Graphite Fluoride Market Synopsis

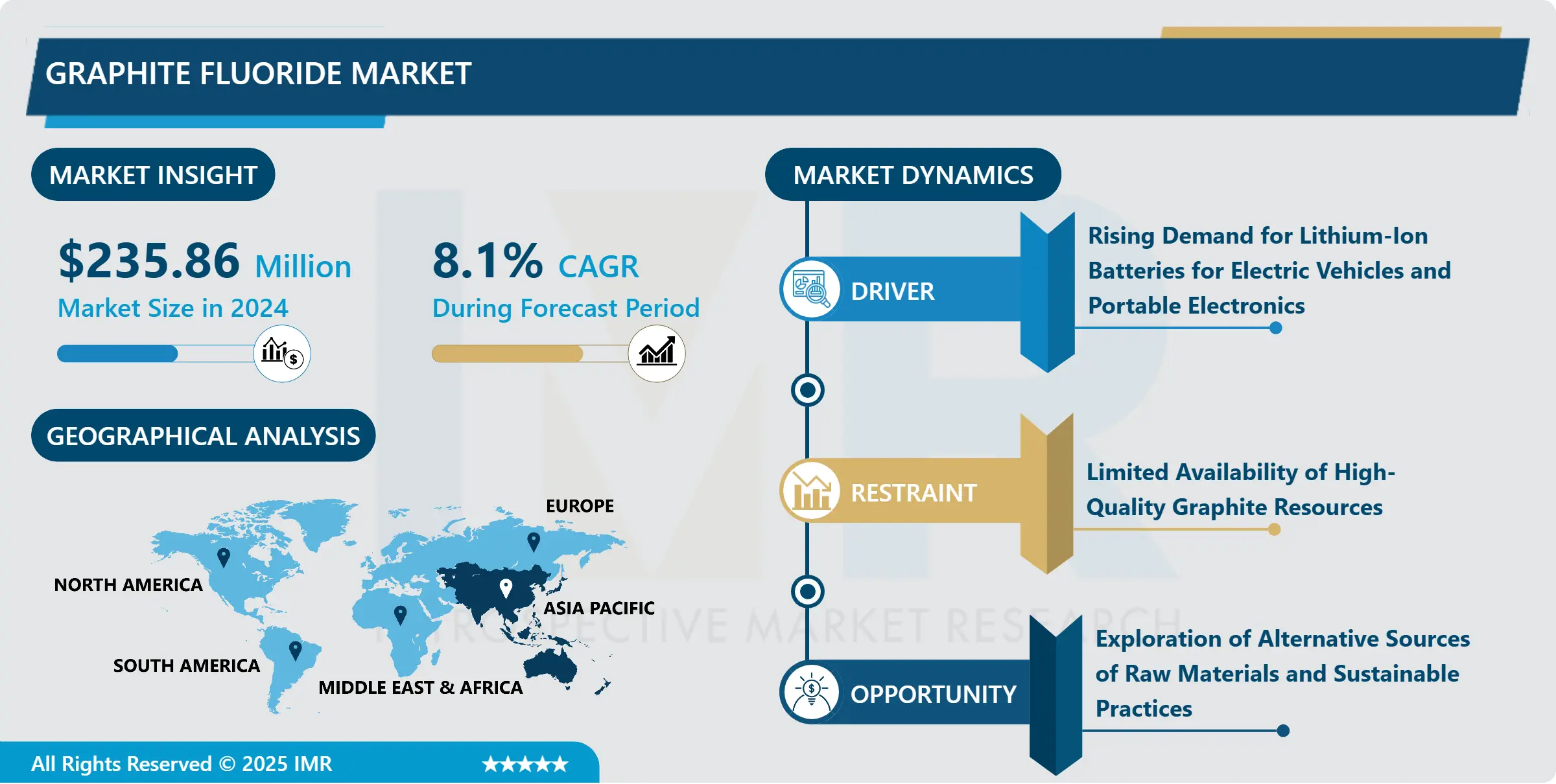

Global Graphite Fluoride Market Size Was Valued at USD 235.86 Million in 2024 and is Projected to Reach USD 555.57 Million by 2035, Growing at a CAGR of 8.1% From 2025-2035.

Graphite fluoride originates from the chemical reaction between graphite and fluorine gas, showcasing distinct characteristics like exceptional thermal stability, chemical inertness, and electrical conductivity. Its utilization spans various fields including lithium-ion batteries, lubrication, and serving as a precursor for generating carbon materials with tailored properties.

Graphite fluoride is widely utilized across industries owing to its distinctive properties. In energy storage applications, particularly in lithium-ion batteries, it offers significant advantages such as high thermal stability and electrical conductivity, which enhance battery performance and longevity. Additionally, as a lubricant additive, graphite fluoride contributes to decreased friction and improved wear resistance in mechanical systems, making it valuable in various industrial applications. Its chemical inertness renders it suitable for harsh operating conditions, including high temperatures and corrosive environments.

Its exceptional thermal stability ensures consistent performance in challenging environments, while its chemical inertness extends equipment lifespan and reduces maintenance needs. Moreover, its electrical conductivity enables efficient energy transfer, enhancing the overall effectiveness of electronic and energy storage systems. These inherent advantages position graphite fluoride as a preferred material for industries seeking high-performance solutions.

its increasing usage in emerging technologies and industries. With the global shift towards sustainable energy solutions and advanced materials, graphite fluoride's role in lithium-ion batteries and other energy storage systems is expected to expand further. Furthermore, ongoing research and development initiatives aimed at optimizing its properties and exploring novel applications will fuel the demand for graphite fluoride, solidifying its position as a crucial material in various technological advancements.

Graphite Fluoride Market Trend Analysis:

Rising Demand for Lithium-Ion Batteries for Electric Vehicles and Portable Electronics

- The increasing demand for lithium-ion batteries, primarily fueled by the growing adoption of electric vehicles (EVs) and portable electronics, acts as a significant catalyst for the expansion of the graphite fluoride market. Graphite fluoride assumes a pivotal role in lithium-ion battery technology, particularly in enhancing battery performance and durability. With the global surge in EV adoption driven by environmental considerations and government incentives, there arises a commensurate need for high-performance lithium-ion batteries, where graphite fluoride plays a crucial role in augmenting battery efficiency and stability.

- The widespread use of portable electronic devices like smartphones, laptops, and tablets drives the demand for lithium-ion batteries, consequently stimulating the growth of the graphite fluoride market. Leveraging its distinctive properties such as high thermal stability and electrical conductivity, graphite fluoride proves instrumental in improving the performance and reliability of lithium-ion batteries employed in these devices. With consumers increasingly demanding extended battery life and faster charging capabilities in their electronic gadgets, the demand for graphite fluoride is poised to witness steady growth in the foreseeable future.

- Ongoing advancements in lithium-ion battery technology and intensified research and development endeavors aimed at enhancing battery performance and energy density further propel the expansion of the graphite fluoride market. As manufacturers strive to devise more efficient and sustainable battery solutions to cater to evolving consumer needs and address environmental concerns, graphite fluoride continues to play a pivotal role in enhancing the overall performance and reliability of lithium-ion batteries, thus fostering the market's growth.

Exploration of Alternative Sources of Raw Materials and Sustainable Practices

- Exploring alternative raw material sources and integrating sustainable practices offer a significant growth opportunity for the graphite fluoride market. With industries increasingly emphasizing sustainability, there's a rising demand for eco-friendly substitutes to traditional raw materials in graphite fluoride production. By opting for renewable resources and implementing sustainable manufacturing techniques, firms can minimize their ecological impact and align with evolving consumer and regulatory expectations.

- Delving into alternative raw material sources fosters innovation and product advancement within the graphite fluoride sector. Researchers actively seek novel methods and materials, such as biomass-derived precursors and recycled graphite, to manufacture graphite fluoride. These endeavors not only reduce reliance on conventional materials but also pave the way for greener and more efficient production processes.

- Embracing sustainability across the graphite fluoride supply chain enhances market competitiveness and long-term viability. Companies prioritizing sustainability appeal to environmentally conscious consumers and forge alliances with eco-friendly brands. Through investments in renewable energy, waste reduction, and recycling initiatives, firms can distinguish themselves and tap into the growing demand for sustainable solutions. In essence, the pursuit of alternative raw materials and sustainable practices presents a compelling opportunity for the graphite fluoride market to align with global sustainability objectives and foster future growth.

Graphite Fluoride Market Segment Analysis:

Graphite Fluoride Market Segmented on the basis of Type and Application

By Type, Nanometer Grade segment is expected to dominate the market during the forecast period

- The dominance of the Graphite Fluoride Market is anticipated to be led by the Nanometer Grade segment. This segment primarily focuses on producing and utilizing graphite fluoride particles at the nanoscale, offering enhanced attributes and applications compared to standard grades. Nanometer-grade graphite fluoride showcases superior thermal stability, electrical conductivity, and chemical resistance, rendering it suitable for a myriad of advanced applications across industries such as electronics, aerospace, and energy storage.

- The Nanometer Grade segment leverages the escalating demand for high-performance materials in emerging technologies. As the need for smaller, lighter, and more efficient devices continues to rise, there is an increasing necessity for nanoscale materials like graphite fluoride. In sectors like electronics and energy storage, nanometer-grade graphite fluoride facilitates the creation of innovative products with heightened performance and functionality, thus propelling its dominance in the market. With industries persistently pursuing technological advancements, the Nanometer Grade segment is poised to witness sustained growth, driven by the perpetual demand for state-of-the-art materials and applications.

By Application, Lithium-Ion Battery Material segment held the largest share of 58.10% in 2024

- Graphite fluoride stands out as the primary material for lithium-ion batteries, propelling the expansion of the Graphite Fluoride Market. Its significance in the industry stems from its critical role in augmenting the effectiveness and endurance of lithium-ion batteries. Within lithium-ion battery cathodes, graphite fluoride plays a vital function by enhancing conductivity, stability, and overall battery efficacy. As the demand for lithium-ion batteries escalates across diverse sectors, notably in electric vehicles (EVs) and portable electronics, the market for graphite fluoride experiences a notable upsurge

- The widespread adoption of lithium-ion batteries in renewable energy storage systems adds impetus to the demand for graphite fluoride. With the global shift towards sustainable energy sources gaining momentum, the necessity for efficient and dependable energy storage solutions amplifies, thereby fueling the demand for high-performance lithium-ion batteries. Graphite fluoride's distinctive characteristics position it as the preferred option for enhancing the functionality and longevity of lithium-ion batteries, solidifying its dominance in the Graphite Fluoride Market within the realm of lithium-ion battery applications.

Graphite Fluoride Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is expected to emerge as the primary region for the expansion of the Graphite Fluoride market. The region's growing industrial sector, along with increased investments in research and development, is fueling the demand for advanced materials such as graphite fluoride. Moreover, Asia Pacific serves as a significant center for the production and utilization of lithium-ion batteries, which are crucial applications for graphite fluoride. The increasing adoption of electric vehicles and portable electronics in nations like China, Japan, and South Korea further contributes to the demand for graphite fluoride in the area.

- Governmental efforts to promote clean energy and sustainable technologies are driving the demand for graphite fluoride in Asia Pacific. Countries in the region are actively investing in renewable energy sources and energy storage solutions, fostering an environment conducive to the growth of the graphite fluoride market. With its expanding manufacturing capacities and advancements in technology, Asia Pacific is positioned to sustain its dominance in the graphite fluoride market, providing profitable opportunities for industry players and fostering innovation within the sector.

Graphite Fluoride Market Top Key Players:

- ACS Material LLC (U.S.)

- Sigma-Aldrich (U.S.)

- Noah Chemicals (U.S.)

- American Elements (U.S.)

- Merck KGaA (Germany)

- Fuzhou Topda New Material Co., Ltd. (China)

- Shandong Zhongshan Photoelectric Materials Co., Ltd (China)

- Hubei Zhuoxi Fluorochemical (China)

- Nanjing XFNANO Materials (China)

- Daikin Industries (Japan)

- Central Glass Co., Ltd. (Japan)

- Kanto Chemical Co., Inc. (Japan), and Other Major Players

Key Industry Developments in the Graphite Fluoride Market:

- In January 2022, Honeywell and Navin Fluorine International Limited part of the Padmanabh Mafatlal Group, announced a partnership to manufacture Honeywell’s proprietary Solstice range of hydrofluoroolefins (HFO) in India.

|

Global Graphite Fluoride Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 235.86 Mn. |

|

Forecast Period 2025-35 CAGR: |

8.1% |

Market Size in 2035: |

USD 555.57 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Graphite Fluoride Market by Type (2018-2035)

4.1 Graphite Fluoride Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Nanometer Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Micron Grade

Chapter 5: Graphite Fluoride Market by Application (2018-2035)

5.1 Graphite Fluoride Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Lithium-Ion Battery Material

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lubricating Oil Additive

5.5 Nuclear Reactor Neutron Moderator

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Graphite Fluoride Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CA TECHNOLOGIES

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BMC SOFTWARE

6.4 IBM

6.5 DELL

6.6 DYNATRACE

6.7 MICROSOFT

6.8 SPLUNKBASE

6.9 APPDYNAMICS

6.10 NEW RELIC

6.11 RIVERBED

Chapter 7: Global Graphite Fluoride Market By Region

7.1 Overview

7.2. North America Graphite Fluoride Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Nanometer Grade

7.2.4.2 Micron Grade

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Lithium-Ion Battery Material

7.2.5.2 Lubricating Oil Additive

7.2.5.3 Nuclear Reactor Neutron Moderator

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Graphite Fluoride Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Nanometer Grade

7.3.4.2 Micron Grade

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Lithium-Ion Battery Material

7.3.5.2 Lubricating Oil Additive

7.3.5.3 Nuclear Reactor Neutron Moderator

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Graphite Fluoride Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Nanometer Grade

7.4.4.2 Micron Grade

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Lithium-Ion Battery Material

7.4.5.2 Lubricating Oil Additive

7.4.5.3 Nuclear Reactor Neutron Moderator

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Graphite Fluoride Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Nanometer Grade

7.5.4.2 Micron Grade

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Lithium-Ion Battery Material

7.5.5.2 Lubricating Oil Additive

7.5.5.3 Nuclear Reactor Neutron Moderator

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Graphite Fluoride Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Nanometer Grade

7.6.4.2 Micron Grade

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Lithium-Ion Battery Material

7.6.5.2 Lubricating Oil Additive

7.6.5.3 Nuclear Reactor Neutron Moderator

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Graphite Fluoride Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Nanometer Grade

7.7.4.2 Micron Grade

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Lithium-Ion Battery Material

7.7.5.2 Lubricating Oil Additive

7.7.5.3 Nuclear Reactor Neutron Moderator

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Graphite Fluoride Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 235.86 Mn. |

|

Forecast Period 2025-35 CAGR: |

8.1% |

Market Size in 2035: |

USD 555.57 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||