Cloud managed service Market Synopsis

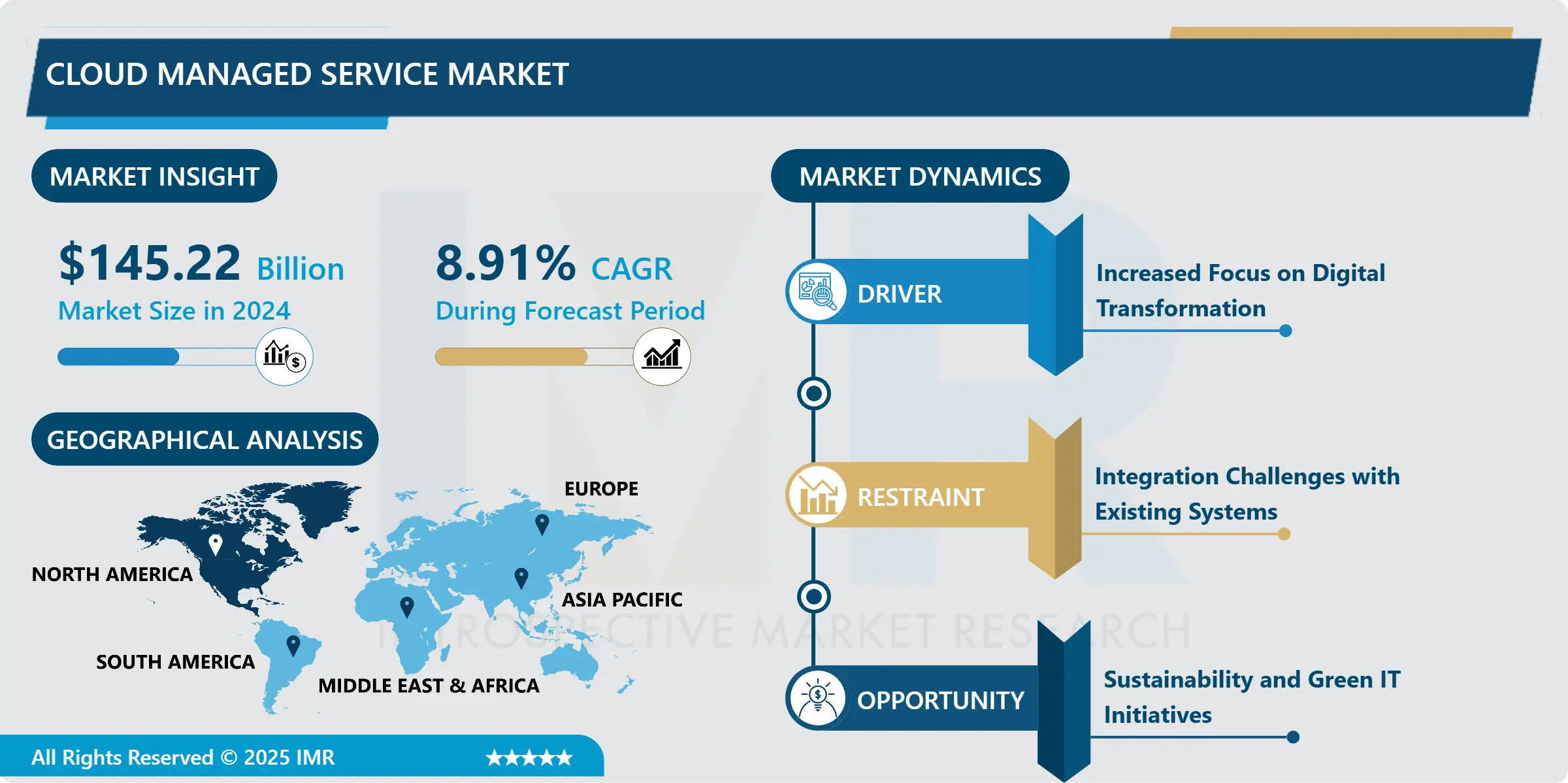

Cloud managed service Market Size is Valued at USD 145.22 Billion in 2024, and is Projected to Reach USD 371.34 Billion by 2035, Growing at a CAGR of 8.91% From 2025-2035.

The Cloud Managed Services Market includes services which enable an organization to delegate the management of their cloud solutions. This involves the observation, upkeep, and improvement of the organizational cloud assets so that a business can pursue its fundamental processes with the advantages of utilizing the cloud. MSPs provide fully integrated solutions that include IaaS, PaaS and SaaS freeing the cloud environments from possible infections, optimizing resource use and guaranteeing flexibility to reflect the changing needs of clients.

- Cloud managed services market has been significantly influenced by the need for scalability and flexibility at IT level. This is because organizations are migrating to cloud solutions for dynamism to be able to manage the changing workload without much investment on physical structures. This is as a result of an increasing number of industries embracing digital processes thus increasing demand for agility and cloud solutions in their operations.

- The two other nostalgic forces are increased concern for cost containment and more rational utilization of resources. Business organizations are starting to see that the internal management of cloud resources increases operational costs and challenges. The integration of the cloud managed services means that organizations are able to cut back on their expenses, minimize on the downtime opportunities and increase their ROI. Further, heightened concern for compliance and security in the new world also compels businesses to turn to their cloud environments to seek professional help.

Cloud managed service Market Trend Analysis

Increasing adoption of multi-cloud strategies

- Multi-cloud strategy, which emerged as a popular trend in the Cloud Managed Services Market, takes some of the shares at this level. More and more organizations have adopted the use of multiple clouds from different CSPs to reduce the risk of vendor lock in, gain more freedom and achieve higher performance. This trend assists the businesses to take advantage of service specialties that different clouds unveil while at the same time improving disaster recovery and data duplication measures. That is why the MSPs are adapting to changes by aiming at offering bundled solutions that will help to manage multiple clouds at once.

- The second one is the continued growth of automation and artificial intelligence (AI) solutions within managed services. Given the increased sophistication of cloud platforms, enterprise search increasingly relies on automated approaches to management and protection of their cloud assets. They predict and gain information about the cloud services in advance and thereby manage them effectively. This has now shifted towards automation not only making performance better, but also eradicating the chances of human interference making outputs better in terms of their quality.

The increasing emphasis on sustainability and green IT initiatives

- The Cloud Managed Services Market indicates imminent growth prospects for service providers to gain penetrating market insights to build new industry-specific solutions. With a range of industries like the healthcare, finance and manufacturing industry going digital, there is emerging call for vertical-specific managed services to respond to specific regulatory plus operational considerations. In their turn, MSPs can go deeper into clients’ needs pertinent to their industries, and thus create competitive advantages, recurring business relationships, and increase revenues.

- Also, the demands for the high impact of sustainability and green IT initiatives should also serve as a positive impact of cloud managed services to the needed goals. Enterprise are waking up to the realization of the impact of carbon emissions and are looking at cloud solutions that are energy optimized. Any managed service providers that bring sustainability strategies into their portfolio are well positioned to attract and appeal to businesses within that niche, which results in competitive advantage.

Cloud managed service Market Segment Analysis:

Cloud managed service Market Segmented on the basis of service type, Deployment Type and End User.

By Service Type, Infrastructure as a Service (IaaS) segment is expected to dominate the market during the forecast period

- Based on service type, the Cloud Managed Services Market has been divided into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). IaaS delivers computing resources through internet for handling and expanding corporate information technology infrastructure while avoiding commitments to actual hardware. PaaS provides a useful basis for development of different applications when the developers can focus on application development and do not need to think about underlying system and its capabilities. SaaS, generally deployed on a subscription model, refers to the practice of delivering applications through the internet to the customer’s desktop, and the end-users are able to access the applications through the web with limited reinstallation and upgrading. This segmentation is based on the requirement consideration of the value organizations derive from flexibility scalabilty and cost of cloud operations.

By Deployment Model, Public Cloud segment held the largest share in 2024

- By deployment model, the Cloud Managed Services Market can further be divided into types such as: Public Cloud, Private Cloud, Hybrid Cloud. Public Cloud is a cloud solution created to accommodate multiple users, which deliver resource and cost saving while the acquisition of infrastructure is managed by a third party. Lastly, Private Cloud is a sort of cloud solution that has pool of resources dedicated solely to a given organization as it supports higher security measures, organizational control and compliancy with some of the set rules. Hybrid Cloud is a model that means that certain aspects can be drawn from both public and private Cloud arrangements because it can give an organization the best of both worlds by making it possible for data and applications to be transferred between the different Cloud settings. This segmentation shows how organizations’ cloud strategies differ to adapt to the particular needs and operational parameters of corporations.

Cloud managed service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has emerged as the market leader in cloud managed services market, because of the efficient technology and usage of cloud solutions at a faster pace compared to others. The availability of quite a number of top cloud service players and managed service companies has fostered a strong market for cloud management services. The advanced matching qualifications also indicate that the region is experiencing skills shortage of skilled IT professionals while research and development investments to support advancement of innovative cloud technology is also high.

- In addition, the trend for digital transformation across sectors clearly in North America region is fueling request for cloud managed services. These services are being used by enterprises in matters related to operational optimization, customer satisfaction and to ensure that they stay relevant. Enhanced by the technology, a friendly business environment, and sustained emphasis on innovation, North America remains a pivotal market in the cloud managed services market.

Active Key Players in the Cloud managed service Market

- Amazon Web Services (AWS) (USA)

- Microsoft Azure (USA)

- IBM Cloud (USA)

- Google Cloud Platform (USA)

- Oracle Cloud (USA)

- Rackspace (USA)

- VMware (USA)

- Accenture (Ireland)

- CenturyLink (USA)

- Cisco Systems (USA), Others Active players.

|

Global Cloud managed service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 145.22 Bn. |

|

Forecast Period 2025-35 CAGR: |

8.91 % |

Market Size in 2035: |

USD 371.34 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Deployment Model |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud managed service Market by Service Type (2018-2032)

4.1 Cloud managed service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Infrastructure as a Service (IaaS)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Platform as a Service (PaaS)

4.5 Software as a Service (SaaS)

Chapter 5: Cloud managed service Market by Deployment Model (2018-2032)

5.1 Cloud managed service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Private Cloud

5.5 Hybrid Cloud

Chapter 6: Cloud managed service Market by End user (2018-2032)

6.1 Cloud managed service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI (Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Financial Services

6.5 and Insurance)

6.6 IT and Telecommunications

6.7 Retail

6.8 Healthcare

6.9 Government

6.10 Manufacturing

6.11 Education

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cloud managed service Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMAZON WEB SERVICES (AWS) (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICROSOFT AZURE (USA)

7.4 IBM CLOUD (USA)

7.5 GOOGLE CLOUD PLATFORM (USA)

7.6 ORACLE CLOUD (USA)

7.7 RACKSPACE (USA)

7.8 VMWARE (USA)

7.9 ACCENTURE (IRELAND)

7.10 CENTURYLINK (USA)

7.11 CISCO SYSTEMS (USA)

7.12 OTHERS ACTIVE PLAYERS

Chapter 8: Global Cloud managed service Market By Region

8.1 Overview

8.2. North America Cloud managed service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Service Type

8.2.4.1 Infrastructure as a Service (IaaS)

8.2.4.2 Platform as a Service (PaaS)

8.2.4.3 Software as a Service (SaaS)

8.2.5 Historic and Forecasted Market Size by Deployment Model

8.2.5.1 Public Cloud

8.2.5.2 Private Cloud

8.2.5.3 Hybrid Cloud

8.2.6 Historic and Forecasted Market Size by End user

8.2.6.1 BFSI (Banking

8.2.6.2 Financial Services

8.2.6.3 and Insurance)

8.2.6.4 IT and Telecommunications

8.2.6.5 Retail

8.2.6.6 Healthcare

8.2.6.7 Government

8.2.6.8 Manufacturing

8.2.6.9 Education

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cloud managed service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Service Type

8.3.4.1 Infrastructure as a Service (IaaS)

8.3.4.2 Platform as a Service (PaaS)

8.3.4.3 Software as a Service (SaaS)

8.3.5 Historic and Forecasted Market Size by Deployment Model

8.3.5.1 Public Cloud

8.3.5.2 Private Cloud

8.3.5.3 Hybrid Cloud

8.3.6 Historic and Forecasted Market Size by End user

8.3.6.1 BFSI (Banking

8.3.6.2 Financial Services

8.3.6.3 and Insurance)

8.3.6.4 IT and Telecommunications

8.3.6.5 Retail

8.3.6.6 Healthcare

8.3.6.7 Government

8.3.6.8 Manufacturing

8.3.6.9 Education

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cloud managed service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Service Type

8.4.4.1 Infrastructure as a Service (IaaS)

8.4.4.2 Platform as a Service (PaaS)

8.4.4.3 Software as a Service (SaaS)

8.4.5 Historic and Forecasted Market Size by Deployment Model

8.4.5.1 Public Cloud

8.4.5.2 Private Cloud

8.4.5.3 Hybrid Cloud

8.4.6 Historic and Forecasted Market Size by End user

8.4.6.1 BFSI (Banking

8.4.6.2 Financial Services

8.4.6.3 and Insurance)

8.4.6.4 IT and Telecommunications

8.4.6.5 Retail

8.4.6.6 Healthcare

8.4.6.7 Government

8.4.6.8 Manufacturing

8.4.6.9 Education

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cloud managed service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Service Type

8.5.4.1 Infrastructure as a Service (IaaS)

8.5.4.2 Platform as a Service (PaaS)

8.5.4.3 Software as a Service (SaaS)

8.5.5 Historic and Forecasted Market Size by Deployment Model

8.5.5.1 Public Cloud

8.5.5.2 Private Cloud

8.5.5.3 Hybrid Cloud

8.5.6 Historic and Forecasted Market Size by End user

8.5.6.1 BFSI (Banking

8.5.6.2 Financial Services

8.5.6.3 and Insurance)

8.5.6.4 IT and Telecommunications

8.5.6.5 Retail

8.5.6.6 Healthcare

8.5.6.7 Government

8.5.6.8 Manufacturing

8.5.6.9 Education

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cloud managed service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Service Type

8.6.4.1 Infrastructure as a Service (IaaS)

8.6.4.2 Platform as a Service (PaaS)

8.6.4.3 Software as a Service (SaaS)

8.6.5 Historic and Forecasted Market Size by Deployment Model

8.6.5.1 Public Cloud

8.6.5.2 Private Cloud

8.6.5.3 Hybrid Cloud

8.6.6 Historic and Forecasted Market Size by End user

8.6.6.1 BFSI (Banking

8.6.6.2 Financial Services

8.6.6.3 and Insurance)

8.6.6.4 IT and Telecommunications

8.6.6.5 Retail

8.6.6.6 Healthcare

8.6.6.7 Government

8.6.6.8 Manufacturing

8.6.6.9 Education

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cloud managed service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Service Type

8.7.4.1 Infrastructure as a Service (IaaS)

8.7.4.2 Platform as a Service (PaaS)

8.7.4.3 Software as a Service (SaaS)

8.7.5 Historic and Forecasted Market Size by Deployment Model

8.7.5.1 Public Cloud

8.7.5.2 Private Cloud

8.7.5.3 Hybrid Cloud

8.7.6 Historic and Forecasted Market Size by End user

8.7.6.1 BFSI (Banking

8.7.6.2 Financial Services

8.7.6.3 and Insurance)

8.7.6.4 IT and Telecommunications

8.7.6.5 Retail

8.7.6.6 Healthcare

8.7.6.7 Government

8.7.6.8 Manufacturing

8.7.6.9 Education

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cloud managed service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 145.22 Bn. |

|

Forecast Period 2025-35 CAGR: |

8.91 % |

Market Size in 2035: |

USD 371.34 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Deployment Model |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :