Data Center Infrastructure Management (DCIM) Solutions Market Synopsis

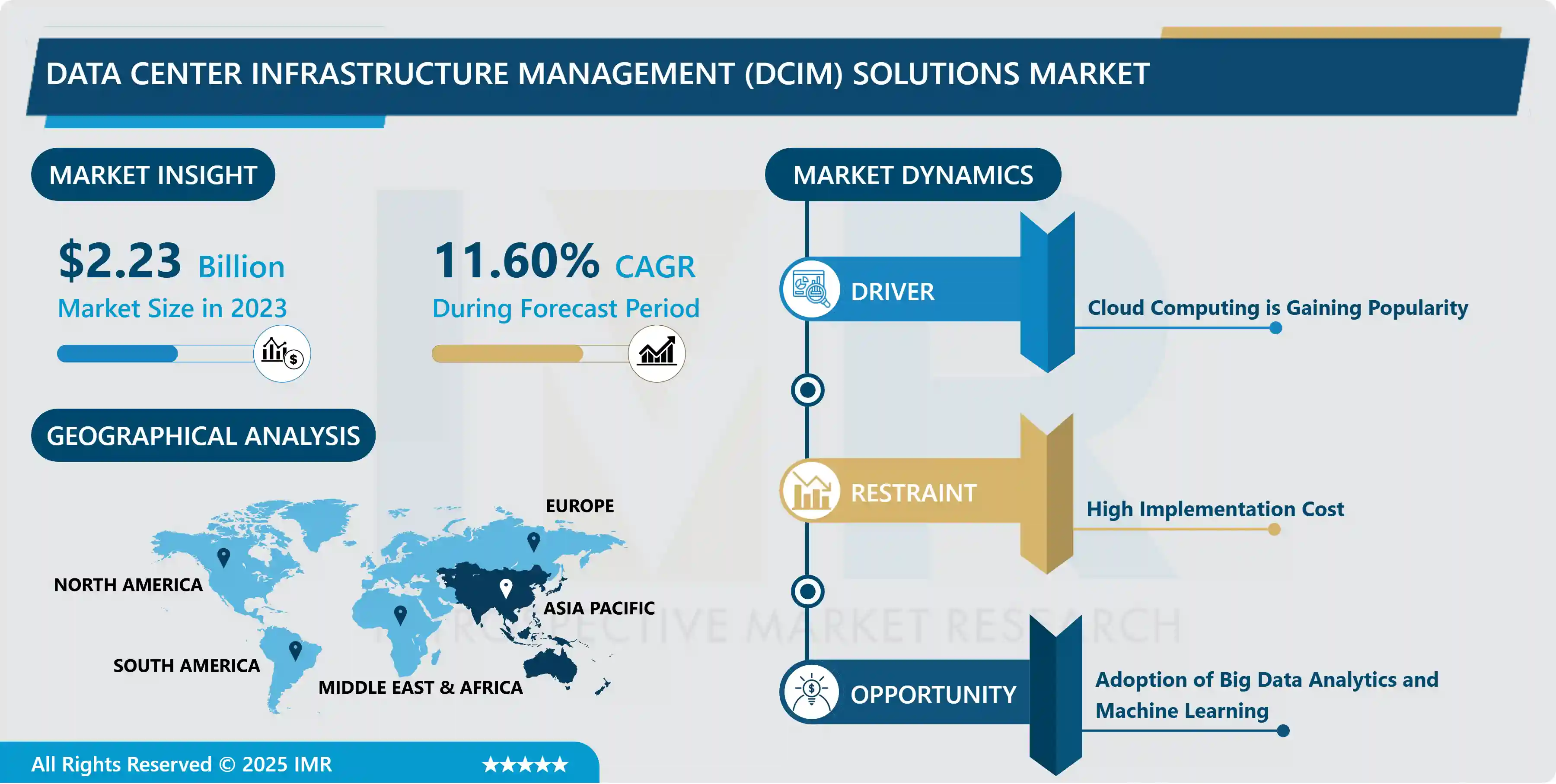

The Global Data Center Infrastructure Management (DCIM) Solutions Market was valued at USD 2.23 billion in 2023 and is projected to reach USD 5.99 billion by 2032, Growing at a CAGR of 11.60 % From 2024-2032.

DCIM solutions are all-encompassing software platforms crafted to oversee, handle, and enhance both the physical and IT infrastructure within data centers. They offer instantaneous insight into power consumption, cooling effectiveness, space utilization, and equipment condition, empowering data center operators to elevate performance, cut costs, and guarantee optimal resource distribution.

DCIM solutions play an active role in monitoring and managing the physical assets and resources within data centers, focusing on optimizing space utilization, power consumption, cooling efficiency, and overall infrastructure performance. By continually monitoring temperature, humidity, power usage, and airflow, DCIM solutions assist data center operators in identifying and addressing inefficiencies, preventing downtime, and enhancing resource allocation in real-time.

They facilitate proactive maintenance and troubleshooting, thereby mitigating the risk of unplanned downtime and associated losses. Secondly, through the optimization of cooling and power distribution, DCIM solutions help organizations significantly reduce energy consumption and operational costs. Moreover, these solutions provide valuable insights and analytics that support data-driven decision-making for capacity planning, resource allocation, and infrastructure upgrades.

The future demand for DCIM solutions is projected to increase as data center infrastructure continues to expand and evolve in line with growing digitalization trends. With the rising complexity and scale of data centers, the necessity for comprehensive management tools such as DCIM is expected to become even more crucial. Additionally, as environmental sustainability becomes a paramount concern for organizations worldwide, the energy efficiency and resource optimization capabilities offered by DCIM solutions will further drive their adoption and integration into modern data center operations.

Data Center Infrastructure Management (DCIM) Solutions Market Trend Analysis

Cloud Computing is Gaining Popularity

- The rising popularity of cloud computing serves as a significant catalyst for the expansion of the Data Center Infrastructure Management (DCIM) Solutions market. As more organizations transition their IT infrastructure to cloud-based platforms, there is a growing demand for robust DCIM solutions. These solutions empower businesses to monitor, manage, and optimize their data center resources efficiently, whether they are hosted on-premises or in the cloud.

- A primary driver behind the adoption of DCIM solutions is the imperative for efficient resource utilization and cost management in cloud computing environments. Given the dynamic nature of cloud setups, organizations require comprehensive tools to oversee and control their infrastructure in real time, ensuring optimal performance while minimizing operational costs. DCIM solutions offer the necessary visibility and governance over cloud-based resources, enabling businesses to streamline operations and allocate resources more judiciously.

- The scalability and adaptability inherent in cloud computing contribute to the increasing demand for DCIM solutions. As organizations expand their operations or respond to evolving business needs, they seek agile infrastructure management solutions capable of accommodating growth and providing insights into resource utilization. DCIM solutions empower businesses to scale their data center operations seamlessly, ensuring sustained efficiency and performance as they harness the advantages of cloud computing.

Adoption of Big Data Analytics and Machine Learning

- The integration of Big Data Analytics and Machine Learning presents significant growth opportunities for the Data Center Infrastructure Management (DCIM) Solutions Market. These advanced technologies enable data center operators to collect and analyze vast amounts of data from various infrastructure components in real-time. Through Big Data Analytics, operators can gain valuable insights into data center performance, efficiency, and capacity utilization, facilitating operational optimization and enhancing reliability.

- Machine Learning algorithms further augment DCIM solutions by enabling predictive analytics and proactive maintenance capabilities. By analyzing historical data patterns and predicting potential failures or performance bottlenecks, machine learning algorithms empower operators to take preemptive actions to prevent downtime and optimize resource allocation.

- The integration of Big Data Analytics and Machine Learning into DCIM solutions enhances agility and scalability in data center operations. By continuously monitoring and analyzing performance metrics, operators can identify optimization opportunities and dynamically adjust their infrastructure to meet evolving workload demands and business needs. This agility is vital in today's rapidly changing digital landscape, where organizations must rapidly scale their IT infrastructure to support growing data volumes and emerging technologies.

Data Center Infrastructure Management (DCIM) Solutions Market Segment Analysis:

Data Center Infrastructure Management (DCIM) Solutions Market Segmented on the basis of Type, Component, Deployment Model, Application and Industry Vertical.

By Deployment Model, Cloud segment is expected to dominate the market during the forecast period

- The Cloud segment is positioned to lead the Data Center Infrastructure Management (DCIM) Solutions market due to its inherent benefits. Cloud-based DCIM solutions offer scalability, flexibility, and accessibility, allowing businesses to efficiently oversee their data center infrastructure from any location with internet access. This remote accessibility reduces reliance on on-premises hardware and maintenance, streamlining operations and reducing costs.

- Cloud-based DCIM solutions provide real-time monitoring and analytics capabilities, facilitating proactive management and optimization of data center resources. This proactive approach enhances efficiency, decreases downtime, and improves overall performance, resulting in heightened productivity and customer satisfaction. Additionally, Cloud-based solutions often feature subscription-based pricing models, making them more cost-efficient and attractive to businesses of various sizes. As organizations continue to prioritize agility, cost-effectiveness, and scalability in their data center operations, the Cloud segment is poised to maintain its dominance in the DCIM Solutions market.

By Application, Asset Management segment held the largest share of 39.21% in 2022

- The Asset Management segment has held a significant share in the Data Center Infrastructure Management (DCIM) Solutions market, primarily due to its pivotal role in maximizing operational efficiency and cost savings. Through active tracking and management of physical assets like servers, storage devices, and networking equipment, organizations can optimize resource utilization, reduce downtime, and streamline maintenance processes. This proactive approach empowers data center operators to identify underutilized assets, allocate resources more efficiently, and plan for future expansion, thereby driving the segment's dominance in the market.

- Asset Management solutions integrated within DCIM platforms offer robust functionalities such as asset tracking, inventory management, and lifecycle planning, crucial for maintaining compliance with regulatory standards and industry best practices. The capability to monitor asset performance in real-time, predict equipment failures, and schedule timely maintenance activities enhances operational resilience and uptime, thereby reinforcing the Asset Management segment's position as a cornerstone of DCIM adoption across diverse industries and sectors.

Data Center Infrastructure Management (DCIM) Solutions Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region maintains its dominance in the Data Center Infrastructure Management (DCIM) Solutions due to the rapid urbanization and industrialization observed in countries such as China and India have spurred significant growth in data center construction, resulting in a substantial demand for DCIM solutions to effectively manage these facilities. Additionally, the region's increasing adoption of cloud computing, IoT, and big data analytics contributes to the necessity for robust infrastructure management tools to support the expanding digital landscape.

- Furthermore, local governments in the Asia Pacific region actively promote digital transformation initiatives and invest in advanced technologies, thereby further driving the demand for DCIM solutions. Companies in the region prioritize data center efficiency and sustainability, leading to increased adoption of DCIM solutions to optimize energy consumption and lower operational costs. With a growing understanding of the advantages offered by DCIM solutions and a proactive stance towards technological innovation, the Asia Pacific region continues to lead the global DCIM market.

Data Center Infrastructure Management (DCIM) Solutions Market Top Key Players:

- Broadcom Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- CommScope Holding Co. Inc. (U.S.)

- Carrier Global Corp. (U.S.)

- Device42 Inc. (U.S.)

- Modius Inc. (U.S.)

- Panduit Corp. (U.S.)

- Rackwise Inc. (U.S.)

- RF Code Inc. (U.S.)

- Unisys Corp. (U.S.)

- Vertiv Holdings Co. (U.S.)

- BGIS Global Integrated Solutions (Cananda)

- FNT GmbH (Germany)

- Siemens AG (Germany)

- Legrand SA (France)

- Schneider Electric SE (France)

- Eaton Corp. Plc (Ireland)

- Huawei Technologies Co. Ltd. (China)

- Sunbird Inc. (India), and Other Major Players

Key Industry Developments in the Data Center Infrastructure Management (DCIM) Solutions Market:

- In September 2023, Nlyte Software, a leader in data center management software, announced the release of its Data Center Sustainability Compliance Reporting solution, an all-in-one platform with a dashboard for sustainability scores and a reporting framework with industry-defined calculations and metrics to streamline environmental compliance reporting.

- In February 2023, Schneider Electric released a new whitepaper and trade-off tool addressing ‘how DCIM addresses hybrid IT management challenges.

|

Global Data Center Infrastructure Management (DCIM) Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.60 % |

Market Size in 2032: |

USD 5.99 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Deployment Model |

|

||

|

By Application |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Center Infrastructure Management (DCIM) Solutions Market by Type (2018-2032)

4.1 Data Center Infrastructure Management (DCIM) Solutions Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Enterprise Data Center

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Colocation Data Center

4.5 Managed Data Center

Chapter 5: Data Center Infrastructure Management (DCIM) Solutions Market by Component (2018-2032)

5.1 Data Center Infrastructure Management (DCIM) Solutions Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Services

Chapter 6: Data Center Infrastructure Management (DCIM) Solutions Market by Deployment Model (2018-2032)

6.1 Data Center Infrastructure Management (DCIM) Solutions Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On-Premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cloud

Chapter 7: Data Center Infrastructure Management (DCIM) Solutions Market by Application (2018-2032)

7.1 Data Center Infrastructure Management (DCIM) Solutions Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Capacity Planning

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Power Monitoring

7.5 Asset Management

7.6 Environmental Monitoring

7.7 BI and Analytics

7.8 Others

Chapter 8: Data Center Infrastructure Management (DCIM) Solutions Market by Industry Vertical (2018-2032)

8.1 Data Center Infrastructure Management (DCIM) Solutions Market Snapshot and Growth Engine

8.2 Market Overview

8.3 BFSI

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 IT & Telecommunication

8.5 Government & Public Sector

8.6 Manufacturing

8.7 Retail

8.8 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Data Center Infrastructure Management (DCIM) Solutions Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AFIMILK LTD. (ISRAEL)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BOUMATIC LLC (UNITED STATES)

9.4 DAIRYMASTER (IRELAND)

9.5 DELAVAL (TETRA LAVAL) (SWEDEN)

9.6 FULLWOOD (UNITED KINGDOM)

9.7 JOZ (NETHERLANDS)

9.8 GEA GROUP AG (GERMANY)

9.9 LELY (NETHERLANDS)

9.10 NEDAP N.V. (NETHERLANDS)

9.11 SUM-IT COMPUTER SYSTEMS LTD. (UNITED KINGDOM)

9.12 VALLEY AGRICULTURAL SOFTWARE INC. (URUS GROUP LP) (UNITED STATES)

9.13 OTHERS

9.14

Chapter 10: Global Data Center Infrastructure Management (DCIM) Solutions Market By Region

10.1 Overview

10.2. North America Data Center Infrastructure Management (DCIM) Solutions Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Enterprise Data Center

10.2.4.2 Colocation Data Center

10.2.4.3 Managed Data Center

10.2.5 Historic and Forecasted Market Size by Component

10.2.5.1 Software

10.2.5.2 Services

10.2.6 Historic and Forecasted Market Size by Deployment Model

10.2.6.1 On-Premises

10.2.6.2 Cloud

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Capacity Planning

10.2.7.2 Power Monitoring

10.2.7.3 Asset Management

10.2.7.4 Environmental Monitoring

10.2.7.5 BI and Analytics

10.2.7.6 Others

10.2.8 Historic and Forecasted Market Size by Industry Vertical

10.2.8.1 BFSI

10.2.8.2 IT & Telecommunication

10.2.8.3 Government & Public Sector

10.2.8.4 Manufacturing

10.2.8.5 Retail

10.2.8.6 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Data Center Infrastructure Management (DCIM) Solutions Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Enterprise Data Center

10.3.4.2 Colocation Data Center

10.3.4.3 Managed Data Center

10.3.5 Historic and Forecasted Market Size by Component

10.3.5.1 Software

10.3.5.2 Services

10.3.6 Historic and Forecasted Market Size by Deployment Model

10.3.6.1 On-Premises

10.3.6.2 Cloud

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Capacity Planning

10.3.7.2 Power Monitoring

10.3.7.3 Asset Management

10.3.7.4 Environmental Monitoring

10.3.7.5 BI and Analytics

10.3.7.6 Others

10.3.8 Historic and Forecasted Market Size by Industry Vertical

10.3.8.1 BFSI

10.3.8.2 IT & Telecommunication

10.3.8.3 Government & Public Sector

10.3.8.4 Manufacturing

10.3.8.5 Retail

10.3.8.6 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Data Center Infrastructure Management (DCIM) Solutions Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Enterprise Data Center

10.4.4.2 Colocation Data Center

10.4.4.3 Managed Data Center

10.4.5 Historic and Forecasted Market Size by Component

10.4.5.1 Software

10.4.5.2 Services

10.4.6 Historic and Forecasted Market Size by Deployment Model

10.4.6.1 On-Premises

10.4.6.2 Cloud

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Capacity Planning

10.4.7.2 Power Monitoring

10.4.7.3 Asset Management

10.4.7.4 Environmental Monitoring

10.4.7.5 BI and Analytics

10.4.7.6 Others

10.4.8 Historic and Forecasted Market Size by Industry Vertical

10.4.8.1 BFSI

10.4.8.2 IT & Telecommunication

10.4.8.3 Government & Public Sector

10.4.8.4 Manufacturing

10.4.8.5 Retail

10.4.8.6 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Data Center Infrastructure Management (DCIM) Solutions Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Enterprise Data Center

10.5.4.2 Colocation Data Center

10.5.4.3 Managed Data Center

10.5.5 Historic and Forecasted Market Size by Component

10.5.5.1 Software

10.5.5.2 Services

10.5.6 Historic and Forecasted Market Size by Deployment Model

10.5.6.1 On-Premises

10.5.6.2 Cloud

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Capacity Planning

10.5.7.2 Power Monitoring

10.5.7.3 Asset Management

10.5.7.4 Environmental Monitoring

10.5.7.5 BI and Analytics

10.5.7.6 Others

10.5.8 Historic and Forecasted Market Size by Industry Vertical

10.5.8.1 BFSI

10.5.8.2 IT & Telecommunication

10.5.8.3 Government & Public Sector

10.5.8.4 Manufacturing

10.5.8.5 Retail

10.5.8.6 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Data Center Infrastructure Management (DCIM) Solutions Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Enterprise Data Center

10.6.4.2 Colocation Data Center

10.6.4.3 Managed Data Center

10.6.5 Historic and Forecasted Market Size by Component

10.6.5.1 Software

10.6.5.2 Services

10.6.6 Historic and Forecasted Market Size by Deployment Model

10.6.6.1 On-Premises

10.6.6.2 Cloud

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Capacity Planning

10.6.7.2 Power Monitoring

10.6.7.3 Asset Management

10.6.7.4 Environmental Monitoring

10.6.7.5 BI and Analytics

10.6.7.6 Others

10.6.8 Historic and Forecasted Market Size by Industry Vertical

10.6.8.1 BFSI

10.6.8.2 IT & Telecommunication

10.6.8.3 Government & Public Sector

10.6.8.4 Manufacturing

10.6.8.5 Retail

10.6.8.6 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Data Center Infrastructure Management (DCIM) Solutions Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Enterprise Data Center

10.7.4.2 Colocation Data Center

10.7.4.3 Managed Data Center

10.7.5 Historic and Forecasted Market Size by Component

10.7.5.1 Software

10.7.5.2 Services

10.7.6 Historic and Forecasted Market Size by Deployment Model

10.7.6.1 On-Premises

10.7.6.2 Cloud

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Capacity Planning

10.7.7.2 Power Monitoring

10.7.7.3 Asset Management

10.7.7.4 Environmental Monitoring

10.7.7.5 BI and Analytics

10.7.7.6 Others

10.7.8 Historic and Forecasted Market Size by Industry Vertical

10.7.8.1 BFSI

10.7.8.2 IT & Telecommunication

10.7.8.3 Government & Public Sector

10.7.8.4 Manufacturing

10.7.8.5 Retail

10.7.8.6 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Data Center Infrastructure Management (DCIM) Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.60 % |

Market Size in 2032: |

USD 5.99 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Deployment Model |

|

||

|

By Application |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||