Business Process Outsourcing Market Synopsis

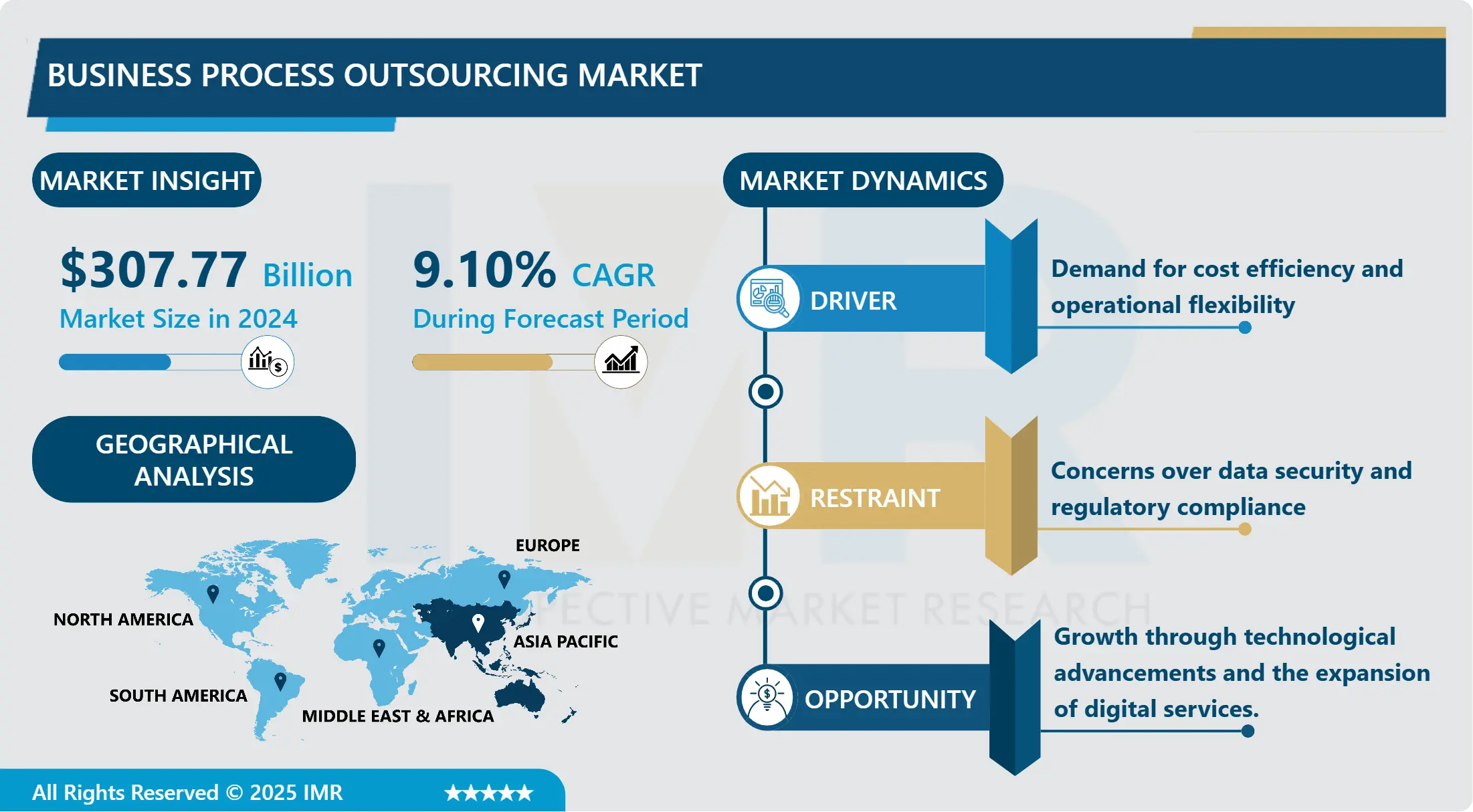

Business Process Outsourcing Market Size is Valued at USD 307.77 Billion in 2024, and is Projected to Reach USD 617.77 Billion by 2032, Growing at a CAGR of 9.10% From 2025-2032.

The business process outsourcing (BPO) market is a sector that is significantly evolving and is defined by the outsourcing of non-core business activities to third-party service providers. The market has undergone significant development as a result of companies' growing emphasis on core competencies, cost reduction, and access to specialized skills and technologies. The BPO industry encompasses a variety of services, including finance, human resources, IT services, and customer support. The global market is expanding as businesses strive to improve efficiency and respond to technological advancements. Emerging economies are particularly noteworthy for their cost-effective solutions and skilled workforce. The emergence of digital transformation and automation technologies further fuels market expansion, promoting innovation and efficiency across various sectors.

The demand for cost efficiency and operational flexibility among companies has driven significant growth in the business process outsourcing (BPO) market. Organizations are outsourcing non-core functions, including finance, human resources, and customer service, to specialized service providers in order to optimize operations and concentrate on strategic initiatives.

Technological advancements and the proliferation of digital platforms are the primary drivers of this market, as they facilitate the more efficient administration and integration of outsourced processes. Furthermore, the globalization of business operations has resulted in an increase in cross-border outsourcing, facilitating market expansion.

The Asia-Pacific region, particularly India and the Philippines, has emerged as a significant center for BPO services as a result of their cost advantages and extensive, skilled labor pools. In the interim, North America and Europe remain substantial markets, which underscores the importance of both domestic and international outsourcing strategies.

Data security concerns and regulatory compliance are among the obstacles that the BPO market encounters. However, we anticipate that technological advancements and process optimization will spur further expansion, making BPO an indispensable part of modern business strategies.

Business Process Outsourcing Market Trend Analysis

Business Process Outsourcing Market Growth Driver- Increased Adoption of AI and Automation

- The business process outsourcing (BPO) market is undergoing a transformative transition as a result of the heightened adoption of AI and automation technologies. BPO providers are integrating sophisticated AI solutions to streamline and optimize various processes as businesses strive to reduce operational costs and improve efficiency. This integration is allowing companies to automate routine duties, including data entry and customer support, resulting in swifter and more precise service delivery.

- The proliferation of AI is causing the BPO sector to experience a significant increase in operational efficacy and decision-making capabilities. Companies are implementing advanced analytics and machine learning algorithms to analyze vast amounts of data, producing valuable insights and predictions that guide strategic business decisions. This data-driven approach is becoming a more significant competitive advantage for both BPO providers and their clients.

- Automation is also important in changing consumer interactions. AI-powered virtual assistants and chatbots are currently handling consumer inquiries and support requests around the clock. This change not only enhances the customer experience but also enables human agents to concentrate on more intricate and value-added duties, thereby boosting overall productivity.

- As AI and automation continue to develop, we anticipate additional development in the BPO market. Companies that adopt these technologies are likely to gain a substantial competitive advantage, thereby advancing the future of business process outsourcing toward increased efficiency and innovation.

Business Process Outsourcing Market Expansion Opportunity- Shift Towards Specialized BPO Services

- In recent years, there has been a discernible transition to specialized business process outsourcing (BPO) services. This trend is indicative of an increasing demand for outsourcing partners that provide customized solutions rather than generic services. Companies are increasingly in search of BPO providers who possess specialized knowledge in sectors such as finance, healthcare, and customer experience management. This specialization allows businesses to leverage advanced technologies and extensive industry expertise to optimize efficiency and stimulate expansion.

- Several factors, such as the necessity for cost reduction and the availability of specialized skills that are not in-house, are contributing to the growth of specialized BPO services. Organizations can leverage the efficiency and innovation provided by specialized providers while concentrating on their core competencies by outsourcing specific functions to specialists. This method not only enhances customer satisfaction and service quality but also decreases operational costs.

- Additionally, BPO organizations are capable of providing more sophisticated and efficient solutions as a result of technological advancements, including automation and artificial intelligence. These technologies improve the capabilities of specialized BPO services, enabling more efficient operations, predictive analytics, and improved data management. Consequently, businesses can enhance their operational agility and scalability.

- We anticipate that the BPO market will continue to evolve, placing a greater emphasis on specialization in the future. Companies are likely to prioritize partnerships with providers who offer advanced technological solutions and niche expertise. This trend underscores the growing significance of specialized BPO services in facilitating business transformation and fostering a competitive edge in a market that is undergoing rapid change.

Business Process Outsourcing Market Segment Analysis:

Business Process Outsourcing Market Segmented on the basis of Service Type, Operating Model, Organization Size, Vertical, and Region

By Service Type, Finance and Accounting Outsourcing segment is expected to dominate the market during the forecast period

- A diverse array of specialized service types that cater to the diverse requirements of businesses is transforming the business process outsourcing (BPO) market. Finance and accounting outsourcing entails the delegation of financial operations, including financial reporting and recordkeeping, to external experts. This enables companies to concentrate on their essential activities while simultaneously guaranteeing the accuracy and compliance of their financial transactions.

- Marketing and sales outsourcing provides businesses with the opportunity to leverage specialized technologies and skills for market research, lead generation, and sales management. By outsourcing these functions, companies can improve their market reach and efficiency without the need for extensive internal resources.

- Customer support outsourcing is essential for the preservation of customer satisfaction, as it facilitates the management of inquiries, complaints, and support tickets through dedicated service centers. This service is essential for businesses that are seeking to enhance their operational efficiency and client experience.

- Human resource and recruitment outsourcing, as well as training and development outsourcing, provide businesses with extensive expertise in talent acquisition and employee development. These services assist organizations in effectively managing their workforce, ensuring that they have the necessary skills and talent to fuel growth. Document management and processing are also essential, as they offer efficient solutions for the organization and management of critical business documents. Collectively, these outsourcing services allow organizations to streamline operations, minimize expenditures, and concentrate on strategic expansion.

By Vertical, the BFSI segment held the largest share in 2024

- Various verticals, such as BFSI (Banking, Financial Services, and Insurance), IT & Telecommunications, Retail & Consumer Goods, and Manufacturing, have experienced substantial growth in the Business Process Outsourcing (BPO) market. These sectors are increasingly dependent on BPO services to optimize operational efficiency, minimize expenses, and capitalize on specialized knowledge.

- BPO providers in the BFSI sector provide services such as customer support, claims processing, and compliance management, enabling financial institutions to concentrate on core business activities while navigating complex regulatory landscapes. In the same vein, the IT and telecommunications sector capitalizes on BPO solutions that optimize software development, network management, and technical support, thereby enabling organizations to remain competitive in a technological environment that is swiftly changing.

- Retail and consumer goods companies employ BPO to oversee marketing strategies, supply chain operations, and consumer interactions. This allows them to improve customer experiences and promptly address market demands. The manufacturing sector implements BPO services to enhance operating efficiency and cost-effectiveness by optimizing supply chain management, procurement, and production processes.

- In general, the BPO market's expansion into these verticals underscores the increasing significance of outsourcing as a strategic instrument for organizations that are striving to promote business growth and achieve operational excellence.

Business Process Outsourcing Market Regional Insights:

Asia Pacific Business Process Outsourcing Market Trends

- The Asia Pacific Business Process Outsourcing (BPO) market is undergoing substantial growth, which is being driven by the growing demand for scalable and cost-effective business solutions. BPO services are being employed by companies in the region to improve efficiency and streamline operations. The trend is being further fueled by the emergence of digital technologies, such as artificial intelligence and automation, which have enabled the development of more sophisticated and integrated BPO solutions.

- In particular, the BPO market is experiencing robust growth as a result of the expansion of the IT and telecommunications sectors in Asia Pacific. Organizations are progressively outsourcing non-core functions, including finance, human resources, and customer service, to specialized service providers. This enables them to concentrate on high-level strategic initiatives.

- Additionally, the BPO industry is being transformed by the emergence of digital transformation and remote work. In order to accommodate the changing business landscape, organizations are actively pursuing partners who can provide adaptable, cloud-based solutions. This transition is promoting competition and innovation among BPO service providers.

- In general, the Asia Pacific BPO market is on the brink of further growth as businesses increasingly acknowledge the strategic benefits of outsourcing. It is anticipated that the sector will experience future development as a result of the integration of advanced technologies and the emphasis on operational efficiency.

Active Key Players in the Business Process Outsourcing Market

- Accenture (USA)

- Amdocs (Israel)

- Capgemini (France)

- CBRE Group Inc. (USA)

- HCL Technologies Limited (India)

- Infosys Limited (Infosys BPM) (India)

- NCR Corporation (USA)

- Sodexo (France)

- TTEC Holdings, Inc. (USA)

- Wipro Limited (India)

- Other Active Players

|

Global Business Process Outsourcing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 307.77 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.10% |

Market Size in 2032: |

USD 617.77 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Operating Model |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Process Outsourcing Market by Service Type (2018-2032)

4.1 Business Process Outsourcing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Finance and Accounting Outsourcing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Marketing & Sales Outsourcing

4.5 Customer Support Outsourcing

4.6 Training & Development Outsourcing

4.7 Human Resource and Recruitment Outsourcing

4.8 Document Management & Processing

Chapter 5: Business Process Outsourcing Market by Operating Model (2018-2032)

5.1 Business Process Outsourcing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Traditional (On-Premise)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Business Process as a Service (Cloud-based)

Chapter 6: Business Process Outsourcing Market by Organization Size (2018-2032)

6.1 Business Process Outsourcing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 SME’S

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Business Process Outsourcing Market by Vertical (2018-2032)

7.1 Business Process Outsourcing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 IT & Telecommunication

7.5 Retail & Consumer Goods

7.6 Manufacturing

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Business Process Outsourcing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ACCENTURE (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AMDOCS (ISRAEL)

8.4 CAPGEMINI (FRANCE)

8.5 CBRE GROUP INC. (USA)

8.6 HCL TECHNOLOGIES LIMITED (INDIA)

8.7 INFOSYS LIMITED (INFOSYS BPM) (INDIA)

8.8 NCR CORPORATION (USA)

8.9 SODEXO (FRANCE)

8.10 TTEC HOLDINGS INC. (USA)

8.11 WIPRO LIMITED (INDIA)

8.12 OTHERS

8.13

Chapter 9: Global Business Process Outsourcing Market By Region

9.1 Overview

9.2. North America Business Process Outsourcing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Service Type

9.2.4.1 Finance and Accounting Outsourcing

9.2.4.2 Marketing & Sales Outsourcing

9.2.4.3 Customer Support Outsourcing

9.2.4.4 Training & Development Outsourcing

9.2.4.5 Human Resource and Recruitment Outsourcing

9.2.4.6 Document Management & Processing

9.2.5 Historic and Forecasted Market Size by Operating Model

9.2.5.1 Traditional (On-Premise)

9.2.5.2 Business Process as a Service (Cloud-based)

9.2.6 Historic and Forecasted Market Size by Organization Size

9.2.6.1 SME’S

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by Vertical

9.2.7.1 BFSI

9.2.7.2 IT & Telecommunication

9.2.7.3 Retail & Consumer Goods

9.2.7.4 Manufacturing

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Business Process Outsourcing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Service Type

9.3.4.1 Finance and Accounting Outsourcing

9.3.4.2 Marketing & Sales Outsourcing

9.3.4.3 Customer Support Outsourcing

9.3.4.4 Training & Development Outsourcing

9.3.4.5 Human Resource and Recruitment Outsourcing

9.3.4.6 Document Management & Processing

9.3.5 Historic and Forecasted Market Size by Operating Model

9.3.5.1 Traditional (On-Premise)

9.3.5.2 Business Process as a Service (Cloud-based)

9.3.6 Historic and Forecasted Market Size by Organization Size

9.3.6.1 SME’S

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by Vertical

9.3.7.1 BFSI

9.3.7.2 IT & Telecommunication

9.3.7.3 Retail & Consumer Goods

9.3.7.4 Manufacturing

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Business Process Outsourcing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Service Type

9.4.4.1 Finance and Accounting Outsourcing

9.4.4.2 Marketing & Sales Outsourcing

9.4.4.3 Customer Support Outsourcing

9.4.4.4 Training & Development Outsourcing

9.4.4.5 Human Resource and Recruitment Outsourcing

9.4.4.6 Document Management & Processing

9.4.5 Historic and Forecasted Market Size by Operating Model

9.4.5.1 Traditional (On-Premise)

9.4.5.2 Business Process as a Service (Cloud-based)

9.4.6 Historic and Forecasted Market Size by Organization Size

9.4.6.1 SME’S

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by Vertical

9.4.7.1 BFSI

9.4.7.2 IT & Telecommunication

9.4.7.3 Retail & Consumer Goods

9.4.7.4 Manufacturing

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Business Process Outsourcing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Service Type

9.5.4.1 Finance and Accounting Outsourcing

9.5.4.2 Marketing & Sales Outsourcing

9.5.4.3 Customer Support Outsourcing

9.5.4.4 Training & Development Outsourcing

9.5.4.5 Human Resource and Recruitment Outsourcing

9.5.4.6 Document Management & Processing

9.5.5 Historic and Forecasted Market Size by Operating Model

9.5.5.1 Traditional (On-Premise)

9.5.5.2 Business Process as a Service (Cloud-based)

9.5.6 Historic and Forecasted Market Size by Organization Size

9.5.6.1 SME’S

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by Vertical

9.5.7.1 BFSI

9.5.7.2 IT & Telecommunication

9.5.7.3 Retail & Consumer Goods

9.5.7.4 Manufacturing

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Business Process Outsourcing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Service Type

9.6.4.1 Finance and Accounting Outsourcing

9.6.4.2 Marketing & Sales Outsourcing

9.6.4.3 Customer Support Outsourcing

9.6.4.4 Training & Development Outsourcing

9.6.4.5 Human Resource and Recruitment Outsourcing

9.6.4.6 Document Management & Processing

9.6.5 Historic and Forecasted Market Size by Operating Model

9.6.5.1 Traditional (On-Premise)

9.6.5.2 Business Process as a Service (Cloud-based)

9.6.6 Historic and Forecasted Market Size by Organization Size

9.6.6.1 SME’S

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by Vertical

9.6.7.1 BFSI

9.6.7.2 IT & Telecommunication

9.6.7.3 Retail & Consumer Goods

9.6.7.4 Manufacturing

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Business Process Outsourcing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Service Type

9.7.4.1 Finance and Accounting Outsourcing

9.7.4.2 Marketing & Sales Outsourcing

9.7.4.3 Customer Support Outsourcing

9.7.4.4 Training & Development Outsourcing

9.7.4.5 Human Resource and Recruitment Outsourcing

9.7.4.6 Document Management & Processing

9.7.5 Historic and Forecasted Market Size by Operating Model

9.7.5.1 Traditional (On-Premise)

9.7.5.2 Business Process as a Service (Cloud-based)

9.7.6 Historic and Forecasted Market Size by Organization Size

9.7.6.1 SME’S

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by Vertical

9.7.7.1 BFSI

9.7.7.2 IT & Telecommunication

9.7.7.3 Retail & Consumer Goods

9.7.7.4 Manufacturing

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Business Process Outsourcing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 307.77 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.10% |

Market Size in 2032: |

USD 617.77 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Operating Model |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||