Global Ink Resins Market Synopsis

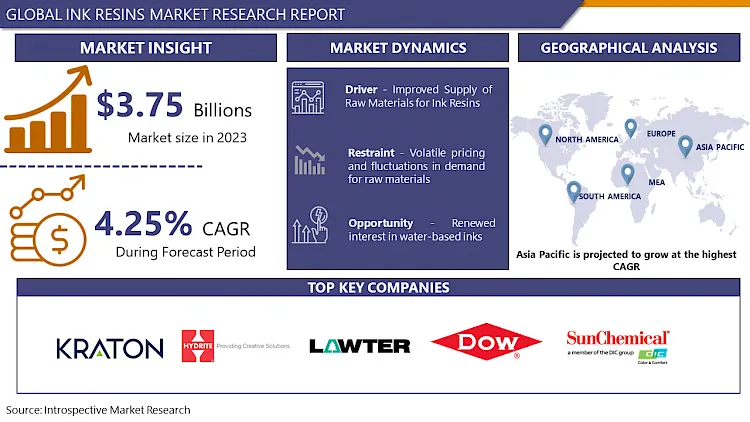

Global Ink Resins Market Size Was Valued at USD 3.75 Billion in 2024, and is Projected to Reach USD 5.93 Billion by 2035, Growing at a CAGR of 4.25% From 2025-2035.

The Ink Resins Market is set to experience substantial growth, fueled by the rising need for high-performance printing inks in the packaging, commercial, and digital printing sectors. The market is experiencing a change towards eco-friendly and sustainable ink resins, along with improvements in digital printing technologies, which are projected to boost market growth even more. The demand for Ink Resins is anticipated to surge in the upcoming years due to the growing popularity of e-commerce and the requirement for stronger packaging. The increasing utilization of ink resins in the labels and packaging industry is also predicted to aid in the market's expansion. In general, the Ink Resins Market is projected to undergo a notable increase, propelled by technological advancements and the increasing need for flexible and eco-friendly printing options.

Resins are essential components adopted in producing various types of inks used in packaging industries. Furthermore, increasing e-commerce business globally is turning demand for packaging solutions further fueling the growth of the market. Lithographic, flexographic, inkjet, offset, and sheet-fed printing are some other examples that deploy these resins which are anticipated to drive ink resins market growth during the projected period.

Ink resins are used in the production of printing inks. They are used in pigments and scattering of the inks to change the property of the end product. Growing demand for packaged food and beverages is anticipated to be a key contributing factor to ink resins market growth during the forecast period.

.webp)

Global Ink Resins Market Trend Analysis

Improved Supply of Raw Materials for Ink Resins

- The enhanced supply of raw materials for ink resins stands as a pivotal driving force propelling the growth of the Global Ink Resins Market. This surge in raw material availability has substantially alleviated historical constraints and bottlenecks within the ink resin manufacturing sector. With a more stable and accessible resource base, manufacturers now enjoy greater flexibility and reliability in their production processes. This has led to a more consistent quality of ink resins and a broader spectrum of offerings catering to diverse industry demands.

- The improved raw material supply has fostered innovation within the sector. Manufacturers are now able to experiment with new formulations and develop advanced ink resin varieties. This not only bolsters product quality but also enables the creation of specialized inks with enhanced properties such as improved adhesion, durability, and eco-friendliness. As a result, the market experiences a surge in demand for these high-performance ink solutions across various application domains, further amplifying market growth.

- The stabilized and improved raw material supply chain has also contributed significantly to cost optimization within the ink resin industry. With a steady influx of essential components, manufacturers can better manage production costs, ensuring a more competitive pricing strategy. This cost-efficiency factor not only benefits manufacturers but also resonates positively with consumers and downstream industries, fostering increased adoption and consumption of ink resins globally.

Renewed interest in water-based inks

- The resurgence of interest in water-based inks presents a significant opportunity for the Global Ink Resins Market. This renewed attention is primarily fueled by the growing environmental consciousness and stringent regulatory measures aimed at reducing volatile organic compounds (VOCs) and hazardous emissions. Water-based inks offer a eco-friendlier alternative, characterized by lower VOC content and reduced environmental impact compared to solvent-based counterparts. As sustainability becomes a key focus across industries, the shift toward water-based inks presents a substantial growth avenue for ink resin manufacturers.

- The technological advancements in water-based ink formulations have significantly improved their performance characteristics. Modern water-based inks now boast enhanced color vibrancy, improved adhesion, and increased durability, rivaling the quality and versatility of solvent-based inks. This advancement paves the way for broader applications across packaging, labels, textiles, and other industries, expanding the market potential for ink resins catering to water-based ink formulations.

Global Ink Resins Market Segment Analysis:

Global Ink Resins Market Segmented on the basis of type, application, and end-users.

By Resin Type, Modified Rosins segment is expected to dominate the market during the forecast period

- Modified rosins represent a burgeoning segment within the resin industry, showing robust growth due to their versatile applications and enhanced properties. These modified forms of natural rosin, extracted from pine trees, undergo chemical alterations to tailor their characteristics for specific industrial needs. This customization allows manufacturers to create resins with improved solubility, adhesion, flexibility, and compatibility with various substrates, thereby broadening their utility across multiple sectors.

- The growth in demand for modified rosins stems from several factors. Firstly, their adaptability makes them highly sought-after in adhesive formulations, where these resins offer superior bonding properties in diverse applications such as packaging, construction, and automotive industries. Their ability to improve the adhesive's performance under different conditions, including temperature variations and exposure to various surfaces, contributes to their rising popularity.

By Technology, UV-curable segment held the largest share in 2024

- UV-curable inks represent a transformative innovation in the printing industry, driving significant advancements in print technology. These inks, cured instantly by exposure to ultraviolet (UV) light, offer numerous advantages over traditional solvent or water-based inks. Their rapid curing process results in almost immediate drying, enabling faster production speeds and reduced production time. This characteristic makes them highly efficient, especially in high-speed printing applications, such as packaging and labeling, where quick turnaround times are essential.

- The unique chemistry of UV-curable inks allows them to bond instantly with the substrate upon exposure to UV light. This results in prints with exceptional durability, scratch resistance, and vibrant colors. Their ability to adhere to a wide range of materials, including plastics, glass, metal, and paper, makes them versatile for various printing applications across industries. Additionally, their low volatile organic compound (VOC) content contributes to their eco-friendly profile, aligning with the increasing demand for sustainable printing solutions.

Global Ink Resins Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Fueled by booming economies in China, India, and a few smaller countries, the ink industry is growing. In particular, the packaging sector offers opportunities as manufacturers and global packaging converters expand to the region. Growth of the printing inks industry varied throughout the Asia Pacific region, with China witnessing the highest increase at 10%. Inkjet printing is on the rise in the Asia Pacific and is growing at a high rate throughout the region, both, in industrial segments such as wide format signage as well as in personal use. Apart from personal use, inkjet inks have an increasing demand from the wide format markets in India and Australia.

Global Ink Resins Market Top Key Players:

-

Kraton Chemical Ltd (U.S.)

- Hydrite Chemical (U.S.)

- Lawter B.V. (U.S.)

- The Dow Chemical Company (U.S.)

- Sun Chemical(U.S.)

- Huntsman Corporation (U.S.)

- Emerald Performance Materials (U.S.)

- Celanese Corporation (U.S.)

- Wacker Chemie AG(Germany)

- BASF SE (Germany)

- Evonik Tego Chemie GmbH (Germany)

- Covestro AG (Germany),

- Indulor (Germany)

- Lanxess (Germany)

- IGM Resins (Netherlands)

- DSM (Netherlands)

- Flint Group (Netherlands)

- Arakawa Chemical (Japan)

- Nippon Steel Chemical Co., Ltd. (Japan)

- DIC Corporation (Japan)

- Royal DSM N.V. (Netherlands)

- SK Chemicals Co., Ltd. (South Korea)

- LOTTE Chemical Corporation (South Korea)

- Jilin Chemical Industry Group Co., Ltd. (China)

- Sinopec Corporation (China)

- Other Active Players

|

Ink Resins Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.6 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.25% |

Market Size in 2035: |

USD 5.02 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ink Resins Market by Resin Type (2018-2035)

4.1 Ink Resins Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Modified Rosins

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hydrocarbon

4.5 Modified Cellulose

Chapter 5: Ink Resins Market by Technology (2018-2035)

5.1 Ink Resins Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oil

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Solvent

5.5 Water

5.6 UV-curable

Chapter 6: Ink Resins Market by Application (2018-2035)

6.1 Ink Resins Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Printing & Publication

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Flexible Packaging

6.5 Corrugated Cardboards & Cartons

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ink Resins Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACACIA COMMUNICATIONS (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADVA OPTICAL NETWORKING (GERMANY)

7.4 APPLIED OPTOELECTRONICS INC.(US)

7.5 CIENA CORPORATION (US)

7.6 CISCO SYSTEMS INC. (US)

7.7 ECI TELECOM (ISRAEL)

7.8 FUJITSU LIMITED (JAPAN)

7.9 HUAWEI TECHNOLOGIES COLTD. (CHINA)

7.10 II-VI INCORPORATED (US)

7.11 INFINERA CORPORATION (US)

7.12 LUMENTUM HOLDINGS INC. (US)

7.13 MARVELL TECHNOLOGY INC. (BERMUDA)

7.14 NEC CORPORATION (JAPAN)

7.15 NEOPHOTONICS CORPORATION (US)

7.16 NOKIA CORPORATION (FINLAND)

7.17 OCLARO INC. (US)

7.18 RIBBON COMMUNICATIONS OPERATING COMPANY INC. (US)

7.19 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.20 TELEFONAKTIEBOLAGET LM ERICSSON (ERICSSON) (SWEDEN)

7.21 VIAVI SOLUTIONS INC. (US)

7.22 XTERA COMMUNICATIONS INC. (US)

7.23 ZTE CORPORATION (CHINA)

Chapter 8: Global Ink Resins Market By Region

8.1 Overview

8.2. North America Ink Resins Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Resin Type

8.2.4.1 Modified Rosins

8.2.4.2 Hydrocarbon

8.2.4.3 Modified Cellulose

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Oil

8.2.5.2 Solvent

8.2.5.3 Water

8.2.5.4 UV-curable

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Printing & Publication

8.2.6.2 Flexible Packaging

8.2.6.3 Corrugated Cardboards & Cartons

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ink Resins Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Resin Type

8.3.4.1 Modified Rosins

8.3.4.2 Hydrocarbon

8.3.4.3 Modified Cellulose

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Oil

8.3.5.2 Solvent

8.3.5.3 Water

8.3.5.4 UV-curable

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Printing & Publication

8.3.6.2 Flexible Packaging

8.3.6.3 Corrugated Cardboards & Cartons

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ink Resins Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Resin Type

8.4.4.1 Modified Rosins

8.4.4.2 Hydrocarbon

8.4.4.3 Modified Cellulose

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Oil

8.4.5.2 Solvent

8.4.5.3 Water

8.4.5.4 UV-curable

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Printing & Publication

8.4.6.2 Flexible Packaging

8.4.6.3 Corrugated Cardboards & Cartons

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ink Resins Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Resin Type

8.5.4.1 Modified Rosins

8.5.4.2 Hydrocarbon

8.5.4.3 Modified Cellulose

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Oil

8.5.5.2 Solvent

8.5.5.3 Water

8.5.5.4 UV-curable

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Printing & Publication

8.5.6.2 Flexible Packaging

8.5.6.3 Corrugated Cardboards & Cartons

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ink Resins Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Resin Type

8.6.4.1 Modified Rosins

8.6.4.2 Hydrocarbon

8.6.4.3 Modified Cellulose

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Oil

8.6.5.2 Solvent

8.6.5.3 Water

8.6.5.4 UV-curable

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Printing & Publication

8.6.6.2 Flexible Packaging

8.6.6.3 Corrugated Cardboards & Cartons

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ink Resins Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Resin Type

8.7.4.1 Modified Rosins

8.7.4.2 Hydrocarbon

8.7.4.3 Modified Cellulose

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Oil

8.7.5.2 Solvent

8.7.5.3 Water

8.7.5.4 UV-curable

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Printing & Publication

8.7.6.2 Flexible Packaging

8.7.6.3 Corrugated Cardboards & Cartons

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Ink Resins Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.6 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.25% |

Market Size in 2035: |

USD 5.02 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||