DRAM Market Synopsis

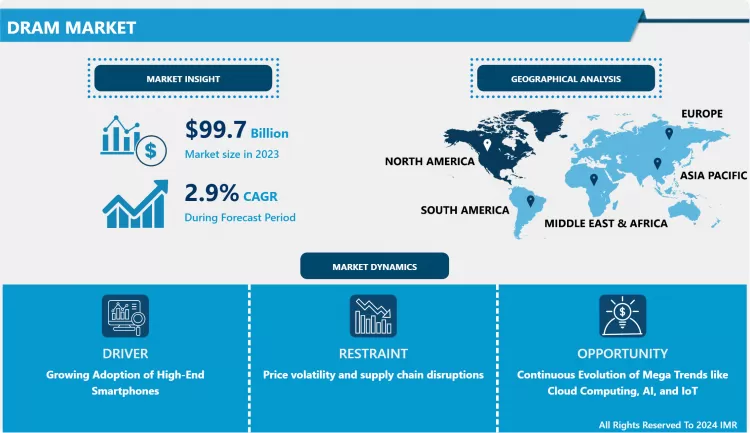

DRAM Market Size Was Valued at USD 99.7 Billion in 2023 and is Projected to Reach USD 129.0 Billion by 2032, Growing at a CAGR of 2.9% From 2024-2032.

DRAM stands for Dynamic Random-Access Memory and is a type of volatile semiconductor memory that is used in computer systems. It affords faster temporary storage to the CPU which is very needed for executing programs and applications present in a computer. DRAM, in contrast to most other storage media, has the characteristic of being volatile, they erase data every time power is turned off. It is, however, much better for far faster access times than storage devices making it vital for real-time computation.

DRAM or the Dynamic Random-Access Memory on the other hand is used in computers and other gadgets to store data temporarily so that the CPU can have an easy time to retrieve the information. It is necessary in system memory which enables such features such as multitasking, fast access to data and is used in products such as PCs, laptops, cell phones and servers.

The other relevant utilization of DRAM (Dynamic Random-Access Memory) in the future is to enhance output in AI, machine learning, and big data. This will make computations in end-point devices, clouds and HPC to happen faster, more efficiently thereby permitting real-time & complex analysis.

- The primary advantages of eDRAM are the basic scheme and single needed transistor. Compared with SRAM, it also costs less and has higher storage capacities on a given chip area. More data can be stored in it, and its data can be wiped off, or modified. Of course, DRAM volatile memory and high powere consumption in comparison with other options would be regarded as its shortcomings. It must be manufactured with cutting edge technology, information placed in the storage cells have to be altered, and it is slower than SRAM. The field of DRAM has enormous potential for further evolution while the audience of mobile solutions is compulsory to equip high-speed, but power-saving DRAM. More smartphone users were witnessed in emerging markets like China, India, and Japan and such factors would lead to market growth.

- The dynamic random access memory market is expected to grow over the forecast period in the worldwide markets on account of the growing use of the personal computing devices. It was examined that high-memory smart mobiles and tablets, continuously rising requirement of fast online functionality and the availability of internet connection are expected to foster the market growth in the future years. In addition, increasing popularity of cloud computing and high frequency of data transfer communication might propel the demand for dynamic random access memory (DRAM) particularly in data center segments. The servers need to have cooling, high-speed data transmission and back up facilities of the cloud services and all these are powered by low power consumption and high memory density such as, dynamic RAM.

- Among the new technologies in the market including the ultra-thin notebooks that are usually associated with long battery life, a sturdy physical profile and high performance, the driving force is dynamic RAM technology. Flourishing demand of high performance and low power consumption DRAM in mobile applications will likely create healthy demand in dynamic RAM. However, high research & development cost, constraints in circuit integration, and increasing cost of design and fabrications may reduce the market development in the course of the forecasted period. Hence, the market could face a major competitor through substitutes such as NAND flash memory. Optimistic data may be associated with developing countries’ and replacement markets’ potential to further increase DRAM demand.

DRAM Market Trend Analysis

Growing Construction of Smart Cities

- The increase in the used of smart cities also contributes to the market growth of dynamic random access memory. Smart cities are conceived as existing cities in which extra attention is paid both to the ideology of the Internet of Things and information and communication technology to improve effectiveness of the urban services. This is expected to enhance the complexity, and especification of constructing modern technology based buildings, structures infrastructures, and other constructions.

- Furthermore, DRAM is expected to be used in the creation of, in the context of, and for the development of other IoT devices and the likes to form smart cities. Therefore, there will be an augmentation in the number of new constructions globally under smart cities, which will subsequently drive the demand for DRAMs upwards. Therefore, as smart city projects are progressing at the international level, the international DRAM market will see considerable growth throughout the forecasted period.

Rising Demand for Consumer Electronics

- Computing devices such as laptops/tables, mobile phones, digital cameras, have registered high growth because of urbanization across the world and gadgets improvement. Mobile advertising predictions per Zenith that, by 2019, mobile devices will account for 73 percent of global Internet usage. Some of the factors prominent in this growth include; population factor; rise in disposable income per capita; availability of higher internet speed along with low cost end-user product.

- Furthermore, the enhanced popularity of smartphones has raised consumer expectations in handset that possess advanced processing capacity, low energy consuming feature and large sized memory storage. Thus, this has supplemented the need for DRAM. Thus, the growing manufacturing of smartphones equipped with advanced processing and memory traits is expected to boost the market within the forecast period.

DRAM Market Segment Analysis:

- DRAM Market Segmented based on Architecture and Application.

By Architecture, DDR4 segment is expected to dominate the market during the forecast period

- Consumer electronics’ DDR4 segment holds the largest market share across the world and will continue to expand its market size during the forecast period. It is concluded that the segment is anticipated to grow on the back of a rising call for high-speed memory modules within the forecasted timeframe. Higher capacity and higher density data transfer and storage segments using computers, smart phones, servers and so on are few factors that are pushing the market of DDR4 Memory Module forward. RAM or Random Access Memory is used temporarily in computers and they use DDR memory. The intensity increases with the volume and velocity of the processes: the more and faster the processes in the organization, the more frequent is the use of such means. New generation of DDR DRAMs has proved to dissipate less energy as compared to its predecessors as well as occupy less area.

- Further, to many customer needs, it has seen the two companies devise new products to the market. For example, in February 2022 Lexar is a maker of flash memory solutions these great news are the newest addition in the new Lexar ARES DDR4 Desktop Memory product line which incorporate colorful RGB illumination and DDR4 overclocked performance to customer PC to boost their gaming experience. In particular, it might be interesting to buyers who want to increase the performance of their games with the help of overclocked memory.

- Thus, it can be concluded that the DDR5 era has arrived. High-performance computing challenges the server environment to read significant amounts of data at very high speed and instantaneously, including 5G, AI, metaverse, and AR. In the same manner, after the release of CPUs compatible with DDR5, the computing industry stands to change and growth is foreseen within gaming and mainstream PCs. The companies are also formulating their new products capturing the broad market and hence creating a bigger client base. For example, in May 2022 Lexar introduced a new model which is Lexar Ares DDR5 OC desktop memory. As put by the manufacturer, the new RAM was designed and developed with the PC gamers and enthusiast in mind. The Lexar Ares DDR5 OC desktop memory are compatible with Intel XMP 3. 02 and DDR5 technology appropriate for the new platform of Intel Core processors. About this module the memory is stated to have a maximum clock speed of 5200MHz and a bandwidth of 1. 63 times more than DDR4 RAM.

By Application, smartphone/tablet segment held the largest share in 2023

- The smartphone/tablet segment has the largest dynamic random access memory market share in the forecast period. Memory has the potential of further development due to the emerging technologies where huge amount of memories can be stored at a relatively lower cost than the silicon chips encompassed in the most used consumer electronics such as cell phones and tabs. Second, there is a currently aggressive trend of amassing users’ daily information through the use of smartphone cameras. The dimensions of Smartphone photos have steadily risen as the pixelation capabilities have escalated. Thus, high storage capacity is required due to the increase in demand for high-capacity smartphone applications such as mobile games.

- In addition, the volumes of constant mobile and tablet segments are increasing daily, stimulating the analyzed market. The growth of new production facilities is also common among many market players, working to drive the studied market.

- The consumer products are SSDs, video cards, digital cameras, portable media players, gaming consoles and more, many businesses need frequently accessible, high-performance, highly reliable, and low power-consumption devices. Indeed, SSDs meet all the stated business needs. Furthermore, SSDs in the enterprises include those that capture and store data persistently or those that cache data in volatile semiconductor memory; the products are designed for storage systems, servers, and direct-attached storage (DAS) devices. Through the analysis highlighted in this paper, clients who require faster and more efficient solutions are embracing SSDs. Most of the companies that produce high-end machines and notebooks feature this technology to act as the device’s main memory, which gains a lot of favor with the clients. Increasing usage of SSDs as client systems should help drive the market over the forecast period.

DRAM Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Due to the presence of a number of key players such as Cypress Semiconductor Corporation, Micron Technology, Incorporated and Integrated Silicon Solution Incorporated and others North America is among the biggest drivers for the market for DRAM.

- High-end smartphone consumption, along with the machine learning Artificial Intelligence, and several other innovative solutions and technologies are fuelling the DRAMs demand across the different niche applications. Samsung and the Apple Inc. are among the mobile manufacturers that have integrated their smartphones with DRMs to support several 5G, AI-based mobile applications. On the other hand, cloud service providers like Google and Amazon are using DRAMs in their data center for cloud computing, as well as scalability and better memory in capacities.

Active Key Players in the DRAM Market

- Winbond Electronics Corporation

- Nanya Technology Corporation

- ATP Electronics, Inc.

- Micron Technology, Inc.

- Integrated Silicon Solution, Inc.

- SK Hynix, Inc.

- Powerchip Technology Corporation

- Kingston Technology Corporation

- Transcend Information, Inc.

- Other Key Players

Key Industry Developments in the DRAM Market:

- In February 2024, Samsung released the actual industrial first 36GB HBM3E 12H DRAM, opening new application for future superior memory.

- In December 2023, Micron launched an inch 128GB DDR5 RDIMM memory with 32GB monolithic design. This memory comes with superior throughput and does up to 8000 MT this making it perfect for use in data centers.

- In September 2023, Samsung released 32-gigabit DDR5, the largest DRAM based on the 12-nanometer production line due to the ever-increasing demand for Al and big data.

|

Global DRAM Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 99.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

2.9 % |

Market Size in 2032: |

USD 129.0 Bn. |

|

Segments Covered: |

By Architecture |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: DRAM Market by Architecture (2018-2032)

4.1 DRAM Market Snapshot and Growth Engine

4.2 Market Overview

4.3 DDR3

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 DDR4

4.5 DDR5

4.6 DDR2/Others

Chapter 5: DRAM Market by Applications (2018-2032)

5.1 DRAM Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Smartphone/Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 PC/Laptop

5.5 Data Centers

5.6 Graphics

5.7 Consumer Products

5.8 Automotive

5.9 Other Applications

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 DRAM Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 WINBOND ELECTRONICS CORPORATION

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NANYA TECHNOLOGY CORPORATION

6.4 ATP ELECTRONICS INCMICRON TECHNOLOGY INCINTEGRATED SILICON SOLUTION INCSK HYNIX INCPOWERCHIP TECHNOLOGY CORPORATION

6.5 KINGSTON TECHNOLOGY CORPORATION

6.6 TRANSCEND INFORMATION INCOTHER KEY PLAYERS

Chapter 7: Global DRAM Market By Region

7.1 Overview

7.2. North America DRAM Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Architecture

7.2.4.1 DDR3

7.2.4.2 DDR4

7.2.4.3 DDR5

7.2.4.4 DDR2/Others

7.2.5 Historic and Forecasted Market Size by Applications

7.2.5.1 Smartphone/Tablets

7.2.5.2 PC/Laptop

7.2.5.3 Data Centers

7.2.5.4 Graphics

7.2.5.5 Consumer Products

7.2.5.6 Automotive

7.2.5.7 Other Applications

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe DRAM Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Architecture

7.3.4.1 DDR3

7.3.4.2 DDR4

7.3.4.3 DDR5

7.3.4.4 DDR2/Others

7.3.5 Historic and Forecasted Market Size by Applications

7.3.5.1 Smartphone/Tablets

7.3.5.2 PC/Laptop

7.3.5.3 Data Centers

7.3.5.4 Graphics

7.3.5.5 Consumer Products

7.3.5.6 Automotive

7.3.5.7 Other Applications

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe DRAM Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Architecture

7.4.4.1 DDR3

7.4.4.2 DDR4

7.4.4.3 DDR5

7.4.4.4 DDR2/Others

7.4.5 Historic and Forecasted Market Size by Applications

7.4.5.1 Smartphone/Tablets

7.4.5.2 PC/Laptop

7.4.5.3 Data Centers

7.4.5.4 Graphics

7.4.5.5 Consumer Products

7.4.5.6 Automotive

7.4.5.7 Other Applications

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific DRAM Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Architecture

7.5.4.1 DDR3

7.5.4.2 DDR4

7.5.4.3 DDR5

7.5.4.4 DDR2/Others

7.5.5 Historic and Forecasted Market Size by Applications

7.5.5.1 Smartphone/Tablets

7.5.5.2 PC/Laptop

7.5.5.3 Data Centers

7.5.5.4 Graphics

7.5.5.5 Consumer Products

7.5.5.6 Automotive

7.5.5.7 Other Applications

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa DRAM Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Architecture

7.6.4.1 DDR3

7.6.4.2 DDR4

7.6.4.3 DDR5

7.6.4.4 DDR2/Others

7.6.5 Historic and Forecasted Market Size by Applications

7.6.5.1 Smartphone/Tablets

7.6.5.2 PC/Laptop

7.6.5.3 Data Centers

7.6.5.4 Graphics

7.6.5.5 Consumer Products

7.6.5.6 Automotive

7.6.5.7 Other Applications

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America DRAM Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Architecture

7.7.4.1 DDR3

7.7.4.2 DDR4

7.7.4.3 DDR5

7.7.4.4 DDR2/Others

7.7.5 Historic and Forecasted Market Size by Applications

7.7.5.1 Smartphone/Tablets

7.7.5.2 PC/Laptop

7.7.5.3 Data Centers

7.7.5.4 Graphics

7.7.5.5 Consumer Products

7.7.5.6 Automotive

7.7.5.7 Other Applications

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global DRAM Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 99.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

2.9 % |

Market Size in 2032: |

USD 129.0 Bn. |

|

Segments Covered: |

By Architecture |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the DRAM Market research report is 2024-2032.

Winbond Electronics Corporation, Nanya Technology Corporation, ATP Electronics, Inc., Micron Technology, Inc., Integrated Silicon Solution, Inc., SK Hynix, Inc., Powerchip Technology Corporation, Kingston Technology Corporation, Transcend Information, Inc, and Other Major Players.

The DRAM Market is segmented into architecture, application, and region. By architecture, the market is categorized into DDR3, DDR4, DDR5, and DDR2/others. By application, the market is categorized into smartphones/tablets, PC/laptops, data centers, graphics, consumer products, automotive, and other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

It is a specific type of semiconductor memory called DRAM designed to store computer information in what is necessary for the normal functioning of the computer’s CPU. This type of random-access memory is usually found in servers, workstations, and personal computers. In the case of random access, even the PC processor can randomly seek a point in memory without having to begin at one particular point and then move location by location through the memory area. Described to be located right beside the CPU of a computer, RAM provides better data access than a combination of SSD and HDD.

DRAM Market Size Was Valued at USD 99.7 Billion in 2023 and is Projected to Reach USD 129.0 Billion by 2032, Growing at a CAGR of 2.9% From 2024-2032.