Hadoop-as-a-Service (HaaS) Market Synopsis

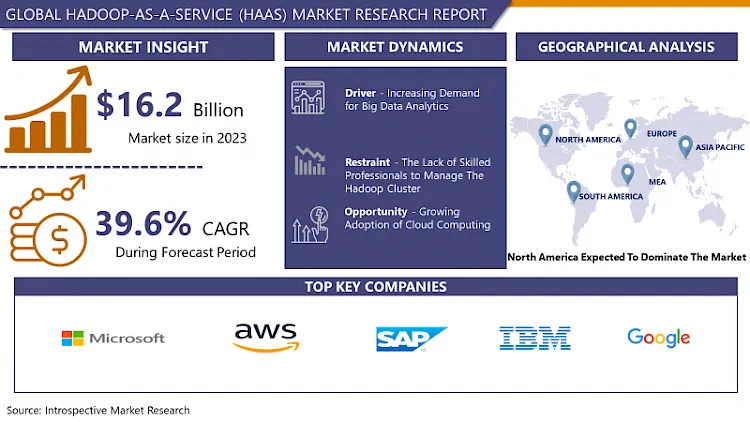

Hadoop-as-a-Service (HaaS) Market Size Was Valued at USD 22.62 Billion in 2024 and is Projected to Reach USD 326.27 Billion by 2032, Growing at a CAGR of 39.6% From 2025-2032.

Hadoop-as-a-service (HaaS) helps organizations lacking the requisite internal resources as well as personnel to store and process tremendous volumes of data and perform big data analytics and mop up the benefits that are associated with it. With the help of the cloud Big data processing tool, Hadoop is available as an open-source analytics framework. While the Hadoop usage is free of charge for all organizations and commercial companies, not all the organizations can create and control internal Hadoop infrastructures. Such an endeavor would require capital investment in the hardware, physical space, energy input, and people to manage the facilities and hardware. Since there was such a high demand for Hadoop and there were not enough resources or people who knew how to build it, HaaS was invented.

Hadoop is administered by the Apache Software Foundation that is a non-profit organisation located in America. Before moving further let me tell you that Hadoop is an open-source application. It is a type of distributed processing technology, which can effectively be used for processing Big Data in different fields. In terms of cost, for example, when compared with traditional data analysis tools such as Relational Database Management Systems (RDBMS), Hadoop is somewhat more efficient. Apache Hadoop is a computing platform that is collaborative, simple, powerful, and efficient. While scalability is a benefit that defines the state of deploying the Hadoop technologies where they help in controlling expenses and use generic and reliable hardware for distribution.

Big data analysis has become a popular tool that organizations use in order to make their decisions based on data. It enables organizations to exploit large and complex data sets which are beyond the ability of traditional analytic applications to handle. The growth in the Hadoop as a Service (HaaS) market mainly stems from the growing demand of the big data across the globe since organizations look for affordable means and ways of storing and analyzing their business data.

Another key factor that is the driving force of the growth of the Hadoop as a Service (HaaS) market globally is cloud computing. While striving for savings on capital investments, cloud computing is gradually becoming established as an even more attractive solution. This paper highlights that cloud can provide businesses with advantages of Hadoop technologies such as scalability, flexibility and cost. Due to this, the growth of cloud-based Hadoop solutions, which is driving the advancement of the global HaaS market.

_MARKET_(1).webp)

Hadoop-as-a-Service (HaaS) Market Trend Analysis

The Rise in the Adoption of Cloud and Virtualization

- Many organizations are planning or are likely to plan to use cloud computing in the future or are already planning towards it. Studies have found that while mega companies have not adopted cloud as swiftly as others, it was the small businesses which lagged behind in moving to cloud technology. Security of data poses a major challenge to the implementation of cloud computing services for the enterprise organizations. Public cloud, as discussed previously, leverages virtualization and common infrastructures shared among multiple tenants, and it further compounds the security concern by offering data access on the virtual machine. Most organizations believe that even if their data is kept in a cloud, the protection provided is not as adequate as the one offered in private data centers.

- Furthermore, it can be appreciated that cloud adoption is continuing to grow at a tremendous rate based on some of the benefits that have been clearly evident in flexibility and the cost savings model it brings in comparison with conventional systems. This growth is expected to contribute to the desire for encryption, and this seems likely to happen as more entities adopt the blockchain. Encryption allows organizations to take advantage of cloud and at the same time protect information assets by encrypting data as it resides in the cloud, as well as while it is being transferred over networks. Besides, it can also aid in the reconstruction of its domain of control over the data regardless of such information having physically left the place of the establishment. This can be achieved by making sure that the key management remains in the rightful possession of the individuals, organization or country that is involved in the secure communications. Should the service provider replicate the virtual machine, they do it of the data which was encrypted only. This imparts to the organization the prerogative to decide on the periods to generate or withdraw the keys.

Flexibility and Agility for Businesses Provided by HaaS

- HaaS providers provide different dod options for choosing pricing strategies for their clients. The Amazon EMR user can pay according to usage where they make hourly payments for each instance hour used. The client may decide to make hourly contribution; for instance, 10-node cluster for 10hrs<|reserved_special_token_258|> is as costly as one hundred node operating for one hour. The cost per hour is slightly higher based on the instance type that an individual is choosing. In addition, a few more factors include hourly rates that are pegged between $0. 011/hour to $0. 27/hour which, of course, is in addition to the fees associated with the use of EC2. It therefore implies that HaaS has the potential of extending choice when it comes to consumer requirements and payment instruments. The hourly rate that will be levied depends with the instance type, and attributes like CPU, RAM, and storage as listed below. HaaS scalability is also one of its distinctive features making the service different from traditional Hadoop. HAAS supports the per-usage billing model since it has high scalability and will use resources unpredictably. It is good to know that users control the capacity of the clusters in their possession. in addition, the scale can be set up or down at any time by a mouse click of a button. Hence, it could be said that these numerous benefits that are associated with HaaS such as flexibility and agility are expected to have kept the market afloat in the recent time.

Hadoop-as-a-Service (HaaS) Market Segment Analysis:

Hadoop-as-a-Service (HaaS) Market is segmented based on deployment type, organization size, end user and Region

By deployment type, run it yourself (RIY) segment is expected to dominate the market during the forecast period

- As in 2021, the leading segment of the market in 2021 is the run-it-yourself (RIY) sector for providing Hadoop-as-a-Service solutions. This trend is expected to continue in the future period under consideration. Moreover, it is predicted that the pure play (PP) segment will have the highest forecast period Compound Annual Growth Rate (CAGR). This is so because compared to integrated HaaS vendors, pureplay HaaS has an ever-green Hadoop cluster that the end user will use ready to use immediately for instance a data scientist. Therefore, this enhances its growth of the pureplay HaaS in the ensuing years. Moreover, it is possible to state that pureplay services are likely to support other components of the Hadoop ecosystem, for instance, Sqooop data transfer tool and Oozie for scheduling. This approximate rise in adoption is expected to drive the market, as stated before.

By organization size, large enterprises segment held the largest share in 2024

- Under this segment in the year 2021, the large enterprises is identified to have the largest Hadoop-as-a-Service market share. Such a trend is expected to unfold over the forecast period, based on data obtained from the previous years. This could be attributed to the fact that large organizations deal with structured, unstructured or binary data that has helped to propel the use of Hadoop in such organizations. Based on the analysis made in this report, more specifically on the forecast period, it can be stated that the growth rates will be the highest among small and medium enterprises. This may vary due to the Wf, consisting of SMEs in developing countries together with the raising of awareness of HaaSam among the end users. Consequently, the advancement made in HaaS is a supporting factor that helps organizations and businesses perform analytics with nominal fund investments. This is the reason why many SMEs all over the world showed interest in adopting HaaS solutions and thus creating successful market revenues.

Hadoop-as-a-Service (HaaS) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Market development in North America is forecasted to stay dominant in the Hadoop-as-a-service market in the forecast period of 2022 also. The increased market players’ participation: As with most technologies, Amazon Web Services, Microsoft Corporation, and the International Business Machines Corporation, among others, have brought a positive influence to the region. In addition to this, the growth in the continual use of Big Data technologies in various business sectors to enhance their capacity to reach consumers and minimize risk points to more opportunity for the market to grow.

Active Key Players in the Hadoop-as-a-Service (HaaS) Market

- Microsoft Corporation

- Amazon web services

- IBM Corporation

- Cloudera Inc.

- Google Inc.

- EMC Corporation

- MapR Technologies

- Mortar Data (Datadog)

- SAP SE

- Datameer

- Other Active Players

|

Global Hadoop-as-a-Service (HaaS) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 22.62 Bn. |

|

Forecast Period 2025-32 CAGR: |

39.6 % |

Market Size in 2032: |

USD 326.27 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Organization Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hadoop-as-a-Service (HaaS) Market by Deployment Type (2018-2032)

4.1 Hadoop-as-a-Service (HaaS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Run It Yourself (RIY)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pure Play (PP)

Chapter 5: Hadoop-as-a-Service (HaaS) Market by Organization Size (2018-2032)

5.1 Hadoop-as-a-Service (HaaS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small & Medium-sized Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Hadoop-as-a-Service (HaaS) Market by End User (2018-2032)

6.1 Hadoop-as-a-Service (HaaS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSI

6.5 Retail & Consumer Goods

6.6 Healthcare & Life Sciences

6.7 Government & Defense

6.8 Media & Entertainment

6.9 Education

6.10 IT & Telecommunication

6.11 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hadoop-as-a-Service (HaaS) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 COMMVAULT (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VEEAM SOFTWARE (SWITZERLAND)

7.4 IBM CORPORATION (USA)

7.5 HEWLETT PACKARD ENTERPRISE (HPE) (USA)

7.6 DELL TECHNOLOGIES (USA)

7.7 VERITAS TECHNOLOGIES (USA)

7.8 ACRONIS INTERNATIONAL GMBH (SWITZERLAND)

7.9 CARBONITE (OPENTEXT) (USA)

7.10 DATTO INC. (USA)

7.11 UNITRENDS (KASEYA LIMITED) (USA)

7.12 BARRACUDA NETWORKS INC. (USA)

7.13 ASIGRA INC. (CANADA)

7.14 ARCSERVE (MARLIN EQUITY PARTNERS) (USA)

7.15 STORAGECRAFT TECHNOLOGY CORPORATION (USA)

7.16 CODE42 SOFTWARE (USA)

7.17 OTHERS ACTIVE PLAYERS.

7.18

Chapter 8: Global Hadoop-as-a-Service (HaaS) Market By Region

8.1 Overview

8.2. North America Hadoop-as-a-Service (HaaS) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment Type

8.2.4.1 Run It Yourself (RIY)

8.2.4.2 Pure Play (PP)

8.2.5 Historic and Forecasted Market Size by Organization Size

8.2.5.1 Small & Medium-sized Enterprises

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Manufacturing

8.2.6.2 BFSI

8.2.6.3 Retail & Consumer Goods

8.2.6.4 Healthcare & Life Sciences

8.2.6.5 Government & Defense

8.2.6.6 Media & Entertainment

8.2.6.7 Education

8.2.6.8 IT & Telecommunication

8.2.6.9 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hadoop-as-a-Service (HaaS) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment Type

8.3.4.1 Run It Yourself (RIY)

8.3.4.2 Pure Play (PP)

8.3.5 Historic and Forecasted Market Size by Organization Size

8.3.5.1 Small & Medium-sized Enterprises

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Manufacturing

8.3.6.2 BFSI

8.3.6.3 Retail & Consumer Goods

8.3.6.4 Healthcare & Life Sciences

8.3.6.5 Government & Defense

8.3.6.6 Media & Entertainment

8.3.6.7 Education

8.3.6.8 IT & Telecommunication

8.3.6.9 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hadoop-as-a-Service (HaaS) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment Type

8.4.4.1 Run It Yourself (RIY)

8.4.4.2 Pure Play (PP)

8.4.5 Historic and Forecasted Market Size by Organization Size

8.4.5.1 Small & Medium-sized Enterprises

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Manufacturing

8.4.6.2 BFSI

8.4.6.3 Retail & Consumer Goods

8.4.6.4 Healthcare & Life Sciences

8.4.6.5 Government & Defense

8.4.6.6 Media & Entertainment

8.4.6.7 Education

8.4.6.8 IT & Telecommunication

8.4.6.9 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hadoop-as-a-Service (HaaS) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment Type

8.5.4.1 Run It Yourself (RIY)

8.5.4.2 Pure Play (PP)

8.5.5 Historic and Forecasted Market Size by Organization Size

8.5.5.1 Small & Medium-sized Enterprises

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Manufacturing

8.5.6.2 BFSI

8.5.6.3 Retail & Consumer Goods

8.5.6.4 Healthcare & Life Sciences

8.5.6.5 Government & Defense

8.5.6.6 Media & Entertainment

8.5.6.7 Education

8.5.6.8 IT & Telecommunication

8.5.6.9 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hadoop-as-a-Service (HaaS) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment Type

8.6.4.1 Run It Yourself (RIY)

8.6.4.2 Pure Play (PP)

8.6.5 Historic and Forecasted Market Size by Organization Size

8.6.5.1 Small & Medium-sized Enterprises

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Manufacturing

8.6.6.2 BFSI

8.6.6.3 Retail & Consumer Goods

8.6.6.4 Healthcare & Life Sciences

8.6.6.5 Government & Defense

8.6.6.6 Media & Entertainment

8.6.6.7 Education

8.6.6.8 IT & Telecommunication

8.6.6.9 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hadoop-as-a-Service (HaaS) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment Type

8.7.4.1 Run It Yourself (RIY)

8.7.4.2 Pure Play (PP)

8.7.5 Historic and Forecasted Market Size by Organization Size

8.7.5.1 Small & Medium-sized Enterprises

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Manufacturing

8.7.6.2 BFSI

8.7.6.3 Retail & Consumer Goods

8.7.6.4 Healthcare & Life Sciences

8.7.6.5 Government & Defense

8.7.6.6 Media & Entertainment

8.7.6.7 Education

8.7.6.8 IT & Telecommunication

8.7.6.9 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hadoop-as-a-Service (HaaS) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 22.62 Bn. |

|

Forecast Period 2025-32 CAGR: |

39.6 % |

Market Size in 2032: |

USD 326.27 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Organization Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||