Consumer NAS and SMB NAS Market Synopsis

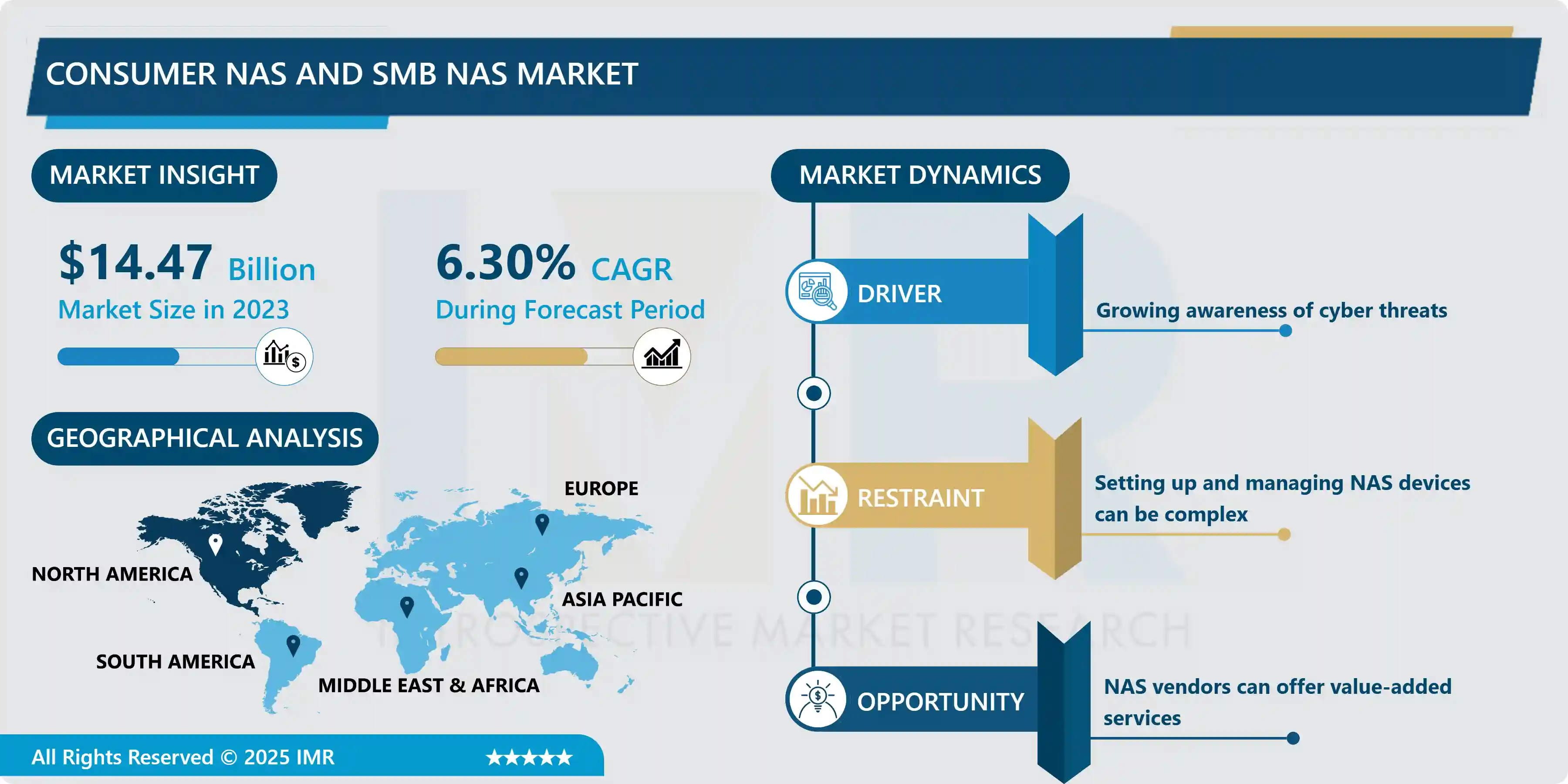

Consumer NAS and SMB NAS Market Size Was Valued at USD 14.47 Billion in 2023, and is Projected to Reach USD 28.35 Billion by 2032, Growing at a CAGR of 6.30% From 2024-2032.

SMB NAS solutions and consumer network-attached storage (NAS) solutions cater to different user bases with unique demands and requirements. Consumer NAS devices, which provide convenient centralized storage and access to files, media, and backups within a home network environment, are intended primarily for individual or domestic use.

Designed with multimedia streaming capabilities, user-friendly interfaces, and straightforward setup procedures, these devices are ideal for storing and sharing personal information such as documents, photos, videos, and audio. Consumer NAS systems frequently emphasize simplicity and affordability, offering users a dependable and economical storage alternative to fulfill their home computing requirements.

In contrast, SMB NAS solutions are designed specifically for enterprises and institutions that necessitate more resilient storage functionalities in order to effectively oversee their expanding data volumes. SMB NAS devices provide integration with enterprise applications and protocols, support for RAID configurations, and scalability options, among other advanced features.

Designed to support multiple users, intensive duties, and business-critical applications, these systems provide small and medium-sized businesses with dependable and scalable storage solutions. SMB NAS solutions place a premium on data protection, performance, and dependability, providing organizations with the adaptability and capabilities necessary to satisfy their changing storage needs and IT infrastructure requirements.

Consumer NAS and SMB NAS Market Trend Analysis

The growing digitization of personal and professional data

- Increasing digitization of personal and business data is a key driver for the growth of the consumer NAS and SMB NAS market. As reliance on digital information grows, so does the need for secure, centralized storage solutions that can handle this data efficiently and organized Consumer NAS devices provide a convenient way for individuals and households to store and access their digital assets on their home network, with central storage for multimedia files, backups and personal documents provided by the Centre

- Similarly, the digitization of applications, customer interfaces and business processes for small and medium enterprises has greatly increased data processing and storage needs SMB NAS solutions address the need for scalable and capable storage use reliability to accommodate this growing number of digital.

- These systems offer businesses a cost-effective and efficient way to store, manage, and protect their critical data assets, enabling them to streamline operations, enhance productivity, and ensure data accessibility and security. As the trend towards digitization continues to accelerate, the demand for Consumer NAS and SMB NAS solutions is expected to further surge, driving market growth and innovation in the storage industry.

Integrating NAS with cloud storage services

- The integration of NAS into cloud storage services provides tremendous opportunities for the consumer NAS and SMB NAS markets, allowing users to take advantage of local and cloud-based storage solutions. Easy integration of NAS devices with cloud storage platforms allows users to benefit from the scalability, accessibility and redundancy of the cloud while maintaining the quality, control and privacy of local storage

- This integration provides customers with an easy way to extend their storage beyond the limits of their NAS devices, ensuring that they can store and access their data with an internet connection from anywhere Additionally, cloud integration provides data security is enhanced by enabling automatic backup and synchronization between NAS and cloud storage Data happens to remain safe and accessible even in the event of a hardware failure or disaster

- Integrating NAS into cloud storage services provides scalability and flexibility to meet the evolving storage needs of growing businesses. By moving rarely accessed or stored data to the cloud, SMBs can optimize their NAS storage infrastructure, reduce costs and complexity and ensure data availability and compliance

- Cloud integration simplifies collaboration and remote access, enables employees to access and share files efficiently from anywhere, enhances productivity and productivity Additionally, SMBs can benefit from cloud-based services such as data analytics, machine learning and AI, To extract insights, benefit from their stored data and overall, the integration of NAS with cloud storage services opens up new opportunities for consumers and SMBs to provide data management, accessibility and efficiency increase, leading to greater acceptance and innovation in the NAS market

Consumer NAS and SMB NAS Market Segment Analysis:

Consumer NAS and SMB NAS Market is segmented based on Form Factors, and End Use.

By Form Factors, 2-Bay segment is expected to dominate the market during the forecast period

- The 2-bay segment typically exhibits market dominance in the consumer NAS and SMB NAS markets due to the combined advantages of affordability, versatility and performance so 2-bay NAS devices offer a robust solution for businesses small and medium-sized enterprises (SMEs) and consumers, how to develop cost-effective balanced storage capacity. In addition to providing storage that is suitable for small businesses and most residential users, these systems also enable RAID configuration for data redundancy and fault tolerance

- In addition, 2-Bay NAS devices typically offer a wide range of functionality, such as the ability to stream multimedia, facilitate remote access, and integrate with cloud services this makes them ideally suited for a variety of applications.

- High-capacity network-attached storage systems (NAS) systems, including 4-bay, 6-bay, and 12-bay models for users with more stringent storage requirements However, a 2-bay segment the by customers and SMBs It has always well- appreciated the demand for cost-effective, reliable, and scalable storage solutions.

By End Use, Small and Medium-sized Businesses (SMBs) segment held the largest share

- Consumer NAS and SMB The NAS market is primarily inhabited by the small and medium-sized businesses (SMBs) segment, due to the high need for scalable and reliable storage solutions among these specific demographics yi in the reason

- Small to medium-sized businesses (SMBs) need storage solutions that can effectively manage their expanding data volumes, facilitate multiple users, and provide robust security features—all the while a SMB remains cost-effective -typical NAS devices typically offer consolidation and workflows, RAID for configuration, data duplication, and snapshot backups, among other advanced functionality

- This makes it more compatible with the differing needs of SMBs across multiple industries. While the consumer segment has the largest market share, especially in the home use and small office/home office (SOHO) environments, the SMB segment dominates the market due to large business demand for storage solutions convenient facilitating their operation and expansion.

Consumer NAS and SMB NAS Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the consumer NAS and SMB NAS markets for several reasons. Many leading NAS vendors and technology companies are present in North America, driving innovation and competition in the market. These companies are investing heavily in research and development, and are constantly introducing new features and enhancements to their NAS offerings to drive market growth and increased adoption

- Furthermore, the North American market benefits from a strong economy and favorable business environment which encourages investments in IT, infrastructure and technology solutions especially among small and medium-sized businesses (SMBs) that form a major part of the NAS market Growth no business imperative to improve data management, improve efficiency, ensure data security and compliance and invest in NAS solutions

- Furthermore, well-established regional distribution networks and strong sales channels make it easier for NAS vendors to acquire customers and expand their market share in Overall, North American Consumer NAS through technological advancements, markets over a combination of strong demand and a supportive business environment -Positions SMBs as a key force in the NAS market.

Active Key Players in the Consumer NAS and SMB NAS Market

- Apple (Cupertino, California, USA)

- Buffalo Technology (Nagoya, Japan)

- NETGEAR (San Jose, California, USA)

- QNAP (Taipei, Taiwan)

- Seagate (Dublin, Ireland)

- Synology (Taipei, Taiwan)

- Western Digital (San Jose, California, USA)

- Asustor (Taipei, Taiwan)

- Dell (Round Rock, Texas, USA)

- D-Link (Taipei, Taiwan)

- Other Key Players

Key Industry Developments in the Consumer NAS and SMB NAS Market:

- In June 2022, A small NAS device designed for SMBs that need to store data peripheral or on-premises was introduced by Nexsan. Nexsan has expanded the range of storage solutions to suit entry-level needs with the introduction of EZ-NAS, which operates over server message block (SMB) and network file system (NFS) protocols

|

Global Consumer NAS and SMB NAS Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 14.47 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.30 % |

Market Size in 2032: |

USD 28.35 Bn. |

|

Segments Covered: |

By Form Factors |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Consumer NAS and SMB NAS Market by Form Factors (2018-2032)

4.1 Consumer NAS and SMB NAS Market Snapshot and Growth Engine

4.2 Market Overview

4.3 1-Bay

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 2-Bay

4.5 4-Bay and 5-Bay

4.6 6-Bay to 12-Bay

Chapter 5: Consumer NAS and SMB NAS Market by End User (2018-2032)

5.1 Consumer NAS and SMB NAS Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Consumer

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 SOHO

5.5 SMBs

5.6 SMEs

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Consumer NAS and SMB NAS Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALTRAD INVESTMENT AUTHORITY S.A.S. (FRANCE)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CONDOR S.P.A. (ITALY)

6.4 SUNBELT RENTALS INC. (UNITED STATES)

6.5 ULMA C Y E COOP. (SPAIN)

6.6 UNITED RENTALS INC. (UNITED STATES)

6.7 APOLLO SCAFFOLD SERVICES LTD. (UNITED KINGDOM)

6.8 ASA SCAFFOLDING SERVICES LTD. (UNITED KINGDOM)

6.9 ASW SCAFFOLDING LTD. (UNITED KINGDOM)

6.10 ATLANTIC PACIFIC EQUIPMENT (AT-PAC) INC. (UNITED STATES)

6.11 BRAND ENERGY & INFRASTRUCTURE HOLDINGS INC. (UNITED STATES)

6.12 OTHER KEY PLAYERS

6.13

Chapter 7: Global Consumer NAS and SMB NAS Market By Region

7.1 Overview

7.2. North America Consumer NAS and SMB NAS Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Form Factors

7.2.4.1 1-Bay

7.2.4.2 2-Bay

7.2.4.3 4-Bay and 5-Bay

7.2.4.4 6-Bay to 12-Bay

7.2.5 Historic and Forecasted Market Size by End User

7.2.5.1 Consumer

7.2.5.2 SOHO

7.2.5.3 SMBs

7.2.5.4 SMEs

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Consumer NAS and SMB NAS Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Form Factors

7.3.4.1 1-Bay

7.3.4.2 2-Bay

7.3.4.3 4-Bay and 5-Bay

7.3.4.4 6-Bay to 12-Bay

7.3.5 Historic and Forecasted Market Size by End User

7.3.5.1 Consumer

7.3.5.2 SOHO

7.3.5.3 SMBs

7.3.5.4 SMEs

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Consumer NAS and SMB NAS Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Form Factors

7.4.4.1 1-Bay

7.4.4.2 2-Bay

7.4.4.3 4-Bay and 5-Bay

7.4.4.4 6-Bay to 12-Bay

7.4.5 Historic and Forecasted Market Size by End User

7.4.5.1 Consumer

7.4.5.2 SOHO

7.4.5.3 SMBs

7.4.5.4 SMEs

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Consumer NAS and SMB NAS Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Form Factors

7.5.4.1 1-Bay

7.5.4.2 2-Bay

7.5.4.3 4-Bay and 5-Bay

7.5.4.4 6-Bay to 12-Bay

7.5.5 Historic and Forecasted Market Size by End User

7.5.5.1 Consumer

7.5.5.2 SOHO

7.5.5.3 SMBs

7.5.5.4 SMEs

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Consumer NAS and SMB NAS Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Form Factors

7.6.4.1 1-Bay

7.6.4.2 2-Bay

7.6.4.3 4-Bay and 5-Bay

7.6.4.4 6-Bay to 12-Bay

7.6.5 Historic and Forecasted Market Size by End User

7.6.5.1 Consumer

7.6.5.2 SOHO

7.6.5.3 SMBs

7.6.5.4 SMEs

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Consumer NAS and SMB NAS Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Form Factors

7.7.4.1 1-Bay

7.7.4.2 2-Bay

7.7.4.3 4-Bay and 5-Bay

7.7.4.4 6-Bay to 12-Bay

7.7.5 Historic and Forecasted Market Size by End User

7.7.5.1 Consumer

7.7.5.2 SOHO

7.7.5.3 SMBs

7.7.5.4 SMEs

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Consumer NAS and SMB NAS Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 14.47 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.30 % |

Market Size in 2032: |

USD 28.35 Bn. |

|

Segments Covered: |

By Form Factors |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||