Cylinder Deactivation Systems Market Synopsis

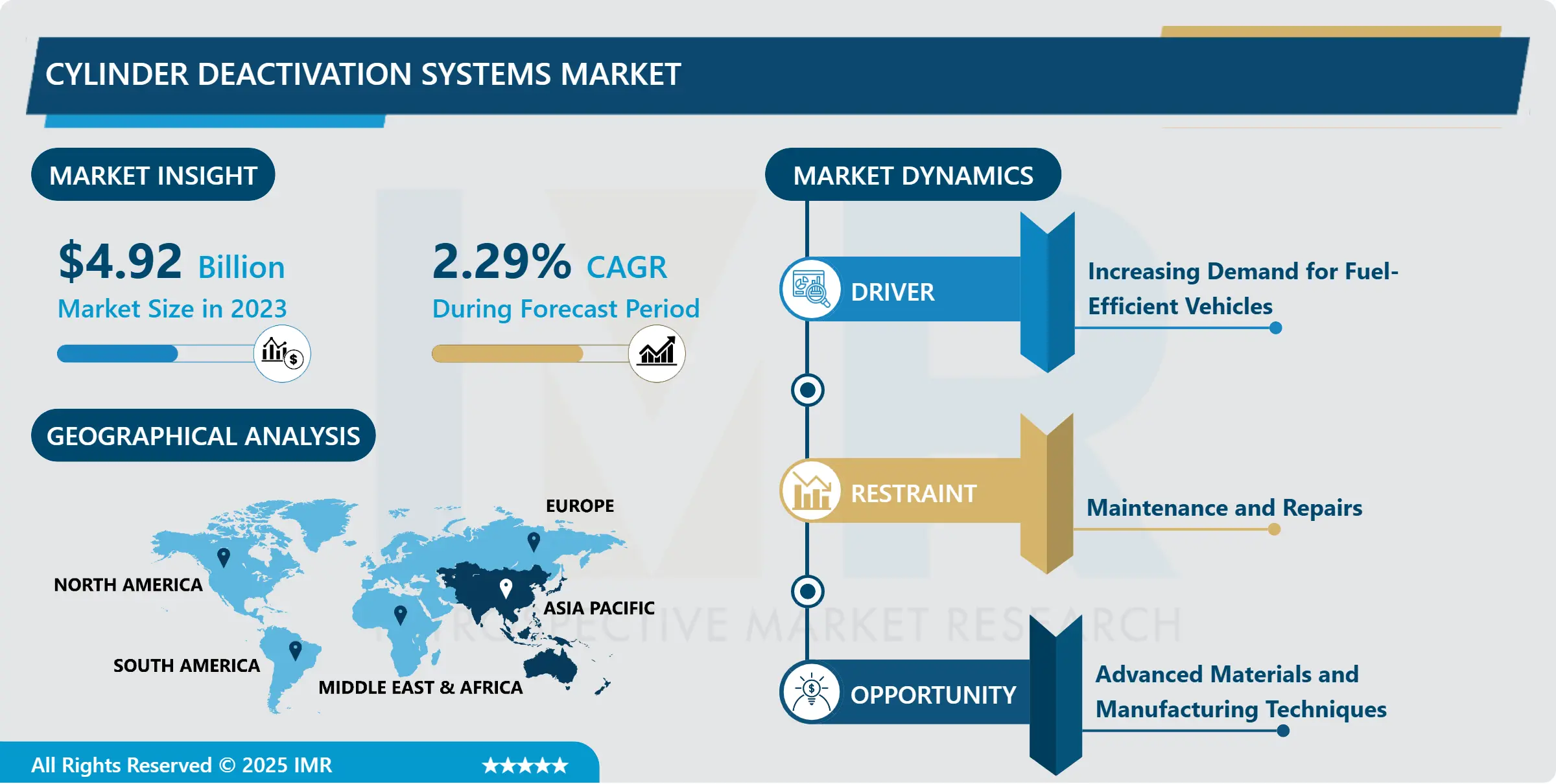

The Cylinder Deactivation Systems Market was valued at USD 4.92 Billion in 2023 and is projected to reach USD 6.03 Billion by 2032, growing at a CAGR of 2.29% from 2024 to 2032.

Cylinder deactivation systems, also known as variable displacement or active fuel management systems, are innovative technologies employed in internal combustion engines to enhance fuel efficiency and reduce emissions. This technology allows an engine to selectively shut down specific cylinders under light-load conditions, effectively transforming a larger engine into a more efficient, smaller one.

The benefits of cylinder deactivation systems are substantial. One of the most significant advantages is improved fuel efficiency. When operating in a reduced-cylinder mode, the engine expends less energy, resulting in reduced fuel consumption. This is particularly noticeable during steady-state driving conditions.Additionally, cylinder deactivation contributes to a reduction in harmful emissions. With fewer active cylinders, there is less fuel combustion and subsequently, lower exhaust emissions. This aids in meeting stringent environmental regulations and reducing the overall carbon footprint of vehicles equipped with this technology.

Cylinder Deactivation Systems are a prominent technology in the automotive industry aimed at improving fuel efficiency. These systems temporarily deactivate specific cylinders in an internal combustion engine under light load conditions to reduce fuel consumption. The market for Cylinder Deactivation Systems is steadily growing due to stringent emissions regulations and increasing consumer demand for more fuel-efficient vehicles.

Cylinder Deactivation Systems Market Trend Analysis

Increasing Demand for Fuel-Efficient Vehicles

- The constant necessity for compliance with strict fuel efficiency and pollution standards imposed by governments all around the world is driving up demand for Cylinder Deactivation Systems. Car manufacturers are under a lot of pressure to comply with these regulations, and cylinder deactivation technology provides a practical answer. Manufacturers can significantly lower carbon dioxide emissions and boost fuel efficiency by incorporating Cylinder Deactivation Systems into their vehicles, meeting or even exceeding legal requirements.

- Moreover, rising fuel prices have amplified consumer interest in vehicles that offer better mileage. As the cost of fuel continues to be a significant concern for consumers, there is a strong inclination towards purchasing vehicles equipped with advanced fuel-saving technologies like cylinder deactivation systems.

- Environmental and economic benefits, cylinder deactivation technology also contributes to enhanced driving experiences. When coupled with other advanced engine management systems, Cylinder Deactivation Systems can seamlessly transition between activated and deactivated cylinder modes, ensuring a smooth and imperceptible shift for the driver.

- Moreover, automakers are actively investing in research and development to further enhance the efficiency and effectiveness of cylinder deactivation systems. This ongoing innovation is expected to result in more advanced and sophisticated CDS solutions, making them even more appealing to consumers.

Advanced Materials and Manufacturing Techniques Creates Opportunity for Cylinder Deactivation Systems Market

- Advanced materials and manufacturing techniques have revolutionized various industries. Advancement is the development of Cylinder Deactivation Systems (CDS), a technology that enhances fuel efficiency in internal combustion engines.

- Cylinder Deactivation Systems operates by selectively deactivating specific cylinders under light load conditions, allowing the engine to function on fewer cylinders, thereby reducing fuel consumption. This technology is particularly effective in situations where high-power output is not required, such as cruising on highways or during steady-state driving. By temporarily shutting down cylinders, the engine can operate more efficiently, resulting in significant fuel savings.

- The integration of advanced materials in the manufacturing process of Cylinder Deactivation Systems components plays a pivotal role in its effectiveness. High-strength alloys and lightweight materials, such as advanced composites and alloys like aluminum and titanium, are utilized in critical engine components. These materials offer a balance of strength and weight reduction, contributing to overall engine efficiency.

- Moreover, the implementation of advanced materials and manufacturing techniques has made Cylinder Deactivation Systems more cost-effective to produce. Mass production of components using these techniques has significantly lowered production costs, making this technology more accessible to a wider range of vehicles across different market segments.

Cylinder Deactivation Systems Market Segment Analysis:

Cylinder Deactivation Systems Market Segmented on the basis of Component, Valve Actuation Method, Fuel Type and Vehicle Type

By Component, Engine Control Unit segment is expected to dominate the market during the forecast period

- The Engine Control Unit (ECU) is a crucial component of Cylinder Deactivation Systems (CDS) that has seen significant advancements, driving its growth. Cylinder Deactivation Systems is an innovative technology designed to improve fuel efficiency in internal combustion engines by temporarily shutting down specific cylinders when their power is not required.

- Advancements in microprocessor technology have allowed for more powerful and sophisticated The Engine Control Units. These modern The Engine Control Unit are capable of processing vast amounts of data in real-time, enabling them to monitor engine parameters with greater precision. This enhanced computational capability facilitates seamless coordination of cylinder deactivation, ensuring smooth transitions between active and deactivated states.

By Fuel Type, Gasoline segment held the largest share of 38.9% in 2022

- Gasoline Cylinder Deactivation Systems, also known as Variable Displacement Technology, have gained popularity due to their potential to enhance fuel efficiency in internal combustion engines. This technology temporarily deactivates a set of cylinders under light load conditions, effectively reducing the engine's displacement and improving efficiency.

- Stringent global emissions regulations have compelled automakers to seek innovative solutions to meet environmental standards. Cylinder deactivation helps reduce emissions by optimizing the engine's performance based on demand, resulting in fewer harmful pollutants being released into the atmosphere.

Cylinder Deactivation Systems Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the market of Cylinder Deactivation Systems for several compelling reasons. This trend is indicative of both the region's economic dynamism and its commitment to sustainability and fuel efficiency.

- Countries like China, India, Japan, and South Korea have seen a surge in vehicle ownership due to rising incomes, urbanization, and an expanding middle class. As these markets continue to grow, the demand for technologies that enhance fuel efficiency becomes critical, not only for cost savings but also for environmental reasons.

- Moreover, stringent government regulations in the region are pushing for higher fuel efficiency standards and lower emissions. Governments in countries like China and India have implemented strict emission norms, forcing automakers to adopt innovative technologies to meet these requirements. Cylinder deactivation systems represent a vital solution in this context, as they allow vehicles to operate on fewer cylinders under light load conditions, significantly reducing fuel consumption and emissions.

- Asia Pacific region has a strong presence of major automakers and a robust automotive supply chain. This ecosystem is conducive to the development, production, and integration of advanced technologies like cylinder deactivation systems. Local manufacturers are increasingly investing in research and development to stay competitive in the global automotive market, and cylinder deactivation systems have become a focal point in these efforts.

COVID-19 Impact Analysis on Cylinder Deactivation Systems Market:

- The COVID-19 pandemic significantly impacted various industries, including the automotive sector. During the initial stages of the pandemic, strict lockdowns and travel restrictions led to a sharp decline in global vehicle sales. This, in turn, affected the demand for advanced automotive technologies, including Cylinder Deactivation Systems. As manufacturing plants shut down and supply chains were disrupted, many automakers faced delays in production schedules, impacting the integration of Cylinder Deactivation Systems into new vehicles.

- The pandemic evolved and industries adapted to the new normal, some trends emerged that could potentially benefit the Cylinder Deactivation Systems market. For instance, there was an increased focus on sustainability and environmental consciousness. This heightened awareness of the need to reduce carbon emissions could drive automakers to invest in technologies like Cylinder Deactivation Systems, which contribute to improved fuel efficiency and reduced greenhouse gas emissions.

- Additionally, governments around the world continued to implement stricter emission regulations to combat climate change. This regulatory environment could incentivize automakers to adopt Cylinder Deactivation Systems and similar technologies to meet these requirements.

- As the vaccination campaigns progressed and economies gradually reopened, there was a gradual recovery in vehicle sales. This recovery could translate into a renewed interest in advanced automotive technologies, including Cylinder Deactivation Systems. Consumers, now more conscious of the long-term benefits of fuel efficiency, may be more inclined to choose vehicles equipped with such systems.

Cylinder Deactivation Systems Market Top Key Players:

- GM(US)

- Chrysler Group (US)

- Jacobs (US)

- Boston (US)

- BorgWarner (US)

- Garmin ltd (US)

- BorgWarner Inc. (US)

- Robert Bosch (Germany)

- Continental AG (Germany)

- Volkswagen (Germany)

- Bosch (Germany)

- Mercedes-Benz (Germany)

- Schaeffler (Germany)

- FEV (Germany)

- Delphi Technologies (UK)

- Eaton (Ireland)

- Valeo (France)

- MAZDA (Japan)

- Toyota (Japan)

- Denso Corporation (Japan)

- Hitachi (Japan)

- Honda (Japan)

Key Industry Developments in the Cylinder Deactivation Systems Market:

- In February 2023, Intelligent power management company Eaton announced its Vehicle Group cylinder deactivation (CDA) and late intake valve closing (LIVC) have been proven to simultaneously reduce nitrogen oxides (NOx) and carbon dioxide (CO2). The technologies were shown to be effective for meeting future global emissions requirements for diesel-engine powered commercial vehicles, according to a recent series of tests conducted by FEV, a recognized leader in design and development of advanced gasoline, diesel, and hybrid powertrains and vehicle systems.

- In December 2022, DENSO announced its sustainability management strategy that contributes to a sustainable society, its corporate value improvement strategy to strengthen the corporate foundation that supports the creation of values.

|

Cylinder Deactivation Systems Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.92 Bn. |

|

|

CAGR (2024-2032) : |

2.29% |

Market Size in 2032: |

USD 6.03 Bn. |

|

|

Segments Covered: |

By Component |

|

|

|

|

By Valve Actuation Method |

|

|

||

|

By Fuel Type |

|

|

||

|

By Vehicle Type |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cylinder Deactivation Systems Market by Component (2018-2032)

4.1 Cylinder Deactivation Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Engine Control Unit

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Valve Solenoid

4.5 Electronic Throttle Control

Chapter 5: Cylinder Deactivation Systems Market by Valve Actuation Method (2018-2032)

5.1 Cylinder Deactivation Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Overhead Camshaft Design

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pushrod Design

Chapter 6: Cylinder Deactivation Systems Market by Fuel Type (2018-2032)

6.1 Cylinder Deactivation Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Gasoline

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diesel

Chapter 7: Cylinder Deactivation Systems Market by Vehicle Type (2018-2032)

7.1 Cylinder Deactivation Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Passenger Vehicle

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Light Commercial Vehicle

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cylinder Deactivation Systems Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CAFEPRESS (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CUSTOM INK (US)

8.4 RUSHORDERTEES.COM (US)

8.5 THE BLUE GECKO PRINTING(US)

8.6 THREADBIRD(US)

8.7 PRINTIFY (US)

8.8 BROKEN ARROW WEAR (US)

8.9 ENTRIPY (CANADA)

8.10 DISCOUNT MUGS (US)

8.11 DESKTOP METAL(US)

8.12 THREAD BIRD (US)

8.13 DESIGNASHIRT (US)

8.14 SHUTTERFLY (US)

8.15 ZAZZLE (US)

8.16 GOTPRINT (US)

8.17 RYONET (CANADA)

8.18 PRINTFUL (AUSTRALIA)

8.19 SPREADSHIRT (GERMANY)

8.20 VISTAPRINT (INDIA)

8.21 UBERPRINTS (GEORGIA)

8.22 MOO(LONDON)

8.23 PSPRINT (CALIFORNIA)

8.24 UPRINTING.COM (CALIFORNIA)

8.25 ANTALIS (FRANCE)

8.26 4IMPRINT INC.(UK)

Chapter 9: Global Cylinder Deactivation Systems Market By Region

9.1 Overview

9.2. North America Cylinder Deactivation Systems Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Engine Control Unit

9.2.4.2 Valve Solenoid

9.2.4.3 Electronic Throttle Control

9.2.5 Historic and Forecasted Market Size by Valve Actuation Method

9.2.5.1 Overhead Camshaft Design

9.2.5.2 Pushrod Design

9.2.6 Historic and Forecasted Market Size by Fuel Type

9.2.6.1 Gasoline

9.2.6.2 Diesel

9.2.7 Historic and Forecasted Market Size by Vehicle Type

9.2.7.1 Passenger Vehicle

9.2.7.2 Light Commercial Vehicle

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cylinder Deactivation Systems Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Engine Control Unit

9.3.4.2 Valve Solenoid

9.3.4.3 Electronic Throttle Control

9.3.5 Historic and Forecasted Market Size by Valve Actuation Method

9.3.5.1 Overhead Camshaft Design

9.3.5.2 Pushrod Design

9.3.6 Historic and Forecasted Market Size by Fuel Type

9.3.6.1 Gasoline

9.3.6.2 Diesel

9.3.7 Historic and Forecasted Market Size by Vehicle Type

9.3.7.1 Passenger Vehicle

9.3.7.2 Light Commercial Vehicle

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cylinder Deactivation Systems Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Engine Control Unit

9.4.4.2 Valve Solenoid

9.4.4.3 Electronic Throttle Control

9.4.5 Historic and Forecasted Market Size by Valve Actuation Method

9.4.5.1 Overhead Camshaft Design

9.4.5.2 Pushrod Design

9.4.6 Historic and Forecasted Market Size by Fuel Type

9.4.6.1 Gasoline

9.4.6.2 Diesel

9.4.7 Historic and Forecasted Market Size by Vehicle Type

9.4.7.1 Passenger Vehicle

9.4.7.2 Light Commercial Vehicle

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cylinder Deactivation Systems Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Engine Control Unit

9.5.4.2 Valve Solenoid

9.5.4.3 Electronic Throttle Control

9.5.5 Historic and Forecasted Market Size by Valve Actuation Method

9.5.5.1 Overhead Camshaft Design

9.5.5.2 Pushrod Design

9.5.6 Historic and Forecasted Market Size by Fuel Type

9.5.6.1 Gasoline

9.5.6.2 Diesel

9.5.7 Historic and Forecasted Market Size by Vehicle Type

9.5.7.1 Passenger Vehicle

9.5.7.2 Light Commercial Vehicle

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cylinder Deactivation Systems Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Engine Control Unit

9.6.4.2 Valve Solenoid

9.6.4.3 Electronic Throttle Control

9.6.5 Historic and Forecasted Market Size by Valve Actuation Method

9.6.5.1 Overhead Camshaft Design

9.6.5.2 Pushrod Design

9.6.6 Historic and Forecasted Market Size by Fuel Type

9.6.6.1 Gasoline

9.6.6.2 Diesel

9.6.7 Historic and Forecasted Market Size by Vehicle Type

9.6.7.1 Passenger Vehicle

9.6.7.2 Light Commercial Vehicle

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cylinder Deactivation Systems Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Engine Control Unit

9.7.4.2 Valve Solenoid

9.7.4.3 Electronic Throttle Control

9.7.5 Historic and Forecasted Market Size by Valve Actuation Method

9.7.5.1 Overhead Camshaft Design

9.7.5.2 Pushrod Design

9.7.6 Historic and Forecasted Market Size by Fuel Type

9.7.6.1 Gasoline

9.7.6.2 Diesel

9.7.7 Historic and Forecasted Market Size by Vehicle Type

9.7.7.1 Passenger Vehicle

9.7.7.2 Light Commercial Vehicle

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Cylinder Deactivation Systems Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.92 Bn. |

|

|

CAGR (2024-2032) : |

2.29% |

Market Size in 2032: |

USD 6.03 Bn. |

|

|

Segments Covered: |

By Component |

|

|

|

|

By Valve Actuation Method |

|

|

||

|

By Fuel Type |

|

|

||

|

By Vehicle Type |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||