Global Animal Feed Organic Trace Minerals Market Overview

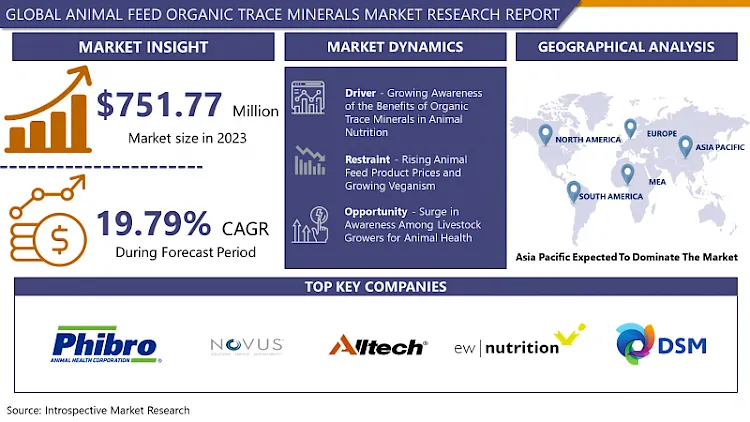

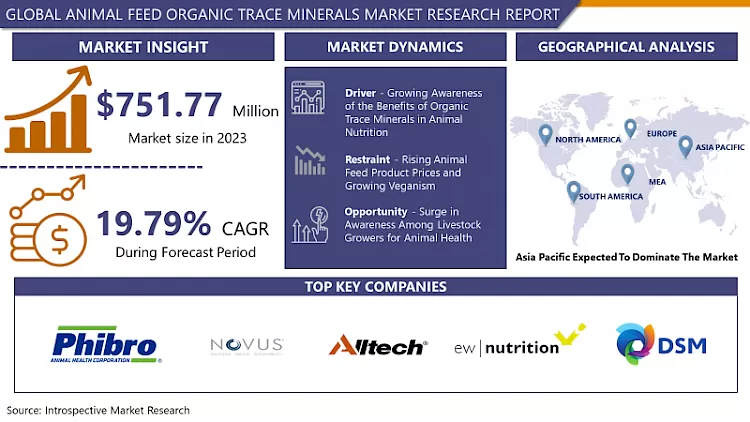

Animal Feed Organic Trace Minerals Market Size Was Valued at USD 751.77 Million in 2023 and is Projected to Reach USD 1410.25 Million by 2032, Growing at a CAGR of 19.79% From 2024-2032

Minerals that are required by animals in small amounts for their development and growth are known as trace or microminerals. When the source from which these minerals are obtained is organic then these minerals are known as trace organic minerals or mineral chelates. Trace minerals play a vital role in several metabolic processes in the body. Moreover, commonly used trace organic minerals in animal nutrition are manganese (Mn), zinc (Zn), copper (Cu), iron (Fe), chromium (Cr), and selenium (Se). Zinc plays an important role in carbohydrate metabolism, protein synthesis, and numerous other biochemical reactions thus making it one of the vital nutrients for animal development. Iron is known for its oxygen-carrying capacity in blood moreover, several iron-dependent enzymes play a vital role in the various biochemical process. Various researches have shown that utilization of trace organic minerals in animal feed has increased milk yield and quality of meat. Moreover, inorganic minerals may interact with oxalate, phytate, silicates, tannin, fiber, or other minerals in the gastrointestinal tract, which may inhibit their absorption thus hampering animal development and growth.

Market Dynamics And Factors In Animal Feed Organic Trace Minerals Market

Drivers:

The growing awareness of the beneficial effects of organic trace minerals in animal nutrition is the vital driving factor responsible for the growth of the animal feed organic trace minerals market during the period of forecast. The increasing human population has increased the demand for meat and dairy products. Moreover, the consumption of organic mineral complexes has been reported to enhance animal production. Another groundbreaking use of organic mineral sources has reported a reduction in the excretion of methane gases and thereby decreasing environmental pollution. Furthermore, mineral chelates are designed to improve gut absorption and bioavailability thus spurring the demand for trace minerals during the forecast period. One of the reasons for the increased bioavailability of organic minerals is attributed to their non-interaction with oxalate, phytate, silicates, tannin, fiber, or other minerals present in the gastrointestinal tract.

The use of mineral chelates has shown promising effects in poultry uses. The use of mineral chelates supports overall health, improves fertility and hatchability, and improvises chick quality thus promoting the use of trace minerals in poultry and propelling the market growth in the period of forecast. Moreover, the harmful effects of inorganic trace minerals on animal health and performance are going to boost the use of organic trace minerals in animal feed. The innovations in agriculture and production methods have led to an increase in mineral deficiencies in animals specifically ruminants thus, promoting the use of trace organic minerals in animal feed and further supporting the market growth.

Recently the demand for pork has gradually increased to meet this increasing demand and to enhance the quality of pork many swineherds have incorporated the use of trace organic minerals in swine feed thus, promoting the market growth. Broilers and layers are also supplemented with trace organic minerals to enhance the nutrition content of eggs and to promote muscle growth. The increasing demand for animal protein and the easy availability of eggs as a high and rich source of proteins and other vitamins is propelling the market growth.

Restraints:

Rising animal feed product prices due to investments made by key market players in research and development to enhance the product quality is likely going to hamper the market growth during the forecast period. Moreover, people are unaware of the advantageous effects of organic trace minerals in animal nutrition thus restraining the growth of the animal feed organic trace minerals market in the period of forecast. Increase disease outbreaks in animals is promoting individuals to shift towards a vegetarian diet thus constraining the market growth.

Opportunities:

The harmful effects associated with the use of trace inorganic minerals and the growing awareness among livestock growers for animal health is the biggest opportunity for market players to introduce animal feed supplemented with trace organic minerals. Moreover, studies have shown that organic trace minerals play an essential role in enhancing gut absorption and improves the intake of fodder in animals thus, instigating market players to provide nutrition-rich animal feed. In the last decade, various outbreaks of animal diseases have impacted several developing economies negatively. Decreasing fodder quality has led to several mineral deficiencies in animals especially in cows it has caused a decrease in milk yields thus farmers are stimulated to use organic trace minerals in feed to ensure proper growth of cattle. New opportunities are generated for market players with investment in research and development projects to improve specific functions of certain trace organic minerals.

Challenges:

Balance among the minerals, protein, and vitamins is a vital constituent in striving towards optimum animal performance and growth. The balance between the trace minerals themselves has also been considered important as sometimes it poses a large challenge due to adversary interactions that can happen between minerals. To avoid these interactions and to ensure proper nutrition market players need to analyze the interactions between added ingredients and develop better animal feeding products. Reducing the effects of disease outbreaks is the major challenge faced by the key manufacturing companies.

Market Segmentation

Segmentation Analysis of Animal Feed Organic Trace Minerals Market:

Based on Sources, the animal feed organic trace minerals market is going to flourish during the period of forecast owing to the rising awareness of harmful effects of inorganic trace minerals and to provide proper nutrition in animal feed. The zinc segment of trace minerals is the most common ingredient used in animal feed as its consumption is attributed to protein synthesis and enhancing immunity in animals.

Based on Category, amino acid complexes and amino acid chelates are the most common types through which trace minerals are supplemented in animal feed. Glycinate using glycine as ligand is the most practiced method as glycine is readily absorbed in the gut and is then transported to the right cells. Supplementation of zinc using glycine chelate enhances growth performance in swine and broiler birds in poultry.

Based on Livestock, cattle have the highest share in the consumption of trace organic minerals. Production of incompetent fodder due to innovations in agricultural practices has resulted in mineral deficiencies in cattle which has caused a decrease in milk yield and reduced milk nutrient content. Swine is the second most consumer of the organic trace mineral.

Regional Analysis of Animal Feed Organic Trace Minerals Market:

Based on geography, the animal feed organic trace mineral market is divided into five regions North America, Europe, Asia-Pacific, South America, and the Middle East and Africa.

Owing to the huge livestock population in countries like China and India, the Asia-Pacific region is going to dominate the market in the period of forecast. An increasing number of animal feed manufacturers and investments in the research and development sector is the main factors propelling the market growth in this region.

North America region is going to have a significant growth in the period of forecast owing to the trend of adopting pets and the advancement in the technology to manufacture animal feed products. The United States, Canada, and Mexico are the biggest shareholders in the North American region in terms of consumption and manufacturing process.

South America region is the second most consumer of trace organic minerals owing to the large population of livestock in countries like Brazil, Argentina, and Uruguay. Increasing demand for milk and milk products, beef, and pork in this region is supporting the market growth in the period of forecast.

The European region is going to observe a slow but positive growth during the period of forecast. Increasing awareness of the advantages of organic trace minerals in animal feed and meeting the increasing demand for milk, milk products, beef, and pork is promoting market growth in this region.

The Middle East and Africa region are also expected to have a positive impact on market growth owing to the developing poultry and cattle industry.

Players Covered in Animal Feed Organic Trace Minerals Market are:

- Phibro Animal Health Corporation (US)

- Novus International (US)

- Alltech Inc

- EW Nutrition (Germany)

- DSM (Netherlands)

- Cargill Incorporated (US)

- ADM (US)

- Pancosma (Switzerland)

- Ridley Corporation Limited (US)

- Kemin Industries Inc (US)

- QualiTech (India)

- Nutreco (Netherlands)

- Zinpro Corp (US)

- Biochem Zusatzstoffe Handels (Germany)

- Purina Animal Nutrition LLC (US) and other major players.

Key Industry Developments in Animal Feed Organic Trace Minerals Market

- In March 2024, Novus International, Inc. announced it has completed the acquisition of U.S.-based enzyme company BioResource International, Inc. Opens a new window (BRI). Under the terms of the agreement, NOVUS becomes the owner of all BRI’s products and intellectual property and takes control of the company’s facilities.

- In June 2023, MidOcean Partners announced that it had acquired QualiTech, a renowned, family-owned global manufacturer of plant nutrition, animal nutrition, and food ingredient products and services. The transaction, which transfers ownership of the company to MidOcean from the Ploen family, is designed to pave the way for new investment to expand capabilities and capacity, and to drive new levels of growth.

|

Global Animal Feed Organic Trace Minerals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 751.77 Mn. |

|

Forecast Period 2024-32 CAGR: |

19.79% |

Market Size in 2032: |

USD 1410.25 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Animal Feed Organic Trace Minerals Market by Type (2018-2032)

4.1 Animal Feed Organic Trace Minerals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Zinc

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Iron

4.5 Copper

4.6 Manganese

4.7 Selenium

4.8 Others

Chapter 5: Animal Feed Organic Trace Minerals Market by Livestock (2018-2032)

5.1 Animal Feed Organic Trace Minerals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ruminants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Poultry

5.5 Swine

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Animal Feed Organic Trace Minerals Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PHIBRO ANIMAL HEALTH CORPORATION (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NOVUS INTERNATIONAL (US)

6.4 ALLTECH INC

6.5 EW NUTRITION (GERMANY)

6.6 DSM (NETHERLANDS)

6.7 CARGILL INCORPORATED (US)

6.8 ADM (US)

6.9 PANCOSMA (SWITZERLAND)

6.10 RIDLEY CORPORATION LIMITED (US)

6.11 KEMIN INDUSTRIES INC (US)

6.12 QUALITECH (INDIA)

6.13 NUTRECO (NETHERLANDS)

6.14 ZINPRO CORP (US)

6.15 BIOCHEM ZUSATZSTOFFE HANDELS (GERMANY)

6.16 PURINA ANIMAL NUTRITION LLC (US)

Chapter 7: Global Animal Feed Organic Trace Minerals Market By Region

7.1 Overview

7.2. North America Animal Feed Organic Trace Minerals Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Zinc

7.2.4.2 Iron

7.2.4.3 Copper

7.2.4.4 Manganese

7.2.4.5 Selenium

7.2.4.6 Others

7.2.5 Historic and Forecasted Market Size by Livestock

7.2.5.1 Ruminants

7.2.5.2 Poultry

7.2.5.3 Swine

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Animal Feed Organic Trace Minerals Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Zinc

7.3.4.2 Iron

7.3.4.3 Copper

7.3.4.4 Manganese

7.3.4.5 Selenium

7.3.4.6 Others

7.3.5 Historic and Forecasted Market Size by Livestock

7.3.5.1 Ruminants

7.3.5.2 Poultry

7.3.5.3 Swine

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Animal Feed Organic Trace Minerals Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Zinc

7.4.4.2 Iron

7.4.4.3 Copper

7.4.4.4 Manganese

7.4.4.5 Selenium

7.4.4.6 Others

7.4.5 Historic and Forecasted Market Size by Livestock

7.4.5.1 Ruminants

7.4.5.2 Poultry

7.4.5.3 Swine

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Animal Feed Organic Trace Minerals Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Zinc

7.5.4.2 Iron

7.5.4.3 Copper

7.5.4.4 Manganese

7.5.4.5 Selenium

7.5.4.6 Others

7.5.5 Historic and Forecasted Market Size by Livestock

7.5.5.1 Ruminants

7.5.5.2 Poultry

7.5.5.3 Swine

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Animal Feed Organic Trace Minerals Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Zinc

7.6.4.2 Iron

7.6.4.3 Copper

7.6.4.4 Manganese

7.6.4.5 Selenium

7.6.4.6 Others

7.6.5 Historic and Forecasted Market Size by Livestock

7.6.5.1 Ruminants

7.6.5.2 Poultry

7.6.5.3 Swine

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Animal Feed Organic Trace Minerals Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Zinc

7.7.4.2 Iron

7.7.4.3 Copper

7.7.4.4 Manganese

7.7.4.5 Selenium

7.7.4.6 Others

7.7.5 Historic and Forecasted Market Size by Livestock

7.7.5.1 Ruminants

7.7.5.2 Poultry

7.7.5.3 Swine

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Animal Feed Organic Trace Minerals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 751.77 Mn. |

|

Forecast Period 2024-32 CAGR: |

19.79% |

Market Size in 2032: |

USD 1410.25 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Animal Feed Organic Trace Minerals Market research report is 2024-2032.

Phibro Animal Health Corporation (US), Novus International (US), Alltech Inc, EW Nutrition (Germany), DSM (Netherlands), Cargill Incorporated (US), ADM (US), Pancosma (Switzerland), Ridley Corporation Limited (US), Kemin Industries Inc (US), QualiTech (India), Nutreco (Netherlands), Zinpro Corp (US), Biochem Zusatzstoffe Handels (Germany), Purina Animal Nutrition LLC (US), and other major players.

The Animal Feed Organic Trace Minerals Market is segmented into type, livestock, and region. By Vehicle Type, the market is categorized into Zinc, Iron, Copper, Manganese, Selenium, and Others. By Livestock, the market is categorized into Ruminants, Poultry, Swine, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Minerals that are required by animals in small amounts for their development and growth are known as trace or microminerals. When the source from which these minerals are obtained is organic then these minerals are known as trace organic minerals or mineral chelates.

Animal Feed Organic Trace Minerals Market Size Was Valued at USD 751.77 Million in 2023 and is Projected to Reach USD 1410.25 Million by 2032, Growing at a CAGR of 19.79% From 2024-2032