The application of insulating glass windows can assist reduce energy losses and result in lower energy consumption, which is a crucial requirement. The heat and light transferred by the glass directly impact the comfort level of the people in the room, apart from influencing the energy costs. Shifting to insulating glass windows makes a massive difference in the overall energy consumption. The application of insulating glass windows in residential and commercial buildings can decrease power consumption by almost 50%, thereby proving to be an effective technology for power optimization. Moreover, the rising trend of rating systems in various countries, such as LEED (Leadership in Energy & Environmental Design) in the US, IGBC Green Ratings in India, and others are probably to contribute to the growth of the insulating glass window market.

A rise in investments in research & development activities by key market players to produce sustainable and developed glass insulation materials, and growth in demand for green buildings is projected to stimulate the insulating glass window market during the forecast period. The rise in the number of legislations over the world for more efficient forms of energy conservation is encouraging producers to develop the latest and sustainable methods and products of glass insulation.

Insulating Glass Window Market Restraints- High Cost of Raw Materials

The high cost of raw materials is expected to restraint the global insulated glass market. Raw materials utilized in glass insulation are desiccants, spacers, glazing sealants, inert gases, silicone foams, soda ash, glass, and various adsorbents. The cost of these raw materials is high. This increases the overall cost of insulated glass. This is projected to restrain the global insulated glass market in the upcoming years. Companies are investing crucially in the development of alternative low-cost raw materials to address this issue. The dearth of universal directives concerning applications of insulated glass, and lack of awareness and low adoption of this type of glass in many underdeveloped countries are also probably to restraint the insulating glass window market shortly. Every country has different directives and legislations about the use of insulated glass, as climate and energy savings and building code conditions vary from one country to another. Companies find it difficult to meet these country-wise directives and legislations.

Insulating Glass Window Market Opportunities- Smart Glazing Future Solutions to Overcome Solar Gain and Enhance Comfort of Occupants

Smart Glazing – Future Solutions to Overcome Solar Gain and Enhance Comfort of Occupants.

The current state-of-the-art spectrally selective coatings are highly improved to maximize the daylight/cooling load ratio, they cannot respond to switching exterior illumination (sun, clouds) conditions. The next big advance in coated glazing will be 'smart glazing' that responds dynamically to changing resident and building needs. After 15 years of laboratory development, these coatings are now beginning to be augmented in prototype form for application in buildings. These smart glazing can be segmented into two major categories as 'passively activated', such as thermochromic (heat sensitive) or photochromic (light-sensitive), and 'actively controlled', such as electrochromic or gasochromic, which can be switched on and off as required with a small applied voltage or a small amount of hydrogen, respectively. Each of these should ultimately find a market niche but the actively controllable options are likely to be the preferred choice, assuming the remaining durability and cost issues can be favorably resolved. Commutable glazing can be either integrated into traditional multi-glazed IG units or combined with future, developed technologies for declining heat loss, such as vacuum- or aerogel glazing.

Market Segmentation

Based on the spacer type, the warm edge spacer segment is expected to record the largest share of the insulating glass window market over the forecast period. Flexible warm edge spacers have very low conductivity in comparison to aluminum spacers and provide the primary advantages of enhanced thermal efficiency for insulating glass windows.

Based on the type, silicon is expected to register the maximum insulating glass window market during the forecast period. Silicone sealants are extensively utilized for glass bonding in insulating glass windows as they have the ability to bond materials together with huge power or exceptional lightness and are developed for both permanent and temporary adhesion applications. Different properties of silicone, such as high elongation, longevity, high-temperature resistance, and others are anticipated to drive this segment.

Based on the glazing type, double glazing insulating glass window is expected to dominate the insulating glass window market over the forecast period. Double-glazed windows considerably overcome heat loss and enhance the energy conservation rate. These windows found application in both the residential and commercial sectors. Low-emissivity (Low-e) glass is utilized in double-glazed windows to boost thermal efficiency. Such properties are turning the growth of this segment.

Based on the end-user, the insulating glass window market is segmented into Industrial, Residential, Non-Residential, Others. The residential segment is anticipated to dominate the global market, due to the expansion of the residential construction industry. According to, the insulating glass window market opportunities analyzed across North America, Europe, Asia-Pacific, and Latin America, and the Middle East and Africa.

Players Covered in Insulating Glass Window market are :

- AGC Inc. (Japan)

- Central Glass Co. Ltd. (Japan)

- Compagnie de Saint-Gobain SA (France)

- Dymax (US)

- Glaston Corporation (Finland)

- Guardian Glass (US)

- H.B. Fuller Company (US)

- Henkel AG & Co. KGaA (Germany)

- Internorm (Austria)

- Scheuten (Netherlands)

- Nippon Sheet Glass Co. Ltd. (Japan)

- Sika AG (Switzerland)

- 3M (US)

- Viracon (US)

- Beijing Hanjiang Automatic Glass Machinery Equipment Co. Ltd. (China)

- Cardinal Glass Industries Inc (US)

- Eco Glass Inc (US)

- Ittihad Insulating Glass Co. (Jordan)

- Qingdao Migo Glass Co. Ltd. (China)

- OYADE Sealant (China)

- Shenzhen Jimy Glass Co. Ltd. (China)

- Strathclyde Insulating Glass Ltd. (Scotland)

- Vitro Architectural Glass (US)

- Yongan Adhesive Industry Co. Ltd. (China)

- and Fuso (India) and other active players

Regional Analysis for the Insulating Glass Window Market:

North America is estimated to be the highest regional market for insulating glass windows. North America is dominate the insulating glass windows market over the forecast period. Glass insulation is considered a feasible option for making buildings energy-efficient. In addition, factors such as the high quality of infrastructural construction, decreased environmental impact, climatic conditions, and government regulations are accelerating the growth of energy-efficient windows in North America. Moreover, the growth in recreational and renovation activities of old buildings along with other factors in economies including the U.S. and Canada which are the prominent economies in this region.

Key Industry Developments in the Insulating Glass Window Market:

- In October 2021, AGC Glass Europe and Masterframe form a strategic collaboration to bring FINEO vacuum insulating glazing for PVC-U sash windows to the UK market. Demand for low-energy homes, decreased fossil fuel application for heating and reduced greenhouse gas emissions are rising. High-performant glazing act as an essential role to bring warmth and comfort to homes. This can now even better be achieved with vacuum insulating glass (VIG) installed in new sash windows. With FINEO vacuum insulating glazing, AGC Glass Europe holds innovative technology. This ultra-slim glazing (10 mm total thickness) attains unrivaled thermal and acoustic performances, along with better light transmission.

- In June 2020, Guardian Glass declared the new updates to its residential insulating glass products. The company's proprietary warm edge spacer, which is currently manufactured in its Sun Prairie, Wisc., and fabrication facility is now branded Guardian Align. The company changed the color of its primary polyisobutylene sealant to black to produce cleaner-looking sightliness that seamlessly blends in with more modern and contemporary window frames.

COVID-19 Impact on the Insulating Glass Window Market:

The COVID 19 outbreak has influenced the expansion of the insulating glass window industry due to the lockdown measure in the economies and delay in manufacturing and production of insulating glass windows which are used in residential and non-residential spaces. A majority of the production plants for insulating glass windows have either been closed or were operating with limited capacity in Europe and North America during 2020. The insulating glass window market is mainly turned by the growing trend of energy-efficient building construction. Owing to the COVID-19 pandemic, different building construction activities such as the latest and existing projects, onsite productivity, and contract value, were projected to have decreased by 24% in 2020, when compared to 2019. Nevertheless, there has been a recovery in activity during 2021. China, the attraction of the COVID-19 outbreak, is a major link in the supply chain of raw materials of insulated glass. The main constituent of glass is soda ash. It is mainly found in China. The COVID-19 pandemic is probably to force players in Europe and North America to consider alternative sourcing options. This is projected to have important tax, transfer pricing, and customs implications.

|

Insulating Glass Window Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.39 Billion |

|

Forecast Period 2025-35 CAGR: |

6.8% |

Market Size in 2035: |

USD 31.73 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Spacer Type |

|

||

|

By Sealant Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Insulating Glass Window Market by Type (2018-2035)

4.1 Insulating Glass Window Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Double Glazing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Triple Glazing

Chapter 5: Insulating Glass Window Market by Spacer Type (2018-2035)

5.1 Insulating Glass Window Market Snapshot and Growth Engine

5.2 Market Overview

5.3 4SG Thermoplastic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Aluminum Box

5.5 Composite Spacers

5.6 Warm Edge Spacers

5.7 Galvanized Steel

5.8 Intercept

5.9 Silicone Spacers

5.10 Stainless Steel Box

5.11 Structural Foam Spacers

5.12 Others

Chapter 6: Insulating Glass Window Market by Sealant Type (2018-2035)

6.1 Insulating Glass Window Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Silicone

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Polyisobutylene

6.5 Hot-melt Butyl

6.6 Polysulfide

6.7 Polyurethane

6.8 Epoxy

6.9 Others

Chapter 7: Insulating Glass Window Market by End User (2018-2035)

7.1 Insulating Glass Window Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Non-residential

7.5 Industrial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Insulating Glass Window Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BASF SE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DOW INCNOVAMONT S.P.APLANTIC

8.4 NATUREWORKS

8.5 CORBION N.VBIOME TECHNOLOGIES PLC

8.6 MITSUBISHI CHEMICAL HOLDINGS

8.7 EASTMAN CHEMICAL COMPANY

8.8 DANIMER SCIENTIFIC

Chapter 9: Global Insulating Glass Window Market By Region

9.1 Overview

9.2. North America Insulating Glass Window Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Double Glazing

9.2.4.2 Triple Glazing

9.2.5 Historic and Forecasted Market Size by Spacer Type

9.2.5.1 4SG Thermoplastic

9.2.5.2 Aluminum Box

9.2.5.3 Composite Spacers

9.2.5.4 Warm Edge Spacers

9.2.5.5 Galvanized Steel

9.2.5.6 Intercept

9.2.5.7 Silicone Spacers

9.2.5.8 Stainless Steel Box

9.2.5.9 Structural Foam Spacers

9.2.5.10 Others

9.2.6 Historic and Forecasted Market Size by Sealant Type

9.2.6.1 Silicone

9.2.6.2 Polyisobutylene

9.2.6.3 Hot-melt Butyl

9.2.6.4 Polysulfide

9.2.6.5 Polyurethane

9.2.6.6 Epoxy

9.2.6.7 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Residential

9.2.7.2 Non-residential

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Insulating Glass Window Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Double Glazing

9.3.4.2 Triple Glazing

9.3.5 Historic and Forecasted Market Size by Spacer Type

9.3.5.1 4SG Thermoplastic

9.3.5.2 Aluminum Box

9.3.5.3 Composite Spacers

9.3.5.4 Warm Edge Spacers

9.3.5.5 Galvanized Steel

9.3.5.6 Intercept

9.3.5.7 Silicone Spacers

9.3.5.8 Stainless Steel Box

9.3.5.9 Structural Foam Spacers

9.3.5.10 Others

9.3.6 Historic and Forecasted Market Size by Sealant Type

9.3.6.1 Silicone

9.3.6.2 Polyisobutylene

9.3.6.3 Hot-melt Butyl

9.3.6.4 Polysulfide

9.3.6.5 Polyurethane

9.3.6.6 Epoxy

9.3.6.7 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Residential

9.3.7.2 Non-residential

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Insulating Glass Window Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Double Glazing

9.4.4.2 Triple Glazing

9.4.5 Historic and Forecasted Market Size by Spacer Type

9.4.5.1 4SG Thermoplastic

9.4.5.2 Aluminum Box

9.4.5.3 Composite Spacers

9.4.5.4 Warm Edge Spacers

9.4.5.5 Galvanized Steel

9.4.5.6 Intercept

9.4.5.7 Silicone Spacers

9.4.5.8 Stainless Steel Box

9.4.5.9 Structural Foam Spacers

9.4.5.10 Others

9.4.6 Historic and Forecasted Market Size by Sealant Type

9.4.6.1 Silicone

9.4.6.2 Polyisobutylene

9.4.6.3 Hot-melt Butyl

9.4.6.4 Polysulfide

9.4.6.5 Polyurethane

9.4.6.6 Epoxy

9.4.6.7 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Residential

9.4.7.2 Non-residential

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Insulating Glass Window Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Double Glazing

9.5.4.2 Triple Glazing

9.5.5 Historic and Forecasted Market Size by Spacer Type

9.5.5.1 4SG Thermoplastic

9.5.5.2 Aluminum Box

9.5.5.3 Composite Spacers

9.5.5.4 Warm Edge Spacers

9.5.5.5 Galvanized Steel

9.5.5.6 Intercept

9.5.5.7 Silicone Spacers

9.5.5.8 Stainless Steel Box

9.5.5.9 Structural Foam Spacers

9.5.5.10 Others

9.5.6 Historic and Forecasted Market Size by Sealant Type

9.5.6.1 Silicone

9.5.6.2 Polyisobutylene

9.5.6.3 Hot-melt Butyl

9.5.6.4 Polysulfide

9.5.6.5 Polyurethane

9.5.6.6 Epoxy

9.5.6.7 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Residential

9.5.7.2 Non-residential

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Insulating Glass Window Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Double Glazing

9.6.4.2 Triple Glazing

9.6.5 Historic and Forecasted Market Size by Spacer Type

9.6.5.1 4SG Thermoplastic

9.6.5.2 Aluminum Box

9.6.5.3 Composite Spacers

9.6.5.4 Warm Edge Spacers

9.6.5.5 Galvanized Steel

9.6.5.6 Intercept

9.6.5.7 Silicone Spacers

9.6.5.8 Stainless Steel Box

9.6.5.9 Structural Foam Spacers

9.6.5.10 Others

9.6.6 Historic and Forecasted Market Size by Sealant Type

9.6.6.1 Silicone

9.6.6.2 Polyisobutylene

9.6.6.3 Hot-melt Butyl

9.6.6.4 Polysulfide

9.6.6.5 Polyurethane

9.6.6.6 Epoxy

9.6.6.7 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Residential

9.6.7.2 Non-residential

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Insulating Glass Window Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Double Glazing

9.7.4.2 Triple Glazing

9.7.5 Historic and Forecasted Market Size by Spacer Type

9.7.5.1 4SG Thermoplastic

9.7.5.2 Aluminum Box

9.7.5.3 Composite Spacers

9.7.5.4 Warm Edge Spacers

9.7.5.5 Galvanized Steel

9.7.5.6 Intercept

9.7.5.7 Silicone Spacers

9.7.5.8 Stainless Steel Box

9.7.5.9 Structural Foam Spacers

9.7.5.10 Others

9.7.6 Historic and Forecasted Market Size by Sealant Type

9.7.6.1 Silicone

9.7.6.2 Polyisobutylene

9.7.6.3 Hot-melt Butyl

9.7.6.4 Polysulfide

9.7.6.5 Polyurethane

9.7.6.6 Epoxy

9.7.6.7 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Residential

9.7.7.2 Non-residential

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Insulating Glass Window Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.39 Billion |

|

Forecast Period 2025-35 CAGR: |

6.8% |

Market Size in 2035: |

USD 31.73 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Spacer Type |

|

||

|

By Sealant Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||