Key Market Highlights:

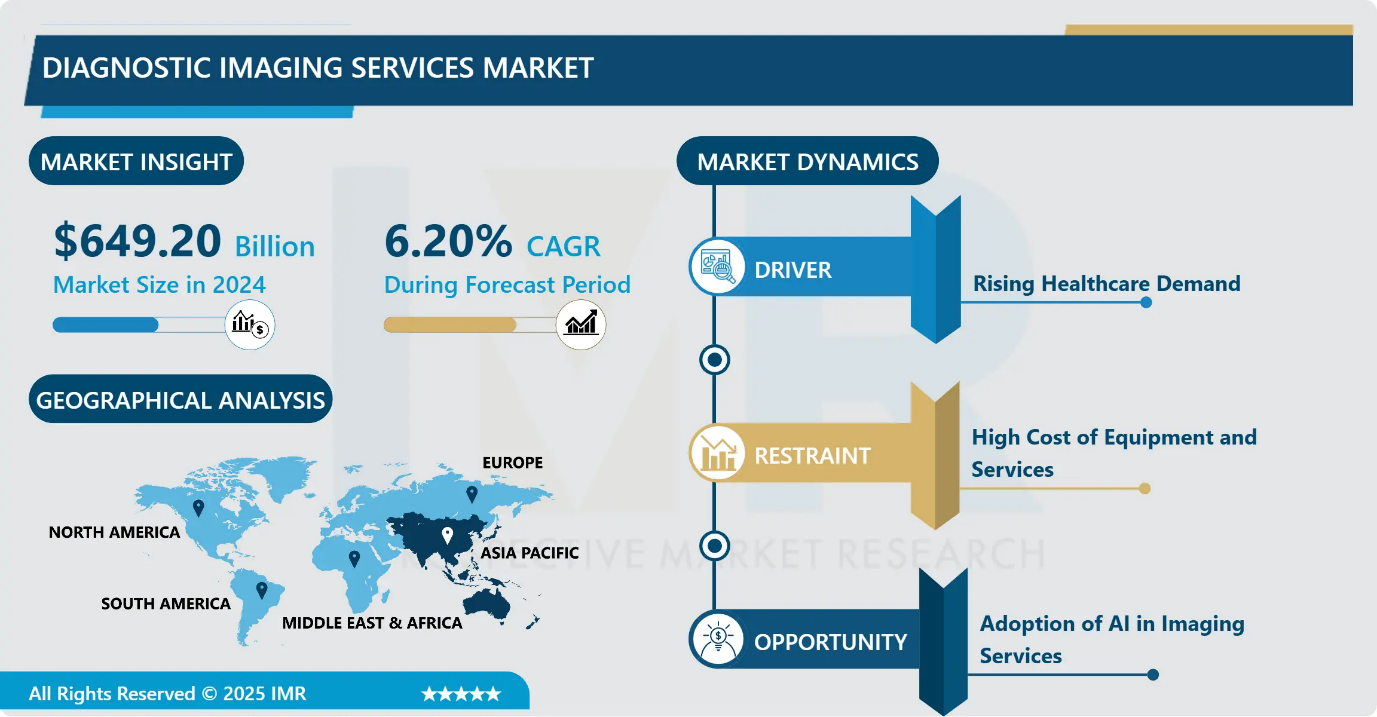

Diagnostic Imaging Services Market Size Was Valued at USD 649.20 Billion in 2024, and is Projected to Reach USD 1184.74 Billion by 2035, Growing at a CAGR of 6.20% from 2025-2035.

- Market Size in 2024: USD 649.20 Billion

- Projected Market Size by 2035: USD 1184.74 Billion

- CAGR (2025–2035): 6.20%

- Leading Market in 2024: Asia Pacific

- Fastest-Growing Market: North America

- By Imaging Modality: The Computed Tomography segment is anticipated to lead the market by accounting for 26.45% of the market share throughout the forecast period.

- By Application: The Oncology segment is expected to capture 24.78% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: Asia-Pacific region is projected to hold 31.56% of the market share during the forecast period.

- Active Players: Novant Health, RadNet, Dignity Health, Alliance Medical, Medica Group, and Other Major Players.

Diagnostic Imaging Services Market Synopsis:

Diagnostic Imaging Services is a medical procedure using advanced technologies to visualize the internal structures of the body, aiding in disease detection and diagnosis. Techniques like X-ray, CT scan, MRI, ultrasound, and nuclear medicine are employed to create detailed images of organs and tissues. These services play a crucial role in identifying and assessing various medical conditions, enabling healthcare professionals to formulate accurate treatment plans.

Advancements in imaging technologies services provide healthcare professionals with essential insights for early detection and effective treatment planning, leading to improved patient outcomes. It can be performed in hospitals, and diagnostic imaging services contribute to early detection, monitoring, and management of diseases, enhancing patient care. Rapid advancements

Diagnostic Imaging Services Market Dynamics and Trend Analysis:

Diagnostic Imaging Services Market Growth Driver- Increasing Applications in the Automotive Industry

- The diagnostic imaging services market is expanding rapidly due to rising chronic diseases such as cancer, cardiac disorders, and neurological conditions that demand frequent and advanced imaging. Technological upgrades AI-enabled reporting, low-dose CT, high-field MRI, portable ultrasound are improving accuracy, speed, and accessibility, driving higher adoption across hospitals and diagnostic centres.

- Growing demand for early diagnosis, expanding health insurance coverage, and the shift toward outpatient imaging further accelerate market volumes. Emerging markets like India and Southeast Asia are witnessing rapid imaging infrastructure development, while aging populations globally increase scan utilization, collectively propelling strong, sustained market growth.

Diagnostic Imaging Services Market Limiting Factor- Structural Barriers Slowing the Expansion of Diagnostic Imaging Services

- The diagnostic imaging services market faces key restraints, primarily the high cost of advanced modalities such as MRI, CT, and PET, which limits adoption in low-resource settings. Reimbursement pressures and declining scan tariffs reduce profitability for imaging centers, while workforce shortages radiologists, technologists, and trained sonographers slow service delivery.

- Regulatory hurdles, including radiation-dose compliance and equipment approvals, add delays and costs. Limited radiotracer availability affects nuclear imaging growth. Additionally, uneven infrastructure, especially in rural regions, restricts patient access. Data privacy concerns and slow integration of digital health systems further constrain efficiency, collectively tempering market expansion.

Diagnostic Imaging Services Market Expansion Opportunity- Expansion of Outpatient and Point-of-Care Imaging Networks

- A major growth opportunity in the diagnostic imaging services market lies in the rapid expansion of outpatient and point-of-care imaging networks. As healthcare shifts away from hospital-centric models, demand for affordable, quick-turnaround imaging in standalone diagnostic centers, urgent care clinics, and primary-care settings is rising sharply.

- Portable ultrasound, compact CT, and lower-cost MRI systems enable high-quality imaging closer to the patient, improving convenience and reducing wait times. This model offers higher patient throughput, lower operating costs, and strong profitability. For emerging markets, decentralized imaging hubs can significantly increase access, creating a scalable, high-volume service opportunity for providers and investors.

Diagnostic Imaging Services Market Challenge and Risk- Operational and Technology Risks

- The diagnostic imaging services market faces significant challenges and risks, including equipment downtime and high maintenance requirements for MRI, CT, and PET systems, which can disrupt service continuity and inflate operating costs. Cybersecurity threats pose rising risks as imaging centres increasingly rely on cloud-based PACS, teleradiology, and AI tools.

- Radiologist burnout and staffing shortages create reporting delays and reduce service quality. Fluctuating radiotracer supply threatens nuclear imaging reliability. Additionally, evolving regulatory and reimbursement rules increase uncertainty for investments. Together, these operational, technological, and financial risks require robust planning to maintain efficiency and profitability in imaging services.

Diagnostic Imaging Services Market Trend- AI-Driven Imaging Workflow Automation is Reshaping Diagnostic Services

- A notable trend in the diagnostic imaging services market is the rapid adoption of AI-powered workflow automation across acquisition, triage, and reporting. Imaging centers are integrating AI for auto-protocol selection, dose optimization, anomaly detection, and preliminary reads to reduce reporting time and manage rising scan volumes with limited staff.

- AI-enabled PACS, real-time prioritization tools, and automated measurement systems are improving accuracy and cutting turnaround times. This trend is accelerating due to radiologist shortages and increasing case complexity, making AI a critical enabler of efficiency, scalability, and enhanced diagnostic quality across hospitals and diagnostic chains.

Diagnostic Imaging Services Market Segment Analysis:

Diagnostic Imaging Services Market Segmented based on Imaging Modality, Application, End-User, and Region

By Imaging Modality, the Computed Tomography (CT) segment is expected to dominate 26.45% of the market during the forecast Period

- The Computed Tomography (CT) segment in the diagnostic imaging services market utilizes X-ray technology to create detailed cross-sectional images of the body. CT scans are widely employed for comprehensive diagnostic purposes, offering high-resolution imaging of organs, bones, and tissues.

- Applications in cardiology, oncology, neurology, and trauma assessment, CT scans provide valuable insights for accurate diagnosis and treatment planning. Continuous advancements in CT technology, including multi-slice and 3D imaging capabilities, contribute to improved diagnostic precision, making it an important modality in modern healthcare.

By Application, the Oncology Segment is Expected to Lead close to 24.74% of the Market During the Forecast Period

- The Oncology segment dominates the diagnostic imaging services market due to the rising global burden of cancer and the critical role imaging plays across the entire cancer care pathway.

- Imaging is essential for early tumor detection, staging, treatment planning, and monitoring therapeutic response. Modalities such as PET/CT, MRI, CT, and ultrasound are widely used to assess tumor size, spread, and metabolic activity with high accuracy.

Diagnostic Imaging Services Market Regional Insights:

Asia Pacific region is estimated to lead the market with around 31.56%% share during the forecast period.

- The Asia Pacific region is experiencing rapid economic development, leading to improved healthcare infrastructure and increased accessibility to medical services. Rising disposable incomes and changing lifestyles contribute to a demand for healthcare, including diagnostic imaging, as chronic diseases are growing. The Asia Pacific region has a large and aging population, which increases the prevalence of age-related health issues. The demand for diagnostic imaging services in areas such as neurology, cardiology, and oncology, is expected to grow the need for early detection and effective management of these conditions.

- Technological advancements and the adoption of innovative medical imaging technologies are on the rise in the Asia Pacific. The region is keen on incorporating state-of-the-art equipment, such as advanced MRI and CT scanners, to improve diagnostic accuracy and patient outcomes. Additionally, there is a growing awareness of the importance of preventive healthcare, prompting individuals to undergo routine diagnostic screenings, further boosting the demand for diagnostic imaging services.

Diagnostic Imaging Services Market Active Players:

- Alliance Medical (UK)

- Centre for Diagnostic Imaging (U.S)

- Concord Medical Services Holdings Limited (China)

- Dignity Health (US)

- Global Diagnostics (UK)

- Healthcare Imaging Services Pty Ltd. (Australia)

- Medica Group (UK)

- Novant Health (US)

- RadNet (U.S)

- Sonic Healthcare (Australia), and Other Active Players

Key Industry Developments in the Diagnostic Imaging Services Market:

- In May 2024, The Australian Society of Medical Imaging and Radiation Therapy (ASMIRT) conference this week in Darwin, Diagnostic Imaging for Women (DFW), together with Volpara Health, announced significant advancements in applying AI to mammography quality assurance. Over 12 months, the application of Volpara Analytics™ AI software markedly improved both diagnostic accuracy and operational efficiency at Difw, Brisbane's premier tertiary women's imaging centre.

- In November 2023, FUJIFILM Healthcare Americas Corporation a leading provider of diagnostic and enterprise imaging solutions, is unveiling several new medical systems at the 2023 Radiological Society of North America (RSNA) annual meeting, booth 1929, held November 26 – 30 at McCormick Place in Chicago. The new imaging systems that will be on display include three new digital radiography (DR) suites, two new fluoroscopy systems, a 0.4T MRI system, and a 128-slice computed tomography (CT) system.

Diagnostic Imaging Services – Key Features, Importance & Future Outlook

- Diagnostic imaging services integrate a wide range of technologies including X-ray, CT, MRI, ultrasound, and nuclear imaging to provide comprehensive anatomical and functional information. Modern systems offer advanced features such as high-resolution 2D/3D imaging, multi-slice CT scanning, high-field MRI for superior soft-tissue contrast, and Doppler and real-time ultrasound for dynamic assessments. Hybrid imaging platforms like PET/CT and PET/MRI combine structural and metabolic data, enhancing accuracy in complex clinical evaluations. In parallel, cloud-based PACS, AI-assisted image analysis, and automated reporting tools are improving workflow efficiency and diagnostic consistency.

- These services are critical because they support timely and precise clinical decision-making across nearly every medical specialty. Imaging enables early detection of disease, guides interventional procedures, supports surgical planning, and allows clinicians to monitor treatment effectiveness over time. By reducing diagnostic uncertainty and avoiding unnecessary invasive procedures, imaging plays a central role in improving patient outcomes and optimizing healthcare resources.

- The diagnostic imaging market is poised for strong growth. Continued advancements in AI-driven automation, low-dose imaging, portable and point-of-care devices, and molecular imaging will expand access and enhance diagnostic precision. Increasing demand for early diagnosis, rising chronic disease prevalence, and expanding outpatient imaging networks will further drive the sector’s evolution toward faster, safer, and more intelligent diagnostic solutions

|

Diagnostic Imaging Services Market Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 649.20 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.20% |

Market Size in 2035: |

USD 1184.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Diagnostic Imaging Services Market by Imaging Modality (2018-2035)

4.1 Diagnostic Imaging Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 X-ray

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Magnetic Resonance Imaging (MRI)

4.5 Ultrasound

4.6 Computed Tomography (CT)

4.7 Nuclear Imaging

Chapter 5: Diagnostic Imaging Services Market by Application (2018-2035)

5.1 Diagnostic Imaging Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gynecology

5.5 Oncology

5.6 Orthopedics & Musculoskeletal

5.7 Neurology & Spine

5.8 General Imaging

Chapter 6: Diagnostic Imaging Services Market by End-User (2018-2035)

6.1 Diagnostic Imaging Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diagnostic Centers

6.5 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Diagnostic Imaging Services Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ALLIANCE MEDICAL (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 CENTRE FOR DIAGNOSTIC IMAGING (U.S)

7.4 CONCORD MEDICAL SERVICES HOLDINGS LIMITED (CHINA)

7.5 DIGNITY HEALTH (US)

7.6 GLOBAL DIAGNOSTICS (UK)

7.7 HEALTHCARE IMAGING SERVICES PTY LTD. (AUSTRALIA)

7.8 MEDICA GROUP (UK)

7.9 NOVANT HEALTH (US)

7.10 RADNET (U.S)

7.11 SONIC HEALTHCARE (AUSTRALIA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Diagnostic Imaging Services Market By Region

8.1 Overview

8.2. North America Diagnostic Imaging Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Diagnostic Imaging Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Diagnostic Imaging Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Diagnostic Imaging Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Diagnostic Imaging Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Diagnostic Imaging Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Diagnostic Imaging Services Market Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 649.20 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.20% |

Market Size in 2035: |

USD 1184.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||