Printing Inks Market Synopsis

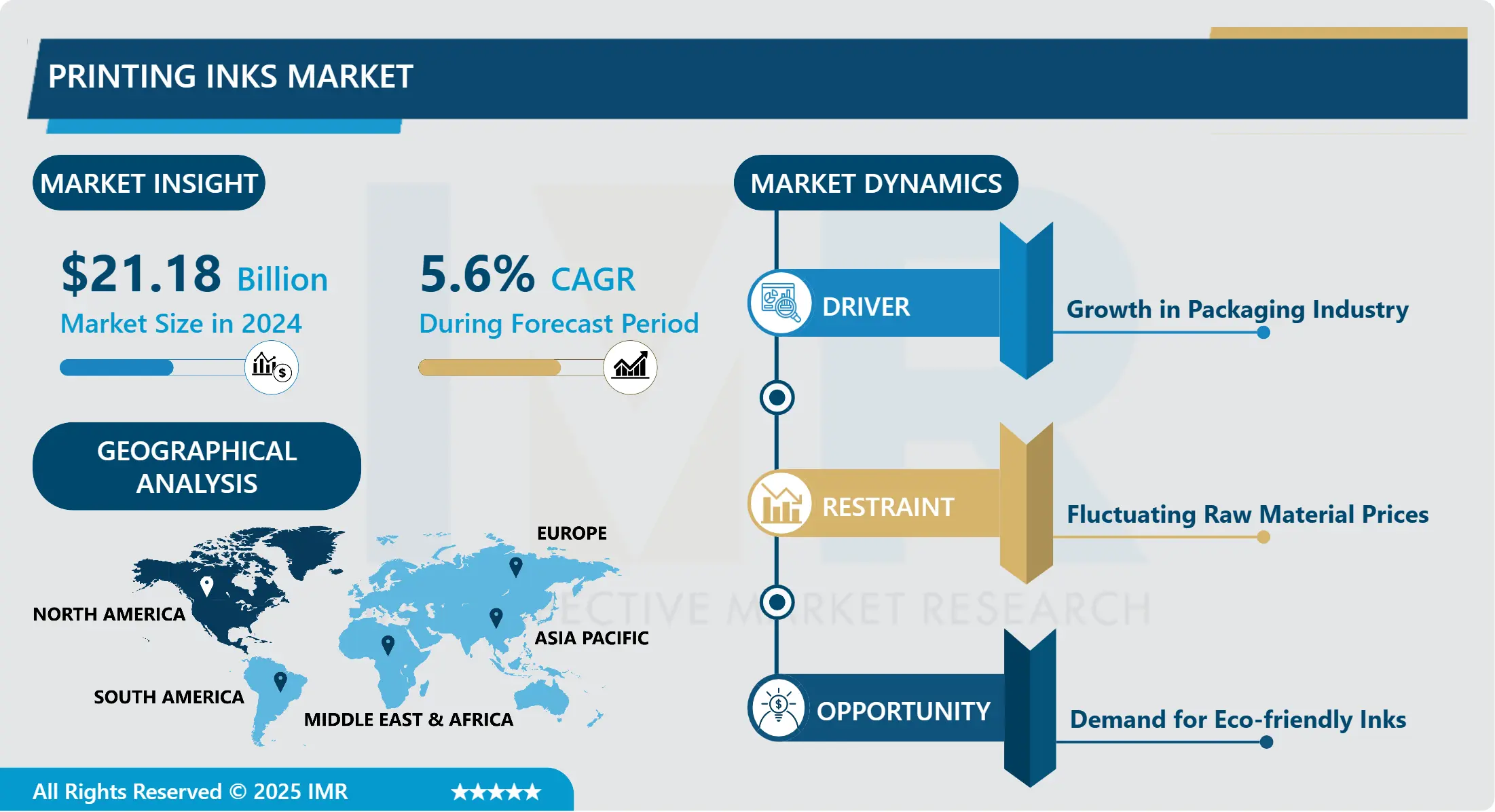

Printing Inks Market Size Was Valued at USD 21.18 Billion in 2024, and is Projected to Reach USD 32.75 Billion by 2032, Growing at a CAGR of 5.60% From 2025-2032.

The printing inks market encompasses the production and distribution of inks used in various printing processes, including offset, flexographic, gravure, digital, and screen printing. These inks are formulated from a blend of pigments, solvents, resins, and additives to ensure proper adhesion, color accuracy, and durability on a variety of substrates such as paper, plastic, and metal. The market is driven by demand across diverse sectors including packaging, publishing, and advertising, with ongoing innovations aimed at improving environmental sustainability, performance, and cost-effectiveness.

The global printing inks market has witnessed significant growth and transformation over the past few years, driven by advancements in technology, increased demand from various end-use industries, and rising environmental consciousness. As of 2024, the market is poised for continued expansion, fueled by the growing preference for high-quality, durable, and eco-friendly inks.

The market can be segmented into several types, including solvent-based, water-based, and UV-curable inks, each catering to distinct applications and industry requirements. Solvent-based inks, known for their superior adhesion and flexibility, continue to dominate the market. However, water-based and UV-curable inks are gaining traction due to their lower environmental impact and superior performance in specific applications.

The packaging industry remains the largest end-user segment, driven by the rising demand for attractive and durable packaging solutions. This trend is particularly notable in the food and beverage sector, where compliance with stringent regulatory standards and consumer preferences for eco-friendly packaging are driving innovation. Additionally, the growth of the e-commerce sector is contributing to increased demand for flexible and high-resolution inks for packaging and labeling.

Geographically, the Asia-Pacific region leads the market, supported by rapid industrialization, urbanization, and growth in the manufacturing sector. China and India are major contributors to this growth, with robust expansion in their packaging and printing industries. North America and Europe also represent significant markets, characterized by high technological adoption and stringent environmental regulations.

Looking ahead, the market is expected to continue evolving with advancements in ink formulations and technologies. Key trends include the development of sustainable and low-VOC inks, the rise of digital printing technologies, and increased focus on circular economy practices. Companies in the printing inks industry are investing in research and development to meet these changing demands and maintain a competitive edge.

Overall, the printing inks market is set for a dynamic period of growth, driven by technological innovations, shifting consumer preferences, and increasing environmental regulations.

Printing Inks Market Trend Analysis

Printing Inks Market Growth Driver- The Rise of Digital and UV-Curable Technologies

- The evolution of digital printing technologies has had a transformative impact on the printing inks market, introducing a range of sophisticated options that address modern printing demands. Digital printing inks have significantly improved in terms of quality, delivering sharper images, richer colors, and more detailed prints compared to traditional methods. These inks are engineered to dry quickly and uniformly, reducing production times and enhancing the efficiency of the printing process. This rapid drying capability is particularly advantageous for high-speed production environments, allowing for quicker turnaround times and the ability to handle more intricate and varied designs. As digital printing technologies continue to advance, the development of inks that can adapt to different types of substrates and conditions is becoming increasingly important, enabling more versatile applications across various industries.

- In parallel, the rise of UV-curable inks has revolutionized the market by offering new possibilities for printing on diverse materials and surfaces. UV-curable inks dry instantly when exposed to ultraviolet light, which not only speeds up production but also enhances the durability and adhesion of prints. This type of ink is particularly valuable for applications that require high-performance characteristics, such as outdoor signage and packaging that must withstand environmental factors. The flexibility of UV-curable inks allows printers to experiment with unconventional substrates, such as plastics, metals, and glass, expanding the range of possible applications and enabling more creative and functional design solutions. The ongoing development and refinement of these technologies are pushing the boundaries of what is possible in printing, meeting the growing demand for customization and high-quality results in an increasingly competitive market.

Printing Inks Market Expansion Opportunity- Environmental Regulations and the Shift Towards Sustainable Printing Inks

- As environmental awareness has surged, the printing inks industry is experiencing a significant shift towards sustainability, driven by both stringent regulations and a growing consumer preference for eco-friendly products. Regulations are increasingly focused on reducing the environmental footprint of industrial processes, including printing. These regulations aim to limit the use of hazardous chemicals and volatile organic compounds (VOCs) that contribute to air pollution and health risks. In response, manufacturers are developing inks that comply with these standards by utilizing renewable resources and minimizing harmful emissions. For instance, water-based inks, which use water as a solvent instead of traditional solvents, are gaining traction due to their lower environmental impact and safer profile. These inks not only reduce VOC emissions but also generally result in fewer hazardous waste byproducts.

- Additionally, soy-based inks are becoming a popular alternative to conventional petroleum-based inks, offering both environmental and performance benefits. Soy-based inks are derived from renewable soybeans, which makes them a more sustainable option compared to the non-renewable petroleum sources used in traditional inks. They also offer improved print quality and color vibrancy while being less harmful to the environment. This shift towards more sustainable ink formulations is a direct response to the dual pressures of regulatory demands and increasing consumer expectations for greener products. As the industry continues to adapt, the development of innovative, eco-friendly inks is expected to play a crucial role in meeting environmental goals and maintaining competitive advantage in the market.

Printing Inks Market Segment Analysis:

Printing Inks Market Segmented based on Product, Resin, Application, and Region.

By Product, Gravure segment is expected to dominate the market during the forecast period

- Gravure printing, also known as rotogravure, is renowned for its ability to produce high-quality, detailed images and is widely regarded as the preferred choice for large-volume printing jobs. This technique utilizes engraved cylinders to transfer ink onto substrates, allowing for exceptional color depth and sharpness in printed materials. The technology excels in producing continuous-tone images and vibrant colors, making it ideal for applications where visual impact and consistency are paramount. This makes gravure printing highly suitable for packaging materials, such as flexible films and labels, as well as for printing high-end magazines and catalogs where image quality is crucial. The high-resolution capabilities and impressive reproduction fidelity contribute significantly to gravure’s dominance in these markets.

- Despite its advantages, gravure printing is characterized by its high setup costs, including the expense of creating engraved cylinders and preparing the press for large production runs. This initial investment, coupled with the need for substantial volumes to offset these costs, means that gravure is typically used for long runs of print jobs. The technology’s inherent efficiency and quality benefits make it economically viable only when large quantities are required, which limits its application to high-volume projects. However, for those applications where quality and durability are critical, and where economies of scale can be achieved, gravure printing remains a leading choice, providing unmatched precision and consistency in the finished product.

By Resin, Acrylic segment held the largest share in 2024

- Acrylic resins are highly valued in the printing and coatings industries due to their outstanding properties, including strong adhesion, durability, and versatility. These resins are commonly used in a variety of applications such as printing inks, varnishes, and protective coatings. Their ability to adhere well to different substrates—ranging from paper and cardboard to plastics and metals—makes them a popular choice in diverse industrial sectors. Additionally, acrylic resins are known for their clarity and gloss, which enhances the visual appeal of printed materials and coatings, ensuring vibrant and sharp images. This clarity, coupled with their ability to maintain color fidelity over time, contributes to their widespread adoption in high-quality printing applications and protective coatings.

- Moreover, acrylic resins offer excellent resistance to environmental factors such as UV radiation, moisture, and temperature fluctuations. This resistance helps extend the longevity of printed products and coated surfaces, making acrylic resins particularly valuable in applications exposed to harsh conditions. For instance, in outdoor signage and packaging, acrylic resins ensure that colors remain vibrant and that the surface remains intact despite exposure to sunlight and weather. Their durability and resistance to wear and tear further enhance their market presence, driving their adoption across a wide range of industries where performance and longevity are critical.

Printing Inks Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America, the printing inks market is experiencing significant growth due to technological advancements and an escalating demand from the packaging sector. The region's robust industrial infrastructure and innovative capabilities position the United States and Canada as central hubs for the development and application of cutting-edge printing technologies. A major driver of this growth is the transition towards digital printing, which is revolutionizing the industry by providing enhanced efficiency, flexibility, and customization options. Digital printing technologies, such as inkjet and laser printers, allow for faster turnaround times and high-quality outputs, catering to the evolving needs of modern consumers and businesses alike.

- Moreover, the North American market is increasingly influenced by stringent environmental regulations and a heightened awareness of sustainability. Regulatory frameworks in the region are enforcing stricter standards for emissions and waste, prompting a shift towards eco-friendly ink formulations. The adoption of low-VOC and water-based inks is becoming more prevalent as companies seek to comply with these regulations while meeting consumer demand for greener products. This focus on sustainability is not only driving innovation in ink formulations but also fostering a competitive edge for companies that prioritize environmental responsibility, ultimately shaping the future trajectory of the printing inks market in North America.

Active Key Players in the Printing Inks Market

- Flint Group

- DIC Corporation;

- Siegwerk Druckfarben AG & Co. KGaA;

- Sakata Inx Corporation;

- T&K TOKA Corporation;

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.;

- DEERS I CO., Ltd.;

- Epple Druckfarben AG;

- TOYO INK SC HOLDINGS CO., LTD.;

- Hubergroup;

- TOKYO PRINTING INK MFG CO., LTD.,

- Other Active Players

|

Global Printing Inks Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 21.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 32.75 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Resin |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Printing Inks Market by Product (2018-2032)

4.1 Printing Inks Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gravure

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flexographic

4.5 Lithographic

4.6 Digital

4.7 Others

Chapter 5: Printing Inks Market by Resin (2018-2032)

5.1 Printing Inks Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Modified rosin

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Modified cellulose

5.5 Acrylic

5.6 Polyurethane

5.7 Others

Chapter 6: Printing Inks Market by Application (2018-2032)

6.1 Printing Inks Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Packaging & labels

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Corrugated cardboards

6.5 Publication & Commercial Printing

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Printing Inks Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 FLINT GROUP

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DIC CORPORATION;

7.4 SIEGWERK DRUCKFARBEN AG & CO. KGAA;

7.5 SAKATA INX CORPORATION;

7.6 T&K TOKA CORPORATION;

7.7 DAINICHISEIKA COLOR & CHEMICALS MFG. COLTD.;

7.8 DEERS I COLTD.;

7.9 EPPLE DRUCKFARBEN AG;

7.10 TOYO INK SC HOLDINGS COLTD.;

7.11 HUBERGROUP;

7.12 TOKYO PRINTING INK MFG COLTD.

7.13

Chapter 8: Global Printing Inks Market By Region

8.1 Overview

8.2. North America Printing Inks Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Gravure

8.2.4.2 Flexographic

8.2.4.3 Lithographic

8.2.4.4 Digital

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Resin

8.2.5.1 Modified rosin

8.2.5.2 Modified cellulose

8.2.5.3 Acrylic

8.2.5.4 Polyurethane

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Packaging & labels

8.2.6.2 Corrugated cardboards

8.2.6.3 Publication & Commercial Printing

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Printing Inks Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Gravure

8.3.4.2 Flexographic

8.3.4.3 Lithographic

8.3.4.4 Digital

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Resin

8.3.5.1 Modified rosin

8.3.5.2 Modified cellulose

8.3.5.3 Acrylic

8.3.5.4 Polyurethane

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Packaging & labels

8.3.6.2 Corrugated cardboards

8.3.6.3 Publication & Commercial Printing

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Printing Inks Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Gravure

8.4.4.2 Flexographic

8.4.4.3 Lithographic

8.4.4.4 Digital

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Resin

8.4.5.1 Modified rosin

8.4.5.2 Modified cellulose

8.4.5.3 Acrylic

8.4.5.4 Polyurethane

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Packaging & labels

8.4.6.2 Corrugated cardboards

8.4.6.3 Publication & Commercial Printing

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Printing Inks Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Gravure

8.5.4.2 Flexographic

8.5.4.3 Lithographic

8.5.4.4 Digital

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Resin

8.5.5.1 Modified rosin

8.5.5.2 Modified cellulose

8.5.5.3 Acrylic

8.5.5.4 Polyurethane

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Packaging & labels

8.5.6.2 Corrugated cardboards

8.5.6.3 Publication & Commercial Printing

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Printing Inks Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Gravure

8.6.4.2 Flexographic

8.6.4.3 Lithographic

8.6.4.4 Digital

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Resin

8.6.5.1 Modified rosin

8.6.5.2 Modified cellulose

8.6.5.3 Acrylic

8.6.5.4 Polyurethane

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Packaging & labels

8.6.6.2 Corrugated cardboards

8.6.6.3 Publication & Commercial Printing

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Printing Inks Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Gravure

8.7.4.2 Flexographic

8.7.4.3 Lithographic

8.7.4.4 Digital

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Resin

8.7.5.1 Modified rosin

8.7.5.2 Modified cellulose

8.7.5.3 Acrylic

8.7.5.4 Polyurethane

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Packaging & labels

8.7.6.2 Corrugated cardboards

8.7.6.3 Publication & Commercial Printing

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Printing Inks Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 21.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 32.75 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Resin |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||