Glycerine Market Synopsis:

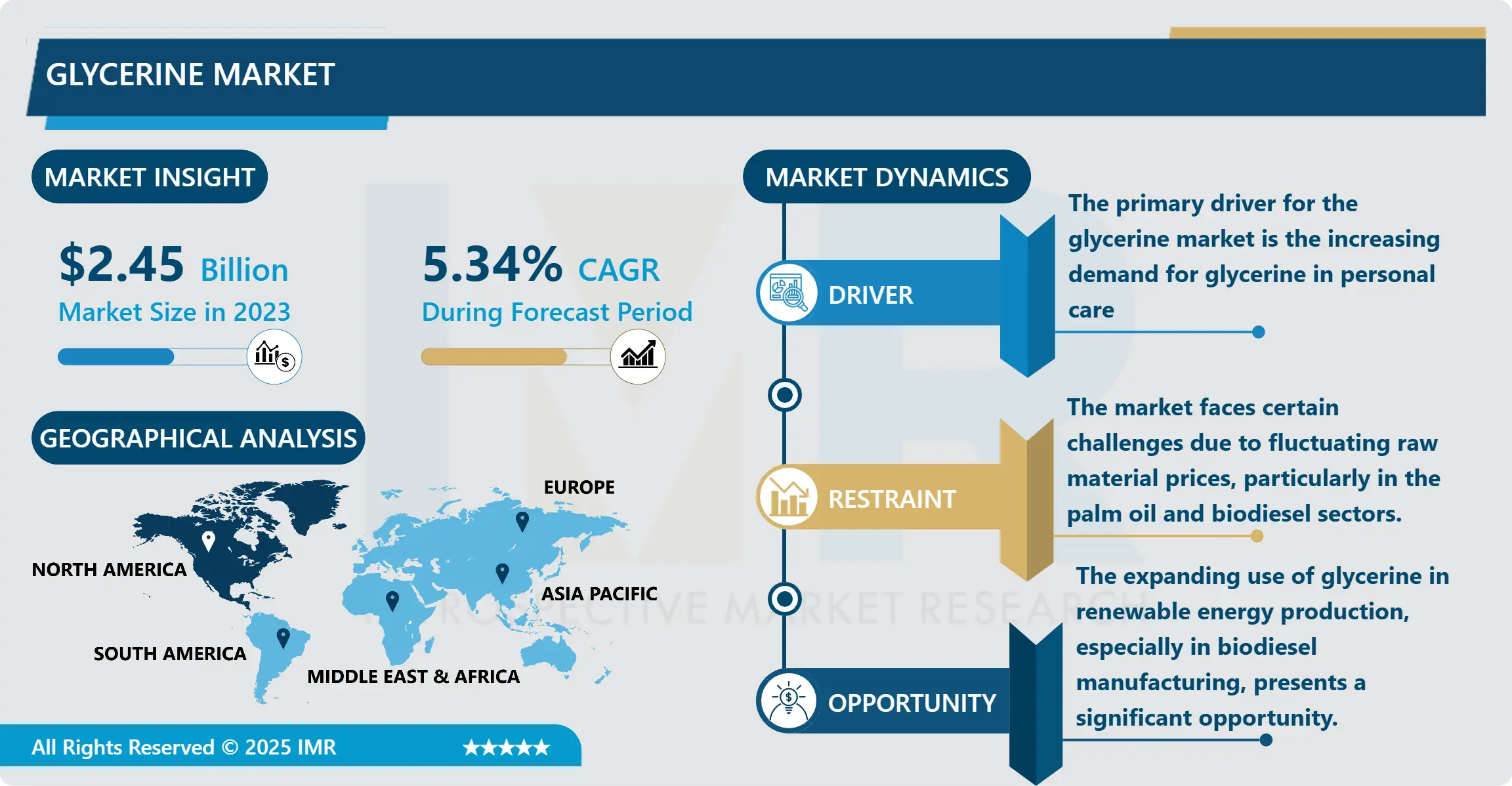

Glycerine Market Size Was Valued at USD 2.45 Billion in 2023, and is Projected to Reach USD 3.91 Billion by 2032, Growing at a CAGR of 5.34% From 2024-2032.

Glycerine or glycerol is a simple polyhydrate which has extensive application due to their properties like moisture retention, stability and non toxicity. It is generated naturally from oils and fats like palm oil and soy, or the residues of biodiesel process. Products including cosmetics, pharmaceuticals, food and beverages and chemical products use glycerine. It is added in production of lotions, creams, ointments, soaps, and other cosmetics and in pharmacy as a lubricant, sweetener and preservative. The extensive use of glycerine in various sectors and its non-toxicity also promotes market growth of glycerine substantially.

The market of glycerine has been growing persistently in several years due to the growing demand from different industries. The global market majorly exists due to the increasing usage of glycerine especially in the personal care and cosmetic products for their functionality as a moisturizer. Secondly, elevation in natural and organic goods demand has also played a role since glycerine is a natural conditioner. In addition, the pharma and F&B industries have effectively buoyed market demand because glycerine is in many cases employed as an anti-freeze, sweetener and preservative. Population increase alongside increased health and beauty innovations has made glycerine market to improve especially in developing nations.

Region wise Asia-Pacific is the largest consumer of glycerine followed by China, India & Indonesia. These nation-consumers have extensive manufacturing industries that apply glycerine to produce personal care products. Besides, Europe and North America have substantial demand in the glycerine market and especially in the pharmaceuticals and food industry. A growth in the biodiesel industry has also spurred the market for glycerine as biodiesel is one of the main producers of glycerine. However, time variance of raw materials particularly oil and palm oil may be regarded as threat to market growth. Nevertheless, the consumption is expected to rise further in future technically propelled development in production techniques, higher demands from the industries and consumers in the international markets for environmentally friendly products such as glycerine.

Glycerine Market Trend Analysis:

Rise of Natural and Organic Products

-

One of the most popular trends which are pushing the glycerine market is the usage of natural and organically derived products in the market. The consumer is increasingly getting aware of the contents of personal care, cosmetics and food substances and thus switching to natural and environmental friendly products. Glycerine also belongs to this trend — it is a natural compound that cannot be associated with the creation of harmful products.

- In personal care products it is used as a humectant, which aids in the retention of water in the formulas, which is good for care product formulations particularly in this era of more natural and non-harsh ingredients. Globally, there is a growing demand in natural additives to replace the synthetic chemicals, especially in the food and beverage industries; glycerine meets this criteria. That’s why the consumption of glycerine in organic products could increase in the future due to the trends in sustainable and healthy consumption.

Expanding Applications in Biofuels and Industrial Uses

-

Without doubt, probably the most promising trend in the glycerine market is the use of glycerine as feedstock in the manufacture of biofuels, especially biodiesel. Glycerine is a by product of biodiesel and as the world shifts to renewable energy sources the production of biodiesel is likely to increase.

- It is favourable that biodiesel production enhances the availability of glycerine that is useful in many industries such as pharmaceuticals, body products and foods. Besides, there are other uses of glycerine as an industrial product, which include the use in the production of plastics, paints and adhesives. Another key application of glycerine is utilised in the renewable energy segment in the increasing industrial sector, thus offering tremendous scope for market development. Thirdly, the advancement in techniques of making glycerine and the increased funding in organic sourcing may enhance the market opportunities in the next years.

Glycerine Market Segment Analysis:

Glycerine Market is Segmented on the basis of Source, Application, End User, and Region

By Source, Vegetable-based Glycerine segment is expected to dominate the market during the forecast period

-

Commercially, glycerine can be obtained from various products with the main divisions being vegetable glycerine, animal glycerine and synthetic glycerines. Vegetable glycerine on the other hand is made from plant oils including palm oil, soy bean oil, and coconut oil this makes it a product of choice for industries that deal with natural products. This material is frequently utilized in the production of personal care products and cosmetics due to its non toxicity and moisturizing effect; the production method follows the global trend of novel products containing natural components.

- Glycerine that is obtained from animal fat, mainly used for industries that pull high purity of glycerine is referred. However, its use has been gradually displaced by vegetable-based glycerine in many markets more so due to concerns in the morality of the use of animal-derived products. Synthetic glycerine, however, is manufactured through chemical means, and frequently comes from petroleum. Despite being cheaper and using it widely especially in industries, the market demand is comparatively low than vegetable glycerine owing to the increasing trends on Organic and plant sources.

By Application, chemicals segment expected to held the largest share

-

The glycerine market is quite popular in many industries including personal care and cosmetics with holding large market share. Glycerine is also appreciated in the sector for its emollient, skin Soothing and non-toxic benefits, making it a common additive in skincare, hair care and beauty aids including lotions, soaps and creams. Also, in the pharmaceutical industry, glycerine acts as a as a laxative, solvent and also a excipient used in formulation of various medicines hence fuelling its demand. Contained uses targeting application in the food and beverages are also are also other important roles played by glycerine, including use as sweetener, preservative, and humectant especially in low calorie and sugar-free products.

- Other examples of the application of this chemical compound are in the tobacco industry where glycerine is used in effort to improve moisture in tobaccos. In biofuels glycerine is obtained as a by-product in the biodiesel industries and together with the increasing trend toward the use of renewable energy sources, the demand for biodiesel is also on the rise. The chemical industry also uses glycerine in the synthesis of several chemicals such as plastics, resins and all forms of adhesive substances. Last of all, there are other uses of glycerine in textile, paint, leather industries due to solvent and plasticizer nature of glycerine that is why it is a versatile compound for a number of trades.

Glycerine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- As per the analysis of the market promising regions in the Asia-Pacific will hold the largest share in glycerine consumption around the world through 2023. This is chiefly attributed the high demand originating from buyers such as China, India and Indonesia, the product being used in cosmetics and personal care products, pharmaceuticals and the food and beverages sector. Furthermore, there is growth of biodiesel and this activity has produced glycerine in the Asia-Pacific region.

- Consequently, exporting countries in this region have turned to glycerine exporting, which has a positive influence on the market. It is forecast that in 2023 Asia-Pacific region will account for 40-45% of the global market of glycerine and will remain the leader among the consuming and producing countries. This trend is expected to persist in the future due to the mature industrial development in the manufacturing sector, the expanding application of the material in industries, and evident consumption trends in the developing countries.

Active Key Players in the Glycerine Market:

- AAK AB (Sweden)

- Archer Daniels Midland Company (USA)

- BASF SE (Germany)

- Cargill, Incorporated (USA)

- Croda International PLC (UK)

- Emery Oleochemicals (Malaysia)

- GODAVARI Biorefineries Ltd. (India)

- Kraton Polymers (USA)

- KLK OLEO (Malaysia)

- P&G Chemicals (USA)

- PTT Group (Thailand)

- REPSOL SA (Spain)

- Solvay S.A. (Belgium)

- Wilmar International Ltd. (Singapore)

- ZF Biosciences (India)

- Other Active Players

|

Glycerine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.45 Billion |

|

Forecast Period 2024-32 CAGR: |

5.34% |

Market Size in 2032: |

USD 3.91 Billion |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glycerine Market by Source

4.1 Glycerine Market Snapshot and Growth Engine

4.2 Glycerine Market Overview

4.3 Vegetable-based Glycerine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Vegetable-based Glycerine: Geographic Segmentation Analysis

4.4 Animal-based Glycerine

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Animal-based Glycerine: Geographic Segmentation Analysis

4.5 Synthetic Glycerine

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Synthetic Glycerine: Geographic Segmentation Analysis

Chapter 5: Glycerine Market by Application

5.1 Glycerine Market Snapshot and Growth Engine

5.2 Glycerine Market Overview

5.3 Personal Care & Cosmetics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Personal Care & Cosmetics: Geographic Segmentation Analysis

5.4 Pharmaceuticals

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pharmaceuticals: Geographic Segmentation Analysis

5.5 Food & Beverages

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Food & Beverages: Geographic Segmentation Analysis

5.6 Tobacco

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Tobacco: Geographic Segmentation Analysis

5.7 Biofuels

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Biofuels: Geographic Segmentation Analysis

5.8 Chemicals

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Chemicals: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Glycerine Market by End User

6.1 Glycerine Market Snapshot and Growth Engine

6.2 Glycerine Market Overview

6.3 Cosmetics & Personal Care

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cosmetics & Personal Care: Geographic Segmentation Analysis

6.4 Pharmaceutical

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pharmaceutical: Geographic Segmentation Analysis

6.5 Food & Beverages

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Food & Beverages: Geographic Segmentation Analysis

6.6 Industrial (Chemicals

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial (Chemicals: Geographic Segmentation Analysis

6.7 Biofuels

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Biofuels: Geographic Segmentation Analysis

6.8 etc

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 etc: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Glycerine Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AAK AB (SWEDEN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARCHER DANIELS MIDLAND COMPANY (USA)

7.4 BASF SE (GERMANY)

7.5 CARGILL INCORPORATED (USA)

7.6 CRODA INTERNATIONAL PLC (UK)

7.7 EMERY OLEOCHEMICALS (MALAYSIA)

7.8 GODAVARI BIOREFINERIES LTD. (INDIA)

7.9 KRATON POLYMERS (USA)

7.10 KLK OLEO (MALAYSIA)

7.11 P&G CHEMICALS (USA)

7.12 PTT GROUP (THAILAND)

7.13 REPSOL SA (SPAIN)

7.14 SOLVAY S.A. (BELGIUM)

7.15 WILMAR INTERNATIONAL LTD. (SINGAPORE)

7.16 ZF BIOSCIENCES (INDIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Glycerine Market By Region

8.1 Overview

8.2. North America Glycerine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Source

8.2.4.1 Vegetable-based Glycerine

8.2.4.2 Animal-based Glycerine

8.2.4.3 Synthetic Glycerine

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Personal Care & Cosmetics

8.2.5.2 Pharmaceuticals

8.2.5.3 Food & Beverages

8.2.5.4 Tobacco

8.2.5.5 Biofuels

8.2.5.6 Chemicals

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Cosmetics & Personal Care

8.2.6.2 Pharmaceutical

8.2.6.3 Food & Beverages

8.2.6.4 Industrial (Chemicals

8.2.6.5 Biofuels

8.2.6.6 etc

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Glycerine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Source

8.3.4.1 Vegetable-based Glycerine

8.3.4.2 Animal-based Glycerine

8.3.4.3 Synthetic Glycerine

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Personal Care & Cosmetics

8.3.5.2 Pharmaceuticals

8.3.5.3 Food & Beverages

8.3.5.4 Tobacco

8.3.5.5 Biofuels

8.3.5.6 Chemicals

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Cosmetics & Personal Care

8.3.6.2 Pharmaceutical

8.3.6.3 Food & Beverages

8.3.6.4 Industrial (Chemicals

8.3.6.5 Biofuels

8.3.6.6 etc

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Glycerine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Source

8.4.4.1 Vegetable-based Glycerine

8.4.4.2 Animal-based Glycerine

8.4.4.3 Synthetic Glycerine

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Personal Care & Cosmetics

8.4.5.2 Pharmaceuticals

8.4.5.3 Food & Beverages

8.4.5.4 Tobacco

8.4.5.5 Biofuels

8.4.5.6 Chemicals

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Cosmetics & Personal Care

8.4.6.2 Pharmaceutical

8.4.6.3 Food & Beverages

8.4.6.4 Industrial (Chemicals

8.4.6.5 Biofuels

8.4.6.6 etc

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Glycerine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Source

8.5.4.1 Vegetable-based Glycerine

8.5.4.2 Animal-based Glycerine

8.5.4.3 Synthetic Glycerine

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Personal Care & Cosmetics

8.5.5.2 Pharmaceuticals

8.5.5.3 Food & Beverages

8.5.5.4 Tobacco

8.5.5.5 Biofuels

8.5.5.6 Chemicals

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Cosmetics & Personal Care

8.5.6.2 Pharmaceutical

8.5.6.3 Food & Beverages

8.5.6.4 Industrial (Chemicals

8.5.6.5 Biofuels

8.5.6.6 etc

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Glycerine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Source

8.6.4.1 Vegetable-based Glycerine

8.6.4.2 Animal-based Glycerine

8.6.4.3 Synthetic Glycerine

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Personal Care & Cosmetics

8.6.5.2 Pharmaceuticals

8.6.5.3 Food & Beverages

8.6.5.4 Tobacco

8.6.5.5 Biofuels

8.6.5.6 Chemicals

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Cosmetics & Personal Care

8.6.6.2 Pharmaceutical

8.6.6.3 Food & Beverages

8.6.6.4 Industrial (Chemicals

8.6.6.5 Biofuels

8.6.6.6 etc

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Glycerine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Source

8.7.4.1 Vegetable-based Glycerine

8.7.4.2 Animal-based Glycerine

8.7.4.3 Synthetic Glycerine

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Personal Care & Cosmetics

8.7.5.2 Pharmaceuticals

8.7.5.3 Food & Beverages

8.7.5.4 Tobacco

8.7.5.5 Biofuels

8.7.5.6 Chemicals

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Cosmetics & Personal Care

8.7.6.2 Pharmaceutical

8.7.6.3 Food & Beverages

8.7.6.4 Industrial (Chemicals

8.7.6.5 Biofuels

8.7.6.6 etc

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Glycerine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.45 Billion |

|

Forecast Period 2024-32 CAGR: |

5.34% |

Market Size in 2032: |

USD 3.91 Billion |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||