Food Minerals Market Synopsis

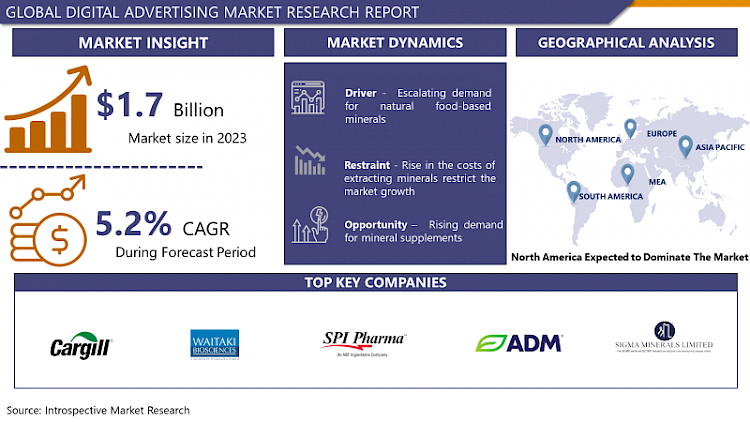

Food Minerals Market Size Was Valued at USD 1.7 Billion in 2023, and is Projected to Reach USD 2.7 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

Food minerals are naturally occurring chemical elements that need to be included in the diet of any individual so as to ensure the right development and functionality of various body organs. Some of the food sources of minerals include the fruits and vegetables, whole grain products, legumes, nuts and seeds, dairy products, lean meat, fish, and seafood. Based on the U. S. Food & Drug Administration’s guidelines, the daily intake of some compounds includes zinc with the recommended quantity being 11 milligrams, magnesium with 420 milligrams, calcium’s recommended dose being 1300 milligrams, iron’s recommended dose being 18 milligrams among others. Thisopposes that sufficient food sources exist as it is well understood that most foods can be consumed in moderation while also identifying that it is essential that proper percentages are maintained to have a sufficient intake of these invaluable minerals for living a healthy lifestyle.

It has been seen that the healthcare costs are increasing and this has been considered to be a key driver to the minerals market. Hence, as per the report of Tennessee Advisory Commission on Intergovernmental Relations, in the U. S. , the overall cost of healthcare was raised in 2019 compared to 2018 and the spending also raised 4. 6% up to $3. 6 trillion. Because of such a sharp increase in health care costs, individuals are turning to mineral and nutrient supplements in order to keep healthy and avert infection and diseases. Hence, the increasing consumer concern to spend more on food supplements, particularly minerals that help prevent diseases and infections, will propel the food minerals market share.

- Manufacturers are changing ways in which they market and brand their products to achieve higher sales in different countries. Producers have applied sophisticated strategies to increase consumer demand for mineral supplements by innovating new products and packaging. One of the strategies practiced by producers to attract more consumers is incorporating natural ingredients in the production of minerals which have no negative impacts on the health of consumers. This goes a long way in increasing the revenue of businesses that operate in this sector. All these strategies employed by manufacturers contribute to the food minerals industry as described below.

- The consumption of plant-based minerals has improved because more people now are becoming conscious of products that have not been tested on animals and also because of concern for the environment. Growth in the count of people getting immersed in corporate life and giving significance to diet and nutritional needs of the body to avoid health issues also contributes to the food minerals market growth. The market is expected to be driven by growing consumer expenditure in health supplements. The main driving forces that can be seen positively influencing the future growth of the market are the rising health concerns and higher disposable income. The change in consumers’ awareness due to advertisements, social media blogs, YouTube channels, and influencers can be expected to drive the food minerals market demand higher.

- Despite the growing demand for food minerals it has not hurdles because fake supplements are available in the market. Since synthetic mineral supplements are directly related to the welfare of consumers, it is crucial to establish the safety of the ingredients and supplement products. Some regulatory agencies like the FDA (Food and Drug Administration) is ensuring that contaminated & hazardous dietary supplements do not reach the market to harm the consumers. But the firms that offer health supplements should adhere to the standards set out in the Dietary Supplement Health and Education Act (DSHEA) and the FDA regulations. Additionally, firms producing dietary supplements need to assess their products to confirm that they are not contaminated and duly labeled for safe consumption. For instance, if a food supplement has a new component incorporated in it, the manufacturers are required to notify the FDA before marketing the food supplement. Therefore, increased regulatory policies on the manufacture of food minerals will negatively affect the expansion of the food minerals market.

Food Minerals Market Trend Analysis

Rise in the logistics channel and development of distribution networks

- The demand for more logistic analysis and an enhancement of how distribution networks like pharmacy, health shops, supermarkets, and websites will also be beneficial for the global food minerals market size during the forecasts timeframe. It has become clear that food minerals of various sorts exhibit anti-inflammatory and anti-oxidizing properties. It assists in lowering high blood pressure levels and also having a good control of blood sugar. The following health benefits can therefore be associated with the consumption of food minerals: enhance eye health, boost memory, reduce the risks of heart diseases and control obesity. Other than this, it assists in managing disorders of the digestion system, heart complications, renal complaints, endocrinal complications, and musculoskeletal comments.

Rise in female population to overcome post menopause conditions

- Increasing concern of female to have food minerals to overcome post menopause conditions also forms market opportunities for food minerals. Common diseases that affect post-menopause female are anemia, osteoporosis, osteoarthritis, fibromyalgia, obesity, and depression. : In the view of the World Health Organization (WHO), 18. According to the worldwide data, 0% of women above 60 years have osteoarthritis and among them, only 80% restricted in movement and 25% unable to perform major tasks. The Food and Drug Administration (FDA) noted that women take dietary supplements to treat perimenopausal symptoms in August 2019. Mineral supplement designed to help in the prevention of certain post-menopause related diseases like osteoporosis is likely to enhance acceptance about the women’s healthcare mineral supplements. Sedentary lifestyle and alteration in diet, improper nutrient intake also leads to cases of fertility disorders and other complaints in women. Diseases such as ovarian, breast and cervical cancer among women will boost the growth of the food minerals market forecast.

Food Minerals Market Segment Analysis:

Food Minerals Market is segmented based on Type, Application and Source.

By Type, Magnesium segment is expected to dominate the market during the forecast period

- Based on Type, Zinc, Magnesium, Calcium, Iodine, Copper, Chromium, and Iron are the leading segments in the market. Magnesium is projected to remain the largest Application segment in terms of market share until 2029. This is mainly owed to situations like insomnia, asthma, hypertension, diabetes, and constipation, among others. It is life-imperative because its ions are responsible for releasing the energy chemical, adenosine triphosphate. These magnesium food minerals play an important role in controlling several enzymatic activities which include fatty acid synthesis and proteins, nerve conduction, and food digestion. Magnesium also has applications as an ingredient and/additive that complements energy. It also aids in the maintenance of potassium and sodium balance which has created market demand for mineral-rich foods.

- However, the Zinc segment is expected to grow at a CAGR of 5 percent in comparison to the expected growth rate of more than 6 percent for the Copper and Coal segments. It is expected to reduce by 3% at the end of the forecast period based on the current trend. This influx is acknowledged to be a rise in instances of melancholy and anxiety due to tight programs and unhealthful eating that is expected to stir the market for the zinc mineral supplements due to cortisol and adrenaline functions. The breakdown of neurotransmitters is facilitated by working with vitamin B6 to ensure the proper positioning of these neurotransmitters in the brain thus promoting market growth.

By Application, Pharmaceuticals Industry segment held the largest share in 2023

- Based on the Application, the market has been categorized into Nutraceuticals Industry, Pharmaceuticals Industry, and Food & Beverage Industry. According to market estimations, the Pharmaceuticals Industry segment is anticipated to be the largest in terms of market share by 2029. Among all the transition metal elements, Zinc can be said to be the most commonly used in developing pharmaceutical drugs. Some of the well-known organometallic complexes include gold complexes such as sodium aurothiomalate and auranofin that are used in medication. It is used in the pharmaceutical business as lubricants, desiccants, disintegrants, diluents, binders, pigments, and opacifiers besides emulsifying, thickening, isotonic agents and anticaking negotiators, savour correctors and active ingredient juggernauts.

Food Minerals Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Food Minerals market share of North America would be 48% due to consistent consumption of healthy and nutritional food in the region. To achieve these objectives, the following strategies will be implemented during the forecast period: Total market share is projected to rise to 2%. The commodity market in North American countries including Canada and United States regarding food minerals is expected to expand in the future because of the increasing cases of obesity and consciousness of healthy living elevated in North America, in conjunction with rising end user inclination towards minerals such as magnesium, zinc and calcium. Over all weights continue to rise among youths in the region, especially with emphasis on healthy living and comprehensive weight reduction explanations focusing on general physique well-being. Obesity is one of the main causes of diabetes, hypertension, and other types of heart diseases inclusive of stroke, coronary artery disease, and angina. All of these factors are still subsidizing customer preference shift towards natural mineral products including calcium, magnesium and zinc thereby supporting regional industry development.

Active Key Players in the Food Minerals Market

- Cargill,

- Incorporated

- Waitaki Bio

- SPI Pharma, Inc.

- Archer-Daniels-Midland Company

- Sigma Minerals Limited

- ABF Ingredients Limited

- CalciTech Europe Limited

- Calspar India

- Balchem Corporation

- Adani Pharmachem Private Limited

- Other Key Players

Key Industry Developments in the Food Minerals Market:

- In August 2022, Balchem Corporation completed the purchase of Cardinal Associates Inc. ( Bergstrom Nutrition ),the science- based manufacturer of Methylsulfonylmethane in an effort to add minerals and nutrients to it product line.

|

Global Food Minerals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 2.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Source

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Food Minerals Market by Type

5.1 Food Minerals Market Overview Snapshot and Growth Engine

5.2 Food Minerals Market Overview

5.3 Magnesium

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Magnesium: Grographic Segmentation

5.4 Iron

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Iron: Grographic Segmentation

5.5 Calcium

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Calcium: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Food Minerals Market by Source

6.1 Food Minerals Market Overview Snapshot and Growth Engine

6.2 Food Minerals Market Overview

6.3 Fruits

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Fruits: Grographic Segmentation

6.4 Vegetables

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Vegetables: Grographic Segmentation

6.5 Seaweed

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Seaweed: Grographic Segmentation

6.6 Nuts

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Nuts: Grographic Segmentation

6.7 Marine

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Marine: Grographic Segmentation

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Grographic Segmentation

Chapter 7: Food Minerals Market by Application

7.1 Food Minerals Market Overview Snapshot and Growth Engine

7.2 Food Minerals Market Overview

7.3 Food & Beverages

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food & Beverages: Grographic Segmentation

7.4 Pharmaceuticals & Nutraceuticals

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pharmaceuticals & Nutraceuticals: Grographic Segmentation

7.5 Animal Feed

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Animal Feed: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Food Minerals Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Food Minerals Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Food Minerals Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 CARGILL INCORPORATED.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ARCHER DANIELS MIDLAND COMPANY (ADM)

8.4 CALCITECH EUROPE LIMITED

8.5 SIGMA MINERALS LTD.

8.6 WAITAKI BIO

8.7 AB ENZYMES

8.8 DANGOTE INDUSTRIES LIMITED

8.9 CK INGREDIENTS

8.10 EISAI CO.LTD.

8.11 AVION PHARMACEUTICALS LLC

8.12 OMYA AG

8.13 MICRONUTRIENTS

8.14 ABF INGREDIENTS

8.15 ALGAECALINC

8.16 SPI PHARMA

8.17 OHLY

8.18 K+S AKTIENGESELLSCHAFT

8.19 ABITEC

8.20 OTHER MAJOR PLAYERS

Chapter 9: Global Food Minerals Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Magnesium

9.2.2 Iron

9.2.3 Calcium

9.2.4 Others

9.3 Historic and Forecasted Market Size By Source

9.3.1 Fruits

9.3.2 Vegetables

9.3.3 Seaweed

9.3.4 Nuts

9.3.5 Marine

9.3.6 Others

9.4 Historic and Forecasted Market Size By Application

9.4.1 Food & Beverages

9.4.2 Pharmaceuticals & Nutraceuticals

9.4.3 Animal Feed

9.4.4 Others

Chapter 10: North America Food Minerals Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Magnesium

10.4.2 Iron

10.4.3 Calcium

10.4.4 Others

10.5 Historic and Forecasted Market Size By Source

10.5.1 Fruits

10.5.2 Vegetables

10.5.3 Seaweed

10.5.4 Nuts

10.5.5 Marine

10.5.6 Others

10.6 Historic and Forecasted Market Size By Application

10.6.1 Food & Beverages

10.6.2 Pharmaceuticals & Nutraceuticals

10.6.3 Animal Feed

10.6.4 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Food Minerals Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Magnesium

11.4.2 Iron

11.4.3 Calcium

11.4.4 Others

11.5 Historic and Forecasted Market Size By Source

11.5.1 Fruits

11.5.2 Vegetables

11.5.3 Seaweed

11.5.4 Nuts

11.5.5 Marine

11.5.6 Others

11.6 Historic and Forecasted Market Size By Application

11.6.1 Food & Beverages

11.6.2 Pharmaceuticals & Nutraceuticals

11.6.3 Animal Feed

11.6.4 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Food Minerals Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Magnesium

12.4.2 Iron

12.4.3 Calcium

12.4.4 Others

12.5 Historic and Forecasted Market Size By Source

12.5.1 Fruits

12.5.2 Vegetables

12.5.3 Seaweed

12.5.4 Nuts

12.5.5 Marine

12.5.6 Others

12.6 Historic and Forecasted Market Size By Application

12.6.1 Food & Beverages

12.6.2 Pharmaceuticals & Nutraceuticals

12.6.3 Animal Feed

12.6.4 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Food Minerals Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Magnesium

13.4.2 Iron

13.4.3 Calcium

13.4.4 Others

13.5 Historic and Forecasted Market Size By Source

13.5.1 Fruits

13.5.2 Vegetables

13.5.3 Seaweed

13.5.4 Nuts

13.5.5 Marine

13.5.6 Others

13.6 Historic and Forecasted Market Size By Application

13.6.1 Food & Beverages

13.6.2 Pharmaceuticals & Nutraceuticals

13.6.3 Animal Feed

13.6.4 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Food Minerals Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Magnesium

14.4.2 Iron

14.4.3 Calcium

14.4.4 Others

14.5 Historic and Forecasted Market Size By Source

14.5.1 Fruits

14.5.2 Vegetables

14.5.3 Seaweed

14.5.4 Nuts

14.5.5 Marine

14.5.6 Others

14.6 Historic and Forecasted Market Size By Application

14.6.1 Food & Beverages

14.6.2 Pharmaceuticals & Nutraceuticals

14.6.3 Animal Feed

14.6.4 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Food Minerals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 2.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD MINERALS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD MINERALS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD MINERALS MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD MINERALS MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD MINERALS MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD MINERALS MARKET BY TYPE

TABLE 008. MAGNESIUM MARKET OVERVIEW (2016-2028)

TABLE 009. IRON MARKET OVERVIEW (2016-2028)

TABLE 010. CALCIUM MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. FOOD MINERALS MARKET BY SOURCE

TABLE 013. FRUITS MARKET OVERVIEW (2016-2028)

TABLE 014. VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 015. SEAWEED MARKET OVERVIEW (2016-2028)

TABLE 016. NUTS MARKET OVERVIEW (2016-2028)

TABLE 017. MARINE MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. FOOD MINERALS MARKET BY APPLICATION

TABLE 020. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 021. PHARMACEUTICALS & NUTRACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 022. ANIMAL FEED MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA FOOD MINERALS MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA FOOD MINERALS MARKET, BY SOURCE (2016-2028)

TABLE 026. NORTH AMERICA FOOD MINERALS MARKET, BY APPLICATION (2016-2028)

TABLE 027. N FOOD MINERALS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE FOOD MINERALS MARKET, BY TYPE (2016-2028)

TABLE 029. EUROPE FOOD MINERALS MARKET, BY SOURCE (2016-2028)

TABLE 030. EUROPE FOOD MINERALS MARKET, BY APPLICATION (2016-2028)

TABLE 031. FOOD MINERALS MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC FOOD MINERALS MARKET, BY TYPE (2016-2028)

TABLE 033. ASIA PACIFIC FOOD MINERALS MARKET, BY SOURCE (2016-2028)

TABLE 034. ASIA PACIFIC FOOD MINERALS MARKET, BY APPLICATION (2016-2028)

TABLE 035. FOOD MINERALS MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA FOOD MINERALS MARKET, BY TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA FOOD MINERALS MARKET, BY SOURCE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA FOOD MINERALS MARKET, BY APPLICATION (2016-2028)

TABLE 039. FOOD MINERALS MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA FOOD MINERALS MARKET, BY TYPE (2016-2028)

TABLE 041. SOUTH AMERICA FOOD MINERALS MARKET, BY SOURCE (2016-2028)

TABLE 042. SOUTH AMERICA FOOD MINERALS MARKET, BY APPLICATION (2016-2028)

TABLE 043. FOOD MINERALS MARKET, BY COUNTRY (2016-2028)

TABLE 044. CARGILL INCORPORATED.: SNAPSHOT

TABLE 045. CARGILL INCORPORATED.: BUSINESS PERFORMANCE

TABLE 046. CARGILL INCORPORATED.: PRODUCT PORTFOLIO

TABLE 047. CARGILL INCORPORATED.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ARCHER DANIELS MIDLAND COMPANY (ADM): SNAPSHOT

TABLE 048. ARCHER DANIELS MIDLAND COMPANY (ADM): BUSINESS PERFORMANCE

TABLE 049. ARCHER DANIELS MIDLAND COMPANY (ADM): PRODUCT PORTFOLIO

TABLE 050. ARCHER DANIELS MIDLAND COMPANY (ADM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CALCITECH EUROPE LIMITED: SNAPSHOT

TABLE 051. CALCITECH EUROPE LIMITED: BUSINESS PERFORMANCE

TABLE 052. CALCITECH EUROPE LIMITED: PRODUCT PORTFOLIO

TABLE 053. CALCITECH EUROPE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SIGMA MINERALS LTD.: SNAPSHOT

TABLE 054. SIGMA MINERALS LTD.: BUSINESS PERFORMANCE

TABLE 055. SIGMA MINERALS LTD.: PRODUCT PORTFOLIO

TABLE 056. SIGMA MINERALS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. WAITAKI BIO: SNAPSHOT

TABLE 057. WAITAKI BIO: BUSINESS PERFORMANCE

TABLE 058. WAITAKI BIO: PRODUCT PORTFOLIO

TABLE 059. WAITAKI BIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AB ENZYMES: SNAPSHOT

TABLE 060. AB ENZYMES: BUSINESS PERFORMANCE

TABLE 061. AB ENZYMES: PRODUCT PORTFOLIO

TABLE 062. AB ENZYMES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DANGOTE INDUSTRIES LIMITED: SNAPSHOT

TABLE 063. DANGOTE INDUSTRIES LIMITED: BUSINESS PERFORMANCE

TABLE 064. DANGOTE INDUSTRIES LIMITED: PRODUCT PORTFOLIO

TABLE 065. DANGOTE INDUSTRIES LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. CK INGREDIENTS: SNAPSHOT

TABLE 066. CK INGREDIENTS: BUSINESS PERFORMANCE

TABLE 067. CK INGREDIENTS: PRODUCT PORTFOLIO

TABLE 068. CK INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. EISAI CO.LTD.: SNAPSHOT

TABLE 069. EISAI CO.LTD.: BUSINESS PERFORMANCE

TABLE 070. EISAI CO.LTD.: PRODUCT PORTFOLIO

TABLE 071. EISAI CO.LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. AVION PHARMACEUTICALS LLC: SNAPSHOT

TABLE 072. AVION PHARMACEUTICALS LLC: BUSINESS PERFORMANCE

TABLE 073. AVION PHARMACEUTICALS LLC: PRODUCT PORTFOLIO

TABLE 074. AVION PHARMACEUTICALS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OMYA AG: SNAPSHOT

TABLE 075. OMYA AG: BUSINESS PERFORMANCE

TABLE 076. OMYA AG: PRODUCT PORTFOLIO

TABLE 077. OMYA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. MICRONUTRIENTS: SNAPSHOT

TABLE 078. MICRONUTRIENTS: BUSINESS PERFORMANCE

TABLE 079. MICRONUTRIENTS: PRODUCT PORTFOLIO

TABLE 080. MICRONUTRIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. ABF INGREDIENTS: SNAPSHOT

TABLE 081. ABF INGREDIENTS: BUSINESS PERFORMANCE

TABLE 082. ABF INGREDIENTS: PRODUCT PORTFOLIO

TABLE 083. ABF INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. ALGAECALINC: SNAPSHOT

TABLE 084. ALGAECALINC: BUSINESS PERFORMANCE

TABLE 085. ALGAECALINC: PRODUCT PORTFOLIO

TABLE 086. ALGAECALINC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. SPI PHARMA: SNAPSHOT

TABLE 087. SPI PHARMA: BUSINESS PERFORMANCE

TABLE 088. SPI PHARMA: PRODUCT PORTFOLIO

TABLE 089. SPI PHARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. OHLY: SNAPSHOT

TABLE 090. OHLY: BUSINESS PERFORMANCE

TABLE 091. OHLY: PRODUCT PORTFOLIO

TABLE 092. OHLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. K+S AKTIENGESELLSCHAFT: SNAPSHOT

TABLE 093. K+S AKTIENGESELLSCHAFT: BUSINESS PERFORMANCE

TABLE 094. K+S AKTIENGESELLSCHAFT: PRODUCT PORTFOLIO

TABLE 095. K+S AKTIENGESELLSCHAFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. ABITEC: SNAPSHOT

TABLE 096. ABITEC: BUSINESS PERFORMANCE

TABLE 097. ABITEC: PRODUCT PORTFOLIO

TABLE 098. ABITEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 099. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 100. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 101. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD MINERALS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD MINERALS MARKET OVERVIEW BY TYPE

FIGURE 012. MAGNESIUM MARKET OVERVIEW (2016-2028)

FIGURE 013. IRON MARKET OVERVIEW (2016-2028)

FIGURE 014. CALCIUM MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. FOOD MINERALS MARKET OVERVIEW BY SOURCE

FIGURE 017. FRUITS MARKET OVERVIEW (2016-2028)

FIGURE 018. VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 019. SEAWEED MARKET OVERVIEW (2016-2028)

FIGURE 020. NUTS MARKET OVERVIEW (2016-2028)

FIGURE 021. MARINE MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. FOOD MINERALS MARKET OVERVIEW BY APPLICATION

FIGURE 024. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 025. PHARMACEUTICALS & NUTRACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 026. ANIMAL FEED MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA FOOD MINERALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE FOOD MINERALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC FOOD MINERALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA FOOD MINERALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA FOOD MINERALS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Minerals Market research report is 2024-2032.

Cargill, Incorporated, Waitaki Bio, SPI Pharma, Inc., Archer-Daniels-Midland Company, Sigma Minerals Limited, ABF Ingredients Limited, CalciTech Europe Limited, Calspar India, Balchem Corporation, Adani Pharmachem Private Limited, and Other Major Players..

The Food Minerals Market is segmented into type, application, source, and region. By type, the market is categorized into Zinc, Magnesium, Calcium, Iodine, Copper, Chromium, and Iron. By application, the market is categorized into Nutraceuticals Industry, Pharmaceuticals Industry, and Food & Beverage Industry. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Food minerals are those that are necessary to be integrated into body to enable health and fitness. Minerals are vital nutrients essential in the digestion process, boosting the immune system, performance of our body, mental well-being, and eating disorders. This is because the quality of agricultural produce and food products being produced in the market is not up to quality hence they affect people health and do not meet the body’s nutrition requirements. Hence it was slightly challenging to meet the required daily food mineral and nutrient intake from the normal diet. As such, mineral supplements are taken in to attain these RDAs which represent daily nutrient requirements. Therefore, the growth of food mineral supplements is gaining pace on an international level, contributing to the growth of the food minerals market.

Food Minerals Market Size Was Valued at USD 1.7 Billion in 2023, and is Projected to Reach USD 2.7 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.