Diamond Tools Market Synopsis:

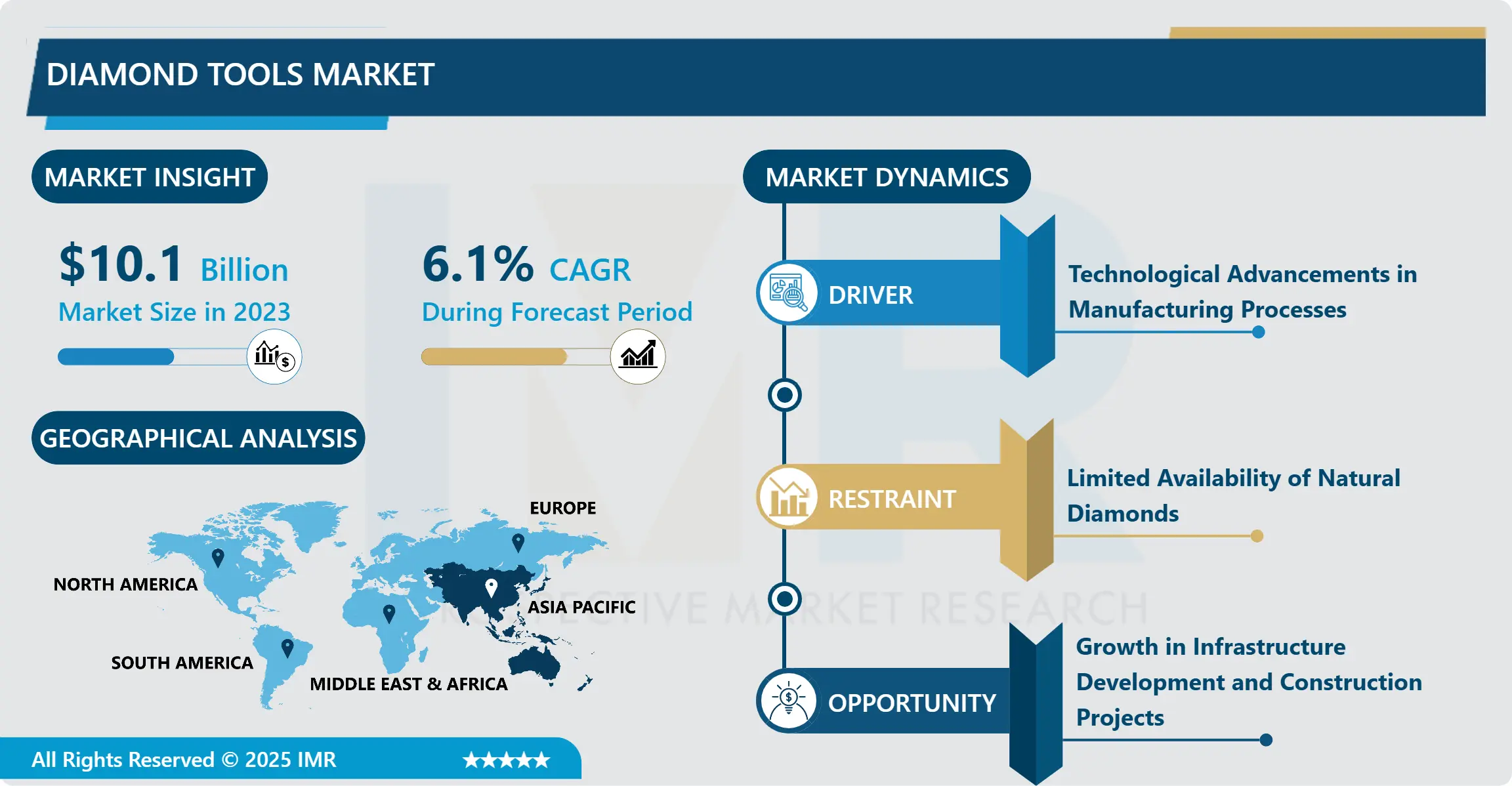

Diamond Tools Market Size Was Valued at USD 10.10 Billion in 2023, and is Projected to Reach USD 17.20 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

The diamond tools means the manufacturing and selling of tools that utilize industrial diamonds, which are hard wearing materials. These are machines for mechanical operations where ones are used for cutting, grinding, drilling, polishing and milling operations on metals, stones, concrete and ceramics. It is preferred where there is high accuracy, strength and abrasiveness due to the nature of the materials being worked on in various sphere like construction, car manufacturing, electronics and mining.

This is because most sectors such as construction, automotive and aerospace industries require enhanced and high precision tools that can be provided by the diamond tools. The diamond tools provide enhanced performance, durability and cost effective when applied as per the increasing manufacturers and industries demand.. There is even a greater demand for such tools in areas of the geographic region, such as Asia-Pacific with the fast increasing industrial growth.

Other drivers include increase demand for the cutting and drilling in mining industry through the use of the diamond tools. Enhanced usage of precious metals and minerals around the world and enhanced technologies in the mining industry further require effective cutting devices, which are diamond tools that are ideal for withstanding the abrasive mining environment. Procedural to this notion is the continued growth of the construction sector globally as illustrated in the following trend.

Diamond Tools Market Trend Analysis:

Growth in demand for synthesised varieties and stone

-

Another trend shaping demand in the diamond tools market is growth in demand for synthesised varieties and stones, which are cheaper and easier to obtain than natural diamonds. The increased use of synthetic diamonds is as a result of new technologies, including the chemical vapor deposition that has seen them apply across diverse fields.

- The other trend is the growing need for multifunctional diamond tools for cutting tool and improved cooler and wear resistance. Thus, there is high demand for products like cutting tools that can withstand high temperature and provide better cutting efficiency which in return fuels the market growth and hence; manufacturers are putting more effort into the research and development of such products.

Existence of automated processes

-

The factor of automation and precision machining industry offers a wide scope of growth in the diamond tools market. The future growth of industries means the existence of automated processes, and therefore there is a growing demand for highly accurate and complex tools. Cutting and grinding ability of diamond tools is high and it is capable of conducting automated production lines in electronics and automobile industries.

- Also, the increased rate of infrastructure construction in developing countries presents new opportunities for manufacturers of diamond tools. The construction industry and more so the governments and private businesses engaging in mega construction projects in the Asia-Pacific region have promptly developed a need for quality diamond cutting, drilling and finishing tools. This market growth is the expectation of seeing more advancements in the diamond tools market.

Diamond Tools Market Segment Analysis:

Diamond Tools Market Segmented on the basis of Type, Material, Application, End User, and Region.

By Type, Diamond Cutting Tools segment is expected to dominate the market during the forecast period

-

By type, the diamond tools market is subdivided into diamond cutting tools, diamond grinding tools, diamond drilling tools, diamond polishing tools, and diamond milling tools. Diamond cutting tools are majorly employed in car manufacturing industries as well as civil construction for the purpose of cutting of metals and specifically concrete. More over Diamond grinding tools are used in finishing of the surfaces so as to obtain smooth surfaces. Drilling tools are used for drilling deep holes through hard content such as rock and metal whereas the polishing tools are used for polishing to high gloss finish on content such as stone and glass. Milling tools are used to effectively shave materials in extremely accurate manner since these industries are particular with accuracy such as, aerospace and electronics, among others.

By Application, Construction segment expected to held the largest share

-

The market has also been classified by applications as construction, automobile, electronics, aerospace, mining, stones, and others. The major applications of diamond tools are in cutting and grinding of materials such as concrete, asphalt and stone during construction exercises. Automotive industries applied diamond tools in machining and finishing some of the engines and high quality precision parts. In electronics, wears are acceptable in the cutting of semiconductor materials, and other precision tools. Examples of field that benefit from diamond tools are aerospace industries where diamond drill and machine hard alloys and mining industry where diamond is used to cut and or drill through rocks. Scmtingfr processions uses diamond tools in completing the rigorous and the final touches to the marbles and granites and other stone products. There are other uses which have been realised and these include the use in medical equipment, optics and research.

Diamond Tools Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

-

Currently, the Asia-Pacific market occupies the largest segment of the sushi with regard to diamond tools. This is mainly due to industrialization that is surging in countries such as China and India that fall in the CPG segment that uses diamond tools in activities such as construction among others. Largely driven by a robust manufacturing sector complemented by numerous infrastructure projects, this region demands a higher use of these tools various applications.

- Besides industrial growth, cost-effective resources, and favorable policies which are easily available in Asia-Pacific are the factors which have led to the development of the market. China particularly, has dominated both the production and consumption of diamond tools and thereby also fuels the growth of the region. This dominance is expected to continue as services providers, in various industries especially those in the emerging economies in the Asia pacific region develop higher demand for precision tools.

Active Key Players in the Diamond Tools Market:

- 3M (USA)

- Asahi Diamond (Japan)

- Bosch (Germany)

- De Beers (UK)

- Diatool (China)

- Hitachi (Japan)

- Iscar (Israel)

- Norton Abrasives (USA)

- Saint-Gobain (France)

- TYROLIT (Austria)

- Other Active Players

|

Diamond Tools Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.10 Billion |

|

Forecast Period 2024-32 CAGR: |

6.10% |

Market Size in 2032: |

USD 17.20 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Diamond Tools Market by Type

4.1 Diamond Tools Market Snapshot and Growth Engine

4.2 Diamond Tools Market Overview

4.3 Diamond Cutting Tools

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Diamond Cutting Tools: Geographic Segmentation Analysis

4.4 Diamond Grinding Tools

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Diamond Grinding Tools: Geographic Segmentation Analysis

4.5 Diamond Drilling Tools

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Diamond Drilling Tools: Geographic Segmentation Analysis

4.6 Diamond Polishing Tools

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Diamond Polishing Tools: Geographic Segmentation Analysis

4.7 Diamond Milling Tools

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Diamond Milling Tools: Geographic Segmentation Analysis

Chapter 5: Diamond Tools Market by Material

5.1 Diamond Tools Market Snapshot and Growth Engine

5.2 Diamond Tools Market Overview

5.3 Natural Diamond

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Natural Diamond: Geographic Segmentation Analysis

5.4 Synthetic Diamond

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Synthetic Diamond: Geographic Segmentation Analysis

Chapter 6: Diamond Tools Market by Application

6.1 Diamond Tools Market Snapshot and Growth Engine

6.2 Diamond Tools Market Overview

6.3 Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Construction: Geographic Segmentation Analysis

6.4 Automotive

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Automotive: Geographic Segmentation Analysis

6.5 Electronics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Electronics: Geographic Segmentation Analysis

6.6 Aerospace

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Aerospace: Geographic Segmentation Analysis

6.7 Mining

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Mining: Geographic Segmentation Analysis

6.8 Stone Processing

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Stone Processing: Geographic Segmentation Analysis

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Geographic Segmentation Analysis

Chapter 7: Diamond Tools Market by End User

7.1 Diamond Tools Market Snapshot and Growth Engine

7.2 Diamond Tools Market Overview

7.3 Industrial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Industrial: Geographic Segmentation Analysis

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation Analysis

7.5 Residential

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Residential: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Diamond Tools Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BOSCH (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 3M (USA)

8.4 SAINT-GOBAIN (FRANCE)

8.5 DE BEERS (UK)

8.6 HITACHI (JAPAN)

8.7 ASAHI DIAMOND (JAPAN)

8.8 DIATOOL (CHINA)

8.9 ISCAR (ISRAEL)

8.10 TYROLIT (AUSTRIA)

8.11 NORTON ABRASIVES (USA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Diamond Tools Market By Region

9.1 Overview

9.2. North America Diamond Tools Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Diamond Cutting Tools

9.2.4.2 Diamond Grinding Tools

9.2.4.3 Diamond Drilling Tools

9.2.4.4 Diamond Polishing Tools

9.2.4.5 Diamond Milling Tools

9.2.5 Historic and Forecasted Market Size By Material

9.2.5.1 Natural Diamond

9.2.5.2 Synthetic Diamond

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Construction

9.2.6.2 Automotive

9.2.6.3 Electronics

9.2.6.4 Aerospace

9.2.6.5 Mining

9.2.6.6 Stone Processing

9.2.6.7 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Industrial

9.2.7.2 Commercial

9.2.7.3 Residential

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Diamond Tools Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Diamond Cutting Tools

9.3.4.2 Diamond Grinding Tools

9.3.4.3 Diamond Drilling Tools

9.3.4.4 Diamond Polishing Tools

9.3.4.5 Diamond Milling Tools

9.3.5 Historic and Forecasted Market Size By Material

9.3.5.1 Natural Diamond

9.3.5.2 Synthetic Diamond

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Construction

9.3.6.2 Automotive

9.3.6.3 Electronics

9.3.6.4 Aerospace

9.3.6.5 Mining

9.3.6.6 Stone Processing

9.3.6.7 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Industrial

9.3.7.2 Commercial

9.3.7.3 Residential

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Diamond Tools Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Diamond Cutting Tools

9.4.4.2 Diamond Grinding Tools

9.4.4.3 Diamond Drilling Tools

9.4.4.4 Diamond Polishing Tools

9.4.4.5 Diamond Milling Tools

9.4.5 Historic and Forecasted Market Size By Material

9.4.5.1 Natural Diamond

9.4.5.2 Synthetic Diamond

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Construction

9.4.6.2 Automotive

9.4.6.3 Electronics

9.4.6.4 Aerospace

9.4.6.5 Mining

9.4.6.6 Stone Processing

9.4.6.7 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Industrial

9.4.7.2 Commercial

9.4.7.3 Residential

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Diamond Tools Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Diamond Cutting Tools

9.5.4.2 Diamond Grinding Tools

9.5.4.3 Diamond Drilling Tools

9.5.4.4 Diamond Polishing Tools

9.5.4.5 Diamond Milling Tools

9.5.5 Historic and Forecasted Market Size By Material

9.5.5.1 Natural Diamond

9.5.5.2 Synthetic Diamond

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Construction

9.5.6.2 Automotive

9.5.6.3 Electronics

9.5.6.4 Aerospace

9.5.6.5 Mining

9.5.6.6 Stone Processing

9.5.6.7 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Industrial

9.5.7.2 Commercial

9.5.7.3 Residential

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Diamond Tools Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Diamond Cutting Tools

9.6.4.2 Diamond Grinding Tools

9.6.4.3 Diamond Drilling Tools

9.6.4.4 Diamond Polishing Tools

9.6.4.5 Diamond Milling Tools

9.6.5 Historic and Forecasted Market Size By Material

9.6.5.1 Natural Diamond

9.6.5.2 Synthetic Diamond

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Construction

9.6.6.2 Automotive

9.6.6.3 Electronics

9.6.6.4 Aerospace

9.6.6.5 Mining

9.6.6.6 Stone Processing

9.6.6.7 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Industrial

9.6.7.2 Commercial

9.6.7.3 Residential

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Diamond Tools Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Diamond Cutting Tools

9.7.4.2 Diamond Grinding Tools

9.7.4.3 Diamond Drilling Tools

9.7.4.4 Diamond Polishing Tools

9.7.4.5 Diamond Milling Tools

9.7.5 Historic and Forecasted Market Size By Material

9.7.5.1 Natural Diamond

9.7.5.2 Synthetic Diamond

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Construction

9.7.6.2 Automotive

9.7.6.3 Electronics

9.7.6.4 Aerospace

9.7.6.5 Mining

9.7.6.6 Stone Processing

9.7.6.7 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Industrial

9.7.7.2 Commercial

9.7.7.3 Residential

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Diamond Tools Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.10 Billion |

|

Forecast Period 2024-32 CAGR: |

6.10% |

Market Size in 2032: |

USD 17.20 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||