Foam Cooler Box Market Synopsis:

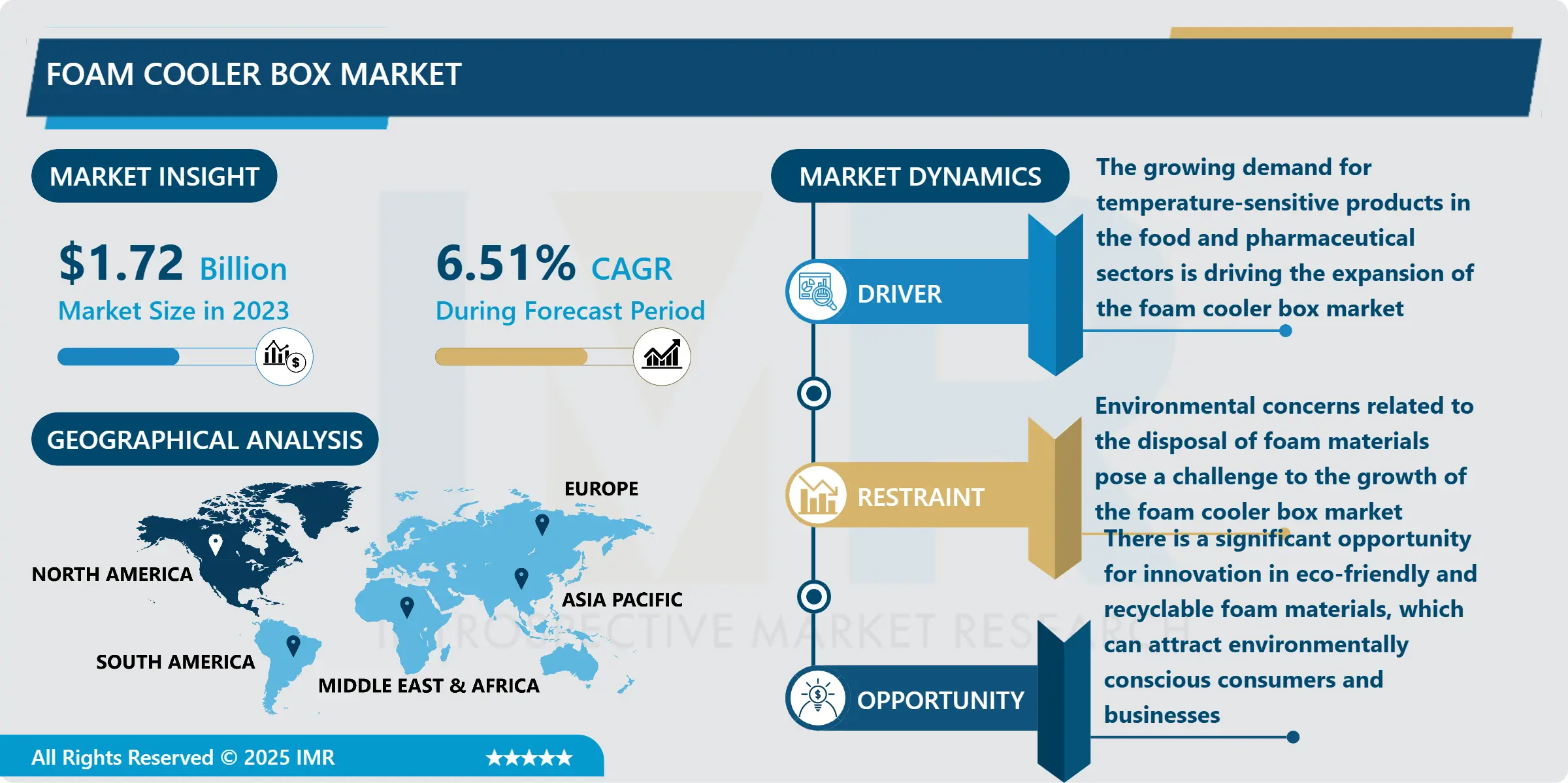

Foam Cooler Box Market Size Was Valued at USD 1.72 Billion in 2023, and is Projected to Reach USD 3.04 Billion by 2032, Growing at a CAGR of 6.51% From 2024-2032.

The foam cooler box market is an essential segment within the packaging industry, primarily catering to the transportation and storage of temperature-sensitive products. These cooler boxes, made from expanded polystyrene (EPS) or polyurethane foam, provide excellent insulation properties, ensuring that perishable goods, pharmaceuticals, and other temperature-sensitive items remain at optimal conditions during transit. The growing demand for fresh food, pharmaceuticals, and biopharmaceutical products has significantly propelled the need for efficient packaging solutions, driving the foam cooler box market's expansion.

· One of the key drivers of the foam cooler box market is the increasing focus on e-commerce and home delivery services, particularly in the food and healthcare sectors. As consumers demand fresh produce and temperature-controlled pharmaceuticals delivered directly to their doors, the necessity for reliable and effective packaging solutions has surged. Additionally, the rising awareness of food safety regulations and the importance of maintaining product integrity during transportation are further fueling the demand for foam cooler boxes. Manufacturers are continuously innovating to enhance the design and functionality of these packaging solutions, ensuring they meet the specific needs of various industries.

· Geographically, North America holds a significant share of the foam cooler box market, driven by a robust logistics infrastructure and a well-established food and pharmaceutical sector. However, the Asia-Pacific region is anticipated to witness the highest growth rate, fueled by rapid urbanization, an expanding middle class, and increasing e-commerce activities. As sustainability becomes a more pressing concern, manufacturers are also exploring eco-friendly alternatives and recycling options for foam cooler boxes, positioning themselves to meet the evolving demands of both consumers and regulatory bodies in the years to come.

Foam Cooler Box Market Trend Analysis:

Growing Demand for Eco-Friendly Packaging Solutions

· As environmental concerns rise, the foam cooler box market is witnessing a significant shift towards sustainable and eco-friendly packaging alternatives. Manufacturers are increasingly developing recyclable and biodegradable foam materials to meet consumer demand for environmentally responsible options. This trend not only helps reduce waste and minimize environmental impact but also aligns with corporate sustainability goals, positioning brands favorably in a market that prioritizes eco-conscious practices.

Technological Advancements in Insulation Materials

· Technological advancements in insulation materials are revolutionizing the foam cooler box market by enhancing thermal performance and durability. Innovations such as advanced multi-layer insulation and improved foam formulations are being integrated into cooler box designs, providing superior temperature retention and protection for sensitive products. These enhancements enable longer transit times and greater reliability in maintaining product integrity, driving adoption in industries like pharmaceuticals, food delivery, and logistics.

Foam Cooler Box Market Segment Analysis:

Foam Cooler Box Market is Segmented on the basis of Product Type, Capacity, Application, Distribution Channel, End User, Material Type, and Region

By Product Type, Hard Body Coolers segment is expected to dominate the market during the forecast period

· The foam cooler box market can be segmented by product type into hard body coolers, soft body coolers, and others. Hard body coolers are typically made from durable materials such as polyethylene, with foam insulation for superior thermal retention, making them ideal for outdoor activities and long-distance transportation of perishable goods. In contrast, soft body coolers are lightweight and often constructed with insulated fabric, offering flexibility and convenience for everyday use, such as picnics or short trips. Additionally, the "others" category includes specialized coolers designed for specific applications, such as pharmaceutical transport or catering, which require tailored insulation solutions. This diverse range of product types caters to various consumer needs, driving growth across different segments of the foam cooler box market.

By Application, Camping segment expected to held the largest share

· The foam cooler box market is segmented by application and distribution channel, catering to various consumer needs. In terms of application, the market includes camping, fishing, hunting, and others, with camping and fishing being the primary drivers due to the rising popularity of outdoor recreational activities. Foam cooler boxes are favored in these settings for their lightweight, portable design, and excellent insulation properties, ensuring that food and beverages stay cool for extended periods. Additionally, the distribution channels for foam cooler boxes are divided into online and offline segments. The online distribution channel is experiencing significant growth, driven by the convenience of e-commerce and the ability to reach a broader audience, while offline channels, including retail stores and specialty outdoor shops, remain essential for hands-on customer experiences and immediate product availability. Together, these segments reflect the diverse applications and purchasing preferences shaping the foam cooler box market.

Foam Cooler Box Market Regional Insights:

North America held the dominant market share in 2024

· In 2024, North America held the dominant market share in the foam cooler box market, driven by its robust logistics infrastructure and well-established food and pharmaceutical sectors. The region's extensive distribution networks and strong emphasis on food safety regulations have propelled the demand for reliable temperature-controlled packaging solutions. Additionally, the increasing popularity of e-commerce and home delivery services, particularly for perishable goods, has further reinforced the need for effective foam cooler boxes. As companies seek to ensure the integrity of temperature-sensitive products during transit, North America's leadership in the market is expected to continue, supported by ongoing innovations and investments in packaging technology.

Active Key Players in the Foam Cooler Box Market:

· YETI Coolers (United States)

· Icemule Coolers (United States)

· Lifetime Products (United States)

· Bison Coolers (United States)

· OtterBox (United States)

· Husky Corporation (United States)

· Scepter (Canada)

· Igloo Products (United States)

· RTIC Outdoors (United States)

· Pelican Products (United States)

· Cambro Manufacturing (United States)

· Coleman (United States)

· Orca Coolers (United States)

· Rubbermaid (United States)

· Engel Coolers (United States)

· Other Active Players

|

Global Foam Cooler Box Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.72 Billion |

|

Forecast Period 2024-32 CAGR: |

6.51% |

Market Size in 2032: |

USD 3.04 Billion |

|

Segments Covered: |

By Product Type |

· Hard Body Coolers · Soft Body Coolers · Others |

|

|

By Capacity |

· Up to 20 Quarts · 21-40 Quarts · 41-60 Quarts · 61-80 Quarts · 1-100 Quarts · Above 100 Quarts · Others |

||

|

By Application |

· Camping · Fishing · Hunting · Others |

||

|

By Distribution Channel |

· Online · Offline |

||

|

By End User |

· Residential · Commercial |

||

|

By Material Type |

· Polyurethane Foam · Polystyrene Foam · Polyethylene Foam · Others |

||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) |

||

|

Key Market Drivers: |

· The growing demand for temperature-sensitive products in the food and pharmaceutical sectors is driving the expansion of the foam cooler box market. |

||

|

Key Market Restraints: |

· Environmental concerns related to the disposal of foam materials pose a challenge to the growth of the foam cooler box market. |

||

|

Key Opportunities: |

· There is a significant opportunity for innovation in eco-friendly and recyclable foam materials, which can attract environmentally conscious consumers and businesses. |

||

|

Companies Covered in the report: |

· YETI Coolers (United States), Icemule Coolers (United States), Lifetime Products (United States), Bison Coolers (United States), OtterBox (United States), Husky Corporation (United States), Scepter (Canada), Igloo Products (United States), RTIC Outdoors (United States), Pelican Products (United States), Cambro Manufacturing (United States), Coleman (United States), Orca Coolers (United States), Rubbermaid (United States), Engel Coolers (United States). |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Foam Cooler Box Market by Product Type

4.1 Foam Cooler Box Market Snapshot and Growth Engine

4.2 Foam Cooler Box Market Overview

4.3 Hard Body Coolers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hard Body Coolers: Geographic Segmentation Analysis

4.4 Soft Body Coolers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Soft Body Coolers: Geographic Segmentation Analysis

4.5 and Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Others: Geographic Segmentation Analysis

Chapter 5: Foam Cooler Box Market by Capacity

5.1 Foam Cooler Box Market Snapshot and Growth Engine

5.2 Foam Cooler Box Market Overview

5.3 Up to 20 Quarts

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Up to 20 Quarts: Geographic Segmentation Analysis

5.4 21-40 Quarts

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 21-40 Quarts: Geographic Segmentation Analysis

5.5 41-60 Quarts

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 41-60 Quarts: Geographic Segmentation Analysis

5.6 61-80 Quarts

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 61-80 Quarts: Geographic Segmentation Analysis

5.7 1-100 Quarts

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 1-100 Quarts: Geographic Segmentation Analysis

5.8 Above 100 Quarts

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Above 100 Quarts: Geographic Segmentation Analysis

5.9 and Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 and Others: Geographic Segmentation Analysis

Chapter 6: Foam Cooler Box Market by Application

6.1 Foam Cooler Box Market Snapshot and Growth Engine

6.2 Foam Cooler Box Market Overview

6.3 Camping

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Camping: Geographic Segmentation Analysis

6.4 Fishing

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fishing: Geographic Segmentation Analysis

6.5 Hunting

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Hunting: Geographic Segmentation Analysis

6.6 and Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Others: Geographic Segmentation Analysis

Chapter 7: Foam Cooler Box Market by Distribution Channel

7.1 Foam Cooler Box Market Snapshot and Growth Engine

7.2 Foam Cooler Box Market Overview

7.3 Online and Offline

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Online and Offline: Geographic Segmentation Analysis

Chapter 8: Foam Cooler Box Market by End User

8.1 Foam Cooler Box Market Snapshot and Growth Engine

8.2 Foam Cooler Box Market Overview

8.3 Residential and Commercial

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Residential and Commercial: Geographic Segmentation Analysis

Chapter 9: Foam Cooler Box Market by Material Type

9.1 Foam Cooler Box Market Snapshot and Growth Engine

9.2 Foam Cooler Box Market Overview

9.3 Polyurethane Foam

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Polyurethane Foam: Geographic Segmentation Analysis

9.4 Polystyrene Foam

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Polystyrene Foam: Geographic Segmentation Analysis

9.5 Polyethylene Foam

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Polyethylene Foam: Geographic Segmentation Analysis

9.6 and Others

9.6.1 Introduction and Market Overview

9.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.6.3 Key Market Trends, Growth Factors and Opportunities

9.6.4 and Others: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Foam Cooler Box Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 YETI COOLERS (UNITED STATES)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 ICEMULE COOLERS (UNITED STATES)

10.4 LIFETIME PRODUCTS (UNITED STATES)

10.5 BISON COOLERS (UNITED STATES)

10.6 OTTERBOX (UNITED STATES)

10.7 HUSKY CORPORATION (UNITED STATES)

10.8 SCEPTER (CANADA)

10.9 IGLOO PRODUCTS (UNITED STATES)

10.10 RTIC OUTDOORS (UNITED STATES)

10.11 PELICAN PRODUCTS (UNITED STATES)

10.12 CAMBRO MANUFACTURING (UNITED STATES)

10.13 COLEMAN (UNITED STATES)

10.14 ORCA COOLERS (UNITED STATES)

10.15 RUBBERMAID (UNITED STATES)

10.16 ENGEL COOLERS (UNITED STATES)

10.17 OTHER ACTIVE PLAYERS

Chapter 11: Global Foam Cooler Box Market By Region

11.1 Overview

11.2. North America Foam Cooler Box Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Product Type

11.2.4.1 Hard Body Coolers

11.2.4.2 Soft Body Coolers

11.2.4.3 and Others

11.2.5 Historic and Forecasted Market Size By Capacity

11.2.5.1 Up to 20 Quarts

11.2.5.2 21-40 Quarts

11.2.5.3 41-60 Quarts

11.2.5.4 61-80 Quarts

11.2.5.5 1-100 Quarts

11.2.5.6 Above 100 Quarts

11.2.5.7 and Others

11.2.6 Historic and Forecasted Market Size By Application

11.2.6.1 Camping

11.2.6.2 Fishing

11.2.6.3 Hunting

11.2.6.4 and Others

11.2.7 Historic and Forecasted Market Size By Distribution Channel

11.2.7.1 Online and Offline

11.2.8 Historic and Forecasted Market Size By End User

11.2.8.1 Residential and Commercial

11.2.9 Historic and Forecasted Market Size By Material Type

11.2.9.1 Polyurethane Foam

11.2.9.2 Polystyrene Foam

11.2.9.3 Polyethylene Foam

11.2.9.4 and Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Foam Cooler Box Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Product Type

11.3.4.1 Hard Body Coolers

11.3.4.2 Soft Body Coolers

11.3.4.3 and Others

11.3.5 Historic and Forecasted Market Size By Capacity

11.3.5.1 Up to 20 Quarts

11.3.5.2 21-40 Quarts

11.3.5.3 41-60 Quarts

11.3.5.4 61-80 Quarts

11.3.5.5 1-100 Quarts

11.3.5.6 Above 100 Quarts

11.3.5.7 and Others

11.3.6 Historic and Forecasted Market Size By Application

11.3.6.1 Camping

11.3.6.2 Fishing

11.3.6.3 Hunting

11.3.6.4 and Others

11.3.7 Historic and Forecasted Market Size By Distribution Channel

11.3.7.1 Online and Offline

11.3.8 Historic and Forecasted Market Size By End User

11.3.8.1 Residential and Commercial

11.3.9 Historic and Forecasted Market Size By Material Type

11.3.9.1 Polyurethane Foam

11.3.9.2 Polystyrene Foam

11.3.9.3 Polyethylene Foam

11.3.9.4 and Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Foam Cooler Box Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Product Type

11.4.4.1 Hard Body Coolers

11.4.4.2 Soft Body Coolers

11.4.4.3 and Others

11.4.5 Historic and Forecasted Market Size By Capacity

11.4.5.1 Up to 20 Quarts

11.4.5.2 21-40 Quarts

11.4.5.3 41-60 Quarts

11.4.5.4 61-80 Quarts

11.4.5.5 1-100 Quarts

11.4.5.6 Above 100 Quarts

11.4.5.7 and Others

11.4.6 Historic and Forecasted Market Size By Application

11.4.6.1 Camping

11.4.6.2 Fishing

11.4.6.3 Hunting

11.4.6.4 and Others

11.4.7 Historic and Forecasted Market Size By Distribution Channel

11.4.7.1 Online and Offline

11.4.8 Historic and Forecasted Market Size By End User

11.4.8.1 Residential and Commercial

11.4.9 Historic and Forecasted Market Size By Material Type

11.4.9.1 Polyurethane Foam

11.4.9.2 Polystyrene Foam

11.4.9.3 Polyethylene Foam

11.4.9.4 and Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Foam Cooler Box Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Product Type

11.5.4.1 Hard Body Coolers

11.5.4.2 Soft Body Coolers

11.5.4.3 and Others

11.5.5 Historic and Forecasted Market Size By Capacity

11.5.5.1 Up to 20 Quarts

11.5.5.2 21-40 Quarts

11.5.5.3 41-60 Quarts

11.5.5.4 61-80 Quarts

11.5.5.5 1-100 Quarts

11.5.5.6 Above 100 Quarts

11.5.5.7 and Others

11.5.6 Historic and Forecasted Market Size By Application

11.5.6.1 Camping

11.5.6.2 Fishing

11.5.6.3 Hunting

11.5.6.4 and Others

11.5.7 Historic and Forecasted Market Size By Distribution Channel

11.5.7.1 Online and Offline

11.5.8 Historic and Forecasted Market Size By End User

11.5.8.1 Residential and Commercial

11.5.9 Historic and Forecasted Market Size By Material Type

11.5.9.1 Polyurethane Foam

11.5.9.2 Polystyrene Foam

11.5.9.3 Polyethylene Foam

11.5.9.4 and Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Foam Cooler Box Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Product Type

11.6.4.1 Hard Body Coolers

11.6.4.2 Soft Body Coolers

11.6.4.3 and Others

11.6.5 Historic and Forecasted Market Size By Capacity

11.6.5.1 Up to 20 Quarts

11.6.5.2 21-40 Quarts

11.6.5.3 41-60 Quarts

11.6.5.4 61-80 Quarts

11.6.5.5 1-100 Quarts

11.6.5.6 Above 100 Quarts

11.6.5.7 and Others

11.6.6 Historic and Forecasted Market Size By Application

11.6.6.1 Camping

11.6.6.2 Fishing

11.6.6.3 Hunting

11.6.6.4 and Others

11.6.7 Historic and Forecasted Market Size By Distribution Channel

11.6.7.1 Online and Offline

11.6.8 Historic and Forecasted Market Size By End User

11.6.8.1 Residential and Commercial

11.6.9 Historic and Forecasted Market Size By Material Type

11.6.9.1 Polyurethane Foam

11.6.9.2 Polystyrene Foam

11.6.9.3 Polyethylene Foam

11.6.9.4 and Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Foam Cooler Box Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Product Type

11.7.4.1 Hard Body Coolers

11.7.4.2 Soft Body Coolers

11.7.4.3 and Others

11.7.5 Historic and Forecasted Market Size By Capacity

11.7.5.1 Up to 20 Quarts

11.7.5.2 21-40 Quarts

11.7.5.3 41-60 Quarts

11.7.5.4 61-80 Quarts

11.7.5.5 1-100 Quarts

11.7.5.6 Above 100 Quarts

11.7.5.7 and Others

11.7.6 Historic and Forecasted Market Size By Application

11.7.6.1 Camping

11.7.6.2 Fishing

11.7.6.3 Hunting

11.7.6.4 and Others

11.7.7 Historic and Forecasted Market Size By Distribution Channel

11.7.7.1 Online and Offline

11.7.8 Historic and Forecasted Market Size By End User

11.7.8.1 Residential and Commercial

11.7.9 Historic and Forecasted Market Size By Material Type

11.7.9.1 Polyurethane Foam

11.7.9.2 Polystyrene Foam

11.7.9.3 Polyethylene Foam

11.7.9.4 and Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Foam Cooler Box Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.72 Billion |

|

Forecast Period 2024-32 CAGR: |

6.51% |

Market Size in 2032: |

USD 3.04 Billion |

|

Segments Covered: |

By Product Type |

· Hard Body Coolers · Soft Body Coolers · Others |

|

|

By Capacity |

· Up to 20 Quarts · 21-40 Quarts · 41-60 Quarts · 61-80 Quarts · 1-100 Quarts · Above 100 Quarts · Others |

||

|

By Application |

· Camping · Fishing · Hunting · Others |

||

|

By Distribution Channel |

· Online · Offline |

||

|

By End User |

· Residential · Commercial |

||

|

By Material Type |

· Polyurethane Foam · Polystyrene Foam · Polyethylene Foam · Others |

||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) |

||

|

Key Market Drivers: |

· The growing demand for temperature-sensitive products in the food and pharmaceutical sectors is driving the expansion of the foam cooler box market. |

||

|

Key Market Restraints: |

· Environmental concerns related to the disposal of foam materials pose a challenge to the growth of the foam cooler box market. |

||

|

Key Opportunities: |

· There is a significant opportunity for innovation in eco-friendly and recyclable foam materials, which can attract environmentally conscious consumers and businesses. |

||

|

Companies Covered in the report: |

· YETI Coolers (United States), Icemule Coolers (United States), Lifetime Products (United States), Bison Coolers (United States), OtterBox (United States), Husky Corporation (United States), Scepter (Canada), Igloo Products (United States), RTIC Outdoors (United States), Pelican Products (United States), Cambro Manufacturing (United States), Coleman (United States), Orca Coolers (United States), Rubbermaid (United States), Engel Coolers (United States). |

||