Corset Market Synopsis

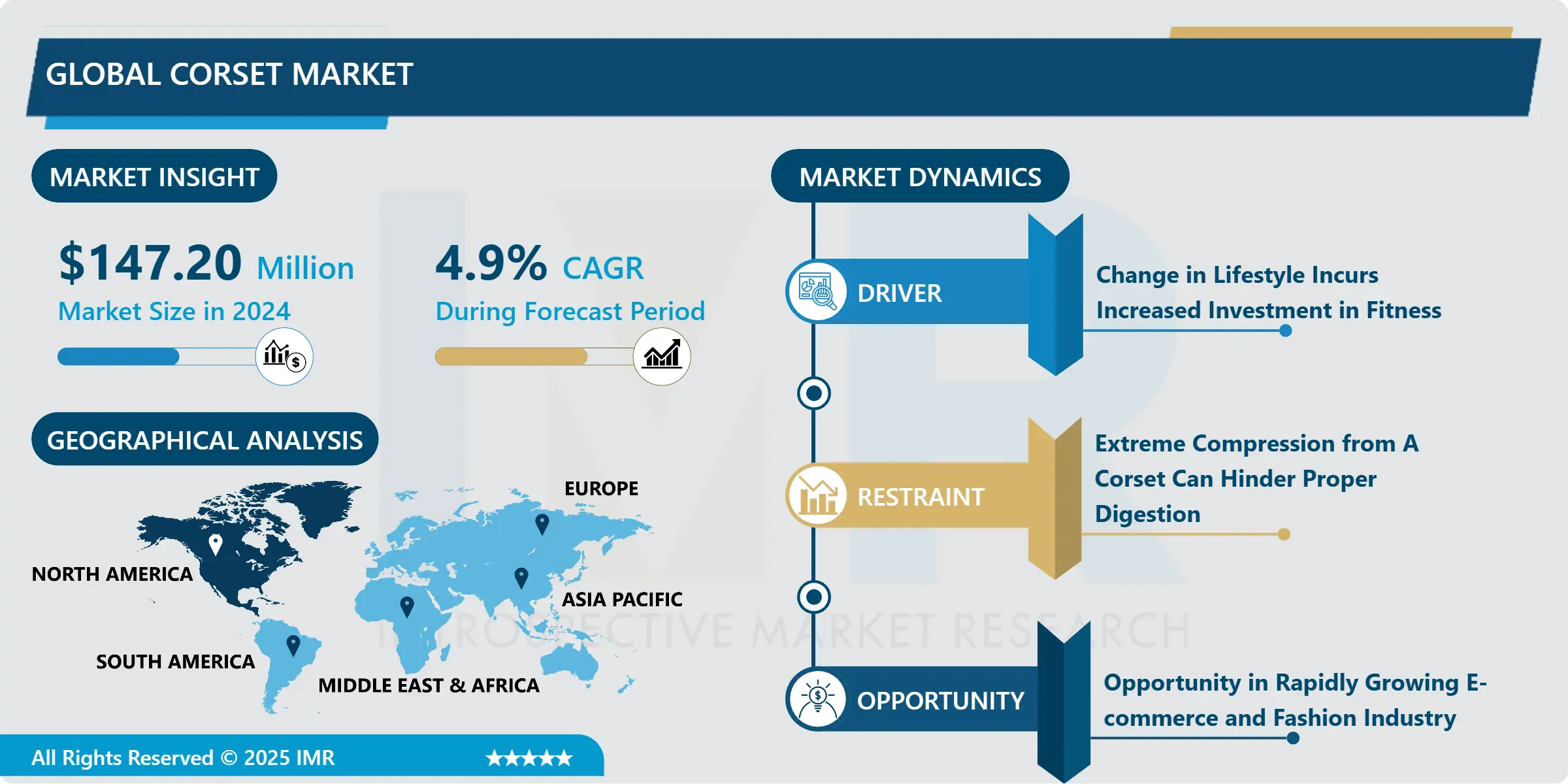

Global Corset Market Size Was Valued at USD 147.20 Million In 2024 And Is Projected to Reach USD 215.83 Million By 2032, Growing at A CAGR of 4.9% From 2025 To 2032.

A corset is a garment worn primarily to train and shape the body or waist in order to achieve the desired shape. Generally speaking, the primary purpose of wearing a corset is to make the waist smaller and the bottoms larger. They can be worn for various purposes, primarily for fashion or medical reasons. It was primarily worn by women in the past, but men are now investing in it as well.

There are a variety of shapes, colors, sizes, and patterns available for corsets. Aside from this, overbust, underbust, and less curvaceous steel and plastic skeleton corsets can be worn under or over the clothing. Additionally, it can be worn alone or with other garments. In addition, they can have various styles, such as zippers, laces, eyelets, and hooks. Lace, satin, velvet, brocade, leather, cotton, or twill may be used.

Many medical applications exist for corsets, particularly those made of steel bone. It can be utilized to maintain body posture, heal past internal injuries, and shape the body.

The expansion of E-commerce industries, the rapid expansion of the fashion industry, the availability of a wide variety of products, and the presence of attractive marketing and promotional strategies are all factors that contribute to the expansion of the market. In the coming years, emerging economies will experience positive growth due to rapid urbanization, rising living standards, and rising disposable incomes.

The Corset Market Trend Analysis

Change in Lifestyle Incurs Increased Investment in Fitness

- Changing lifestyles and rising demand for healthcare products have a substantial impact on the corset market. Changes in societal norms, technological advancements, and a greater emphasis on health and wellness have all contributed to these alterations in lifestyle.

- The rise of social media is a major trend that has influenced lifestyle changes. Platforms like Instagram and YouTube have created a culture of contemporary lifestyles as they have grown in popularity. Therefore, people have made substantial investments in novel product types, such as corsets.

- The corset has a number of advantages, including its ability to alleviate back pain and improve posture, as well as its ability to treat past injuries and wear-and-tear injuries. It can help stabilize the spinal curvature of patients with scoliosis, kyphosis, and lordosis and relieve their back pain and muscle tension. In addition, corsets can conceal asymmetries and assist individuals in avoiding tension or injury caused by asymmetries (PFFD and other birth defects) as well as muscular asymmetries.

- Additionally, correcting the posture prevents other skeletal issues. The demand for corsets is increasing as a result of these advantageous factors, which support the growth of the corset market.

Opportunity in Rapidly Growing E-commerce and Fashion Industry

- The rapid growth of e-commerce and the fashion industry over the past year has supported the expansion of the corset market during the forecast year. The ease and convenience with which consumers can purchase corsets from e-commerce websites have contributed to the growth of the market for these products.

- E-commerce platforms provide access to a global market. Facilitating consumer access to a variety of corsets from a number of brands and manufacturers. As a result, there is increased market competition as companies strive to differentiate themselves by offering unique products and formulations. In addition, e-commerce platforms provide manufacturers with valuable data and insights regarding customer preferences and purchasing patterns. This data can help manufacturers stay ahead of the competition by allowing them to create new corsets and improve existing ones. Therefore, the expanding e-commerce platform facilitates the expansion of the corset market.

- Moreover, Fashion is a dynamic industry at the center of the rapidly evolving corset market. The ever-increasing demand of consumers, which leads to more and more production and sales, is the source of the fashion industry's popularity and power. In 2022, the global apparel market's revenue amounted to $1,53 trillion U.S. dollars. Henceforth, the growing e-commerce platform and the fashion industry create an opportunity for the corset market in the forthcoming years.

Segmentation Analysis Of The Corset Market

Corset market segments cover the Type and application. By Type, the Faux Leather Corset segment is Anticipated to Dominate the Market Over the Forecast period.

- The demand for faux leather corsets has increased in recent years. Most people prefer to purchase faux leather goods due to their numerous advantages, such as being cheaper than real leather, being animal-friendly, being able to be produced in virtually any color, being able to be manufactured with a high-gloss finish, being easily cleaned with a damp cloth, requiring little maintenance, not cracking as easily as real leather, being resistant to UV fading, and lacking the odor of genuine leather. Due to these benefits, the synthetic leather corset is gaining popularity in the fashion industry.

- Due to the increasing demand for faux leather corsets, the major players are increasing their investment in the production of faux leather with various characteristics. In January 2023, for instance, Kim Kardashian released a faux leather collection that included leggings, corsets, and other items. These new products present an opportunity for the corset market in the upcoming year.

Regional Analysis of The Corset Market

North America is Expected to Dominate the Market Over the Forecast period.

- The United States is the largest fashion industry economy. As a result of their changing lifestyles and disposable incomes, young people are increasingly drawn to fashionable goods. The statistic depicts, for instance, the anticipated revenue of the apparel market in 2022, by country. In that year, the United States apparel market generated approximately 312 billion U.S. dollars in revenue, making it the largest market in the world.

- In addition, the development of e-commerce platforms is a major factor propelling the growth of the North American corset market. Internet distribution channels make it easy for customers to gain access to a vast selection of products, while also enabling producers to reach customers outside of traditional brick-and-mortar retail locations. This has created a new opportunity for the players in the corset industry to form new alliances and partnerships, as well as to increase their visibility and build their brands.

- In conclusion, the market for corsets in the United States is expanding due to a number of factors, including the growing demand for healthcare products, the popularity of private label brands, the rise of e-commerce, and the rise in disposable income.

Covid-19 Impact Analysis On Corset Market

The corvid-19 negatively impacted the market for corsets. This is due to governments shutting down manufacturing plants, closing stores, and canceling events in an effort to slow the spread of the virus. The pandemic of coronavirus has had a significant impact on fashion brands worldwide. Concurrently, the fashion industry faces challenges associated with consumer demand. The ongoing COVID-19 pandemic will forever alter the fashion industry.

While the apparel and fashion industry, particularly in the US market, has faced challenges over the past decade (due to a combination of recession aftershocks, increased promotional intensity, channel shifts, and an excess of real estate), it has been on a path of steady, albeit slow, growth over the past three years, with value and off-price formats serving as rare bright spots. In addition, the retail industry in particular has been severely impacted by the government's request for self-quarantine, which severely limited face-to-face service in stores. Henceforth, the covid-19 had a negative impact on the corset market.

Top Key Players Covered in The Corset Market

- VOLLERS CORSETS (United Kingdom)

- ADOREME (United States)

- Easto Garments (India)

- DarkLure (United States)

- Dark Garden Corsetry (United States)

- Isabella Corsetry (United States)

- Versatile Corsets (United States)

- Allure Lingerie (United States)

- Organic Corset Co. (United States)

- Axfords (United Kingdom)

- True Corset (United Kingdom)

- Orchard Corset (United States)

- Lace Embrace Atelier (Canada)

- Beautiful Connection Group (United States), and Other Active Players

Key Industry Developments in the Corset Market

- In March 2024, Bunny Corset, a premium women's apparel label known for high-end corsets, is excited to announce its expansion into Myntra, a leading e-commerce platform. This strategic partnership aims to enhance accessibility for consumers seeking fashionable options. By joining Myntra, Bunny Corset solidifies its position as a destination for premium corsetry and fashion apparel, allowing fashion enthusiasts across India to explore its exquisite collection. "They are thrilled to showcase our designs to Myntra's customers and empower women to feel confident in their silhouette-flattering garments," said Suman Bharti, Founder of Bunny Corset.

|

Global Corset Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 147.20 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.9% |

Market Size in 2032: |

USD 215.83 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Corset Market by Type (2018-2032)

4.1 Corset Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Leather corset

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PVC corset

4.5 Faux Leather Corset

4.6 Others

Chapter 5: Corset Market by Application (2018-2032)

5.1 Corset Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fashion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fetish

5.5 Medical

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Corset Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HEXION (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 METAFRAX (RUSSIA)

6.4 SHCHEKINOAZOT JSC (RUSSIA)

6.5 CHEMANOL (SAUDI ARABIA)

6.6 CALDIC (NETHERLANDS)

6.7 INEOS (UK)

6.8 FENO RESINAS (BRAZIL)

6.9 RUNHUA CHEMICAL (CHINA)

6.10 YUHANG CHEMICAL (CHINA)

6.11 XIANGRUI CHEMICAL (CHINA)

6.12 YANGMEI FENGXI (CHINA)

6.13 RUIXING GROUP (CHINA)

6.14 SHENGXUELONG CHEMICAL (CHINA)

6.15 XUDONG CHEMICAL (CHINA)

6.16 SIMALIN (CHINA)

6.17 MGC (JAPAN)

6.18 KCIL (INDIA)

6.19

Chapter 7: Global Corset Market By Region

7.1 Overview

7.2. North America Corset Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Leather corset

7.2.4.2 PVC corset

7.2.4.3 Faux Leather Corset

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Fashion

7.2.5.2 Fetish

7.2.5.3 Medical

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Corset Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Leather corset

7.3.4.2 PVC corset

7.3.4.3 Faux Leather Corset

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Fashion

7.3.5.2 Fetish

7.3.5.3 Medical

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Corset Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Leather corset

7.4.4.2 PVC corset

7.4.4.3 Faux Leather Corset

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Fashion

7.4.5.2 Fetish

7.4.5.3 Medical

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Corset Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Leather corset

7.5.4.2 PVC corset

7.5.4.3 Faux Leather Corset

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Fashion

7.5.5.2 Fetish

7.5.5.3 Medical

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Corset Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Leather corset

7.6.4.2 PVC corset

7.6.4.3 Faux Leather Corset

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Fashion

7.6.5.2 Fetish

7.6.5.3 Medical

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Corset Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Leather corset

7.7.4.2 PVC corset

7.7.4.3 Faux Leather Corset

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Fashion

7.7.5.2 Fetish

7.7.5.3 Medical

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Corset Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 147.20 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.9% |

Market Size in 2032: |

USD 215.83 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||