Global Fireproofing Materials Market Overview

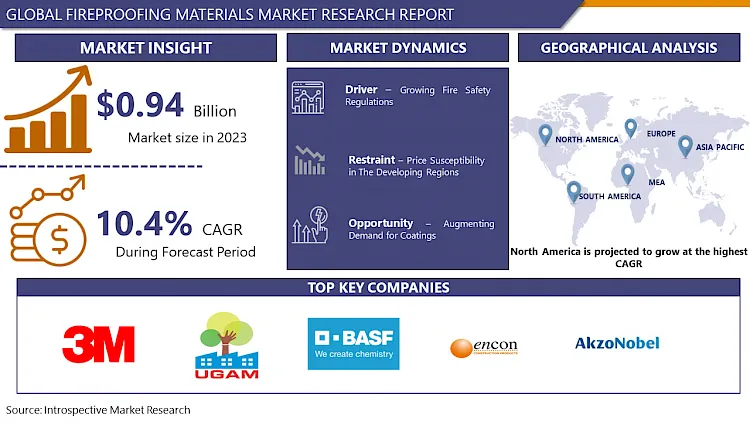

Global Fireproofing Materials Market was valued at USD 0.94 billion in 2023 and is expected to reach USD 2.29 billion by the year 2032, at a CAGR of 10.4%.

Fireproofing materials are essential components in construction and industrial settings, providing critical protection against fire hazards. These materials encompass a wide range of substances and techniques designed to inhibit or delay the spread of flames and reduce the combustibility of surfaces. Common fireproofing materials include intumescent coatings, mineral wool, fire-resistant gypsum boards, and fire-retardant-treated wood. Intumescent coatings, for instance, expand when exposed to high temperatures, forming a protective char layer that insulates underlying structures. Mineral wool, made from natural or synthetic fibers, offers excellent thermal insulation and fire resistance, making it suitable for insulating walls and ceilings. Fireproofing materials play a vital role in safeguarding buildings, infrastructure, and industrial equipment, enhancing overall safety and mitigating the devastating impact of fires.

Fireproofing offers materials and structures resistance to fire so that during an accidental case of fire the critical structures keep operating until the fire is brought under control. Fireproofing is known as applying certain products over the materials or structures which overcome the rise of fire and hence, plant operators get sufficient to play against the fire. In refineries, petrochemical plants, power plants, process terminals, and many other places where the chances of fire are high, different codes and standards (like NFPA) suggest the licensor apply to fireproof. For that purpose, Equipment and structures are fireproofed up to a certain height or whole equipment as dictated by guidelines. Moreover, safeguarding and protecting human life and property are major concerns for the construction industry bearer in regions over the world. This also stems from the requirement to avoid costs related to loss of time and human effort as a result of fire accidents. These factors have been motivating various industries across sectors to install Fireproofing systems wherever needed and feasible. This in turn has been translating into an increase in the utilization of and demand for Fireproofing materials. Fireproofing materials act as two vital roles concerning fire safety applications such as fire suppression and fire prevention. Both of these are key to the complete fire safety assurance for a building. Considering these significant aspects of applications of Fireproofing materials, the study of the Fireproofing materials market becomes an important read.

Market Dynamics For Fireproofing Materials Market

Drivers:

Growing Fire Safety Regulations

The fireproofing materials market is strongly influenced by the strict legal framework and industry standards/regulations, especially in Europe and North America regions. These regulations are leading to the growth of innovative fireproofing materials. They are varied over different regions, depending on the corresponding national regulations for health and environmental security. The strict fire regulations defined by the regulatory agencies of different countries, such as NFPA (U.S), VFDB (Germany), FPA (UK), and FPAA (Australia) are turning the demand for fireproofing materials such as intumescent coatings and cementitious coatings in the construction materials. All these factors collectively are turning the demand for fireproofing materials in the various end-use industries.

Furthermore, the growth in the number of fire accidents, heading to the loss of life and valuable assets has made various construction companies more attentive, compelling them to employ fire protection measures for safety, in turn, boosting the fire protection materials market. Furthermore, the rise in demand from the major application industries, such as industrial and commercial constructions and oil and gas industries, has improved the Fireproofing Materials market growth.

Restraints:

Price Susceptibility in The Developing Regions

Asia Pacific, Africa, and Latin America are price-susceptible markets. Pricing act as a massive role in product placement and marketing in the Asia Pacific. 3M & Akzo Nobel N.V. are the top key market players. Nevertheless, in the Indian subcontinent regional players are heading the market, as per industry experts, the reason behind this is the cost-effective products offered by these companies. Various residential projects lean to avoid few fire compliances to overcome the cost of the project as the fireproofing materials are offered at a high cost. This harms the market for fireproofing material despite the stringent fire safety regulations. It has also been witnessed that contractors tend to avoid or do not comply with building codes to overcome the cost of construction.

Opportunities:

Augmenting Demand for Coatings

Fireproofing coatings are coating systems that are required to be utilized on structural elements in building and construction, across various industries, to offer an adequate rescue and expulsion time during fire accidents. Strict fire safety norms and regulations by governments, as well as insurance companies, and rapid urbanization have increased by the application of fire protection coatings in building and construction projects. Majorly, fireproofing coatings are two-layer coatings comprising of the active layer, which acts as a shield when reveal to the increase in temperature, and a topcoat that not only protects the first layer from water spill and scratches but also offers an attractive matte finish to the wooden surface. Generally, there are two kinds of fire protection coatings cementitious and intumescent coatings or passive fire protection coatings. Two key aspects of fire performance are fire resistance and reaction-to-fire. Fire resistance is known as the ability of a material or system to withstand exposure to high temperatures based on thermal insulation and mechanical integrity evaluations. Silicone-based flame retardant coatings are convenient and effective to overcome the flammability of the substrate materials. All the preceding factors may help the market studied to thrive during the forecast period.

Market Segmentation

Segmentation Analysis of Fireproofing Materials Market:

Based on the Type, the Intumescent Coatings segment is expected to dominate the Fireproofing materials market during the forecast period. When heated, intumescent paints expand and form a heat-resistant barrier. They usually include sodium silicates. Under high heat conditions, the intumescent paint coating thickens, boarding air and forming a layer of greater insulation. Intumescent fireproofing paints are used on metallic pipes, tanks, valves. These properties are anticipated to turn the demand for intumescent coatings during the forecast period.

Based on End-Use, the Commercial segment is expected to dominate the Fireproofing materials market during the forecast period. It is also known as institutional construction. It includes healthcare facilities (hospitals and laboratories), banks, hotels, education institutions (schools and colleges), and government-owned offices. Commercial construction is rising in emerging and emerging economies. In emerged economies, the construction of grocery stores, drugstores, and quick service restaurants are growing, while in emerging economies, the construction of hospitals, schools and colleges, and retail stores are driving the commercial construction segment.

Regional Analysis of Fireproofing Materials Market:

North America's dominance in the global fireproofing market can be attributed to a combination of factors. Firstly, the region has a well-established construction industry, which drives the demand for fireproofing materials. The United States, in particular, has a large and growing construction sector, with both residential and commercial projects requiring fire protection. As a result, there is a steady demand for fireproofing materials, which in turn fuels the growth of the market.

Another factor contributing to North America's dominance is the strict regulatory environment. In the United States, for example, the National Fire Protection Association (NFPA) sets strict standards for fire safety in buildings. These standards require the use of fireproofing materials in various applications, such as walls, ceilings, and floors. As a result, the demand for fireproofing materials is high, and North American manufacturers are well-positioned to meet this demand. Overall, the combination of a large and growing construction industry, strict regulations, and a focus on innovation has cemented North America's position as the leader in the global fireproofing market.

Players Covered in Fireproofing Materials Market are :

- 3M (US)

- Ugam Chemicals (India)

- BASF SE (Germany)

- Encon Insulation Ltd (UK)

- Akzo Nobel N.V. (Netherlands)

- Isolatek International (US)

- Sika AG (Switzerland)

- Etex Group (Belgium)

- FlameOFF Coatings Inc. (US)

- PPG IndustriesInc (US)

- Carboline (US)

- Jotun Group (Norway)

- Rockwool International AS (Denmark)

- RPM International Inc. (US)

- Iris Coatings S.r.l (Italy)

- The Sherwin-Williams Company (US)

- Knauf Insulation (US)

- W.R. Grace & Co. (US)

- Contego International Inc. (US)

- Rolf Kuhn GmbH (Germany)

- Hempel Group (Denmark)

- No-Burn Inc. (US)

- Intumescent Systems Ltd (UK)

- PK Companies (US) and other major players.

Key Industry Developments In The Fireproofing Materials Market

- In January 2021, Firetherm, a smart passive fire protection company, shifted under the brand Nullifire (a part of RPM International Inc.) and began to provide across the UK under the same brand name.

- In June 2021, Carboline declared the accession of Dudick Inc., a global leader in high-performance coatings, flooring, and tank linings, headquartered in Streetsboro, Ohio. Dudick has furnished solutions in corrosion resistance and chemical containment systems for different applications such as food processing, steel production, pulp & paper, chemical processing, power, electronics, and biological research labs.

-

In February 2024, Saint-Gobain, a leader in light and sustainable construction, has acquired the assets of International Cellulose Corporation (ICC), a manufacturer of specialty insulation products. The acquisition will enhance Saint-Gobain's offerings in fireproofing and insulation solutions, aligning with the company's focus on sustainability. The products manufactured by ICC use natural, plant-based fibers and high recycled content, meeting rigorous sustainability standards such as LEED®V.4 and GREENGUARD Gold certifications. This acquisition further solidifies Saint-Gobain's commitment to net-zero carbon by 2050.

|

Global Fireproofing Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 0.94 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.4% |

Market Size in 2032: |

USD 2.29 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fireproofing Materials Market by Type (2018-2032)

4.1 Fireproofing Materials Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gypsum Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cementitious Coatings

4.5 Cement-Based

4.6 Intumescent Coatings

4.7 Others

Chapter 5: Fireproofing Materials Market by Application (2018-2032)

5.1 Fireproofing Materials Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Residential

5.6 Onshore

5.7 Offshore

Chapter 6: Fireproofing Materials Market by End-Use Industry (2018-2032)

6.1 Fireproofing Materials Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Structural Steel Fireproofing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cable & Wire Tray Fireproofing

6.5 Pipe

6.6 Duct

6.7 Others

Chapter 7: Fireproofing Materials Market by Distribution Channels (2018-2032)

7.1 Fireproofing Materials Market Snapshot and Growth Engine

7.2 Market Overview

7.3 E-Commerce

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 B2B

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Fireproofing Materials Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ATKORE INTERNATIONAL GROUP INC

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HUBBELL INCORPORATED

8.4 LEGRAND S.A

8.5 SCHNEIDER ELECTRIC SE LTD

8.6 ALIAXIS GROUP S.A

8.7 SEKISUI CHEMICAL CO LTD

8.8 WIENERBERGER AG

8.9 NATIONAL PIPE & PLASTICS INC

8.10 CANTEX INC

8.11 ORBIA ADVANCE CORPORATION

8.12 ASTRAL POLYTECHNIK LIMITED

8.13 CHINA LESSO GROUP HOLDINGS LTD

8.14 JM EAGLE INC

8.15 NAN YA PLASTICS CORP

8.16 D.P. JINDAL GROUP

8.17 PIPELIFE INTERNATIONAL GMBH

8.18 ZEKELMAN INDUSTRIES INC

8.19 OPW CORPORATION

8.20 PREMIER CONDUIT INC

8.21 INTERNATIONAL METAL HOSE COMPANY

8.22 SANCO INDUSTRIES LTD.

Chapter 9: Global Fireproofing Materials Market By Region

9.1 Overview

9.2. North America Fireproofing Materials Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Gypsum Based

9.2.4.2 Cementitious Coatings

9.2.4.3 Cement-Based

9.2.4.4 Intumescent Coatings

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Industrial

9.2.5.2 Commercial

9.2.5.3 Residential

9.2.5.4 Onshore

9.2.5.5 Offshore

9.2.6 Historic and Forecasted Market Size by End-Use Industry

9.2.6.1 Structural Steel Fireproofing

9.2.6.2 Cable & Wire Tray Fireproofing

9.2.6.3 Pipe

9.2.6.4 Duct

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by Distribution Channels

9.2.7.1 E-Commerce

9.2.7.2 B2B

9.2.7.3 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Fireproofing Materials Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Gypsum Based

9.3.4.2 Cementitious Coatings

9.3.4.3 Cement-Based

9.3.4.4 Intumescent Coatings

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Industrial

9.3.5.2 Commercial

9.3.5.3 Residential

9.3.5.4 Onshore

9.3.5.5 Offshore

9.3.6 Historic and Forecasted Market Size by End-Use Industry

9.3.6.1 Structural Steel Fireproofing

9.3.6.2 Cable & Wire Tray Fireproofing

9.3.6.3 Pipe

9.3.6.4 Duct

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by Distribution Channels

9.3.7.1 E-Commerce

9.3.7.2 B2B

9.3.7.3 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Fireproofing Materials Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Gypsum Based

9.4.4.2 Cementitious Coatings

9.4.4.3 Cement-Based

9.4.4.4 Intumescent Coatings

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Industrial

9.4.5.2 Commercial

9.4.5.3 Residential

9.4.5.4 Onshore

9.4.5.5 Offshore

9.4.6 Historic and Forecasted Market Size by End-Use Industry

9.4.6.1 Structural Steel Fireproofing

9.4.6.2 Cable & Wire Tray Fireproofing

9.4.6.3 Pipe

9.4.6.4 Duct

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by Distribution Channels

9.4.7.1 E-Commerce

9.4.7.2 B2B

9.4.7.3 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Fireproofing Materials Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Gypsum Based

9.5.4.2 Cementitious Coatings

9.5.4.3 Cement-Based

9.5.4.4 Intumescent Coatings

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Industrial

9.5.5.2 Commercial

9.5.5.3 Residential

9.5.5.4 Onshore

9.5.5.5 Offshore

9.5.6 Historic and Forecasted Market Size by End-Use Industry

9.5.6.1 Structural Steel Fireproofing

9.5.6.2 Cable & Wire Tray Fireproofing

9.5.6.3 Pipe

9.5.6.4 Duct

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by Distribution Channels

9.5.7.1 E-Commerce

9.5.7.2 B2B

9.5.7.3 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Fireproofing Materials Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Gypsum Based

9.6.4.2 Cementitious Coatings

9.6.4.3 Cement-Based

9.6.4.4 Intumescent Coatings

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Industrial

9.6.5.2 Commercial

9.6.5.3 Residential

9.6.5.4 Onshore

9.6.5.5 Offshore

9.6.6 Historic and Forecasted Market Size by End-Use Industry

9.6.6.1 Structural Steel Fireproofing

9.6.6.2 Cable & Wire Tray Fireproofing

9.6.6.3 Pipe

9.6.6.4 Duct

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by Distribution Channels

9.6.7.1 E-Commerce

9.6.7.2 B2B

9.6.7.3 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Fireproofing Materials Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Gypsum Based

9.7.4.2 Cementitious Coatings

9.7.4.3 Cement-Based

9.7.4.4 Intumescent Coatings

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Industrial

9.7.5.2 Commercial

9.7.5.3 Residential

9.7.5.4 Onshore

9.7.5.5 Offshore

9.7.6 Historic and Forecasted Market Size by End-Use Industry

9.7.6.1 Structural Steel Fireproofing

9.7.6.2 Cable & Wire Tray Fireproofing

9.7.6.3 Pipe

9.7.6.4 Duct

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by Distribution Channels

9.7.7.1 E-Commerce

9.7.7.2 B2B

9.7.7.3 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Fireproofing Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 0.94 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.4% |

Market Size in 2032: |

USD 2.29 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fireproofing Materials Market research report is 2022-2028.

3M (US), Ugam Chemicals (India), BASF SE (Germany), Encon Insulation Ltd (UK), Akzo Nobel N.V. (Netherlands), Isolatek International (US), Sika AG (Switzerland), Etex Group (Belgium), FlameOFF Coatings Inc. (US), PPG Industries Inc (US), Carboline (US), Jotun Group (Norway), Rockwool International AS (Denmark), RPM International Inc. (US), Iris Coatings Srl (Italy), The Sherwin-Williams Company (US), Knauf Insulation (US), W.R. Grace & Co. (US), Contego International Inc. (US), Rolf Kuhn GmbH (Germany), Hempel Group (Denmark), No-Burn Inc. (US), Intumescent Systems Ltd (UK), PK Companies (US), and other major players.

The Fireproofing Materials Market is segmented into type, application, end-use industry, distribution channels, and region. By Type, the market is categorized into Gypsum Based, Cementitious Coatings, Cement-Based, Intumescent Coatings, and Others. By Application, the market is categorized into Industrial, Commercial, Residential, Onshore, and Offshore. By End-Use Industry, the market is categorized into Structural Steel Fireproofing, Cable & Wire Tray Fireproofing, Pipe, Duct, and Others. By Distribution Channels, the market is categorized into E-Commerce, B2B, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fireproofing is known as applying certain products over the materials or structures which overcome the rise of fire and hence, plant operators get sufficient to play against the fire.

The Fireproofing Materials Market was valued at USD 0.77 Billion in 2021 and is projected to reach USD 1.54 Billion by 2028, growing at a CAGR of 10.4% from 2022 to 2028.